Global Solar Lease Service Market Size, Share, Upcoming Investments Report Ground Mounted (Rooftop, Floating PV, Building Integrated PV (BIPV), Others), By Connection Type (On-Grid, Off-Grid, Hybrid), By Solar Panel Type ( Monocrystalline, Polycrystalline, Thin Film, Others), By Ownership Model (Third Party Ownership, Host Owned, Community, Solar, Solar Leasing, Solar Power Purchase Agreement (PPA), Others), By End User Industry (Residential, Commercial, Industrial, Utilities) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 135900

- Number of Pages: 366

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

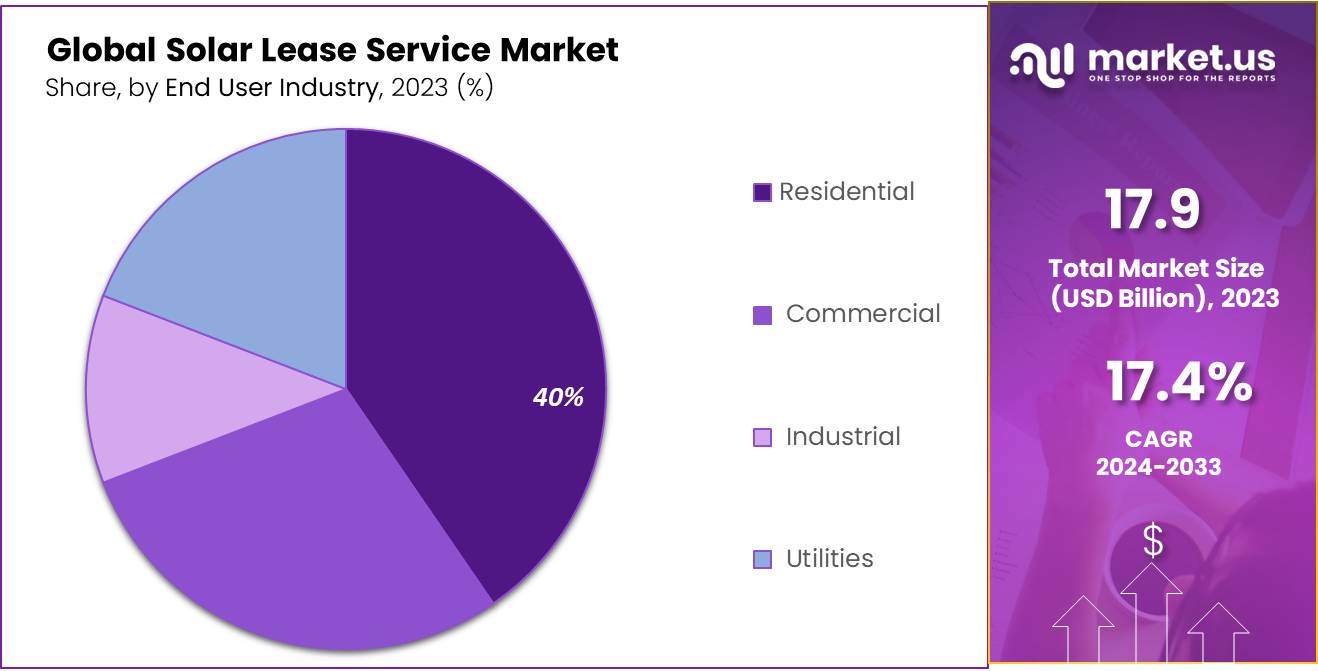

The Global Solar Lease Service Market size is expected to be worth around USD 89.0 Bn by 2033, from USD 17.9 Bn in 2023, growing at a CAGR of 17.4% during the forecast period from 2024 to 2033.

A solar lease service is a financial arrangement where homeowners can install solar panels on their property without the upfront costs of purchasing the system outright. Instead of owning the panels, you pay a monthly fee to a solar company for the duration of the lease, which typically spans 20 to 25 years. This arrangement makes solar power more accessible to those with limited capital, as it removes the high initial investment barrier.

In a solar lease, the responsibility for maintenance, repairs, and any necessary upgrades typically remains with the leasing company. This can relieve homeowners from the technical aspects of managing a solar system. However, it also means that the homeowner has limited control over the system, and won’t benefit from solar tax credits and other incentives that are available to system owners.

