Global Almond Products Market By Type(Whole Almond, Almond Milk, Almond Paste, Almond Pieces, Almond Flour, Others), By Forms(Raw Nuts, Liquid, Powder), By End-use(Personal Care, Pharmaceuticals, Food & Beverages, Others), By Distribution Channel( Hypermarkets/Supermarkets, Retailers, Online Stores, Convenience Stores, Others), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: April 2024

- Report ID: 68946

- Number of Pages: 364

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

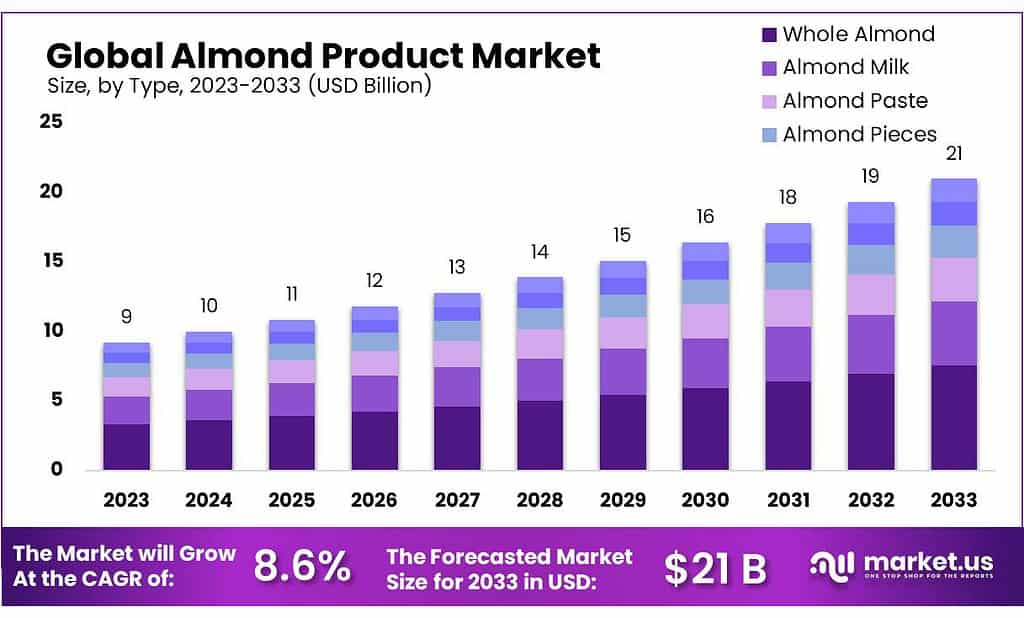

The global Almond Products market size is expected to be worth around USD 21 billion by 2033, from USD 9 billion in 2023, growing at a CAGR of 8.6% during the forecast period from 2023 to 2033.

The Almond Product Market encompasses the global industry involved in processing and selling products derived from almonds. This market includes a diverse array of products such as almond milk, almond butter, almond oil, almond flour, and whole or sliced almonds. Almonds are highly valued for their nutritional benefits, offering a rich source of protein, fiber, healthy fats, vitamins, and minerals. These properties have propelled almonds into various dietary trends, particularly those focused on health, wellness, and plant-based diets.

Almond products have gained immense popularity as alternatives to dairy products, with almond milk leading the charge as a lactose-free, vegan-friendly milk substitute. Almond butter and almond flour have also seen increased demand in the health food sector, appealing to those with gluten sensitivities or those seeking lower-carb or paleo diet options. Additionally, almond oil is widely used in the cosmetics industry for its skin-nourishing benefits.

The market’s growth is driven by the rising awareness of health and nutrition, the increasing prevalence of lactose intolerance and gluten sensitivity, and the growing vegan population. Furthermore, innovations in product development and the expansion of almond-based product offerings in supermarkets and health food stores globally continue to stimulate demand. As consumers increasingly seek out nutritious and sustainable food choices, the almond product market is expected to experience substantial growth, catering to a wide and diverse consumer base looking for healthy and versatile food options.

