Global Battery Separator Market By Battery Type (Lithium-Ion (Li-Ion), Lead Acid, Others), By Type (Coated separator, Non-coated separator), By Material (Polyethylene (PE), Polypropylene (PP), Others), Thickness (5μM-10μM, 10μM-20μM), By Technology (Dry Battery Separator, Wet Battery Separator), By End-Use (Automotive, Consumer Electronics, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 115827

- Number of Pages: 382

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

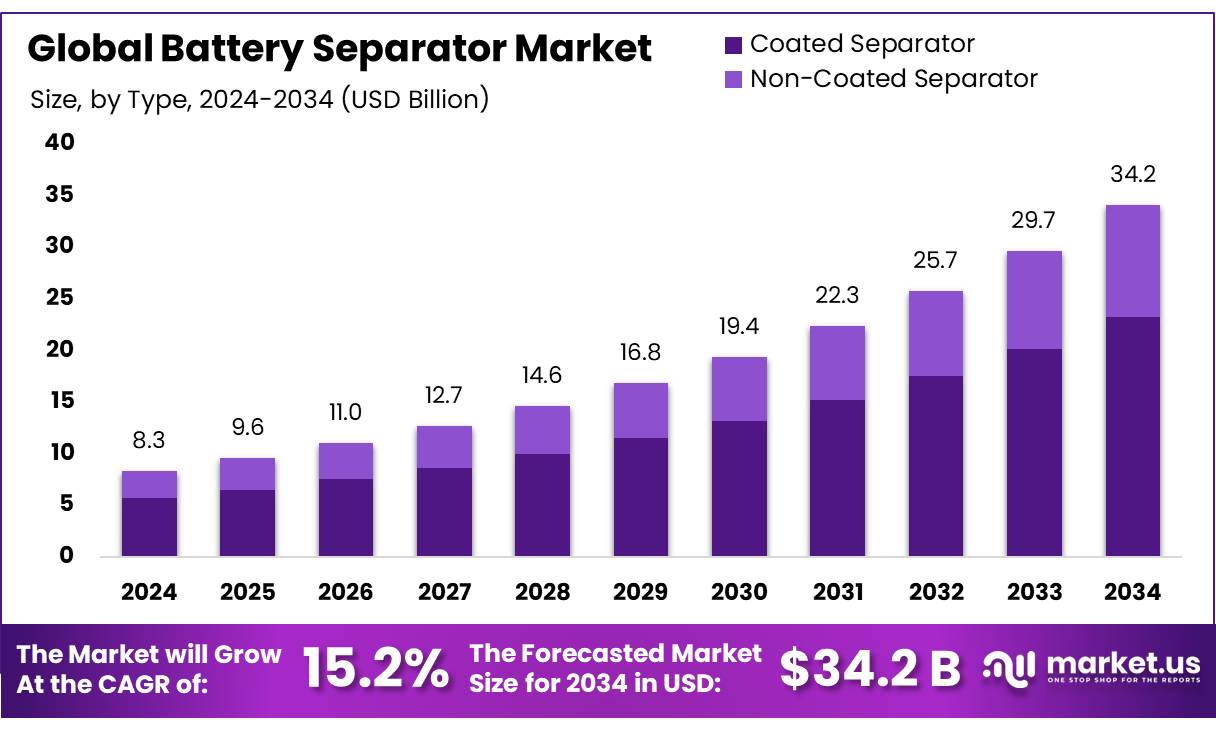

The global Battery Separator Market size is expected to be worth around USD 34.2 billion by 2034, from USD 8.3 billion in 2024, growing at a CAGR of 15.2% during the forecast period from 2025 to 2034.

The battery separator market is pivotal in the landscape of advanced energy storage technologies, serving as a critical component in batteries by ensuring the physical separation of the anode and cathode. This separation is crucial to prevent electrical shorts while facilitating ionic flow within the electrolyte. The global demand for battery separators is primarily driven by the burgeoning electric vehicle (EV) market and the increasing adoption of renewable energy systems requiring efficient storage solutions.

These innovations are essential to enhance the efficiency and safety of batteries, particularly lithium-ion batteries, which dominate the market. In 2022, the production of lithium-ion batteries reached a milestone, with over 500 gigawatt-hours of production capacity reported globally, underscoring the critical role of advanced separators in meeting energy storage demands.

