Global Coke Oven Batteries Market Size, Share, And Business Benefits By Type (Top Charging, Stamp Charging), By Coke Oven Battery Type (Recovery Coke Oven Batteries, Non-Recovery Coke Oven Batteries), By Coke Type (High-Volatile, Medium-Volatile, Low-Volatile), By Battery Configuration (Horizontal, Vertical, Semi-Vertical), By Application (Metallurgical, Power Generation, Chemical Production), By End Use (Steel Manufacturing, Aluminum Production, Chemical Industry, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: February 2025

- Report ID: 141203

- Number of Pages: 233

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Type Analysis

- By Coke Oven Battery Type Analysis

- By Coke Type Analysis

- By Battery Configuration Analysis

- By Application Analysis

- By End Use Analysis

- Key Market Segments

- Driving Factors

- Restraining Factors

- Growth Opportunity

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

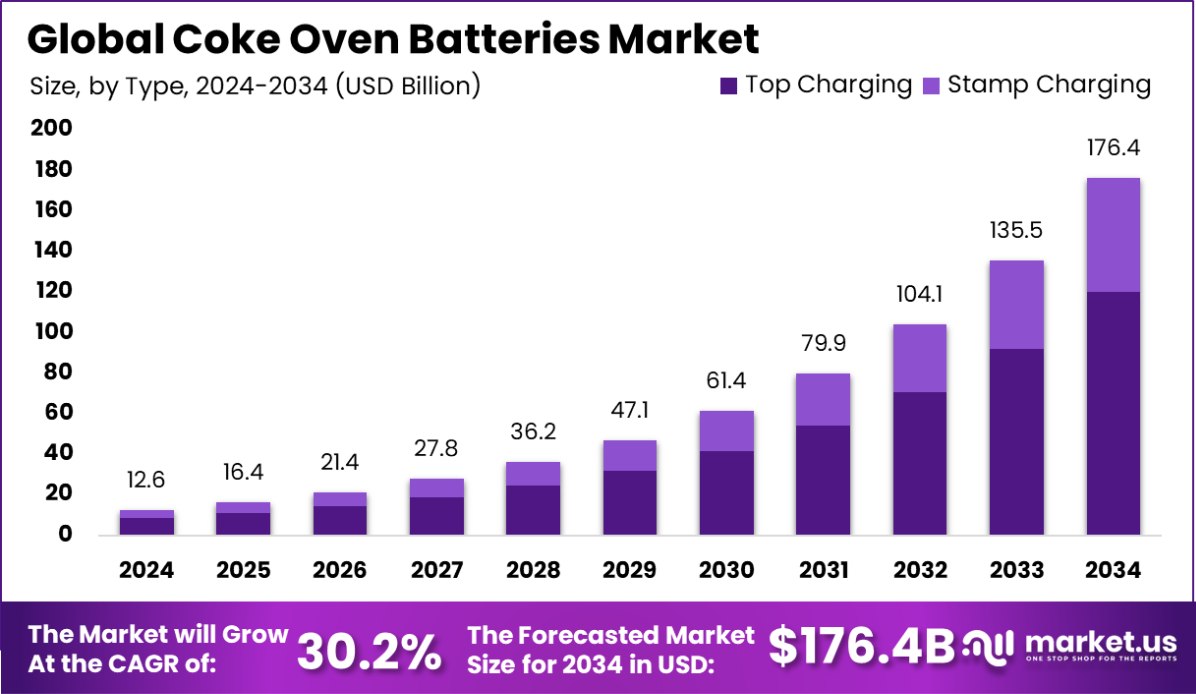

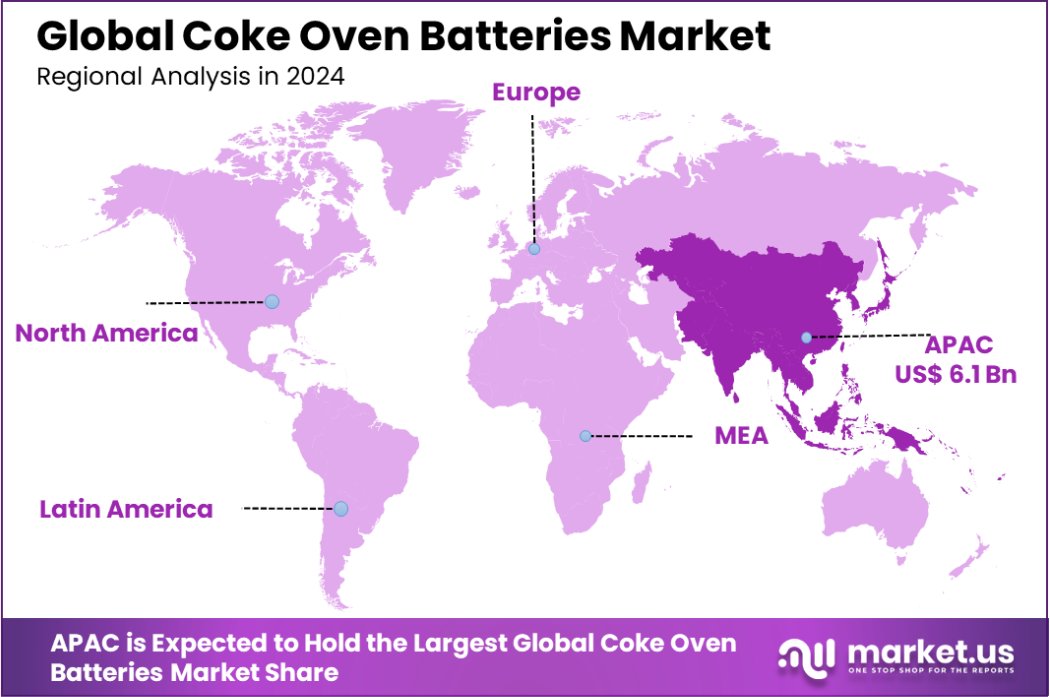

Global Coke Oven Batteries Market is expected to be worth around USD 176.6 billion by 2034, up from USD 12.6 billion in 2024, and grow at a CAGR of 30.2% from 2025 to 2034. Asia-Pacific dominates Coke Oven Batteries Market with 48.7%, USD 6.1 Bn.

Coke oven batteries are industrial systems used in the production of coke, which is a key raw material in the steel manufacturing process. These batteries consist of multiple ovens that heat coal in the absence of air to produce coke. Coke is primarily used as a fuel and reducing agent in blast furnaces for the extraction of iron from iron ore. The design of coke oven batteries has evolved to optimize efficiency, reduce emissions, and enhance safety.

