Global High Performance Alloys Market By Product(Non-ferrous metal, Superalloys, Refractory, Platinum group), Alloy Type(Wrought Alloy, Cast Alloy, Material, Aluminum, Magnesium, Titanium, Others), By Application(Aerospace, Industrial, Industrial Gas Turbine, Oil and Gas, Automotive, Electrical and Electronics, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2023

- Report ID: 17849

- Number of Pages: 221

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

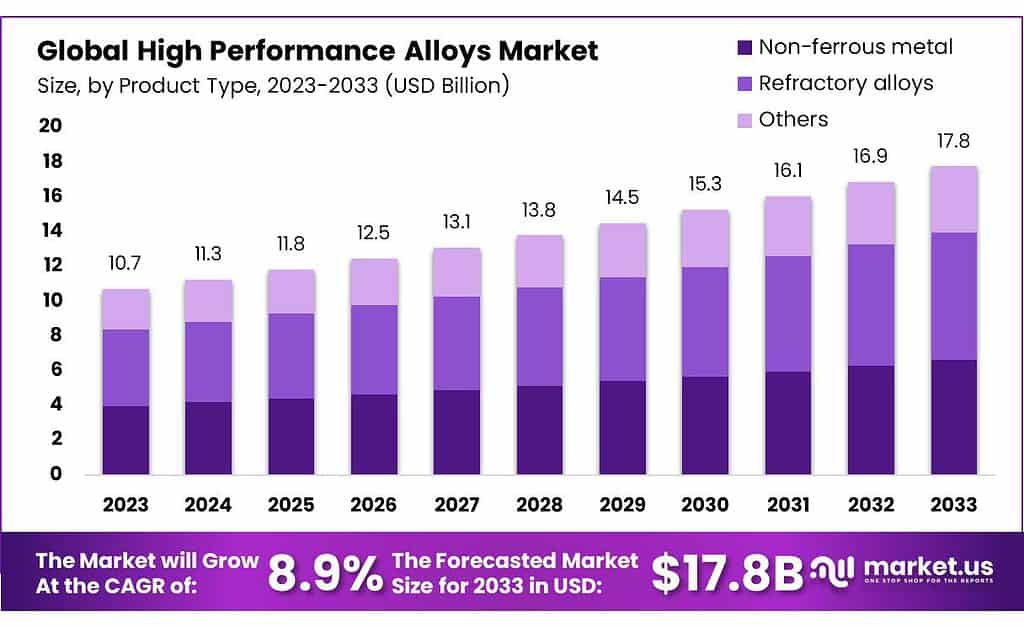

The High-Performance Alloys Market size is expected to be worth around USD 17.8 billion by 2033, from USD 10.7 Bn in 2023, growing at a CAGR of 5.2% during the forecast period from 2023 to 2033.

The market is expected to grow due to the growing demand for light alloys in the aerospace industry and the high demand for new-generation aircraft.

This is due to the increasing demand for alloys in critical areas such as oil and gas extraction, thermal process, and petroleum. Additionally, the industry is expected to grow due to the increased use of power generation for the production of industrial gas turbine components.

Actual Numbers Might Vary in the Final Report

Key Takeaways

- Market Growth Projection: The High-Performance Alloys Market is anticipated to grow from USD 10.7 billion in 2023 to an estimated worth of USD 17.8 billion by 2033, registering a compound annual growth rate (CAGR) of 5.2%.

- Driving Factors: Increased demand for lightweight alloys in aerospace and the surge in next-gen aircraft demand are pivotal growth drivers. These alloys are crucial in sectors like oil and gas extraction, thermal processes, and power generation for industrial gas turbine components.

- Product Dominance: Refractory Alloys Lead the market in 2023 due to exceptional resistance to extreme temperatures, finding applications in aerospace, defense, energy, and chemical processing.

- Applications and Industries: Industrial Gas Turbines Dominated the market in 2023, showcasing the importance of high-performance alloys in sectors requiring materials capable of withstanding extreme conditions while maintaining operational efficiency and safety standards.

- Market Challenges: Raw Material Price Volatility Oscillations in metals like steel, aluminum, nickel, and chromium costs impact production expenses, potentially challenging market stability.

- Opportunities for Growth: Aerospace, Automotive, and Energy Sectors Demand for lighter yet stronger materials in aircraft and vehicles opens avenues for high-performance alloys.

- Regional Analysis: Asia Pacific is Expected to be the fastest-growing region due to increased automobile production, aerospace growth, and economic recovery, likely growing at a 5.9% CAGR in revenue.

