Global Refinery Process Chemicals Market By Type (Corrosion Inhibitor, Antifoaming Agent, Catalysts, Demulsifiers, pH Adjusters) , By Application (Cracking process, Conversion process, Blending Process), By End-Use Industry (Petroleum Refining, Petrochemicals, Natural Gas Processing), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2032

- Published date: Sep 2023

- Report ID: 105880

- Number of Pages: 396

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

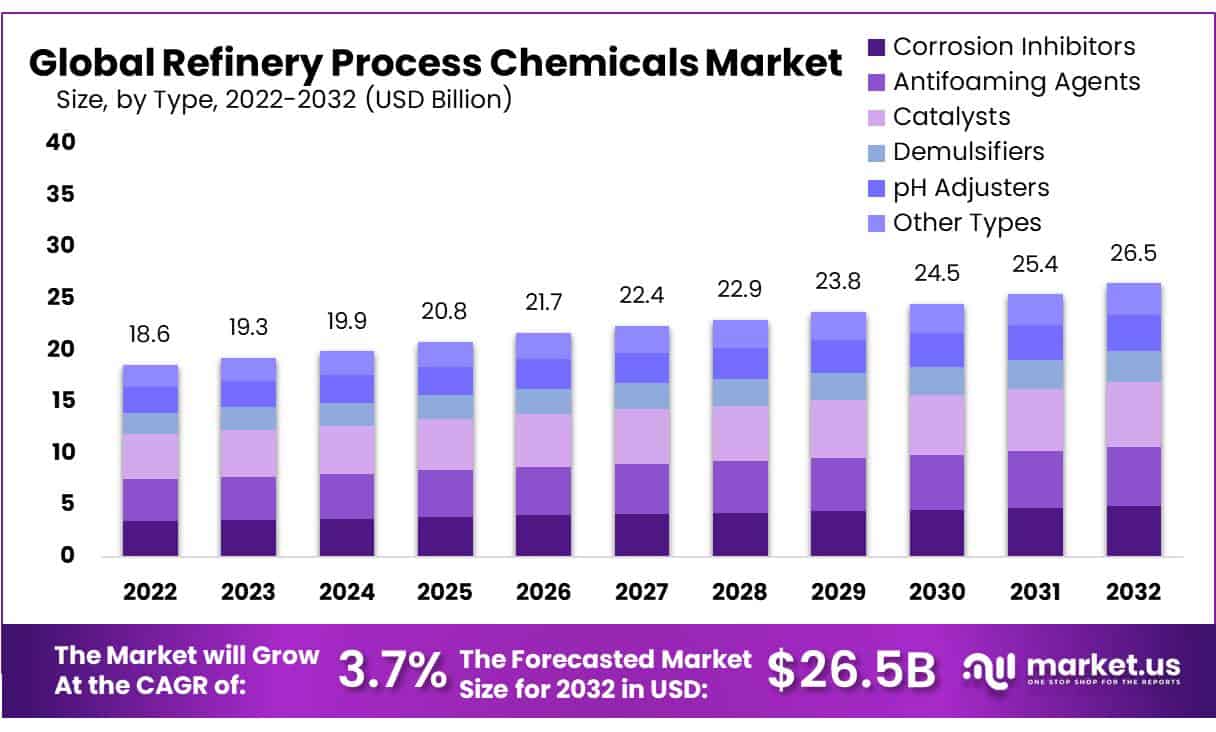

In 2022, the Global Refinery Process Chemicals Market was valued at USD 18.6 Billion, and is expected to reach USD 26.5 Billion in 2032 from 2023 to 2032, this market is estimated to register a CAGR of 3.7%.

Refinery Process Chemicals are used in the petroleum refining business to convert crude oil into usable products such as gasoline, diesel fuel, kerosene, jet fuel, and fuel oils. Refining involves employing numerous chemicals to increase efficiency, quality, and environmental performance.

To maximize operations, crude oil refineries largely use refinery process chemicals. Chemicals used in refinery processes also reduce corrosion, unpleasant odors, and crude oil pollution. Refining chemicals are used in various processes, such as a pH adjustor, antifouling agent, coagulant, antifoam, and defoamers.

Actual Numbers Might Vary in the final report

Key Takeaways

- Market Valuation: The Global Refinery Process Chemicals Market was valued at USD 18.6 Billion in 2022 and is projected to reach USD 26.5 Billion by 2032, with an estimated Compound Annual Growth Rate (CAGR) of 3.7% from 2023 to 2032.

