Global Energy Storage Systems Market By Technology (Electrochemical Energy Storage (Lithium-ion, Lead-acid, Nickel-based, Flow Batteries, Others), Mechanical Energy Storage (Pumped Hydro Storage, Compressed Air Energy Storage (CAES), Flywheels), Thermal Energy Storage, Others), By Application (Utility, Commercial And Industrial (Transportation, Critical Infrastructure, Infrastructure And Commercial Buildings, Others), Residential), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 48512

- Number of Pages: 276

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

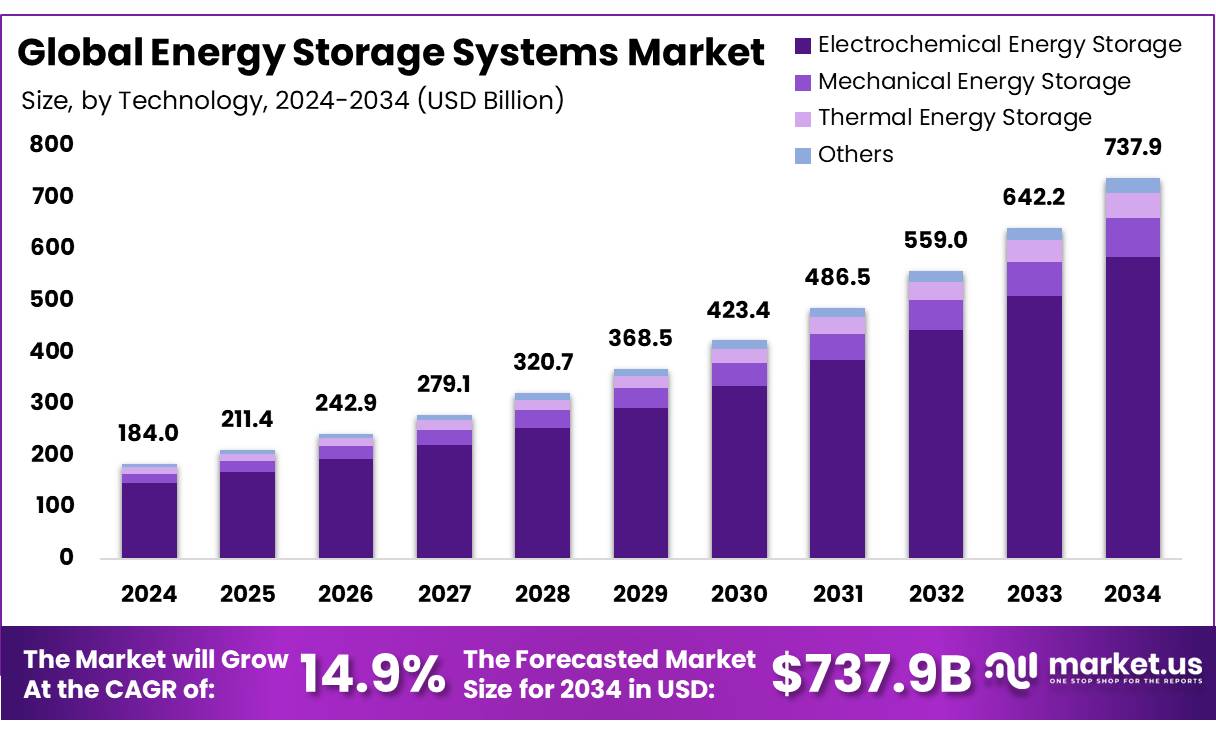

The Global Energy Storage Systems Market size is expected to be worth around USD 738 Billion by 2034, from USD 184 Billion in 2024, growing at a CAGR of 14.9% during the forecast period from 2025 to 2034.

Energy storage systems are technologies specially designed to store energy for later use, playing a critical role in balancing energy supply and demand, enhancing grid stability, and facilitating the integration of intermittent renewable energy sources such as solar and wind power. These systems consist of various types, including batteries, thermal storage, pumped hydro, and mechanical storage, each offering different functionalities and applications. These systems have been a fundamental part of electricity generation, transmission, distribution, and consumption.