- Key Market Players: Companies like Alcoa, Precision Castparts Corp., Outokumpu, Hitachi Metals Ltd., among others, drive market growth through innovative products and strategic alliances.

By Product

The high-performance alloys market witnessed Refractory Alloys taking the forefront in 2023, capturing a dominant share exceeding 41.3%. Refractory alloys stand out for their outstanding resistance to extreme temperatures and harsh environments, making them indispensable across industries such as aerospace, defense, and energy. Refractory molybdenum- and tungsten-based alloys exhibit incredible strength and durability making them great choices for components subjected to intense heat or stress.

These alloys find extensive use in specialized applications where conventional metals may falter under severe conditions. For instance, in aerospace and defense, refractory alloys play a crucial role in manufacturing components for aircraft engines, rocket propulsion systems, and high-temperature structural parts. Their resilience in extreme environments ensures reliable performance in critical operations, enhancing safety and efficiency in these sectors.

Industries such as energy and chemical processing rely heavily on refractory alloys because of their ability to withstand corrosive environments and high temperatures, particularly their use in furnaces, reactors, and high-temperature processing equipment such as furnaces. Refractory alloys also play a pivotal role in supporting high-performance applications across industries – further solidifying their significance within the high-performance alloys market

By Alloy Type

In 2023, Cast Alloy emerged as the dominant force within the high-performance alloys market, capturing a substantial share exceeding 59.8%. These alloys gained traction for their versatile production capabilities, offering the flexibility to create intricate shapes and designs compared to other alloy types. Industries such as automotive, aerospace, and even manufacturing sectors favor cast alloys for their ability to adapt to complex and specific component requirements.

The superior moldability and cost-effectiveness of cast alloys make them a preferred choice for applications demanding intricate shapes or large-scale production. In sectors like automotive, where intricate parts are essential for performance and design, cast alloys provide a crucial advantage. Additionally, in aerospace, where components often require complex geometries and stringent performance standards, these alloys offer the required flexibility without compromising on performance.

Their dominance in the market signifies the trust industries place in cast alloys due to their adaptability, cost-efficiency, and ability to cater to diverse and demanding manufacturing needs. This market segment’s strength reflects the ongoing preference for cast alloys across various industries seeking high-performance materials that can meet intricate design specifications and stringent performance requirements.

By Material Type

In 2023, Aluminum took the lead in the high-performance alloys market, capturing a significant share of over 38.9%. Its dominance was fueled by its versatility and extensive applicability across various industries. Aluminum’s lightweight nature combined with its strong strength and corrosion resistance made it an attractive material choice in various sectors such as aerospace, automotive, and construction.

Aluminum alloys are widely utilized by the aerospace industry due to their outstanding strength-to-weight ratio, making them key components in creating aircraft components. Similarly, in the automotive sector, aluminum’s lightweight properties contribute to fuel efficiency and performance enhancement. Its corrosion resistance also makes it an ideal choice for construction applications, ensuring durability in various structural elements.

The substantial market share held by aluminum underscores its indispensable role in high-performance alloy applications. Its prevalence across key industries highlights the trust placed in aluminum alloys for delivering a balance of strength, lightweight characteristics, and resilience to corrosion, cementing its position as a dominant material within the high-performance alloys market.

By Application

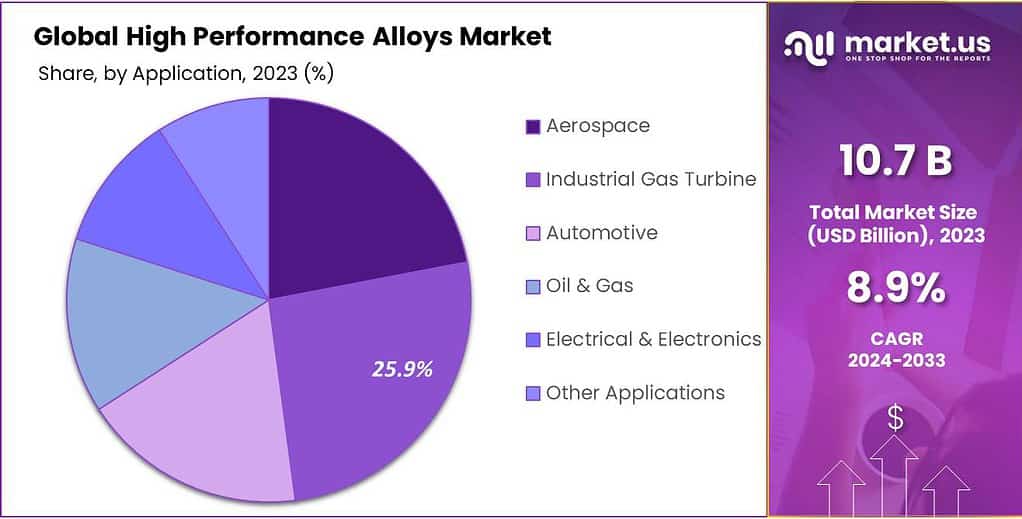

In 2023, the Industrial Gas Turbine segment asserted dominance within the high-performance alloys market, securing a substantial share exceeding 25.9%. This segment’s prominence arises from the critical need for robust materials capable of withstanding extreme conditions within gas turbines.

