Global Energy Storage As a Service Market Size, Share, And Business Benefits By Service Type (Bulk Energy Services, Ancillary Services, Transmission Infrastructure Services, Distribution Infrastructure Services, Customer Energy Management Services, Others), By Technology (Lithium-Ion Batteries, Flow Batteries, Flywheels, Supercapacitors, Pumped Hydro Storage, Others), By Application (Grid Services, Renewable Energy Integration, Others), By End User (Utilities, Commercial, Industrial, Residential), By Ownership Model (Customer-Owned, ESCO-Owned), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: January 2025

- Report ID: 137673

- Number of Pages: 317

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Business Benefits of Energy Storage As a Service Market

- By Service Type Analysis

- By Technology Analysis

- By Application Analysis

- By End User Analysis

- By Ownership Model Analysis

- Key Market Segments

- Driving Factors

- Restraining Factors

- Growth Opportunity

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

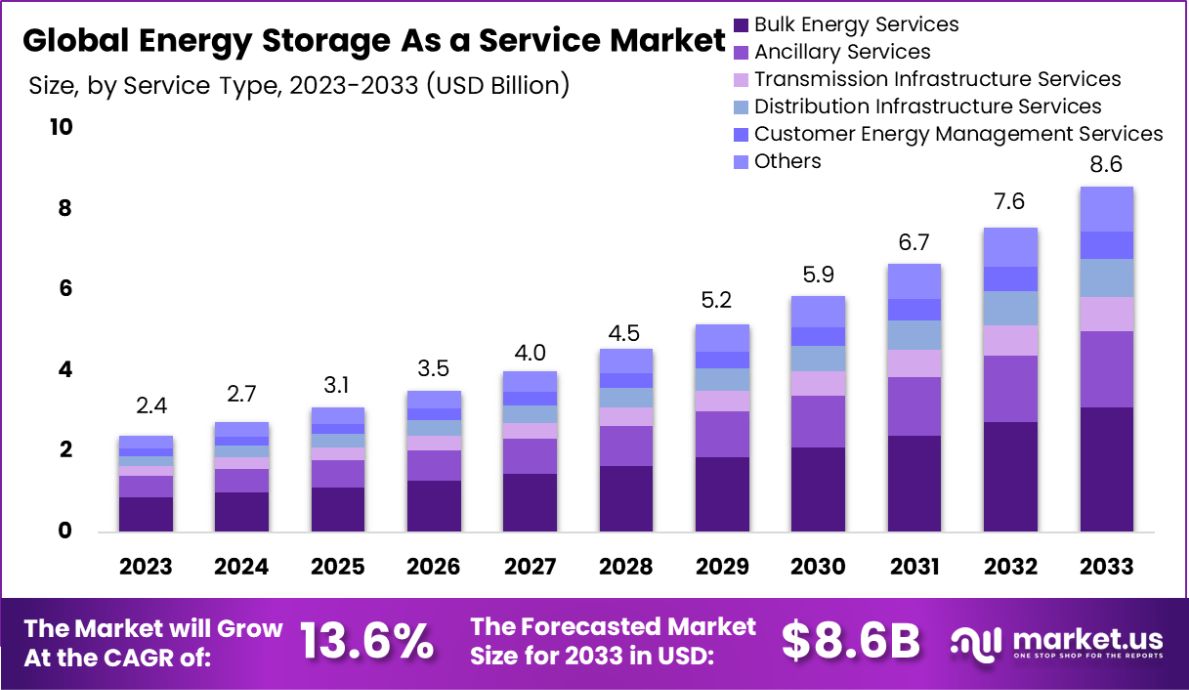

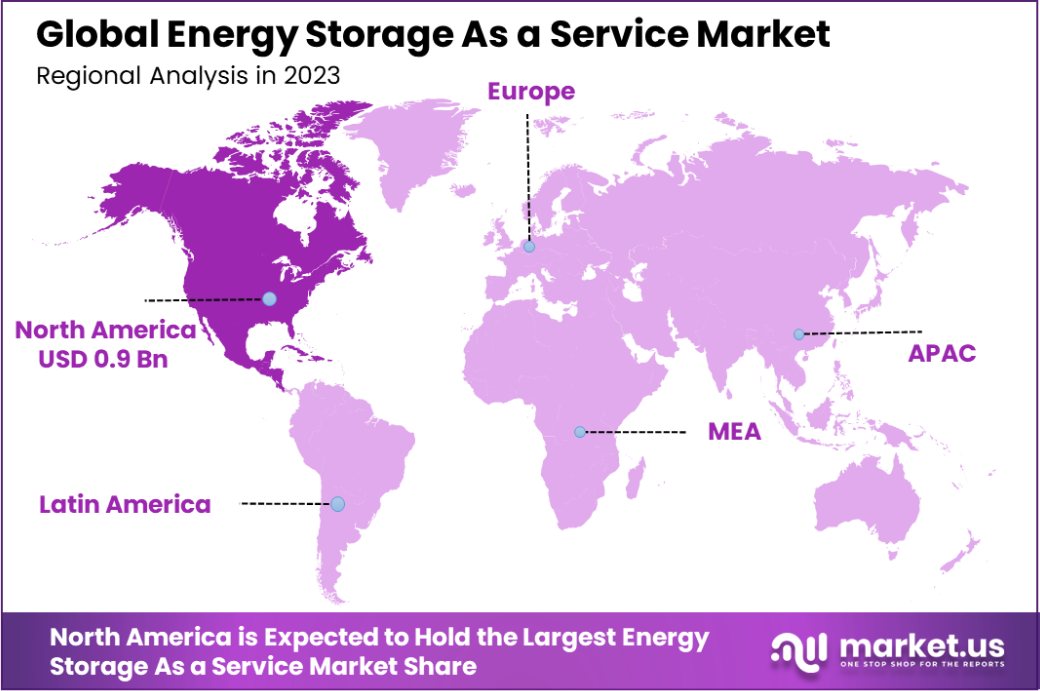

The Global Energy Storage As a Service Market is expected to be worth around USD 8.6 Billion by 2033, up from USD 2.4 Billion in 2023, and grow at a CAGR of 13.6% from 2024 to 2033. In North America, the ESaaS market holds 38.7%, valued at USD 0.9 billion.

The Energy Storage as a Service (ESaaS) market represents a transformative shift in the energy landscape, enabling organizations to optimize energy use and integrate renewable sources without the upfront capital investment associated with traditional storage systems. This innovative approach leverages advanced energy storage technologies, offering operational flexibility and cost-efficiency to industrial, commercial, and utility sectors.

The industrial scenario highlights robust adoption driven by increasing grid instability and the growing need for peak shaving, load shifting, and renewable energy integration. Governments globally are encouraging storage deployments through subsidies and regulations, aiming to reduce carbon emissions and enhance energy resilience.

