Global Green Chemicals Market Based on Product Type (Biopolymers, Bio-alcohols, Bio-organic Acids, Bio-ketones, Platform Chemicals, Others), Based on Source (Plant-Based, Animal-Based, Microorganisms), Based on End-Use (Chemical, Food And Beverages, Pharmaceuticals, Automotive And Transportation, Paints And Coatings, Packaging, Building And Construction, Textiles And Apparel, Electronics And Consumer Goods, Personal Care And Cosmetics, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 14690

- Number of Pages: 388

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

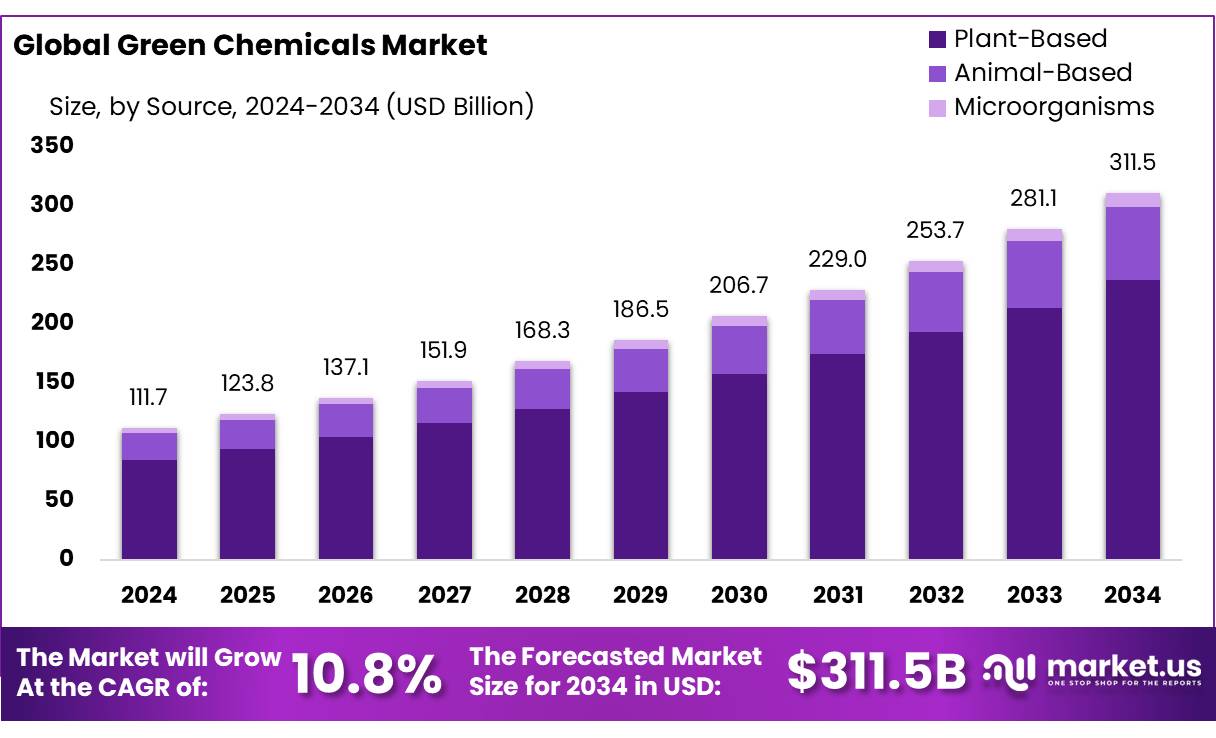

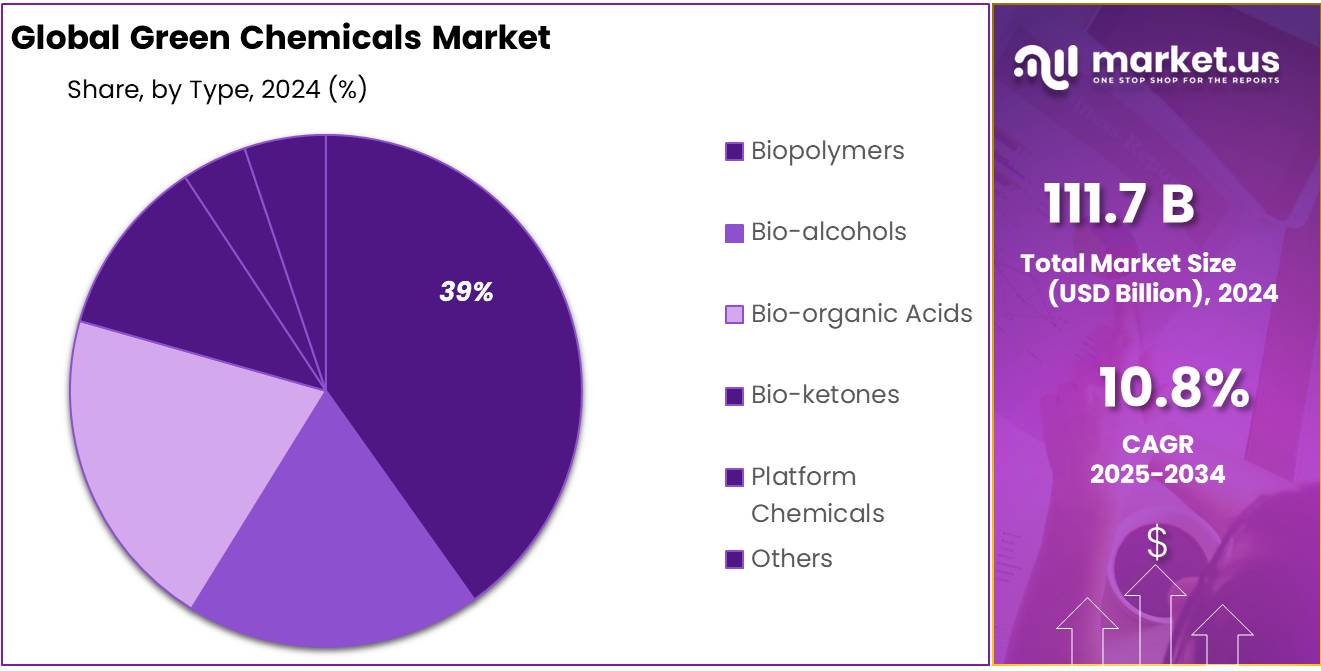

The Global Green Chemicals Market size is expected to be worth around USD 311.5 Billion by 2034, from USD 111.7 Billion in 2024, growing at a CAGR of 10.8% during the forecast period from 2025 to 2034.

The green chemicals concentrates industry in India is experiencing a significant transformation, driven by a confluence of industrial innovation and supportive governmental policies. This sector encompasses the development and application of eco-friendly chemical formulations, including colorants, additives, and functional agents, which are increasingly utilized in packaging, textiles, agriculture, and coatings.

India’s chemical industry is a cornerstone of its economy, contributing approximately 7% to the national GDP and employing over 5 million individuals. The sector is poised for substantial growth, with projections indicating an expansion from USD 220 billion in 2022 to USD 300 billion by 2030. This growth trajectory is underpinned by a robust policy framework and a burgeoning demand for sustainable products.

Central to this evolution is the Indian government’s commitment to sustainability, exemplified by initiatives such as the National Chemical Policy, which promotes the adoption of green chemistry principles to minimize environmental impact. Additionally, the National Action Plan on Climate Change (NAPCC) encompasses missions that indirectly support the green chemicals sector by fostering energy efficiency and sustainable agriculture practices.

The green chemicals concentrates industry is also benefiting from India’s renewable energy initiatives. As of October 2024, renewable sources accounted for 46.3% of India’s total energy capacity, with a target to achieve 500 GW by 2030. This shift towards renewable energy sources provides a sustainable feedstock for green chemical production, aligning with global trends towards decarbonization.