Financially, leasing solar panels often involves an initial low or no down payment followed by fixed monthly payments. These payments may include annual escalators, increasing by a small percentage each year to cover rising electricity costs. Over the long term, this could result in paying more compared to buying a system outright, especially when considering the potential savings from incentives and higher energy costs avoided through ownership.

The Solar Lease Service is significantly shaped by recent government initiatives and investments aimed at expanding access to solar energy, particularly in low-income and disadvantaged communities. For instance, the Biden-Harris Administration has launched the “Solar for All” program, funded by the Inflation Reduction Act. This program allocates a substantial $7 billion to facilitate the deployment of residential solar systems, aiming to serve over 900,000 households and save them around $350 million annually on electric bills

This initiative also focuses on creating high-quality, unionized jobs across the country, with a significant portion of the program’s benefits directed towards communities that are most affected by pollution and underinvestment. The overarching goal is to achieve a carbon pollution-free power sector by 2035 and a net-zero emissions economy by no later than 2050

Significantly, the Solar for All grants are expected to mobilize additional private capital, enhancing the scale of solar deployments through partnerships with various stakeholders, including state energy offices and local government entities. For instance, substantial funds have been allocated to initiatives in Puerto Rico and the U.S. Virgin Islands to enhance energy resilience and affordability through solar and storage systems

Key Takeaways

- Solar Lease Service Market size is expected to be worth around USD 89.0 Bn by 2033, from USD 17.9 Bn in 2023, growing at a CAGR of 17.4%.

- Ground Mounted solar systems held a dominant market position, capturing more than a 35.3% share.

- On-Grid segment of the solar lease service market held a dominant position, capturing more than a 59.1% share.

- Monocrystalline solar panels held a dominant market position in the solar lease service market, capturing more than a 56.1% share.

- Third Party Ownership held a dominant market position in the solar lease service market, capturing more than a 48.1% share.

- Residential segment held a dominant market position in the solar lease service market, capturing more than a 39.1% share.

Ground Mounted

In 2023, Ground Mounted solar systems held a dominant market position, capturing more than a 35.3% share. This segment benefits from its capacity to accommodate large-scale solar projects, which are crucial for utility and commercial applications where space constraints are minimal. Ground-mounted systems are preferred for their flexibility in orientation and tilt, optimizing sun exposure and maximizing energy production.

Rooftop installations, another significant segment, are popular in residential and urban settings due to their direct integration onto existing structures, thus saving space and reducing land use conflicts. These systems leverage the unused areas of roofs to generate power close to the point of consumption, decreasing transmission losses and supporting decentralized energy generation.

Floating PV systems have emerged as an innovative solution, particularly useful in areas with limited land availability. These systems are installed on bodies of water, such as lakes and reservoirs, reducing water evaporation while generating clean energy. The cooling effect of water also enhances panel efficiency, making this a promising segment in regions with suitable water bodies.

Building Integrated Photovoltaics (BIPV) represent a niche but growing segment that integrates photovoltaics into the building material itself, such as in windows, facades, and roofing. BIPV not only serves the dual purpose of building envelope and power generator but also aesthetically blends into building designs, promoting architectural innovation along with energy sustainability.

By Connection Type

In 2023, the On-Grid segment of the solar lease service market held a dominant position, capturing more than a 59.1% share. This segment benefits significantly from its ability to connect directly to the public electricity grid, allowing excess energy produced by solar systems to be fed back into the grid. This not only provides stability and continuous power supply to consumers but also offers financial returns through net metering policies where available, enhancing the economic appeal of solar investments.

Off-Grid solar systems, while smaller in market share, are crucial in remote and rural areas where grid connectivity is either unreliable or non-existent. These systems provide essential energy independence with the help of batteries or other storage solutions to ensure power availability round-the-clock. Their importance continues to grow in regions with poor infrastructure or where the cost of grid extension is prohibitively high.

The Hybrid segment, which combines both grid connection and battery storage, is increasingly popular for its ability to offer energy security and optimization. These systems can store excess power during peak production times and use it during grid outages or peak demand periods, providing a more reliable power supply and reducing dependence on grid electricity.