Key Takeaways

- The Almond Products market is expected to grow from USD 9 Bn in 2023 to around USD 21 Bn by 2033, with a (CAGR) of 8.6%.

- Market Share by Type (2023): Whole Almond: Held over 36.8% market share.

- Raw Nuts: Held over 45.5% market share.

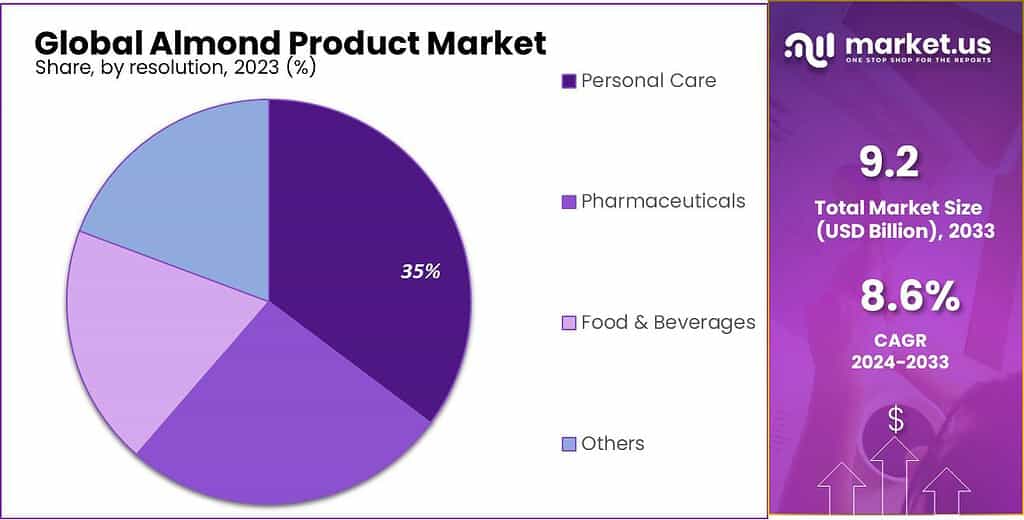

- Personal Care: Held over 36.4% market share.

- Hypermarkets/Supermarkets: Held over 40.8% market share.

- Asia Pacific: Expected to capture around 49% of the global market.

By Type

In 2023, Whole Almond held a dominant market position, capturing more than a 36.8% share. Whole almonds are widely consumed for their health benefits, including heart health support and high nutritional content. They are popular in various forms, from raw snacks to roasted and seasoned nuts.

Almond Milk follows as a highly favored choice among consumers seeking dairy-free alternatives. Its versatility in use—from cereals and smoothies to cooking and baking—makes it a staple in many households, especially those adhering to vegan and lactose-intolerant diets.

Almond Paste is integral to baking and confectionery, prized for its rich, nutty flavor and smooth texture. It’s a key ingredient in marzipan and other sweet treats, adding depth and moisture to recipes.

Almond Pieces, including slivers and chopped almonds, are commonly used as a topping or ingredient in salads, yogurt, oatmeal, and baking products. Their convenience and ease of use boost their popularity in home cooking and commercial food production.

Almond Flour has seen a surge in demand, particularly from the gluten-free market. Its fine texture and nutritional profile make it suitable for baking healthier, low-carb breads, pastries, and other baked goods.

By Forms

In 2023, Raw Nuts held a dominant market position, capturing more than a 45.5% share. Raw almonds are popular due to their nutritional benefits and flexibility in various culinary uses. They are a favorite snack among health-conscious consumers and a key ingredient in both sweet and savory dishes. Their appeal lies in their natural state, which preserves the integrity of their nutrients, making them a wholesome choice for a balanced diet.