The growth of the coke oven batteries market is mainly driven by the rising demand for steel, which is essential for infrastructure, automotive, and construction sectors. As countries industrialize and urbanize, the need for steel increases, subsequently boosting the demand for coke in the manufacturing process. Additionally, technological advancements in coke oven design, including automation and energy-efficient processes, contribute to market growth.

Demand for coke oven batteries is also linked to the ongoing focus on reducing environmental impact. As steel producers seek to lower emissions, there is increasing interest in cleaner technologies and alternative materials, spurring innovation in the coke production process. Demand is particularly high in emerging economies, where industrial growth is rapidly accelerating.

Opportunities within the market include investments in improving battery efficiency, reducing operational costs, and integrating renewable energy sources into coke production. As environmental regulations become stricter, the development of cleaner technologies presents significant opportunities for market players to capitalize on.

The Coke Oven Batteries Market is driven by production capacities, with a typical 48-oven battery producing around 1.5 million tons of Coke annually. Modern coke ovens stand at 7.6m in height and 20m in length, optimizing production efficiency. Over 90% of global coke consumption is dedicated to steel manufacturing, highlighting the sector’s significant demand. Additionally, coke oven plants generate around 170,000 Nm3/h of raw gas, which is supplied to gas refinery plants, further contributing to market growth.

