Global Oil and Gas Custody Metering System Market Size, Share, And Business Benefits By Flow Meter (Coriolis, Ultrasonic, Vortex, Thermal, Differential Pressure, Positive Displacement, Others), By Type (Liquid Custody Metering Systems, Coriolis Meters, Turbine Meters, Gas Custody Metering Systems, Ultrasonic Meters, Vortex Flow Meters), By Application (Pipeline Monitoring, Fiscal Metering), By Location (Offshore, Onshore), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: February 2025

- Report ID: 140972

- Number of Pages: 269

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

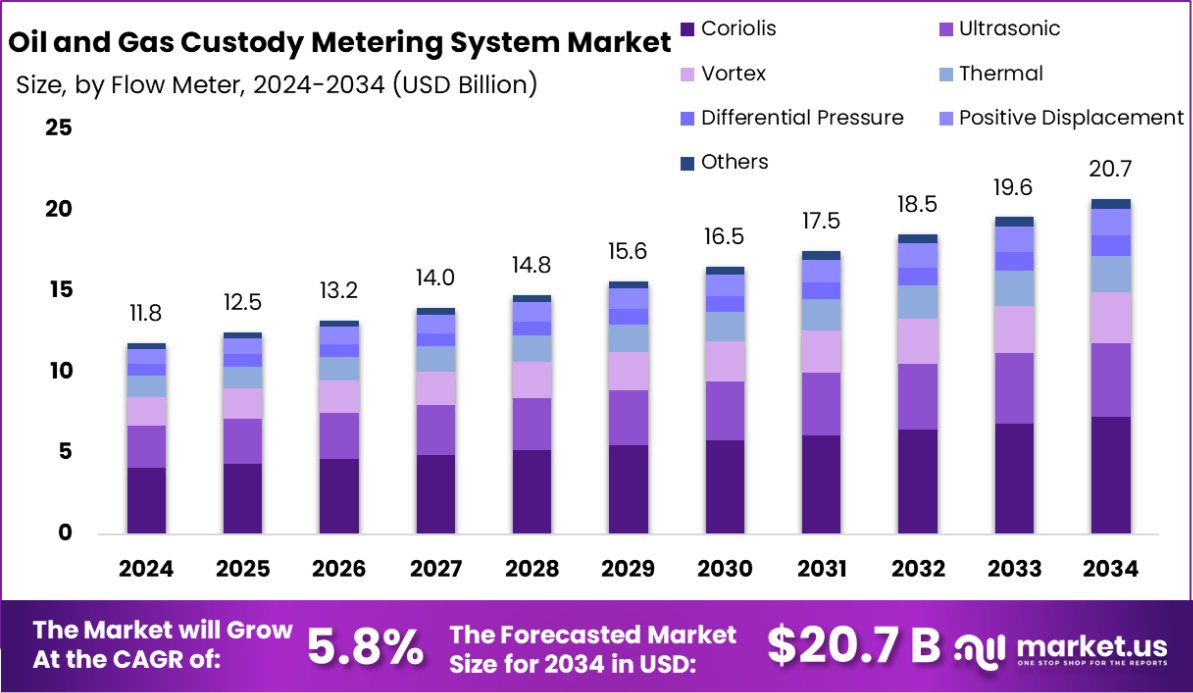

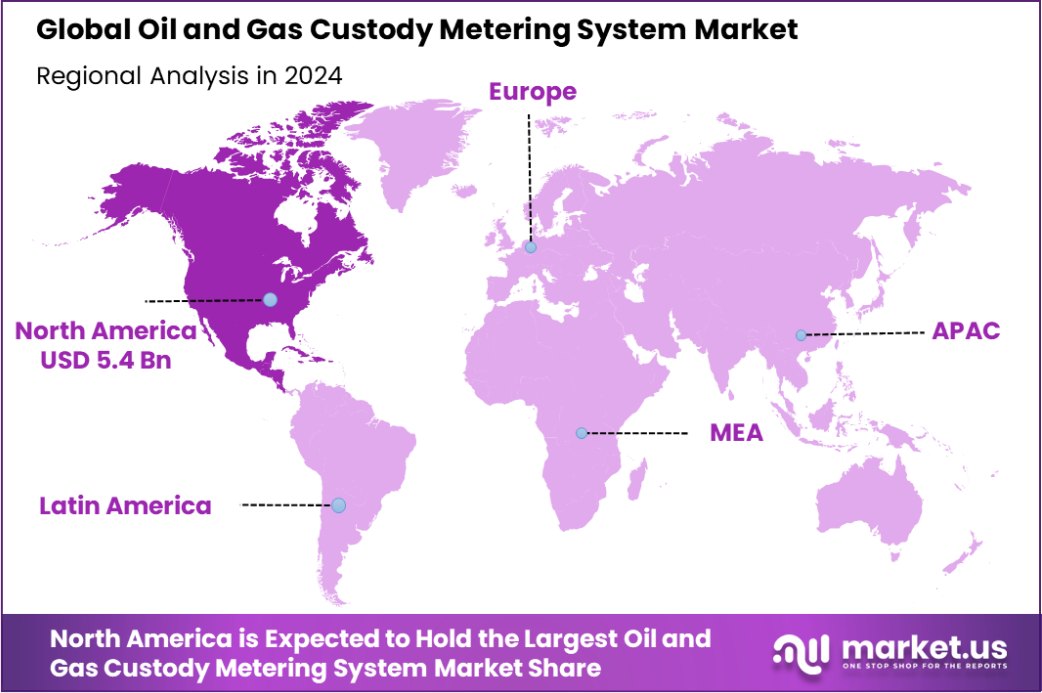

Global Oil and Gas Custody Metering System Market is expected to be worth around USD 20.7 Billion by 2034, up from USD 11.8 Billion in 2024, and grow at a CAGR of 5.8% from 2025 to 2034.North America dominates the Oil and Gas Custody Metering Market with 46.4%, USD 5.4 Bn.

Oil and Gas Custody Metering System refers to the technology used to measure and monitor the transfer of oil or gas from one party to another, ensuring accuracy, transparency, and regulatory compliance. These systems are crucial for determining the quantity and quality of the product being transferred, typically at custody transfer points such as pipelines, terminals, and refineries. They play a vital role in preventing disputes between buyers and sellers over product volumes and are heavily regulated to ensure fairness.

The Oil and Gas Custody Metering System Market is growing due to increasing global energy demand and a rise in oil and gas exploration activities. These systems are essential for accurate billing and compliance with environmental standards, and they help to reduce the risk of fraud. As more countries focus on regulatory frameworks for energy trade, the demand for these systems is expanding rapidly.