High-performance alloys play a pivotal role in these turbines, where they must endure high temperatures, pressure differentials, and corrosive environments while sustaining structural integrity and performance efficiency. Aerospace represents another key application area for high-performance alloys.

Within aerospace, these alloys are indispensable in producing aircraft components requiring superior strength-to-weight ratios and resistance to extreme conditions encountered during flight. Their ability to withstand multiple operational stressors makes them vital components in ensuring aviation safety and reliability.

Automotive industries rely heavily on high-performance alloys due to their lightweight but sturdy nature, as lightweight yet strong alloy components help improve fuel economy, performance, and structural integrity. Furthermore, oil & gas companies also rely heavily on these alloys in challenging environments as they resist corrosion while maintaining mechanical properties, guaranteeing reliable exploration and production activities.

The dominance of Industrial Gas Turbines signifies the strategic importance of high-performance alloys in critical sectors requiring materials capable of withstanding extreme conditions while maintaining operational efficiency and safety standards. This market segment’s strength underscores the pivotal role played by high-performance alloys in supporting diverse industries’ operational needs and technological advancements.

Actual Numbers Might Vary in the Final Report

Key Market Segments

-

Product

- Non-ferrous metal

- Superalloys

- Refractory

- Platinum group

-

Alloy Type

- Wrought Alloy

- Cast Alloy

-

Material

- Aluminum

- Magnesium

- Titanium

- Others

-

Application

- Aerospace

- Industrial

- Industrial Gas Turbine

- Oil & Gas

- Automotive

- Electrical & Electronics

- Others

Drivers

The increasing demand for high-performance alloys in the oil and gas industry stands as a key driver propelling market growth. These alloys serve critical roles in various facets of oil and gas plants, from tanks and pump components to valves and piping systems.

Their ability to withstand extreme temperatures and mechanical stress while offering superior resistance to corrosion from elements like seawater makes them indispensable within these facilities.As the oil and gas sector continues to expand, demand for high-performance alloys is expected to surge, driving significant market expansion.

Increased demand is being driven by both automotive industry expansion and its demand for high-performance alloys. These alloys, including Haynes and Hastelloy, find extensive applications in automotive components, from sensors to electrical systems and other vital parts.

Their unique properties – high strength, conductivity, and resistance to heat, wear, and corrosion – make these alloys the ideal material choice for use in various automotive applications. As demand for automotive manufacturing increases, demand for these alloys within vehicles’ critical systems and components will likely play a key role in driving market expansion shortly.

Restraints

The fluctuating prices of raw materials present a significant restraint in the high-performance alloys market. These alloys primarily rely on metals like steel, aluminum, nickel, and chromium, among others, for their composition. Oscillations in the costs of these essential materials can lead to increased production expenses, subsequently surging the price of high-performance alloys.

For instance, substantial spikes in aluminum prices, reaching up to US$3,000 per ton in September 2021 as reported by the China Nonferrous Metals Association, indicate the volatility in material costs. Forecasts also suggest considerable rises in other metal costs like nickel and copper in the coming years. These fluctuations in material prices pose challenges, potentially impeding market growth during the forecast period.

Additionally, the unpredictability in raw material prices not only impacts production costs but also affects market stability and profitability for manufacturers. The dependence of high-performance alloys on these metals makes them vulnerable to market shifts, challenging the industry’s consistency and hindering potential growth avenues.

Strategies to mitigate the impact of fluctuating raw material costs and establish resilient supply chains will be crucial for market players aiming for sustained growth in the high-performance alloys sector.

Opportunities

The high-performance alloys market offers exciting opportunities for growth and innovation. One significant avenue lies in the aerospace industry, where the demand for lighter yet stronger materials continues to soar. High-performance alloys, renowned for their exceptional strength and lightweight properties, are poised to meet these demands, creating opportunities for advancements in aircraft manufacturing and space exploration.