Liquid forms, such as almond milk, also play a significant role in the market, particularly favored by those seeking dairy-free alternatives. Almond milk is celebrated for its creamy texture and mild flavor, making it a suitable option for cereals, coffee, and smoothies. Its popularity is driven by the growing vegan population and those with lactose intolerance, emphasizing the shift towards plant-based diets.

Almond Powder, or almond flour, is another essential segment, appreciated for its gluten-free property. It serves as a fantastic alternative for traditional flour in baking and cooking, catering especially to those with gluten sensitivities or those following low-carb diets. Almond flour’s ability to provide moisture and a slightly nutty flavor to baked goods has made it a preferred choice in healthy baking recipes.

Each form of almond product caters to different dietary needs and preferences, contributing to the robust growth of the almond product market.

By End-use

In 2023, Personal Care held a dominant market position, capturing more than a 36.4% share. Almond oil and extracts are highly valued in the personal care industry for their hydrating and nourishing properties, making them popular ingredients in skincare, haircare, and cosmetic products. Their rich vitamin E content helps improve skin and hair health, promoting almond products as premium options in natural beauty solutions.

The Food & Beverages sector also significantly utilizes almonds, particularly in forms such as almond milk, flour, and raw nuts. Almonds are incorporated into a wide range of food products for their nutritional benefits and appealing flavor. They serve not only as key ingredients in bakery and snack items but also in plant-based food options, aligning with the growing demand for healthier eating habits.

Pharmaceuticals represent another important application, with almond extracts used for their potential health benefits in various supplements. Almonds are known to support heart health and cholesterol levels, making them a sought-after component in nutraceuticals.

The “Others” category includes diverse applications such as in culinary uses outside of traditional food and beverages, including in gourmet and specialty foods where almonds add texture and flavor.

Each segment benefits from the unique properties of almonds, driving widespread adoption across multiple industries and reflecting the versatility and enduring popularity of almond products in the market.

By Distribution Channel

In 2023, Hypermarkets/Supermarkets held a dominant market position, capturing more than a 40.8% share. These large retail formats are preferred by consumers for their wide selection of almond products, ranging from raw almonds to almond-based snacks, milk, and flours. The convenience of finding various types and brands under one roof, coupled with competitive pricing and regular promotions, makes hypermarkets and supermarkets the go-to option for everyday shopping.

Specialty Retailers also play a significant role in the distribution of almond products, especially for those seeking organic or gourmet varieties. These stores often offer a curated selection that caters to specific dietary needs or preferences, such as gluten-free or vegan almond products.

Online Stores have seen significant growth, driven by the convenience of home shopping and the ability to easily compare prices and read customer reviews. The rise of e-commerce platforms has made it easier for consumers to access a broader range of almond products, including those that are harder to find in physical stores.

Convenience Stores are important for on-the-go purchases, providing easy access to quick snacks like almond bars or small packs of raw almonds. These outlets cater to busy consumers looking for a healthy snack option without the need to visit a larger store.

The “Others” category includes various other sales channels such as direct sales from producers or farmers’ markets, where consumers can buy almonds and almond products directly from the source, often ensuring freshness and supporting local businesses.

Each distribution channel offers distinct advantages, catering to the diverse needs and shopping preferences of consumers, thus supporting the widespread availability and continued popularity of almond products in the market.

Key Market Segments

By Type

- Whole Almond

- Almond Milk

- Almond Paste

- Almond Pieces

- Almond Flour

- Others

By Forms

- Raw Nuts

- Liquid

- Powder

By End-use

- Personal Care

- Pharmaceuticals

- Food & Beverages

- Others

By Distribution Channel

- Hypermarkets/Supermarkets

- Retailers

- Online Stores

- Convenience Stores

- Others

Drivers

Rising Health Consciousness and Demand for Plant-Based Products

A significant driver of the Almond Product Market is the increasing health consciousness among consumers globally, coupled with a surge in demand for plant-based products. As more individuals become aware of the health benefits associated with a plant-based diet, almond products have gained prominence due to their high nutritional value and versatility.