Hybrid systems are particularly appealing in areas with unstable grid infrastructure or frequent power outages, offering a balanced solution between on-grid and off-grid systems. Each connection type serves distinct market needs and geographical conditions, reflecting the diverse approaches within the solar lease service market to harnessing solar energy.

By Solar Panel Type

In 2023, Monocrystalline solar panels held a dominant market position in the solar lease service market, capturing more than a 56.1% share. Known for their high efficiency and sleek aesthetic, monocrystalline panels are made from a single, continuous crystal structure, which allows them to convert more sunlight into electricity compared to other types. This makes them particularly attractive for residential and commercial applications where space and visual impact are considerations.

Polycrystalline solar panels, while generally less expensive than their monocrystalline counterparts, offer slightly lower efficiency. They are made from multiple crystalline cells, which give them a distinctive blue hue and somewhat lower light absorption efficiency. However, their lower cost makes them a viable option for large-scale projects and consumers with less stringent efficiency requirements.

Thin Film solar panels represent a smaller segment of the market but are prized for their versatility and lightweight properties. These panels are made by layering one or more films of photovoltaic material onto a substrate, allowing them to be used on surfaces that might not support traditional panels. Thin film panels are less efficient than crystalline-based solar panels but are improving steadily and are ideal for applications on large, flat commercial spaces where weight and flexibility are concerns.

By Ownership Model

In 2023, Third Party Ownership held a dominant market position in the solar lease service market, capturing more than a 48.1% share. This ownership model, where solar systems are owned by a third party rather than the end user, is popular due to its financial and operational advantages for consumers. It allows homeowners and businesses to enjoy the benefits of solar energy without the upfront costs or responsibilities of system maintenance.

Host Owned models, where the property owner purchases and maintains the solar system, also represent a significant segment. This model appeals to those who prefer to capitalize on long-term savings and potential increases in property value through direct ownership of the solar installations.

Community Solar programs are growing in popularity, especially in urban and suburban areas where direct solar installation is not feasible for each individual. In these programs, multiple parties share the benefits of a single, large-scale solar array, which can be installed on communal property or at a site that maximizes exposure to sunlight.

Solar Leasing and Solar Power Purchase Agreements (PPAs) offer flexibility and accessibility, with little to no upfront costs. In a Solar Lease, customers pay a fixed monthly rent for the solar system, whereas PPAs charge customers based on the amount of electricity the system produces, usually at a rate lower than the utility price.

By End User Industry

In 2023, the Residential segment held a dominant market position in the solar lease service market, capturing more than a 39.1% share. This segment has flourished as more homeowners adopt solar energy to reduce electricity bills and increase energy independence. The ease of integrating solar systems with home construction and renovation has been a significant driver, along with favorable financing options like solar leases and PPAs that eliminate upfront costs.

The Commercial segment, which includes businesses and public institutions, also utilizes solar lease services extensively. Commercial entities often opt for solar to hedge against future energy cost increases, meet corporate sustainability goals, and benefit from tax incentives. The adaptability of solar systems for varying commercial building sizes and the availability of ample roof space in commercial properties enhance this segment’s growth.

Industrial users are turning to solar to mitigate the environmental impact of their operations and reduce energy costs, which can form a significant part of their operating budget. In industries where energy demand is substantial, solar installations can provide a rapid return on investment, which is further amplified by leasing options that minimize initial expenditures.

Utilities represent another key segment, increasingly investing in large-scale solar farms to meet regulatory requirements for renewable energy production and to supply the growing consumer demand for green energy. Utility-scale solar projects benefit from economies of scale, making them more cost-effective per watt than smaller residential or commercial installations.

Key Market Segments

Ground Mounted

- Rooftop

- Floating PV

- Building Integrated PV (BIPV)

- Others

By Connection Type

- On-Grid

- Off-Grid

- Hybrid

By Solar Panel Type

- Monocrystalline

- Polycrystalline

- Thin Film

- Others

By Ownership Model

- Third Party Ownership

- Host Owned

- Community

- Solar

- Solar Leasing

- Solar Power Purchase Agreement (PPA)

- Others

By End User Industry

- Residential

- Commercial

- Industrial

- Utilities

Drivers

Increasing Demand for Renewable Energy and Cost Efficiency of Solar Lease Services

The increasing global emphasis on transitioning to renewable energy sources is a significant driving factor for the Solar Lease Service market. Governments and businesses are keenly adopting sustainable energy solutions to meet their environmental goals and comply with stricter regulations aimed at reducing carbon emissions.

