Global Advanced Battery Energy Storage Market By Technology (Lithium-ion battery, Lead Acid battery, Sodium Sulfur (NaS) battery, Flow battery, Nickel Metal Hydride (NiMH) And Nickel Metal Cadmium (NiCd), Others), By Application (Grid Storage, Transportation, Others), By End-User (Residential, Non-Residential) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 141392

- Number of Pages: 212

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

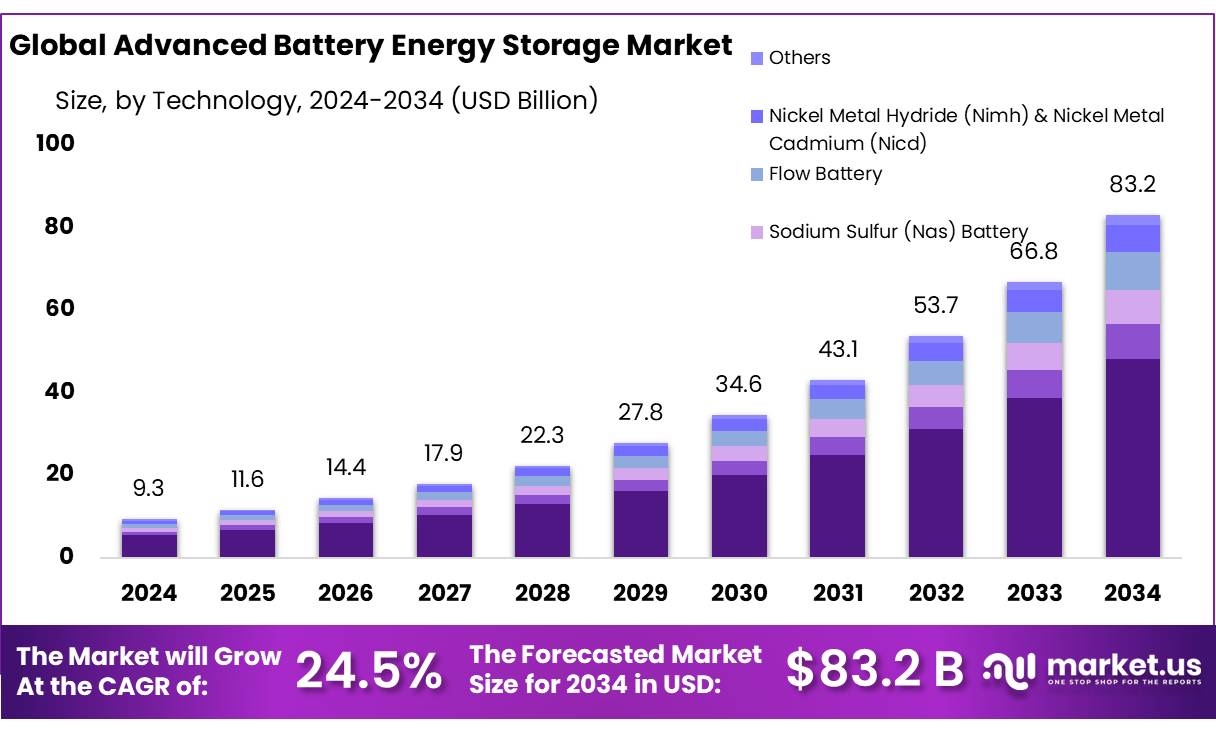

The Global Advanced Battery Energy Storage Market size is expected to be worth around USD 83.2 Bn by 2034, from USD 9.3 Bn in 2024, growing at a CAGR of 24.5% during the forecast period from 2025 to 2034.

Advanced Battery Energy Storage (ABES) has emerged as a critical component in the energy storage market, playing an essential role in the integration of renewable energy sources, grid stabilization, and efficient energy management. As industries, utilities, and governments worldwide focus on reducing carbon emissions and promoting clean energy solutions, ABES technologies have witnessed significant growth. These systems are designed to store surplus energy generated from renewable sources like solar and wind, to be deployed when demand exceeds supply or during periods of low energy generation.