Growth factors for this market include the increasing need for precise measurement technologies to support trade transparency, as well as the growing investments in oil and gas infrastructure. Furthermore, advancements in digital metering and smart sensors are making these systems more efficient and reliable.

The demand for custody metering systems is primarily driven by the booming energy sector and the necessity for regulatory compliance across regions. With stricter environmental policies, accurate measurement systems are crucial for businesses to avoid penalties and ensure sustainability.

Opportunities lie in the development of next-generation custody metering systems equipped with real-time data analytics and IoT technology. These systems can enable better decision-making, increase operational efficiency, and enhance asset management, driving significant growth in the market.

In 2020, Halliburton sold its flow meter business, Halliburton Measurement Systems (HMS), to NuFlo Technologies, Inc. for approximately $33 million in cash, marking a shift in the oil and gas custody metering sector.

Additionally, GMR Smart Electricity Distribution Pvt Ltd is aiming to raise $100-150 million for smart meter rollouts and new tenders, showcasing the growing interest in advanced metering technologies across industries.

In terms of operational capacity, a four-inch turbine meter with an eight-bladed rotor can operate at 720 gallons per minute (gpm), highlighting the efficiency of modern flow measurement systems.

Key Takeaways

- Global Oil and Gas Custody Metering System Market is expected to be worth around USD 20.7 Billion by 2034, up from USD 11.8 Billion in 2024, and grow at a CAGR of 5.8% from 2025 to 2034.

- Coriolis flow meters dominate the market, holding a 34.4% share globally.

- Liquid Custody Metering Systems led the market with a 56.4% share in 2024.