Key trends shaping the market include advancements in battery technology, particularly lithium-ion and solid-state batteries, along with the integration of artificial intelligence and IoT for predictive analytics and real-time energy management. Additionally, flexible service models, such as performance-based contracts, are attracting diverse end-users.

Future opportunities lie in the expansion of ESaaS in emerging economies, where grid infrastructure improvements and renewable energy projects are on the rise. In 2023, global installed energy storage capacity surpassed 50 GW, showcasing the sector’s growing traction. This momentum positions ESaaS as a pivotal driver of the clean energy transition.

The Energy Storage as a Service (ESaaS) market is poised for transformative growth, driven by the global energy transition and increasing focus on renewable integration. In India, the market is witnessing unprecedented momentum.

According to Powermin, the country’s energy storage capacity is projected to reach approximately 60.63 GW by 2030, comprising 18.98 GW from pumped storage projects (PSP) and 41.65 GW from battery energy storage systems (BESS). This trajectory is set to further accelerate, with total capacity targeted to hit 73.93 GW by FY2031-32, equivalent to an impressive 411.4 GWh.

The investment landscape is equally compelling, with an estimated ₹54,203 crore ($6.5 billion) allocated for PSP and ₹56,647 crore ($6.9 billion) for BESS development between 2022 and 2027. These investments underscore a robust pipeline for scalable energy solutions, signaling a lucrative opportunity for ESaaS providers to deliver cost-effective, flexible, and reliable storage solutions tailored to diverse stakeholder needs.

Key Takeaways

- The Global Energy Storage As a Service Market is expected to be worth around USD 8.6 Billion by 2033, up from USD 2.4 Billion in 2023, and grow at a CAGR of 13.6% from 2024 to 2033.