Automotive expansion offers another promising avenue of opportunity. As vehicles evolve into more efficient and technologically advanced models, demand increases for alloys that enhance performance, durability, and fuel efficiency – opening doors for high-performance alloys to be integrated into critical automotive components, stimulating innovation within this sector.

The energy sector also presents an avenue for growth. With the increasing focus on sustainable energy sources and infrastructure development, high-performance alloys can play a pivotal role in constructing reliable and efficient energy systems, contributing to the renewable energy transition.

Technological advances and R&D efforts in metallurgy and alloy development provide opportunities to produce new, more specialized alloys to meet specific industrial needs. This constant innovation drives market expansion by offering alloys with improved properties and capabilities, serving diverse applications across industries.

Challenges

Navigating the high-performance alloys market comes with its share of challenges. One of the significant hurdles lies in the volatility of raw material prices. These alloys rely on metals like titanium, nickel, and chromium, whose prices can fluctuate significantly. These fluctuations directly impact production costs, making it challenging for manufacturers to maintain competitive pricing.

Environmental regulations present another challenge; compliance requires innovative manufacturing processes that minimize their environmental impact and meet all relevant standards. Finding an equitable balance between meeting regulatory requirements and maintaining high-performance alloy standards presents an ongoing struggle.

The complexity of alloy production itself is another obstacle. These alloys often demand precise manufacturing processes due to their specialized properties. Ensuring consistent quality and meeting stringent specifications adds complexity and cost to the manufacturing process.

Market stability can also be threatened by industries like aerospace, automotive and energy that depend on them for revenue generation; economic shifts or downturns affecting any of these sectors could have an immediate impact on demand for high-performance alloys and lead to market instability.

Acknowledging these challenges requires an innovative and strategic approach, from innovative manufacturing techniques to cost-cutting production methods and sustainability initiatives, along with an understanding of market dynamics. Industry players remain focused on finding ways to minimize these difficulties while meeting evolving industry requirements – mitigating those risks remains at the core of what drives their work.

Geopolitical and Recession Impact Analysis

Geopolitical Impact on the High-Performance Alloys Market:

When countries don’t get along or have trade fights, they might put taxes or limits on the metals used in high-performance alloys. This can make it hard to get these metals, cost more, and mess up how they’re made and sent to places.

Changes in rules about how these metals should be used or marked can happen because of big changes in politics. This might mean companies have to change how they make these alloys and follow new rules, which can be a bit tricky.

If places where these alloys are needed have issues like fights or problems, it can be hard for companies to grow there. Also, if there are arguments about where to get the stuff needed to make these alloys, it can cause problems in making them and being eco-friendly.

Recession Impact on the High-Performance Alloys Market:

When the economy isn’t doing well, people might use less of the metals needed for high-performance alloys. Even though these metals are important, folks might look for cheaper options to save money, which can decrease how much is bought.

Because everyone’s watching their wallets, they’ll pay closer attention to how much these alloys cost. Companies might need to rethink prices to stay competitive and keep selling.

Economic tough times can mess up how things are made and sent out. If the companies that make these alloys or send them to stores have money problems, it could slow down making and getting these metals. Also, when money’s tight, people might care more about the environment. They might want alloys that are good for the planet and create less waste.