Energy storage systems are used by utilities, industries, commercial and residential consumers, electric vehicles, and remote communities to ensure reliable power, manage energy costs, and support renewable energy integration. These systems improve grid stability, provide backup power, and optimize energy use across multiple sectors.

- According to the Federal Network Agency, Germany’s installed battery storage capacity surpassed 6 GW in 2024, supporting both residential and grid-scale renewable integration.

The global energy storage market is witnessing robust growth, driven by rising renewable energy installations, supportive government policies, and the growing need for grid modernization, positioning ESS as a key enabler in the transition toward a sustainable and reliable energy future.

Key Takeaways

- The global energy storage systems market was valued at USD 184 billion in 2024.

- The global energy storage systems market is projected to grow at a CAGR of 14.9% and is estimated to reach USD 738 billion by 2034.

- Among technology, electrochemical energy storage accounted for the largest market share of 79.3%.

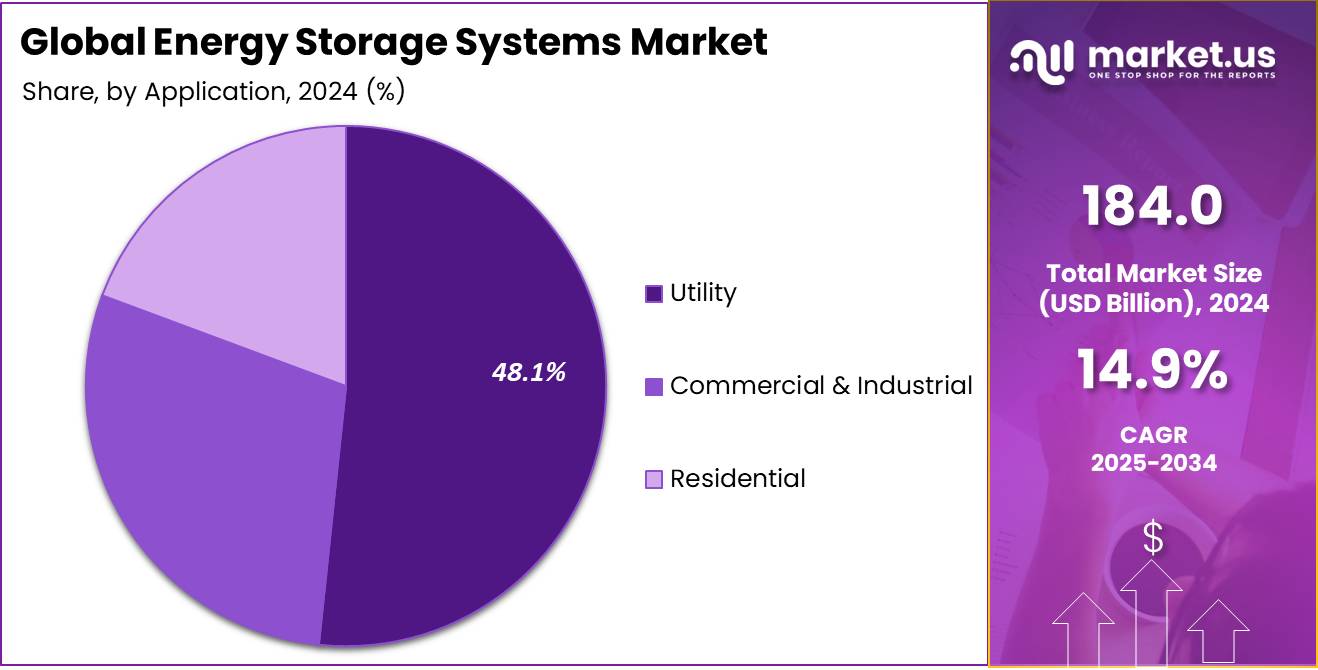

- Among applications, utility accounted for the majority of the market share at 48.1%.