- The Energy Storage as a Service market thrives on bulk energy services, contributing 36.4% of the market share.

- Lithium-ion batteries dominate, with a 47.3% share, revolutionizing storage technologies and ensuring enhanced energy efficiency globally.

- Grid services lead applications, accounting for 54.3%, optimizing energy distribution and ensuring grid stability worldwide.

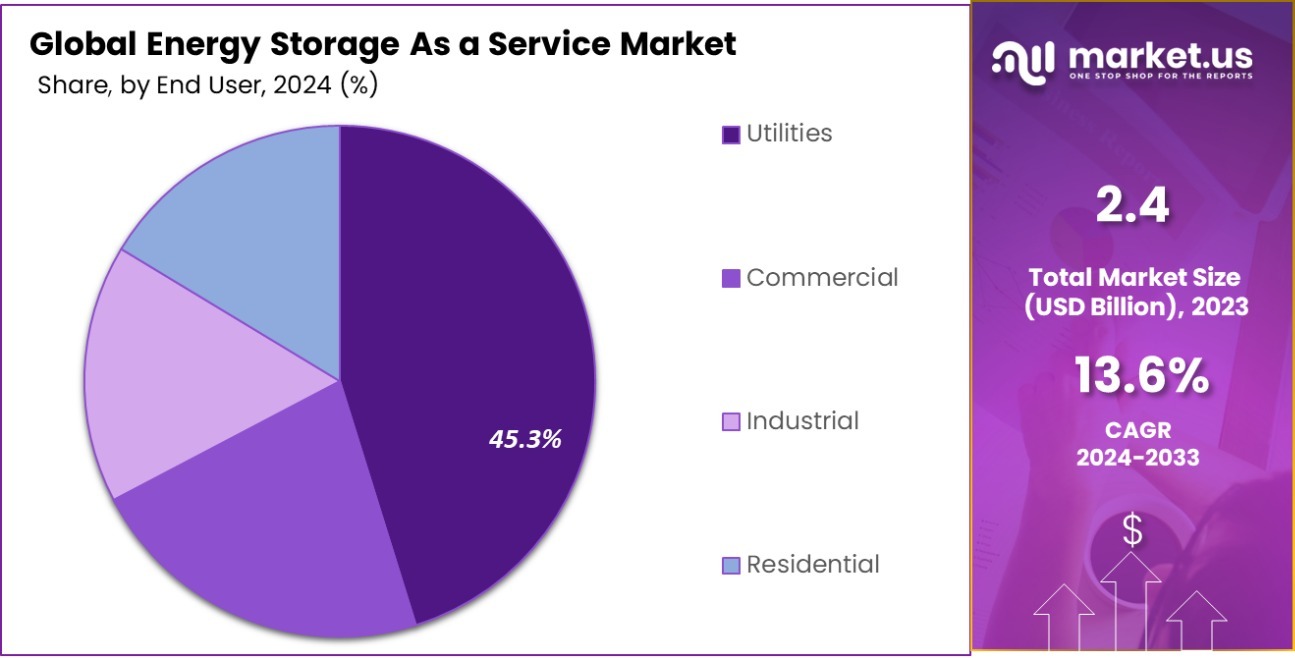

- Utilities dominate end users, holding a 45.3% share, reflecting rising demand for energy storage in power systems.

- The customer-owned model, representing 65.1%, highlights user preference for control and ownership of energy storage systems.

- In North America, the Energy Storage as a Service market is valued at USD 0.9 billion, representing 38.7% of the market share.

Business Benefits of Energy Storage As a Service Market

Energy storage as a service (ESaaS) presents several advantages for businesses aiming to optimize their energy usage and costs. This model allows companies to lease or pay for energy storage systems provided by third parties, eliminating the need for upfront capital investment. This shift turns a significant capital expenditure into a more manageable operational expense, providing financial flexibility.

Additionally, ESaaS helps businesses manage energy demand and reduce charges related to peak usage. Businesses can significantly cut their energy bills by storing energy during low-cost periods and using it during peak hours. This service also enhances the reliability of power supply, which is crucial for industries where consistent energy availability is critical to maintaining operations without disruptions.

Another key benefit is the environmental impact. By optimizing energy usage and relying on stored energy, businesses can reduce their carbon footprint, aligning with global sustainability goals. ESaaS providers often use advanced technologies that can integrate renewable energy sources, further contributing to a company’s green initiatives.

