Global Spray-on Solar Cells Market Size, Share, And Business Benefits By Technology (Organic Photovoltaics, Inorganic Photovoltaics, Perovskite Solar Cells), By Form (Flexible Panels, Rigid Panels, Transparent Panels), By Application (Building Integrated Photovoltaics, Portable Electronics, Transportation, Others), By End Use (Residential, Commercial, Industrial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: February 2025

- Report ID: 140861

- Number of Pages: 369

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

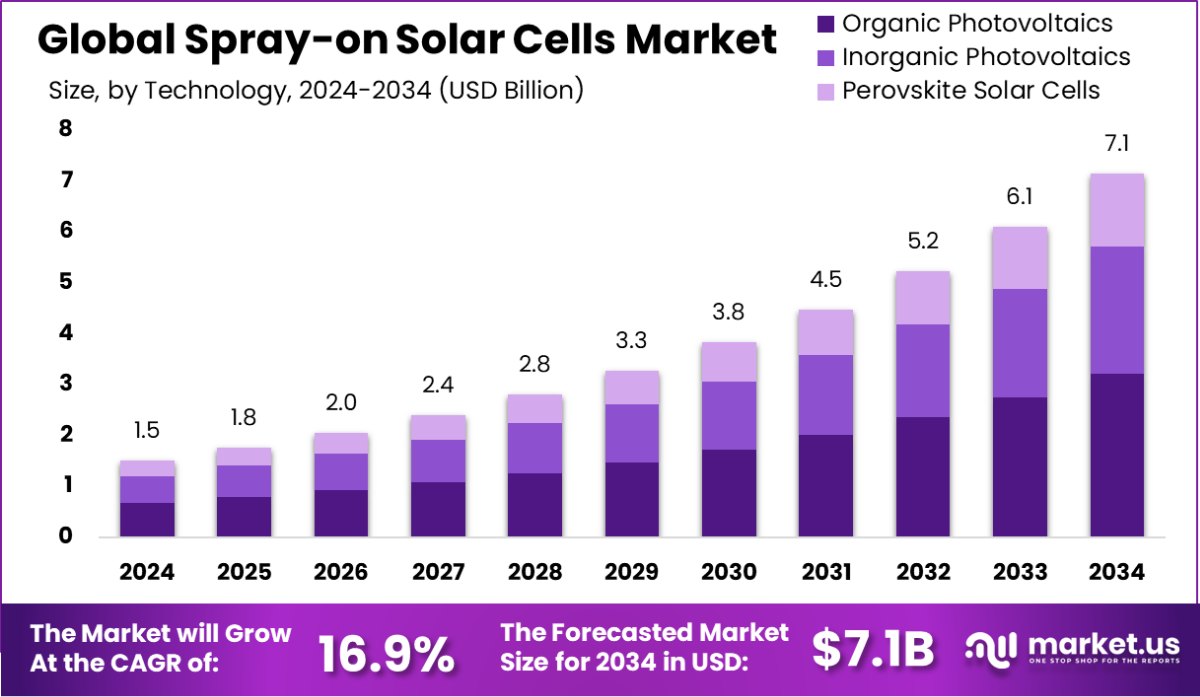

Global Spray-on Solar Cells Market is expected to be worth around USD 7.1 Billion by 2034, up from USD 1.5 Billion in 2024, and grow at a CAGR of 16.9% from 2025 to 2034. North America holds 41.3% of the Spray-on Solar Cells Market, USD 0.6 Bn.

Spray-on solar cells are an innovative photovoltaic technology that allows solar energy capture through a thin-film material that can be sprayed onto various surfaces. Unlike traditional bulky solar panels, these cells utilize perovskite or organic photovoltaic materials, making them lightweight, flexible, and adaptable to a wide range of applications.

The sprayable nature of these cells enables seamless integration into surfaces like glass, metal, plastics, and even fabric, offering new possibilities for energy harvesting in unconventional areas.