Key Takeaways

- Green Chemicals Market size is expected to be worth around USD 311.5 Billion by 2034, from USD 111.7 Billion in 2024, growing at a CAGR of 10.8%.

- Plant-Based held a dominant market position, capturing more than a 76.10% share in the global green chemicals market.

- Biopolymers held a dominant market position, capturing more than a 39.20% share in the global green chemicals market.

- Chemical held a dominant market position, capturing more than a 37.30% share in the global green chemicals market.

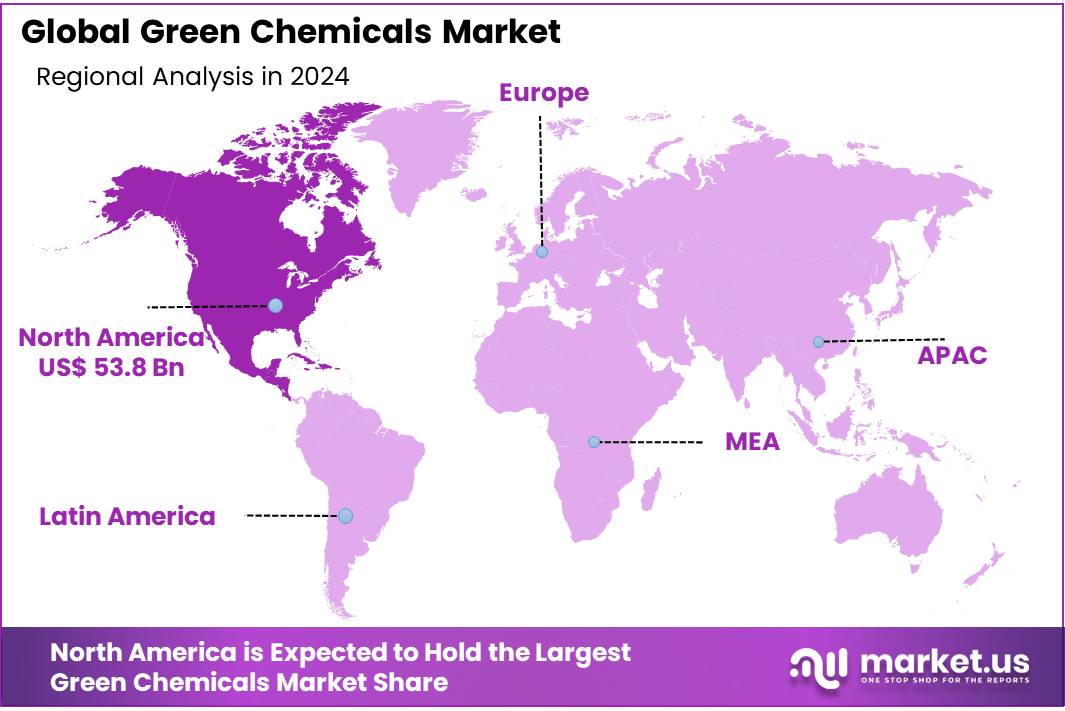

- North America retained a dominant position in the green chemicals market, holding approximately 48.20% of global revenues, equivalent to USD 53.8 billion.

By Product Type Analysis

Plant-Based Green Chemicals dominate with 76.10% in 2024, driven by demand for natural and renewable raw materials.

In 2024, Plant-Based held a dominant market position, capturing more than a 76.10% share in the global green chemicals market by source. This strong lead was mainly due to the growing use of agricultural biomass, starches, sugars, and plant-derived oils in the production of biopolymers, bio-alcohols, and other green intermediates.

Industries such as packaging, textiles, and personal care are increasingly shifting towards plant-based formulations to meet sustainability goals and reduce dependence on fossil-based feedstocks. This segment also benefited from rising consumer awareness and government support for bio-based alternatives. In 2025, the plant-based category is expected to maintain its lead, supported by investments in bio-refinery infrastructure and an expanding base of applications in both industrial and consumer markets.