By Service Type Analysis

Bulk energy services dominate with a 36.4% market share.

In 2023, Bulk Energy Services held a dominant market position in the By Service Type segment of the Energy Storage as a Service Market, with a 36.4% share. This segment primarily focuses on large-scale energy storage solutions that help stabilize the grid and manage peak load demands effectively.

Ancillary Services captured a 29.1% market share, emphasizing support for the primary electricity supply. These services improve power quality and ensure reliable grid operation by providing necessary backup during outages and fluctuations.

Transmission Infrastructure Services accounted for 18.5% of the market. These services are vital for enhancing power transmission efficiency from generators to distribution networks, reducing energy loss, and optimizing grid performance.

Distribution Infrastructure Services had a 10.2% share in the market. This segment concentrates on advanced storage solutions at the distribution level, aiding in better load management, reducing outages, and enhancing the electrical system’s flexibility.

Customer Energy Management Services made up 5.8% of the market. This service type supports end-users in managing their energy consumption more efficiently, integrating renewable energy sources, and optimizing overall energy expenditures through tailored storage solutions.

By Technology Analysis

Lithium-ion batteries lead the segment, holding 47.3% market share.

In 2023, Lithium-Ion Batteries held a dominant market position in the By Technology segment of the Energy Storage as a Service Market, with a 47.3% share. This technology is favored for its high energy density and efficiency in commercial and residential applications.

Flow Batteries accounted for 22.6% of the market. Their ability to store energy for extended periods makes them ideal for stabilizing renewable energy outputs, thus ensuring a consistent power supply.

Flywheels captured 15.4% of the market. These devices are appreciated for their quick response times and durability, making them suitable for providing short-term energy storage and power quality management.

Supercapacitors held an 8.2% market share. They are crucial in applications requiring rapid charge and discharge cycles, enhancing the performance of energy systems in peak shaving and frequency regulation.

Pumped Hydro Storage made up 6.5% of the market. It remains a vital part of energy storage, particularly for grid-scale solutions, due to its capacity to handle large-scale energy transfers and support during high-demand periods.

By Application Analysis

Grid services contribute significantly, accounting for 54.3% of applications.

In 2023, Grid Services held a dominant market position in the By Application segment of the Energy Storage as a Service Market, with a 54.3% share. This segment supports utility operations by stabilizing the grid and managing load shifts during peak and off-peak hours efficiently.

Renewable Energy Integration accounted for 45.7% of the market. This segment focuses on smoothing out the variability of wind and solar energies, ensuring a reliable and constant energy supply by mitigating the intermittency of renewable resources.

By End User Analysis

Utilities remain pivotal, representing 45.3% of market demand.

In 2023, Utilities held a dominant market position in the By End User segment of the Energy Storage as a Service Market, with a 45.3% share. This segment largely focuses on improving grid management and enhancing renewable integration to meet regulatory and environmental targets.

Commercial users accounted for 30.2% of the market. They utilize these services to manage energy costs effectively and improve operational resilience against power disruptions.

Industrial entities captured 16.8% of the market. This sector benefits from tailored energy storage solutions to maintain production stability and energy efficiency in high-demand scenarios.

Residential users made up 7.7% of the market. Homeowners are increasingly adopting energy storage services to increase reliance on renewable energy sources and to optimize household energy spending during varying tariff periods.

By Ownership Model Analysis

Customer-owned systems drive growth, claiming a 65.1% market share.

In 2023, Customer-Owned held a dominant market position in the By Ownership Model segment of the Energy Storage as a Service Market, with a 65.1% share. This model allows end users to have full control and customization of their energy storage solutions, aligning with specific energy usage patterns and needs.

ESCO-Owned accounted for 34.9% of the market. This ownership model is favored by entities looking for a turnkey solution where the energy service company (ESCO) manages the installation, maintenance, and operation of energy storage systems, reducing upfront costs and complexity for the customer.