The spray-on solar cells market represents a rapidly emerging sector within the renewable energy industry, driven by the demand for more efficient, low-cost, and adaptable solar energy solutions. This market is seeing significant traction in industries such as consumer electronics, automotive, construction, and aerospace.

With advancements in nanotechnology and perovskite-based solar materials, companies are racing to commercialize spray-on solar technology, making solar energy more accessible and versatile than ever before.

The primary growth driver for spray-on solar cells is the increasing push for renewable energy solutions with high adaptability. Governments and corporations worldwide are investing heavily in sustainable technologies, and spray-on solar cells provide an innovative alternative to conventional photovoltaic panels. Their lightweight and flexible design allows integration into windows, vehicles, and wearables, reducing dependency on traditional grid electricity.

The demand for spray-on solar cells is rising due to their potential to revolutionize multiple industries. The consumer electronics market is particularly interested in using this technology to develop self-powered devices. The construction industry also sees strong potential for energy-efficient smart buildings, where windows and facades can generate electricity without altering aesthetic appeal.

The opportunity in this market lies in the expansion of commercial-scale production and further efficiency improvements. As research advances, enhancing energy conversion efficiency and durability will be critical for mass adoption. Additionally, developing cost-effective manufacturing techniques will determine how quickly spray-on solar cells can become mainstream, making them a viable competitor to traditional solar panels.

Researchers have made significant advancements in Spray-on Solar Cells, achieving a peak power conversion efficiency (PCE) of 19.4% for spray-coated perovskite solar cells. Demonstrating the capability to spray-coat substrates at speeds exceeding 80 mm/s, a 1.08 cm² spray-coated device reached a PCE of 12.7%.

While spray-on technology has currently reached an efficiency of 11%, it remains competitive compared to moderate-priced silicon-based solar cells, which offer around 25% efficiency, showcasing considerable progress in the field.

Key Takeaways

- Global Spray-on Solar Cells Market is expected to be worth around USD 7.1 Billion by 2034, up from USD 1.5 Billion in 2024, and grow at a CAGR of 16.9% from 2025 to 2034.

- Organic photovoltaics dominate the spray-on solar cells market, capturing a 45.3% share due to their lightweight, cost-effectiveness, and flexibility.

- Flexible panels lead with a 52.2% market share, driven by demand for adaptable, thin-film solar solutions in various applications.