By Source Analysis

Biopolymers lead with 39.20% in 2024, fueled by rising use in packaging and sustainable materials.

In 2024, Biopolymers held a dominant market position, capturing more than a 39.20% share in the global green chemicals market by type. This leadership was supported by growing demand for eco-friendly packaging, compostable plastics, and renewable alternatives to conventional polymers across sectors such as food, agriculture, and consumer goods. Biopolymers like PLA, PHA, and starch blends are being increasingly adopted due to their biodegradability and lower carbon footprint.

Government policies banning single-use plastics and encouraging sustainable material use further pushed the adoption of biopolymers. As of 2025, this segment is expected to grow steadily, with more companies incorporating biopolymers into their product lines to align with environmental goals and consumer expectations.

By End-Use

Chemical sector leads green chemical use with 37.30% share in 2024, backed by rising demand for clean and renewable feedstocks.

In 2024, Chemical held a dominant market position, capturing more than a 37.30% share in the global green chemicals market by end-use. This leadership was mainly driven by the increasing use of bio-based inputs in manufacturing solvents, resins, surfactants, and other specialty chemicals. As industries seek to lower emissions and meet stricter environmental regulations, chemical producers are adopting green feedstocks to reformulate traditional products.

The push for carbon neutrality and sustainable sourcing has made renewable chemicals a preferred choice, especially in industrial manufacturing and chemical processing plants. In 2025, this segment is projected to grow further as large-scale players continue investing in green alternatives and governments tighten environmental standards across chemical supply chains.

Key Market Segments

Based on Product Type

- Biopolymers

- Bio-alcohols

- Bio-organic Acids

- Bio-ketones

- Platform Chemicals

- Others

Based on Source

- Plant-Based

- Animal-Based

- Microorganisms

Based on End-Use

- Chemical

- Food & Beverages

- Pharmaceuticals

- Automotive & Transportation

- Paints & Coatings

- Packaging

- Building & Construction

- Textiles & Apparel

- Electronics & Consumer Goods

- Personal Care & Cosmetics

- Others

Driving Factors

Government Policies and Incentives Driving the Green Chemicals Market

In India, the green chemicals sector is gaining momentum, propelled by robust government policies and incentives aimed at fostering sustainable industrial practices. The government’s proactive approach includes initiatives that not only promote environmental sustainability but also stimulate economic growth and technological innovation within the chemical industry.

A significant policy framework is the National Chemical Policy, which encourages the adoption of green chemistry principles to reduce environmental impact and enhance the competitiveness of the Indian chemical industry. This policy aligns with the government’s broader vision of sustainable development and industrial growth.

Additionally, the Indian government has introduced the Production Linked Incentive (PLI) scheme, allocating substantial funds to various sectors, including chemicals, to boost domestic manufacturing and reduce dependency on imports. For instance, the government has planned an investment of INR 8 lakh crore (approximately USD 107.38 billion) in the chemicals and petrochemicals sector by 2025, aiming to enhance production capabilities and infrastructure.

These initiatives are complemented by the government’s focus on renewable energy, with a target to achieve 500 GW of renewable energy capacity by 2030. This shift towards renewable energy sources provides a sustainable feedstock for green chemical production, aligning with global trends towards decarbonization.

Restraining Factors

High Production Costs and Limited Feedstock Availability

One of the significant challenges hindering the growth of the green chemicals market in India is the high production costs associated with these eco-friendly alternatives. The manufacturing of green chemicals often necessitates advanced technologies and specialized equipment, leading to elevated capital expenditures. For instance, the conversion of biomass into bio-based chemicals requires sophisticated catalytic processes and energy-intensive operations, which can be more expensive than traditional petrochemical methods. These increased costs are typically passed on to consumers, making green chemicals less competitive compared to their conventional counterparts.