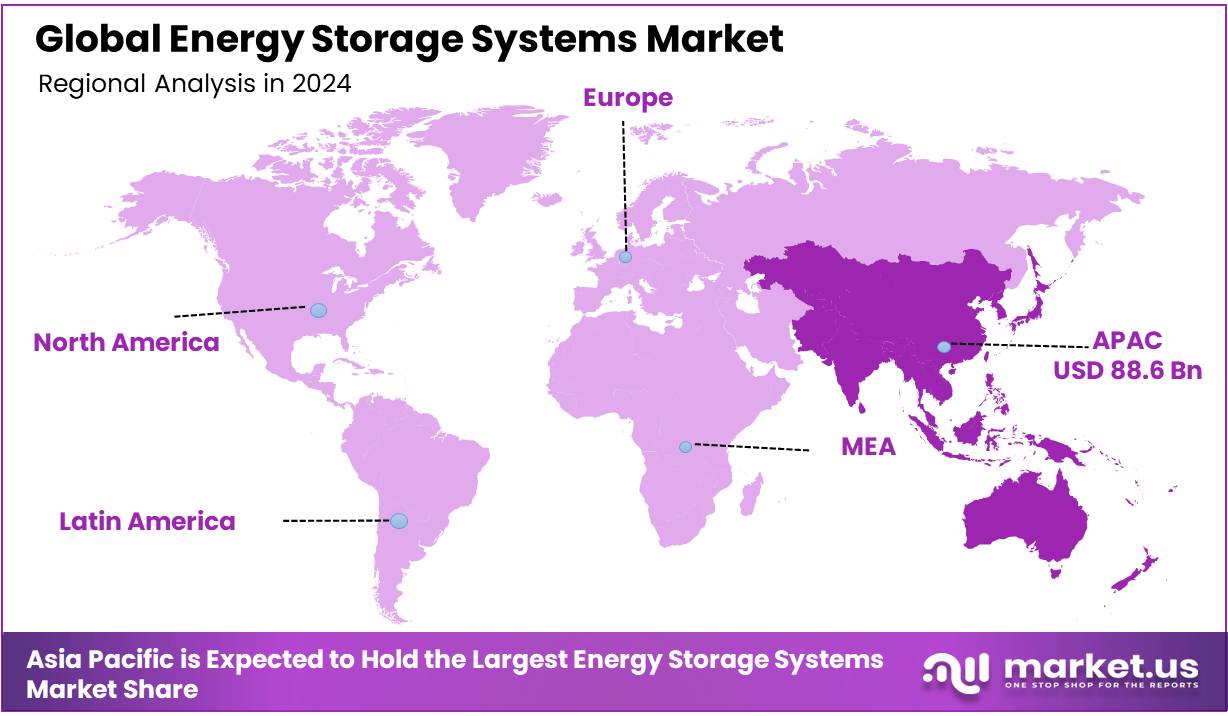

- Asia Pacific is estimated as the largest market for energy storage systems with a share of 48.3% of the market share.

Technology Analysis

The Electrochemical Energy Storage Technology Segment Led the Market with Strong Adoption and Innovation.

The energy storage systems market is segmented based on technology into electrochemical energy storage, mechanical energy storage, thermal energy storage, and others. In 2024, the electrochemical energy storage segment held a significant revenue share of 79.3%. Due to its rapid adoption in battery technology especially lithium-ion batteries due to their high energy density, efficiency, and declining costs. Electrochemical systems are widely used in grid stabilization, renewable integration, and electric vehicles. Continuous advancements in battery technology and rising energy demand across utilities and commercial sectors further support this segment’s growth.

Application Analysis

Utility Segment Dominate Energy Storage Market Share

Based on application, the market is further divided into utility, commercial & industrial, and residential. The predominance of the utility, commanding a substantial 48.1% market share in 2024. due to the increasing integration of renewable energy sources, rising demand for grid stabilization, and growing investments in large-scale energy storage projects by government and private utilities. Utility-scale storage systems are essential for managing intermittent power supply from solar and wind, ensuring energy reliability, and supporting peak load management.