The rapid rise in demand for electric vehicles (EVs) in China is a major driver for the expansion of advanced battery energy storage systems. According to Beijing City’s 13th Five-Year Plan (for 2020), the city is slated to become China’s central hub for alternate energy vehicle R&D. The plan includes the production of around 500,000 electric vehicles by 2020. The integration of AES in this framework is critical for managing the increased load on the grid and ensuring efficient charging solutions for the growing EV market.

Under the 13th Five-Year Plan, Beijing is identified as the main R&D center for China’s alternate energy vehicles. This initiative is part of the nation’s broader strategy to transition to cleaner energy sources, improve energy efficiency, and reduce emissions. Beijing’s commitment to developing both the EV sector and the supporting AES infrastructure will likely serve as a model for other cities and regions in China, accelerating the adoption of clean transportation technologies and energy management systems across the country.

Key Takeaways

- Advanced Battery Energy Storage Market is projected to reaching a value of approximately USD 83.2 billion by 2034, up from USD 9.3 billion in 2024, at a (CAGR) of 24.5%

- Lithium-ion batteries are expected to maintain a dominant position, accounting for over 58.3% of the market share.

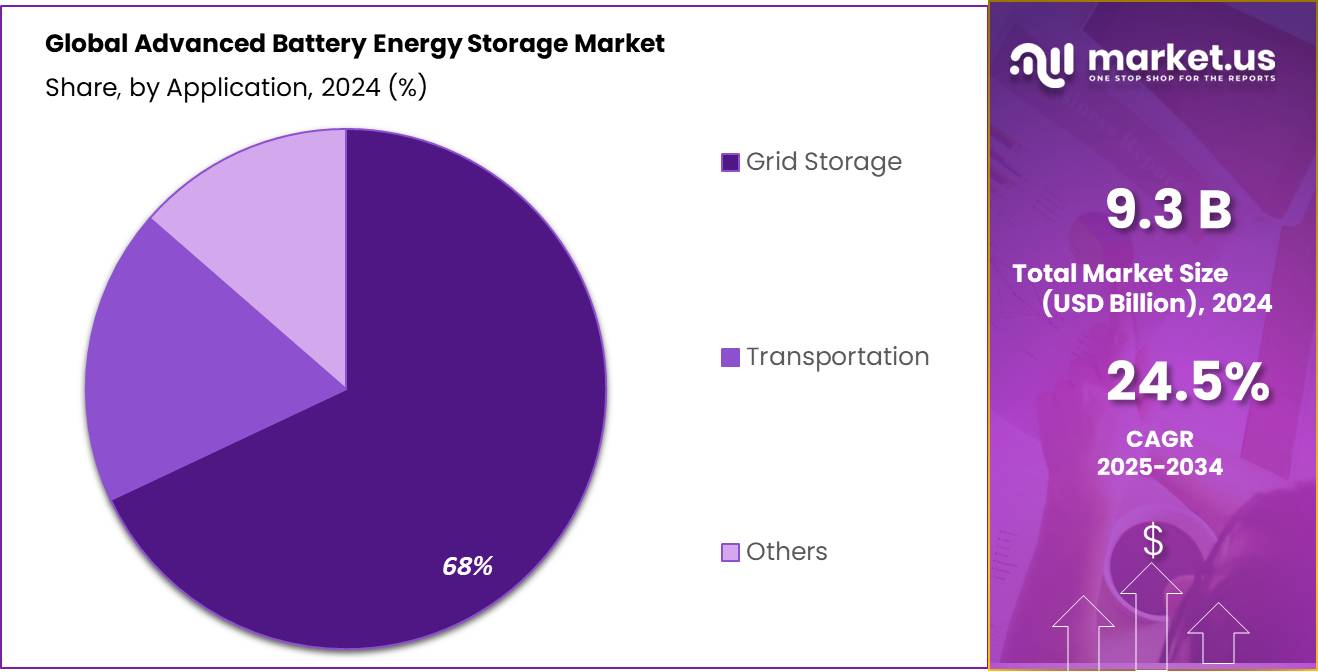

- Grid Storage is anticipated to account for more than 68.3% of the advanced battery energy storage market.