Key Takeaways

- Global Coke Oven Batteries Market is expected to be worth around USD 176.6 billion by 2034, up from USD 12.6 billion in 2024, and grow at a CAGR of 30.2% from 2025 to 2034.

- The Coke Oven Batteries market is dominated by top charging, accounting for 68.4% of the market share.

- Recovery coke oven batteries lead the market, representing 76.3% of the total coke oven battery demand.

- High-volatile coke, used in coke oven batteries, makes up 49.3% of the global market share.

- Horizontal battery configuration is preferred, accounting for 56.4% of coke oven batteries in the industry.

- Metallurgical applications dominate the market, representing 57.5% of total coke oven battery usage globally.

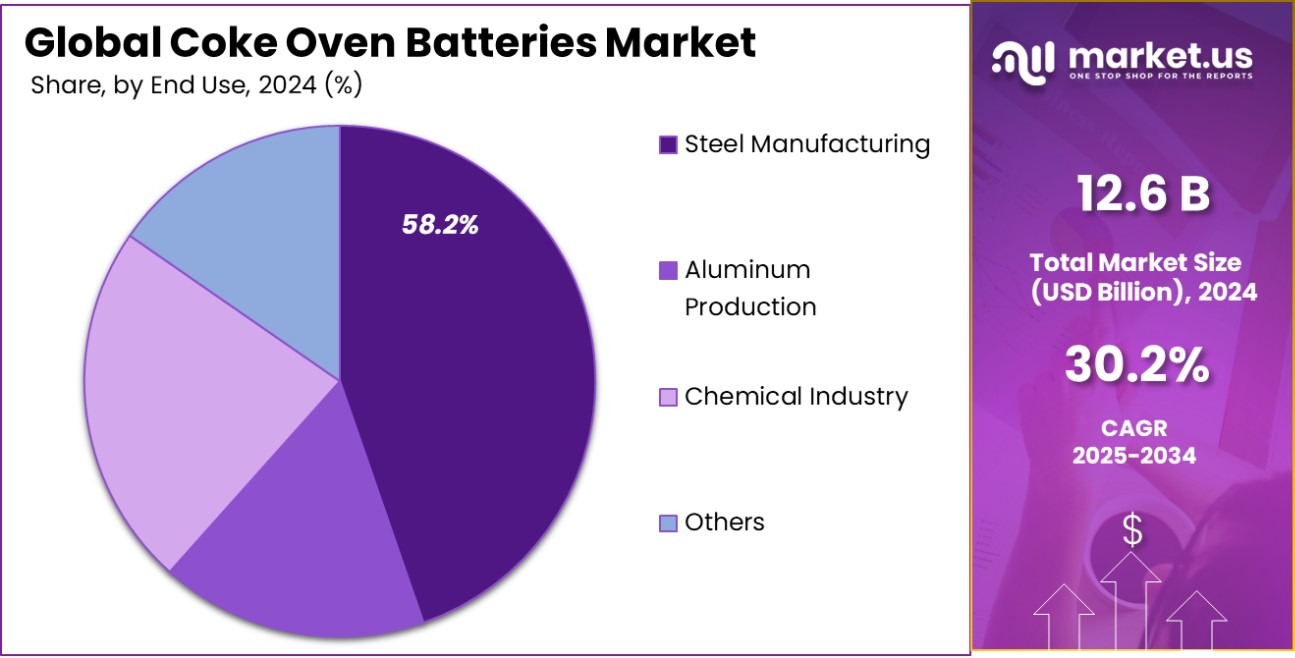

- Steel manufacturing remains the largest end-use sector for coke oven batteries, comprising 58.2% of market demand.

- In 2024, Asia-Pacific held 48.7% of the Coke Oven Batteries Market, valued at USD 6.1 Bn.

By Type Analysis

The Coke Oven Batteries Market is driven by top charging, representing 68.4% share.

In 2024, Top Charging held a dominant market position in the By Type segment of the Coke Oven Batteries Market, with a 68.4% share. Top charging is the most widely used method for coke production, where coal is loaded into the ovens from the top, and the ovens are heated in the absence of air.