Solar Lease Services allow businesses and homeowners to install solar energy systems without the upfront costs associated with purchasing the equipment. This cost-effective solution has made solar energy more accessible to a broader audience, driving the growth of the market.

Growth in Solar Adoption

The rapid growth of solar energy adoption is evident from global trends in renewable energy investment. According to the International Energy Agency (IEA), solar photovoltaic (PV) capacity grew by 22% globally in 2023, with more than 200 GW of new solar power capacity added in that year alone.

This surge in solar installations can be attributed to the affordability of solar equipment and the increasing adoption of solar lease and Power Purchase Agreements (PPAs) as cost-effective alternatives to traditional electricity sources. In 2024, the IEA anticipates that global solar installations will reach an additional 250 GW, bringing the total global installed solar PV capacity to over 1,100 GW by the end of the year.

Cost-Effectiveness of Solar Lease Services

For example, according to data from the U.S. Department of Energy’s National Renewable Energy Laboratory (NREL), the average cost of installing solar panels for residential customers in the U.S. has dropped significantly, from approximately $3.00 per watt in 2010 to around $2.50 per watt in 2023. This reduction in installation costs has been a major factor in driving the adoption of solar systems, especially when combined with financing options like solar leases and PPAs.

In the U.S., the demand for solar lease services has grown alongside this trend. As per a 2023 report by the Solar Energy Industries Association (SEIA), about 40% of residential solar installations were financed through leasing or PPA arrangements, a significant increase from 28% in 2020. This trend is expected to continue in 2024, with solar leases and PPAs being a popular choice among homeowners who prefer not to pay upfront for the solar systems.

Government Incentives and Policy Support

Government policies and incentives also play a critical role in accelerating the demand for solar energy solutions, including solar lease services. In 2023, the U.S. government extended the Investment Tax Credit (ITC) for solar energy projects, which offers a 30% tax credit for residential and commercial solar systems. This policy, along with similar incentives in other regions, has made solar energy more affordable for consumers, further encouraging the growth of the solar lease market.

In Europe, the European Union’s Green Deal and its goal to achieve net-zero emissions by 2050 are providing significant momentum for solar energy adoption. In 2023, countries like Germany, Spain, and France saw record levels of solar installations, with Germany alone adding over 8 GW of new solar capacity in 2023, a 20% increase from the previous year.

Restraints

High Operational Costs and Limited Availability of Financing Options for Solar Lease Services

One of the primary restraint factors for the growth of the Solar Lease Service market is the high operational costs associated with installing, maintaining, and managing solar systems. While solar lease services reduce the upfront costs for consumers, they often involve significant maintenance, insurance, and administrative expenses for solar service providers. These operational costs can limit the expansion of solar leasing models, especially in emerging markets, where financing options are often limited and infrastructure for solar support is underdeveloped.

High Operational and Maintenance Costs

According to the International Renewable Energy Agency (IRENA), while solar installations have become more cost-competitive, the costs associated with the management and maintenance of solar power systems remain a barrier.

In 2023, solar providers in markets like the U.S. spent about USD 0.50–0.70 per watt for maintenance and servicing costs for residential solar installations, which can increase the overall cost of solar lease services. This translates to approximately 10-12% of the total cost of installation for each system. For larger commercial-scale solar systems, operational costs can represent as much as 15-20% of the total project cost.

Moreover, the cost of integrating energy storage solutions, which are often bundled with solar installations to ensure a steady energy supply, further increases the financial burden. In 2024, it is projected that the cost of solar-plus-storage systems in the U.S. will increase by approximately 8-10% compared to previous years, primarily due to rising battery prices.

For example, the cost of lithium-ion batteries, which are commonly used for energy storage, increased by 20% in 2023 alone, largely due to supply chain constraints and increased demand for electric vehicles (EVs), which are also using these batteries.

Financing Challenges and Limited Accessibility

In addition to operational costs, securing financing for solar lease services remains a major challenge, particularly in developing regions. Solar lease models are heavily reliant on financing mechanisms such as loans, PPAs, and tax incentives.