Key Market Segments

By Technology

- Electrochemical Energy Storage

- Lithium-ion

- Lead-acid

- Nickel based

- Flow Batteries

- Others

- Mechanical Energy Storage

- Pumped Hydro Storage

- Compressed Air Energy Storage (CAES)

- Flywheels

- Thermal Energy Storage

- Others

By Application

- Utility

- Commercial & Industrial

- Transportation

- Critical Infrastructure

- Infrastructure & Commercial Buildings

- Others

- Residential

Drivers

Rising Adoption of Renewable Energy

The increasing shift toward renewable energy sources is driving growth in the global energy storage systems market. As industrial, commercial, and residential sectors adopt cleaner energy solutions such as solar, wind, thermal, and hydropower, the demand for reliable and flexible energy storage is rising. The rapid integration of renewable-based power generation like solar, wind, hydro, and biomass into the electricity grid has made energy storage a key component of future power systems. Energy storage systems help capture energy from naturally fluctuating and decentralized sources such as solar panels, wind turbines, and electric vehicles, and integrate them into a flexible, connected network.

- According to an international energy report published in 2023, state that global renewable energy supply from sources such as solar, wind, hydro, geothermal, and ocean increased by over 5%.

Furthermore, another key factor driving the growth of the energy storage systems market is their role in reducing peak electricity demand in renewable power plants. During high-usage periods such as hot summer days or evenings energy storage can supply extra power, easing the load on the grid and lowering the need for costly infrastructure upgrades.

Additionally, energy storage systems enhance grid reliability by providing backup power during outages caused by natural disasters or technical failures. This ensures the uninterrupted operation of essential services. Overall, energy storage improves energy efficiency, strengthens grid stability, and supports the seamless integration of renewable energy into the power system.

- According to a 2017 report by the International Renewable Energy Agency (IRENA), global energy storage capacity must increase from 4.67 TWh in 2017 to between 11.89 and 15.72 TWh by 2030 to accommodate the rising share of renewables in the energy mix. This projected growth underscores the strategic importance of storage systems in enabling large-scale renewable integration, enhancing grid stability, and reducing dependence on fossil fuel-based backup power.

Moreover, governments worldwide are implementing supportive policies and regulatory frameworks to accelerate the deployment of renewable energy and associated storage infrastructure. Furthermore, governments are promoting rural electrification by introducing incentives such as subsidies, tax benefits, and funding programs to encourage investment in green technologies, thereby accelerating the adoption of energy storage systems in underserved regions. As public and private investments in clean energy projects continue to rise, energy storage technologies are poised to become a cornerstone of the modern, decarbonized power grid.

- In March 2023, the European Commission published a series of recommendations on policy actions to support greater deployment of electricity storage in the European Union.

- The United States’ Inflation Reduction Act, passed in August 2022, includes an investment tax credit for stand-alone storage, which is expected to boost the competitiveness of new grid-scale storage projects.

- In December 2022, the Australian Renewable Energy Agency (ARENA) announced funding support for a total of 2 GW/4.2 GWh of grid-scale storage capacity, equipped with grid-forming inverters to provide essential system services that are currently supplied by thermal power plants.

Restraints

Rising Safety Concerns About Battery

The growing safety concern about battery one of the important factors restraining the global energy storage system market growth. As battery technology majorly depends on thermal, chemical, and mechanical energy risks such as thermal runaway, chemical leakage, and explosion hazards, especially in lithium-ion technologies, raises significant issues related to human safety, property damage, and environmental impact. These concerns are further amplified by the complexity of managing battery aging, which affects both operational reliability and long-term costs.

Additionally, Battery safety requires multi-layered system design, including thermal management, electrical protection, and robust enclosure systems. However, incidents involving fire and system failure have heightened regulatory scrutiny, often resulting in stricter safety standards, longer certification timelines, and increased production costs. These factors may limit market expansion, especially in high-density urban and commercial applications.

Opportunity

Growing Cross-Border Energy Storage Projects

The growth of cross-border energy projects is creating major opportunities for the global energy storage systems market. Driven by the need for grid stability, energy security, and seamless renewable integration, countries from worldwide are implementing supportive policies, incentives, and regulations to accelerate the use of energy storage in international power infrastructure. Cross-border storage solutions allow countries to share and balance variable energy sources like wind and solar, enhancing reliable electricity supply and stability across regions.

Additionally, International collaboration is accelerating through initiatives such as the COP29 Global Energy Storage and Grids Pledge, supported by over 65 countries, and the Clean Energy Ministerial’s Supercharging Battery Storage Initiative are encouraging global collaboration to lower storage costs and grow the market. In Europe, projects such as the Danish-German energy storage partnership, the Green Switch project between Austria, Croatia, and Slovenia, and district heating between Austria and Italy are all aimed at boosting renewable use and energy security. Similarly, the U.S. and Canada are working together on clean energy and storage, while China and Russia are investing in storage systems to support electricity trade. These efforts highlight the importance of energy storage as a critical component of large-scale renewable energy integration.