Furthermore, while India possesses abundant agricultural residues and biomass, the infrastructure for efficiently collecting, processing, and transporting these feedstocks is underdeveloped. This inefficiency results in a limited and inconsistent supply of raw materials for green chemical production. The lack of organized collection systems and storage facilities further exacerbates this issue, leading to higher procurement costs and supply chain disruptions.

The Indian government’s initiatives, such as the National Chemical Policy and the National Action Plan on Climate Change (NAPCC), aim to promote sustainable practices within the chemical industry. However, the high initial investment required for green chemical manufacturing and the challenges in feedstock availability continue to pose significant barriers. Without substantial investment in infrastructure and technology, achieving the desired growth in the green chemicals sector remains a formidable challenge.

Growth Opportunities

Government Incentives and Infrastructure Development

The Indian government’s proactive approach to fostering a sustainable chemical industry presents significant growth opportunities for the green chemicals sector. Through a combination of financial incentives, infrastructure development, and strategic policy initiatives, the government is creating a conducive environment for the expansion of green chemical manufacturing.

A notable example is the Production Linked Incentive (PLI) scheme, which offers financial incentives to manufacturers based on their incremental sales from products manufactured in domestic units. This scheme aims to boost the country’s manufacturing potential and reduce reliance on imports. For instance, the government has allocated approximately USD 20.93 million to the Department of Chemicals and Petrochemicals in the Union Budget for 2023-24 to support the growth of the chemical industry.

Additionally, the Petroleum, Chemicals and Petrochemicals Investment Regions (PCPIR) Policy aims to attract investments of around USD 276.46 billion by 2035, facilitating the development of integrated manufacturing hubs with state-of-the-art infrastructure.

Furthermore, the government’s focus on renewable energy aligns with the growth of the green chemicals sector. India has set an ambitious target to achieve 500 GW of renewable energy capacity by 2030, which will provide a sustainable feedstock for green chemical production. This shift towards renewable energy sources not only supports the green chemicals industry but also contributes to the country’s broader environmental goals.

Latest Trends

Government-Backed Infrastructure and Financial Support

A significant trend propelling the green chemicals market in India is the government’s strategic investment in infrastructure and financial incentives aimed at fostering sustainable chemical manufacturing. This approach not only enhances production capabilities but also attracts both domestic and international investments in green technologies.

For instance, the Indian government has allocated approximately ₹32 lakh crore (USD 39 billion) in investments for renewable energy projects, including green hydrogen and solar power initiatives. This substantial funding underscores the government’s commitment to sustainable energy solutions, which are integral to the production of green chemicals. As of March 2025, India had achieved a total installed renewable energy capacity of 220.10 GW, with solar power contributing 106 GW and wind power 50.04 GW.

Additionally, the government has introduced schemes like the Production Linked Incentive (PLI) for the chemical sector, aiming to boost domestic manufacturing and reduce reliance on imports. These initiatives provide financial incentives to companies that increase their production of green chemicals, thereby promoting eco-friendly alternatives in various industries, including food packaging, textiles, and agriculture.

Furthermore, the establishment of Centers of Excellence (CoEs) and Plastic Parks under the Ministry of Chemicals and Fertilizers facilitates research and development in green chemistry. These centers focus on developing sustainable chemical processes and products, thereby advancing the adoption of green chemicals across different sectors.

Regional Analysis

North America commands the green chemicals market with 48.20%, equivalent to USD 53.8 billion in 2024, driven by sustainable reforms and industrial demand.