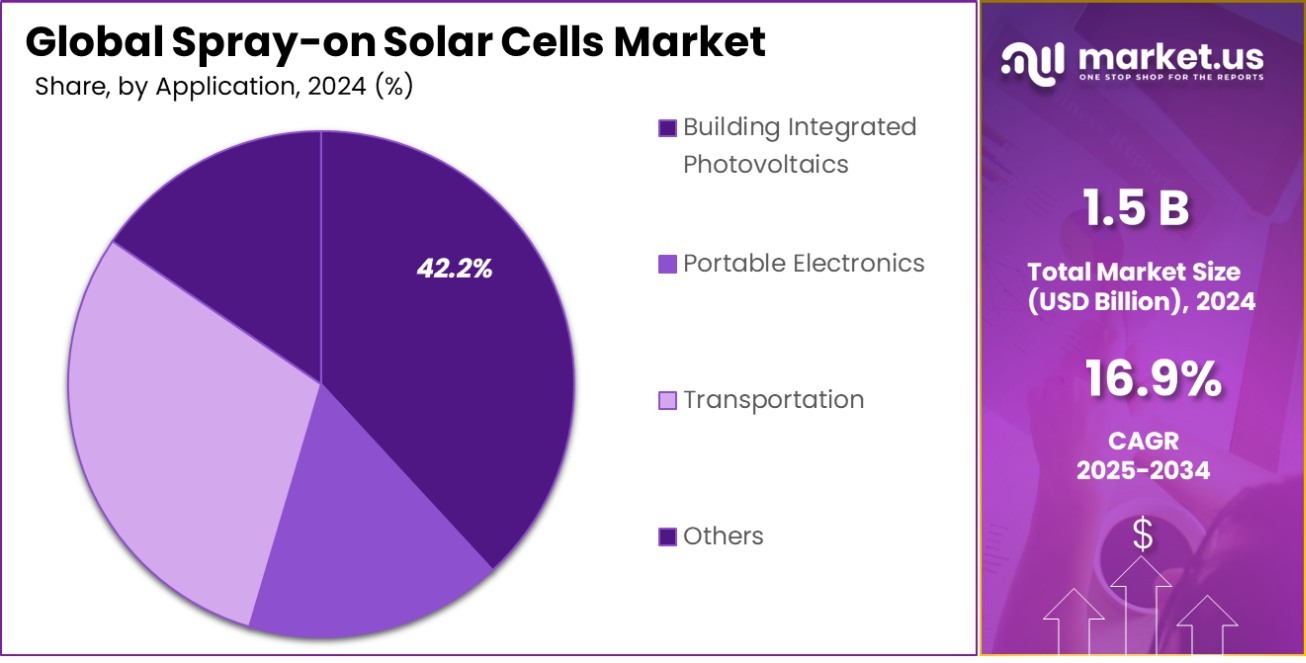

- Building Integrated Photovoltaics (BIPV) holds a 42.2% share, as spray-on solar cells seamlessly integrate into facades, windows, and infrastructure.

- The residential sector accounts for 47.3% market share, fueled by increasing consumer adoption of innovative solar energy solutions.

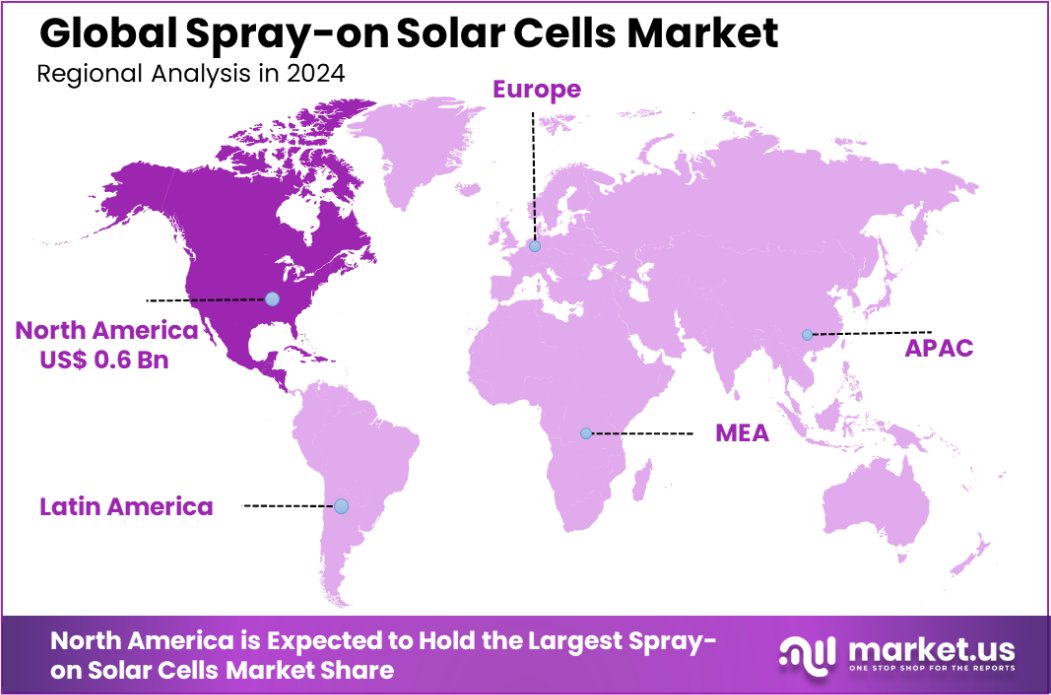

- In 2024, North America held a 41.3% share of the Spray-on Solar Cells Market, valued at USD 0.6 Bn.

By Technology Analysis

Organic photovoltaics dominate the spray-on solar cells market at 45.3% share.