- Role of Refinery Process Chemicals: Refinery Process Chemicals play a vital role in the petroleum refining industry, aiding in the conversion of crude oil into valuable products such as gasoline, diesel fuel, and jet fuel. They enhance efficiency, quality, and environmental performance in the refining process.

- Types of Chemicals: Various chemicals are used in refinery processes, including Corrosion Inhibitors, Antifoaming Agents, Catalysts, Demulsifiers, and pH Adjusters, among others.

- Catalysts Dominance: Catalysts are a crucial type of refinery process chemical, accounting for a market share of 23.6% in 2022. They play a pivotal role in increasing the reaction rate in refining processes.

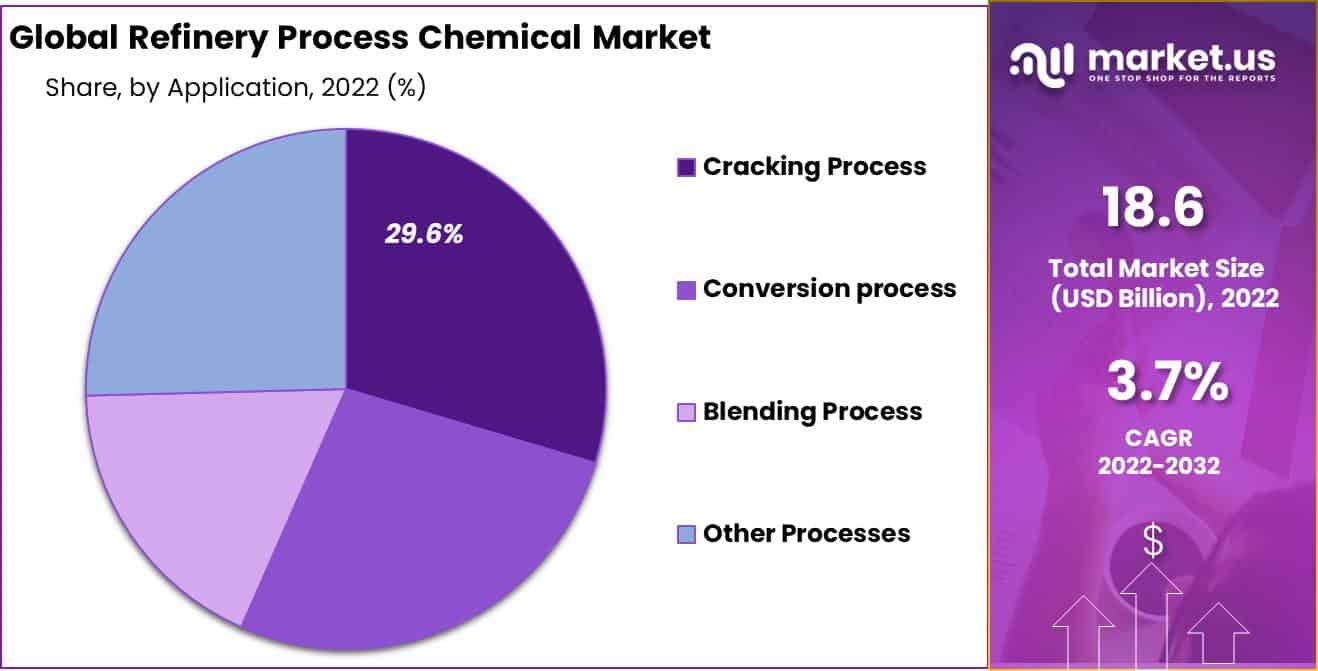

- Application Significance: Cracking applications are widespread in the use of refinery process chemicals, with a 29.6% market share in 2022. Cracking is essential for converting large hydrocarbon molecules into smaller, more valuable fractions.

- End-Use Industries: Petrochemicals are the dominant end-use industry, covering the largest market share in 2022. Petrochemical products are integral to various aspects of modern society, from plastics to digital gadgets.

- Drivers for Market Growth: The increasing demand for transportation fuels, driven by population growth, urbanization, and economic development, is a significant growth driver for the refinery process chemical market. Advancements in refining technologies also require specialized chemicals, increasing their demand.

- Market Restraints: The rising popularity of alternative energy sources like natural gas and solar power, along with environmental concerns related to crude oil, can restrict the growth of the refinery process chemicals market.