Several factors drive the growth of the battery separator industry. First, the shift towards electric mobility is a significant catalyst. With governments worldwide setting stringent emissions targets, there is a pronounced move towards EVs, which rely heavily on lithium-ion batteries. For instance, the European Union has implemented policies aiming for a 30% reduction in vehicle CO2 emissions by 2030, pushing automakers to accelerate the development of EVs and, consequently, advanced battery technologies.

Government initiatives to support sustainable energy contribute profoundly to the market’s expansion. For example, the U.S. Department of Energy announced an investment of $200 million in 2023 to support advanced battery technologies, including the development of better battery separators. This investment is part of a broader effort to bolster the domestic supply chain for critical materials and technologies essential for the energy transition.

Another driving factor is the expansion of renewable energy installations, which necessitates reliable energy storage solutions. Solar and wind energy systems require efficient storage to manage supply variability, making high-capacity batteries with robust separators essential. According to the International Renewable Energy Agency (IRENA), renewable capacity is projected to grow by over 200 GW annually until 2022, highlighting the growing need for efficient battery storage systems.

Key Takeaways

- Battery Separator Market size is expected to be worth around USD 34.2 billion by 2034, from USD 8.3 billion in 2024, growing at a CAGR of 15.2%.

- Lithium-Ion (Li-Ion) batteries maintained a dominant market position, capturing more than a 76.30% share.

- Coated separator segment held a dominant position within the battery separator market, accounting for more than 68.10% of the market share.

- Polypropylene in the battery separator market held a dominant position, capturing more than a 48.40% share.

- 10mm to 20mm secured a commanding position in the market, capturing more than 67.30% of the total share.

- Dry battery separator segment asserted its market dominance by securing a 58.40% share.

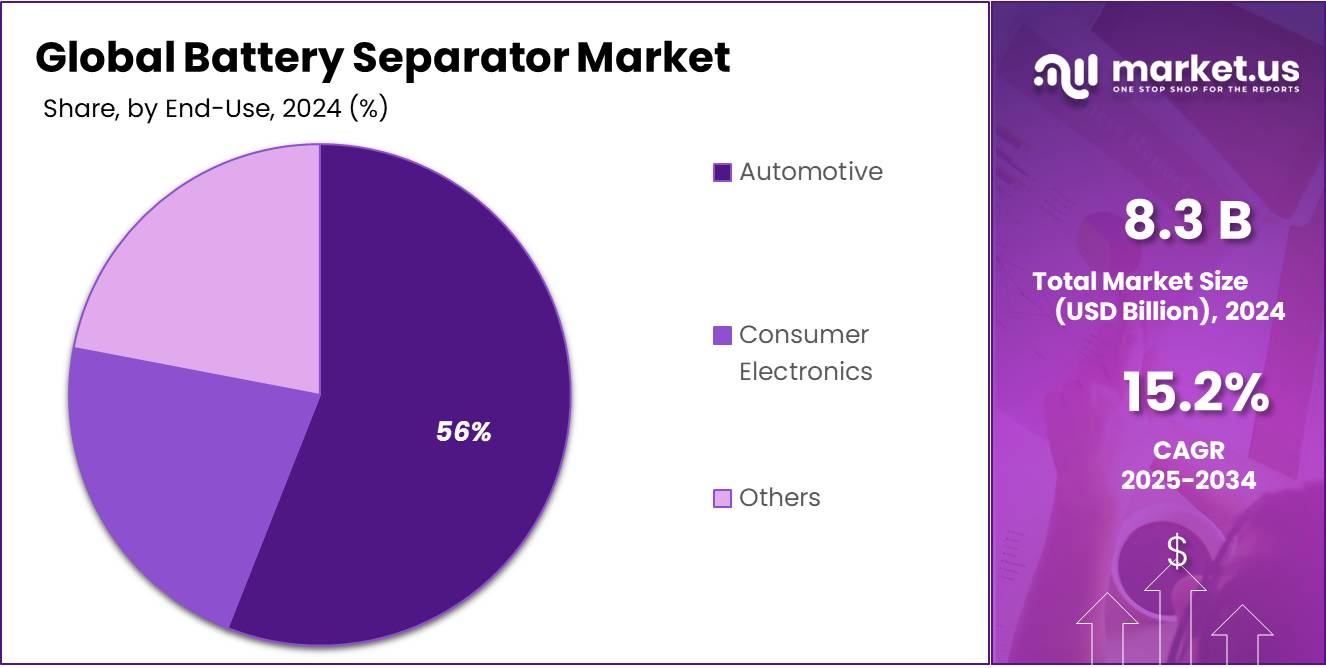

- Automotive sector maintained a dominant position in the battery separator market, capturing more than a 56.30% share.