Regional Analysis

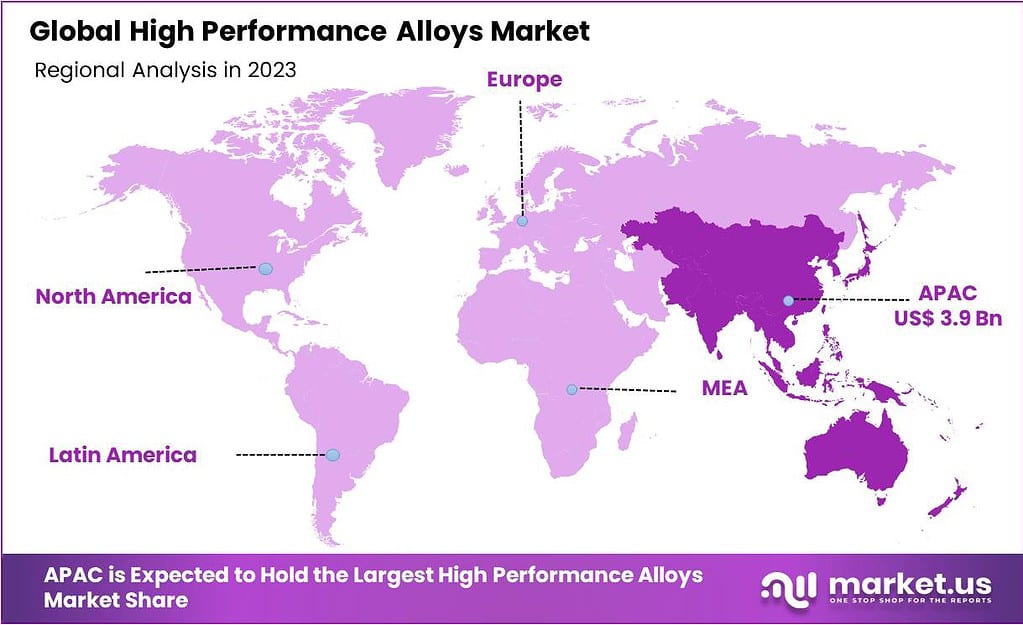

Asia Pacific will be the fastest-growing region. The region is expected to grow at a rate of 5.9% CAGR in terms of revenue, due to an increase in automobile production and the growth of the aerospace industry. Over the forecast period, the demand will be driven by the expected growth in GDP and the increase in manufacturing within the region.

Asia Pacific (APAC) had the largest revenue share at over 36.5% in 2023 because of the large volume of U.S.-based aerospace companies. Additionally, the economic recovery will provide the needed impetus for the market’s growth during the forecast period.

Actual Numbers Might Vary in the Final Report

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

International and regional industry players are active in strategic partnerships that aim to increase market share. In an attempt to increase their global footprint, the companies have opened manufacturing plants around the globe. This trend is expected to continue for the forecast period.

To increase market share, industry key companies are committed to offering unique value propositions. A growing number of manufacturers are innovating their products, offering lightweight components and high precision for specific applications. This will help to drive demand.

Key Market Players

- Alcoa

- Precision Castparts Corp.

- Outokumpu

- Hitachi Metals Ltd.

- Aperam SA

- Allegheny Technologies Incorporated

- Carpenter Technology

- Haynes International Inc.

- Timken Company

- VSMPO-Avisma Corporation

- ThyssenKrupp AG

- RTI International Metals

- Others

Recent Developments

In September 2022, Alcoa Corporation made significant announcements about the research and application of alloys, further solidifying its position as a provider of sophisticated alloys. One of the company’s inventions is the release of A210 ExtruStrong, a new high-strength 6000 series alloy that offers advantages in a variety of extruded applications, including transportation, building, industrial and consumer goods.

Report Scope

Report Features Description Market Value (2023) US$ 10.7 Bn Forecast Revenue (2033) US$ 17.8 Bn CAGR (2023-2032) 5.2% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product(Non-ferrous metal, Superalloys, Refractory, Platinum group), Alloy Type(Wrought Alloy, Cast Alloy, Material, Aluminum, Magnesium, Titanium, Others), By Application(Aerospace, Industrial, Industrial Gas Turbine, Oil & Gas, Automotive, Electrical & Electronics, Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC- China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- GCC, South Africa, & Rest of MEA Competitive Landscape Alcoa, Precision Castparts Corp., Outokumpu, Hitachi Metals Ltd., Aperam SA, Allegheny Technologies Incorporated, Carpenter Technology, Haynes International Inc., Timken Company, VSMPO-Avisma Corporation, ThyssenKrupp AG, RTI International Metals, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are high-performance alloys?High-performance alloys are special metals engineered for exceptional properties like high strength, corrosion resistance, heat resistance, and durability. They're used in demanding environments where standard metals might not suffice.

Where are high-performance alloys used?These alloys are found in critical industries like aerospace, automotive, oil and gas, medical, and manufacturing. They're used in aircraft engines, industrial machinery, surgical implants, and more due to their exceptional properties.

What factors drive the high-performance alloys market?The demand is driven by industries requiring materials that can endure extreme conditions, technological advancements, and the need for lighter and more durable materials in aerospace and automotive sectors.

What innovations can be expected in the high-performance alloys market?Anticipated developments include advancements in alloy compositions for improved performance, cost-effective manufacturing methods, and novel applications in emerging industries.

High Performance Alloys MarketPublished date: Dec 2023add_shopping_cartBuy Now get_appDownload Sample

High Performance Alloys MarketPublished date: Dec 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- Alcoa

- Precision Castparts Corp.

- Outokumpu

- Hitachi Metals Ltd.

- Aperam SA

- Allegheny Technologies Incorporated

- Carpenter Technology

- Haynes International Inc.

- Timken Company

- VSMPO-Avisma Corporation

- ThyssenKrupp AG

- RTI International Metals

- Others