- Non-Residential applications held a dominant market position, capturing more than a 79.2% share of the advanced battery energy storage market.

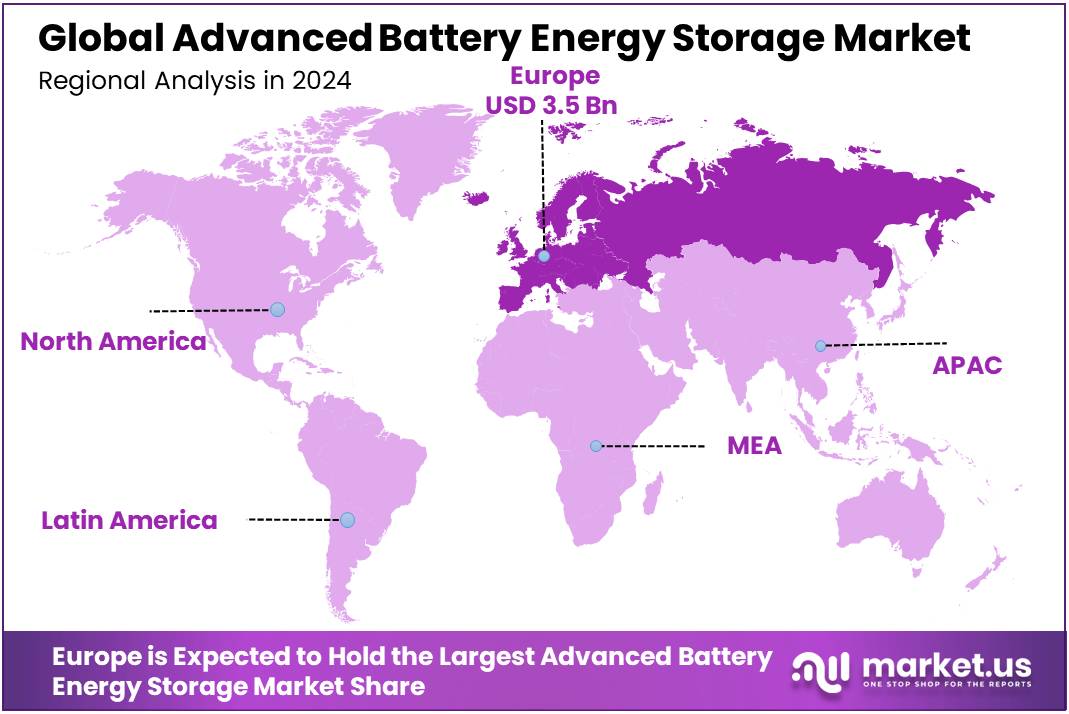

- Europe held a dominant position in the global advanced battery energy storage market, accounting for 38.7% of the market share, valued at approximately USD 3.5 billion.

By Technology

In 2024, Lithium-ion batteries held a dominant market position, capturing more than a 58.3% share of the advanced battery energy storage market. The growing demand for renewable energy storage solutions, combined with the increasing use of electric vehicles (EVs), has significantly boosted the popularity of Lithium-ion batteries. Their high energy density, long cycle life, and relatively low maintenance requirements have made them the preferred choice for both grid storage and transportation applications.

The battery technologies such as sodium-ion and flow batteries are expected to capture a more significant portion of the market in the coming years, albeit at a slower pace. These alternative technologies are still in the early stages of adoption, but they offer potential advantages like improved safety profiles and lower raw material costs, which could appeal to specific segments of the energy storage market. However, Lithium-ion’s established infrastructure and consistent improvements in performance will likely maintain its dominance in the near term.

By Application

In 2024, Grid Storage held a dominant market position, capturing more than a 68.3% share of the advanced battery energy storage market. The increasing demand for renewable energy sources, such as solar and wind, which are intermittent by nature, has fueled the need for efficient and reliable energy storage systems to balance supply and demand. Grid storage solutions, particularly those using advanced battery technologies like Lithium-ion, are critical for ensuring that energy generated during periods of high production can be stored and used when demand spikes or when generation is low.