- Opportunities: The growing adaptability of petroleum-based products in the market is driving the demand for refinery process chemicals. These chemicals are essential for producing a wide range of products, including petrochemicals, plastics, and more.

- Trends: The market is witnessing a shift towards the production of high-value products, such as petrochemicals and specialty chemicals, alongside traditional fuels. There is also a growing trend towards the use of bio-based and renewable chemicals in refinery processes.

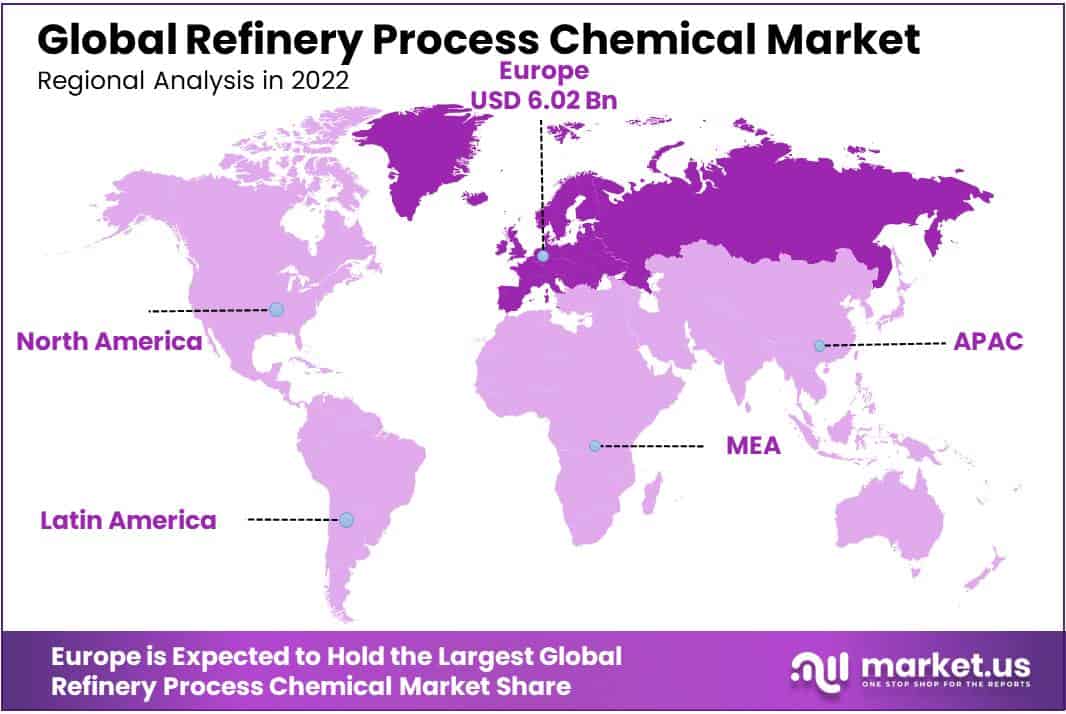

- Regional Analysis: Europe accounted for a significant share of the global refinery process chemicals market, covering 32.4% of the market share. The region dominated the market, driven by expansion in the oil and gas industry.

- Key Players: Major companies in the market include BASF SE, The Dow Chemical Company, SABIC, Chevron Phillips Chemical Company, Clariant, ExxonMobil Chemical, Honeywell, Albemarle Corporation, Evonik Industries AG, Arkema Group, Baker Hughes, Nalco Champion, and other key players.

Type Analysis

Demand For Catalysts Is Rising Due To Their Increasing Rate of Refining Process.

The Refinery Process Chemicals is segmented based on type into Corrosion Inhibitor, Antifoaming Agents, Catalysts, Demulsifiers, pH Adjusters, and Other types. Among these, Catalyst held the majority of revenue share. In 2022, catalysts accounted for a market share of 23.6%, and it is predicted to register a CAGR of 4% during the forecasted period.

The primary role of a catalyst is to increase the reaction rate in the refining process. Catalysts play a critical part in several refining processes, including cracking, reforming, and treating, which explains the significant demand for them in the market for refinery process chemicals. The demand for petroleum derivatives is rising, and it will increase the demand for catalysts in the refinery process chemical market.

Application Analysis

The use of Refinery Process Chemicals in Cracking Applications is Widespread.