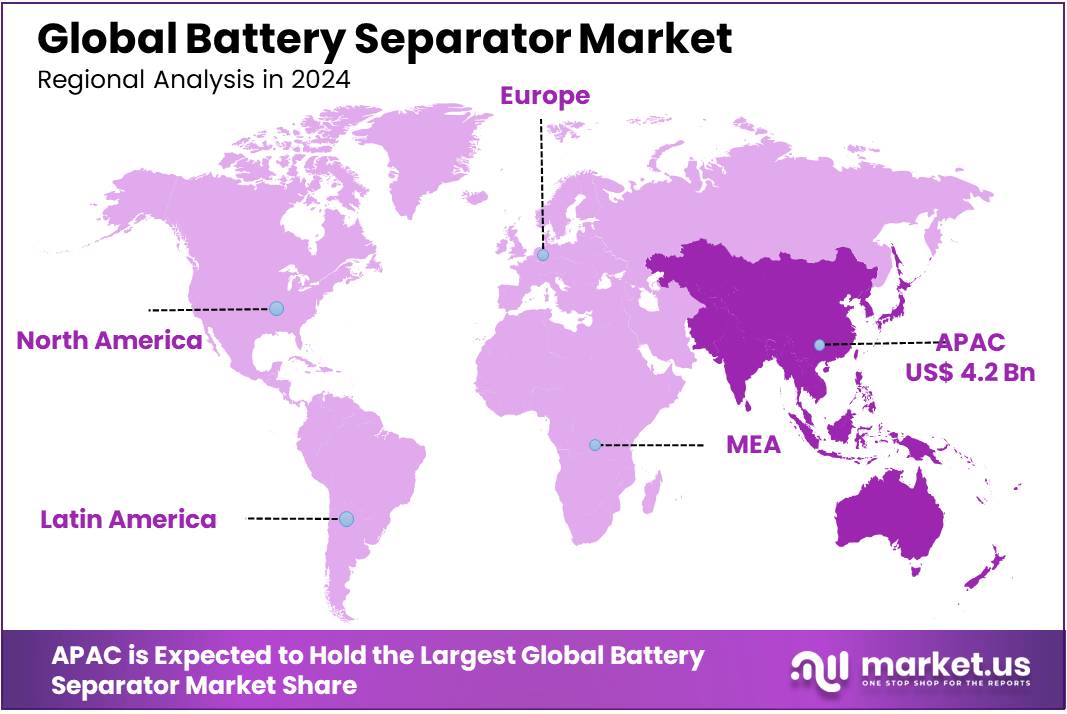

- Asia-Pacific (APAC) region emerged as the undisputed leader in the global battery separator market, capturing a substantial 51.10% market share, equivalent to a value of USD 4.2 billion.

By Battery Type

Lithium-Ion Batteries Dominate with 76.30% Share Owing to Superior Energy Density

In 2024, Lithium-Ion (Li-Ion) batteries maintained a dominant market position, capturing more than a 76.30% share of the battery separator market. This significant market share is primarily attributed to the high energy density and long life span of lithium-ion batteries, which are crucial for applications requiring reliable, long-term energy storage, such as electric vehicles and portable electronic devices. The widespread adoption of these batteries across various sectors, coupled with ongoing advancements in technology that continue to enhance their efficiency and safety, solidifies their dominant position in the market.

By Type

Coated Separator Continues to Lead with 68.10% Share Due to Enhanced Safety Features

In 2024, the coated separator segment held a dominant position within the battery separator market, accounting for more than 68.10% of the market share. This substantial share can be attributed to the segment’s significant advancements in enhancing battery safety and performance. Coated separators, typically featuring a thin ceramic or polymer layer, offer improved thermal stability and resistance to short circuits, key factors in preventing battery failures.