This method remains the preferred choice due to its cost-effectiveness, high production capacity, and the ability to maintain consistent coke quality. The widespread adoption of top charging technologies by major steel manufacturers has significantly contributed to its dominant market share.

The demand for top charging systems continues to be driven by the increasing need for steel in various sectors, particularly infrastructure, construction, and automotive industries. Additionally, technological advancements in top charging systems, such as automation and energy-efficient designs, have further cemented its position in the market. The simplicity and scalability of top charging processes make them ideal for large-scale industrial operations, further reinforcing their widespread usage.

Given the continuous industrialization in emerging economies, the dominance of top charging is expected to persist, with growth opportunities arising from the development of more environmentally friendly and cost-efficient technologies within this segment.

By Coke Oven Battery Type Analysis

Recovery coke oven batteries dominate the market, accounting for 76.3% of sales.

In 2024, Recovery Coke Oven Batteries held a dominant market position in the By Coke Oven Battery Type segment of the Coke Oven Batteries Market, with a 76.3% share. Recovery coke oven batteries are designed to recover valuable by-products, such as coke oven gas, tar, and other chemicals, produced during the cooking process.

These batteries are highly efficient and integral to modern steel manufacturing due to their ability to generate energy and recover waste, contributing to both environmental sustainability and cost savings.

The widespread adoption of recovery coke oven batteries is driven by the increasing demand for energy efficiency and the need for sustainable manufacturing processes. Steel producers are prioritizing technologies that reduce their environmental footprint, and recovery coke oven batteries align with these goals by minimizing waste and enhancing resource utilization. The ability to capture and utilize by-products for energy generation adds to the economic appeal of recovery coke ovens.

In markets with stringent environmental regulations, particularly in regions like Europe and North America, recovery coke ovens are increasingly preferred. Their high operational efficiency, combined with the ability to meet environmental standards, positions them as the dominant choice for new installations and upgrades in the coke production process.

By Coke Type Analysis

High-volatile coke types make up 49.3% of the overall coke market share.

In 2024, High-Volatile held a dominant market position in the By-c Coke Type segment of the Coke Oven Batteries Market, with a 49.3% share. High-volatile coal, which contains a higher percentage of volatile matter, is a preferred raw material in coke production due to its relatively lower cost and ability to produce coke with desirable properties.

The higher volatile content facilitates the coking process, ensuring a better yield of coke in a shorter time compared to lower volatile coals. This has made high-volatile coke a popular choice in the steel industry, where cost-efficiency and quality are key drivers.

The preference for high-volatile coke is largely driven by its availability and cost-effectiveness, particularly in emerging markets where coal prices play a significant role in the overall cost structure of steel production. Additionally, high-volatile coal is easier to process, which contributes to a more streamlined operation in coke oven batteries.

As steel demand continues to rise globally, especially in infrastructure and construction sectors, high-volatile coke is expected to maintain its dominant market share. The ability to scale up production efficiently and the relatively low operational cost further strengthen its position in the market, offering opportunities for growth in regions with expanding steel production capacities.

By Battery Configuration Analysis

Horizontal battery configurations hold a significant share of 56.4% in the market.

In 2024, Horizontal held a dominant market position in the By Battery Configuration segment of the Coke Oven Batteries Market, with a 56.4% share. Horizontal coke oven batteries are the most widely used configuration in the industry, where the ovens are arranged in a horizontal alignment.

This configuration is preferred due to its operational efficiency, ease of maintenance, and ability to accommodate larger volumes of coal, making it ideal for large-scale steel production. The design of horizontal coke ovens ensures uniform heating, which results in higher-quality coke output.

The demand for horizontal coke oven batteries is largely driven by the increasing need for steel in global industrial sectors, particularly in construction, automotive, and infrastructure. Horizontal ovens are favored for their ability to process large quantities of coal while maintaining stable operating conditions, which is crucial for meeting the growing demand for coke.