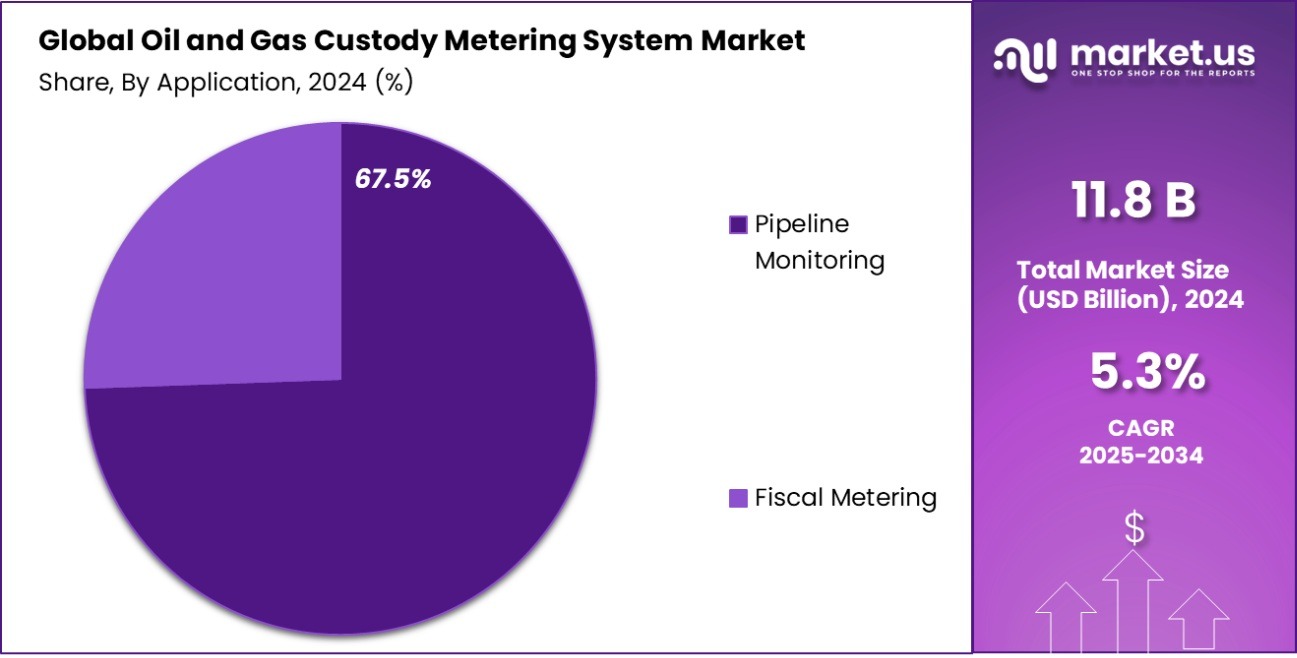

- Pipeline monitoring systems account for 67.5% of the Oil and Gas market.

- Onshore locations dominate, holding a 67.3% market share in custody metering systems.

- North America leads the Oil and Gas Custody Metering System Market with 46.4% share, USD 5.4 Bn.

By Flow Meter Analysis

Coriolis flow meters dominate the custody metering system market for precise measurement accuracy and reliability.

In 2024, Coriolis held a dominant market position in the By Flow Meter segment of the Oil and Gas Custody Metering System Market, with a 34.4% share. Coriolis flow meters are widely recognized for their accuracy and reliability in measuring mass flow, particularly in the oil and gas industry, where precise measurement is essential for custody transfer.

The adoption of Coriolis meters has been driven by their ability to handle complex flow conditions and their versatility across various applications, including crude oil, refined products, and natural gas. Their superior accuracy compared to traditional volumetric meters has made them the preferred choice for operators seeking compliance with stringent regulatory standards.

Additionally, the increasing focus on environmental regulations and the need for improved transparency in the oil and gas sector has further boosted the demand for Coriolis flow meters. These systems enable operators to minimize product loss, improve measurement reliability, and meet the rigorous environmental reporting standards required by governments.

With technological advancements and growing investments in oil and gas infrastructure, Coriolis flow meters are expected to continue dominating the segment. Their integration with real-time data analytics and IoT capabilities presents new opportunities for enhanced operational efficiency and cost reduction in custody metering systems.