Almonds are rich in essential nutrients such as protein, fiber, vitamin E, and magnesium, which contribute to various health benefits, including improved heart health, weight management, and enhanced skin health.

Almonds serve as a key ingredient in numerous health-oriented food products, such as almond milk, which has become a popular dairy alternative for lactose-intolerant and vegan consumers. Its low calorie and cholesterol-free profile, along with significant calcium and vitamin D content, make it an attractive substitute for traditional dairy milk. Similarly, almond flour is favored in gluten-free baking, catering to those with gluten sensitivities or celiac disease, and those following low-carbohydrate diets.

The demand for natural and minimally processed foods is another factor propelling the market. Almonds are often marketed as ‘raw’ or ‘natural’, which aligns well with the clean eating trends that prioritize whole and unprocessed foods. This perception enhances their appeal to health-conscious consumers who are increasingly scrutinizing product labels for artificial additives and preservatives.

Furthermore, the growing awareness of environmental sustainability concerns has also bolstered the popularity of almond products. Plant-based diets are often viewed as more environmentally sustainable compared to diets high in animal-based products. Almonds, being plant-based, are perceived as a more eco-friendly option, particularly among younger consumers who are more inclined to make purchasing decisions that reflect their environmental and ethical values.

The expansion of the almond product range in supermarkets and health food stores worldwide has made these products more accessible to a broader audience, thereby supporting market growth. Continuous innovations in almond product offerings, such as the introduction of flavored almond butters or fortified almond milks, also cater to evolving consumer tastes and preferences, further driving market expansion.

Restraints

Water Intensive Cultivation and Supply Chain Vulnerabilities

A significant restraint facing the Almond Product Market is the water-intensive nature of almond cultivation, coupled with the vulnerabilities in its supply chain. Almonds require a substantial amount of water to grow, with the cultivation process being notably water-intensive compared to other crops.

This aspect poses a significant environmental challenge, particularly in regions like California, which produces a majority of the world’s almonds but also faces frequent drought conditions. The high water usage has led to criticism and scrutiny from environmental groups and consumers concerned about sustainable agricultural practices, potentially affecting consumer perceptions and demand.

Additionally, the majority of almond production being concentrated in specific geographic areas such as California, adds a layer of risk to the supply chain. Any climatic adversities, such as droughts or unexpected frosts, can significantly impact production outputs, leading to volatility in almond prices and availability. Such supply chain vulnerabilities not only affect the stability of almond markets but also the pricing structure across the global marketplace, making it challenging for manufacturers and retailers to maintain consistent product availability and cost.

Furthermore, the global nature of the almond market introduces complexities in logistics and distribution. Transporting almonds and almond products from primary areas of production to international markets incurs substantial costs and logistical challenges. The need for efficient cold storage to maintain product quality during transit adds another layer of complexity and cost, potentially limiting market expansion in regions far from production sites.

Regulatory challenges also pose restrictions on the almond market. As almonds are subject to international trade, they must comply with varying regulatory standards across different countries, which can be a barrier to entry in some markets. Regulatory hurdles not only complicate the export-import process but also increase the operational costs for producers and distributors, impacting the overall profitability and growth potential of the almond market.

Opportunity

Diversification into New Product Innovations and Markets

A significant opportunity within the Almond Product Market lies in the diversification into new product innovations and expanding into untapped markets. As consumer preferences continue to evolve towards healthier and more sustainable dietary choices, there is a growing demand for plant-based and nutrient-rich foods. Almonds, with their versatile profile and health benefits, are ideally positioned to capitalize on this trend through the introduction of innovative almond-based products.