In 2024, Organic Photovoltaics held a dominant market position in the By Technology segment of the Spray-on Solar Cells Market, with a 45.3% share. Organic Photovoltaics (OPVs) are increasingly being adopted due to their flexibility, lightweight nature, and ease of integration into various surfaces, making them highly suitable for spray-on applications.

The material’s ability to be deposited onto a wide variety of substrates, including plastic, glass, and fabric, contributes to its leading position in the market. The growth of OPVs in spray-on solar cells can also be attributed to significant advances in the efficiency of organic materials and the reduction in production costs, making them a viable alternative to traditional solar technologies.

The expansion of OPVs in the spray-on solar cells market is further supported by the growing demand for renewable energy solutions that are adaptable, cost-effective, and energy-efficient. This is particularly evident in industries such as consumer electronics, automotive, and construction, where the ability to integrate solar technology seamlessly into various products and structures is highly valued.

With ongoing research into improving the performance and durability of organic materials, OPVs are expected to maintain their market leadership and continue to dominate the Spray-on Solar Cells Market in the coming years.

By Form Analysis

Flexible panels lead the segment, capturing 52.2% of the market.

In 2024, Flexible Panels held a dominant market position in the By Form segment of the Spray-on Solar Cells Market, with a 52.2% share. Flexible panels are increasingly preferred due to their versatility and adaptability, allowing them to be applied to a wide range of surfaces and structures.

These panels can be easily integrated into various materials, including curved surfaces, which significantly enhances their application in sectors such as automotive, construction, and consumer electronics.

The lightweight and bendable nature of flexible panels allows them to be used in unconventional applications like wearables, making them a highly attractive option for industries looking to incorporate solar energy solutions without compromising on design.

The growth of flexible panels in the Spray-on Solar Cells Market is largely driven by the rising demand for energy-efficient and sustainable solutions across different industries. As these panels become more cost-effective and efficient, their adoption in diverse sectors is expected to expand.

The ability to integrate flexible panels into existing products and infrastructures, without the need for structural modifications, adds to their appeal. This trend is anticipated to continue, with flexible panels maintaining their dominant position in the By Form segment due to their unique benefits and growing market applications.

By Application Analysis

Building-integrated photovoltaics (BIPV) holds a 42.2% share in applications.

In 2024, Building Integrated Photovoltaics (BIPV) held a dominant market position in the By Application segment of the Spray-on Solar Cells Market, with a 42.2% share. BIPV applications are gaining significant traction due to the growing demand for energy-efficient and sustainable buildings.

These systems integrate solar technology directly into building materials, such as facades, windows, and roofs, eliminating the need for traditional bulky solar panels. Spray-on solar cells, with their ability to seamlessly integrate into building materials, are particularly well-suited for BIPV, offering both aesthetic appeal and energy generation capabilities.

The dominance of BIPV in the market can be attributed to the increasing focus on sustainable construction and the push for energy-efficient solutions in urban development. As building regulations become more stringent regarding energy use and sustainability, BIPV systems offer a practical solution for meeting these demands.

Furthermore, the potential to reduce energy costs while enhancing the visual appeal of buildings makes BIPV a highly attractive option for architects, developers, and property owners. The growing integration of spray-on solar cells in BIPV systems is expected to continue, with this application maintaining its leading position in the market as the demand for smart, energy-efficient buildings rises globally.

By End-Use Analysis

The residential sector drives demand, accounting for 47.3% market share.

In 2024, Residential held a dominant market position in the By End Use segment of the Spray-on Solar Cells Market, with a 47.3% share. The residential sector has been a key driver for the growth of spray-on solar cells, as homeowners increasingly seek sustainable and cost-effective energy solutions.

Spray-on solar cells, with their flexible, lightweight, and easy-to-apply nature, are ideal for residential applications, allowing homeowners to integrate solar energy technology into various surfaces such as rooftops, windows, and walls.

This ability to seamlessly blend solar cells into the aesthetic design of homes without compromising space or appearance has contributed significantly to their popularity in the residential market.