In the U.S., despite the increasing popularity of solar, 30% of the population, particularly those in rural or low-income areas, still faces significant barriers in accessing financing for solar installations. According to the Solar Energy Industries Association (SEIA), the lack of available capital is a major issue that affects approximately 40% of potential customers in the residential solar market.

Opportunity

Expansion of Solar Lease Services in Emerging Markets

A significant growth opportunity for the Solar Lease Service market lies in expanding solar adoption in emerging markets, where there is a rising demand for sustainable energy solutions, and traditional energy infrastructure may be less reliable. With increasing concerns about energy security, rising electricity prices, and climate change, countries in regions such as Southeast Asia, Sub-Saharan Africa, and Latin America are showing considerable interest in solar energy. The solar lease model provides an attractive alternative to the traditional upfront purchase model, making it easier for consumers and businesses to access solar energy without significant capital investments.

Increasing Solar Adoption in Emerging Markets

According to the International Energy Agency (IEA), emerging economies are projected to account for 60% of global solar capacity additions by 2024. In 2023, the solar market in Southeast Asia alone is expected to grow by 13%, with the overall installed capacity increasing from 9.3 gigawatts (GW) in 2020 to over 18 GW by 2024.

In particular, countries like India, Indonesia, and Brazil are poised for growth in solar installations, supported by favorable policies, lower installation costs, and growing awareness about the environmental benefits of renewable energy.

This growth is reflected in a notable increase in demand for Solar Lease Services. In India, the government has set an ambitious target to reach 500 GW of renewable energy capacity by 2030, with solar accounting for a significant portion of this target.

In 2023, India’s solar capacity grew by over 20% year-on-year, and residential solar installations, especially in urban areas, grew by 15-20%. These developments create a substantial opportunity for solar leasing companies to enter the market and offer affordable, flexible financing options for residential and commercial customers.

The Role of Local Financing Models

One of the key drivers of this opportunity is the increased availability of financing models tailored for local markets. For example, in Brazil, a solar lease provider like “Solarify” is collaborating with local banks to offer low-interest solar financing for residential customers.

In 2024, the Brazilian government’s National Development Bank (BNDES) has approved a funding pool of USD 500 million to support the growth of solar energy, which can be leveraged by solar lease companies to expand their customer base.

Technological Advancements

Technological advancements also present a growth opportunity for solar lease providers in emerging markets. In 2023, the cost of solar panels continued to decline, with prices dropping by over 15% compared to 2020, driven by improvements in solar panel efficiency and manufacturing technologies.

Additionally, innovations in energy storage solutions are making solar installations more reliable, even in off-grid areas. According to the World Bank, by 2024, energy storage systems are expected to become more affordable and widely available, which will further drive solar adoption and the use of solar lease services.

Trends

Increased Demand for Green and Sustainable Energy Solutions

One of the most notable trends driving the growth of the Solar Lease Service market is the increasing demand for green and sustainable energy solutions. With growing awareness of climate change and the environmental impacts of fossil fuels, both consumers and businesses are actively seeking cleaner energy alternatives.

This shift towards sustainability is being reinforced by government policies, tax incentives, and the falling cost of solar technology, making solar energy more accessible than ever. As more individuals and organizations strive to reduce their carbon footprints, the popularity of solar lease services—where consumers can install solar panels without the upfront capital expense—has surged.

Growing Consumer Interest in Clean Energy

In recent years, global investments in renewable energy have reached record highs. According to the International Renewable Energy Agency (IRENA), global renewable energy investments exceeded $400 billion in 2023, with a significant portion directed towards solar power.

The rapid decline in the cost of photovoltaic (PV) modules, driven by technological advancements and economies of scale, has made solar installations more affordable. This trend has directly benefited the solar leasing market, where customers can benefit from energy savings without the need for a significant upfront investment.

In 2023, the average cost of installing a solar system fell by approximately 10% compared to the previous year, from around $2.77 per watt to $2.49 per watt, according to the Solar Energy Industries Association (SEIA). The reduction in costs, along with increasing awareness of solar energy’s environmental benefits, is fostering more widespread adoption of solar leases.

Government Support and Policy Initiatives

Governments around the world are implementing favorable policies to encourage the transition to solar energy. In the U.S., the introduction of the Solar Investment Tax Credit (ITC) has played a crucial role in stimulating the adoption of solar energy solutions.