Almond milk, butter, and flour have already established strong market positions, but there remains substantial potential for further innovation. For example, the development of flavored almond milks, almond-based yogurts, and ready-to-eat almond snacks could cater to the convenience-seeking behavior of modern consumers. Additionally, almond protein powders and almond-based meal replacements are emerging categories that can appeal to fitness enthusiasts and those following specific diet plans, such as keto or paleo diets.

Expanding into new geographic markets also presents a lucrative opportunity for the almond industry. While North America and Europe are currently the leading markets for almond products, Asia-Pacific and Latin America are rapidly growing regions with increasing health awareness and disposable incomes. Promoting almonds in these markets as a premium health food can drive significant growth, particularly if marketing strategies are tailored to local tastes and dietary habits.

Furthermore, the cosmetic industry offers another promising avenue for almond products. Almond oil is revered for its skin and hair benefits, and incorporating this ingredient into organic and natural beauty products can meet the rising consumer demand for clean and sustainable cosmetics. Almond shells and meals, which are byproducts of almond processing, also hold potential for use in exfoliating scrubs and other skincare products, promoting zero-waste production practices.

The potential for almond products in the health and wellness sector, especially within areas focusing on mental health and stress relief, is another area ripe for exploration. Almonds are rich in magnesium and vitamin E, which have been linked to improved mood and reduced stress levels, making them suitable for inclusion in products targeted at mental well-being.

Trends

Surge in Plant-Based and Gluten-Free Product Demand

A major trend shaping the Almond Product Market is the significant surge in demand for plant-based and gluten-free products. As consumers become more health conscious and aware of the environmental impacts of their dietary choices, there is a growing preference for plant-based alternatives to traditional dairy and wheat-based products. Almonds, with their versatile applications and nutritional benefits, are at the forefront of this trend.

Almond milk has emerged as one of the most popular dairy alternatives, appreciated for its creamy texture and subtle nutty flavor, making it a preferred choice for those avoiding dairy due to allergies, lactose intolerance, or ethical reasons. Its use has expanded beyond just a beverage to an ingredient in coffee, smoothies, and even in culinary recipes as a milk substitute. The rising popularity of veganism and vegetarianism, particularly in Western markets, continues to propel the demand for almond milk and other almond-based dairy alternatives such as almond yogurt and almond-based cheeses.

Furthermore, the demand for gluten-free products is also driving innovations in the Almond Product Market. Almond flour has become a staple in gluten-free baking, offering a low-carb, high-protein alternative to traditional wheat flour. It is ideal for consumers following gluten-free, paleo, or keto diets, catering to a niche but rapidly growing segment of the market. Almond flour is used in a wide range of products from baked goods like breads and pastries to pancakes and even as a coating for fried foods.

The clean eating movement also complements this trend, as almonds are perceived as a ‘clean’ ingredient with minimal processing involved and no additives, aligning with consumer demand for transparent and simple ingredient lists. This has led to increased use of almonds in snack products, where they are marketed as a natural source of energy and nutrients, perfect for health-conscious consumers seeking snacks without artificial ingredients or added sugars.

Additionally, sustainability concerns are influencing consumer behavior, with more individuals seeking out environmentally friendly food options. The water-intensive nature of almond cultivation has prompted some criticism, but it has also led to significant efforts within the industry to adopt more sustainable and water-efficient practices, which could mitigate environmental concerns and improve consumer perception.

Regional Analysis

The Asia Pacific region is poised to lead the global Almond Product Market, capturing a significant market share of 49%. This robust growth is primarily driven by the increasing demand for almond-based products in crucial applications such as food & beverages, personal care products, and nutraceuticals, among others.

The surge in almond product production in countries like China, India, and various Southeast Asian nations, including Korea, Thailand, Malaysia, and Vietnam, is expected to drive market expansion across the region during the forecast period. This growth trajectory is supported by the region’s expanding health and wellness industry, rising disposable incomes, and growing consumer awareness regarding nutritional benefits and wellness.