The growing awareness of environmental sustainability and rising electricity costs have further fueled the demand for solar energy solutions in residential buildings. Homeowners are now more inclined to invest in solar systems that offer energy independence while reducing their carbon footprint.

As spray-on solar cells become more efficient and affordable, their adoption in residential applications is expected to grow, with increasing numbers of homeowners opting for this innovative energy solution. The trend of integrating solar technology into home designs is expected to continue, reinforcing the dominance of the residential sector in the Spray-on Solar Cells Market.

Key Market Segments

By Technology

- Organic Photovoltaics

- Inorganic Photovoltaics

- Perovskite Solar Cells

By Form

- Flexible Panels

- Rigid Panels

- Transparent Panels

By Application

- Building Integrated Photovoltaics

- Portable Electronics

- Transportation

- Others

By End Use

- Residential

- Commercial

- Industrial

Driving Factors

Growing Demand for Sustainable Energy Solutions

One of the key driving factors for the Spray-on Solar Cells Market is the increasing demand for sustainable energy solutions. As climate change concerns rise and governments around the world set stricter environmental regulations, there is a significant push for renewable energy sources, such as solar power. Spray-on solar cells, with their lightweight, flexible, and adaptable design, are perfectly positioned to meet this demand.

Unlike traditional solar panels, spray-on solar cells can be integrated into a wide range of surfaces, from windows to walls, without the need for large, bulky installations. This ease of integration into everyday products and buildings allows consumers and businesses to adopt renewable energy solutions more effectively, contributing to the growth of this market.

Restraining Factors

Challenges in Improving Efficiency and Durability

A major restraining factor in the Spray-on Solar Cells Market is the ongoing challenge of improving the efficiency and durability of these cells. While spray-on solar cells offer flexibility and ease of integration, they currently face lower energy conversion efficiency compared to traditional silicon-based solar panels.

Additionally, their long-term durability, especially when exposed to environmental elements like heat, moisture, and UV rays, remains a concern. This limits their widespread adoption, particularly in outdoor applications.

Manufacturers are investing in research to address these issues, but until efficiency levels and longevity can match or exceed those of conventional solar technology, spray-on solar cells may face slow growth in the market.

Growth Opportunity

Expansion in Building Integrated Photovoltaics (BIPV)

A significant growth opportunity for the Spray-on Solar Cells Market lies in the expansion of Building Integrated Photovoltaics (BIPV). As the construction industry increasingly adopts sustainable building practices, integrating solar technology directly into building materials like windows, facades, and roofs is becoming a key trend.

Spray-on solar cells are ideal for BIPV applications because of their flexibility, lightweight nature, and ability to seamlessly blend into architectural designs without compromising aesthetics.

This opportunity is especially appealing in urban areas, where space is limited, and energy efficiency is highly valued. As the demand for green, energy-efficient buildings rises, spray-on solar cells have the potential to play a crucial role in powering modern infrastructure, and driving market growth.

Latest Trends

Advancements in Perovskite Solar Cell Technology

One of the latest trends in the Spray-on Solar Cells Market is the rapid advancements in perovskite solar cell technology. Perovskite materials have shown significant promise due to their high efficiency and cost-effective production processes.

In recent years, researchers have made substantial improvements in the stability and performance of perovskite-based solar cells, making them more viable for spray-on applications. These cells offer a higher energy conversion rate compared to traditional organic photovoltaics and can be applied on flexible substrates, making them ideal for spray-on use.

As the technology continues to evolve, it is expected to enhance the market’s growth by offering more efficient, durable, and affordable solutions for solar energy integration in various sectors, particularly in architecture and consumer electronics.

Regional Analysis

In 2024, North America accounted for 41.3% of the Spray-on Solar Cells Market, valued at USD 0.6 Bn.

The Spray-on Solar Cells market is witnessing significant growth across various regions, with North America dominating the market with a share of 41.3%, valued at USD 0.6 billion. The region benefits from a strong presence of innovative companies and increased government investments in renewable energy technologies.