- For instance, the European Union has allocated nearly €1.25 billion in grants through the Connecting Europe Facility to fund 41 cross-border energy infrastructure projects, including major electricity grid and storage initiatives designed to enhance energy market integration and decarbonization across the continent.

- The U.S. and Canada are advancing cross-border clean energy and storage initiatives, supported by companies like Canadian Solar and Solar Bank, alongside joint policies such as the 50% clean power goal by 2025 and participation in the Supercharging Battery Storage Initiative.

- The Clean Energy Ministerial’s Supercharging Battery Storage Initiative, backed by the US, Canada, Australia, and the European Commission, promotes international collaboration to lower battery storage costs, strengthen supply chains, and support large-scale renewable integration and cross-border energy flows.

Trends

Integration of energy storage system into virtual power plants

The integration of energy storage systems into Virtual Power Plants (VPPs) is becoming a major trend in the global energy storage market. VPPs bring together distributed energy resources (DERs) like solar panels, wind turbines, batteries, and electric vehicles, using smart technology to manage them as one coordinated system.

Unlike traditional power plants, VPPs don’t rely on a single physical location—they use digital platforms to control and balance energy from different sources spread across many areas. Energy storage is a key part of this system, helping to manage the ups and downs of renewable energy by storing extra power when it’s available and supplying it when demand is high. This makes the grid more stable and responsive.

As more renewable energy systems are installed around the world, energy storage-backed VPPs are gaining momentum, supported by advances in technology and government policies. This trend is playing a big role in making renewable energy more reliable and scalable for the future.

Geopolitical Impact Analysis

Geopolitical Impact of US-China-EU Trade Disputes On the Disrupt Supply Chain and Production of Energy Storage System.

Recent geopolitical developments, particularly the ongoing trade tensions among the United States, China, and the European Union, have significantly disrupted the global energy storage market by affecting supply chains and production capabilities. The imposition of tariffs during the Trump administration has notably increased the cost of imported batteries and critical materials, especially those sourced from China. China currently supplies over 90% of the lithium-ion battery cells for U.S. energy storage projects, making the sector highly vulnerable to such policy changes.

As a global leader in battery manufacturing, China plays a dominant role in the clean energy supply chain, particularly in lithium-ion battery production. In response to U.S. trade restrictions, China introduced its own export controls and licensing requirements on critical raw materials used in battery and energy storage technologies. In April 2025, China escalated these measures by restricting exports of seven rare earth elements and specialized magnets. These materials are essential for a wide range of applications, including electric vehicle batteries, renewable energy systems, and advanced defense technologies.

- For instance, after the United States imposed tariffs as high as 145% on Chinese battery imports, China retaliated with tariffs of up to 125% on select U.S. goods, including those in the clean energy sector. This tariff exchange between two major economic powers has led to widespread disruptions across global supply chains.

These tariff wars between two global power countries have disrupted global supply chains, driven up demand for non-Chinese battery suppliers, and introduced widespread price volatility. U.S. developers, in search of alternative sources, are now facing intensified competition, leading to higher prices and extended lead times in international markets. Overall, this geopolitical tension is impacting energy storage project development and investment worldwide. However, it is also driving strategic shifts, promoting countries to accelerate domestic battery manufacturing and diversify supply chains to reduce dependency on imports vulnerable to international trade policies.

Regional Analysis

Asia-Pacific region Emerges as a Global Hub for Energy Storage System Market Growth and Innovation.

In 2024, Asia Pacific dominated the global energy storage systems market, accounting for 48.3% of the total market share, driven by rapid renewable energy developments, rising electricity demand, and increasing investments in grid modernization. Countries across the region especially China, Japan, South Korea, India, and Australia are prioritizing energy storage to enhance grid reliability, support peak load management, and integrate variable renewable sources such as solar and wind.