As of 2023, the ITC provides a 30% tax credit for residential and commercial solar installations. This incentive is expected to drive continued growth in the solar leasing market, as it reduces the financial burden on consumers, making solar energy a more viable option.

Similarly, in countries like India and Brazil, government-backed schemes and subsidies for solar power are boosting the popularity of solar lease services. In India, for example, the government’s push to install 175 GW of renewable energy capacity by 2022, and its more recent target of 500 GW by 2030, is expected to accelerate the growth of the solar market. This increasing government support is expected to propel the solar leasing model, where individuals and businesses can enjoy the benefits of solar energy without the burden of ownership.

Impact on the Solar Lease Service Market

The rising consumer preference for sustainable energy solutions, coupled with attractive government incentives, is rapidly expanding the solar lease service market. Solar leasing allows consumers to install solar panels with little to no upfront cost, which is particularly attractive in regions where purchasing a system outright may not be feasible. The availability of flexible leasing terms, lower energy costs, and long-term savings are key drivers for the growth of solar leasing in both residential and commercial sectors.

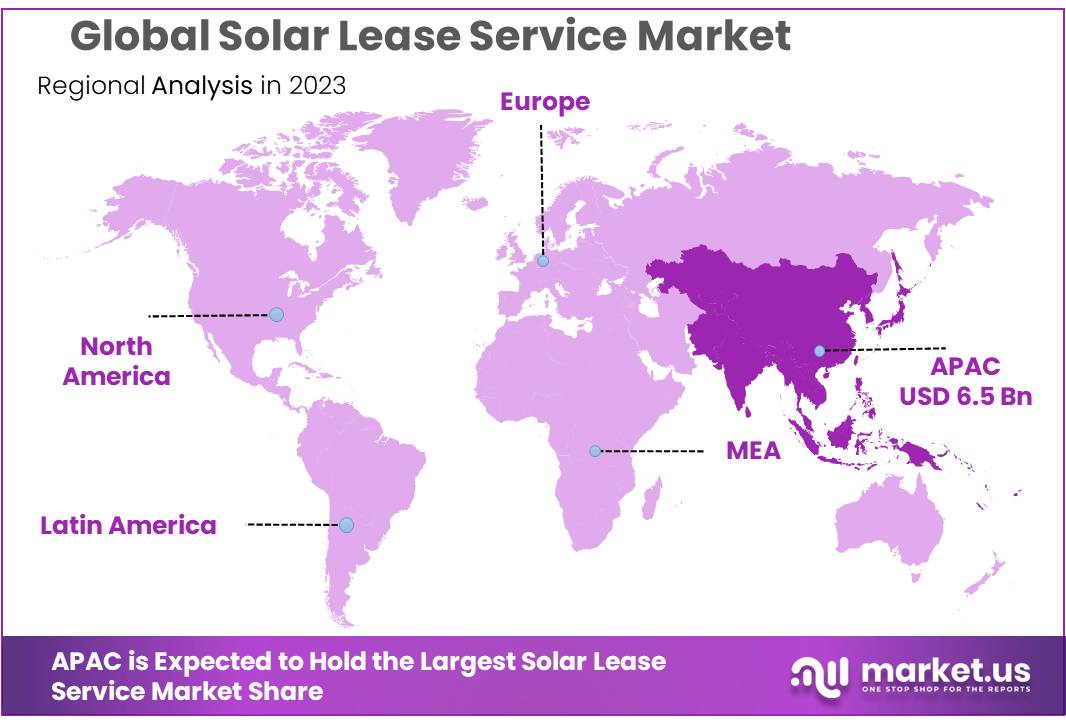

Regional Analysis

In the Asia Pacific (APAC) region, the market has emerged as a global leader, commanding a dominant 36.5% share, valued at approximately USD 6.5 billion. Rapid urbanization, government-led solar initiatives, and declining installation costs in countries such as China, India, and Japan underpin this dominance. China’s aggressive solar expansion policies and India’s emphasis on renewable energy in rural and urban areas drive substantial demand for solar leasing solutions.

The Solar Lease Service Market exhibits significant regional diversity, influenced by varying solar energy adoption rates, government policies, and consumer awareness. In North America, the market thrives due to favorable tax incentives and policies such as the Federal Investment Tax Credit (ITC).