The market for horizontal coke oven batteries is expected to continue its dominance as steel production scales up in emerging markets. Their efficiency, cost-effectiveness, and operational reliability offer strong growth prospects. Additionally, with ongoing advancements in battery design and environmental standards, horizontal coke ovens are well-positioned to maintain their leading share in the market for the foreseeable future.

By Application Analysis

Metallurgical applications remain the largest use case, holding 57.5% market share.

In 2024, Metallurgical held a dominant market position in the By Application segment of the Coke Oven Batteries Market, with a 57.5% share. Metallurgical coke is a crucial component in the production of steel, serving as both a fuel and a reducing agent in blast furnaces.

The high demand for metallurgical coke is driven by its vital role in the steelmaking process, where it helps in the reduction of iron ore to produce molten iron, which is then further processed into steel. This application accounts for the largest share due to the growing global demand for steel in various industries, including construction, automotive, and infrastructure development.

The dominance of metallurgical coke in the market is further supported by its effectiveness in providing the necessary properties for efficient furnace operation, such as high carbon content and low impurities. As the demand for steel continues to rise, particularly in emerging economies, the need for metallurgical coke is expected to remain robust, reinforcing its significant market share.

Looking ahead, opportunities in the metallurgical segment lie in improving coke quality and production efficiency, along with integrating more sustainable practices to meet the increasing environmental standards in steel production. As the market grows, metallurgical coke will continue to be a key driver in the coke oven batteries sector.

By End Use Analysis

Steel manufacturing accounts for 58.2% of the overall demand for coke oven batteries.

In 2024, Manufacturing held a dominant market position in the By End Use segment of the Coke Oven Batteries Market, with a 58.2% share. The manufacturing sector, particularly steel production, is the largest consumer of coke oven batteries, as coke is a critical raw material in the steelmaking process.

The use of coke in blast furnaces is essential for producing high-quality steel, which is in high demand across industries such as construction, automotive, and infrastructure. This has driven significant growth in the market share for manufacturing as the primary end-use segment.

The dominance of the manufacturing sector is largely attributed to the continuous industrialization and urbanization in emerging economies, where steel consumption is rapidly increasing.

Additionally, ongoing advancements in manufacturing processes, such as automation and energy efficiency improvements, have further supported the widespread adoption of coke oven batteries. As these processes evolve, the demand for high-quality coke remains strong, ensuring the continued importance of coke oven batteries in the manufacturing industry.

Looking ahead, the manufacturing sector is expected to maintain its lead in the market, driven by sustained demand for steel and other metal products. Opportunities for growth in this segment include investments in cleaner, more sustainable coke production technologies to meet both economic and environmental objectives.

Key Market Segments

By Type

- Top Charging

- Stamp Charging

By Coke Oven Battery Type

- Recovery Coke Oven Batteries

- Non-Recovery Coke Oven Batteries

By Coke Type

- High-Volatile

- Medium-Volatile

- Low-Volatile

By Battery Configuration

- Horizontal

- Vertical

- Semi-Vertical

By Application

- Metallurgical

- Power Generation

- Chemical Production

By End Use

- Steel Manufacturing

- Aluminum Production

- Chemical Industry

- Others

Driving Factors

Rising Steel Demand Drives Coke Oven Batteries Market

One of the primary driving factors for the growth of the Coke Oven Batteries Market is the rising demand for steel, which is essential for industries such as construction, automotive, infrastructure, and manufacturing.

As global urbanization and industrialization accelerate, particularly in emerging economies, the need for steel production continues to rise. Steel is a key material for building infrastructure, vehicles, and machinery, which directly impacts the demand for coke in blast furnaces. Coke oven batteries are integral in producing coke, which serves as both fuel and a reducing agent in the iron and steelmaking process.

With the continuous growth in steel demand, particularly in Asia-Pacific and other developing regions, the market for coke oven batteries is expected to experience sustained growth, driven by the increasing need for steel production and efficient coke production processes.