Based on applications, the market for refinery process chemicals is further divided into cracking, conversion, blending, and other processes. Among these applications, the cracking application led the market with a 29.6% market share in 2022.

The cracking process is pivotal in converting larger hydrocarbon molecules into smaller, more valuable fractions, which are essential for producing fuels, petrochemical feedstocks, and various other high-demand products. This process involves breaking down complex hydrocarbons to generate lighter, more desirable components, fulfilling the growing demand for refinery process chemicals.

The conversion process application also holds a notable share within the refinery process chemicals market. Conversion processes allow refineries to process different types of crude oil feedstocks, accommodating feedstock quality and composition variations.

End-Use Industry Analysis

The Diversity Of Products In The Petrochemical Industry Increases Demand.

Based on applications, the market is further divided into petroleum refining, petrochemicals, natural gas processing, and other end-use industries. Among these applications, petrochemicals accounted for the largest market share in 2022. Products made by petrochemicals are ubiquitous and essential to contemporary society.

Plastics, fertilizers, packaging, apparel, digital gadgets, medical equipment, detergents, tires, and many more items fall under this category. They may also be found in several components of the current energy system, including those for solar panels, wind turbine blades, batteries, building thermal insulation, and electric vehicle components.

Petrochemicals are already a significant part of the world’s energy system, and their significance is increasing. Plastics are the most well-known category of petrochemical goods, and demand for them has exceeded that for all other bulk materials.

Key Market Segments

Type

- Corrosion Inhibitor

- Antifoaming Agent

- Catalysts

- Demulsifiers

- pH Adjustor

- Other Types

Application

- Cracking Process

- Conversion process

- Blending Process

- Other Processes

End-Use Industry

- Petroleum Refining

- Petrochemicals

- Natural Gas Processing

- Other End-Use Industries

Drivers

The Rise of The Refinery Process Chemical Industry Is Being Driven By Increased Demand For Transportation Fuels.

The ever-increasing need for, particularly from the transportation industry, will likely emerge as a key growth driver for the worldwide refinery process chemical market. Demand for fuel is rising in the future, which will increase with growth in the population, urbanization, and economic development.

However, specialized chemicals and methods must be used for cost-effective and efficient fuel generation. As a result, increased demand for transportation fuels drives the demand for refinery chemicals. Furthermore, advancements in refining technologies necessitate the utilization of sophisticated refinery process chemicals to enhance the efficiency of conversion processes, improve catalyst performance, and maximize yields of desired products.

Emerging technologies such as hydrotreating, hydrocracking, and fluid catalytic cracking demand specialized chemicals for optimal performance, increasing demand for refinery chemicals.

Growing environmental awareness and tightening regulatory standards necessitate the utilization of refinery process chemicals to reduce emissions, optimize energy consumption, and mitigate environmental impacts. Compliance with emissions reduction targets and regulations often entails using specialized chemicals that aid in pollutant capture and abatement.

Restraints

Increasing Demand For Alternative Sources Decrease The Growth Of Refinery Process Chemicals Market.

The rise in popularity of renewable energy sources, such as natural gas, solar energy, and other alternative energy, will likely restrict the growth of the global market for process chemicals.

Additionally, it is well known that crude oil has very high carbon emissions, which is bad for the environment worldwide. Since businesses are searching for environmentally clean and less harmful methods, this issue is another significant barrier to market expansion.

The increasing acceptance of solar power plants and electric cars is projected to constrain growth significantly. Rising demand for these goods is anticipated to lessen the reliance on crude oil products, paving the way for industrial growth.

Opportunity

Growing Petroleum-Based Product Adaptability In The Market.

Petroleum-based goods can only be produced effectively and economically using specialized chemicals and procedures. Chemicals for refinery operations are used to boost productivity and efficiency, lessen the environmental effects of refining, and provide higher-quality products. As a result, the market value for refinery process chemicals is increasing as more goods based on petroleum are used.

To produce petrochemicals like ethylene and propylene, sophisticated refining techniques and catalysts must be used. Plastics, synthetic fabrics, and medicines are just a few of the items made with these substances. In addition to producing lubricating oils, waxes, and asphalt, essential components of the building and automobile industries, refineries also use chemicals.

Trends

Shift Towards High-Value Products And Bio-Based And Renewable Chemicals

Refineries focus on producing higher-value products, such as petrochemicals and specialty chemicals, alongside traditional fuels. This shift has created a demand for specialized refinery process chemicals that enable the production of these complex products.