This safety feature is particularly crucial in high-demand applications such as electric vehicles and portable electronics, where safety concerns are paramount. Moreover, the ability of coated separators to operate at higher temperatures without compromising the battery’s integrity makes them indispensable in modern battery architecture, thereby securing their dominant market position.

By Material

Polypropylene Leads with 48.40% Share Due to Cost-Effectiveness and Durability

In 2024, polypropylene in the battery separator market held a dominant position, capturing more than a 48.40% share. This prevalence is largely due to polypropylene’s inherent attributes such as chemical resistance, low moisture absorption, and excellent mechanical properties, which are essential for the effective functioning of battery separators.

The material’s cost-effectiveness combined with its durability makes it a preferred choice in both automotive and consumer electronics sectors. As battery manufacturers continue to seek reliable and economical materials to improve battery performance and safety, polypropylene’s role remains crucial in meeting these industry demands.

Thickness

10mm-20mm Battery Separators Command 67.30% Market Share Due to Optimal Performance

In 2024, battery separators with a thickness ranging from 10mm to 20mm secured a commanding position in the market, capturing more than 67.30% of the total share. This preference is largely driven by the balance these separators provide between physical robustness and electrochemical performance, making them ideal for a wide range of applications, including consumer electronics and electric vehicles.

Their thickness ensures sufficient mechanical strength to withstand the rigors of battery operation while maintaining the necessary porosity for efficient ionic conductivity. This combination not only optimizes battery performance but also enhances the overall safety and longevity of the battery systems, justifying their dominant stance in the market.

By Technology

Dry Battery Separator Captures 58.40% Market Share, Favored for Its Efficiency and Stability

In 2024, the dry battery separator segment asserted its market dominance by securing a 58.40% share. This type of separator is highly valued for its contribution to enhancing battery efficiency and stability, particularly in high-energy applications such as electric vehicles and renewable energy storage systems.

Dry battery separators are produced through a dry process which typically involves less environmental impact compared to wet processes, offering a more sustainable option. Their ability to maintain structural integrity at high temperatures and during rapid charge and discharge cycles makes them indispensable in modern battery technology, underpinning their substantial market share.

By End-Use

Automotive Sector Leads with 56.30% Share, Driven by Demand for Electric Vehicles

In 2024, the automotive sector maintained a dominant position in the battery separator market, capturing more than a 56.30% share. This significant market share is primarily fueled by the escalating demand for electric vehicles (EVs), which require reliable and efficient battery systems to ensure optimal performance and range.

Battery separators play a crucial role in these systems, improving battery safety and functionality, which is vital in automotive applications. As global initiatives increase to reduce carbon emissions and move away from fossil fuels, the demand within the automotive industry for advanced battery technology continues to grow, thereby bolstering the need for high-quality battery separators.

Market Key Segments

By Battery Type

- Lithium-Ion (Li-Ion)

- Lead Acid

- Others

By Type

- Coated separator

- Non-coated separator

By Material

- Polyethylene (PE)

- Polypropylene (PP)

- Others

Thickness

- 5μM-10μM

- 10μM-20μM

By Technology

- Dry Battery Separator

- Wet Battery Separator

By End-Use

- Automotive

- Consumer Electronics

- Others

Drivers

Government Support for Electric Vehicles Boosts Battery Separator Market

One of the primary driving factors for the growth of the battery separator market is the increasing government support for electric vehicles (EVs). Governments worldwide are implementing a range of initiatives and incentives to encourage the adoption of EVs, which in turn drives the demand for advanced batteries and their components, including separators.

For instance, the European Commission has committed to reducing greenhouse gas emissions by 55% by 2030 compared to 1990 levels. This ambitious target is supported by significant financial incentives for EV buyers and investments in EV infrastructure. These policies are designed to facilitate a shift away from internal combustion engine vehicles towards more sustainable electric alternatives.

Similarly, in the United States, the Biden administration has proposed a $174 billion investment to boost the EV market. This plan includes point-of-sale rebates and tax incentives to lower the cost of EVs for consumers. Additionally, there is a push to establish grant and incentive programs for state and local governments to build a nationwide network of 500,000 EV chargers by 2030.

China, the world’s largest automotive market, is also playing a crucial role in promoting EVs. The Chinese government has extended subsidies for new energy vehicles (NEVs) until 2022, despite originally planning to phase them out by 2020. These subsidies have significantly reduced the upfront cost of EVs, making them more accessible to consumers and stimulating the domestic EV market.