The grid storage is expected to remain strong, driven by continued investment in smart grids, renewable energy infrastructure, and the ongoing transition toward decarbonized power systems. As renewable energy penetration increases, grid operators will continue to rely heavily on energy storage to manage fluctuations in energy supply and stabilize the grid. Technological improvements in battery performance, such as enhanced efficiency, longer lifespan, and lower costs, will further support the adoption of grid storage solutions.

By End-User

In 2024, Non-Residential applications held a dominant market position, capturing more than a 79.2% share of the advanced battery energy storage market. This segment is primarily driven by the increasing need for energy independence, cost reduction, and sustainability initiatives among commercial, industrial, and institutional entities. Large-scale facilities, such as factories, data centers, and office buildings, require reliable and cost-effective energy solutions to manage peak demand, reduce energy costs, and ensure backup power in case of grid outages.

The Non-Residential segment is expected to remain strong, as more businesses and organizations shift towards greener and more energy-efficient solutions. Many companies are looking to offset the rising costs of electricity and mitigate the volatility of energy prices by investing in advanced energy storage systems. As more renewable energy sources are integrated into commercial operations, the need for energy storage to smooth out production and consumption mismatches will further drive growth in this segment.

Key Market Segments

By Technology

- Lithium-ion battery

- Lead Acid battery

- Sodium Sulfur (NaS) battery

- Flow battery

- Nickel Metal Hydride (NiMH) & Nickel Metal Cadmium (NiCd)

- Others

By Application

- Grid Storage

- Transportation

- Others

By End-User

- Residential

- Non-Residential

Drivers

Government Initiatives and Sustainability Goals Driving Growth in Energy Storage

One of the major driving factors behind the growth of the advanced battery energy storage market is the increasing number of government initiatives and sustainability goals focused on reducing carbon emissions and supporting renewable energy integration. Governments around the world are introducing policies, incentives, and subsidies that encourage both private companies and consumers to adopt clean energy solutions, including advanced battery storage systems. These efforts are essential as the world moves toward achieving net-zero emissions targets and enhancing energy security.

For example, in the United States, the Biden administration has been pushing for a cleaner, more sustainable energy future. As part of this initiative, the U.S. Department of Energy allocated over $6 billion in funding for energy storage projects in 2022. These efforts are designed to support grid modernization, improve energy resilience, and reduce reliance on fossil fuels.

According to the U.S. Department of Energy, energy storage could play a key role in helping the U.S. meet its goal of decarbonizing the power sector by 2035. This has spurred significant investments in battery energy storage systems, especially those that can handle the variability of renewable energy sources like solar and wind.

Additionally, in the European Union, policies such as the European Green Deal have set ambitious climate goals. The EU aims to become carbon neutral by 2050, and energy storage is seen as a key enabler of this vision. The European Commission’s “Clean Energy for All Europeans” package emphasizes the need for energy storage technologies to ensure a flexible, low-carbon energy system. In fact, the EU is investing billions in energy storage research and development to scale up these technologies, with a focus on driving down costs and improving efficiency

Restraints

High Initial Costs and Limited Affordability

One of the significant restraining factors for the growth of the advanced battery energy storage market is the high initial cost of battery storage systems. Despite the technological advancements in battery chemistry, manufacturing, and efficiency, the upfront costs for deploying large-scale energy storage systems remain a major hurdle for many organizations, especially small and medium-sized businesses. This issue is particularly critical in industries like food manufacturing and agriculture, where tight margins often make it difficult to justify the investment in expensive energy solutions.

For example, major food companies such as Nestlé and PepsiCo have committed to sustainability goals, but they also face significant cost concerns when investing in energy storage systems. PepsiCo has been actively working towards its goal of achieving net-zero emissions by 2040, and while the company has made notable strides in adopting renewable energy, energy storage remains a cost-intensive barrier.

According to PepsiCo’s 2022 sustainability report, the company has invested over $1 billion in energy efficiency and renewable energy initiatives, yet high initial costs for energy storage solutions still limit widespread deployment across their global operations.

Similarly, Nestlé, which is striving to reach net-zero emissions by 2050, has faced challenges in scaling energy storage systems across its extensive network of production facilities. In their 2021 report, they highlighted that despite efforts to reduce carbon emissions, high capital expenditure costs for energy storage solutions are one of the key barriers to faster implementation, especially in developing markets.