Restraining Factors

Environmental Regulations Limit Coke Oven Batteries Growth

A key restraining factor for the Coke Oven Batteries Market is the growing pressure from environmental regulations. Coke production is a significant source of pollution, including air emissions and the release of toxic by-products, such as sulfur and benzene. Governments and regulatory bodies are increasingly imposing stricter environmental standards to reduce industrial emissions and promote sustainable practices.

As a result, coke oven operators are faced with higher compliance costs and the need for investments in cleaner technologies. These regulations can limit the expansion of new coke oven batteries or increase the operational costs of existing ones.

Moreover, industries are being pushed to adopt greener alternatives to traditional Coke, further restricting market growth. While environmental measures are necessary, they pose challenges for companies seeking to balance production efficiency and sustainability.

Growth Opportunity

Technological Advancements Create Growth Opportunities in the Market

A significant growth opportunity for the Coke Oven Batteries Market lies in the continued advancement of technology aimed at improving operational efficiency and reducing environmental impact.

Innovations such as automation, energy recovery systems, and the development of cleaner coke production processes are helping to enhance the performance of coke ovens. New technologies can increase coke yield, reduce energy consumption, and minimize harmful emissions, addressing both cost efficiency and sustainability concerns.

As steel producers seek ways to meet stricter environmental regulations while maintaining production capacity, adopting these advanced technologies will become crucial. Moreover, the development of alternative and more eco-friendly raw materials for coke production could offer further opportunities for growth in the market.

Latest Trends

Shift Towards Sustainable and Green Coke Production

A key trend shaping the Coke Oven Batteries Market is the increasing focus on sustainability and green Coke production. As environmental concerns grow globally, steel manufacturers and coke producers are increasingly adopting cleaner technologies to minimize the environmental impact of coke production.

This includes the implementation of energy-efficient systems, waste heat recovery, and the reduction of harmful emissions during the cooking process. Additionally, there is rising interest in exploring alternative, more sustainable raw materials for coke production, such as biomass or renewable energy sources, to reduce reliance on traditional coal-based methods.

With stricter environmental regulations and a global push for carbon neutrality, these green technologies are becoming essential in ensuring the long-term growth of the coke oven batteries market while aligning with industry sustainability goals.

Regional Analysis

The Asia-Pacific region holds 48.7% of the Coke Oven Batteries Market, valued at USD 6.1 billion.

In 2024, Asia-Pacific dominated the Coke Oven Batteries Market, holding a significant share of 48.7%, valued at USD 6.1 billion. The region’s dominance is driven by robust industrial growth, particularly in countries like China, India, and Japan, where steel production is a major economic contributor. With rapid urbanization and infrastructure development, the demand for steel, and consequently coke, remains strong, further supporting market growth in Asia-Pacific.

North America follows as a notable player in the market, benefiting from advanced technologies in coke oven production and strict environmental regulations promoting cleaner technologies. The U.S. is a key contributor to this market, with a focus on improving energy efficiency and reducing emissions in coke production.

Europe also holds a substantial share, driven by high industrialization levels and stringent environmental policies that push for cleaner, more sustainable coke production methods. Countries like Germany and Russia are significant consumers of coke for steel production, leading the market in Europe.

The Middle East & Africa and Latin America are relatively smaller markets for coke oven batteries, but they are showing gradual growth. The demand in these regions is primarily driven by expanding infrastructure and industrial sectors, with countries like Brazil and Saudi Arabia contributing to market development.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, the global Coke Oven Batteries Market is characterized by a competitive landscape with several key players driving innovation and market growth. ArcelorMittal and POSCO continue to lead the market, supported by their extensive steel production capabilities and commitment to sustainability.

Both companies are investing in advanced coke production technologies to meet the growing demand for steel while minimizing environmental impact. Their focus on energy efficiency, emissions reduction, and sustainable production practices positions them as leaders in the market.

China National Coal Group and Shaanxi Coal and Chemical Industry represent strong players in the Asia-Pacific region, where demand for coke is high due to rapid industrialization. These companies benefit from their proximity to major steel-producing countries and are pivotal in supplying coke to the growing steel manufacturing sector in China and surrounding areas.