Restraints

Supply Chain Disruptions Challenge Battery Separator Industry

A major restraining factor affecting the growth of the battery separator market is the vulnerability of the supply chain, which has been particularly evident in the face of global disruptions such as the COVID-19 pandemic. The battery separator industry relies heavily on the precise and timely delivery of raw materials, which are often sourced internationally.

During the pandemic, restrictions on international travel and trade severely impacted the ability to transport these crucial materials, leading to delays and shortages. For example, polypropylene, a key material used in the production of battery separators, saw disrupted supply lines due to factory shutdowns and logistics issues. This not only delayed production schedules but also pushed up prices temporarily, affecting the overall cost-effectiveness of manufacturing battery separators.

Furthermore, geopolitical tensions and trade disputes can exacerbate these supply chain vulnerabilities. For instance, the ongoing trade tensions between major economic powers such as the United States and China have led to tariffs and other trade barriers that can increase costs and complicate the procurement of necessary materials.

Government initiatives aimed at strengthening domestic supply chains are in place to mitigate these issues. For example, the U.S. Department of Energy has launched programs to support the domestic sourcing and production of critical minerals and materials essential for battery production. This includes funding opportunities aimed at reducing reliance on imported materials and enhancing the resilience of the battery manufacturing sector.

Opportunity

Expansion into Energy Storage Solutions Presents Major Growth Opportunity

A significant growth opportunity for the battery separator market lies in the expansion into energy storage solutions, particularly for renewable energy systems. As the world increasingly turns towards sustainable energy sources like solar and wind, the need for efficient energy storage systems to manage intermittency and ensure reliable power supply has become crucial. Battery separators play a vital role in these systems by enhancing the efficiency and safety of batteries used for energy storage.

Governments worldwide are supporting this shift towards renewable energy through various incentives and funding. For example, the European Union’s Green Deal aims to make Europe climate-neutral by 2050, part of which involves a massive increase in renewable energy production and corresponding storage capacities. The EU has pledged substantial funds to support innovation and infrastructure in renewable energy, including battery storage technologies.

In the United States, the Department of Energy’s Energy Storage Grand Challenge seeks to establish American leadership in energy storage technologies, including those used in battery production. Initiatives under this challenge are focused on developing and domesticating breakthrough technologies that can improve the performance of batteries and their components, such as separators.

Moreover, the rapid adoption of electric vehicles (EVs), which rely heavily on advanced battery technologies, also supports the demand for high-quality battery separators. With governments pushing for a decrease in greenhouse gas emissions by promoting EVs, the automotive sector’s demand for batteries that are both powerful and safe (thanks to reliable separators) is expected to continue growing.

Trends

Solid-State Batteries Drive New Trends in Battery Separator Technology

A major trend shaping the battery separator market is the development of solid-state batteries, which promise to revolutionize the energy storage landscape. Unlike traditional liquid electrolyte solutions, solid-state batteries use a solid electrolyte that can significantly enhance safety and energy density. This shift is critical as the demand for more efficient, longer-lasting batteries grows, particularly in the electric vehicle (EV) and consumer electronics sectors.

Governments and industries are investing heavily in solid-state technology to push these advancements forward. For instance, the U.S. Department of Energy has funded multiple projects through its Advanced Research Projects Agency-Energy (ARPA-E) aimed at accelerating the development of solid-state battery technologies. These projects focus on improving the interface between the solid electrolyte and the electrodes, a key challenge in the commercial viability of these batteries.

The move towards solid-state batteries also necessitates the development of new types of separators that are compatible with solid electrolytes. These separators must not only prevent physical contact between electrodes but also facilitate the movement of ions through the solid medium. Advances in ceramic and polymer composites are being explored to meet these needs, providing substantial opportunities for innovation in material science.

Regional Analysis

In 2024, the Asia-Pacific (APAC) region emerged as the undisputed leader in the global battery separator market, capturing a substantial 51.10% market share, equivalent to a value of USD 4.2 billion. This dominance is primarily attributed to the presence of major battery manufacturing hubs in countries such as China, South Korea, and Japan. These nations are home to some of the world’s largest lithium-ion battery producers, including CATL, LG Energy Solution, Panasonic, and BYD, which significantly drive the demand for high-performance battery separators.