Although government incentives and grants are helping to reduce some of the financial burden—such as the U.S. Department of Energy’s $6 billion investment into energy storage projects—the initial costs remain prohibitive for many. Until battery storage costs decrease further or until governments and organizations increase funding, the high upfront expense will continue to be a major barrier to widespread adoption, particularly in energy-intensive industries like food manufacturing.

Opportunity

Increasing Demand for Renewable Energy Integration

One of the most significant growth opportunities for the advanced battery energy storage market is the increasing demand for renewable energy integration, particularly in the food and beverage industry. As companies strive to meet sustainability targets and reduce their carbon footprint, many are turning to renewable energy sources like solar and wind.

However, these sources are intermittent, making reliable energy storage systems essential to ensuring a consistent power supply. This is where advanced battery energy storage solutions come in, providing a way to store excess renewable energy during periods of high generation and release it during times of low generation or peak demand.

Leading companies in the food industry, such as Unilever, have already started capitalizing on this opportunity. Unilever, which has committed to becoming carbon neutral by 2039, is investing in renewable energy and battery storage systems to power its manufacturing facilities.

In 2021, Unilever reported that 61% of its global energy usage came from renewable sources, and the company has been exploring energy storage to enhance grid flexibility at its plants. The integration of energy storage with renewable sources is key to Unilever’s sustainability strategy, helping the company manage energy costs and improve the reliability of renewable energy supply.

Governments are also actively supporting this transition. For instance, the U.S. government’s recent push for renewable energy adoption has been accompanied by financial incentives aimed at supporting energy storage projects.

The Department of Energy’s $6 billion funding initiative, designed to boost energy storage capacity, has led to increased investments in both large-scale and distributed energy storage systems. This financial backing is helping make energy storage systems more accessible to industries like food manufacturing, which rely on stable, cost-effective power for their operations

Trends

Adoption of Hybrid Energy Storage Systems

One of the latest trends in the advanced battery energy storage market is the growing adoption of hybrid energy storage systems, which combine different battery technologies and energy storage solutions to improve efficiency, reduce costs, and enhance performance. These systems typically integrate advanced lithium-ion batteries with other technologies, such as flow batteries or even thermal storage, to meet diverse energy storage needs across various applications. This hybrid approach is gaining traction in industries like food manufacturing, where reliability and cost-effectiveness are critical.

In the food sector, companies like Nestlé and Coca-Cola are exploring hybrid energy storage systems to reduce energy costs and improve sustainability. For instance, Nestlé’s efforts to decarbonize its operations include the use of hybrid energy systems in its production plants. By combining solar energy with battery storage, the company can ensure a continuous energy supply even when the sun isn’t shining. In 2020, Nestlé reported that nearly 50% of its global operations were powered by renewable energy, and hybrid storage systems play a key role in optimizing this renewable energy usage.

The U.S. government is also backing the development of hybrid storage solutions, recognizing their potential to balance renewable energy fluctuations and offer more cost-effective storage options. The Department of Energy’s funding for energy storage innovation includes support for hybrid storage technologies, helping to drive further adoption in sectors with high energy demand. As part of its broader clean energy strategy, the U.S. has committed to investing in energy storage technologies, including hybrid systems, to meet its decarbonization goals by 2035.

Regional Analysis

In 2024, Europe held a dominant position in the global advanced battery energy storage market, accounting for 38.7% of the market share, valued at approximately $3.5 billion. The region’s leadership is largely driven by strong government support for renewable energy adoption, ambitious decarbonization goals, and the region’s rapid transition towards a low-carbon economy.

Europe’s energy storage market is supported by policies like the European Green Deal, which targets carbon neutrality by 2050, and the Clean Energy for All Europeans package, aimed at increasing renewable energy integration across member states. These regulatory frameworks are pushing both public and private investments into energy storage solutions to stabilize power grids and enhance the efficiency of renewable energy sources such as wind and solar.

Countries like Germany, the UK, and France are leading the charge, with significant investments in energy storage infrastructure. For example, Germany’s energy storage capacity is expected to grow significantly, with projections indicating a 20% increase by 2025.