JSW Steel, JFE Steel Corporation, and Nippon Steel Corporation are key players in the Asia-Pacific and global markets, leveraging their large-scale steel production facilities and advanced coke oven battery technologies. Their market strategies often focus on upgrading existing coke oven systems and implementing energy-efficient solutions to meet stricter environmental regulations.

Severstal and CSN are influential in Europe and Latin America, where they focus on improving coke quality and production processes to meet the region’s stringent environmental standards. Additionally, Hindalco Industries Limited and Graycor International Inc. play important roles in providing engineering, procurement, and construction (EPC) services, assisting in the development and optimization of coke oven battery systems.

Top Key Players in the Market

- ArcelorMittal

- China National Coal Group

- CSN

- Danieli Corus

- GIPROKOKS

- Graycor International Inc.

- Heavy Engineering Corporation Ltd.

- Hindalco Industries Limited

- Ingesteam Power Technology Industry

- ISGEC

- JFE Steel Corporation

- JSW Steel

- Nippon Steel Corporation

- Paul Wruth

- POSCO

- Severstal

- Shaanxi Coal and Chemical Industry

- Shougang Group

- Sinosteel Equipment & Engineering

- Tata Steel

- TENOVA

- Thyssenkrupp AG

- United States Steel Corporation

- Vizag

- Wuhan Engineering

- Yitai Coal Group

Recent Developments

- In July 2024, SMS group and POSCO celebrated the successful commissioning of a new coke-making complex at POSCO’s Gwangyang Works. The complex includes two coke oven batteries (COB A and COB B) with 48 ovens each, designed to produce 1.5 million tons of coke annually.

- In 2024, Nippon Steel is investing 213 billion yen to strengthen its manufacturing system for high-end electrical steel sheets, including improvements to coke oven batteries. This investment aims to meet the increasing demand for high-efficiency electrical steel sheets used in electric vehicles and transformers.

Report Scope

Report Features Description Market Value (2024) USD 12.6 Billion Forecast Revenue (2034) USD 176.6 Billion CAGR (2025-2034) 30.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Top Charging, Stamp Charging), By Coke Oven Battery Type (Recovery Coke Oven Batteries, Non-Recovery Coke Oven Batteries), By Coke Type (High-Volatile, Medium-Volatile, Low-Volatile), By Battery Configuration (Horizontal, Vertical, Semi-Vertical), By Application (Metallurgical, Power Generation, Chemical Production), By End Use (Steel Manufacturing, Aluminum Production, Chemical Industry, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ArcelorMittal, China National Coal Group, CSN, Danieli Corus, GIPROKOKS, Graycor International Inc., Heavy Engineering Corporation Ltd., Hindalco Industries Limited, Ingesteam Power Technology Industry, ISGEC, JFE Steel Corporation, JSW Steel, Nippon Steel Corporation, Paul Wruth, POSCO, Severstal, Shaanxi Coal and Chemical Industry, Shougang Group, Sinosteel Equipment & Engineering, Tata Steel, TENOVA, Thyssenkrupp AG, United States Steel Corporation, Vizag, Wuhan Engineering, Yitai Coal Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Coke Oven Batteries MarketPublished date: February 2025add_shopping_cartBuy Now get_appDownload Sample

Coke Oven Batteries MarketPublished date: February 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- ArcelorMittal

- China National Coal Group

- CSN

- Danieli Corus

- GIPROKOKS

- Graycor International Inc.

- Heavy Engineering Corporation Ltd.

- Hindalco Industries Limited

- Ingesteam Power Technology Industry

- ISGEC

- JFE Steel Corporation

- JSW Steel

- Nippon Steel Corporation

- Paul Wruth

- POSCO

- Severstal

- Shaanxi Coal and Chemical Industry

- Shougang Group

- Sinosteel Equipment & Engineering

- Tata Steel

- TENOVA

- Thyssenkrupp AG

- United States Steel Corporation

- Vizag

- Wuhan Engineering

- Yitai Coal Group