China leads the region with large-scale government-supportive projects with a strong industrial battery manufacturing base, additionally, Japan and South Korea are investing heavily in advanced battery technologies and smart grid infrastructure. In emerging markets like India and Southeast Asia, supportive policies, rural electrification goals, and falling battery costs are accelerating adoption. As governments from these regions continue to introduce regulatory frameworks and financial incentives, and as technology matures, the Asia-Pacific region is poised to become a global hub for energy storage development, both in scale and innovation.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Key Players in the Global Energy Storage System Market Maintain Dominance through Innovation and Expansion

Leading companies in the global energy storage market such as BYD, Siemens AG, Samsung SDI, Panasonic, LG Energy Solution Ltd, Mitsubishi Heavy Industries, Ltd., and Voith GmbH & Co. KGaA—are actively shaping the industry landscape through innovation, global expansion, and strategic collaborations. These firms are at the forefront of market growth, innovating advanced battery technologies, forming strategic partnerships, and implementing large-scale project deployments to maintain their dominance in this rapidly evolving sector.

Companies like BYD are making significant R&D investments, focusing on developing next-generation battery chemistries with improved safety, energy density, and cost-efficiency. The BYD Blade Battery is a key example of this innovation, enhancing both product performance and safety standards. Companies forming Strategic alliances with utilities, renewable energy developers, and governments are central to these companies’ growth strategies.

- For instance, BYD’s agreement with Spain’s Grenergy for the large-scale “Oasis de Atacama” project in Chile, along with Fluence’s multiple utility-scale deployments, highlights collaborations that are driving global energy storage adoption.

The Major Players in The Industry

- General Electric

- Siemens AG

- Mitsubishi Heavy Industries, Ltd.

- BYD Co. Ltd.

- Panasonic Corporation

- LG Energy Solution Ltd

- Andritz AG

- Samsung SDI Co., Ltd.

- Ecoult

- Langley Holdings plc

- Saft

- BrightSource Energy Inc

- Abengoa SA

- Baltimore Aircoil Company

- Voith GmbH & Co. KGaA

- Other Key Players

Recent Development

- In March 2025 – BYD Energy Storage launched its new Battery-Box LV5.0+ and Power-Box hybrid inverters at Solar & Storage Live Africa 2025, offering improved performance, higher power output, and enhanced safety features for residential energy storage, with a focus on supporting Africa’s green energy transition.

- In May 2024 – Mitsubishi Electric and Musashi Energy Solutions signed a co-development agreement to create advanced energy storage modules and battery management systems for railways, aiming to support carbon neutrality through innovative hybrid super capacitor technology. The collaboration targets both domestic and global railway markets with solutions for regenerative energy use and eco-friendly train operations.

Report Scope

Report Features Description Market Value (2024) USD 184 Bn Forecast Revenue (2034) USD 738 Bn CAGR (2025-2034) 5.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Technology (Electrochemical Energy Storage (Lithium-ion, Lead-acid, Nickel-based, Flow Batteries, Others), Mechanical Energy Storage (Pumped Hydro Storage, Compressed Air Energy Storage (CAES), Flywheels), Thermal Energy Storage, Others), By Application (Utility, Commercial & Industrial (Transportation, Critical Infrastructure, Infrastructure & Commercial Buildings, Others), residential), Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC- China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- GCC, South Africa, & Rest of MEA Competitive Landscape General Electric, Siemens AG, Mitsubishi Heavy Industries, Ltd., BYD Co. Ltd., Panasonic Corporation, LG Energy Solution Ltd, Andritz AG, Samsung SDI Co., Ltd., Ecoult , Langley Holdings plc, Saft, BrightSource Energy Inc, Abengoa SA, Baltimore Aircoil Company, Voith GmbH & Co. KGaA, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Energy Storage Systems MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Energy Storage Systems MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- General Electric

- Siemens AG

- Mitsubishi Heavy Industries, Ltd.

- BYD Co. Ltd.

- Panasonic Corporation

- LG Energy Solution Ltd

- Andritz AG

- Samsung SDI Co., Ltd.

- Ecoult

- Langley Holdings plc

- Saft

- BrightSource Energy Inc

- Abengoa SA

- Baltimore Aircoil Company

- Voith GmbH & Co. KGaA

- Other Key Players