By Type Analysis

Liquid custody metering systems account for the majority of market share, ensuring accurate liquid product transfer.

In 2024, Liquid Custody Metering Systems held a dominant market position in the By Type segment of the Oil and Gas Custody Metering System Market, with a 56.4% share. These systems are essential for accurately measuring liquid hydrocarbons, such as crude oil, refined products, and liquid natural gas, during the custody transfer process.

The increasing demand for precise measurement solutions in the oil and gas sector, combined with the need for regulatory compliance, has significantly contributed to the market share of liquid custody metering systems.

Liquid custody metering systems are favored for their high accuracy, efficiency, and reliability, which are critical in ensuring correct billing and minimizing disputes during oil and gas transactions.

These systems typically incorporate advanced technologies such as Coriolis, ultrasonic, and turbine meters, providing enhanced measurement capabilities across a variety of liquid transfer applications. Their ability to handle large volumes and meet stringent measurement standards has made them indispensable in the industry.

The demand for these systems is further driven by the growing need for transparency in global energy trade and the rising investments in pipeline infrastructure. As the oil and gas sector continues to expand, particularly in emerging markets, the adoption of liquid custody metering systems is expected to grow.

Looking forward, the market will likely benefit from innovations in automation and real-time data monitoring, which will enhance the efficiency and accuracy of liquid custody metering systems. With continuous technological advancements, these systems are set to remain a key component in the oil and gas custody metering landscape.

By Application Analysis

Pipeline monitoring is the leading application for custody metering systems, ensuring efficient and secure energy transportation.

In 2024, Pipeline Monitoring held a dominant market position in the By Application segment of the Oil and Gas Custody Metering System Market, with a 67.5% share. Pipeline monitoring systems are integral to ensuring the safe and efficient transportation of oil and gas through pipelines, where they serve to monitor flow rates, pressure, and temperature.

These systems are crucial for maintaining operational integrity and compliance with safety and regulatory standards, which has driven their widespread adoption in the oil and gas industry.

The growing demand for pipeline monitoring is largely attributed to the expansion of global pipeline infrastructure and the increasing need for real-time, accurate data to prevent leaks, ensure the safety of operations, and reduce environmental risks.

With a focus on reducing downtime and minimizing potential product loss, pipeline monitoring systems equipped with advanced sensors and automation technologies are becoming a standard in the industry.

Moreover, the rising number of regulatory requirements surrounding pipeline safety and environmental protection has further fueled the demand for custody metering systems in pipeline applications. These systems enable operators to ensure compliance and optimize operational performance, thus driving their market share.

In the future, the integration of artificial intelligence (AI) and machine learning (ML) into pipeline monitoring systems is expected to create new opportunities for predictive maintenance and fault detection. This technological advancement is poised to enhance the overall efficiency and safety of pipeline operations, ensuring sustained market growth in this application segment.

By Location Analysis

Onshore applications hold the largest share, driven by extensive oil and gas production facilities on land.

In 2024, Onshore held a dominant market position in the By Location segment of the Oil and Gas Custody Metering System Market, with a 67.3% share. Onshore applications have long been the primary focus of custody metering systems, owing to the vast majority of global oil and gas reserves being located onshore.

These systems are essential for accurate measurement and monitoring of product transfer between operators and buyers, ensuring proper billing and compliance with industry regulations.

The dominance of onshore installations is driven by the extensive infrastructure in place for oil and gas exploration, extraction, and transportation. Onshore locations often feature large, centralized facilities such as refineries and pipelines, which require robust and reliable custody metering systems to ensure efficient operations and accurate reporting.

Moreover, onshore sites generally offer easier access for maintenance and system upgrades compared to offshore locations, further contributing to the preference for onshore installations.

The growth of the onshore custody metering market is also supported by the increasing demand for transparency in energy transactions and the need for real-time monitoring and control of oil and gas production. As companies strive to meet regulatory and environmental requirements, accurate custody metering systems are essential to ensure compliance and reduce the risk of product loss.

Looking ahead, while offshore projects are gaining traction, onshore applications are expected to maintain a strong position due to continued investments in infrastructure and the ongoing need for efficiency and accuracy in oil and gas measurement.