In North America, economic prosperity, coupled with the growth of industries that rely on almonds for food formulations and personal care products, is anticipated to boost the demand for almond products. The region’s focus on product innovation, coupled with the increasing emphasis on natural and organic ingredients, further propels this demand, positioning North America as a pivotal market for almond products.

Europe is also projected to witness substantial growth in the Almond Product Market. This growth is driven by the growing consumer preference for products that offer health benefits, including gluten-free and plant-based options, as well as the increasing demand from the food & beverage and personal care sectors. Europe’s stringent regulations regarding product safety and efficacy contribute to the rising adoption of almond products in various formulations.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In the almond product market, several key players wield substantial influence, shaping industry dynamics and consumer preferences. Blue Diamond Growers stands out as a dominant force, renowned for its comprehensive range of almond-based offerings, from whole almonds to almond milk and beyond. With a global footprint and a legacy of quality, Blue Diamond commands a significant market share, leveraging its expertise in almond cultivation and processing.

Market Key Players

- Archer Daniels Midland Company

- Barry Callebaut Group

- Blue Diamond Growers

- Borges Agricultural & Industrial Nuts

- Döhler GmbH

- Harris Woolf California Almonds

- John B. Sanfilippo & Son

- Kanegrade Limited

- Modern Ingredients

- Olam International Limited

- Repute Foods Pvt Ltd

- Royal Nut Company

- Savencia SA

- The Wonderful Company

- Treehouse California Almonds

Recent Development

In September, ADM showcased its commitment to sustainability by investing in eco-friendly packaging for its almond products, aligning with consumer preferences for environmentally conscious brands.

July 2023, Barry Callebaut Group unveiled innovative almond-based coatings for bakery and pastry applications, catering to the rising demand for indulgent yet healthier alternatives.

Report Scope

Report Features Description Market Value (2023) USD 9 Bn Forecast Revenue (2033) USD 21 Bn CAGR (2024-2033) 8.6% Base Year for Estimation 2023 Historic Period 2020-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type(Whole Almond, Almond Milk, Almond Paste, Almond Pieces, Almond Flour, Others), By Forms(Raw Nuts, Liquid, Powder), By End-use(Personal Care, Pharmaceuticals, Food & Beverages, Others), By Distribution Channel( Hypermarkets/Supermarkets, Retailers, Online Stores, Convenience Stores, Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Archer Daniels Midland Company, Barry Callebaut Group, Blue Diamond Growers, Borges Agricultural & Industrial Nuts, Döhler GmbH, Harris Woolf California Almonds, John B. Sanfilippo & Son, Kanegrade Limited, Modern Ingredients, Olam International Limited, Repute Foods Pvt Ltd, Royal Nut Company, Savencia SA, The Wonderful Company, Treehouse California Almonds Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of Almond Products market?Almond Products market size is expected to be worth around USD 21 billion by 2033, from USD 9 billion in 2023

What CAGR is projected for the Almond Product Market?The Almond Product Market is expected to grow at 8.6% CAGR (2024-2033).Name the major industry players in the Almond Product Market?Archer Daniels Midland Company, Barry Callebaut Group, Blue Diamond Growers, Borges Agricultural & Industrial Nuts, Döhler GmbH, Harris Woolf California Almonds, John B. Sanfilippo & Son, Kanegrade Limited, Modern Ingredients, Olam International Limited, Repute Foods Pvt Ltd, Royal Nut Company, Savencia SA, The Wonderful Company, Treehouse California Almonds

-

-

- Archer Daniels Midland Company

- Barry Callebaut Group

- Blue Diamond Growers

- Borges Agricultural & Industrial Nuts

- Döhler GmbH

- Harris Woolf California Almonds

- John B. Sanfilippo & Son

- Kanegrade Limited

- Modern Ingredients

- Olam International Limited

- Repute Foods Pvt Ltd

- Royal Nut Company

- Savencia SA

- The Wonderful Company

- Treehouse California Almonds