China, in particular, continues to lead in electric vehicle (EV) production and adoption, with the China Association of Automobile Manufacturers (CAAM) reporting over 9.4 million new energy vehicles (NEVs) sold in 2023 alone. This explosive growth in EVs has directly boosted the need for efficient and safe battery components, including separators. Additionally, favorable government policies, such as China’s extended NEV subsidies and the “Made in China 2025” initiative, have strengthened local battery manufacturing capabilities, further enhancing regional market growth.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Toray Battery Separator Film Korea Limited is a key player in the global battery separator market, known for its high-quality lithium-ion battery separator films. As a subsidiary of Toray Industries, the company focuses on advanced multilayer films that offer excellent heat resistance and durability. Its production facilities in South Korea cater primarily to electric vehicles and energy storage applications. The company continues to expand its footprint globally, supported by strong R&D and strategic partnerships in the battery value chain.

Sumitomo Chemical Co., Ltd. is a major Japanese company actively involved in producing battery separators, particularly for lithium-ion batteries. It develops polyolefin-based separators with proprietary coating technologies to improve safety and efficiency. The company supplies key customers in the electric vehicle, consumer electronics, and industrial battery sectors. With a focus on innovation and quality, Sumitomo continues to invest in expanding production capacities across Asia and enhancing separator properties for next-generation battery technologies.

Asahi Kasei Corporation is a global leader in battery separator manufacturing through its Hipore™ and Celgard™ brands. The company offers both wet and dry process separators, serving automotive and energy storage system markets. Its strategic acquisition of Polypore International enhanced its technological base and global presence. Asahi Kasei is heavily focused on research, consistently advancing separator safety and performance to meet evolving demands from the EV industry and grid storage sectors worldwide.

Market Key Players

- Asahi Kasei Corporation

- Toray Battery Separator Film Korea Limited

- Sumitomo Chemical Co., Ltd.

- SK Innovation Co., Ltd.

- Freudenberg Performance Materials

- ENTEK International, LLC

- W-Scope Corporation

- UBE Corporation

- Bernard Dumas

- Dow, Inc.

- Mitsubishi Paper Mills, Ltd.

- Teijin Limited

- Eaton Corporation plc

- Ahlstrom

- Sinoma Lithium Film Co., Ltd.

Recent Developments

2023 Asahi Kasei Corporation: Expanded coating capacity for lithium-ion battery separators in October, enabling supply for batteries equivalent to 1.7 million electric vehicles.

Toray Battery Separator Film Korea Limited has been focusing on developing thinner separators, aiming to reduce thickness from 10 micrometers to 7 micrometers, enhancing battery efficiency and performance. Additionally, TBSK has been expanding its production capacity, with plans to increase separator production to 1.5 billion square meters annually.

Report Scope

Report Features Description Market Value (2024) USD 8.3 Bn Forecast Revenue (2034) USD 34.2 Bn CAGR (2025-2034) 15.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Battery Type (Lithium-Ion (Li-Ion), Lead Acid, Others), By Type (Coated separator, Non-coated separator), By Material (Polyethylene (PE), Polypropylene (PP), Others), Thickness (5μM-10μM, 10μM-20μM), By Technology (Dry Battery Separator, Wet Battery Separator), By End-Use (Automotive, Consumer Electronics, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Asahi Kasei Corporation, Toray Battery Separator Film Korea Limited, Sumitomo Chemical Co., Ltd., SK Innovation Co., Ltd., Freudenberg Performance Materials, ENTEK International, LLC, W-Scope Corporation, UBE Corporation, Bernard Dumas, Dow, Inc., Mitsubishi Paper Mills, Ltd., Teijin Limited, Eaton Corporation plc, Ahlstrom, Sinoma Lithium Film Co., Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Asahi Kasei Corporation

- Toray Battery Separator Film Korea Limited

- Sumitomo Chemical Co., Ltd.

- SK Innovation Co., Ltd.

- Freudenberg Performance Materials

- ENTEK International, LLC

- W-Scope Corporation

- UBE Corporation

- Bernard Dumas

- Dow, Inc.

- Mitsubishi Paper Mills, Ltd.

- Teijin Limited

- Eaton Corporation plc

- Ahlstrom

- Sinoma Lithium Film Co., Ltd.