Key Market Segments

By Flow Meter

- Coriolis

- Ultrasonic

- Vortex

- Thermal

- Differential Pressure

- Positive Displacement

- Others

By Type

- Liquid Custody Metering Systems

- Coriolis Meters

- Turbine Meters

- Gas Custody Metering Systems

- Ultrasonic Meters

- Vortex Flow Meters

By Application

- Pipeline Monitoring

- Fiscal Metering

By Location

- Offshore

- Onshore

Driving Factors

Increasing Regulatory Compliance Demands in Oil & Gas

One of the primary driving factors behind the growth of the Oil and Gas Custody Metering System Market is the increasing demand for regulatory compliance. As governments worldwide enforce stricter regulations for energy trading, accurate measurement and monitoring of oil and gas transfers have become crucial for operators.

Custody metering systems ensure that energy transactions are transparent, providing accurate data for billing, reporting, and environmental compliance. This demand for precise and reliable data is accelerating the adoption of these systems in the industry.

As regulatory frameworks tighten, companies are under pressure to adopt advanced metering technologies to avoid penalties, optimize operations, and maintain industry credibility. The push for sustainability and environmental stewardship further amplifies the need for compliant metering systems.

Restraining Factors

High Initial Investment Costs for Advanced Systems

A key restraining factor in the growth of the Oil and Gas Custody Metering System Market is the high initial investment cost associated with implementing advanced metering technologies. The sophisticated systems required for accurate measurement and compliance come with a significant price tag, which can be a barrier for smaller operators or companies in emerging markets.

These systems often involve complex installations, specialized components, and ongoing maintenance, all of which add to the upfront financial burden. Despite the long-term cost benefits in terms of accurate billing and reduced operational errors, the capital required for these systems can deter investment, especially in regions with lower budgets or where margins are tight.

Growth Opportunity

Integration of Smart Technologies in Metering Systems

A significant growth opportunity in the Oil and Gas Custody Metering System Market lies in the integration of smart technologies such as the Internet of Things (IoT), real-time data analytics, and artificial intelligence (AI). These technologies enable metering systems to provide more accurate, efficient, and real-time monitoring of oil and gas transfers, offering enhanced decision-making capabilities for operators.

With IoT-enabled sensors, data can be continuously monitored and transmitted to centralized systems, allowing for quicker response times to potential issues like leaks or discrepancies. The adoption of AI and machine learning further enhances predictive maintenance, reducing downtime and operational costs.

As these technologies continue to evolve, they present a major opportunity to improve the efficiency, safety, and cost-effectiveness of custody metering systems, making them a valuable investment for operators in the industry.

Latest Trends

Adoption of Remote Monitoring and Automation Solutions

A key trend shaping the Oil and Gas Custody Metering System Market is the increasing adoption of remote monitoring and automation solutions. With the rise of digital technologies, operators are seeking ways to optimize operations and reduce human intervention by incorporating automated systems that provide real-time monitoring and control.

Remote monitoring allows operators to track critical parameters like flow rates, pressure, and temperature from a centralized location, improving operational efficiency and reducing the need for on-site personnel.

This trend not only enhances safety by minimizing human error but also cuts operational costs by enabling predictive maintenance and quicker issue resolution. As technology advances, the market is shifting towards more autonomous, data-driven custody metering solutions to support smarter, more sustainable oil and gas operations.

Regional Analysis

North America dominates the Oil and Gas Custody Metering System Market with a 46.4% share, valued at USD 5.4 billion.

North America dominates the Oil and Gas Custody Metering System Market, holding a 46.4% market share, valued at USD 5.4 billion in 2024. The region’s significant market position is driven by the presence of key oil and gas producers, advanced infrastructure, and stringent regulatory frameworks.

The U.S. and Canada, with their vast oil reserves and pipeline networks, are leading the adoption of custody metering systems to ensure accurate measurement, transparency, and compliance with environmental regulations.

Europe follows as a substantial market for custody metering systems, supported by the region’s well-established oil and gas infrastructure. The emphasis on regulatory compliance and environmental standards in countries like Germany, the UK, and Norway contributes to the demand for advanced metering solutions. However, Europe’s market share is smaller compared to North America due to a more mature energy landscape.