In 2024, North America retained a dominant position in the green chemicals market, holding approximately 48.20% of global revenues, equivalent to USD 53.8 billion. This leadership reflects a regional prioritization of sustainability and clean chemical production. The United States, as the largest market, has accelerated adoption of bio-based solvents, biodegradable plastics, and non-toxic feedstocks—trends underpinned by both regulatory frameworks and investment incentives

State-level initiatives also contribute significantly. For example, California’s Green Chemistry Initiative, enacted through AB 1879 and SB 509 in 2008, mandates reporting and promotes safer, biodegradable chemical design—encouraging manufacturers to innovate beyond fossil-based materials.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASIAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

BASF is actively steering its portfolio toward sustainability by integrating renewable feedstocks and reducing carbon emissions. The company targets a 25% reduction in Scope 1 and 2 greenhouse gas emissions by 2030, with net-zero ambition by 2050, and has allocated approximately €4 billion toward clean-technology investments. BASF’s “eFurnace” pilot aims to curtail CO2 emissions from conventional steam crackers by at least 90%. Initiatives like “Together for Sustainability” further reinforce its green supplier evaluation and auditing protocols.

Braskem has scaled its green ethylene capacity by 37%, reaching 275,000 tonnes per year at its Triunfo facility, compared to 200,000 tonnes in 2010. This expansion captures roughly 159,000 tonnes of CO2 annually. In 2024, Braskem reported a 7 point rise in green ethylene utilization, achieving a 76% rate, and a 23% year on year increase in green polyethylene sales to 191,000 tonnes. The firm continues to pioneer bio-based polyethylene across packaging and industrial segments.

Evonik pursues a transformation toward bio‑based solutions, green hydrogen integration, and circular economy strategies. The company plans to source green hydrogen at its production sites beginning in 2026, replacing fossil-based acetic acid. By 2030, Evonik aims for over 50% of sales from next‑generation sustainable solutions (up from 43%) and commits €3 billion to low carbon technology investments to reduce emissions and achieve €100 million in annual savings.

Market Key Players

- BASF SE

- Braskem

- Arkema

- Evonik Industries AG

- Toray Industries, Inc.

- Cargill, Incorporated

- Mitsubishi Chemical Group Corporation

- Archer Daniels Midland

- DSM

- PTT Global Chemical

- Corbion N.V.

- BioAmber, Inc.

- DuPont

- Novozymes A/S

- Amyris, Inc.

- SABIC

- POET, LLC

- Valero Energy Corporation

- Green Plains Inc.

- Other Key Players

Recent Developments

In 2024, BASF SE invested in sustainability by cutting its Scope 1 and 2 CO2 emissions to 17.0 million metric tons, maintaining the same level as in 2023, and achieved a 26% share of renewable electricity use.

In 2024, Evonik Industries AG recorded total sales of €15.157 billion and achieved a notable 45% share of Next Generation Solutions, up from 43% in 2023.

Report Scope

Report Features Description Market Value (2024) USD 111.7 Bn Forecast Revenue (2034) USD 311.5 Bn CAGR (2025-2034) 10.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered Based on Product Type (Biopolymers, Bio-alcohols, Bio-organic Acids, Bio-ketones, Platform Chemicals, Others), Based on Source (Plant-Based, Animal-Based, Microorganisms), Based on End-Use (Chemical, Food And Beverages, Pharmaceuticals, Automotive And Transportation, Paints And Coatings, Packaging, Building And Construction, Textiles And Apparel, Electronics And Consumer Goods, Personal Care And Cosmetics, Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC- China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- GCC, South Africa, &Rest of MEA Competitive Landscape BASF SE, Braskem, Arkema, Evonik Industries AG, Toray Industries, Inc., Cargill, Incorporated, Mitsubishi Chemical Group Corporation, Archer Daniels Midland, DSM, PTT Global Chemical, Corbion N.V., BioAmber, Inc., DuPont, Novozymes A/S, Amyris, Inc., SABIC, POET, LLC, Valero Energy Corporation, Green Plains Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- BASF SE

- Braskem

- Arkema

- Evonik Industries AG

- Toray Industries, Inc.

- Cargill, Incorporated

- Mitsubishi Chemical Group Corporation

- Archer Daniels Midland

- DSM

- PTT Global Chemical

- Corbion N.V.

- BioAmber, Inc.

- DuPont

- Novozymes A/S

- Amyris, Inc.

- SABIC

- POET, LLC

- Valero Energy Corporation

- Green Plains Inc.

- Other Key Players