The UK’s energy storage market is also expanding rapidly, driven by its offshore wind capacity, which is expected to become the largest in the world by 2030. As renewable energy generation increases, the need for advanced energy storage systems to manage grid stability and optimize energy supply will continue to propel Europe’s market forward.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

ABB Ltd., a global leader in electrification and automation, has been at the forefront of providing integrated energy storage solutions for both commercial and industrial applications. ABB’s expertise in power grids and energy management systems has positioned it as a major player in the storage sector, with a focus on scaling up renewable energy integration and enhancing grid stability.

Basell Industries N.V. and CALMAC are also making significant strides in energy storage. Basell, with its strong portfolio in materials science, has been increasingly involved in providing advanced solutions for energy storage systems that help improve efficiency, reduce costs, and promote sustainability. CALMAC, a leader in thermal energy storage, has focused on creating systems that store energy during off-peak hours, reducing peak demand and ensuring energy efficiency in industrial applications.

Dynapower Company LLC, known for its work in power conversion and energy storage systems for renewable energy integration, and EDF Renewables, which has been expanding its renewable energy and storage portfolio to enhance grid resilience and support decarbonization efforts. EOS Energy Storage, with its innovative zinc-based battery technology, is also emerging as a strong player, offering scalable, cost-effective solutions for large-scale energy storage needs.

Top Key Players

- ABB Ltd.

- Basell Industries N.V.

- CALMAC

- Dynapower Company LLC

- EDF Renewables

- EOS Energy Storage

- ES Corporation

- General Electric Company

- Green Charge Networks LLC

- GS Yuasa Corporation

- INEOS Group AG

- LG Chem, Ltd.

- Maxwell Corporation Lyondell

- NEC Corporation Beacon Power LLC

- Panasonic Corporation

- S&C Electric Company

- SAFT S.A

- Samsung SDI Co Itd

- Schneider Electric

- Siemens Ltd.

- Tesla Inc

- Toshiba Corporation

Recent Developments

In 2024, ABB’s energy storage business is valued at over $1.2 billion, reflecting its growing presence in sectors like industrial manufacturing, utilities, and commercial energy.

In 2024, Basell’s energy storage-related business has contributed to a substantial share of its annual revenue, estimated at $10 billion, driven by demand from industries looking to adopt sustainable, cost-effective energy solutions.

Report Scope

Report Features Description Market Value (2024) USD 9.3 Bn Forecast Revenue (2034) USD 83.2 Bn CAGR (2025-2034) 24.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered by Technology (Lithium-ion battery, Lead Acid battery, Sodium Sulfur (NaS) battery, Flow battery, Nickel Metal Hydride (NiMH) And Nickel Metal Cadmium (NiCd), Others), By Application (Grid Storage, Transportation, Others), By End-User (Residential, Non-Residential) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ABB Ltd., Basell Industries N.V., CALMAC, Dynapower Company LLC, EDF Renewables, EOS Energy Storage, ES Corporation, General Electric Company, Green Charge Networks LLC, GS Yuasa Corporation, INEOS Group AG, LG Chem, Ltd., Maxwell Corporation Lyondell, NEC Corporation Beacon Power LLC, Panasonic Corporation, S&C Electric Company, SAFT S.A, Samsung SDI Co Itd, Schneider Electric, Siemens Ltd., Tesla Inc, Toshiba Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Advanced Battery Energy Storage MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample

Advanced Battery Energy Storage MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- ABB Ltd.

- Basell Industries N.V.

- CALMAC

- Dynapower Company LLC

- EDF Renewables

- EOS Energy Storage

- ES Corporation

- General Electric Company

- Green Charge Networks LLC

- GS Yuasa Corporation

- INEOS Group AG

- LG Chem, Ltd.

- Maxwell Corporation Lyondell

- NEC Corporation Beacon Power LLC

- Panasonic Corporation

- S&C Electric Company

- SAFT S.A

- Samsung SDI Co Itd

- Schneider Electric

- Siemens Ltd.

- Tesla Inc

- Toshiba Corporation