Key Market Segments

By Service Type

- Bulk Energy Services

- Ancillary Services

- Transmission Infrastructure Services

- Distribution Infrastructure Services

- Customer Energy Management Services

- Others

By Technology

- Lithium-Ion Batteries

- Flow Batteries

- Flywheels

- Supercapacitors

- Pumped Hydro Storage

- Others

By Application

- Grid Services

- Renewable Energy Integration

- Others

By End User

- Utilities

- Commercial

- Industrial

- Residential

By Ownership Model

- Customer-Owned

- ESCO-Owned

Driving Factors

Growing Demand for Renewable Energy Sources

The Energy Storage as a Service (ESaaS) market is thriving primarily because of the increasing adoption of renewable energy sources like solar and wind power. As these sources depend heavily on weather conditions, energy storage plays a crucial role in managing supply and demand, ensuring a steady power supply even when conditions are not ideal for energy generation.

This service allows energy providers to store excess power during peak production times and release it during lower production periods, stabilizing the grid and supporting consistent energy availability.

Technological Advancements in Energy Storage Systems

Technological innovations are a core driver of the ESaaS market. Improved battery technologies, such as lithium-ion and solid-state batteries, offer higher efficiency and longer life spans, making energy storage more practical and affordable.

These advancements enhance the attractiveness of ESaaS by lowering operational costs and increasing the reliability of energy storage solutions. Businesses are particularly benefited as they can leverage these technologies to manage their energy usage more effectively, reducing costs and increasing energy independence.

Regulatory Support and Financial Incentives

Governments worldwide are implementing policies and incentives to encourage the use of energy storage systems. These include grants, tax rebates, and regulations that favor the adoption of green energy technologies. Such support is crucial in driving the growth of the ESaaS market by making it more financially viable for companies to invest in energy storage infrastructure.

This governmental push helps bridge the gap between the technology’s cost and its benefits, accelerating the deployment of energy storage solutions across various sectors.

Restraining Factors

High Initial Costs for Energy Storage Systems

One of the primary barriers to the adoption of Energy Storage as a Service (ESaaS) is the high initial investment required to establish or upgrade energy storage systems. These costs include the price of batteries, associated hardware, and installation services.

For many businesses, particularly small and medium enterprises, these upfront expenses can be prohibitive, limiting their ability to implement these technologies despite the long-term savings and environmental benefits they offer.

Complexity of Integration with Existing Infrastructure

Integrating new energy storage systems with existing energy infrastructures presents significant technical challenges. This integration often requires substantial system upgrades and can disrupt current operations. The complexity increases with the age and design of the existing power systems, which may not be optimized for modern energy storage solutions.

This can deter organizations from adopting ESaaS, as the potential for operational disruptions and the need for additional investments in system compatibility can be considerable deterrents.

Limited Awareness and Understanding of ESaaS Benefits

A key restraint in the market growth of ESaaS is the limited awareness and understanding of its benefits and potential applications among potential users. Many companies and energy managers are not fully informed about how energy storage can be utilized effectively or the specific advantages it offers, such as cost savings, energy efficiency, and enhanced power reliability.

This lack of awareness hampers the adoption rate as decision-makers may not prioritize or invest in energy storage solutions without a clear understanding of their impact and utility.

Growth Opportunity

Expansion into Emerging Markets with Growing Energy Needs

Emerging markets present a substantial growth opportunity for the Energy Storage as a Service (ESaaS) market. These regions often face energy stability issues and have a rapidly increasing demand for reliable power solutions due to urbanization and economic growth.

ESaaS providers can capitalize on this need by offering scalable energy storage solutions that enhance grid stability and support the integration of renewable energy sources, helping to fill critical gaps in these fast-developing markets.

Partnerships with Renewable Energy Projects

There is a notable opportunity for growth in ESaaS through partnerships with renewable energy projects. As global investment in renewable energy continues to rise, the integration of energy storage services becomes essential for managing the variability of power generation from sources like smart solar and wind.

ESaaS companies can leverage this trend by collaborating with renewable energy producers to offer bundled services that ensure energy reliability and optimize production, creating mutually beneficial partnerships that can drive market expansion.

Advancements in Energy Storage Technology

Continuous advancements in technology represent a key growth avenue for the ESaaS market. As energy storage technologies evolve, they become more efficient, cost-effective, and capable of longer lifespans. Innovations such as enhanced battery materials or software for better energy management systems can significantly increase the attractiveness of ESaaS by reducing costs and improving service offerings.

Companies that stay at the forefront of these technological improvements can gain a competitive edge, attracting more customers and expanding their market presence.