The United States, with its robust solar infrastructure and high residential adoption, remains a key contributor to regional growth. Europe also stands out, supported by stringent environmental regulations and strong demand for renewable energy. Countries like Germany, the UK, and Spain have shown a notable inclination toward leasing models as they aim to achieve ambitious climate targets.

The Middle East & Africa (MEA) region experiences moderate growth, propelled by high solar irradiance levels and investments in solar infrastructure in nations like Saudi Arabia and the UAE. However, the adoption of leasing models remains in the nascent stages, constrained by economic disparities. Finally, Latin America demonstrates promising potential, led by Brazil and Mexico, where solar power leasing is gaining traction due to supportive government policies and rising energy demand.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Solar Lease Service Market is highly competitive, with several key players driving innovation and market expansion. Leading companies like Sungevity, Vivint Solar, Sunnova Energy International, and Sunrun have established themselves as prominent players, offering flexible leasing options and robust customer service.

These companies leverage technological advancements and strategic partnerships to enhance their market reach and provide affordable solar solutions. For instance, Sunrun leads the U.S. market by offering tailored leasing solutions, while Sunnova Energy International focuses on delivering comprehensive energy services with battery integration options.

Mid-sized players such as Trinity Solar, Palmetto Solar, and Momentum Solar are also gaining traction, particularly in regions where residential solar adoption is growing. Companies like Freedom Forever, Solcius, and Vision Solar cater to niche markets, providing localized solutions and focusing on customer-centric strategies.

Additionally, financial service providers like Sunlight Financial and Dividend Finance play a crucial role in enabling leasing models by offering financing options that make solar installations more accessible to homeowners.

Emerging players like Renova Energy, Green Ridge Solar, and Infinity Energy are capitalizing on the growing demand in less saturated markets, leveraging regional incentives and targeting eco-conscious consumers.

The market is marked by intense competition, with companies striving to differentiate through value-added services, competitive pricing, and technological innovation. Overall, these players collectively contribute to the dynamic growth of the solar lease service market, catering to the increasing demand for renewable energy solutions globally.

Top Key Players in the Market

- Sungevity

- Vivint Solar

- Sunnova Energy International

- Sunrun

- Trinity Solar

- Palmetto Solar

- Momentum Solar Sunworks

- Solar Max Technology

- Vision Solar

- Freedom Forever

- Infinity Energy

- Solcius

- Sunlight Financial

- Dividend Finance

- Spruce Finance

- Posi Gen

- Sun Power by Stellar Solar

- Renova Energy

- Green Ridge Solar

Recent Developments

In 2024, Sungevity Renewables Private Limited, an Indian subsidiary established in 2021, reported an authorized capital of ₹1 crore and a paid-up capital of ₹50 lakh, with total open charges amounting to ₹2.39 crore.

Report Scope

Report Features Description Market Value (2023) USD 17.9 Bn Forecast Revenue (2033) USD 89.0 Bn CAGR (2024-2033) 17.4% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered Ground Mounted (Rooftop, Floating PV, Building Integrated PV (BIPV), Others), By Connection Type (On-Grid, Off-Grid, Hybrid), By Solar Panel Type ( Monocrystalline, Polycrystalline, Thin Film, Others), By Ownership Model (Third Party Ownership, Host Owned, Community, Solar, Solar Leasing, Solar Power Purchase Agreement (PPA), Others), By End User Industry (Residential, Commercial, Industrial, Utilities) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Sungevity, Vivint Solar, Sunnova Energy International, Sunrun, Trinity Solar, Palmetto Solar, Momentum Solar Sunworks, Solar Max Technology, Vision Solar, Freedom Forever, Infinity Energy, Solcius, Sunlight Financial, Dividend Finance, Spruce Finance, Posi Gen, Sun Power by Stellar Solar, Renova Energy, Green Ridge Solar Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Sungevity

- Vivint Solar

- Sunnova Energy International

- Sunrun

- Trinity Solar

- Palmetto Solar

- Momentum Solar Sunworks

- Solar Max Technology

- Vision Solar

- Freedom Forever

- Infinity Energy

- Solcius

- Sunlight Financial

- Dividend Finance

- Spruce Finance

- Posi Gen

- Sun Power by Stellar Solar

- Renova Energy

- Green Ridge Solar