Europe follows with a substantial market share, driven by stringent environmental regulations and a growing adoption of sustainable energy solutions. The Asia Pacific region is also experiencing robust growth due to the expanding renewable energy sector in countries like China and India, alongside the increasing manufacturing of solar technologies.

The Middle East & Africa, while a smaller market, is showing potential due to large-scale infrastructure projects and the rising demand for sustainable energy sources.

Latin America, though currently a smaller market, is gradually gaining traction, especially in Brazil, where solar energy adoption is increasing due to favorable government policies and high solar irradiance.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, the global Spray-on Solar Cells market is expected to continue evolving with increasing competition and innovation, driven by several key players. Heliatek, a pioneer in organic photovoltaic (OPV) technology, is positioned as a market leader, leveraging its expertise to deliver lightweight, flexible, and efficient spray-on solar cell solutions. Their focus on reducing production costs and increasing efficiency is set to impact both the commercial and residential solar markets significantly.

SolarWindow Technologies has been advancing transparent solar coatings, pushing the boundaries of architectural integration with spray-on solar cells. Their innovative approach to incorporating solar cells into windows and glass facades offers significant growth opportunities for urban infrastructure.

Nanoco Technologies is capitalizing on its expertise in quantum dots, aiming to enhance the efficiency of spray-on solar cells through next-generation materials. This approach holds promise for increased performance and better efficiency in various environmental conditions.

Tesla, known for its solar roof and battery products, is expected to maintain a strong presence in the market by integrating spray-on solar cells into their portfolio, combining its energy storage capabilities with photovoltaic technology.

Companies like Oxford PV and Nanosolar are at the forefront of perovskite solar cell research, which offers the potential to improve the efficiency of spray-on solar cells. First Solar and SunPower are also strengthening their positions by investing in advanced thin-film solar cell technology.

Applied Materials and Dyesol contribute through their manufacturing expertise and innovative processes, facilitating the commercial scalability of spray-on solar cells. With a strong focus on sustainable energy, these players will likely play a pivotal role in shaping the market dynamics in 2024.

Top Key Players in the Market

- Heliatek

- SolarWindow Technologies

- Nanoco Technologies

- Tesla

- Nanosolar

- Oxford PV

- New Energy Technologies

- Enlight Renewable Energy

- First Solar

- Solaria Energy

- PowerFilm Solar

- UNSW Sydney

- Applied Materials

- SunPower

- Dyesol

Recent Developments

- In November 2024, While not directly related to spray-on solar, Enlight secured a major power purchase agreement for its Snowflake A project in Arizona, which will include 600 MW of solar generation and 1900 MWh of energy storage. This showcases the growing scale of utility solar projects.

- In April 2024, Tesla announced plans to introduce new solar roof tiles with improved efficiency and easier installation. While not strictly spray-on, these tiles represent Tesla’s continued innovation in building-integrated photovoltaics.

Report Scope

Report Features Description Market Value (2024) USD 1.5 Billion Forecast Revenue (2034) USD 7.1 Billion CAGR (2025-2034) 16.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Technology (Organic Photovoltaics, Inorganic Photovoltaics, Perovskite Solar Cells), By Form (Flexible Panels, Rigid Panels, Transparent Panels), By Application (Building Integrated Photovoltaics, Portable Electronics, Transportation, Others), By End Use (Residential, Commercial, Industrial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Heliatek, SolarWindow Technologies, Nanoco Technologies, Tesla, Nanosolar, Oxford PV, New Energy Technologies, Enlight Renewable Energy, First Solar, Solaria Energy, PowerFilm Solar, UNSW Sydney, Applied Materials, SunPower, Dyesol Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Spray-on Solar Cells MarketPublished date: February 2025add_shopping_cartBuy Now get_appDownload Sample

Spray-on Solar Cells MarketPublished date: February 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Heliatek

- SolarWindow Technologies

- Nanoco Technologies

- Tesla

- Nanosolar

- Oxford PV

- New Energy Technologies

- Enlight Renewable Energy

- First Solar

- Solaria Energy

- PowerFilm Solar

- UNSW Sydney

- Applied Materials

- SunPower

- Dyesol