Catalysts, additives, and separation agents that support the production of petrochemicals like ethylene and propylene are witnessing increased demand.

The market has shifted towards using bio-based and renewable chemicals in refinery processes. This trend is driven by concerns about fossil fuel depletion and the need to reduce the industry’s carbon footprint. Bio-based chemicals offer potential benefits in reducing greenhouse gas emissions and decreasing reliance on non-renewable resources.

Regional Analysis

European Region Accounted Significant Share of the Global Refinery Process Chemicals Market

Europe is anticipated to have the highest share in the forecasted period, according to the most recent prediction for the market for refinery process chemicals. European region covered 32.4% of the market share and dominated the market in 2022. Market trends in the area are driven by expansion in the oil and gas industry in the region.

Rapid economic expansion in the European countries has accelerated urbanization and industrialization. This growth could drive demand for refinery process chemicals. The restructuring of the current refining complexes and new optimization technologies are to blame for the rise in demand for refining catalysts in European countries. Germany mostly imports crude oil from Russia.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Strong Focus On Product Portfolio Expansion Through Various Strategies.

Many businesses are implementing sustainability efforts, such as developing eco-friendly catalysts, recycling schemes for old catalysts, and waste minimization techniques. These projects support both commercial demands for sustainable solutions and environmental aims. Key industry participants in the market for refinery process chemicals are growing their presence in emerging markets.

Key Businesses are spending money on R&D projects to create novel chemicals for refineries that will increase process efficiency, lower emissions, and abide by environmental requirements. The emphasis is on producing sustainable additives, enhancing catalyst performance, and developing refining technologies.

Industry collaboration and collaborations between chemical producers, refineries, and academic institutions are frequent. These partnerships seek to pool resources, produce cutting-edge refinery process chemicals, and combine expertise.

Major Key Players

- BASF SE

- The Dow Chemical Company

- SABIC

- Chevron Phillips Chemical Company

- Clariant

- ExxonMobil Chemical

- Honeywell

- Albemarle Corporation

- Evonik Industries AG

- Arkema Group

- Baker Hughes

- Nalco Champion

- Other key Player

Recent Development

- In January 2023, Baker Hughes Company launched Cordant, an integrated system for performance management. Cordant’s simple, flexible, connected solutions will likely allow customers to analyze performance and planning while driving more efficient and informed decision-making.

- In October 2021, In reaction to significant inflation in the chemical sector, W. R. Grace & Co. announced global price hikes for their fluid catalytic catalysts.

Report Scope

Report Features Description Market Value (2022) US$ 18.6 Bn Forecast Revenue (2032) US$ 26.5 Bn CAGR (2023-2032) 3.7% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered Type (Corrosion Inhibitor, Antifoaming Agent, Catalysts, Demulsifiers, pH Adjusters, Other Types), By Application (Cracking Process, Conversion Process, Blending Process, Other Process), By End-Use Industry(Petroleum Refining, Petrochemicals, Natural Gas Processing, and Other End-Use Industries) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape BASF SE, The Dow Chemical Company, SABIC, Chevron Phillips Chemical Company, Clariant, ExxonMobil Chemical, Honeywell, Albemarle Corporation, Evonik Industries AG, Arkema Group, Baker Hughes, Nalco Champion, and Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Refinery Process Chemicals market?In 2022, the Global Refinery Process Chemicals Market was valued at USD 18.6 Billion, and is expected to reach USD 26.5 Billion in 2032 from 2023 to 2032

What is the projected CAGR at which the Refinery Process Chemicals market is expected to grow at?The Refinery Process Chemicals market is expected to grow at a CAGR of 3.7% (2022-2032).What are the future prospects for the refinery process chemicals market?The market is expected to grow as the global demand for energy continues to rise, and the industry strives to meet environmental goals. Innovations in cleaner technologies and sustainable practices are likely to shape its future.

Refinery Process Chemicals MarketPublished date: Sep 2023add_shopping_cartBuy Now get_appDownload Sample

Refinery Process Chemicals MarketPublished date: Sep 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- BASF SE

- The Dow Chemical Company

- SABIC

- Chevron Phillips Chemical Company

- Clariant

- ExxonMobil Chemical

- Honeywell

- Albemarle Corporation

- Evonik Industries AG

- Arkema Group

- Baker Hughes

- Nalco Champion

- Other key Player