Asia Pacific is witnessing rapid growth in the Oil and Gas Custody Metering System Market, primarily driven by increasing energy demand and investments in oil and gas exploration, especially in countries like China, India, and Australia. This market is projected to grow as the region’s demand for accurate and reliable measurement technologies rises in line with the expanding energy trade.

Middle East & Africa and Latin America represent emerging markets, with growing investments in oil and gas infrastructure boosting demand for custody metering systems in these regions. However, these markets still trail behind North America and Europe in terms of overall market share.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, the global Oil and Gas Custody Metering System Market will be highly competitive, with several key players dominating the space, each contributing to the ongoing evolution of accurate and efficient metering solutions. Among the leading companies, ABB Ltd., Emerson Electric Co., Honeywell International Inc., and Schlumberger Limited stand out due to their long-standing expertise in providing high-quality measurement and automation technologies.

ABB Ltd. and Emerson Electric Co. continue to drive innovation in metering systems, integrating cutting-edge technologies such as IoT and AI to enable real-time monitoring, predictive maintenance, and enhanced data analytics. Their products cater to large-scale energy operations, where accuracy and regulatory compliance are paramount.

Honeywell International Inc. remains a significant player with its wide range of custody metering systems designed to provide precise and reliable measurements in the oil and gas industry. The company’s advanced solutions are well-regarded for optimizing operational efficiency while ensuring compliance with environmental standards.

KROHNE Group and Yokogawa Electric are key contributors to the development of highly advanced flow measurement technologies, particularly in harsh environments like offshore oil fields and remote pipelines. Their focus on developing durable, high-performance solutions ensures that operators can monitor and control flow with maximum precision.

The market is also seeing new entrants like Isystems and KamehrSdn Bhd., which are focusing on creating regionally tailored metering systems for emerging markets in the Asia Pacific, the Middle East, and Latin America.

Top Key Players in the Market

- ABB ltd.

- Azbil

- Emerson Electric Co.

- ENCE GmbH

- Endress+ Hauser Management AG

- Honeywell International Inc.

- Isystems

- KamehrSdn Bhd.

- KROHNE Group

- ODS Metering Systems

- Oil & Gas Systems International Endress+Hauser Management AG

- Schlumberger Limited

- Siemens

- Yokogawa Electric

Recent Developments

- In September 2024, Emerson completed its $1.81 billion acquisition of Air Products’ liquefied natural gas (LNG) process technology and equipment business.

- In March 2024, Yokogawa announced plans to acquire Adept Fluidyne, an Indian flowmeter manufacturer, to strengthen its presence in the Indian market.

Report Scope

Report Features Description Market Value (2024) USD 11.8 Billion Forecast Revenue (2034) USD 20.7 Billion CAGR (2025-2034) 10.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Flow Meter (Coriolis, Ultrasonic, Vortex, Thermal, Differential Pressure, Positive Displacement, Others), By Type (Liquid Custody Metering Systems, Coriolis Meters, Turbine Meters, Gas Custody Metering Systems, Ultrasonic Meters, Vortex Flow Meters), By Application (Pipeline Monitoring, Fiscal Metering), By Location (Offshore, Onshore) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ABB ltd., Azbil, Emerson Electric Co., ENCE GmbH, Endress+ Hauser Management AG, Honeywell International Inc., Isystems, KamehrSdn Bhd., KROHNE Group, ODS Metering Systems, Oil & Gas Systems International Endress+Hauser Management AG, Schlumberger Limited, Siemens, Yokogawa Electric Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Oil and Gas Custody Metering System MarketPublished date: February 2025add_shopping_cartBuy Now get_appDownload Sample

Oil and Gas Custody Metering System MarketPublished date: February 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- ABB ltd.

- Azbil

- Emerson Electric Co.

- ENCE GmbH

- Endress+ Hauser Management AG

- Honeywell International Inc.

- Isystems

- KamehrSdn Bhd.

- KROHNE Group

- ODS Metering Systems

- Oil & Gas Systems International Endress+Hauser Management AG

- Schlumberger Limited

- Siemens

- Yokogawa Electric