Latest Trends

Increased Use of Artificial Intelligence in Energy Management

The integration of artificial intelligence (AI) into energy storage systems is a prominent trend in the Energy Storage as a Service (ESaaS) market. AI technologies enable smarter energy management by optimizing charging and discharging cycles based on predictive analytics and real-time data.

This improves the efficiency and longevity of storage systems while maximizing cost savings for users. As AI technology advances, its adoption in ESaaS is expected to increase, offering more sophisticated and adaptive energy solutions.

Transition to Multi-Use Energy Storage Applications

A significant trend in the ESaaS market is the shift towards multi-use applications for energy storage systems. Instead of just storing energy for later use, these systems are now being designed to provide additional services such as grid balancing, emergency backup, and peak shaving.

This versatility adds value to energy storage investments and attracts a broader range of customers, from residential to industrial sectors, who benefit from the multifunctional capabilities of modern energy storage solutions.

Regulatory Changes Promoting Energy Storage Adoption

Changes in regulatory frameworks around the world are increasingly favoring the adoption of energy storage systems. New policies and regulations are being implemented to support energy sustainability and resilience, encouraging the deployment of storage technologies.

These regulatory shifts often include incentives for energy storage installation and use, which can significantly reduce barriers to entry for businesses and residential consumers alike. As these policies evolve, they drive the growth of the ESaaS market by making energy storage solutions more accessible and financially attractive.

Regional Analysis

The North American Energy Storage as a Service market holds a 38.7% share, valued at USD 0.9 billion.

The Energy Storage as a Service (ESaaS) market exhibits varied growth dynamics across different regions. In North America, it dominates with a substantial 38.7% market share, valued at USD 0.9 billion, driven by advanced technological infrastructure and supportive regulatory policies promoting renewable energy storage.

Europe follows, leveraging its strong policy framework aimed at reducing carbon emissions and encouraging energy storage solutions integration into the grid, supporting renewable installations across the region.

Asia Pacific is witnessing rapid growth in the ESaaS market, fueled by escalating energy demands in emerging economies such as China and India. These countries are investing heavily in renewable energy projects, which in turn drives the need for efficient energy storage solutions to manage supply and demand effectively.

The Middle East & Africa, although at a nascent stage, is beginning to recognize the potential of ESaaS, particularly as it seeks to diversify energy sources away from traditional fossil fuels towards more sustainable options.

Latin America shows promise with the increasing adoption of renewable energy technologies and the gradual establishment of regulatory frameworks that could foster further growth of the ESaaS market in this region.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, the global Energy Storage as a Service (ESaaS) market remains highly competitive with key players like AES, Ameresco, and Fluence Energy leading the charge. These companies are pivotal in shaping market dynamics through their robust service offerings and strategic expansions.

AES stands out with its innovative energy storage solutions, focusing on enhancing grid stability and energy management for utilities and large power users. This is complemented by Ameresco’s approach, which emphasizes customized renewable energy solutions, effectively reducing operational costs and carbon footprints for diverse clients including governments, schools, and healthcare facilities.

Fluence Energy, a joint venture between Siemens and AES, continues to excel by leveraging advanced battery technology and software-driven analytics to optimize energy storage systems. This strategic partnership combines technical expertise and market reach, positioning Fluence Energy as a leader in both technological innovation and scalability.

Other notable players like Tesla and Siemens Energy are also critical in driving the ESaaS market. Tesla’s integration of renewable energy solutions with high-capacity battery storage systems has revolutionized residential and commercial energy storage. Similarly, Siemens Energy focuses on integrating renewable sources into existing grids, enhancing efficiency and reliability.

Smaller but agile firms like Convergent Energy + Power and NRStor Inc. specialize in bespoke solutions that address specific local energy storage needs, demonstrating the market’s diversity. These companies focus on tailoring their offerings to fit unique customer requirements, often leading to higher penetration in niche markets.

Top Key Players in the Market

- AES

- Ameresco

- Axium Infrastructure

- Brookfield Renewable Partners

- Convergent Energy + Power

- Customized Energy Solutions Ltd.

- Enel X

- ENGIE Storage Services NA LLC

- Fluence Energy

- Generac Power Systems

- Honeywell International Inc.

- Hydrostor Inc.

- Invenergy

- NextEra Energy Partners

- NRStor Inc.

- Siemens Energy

- Suntuity

- Tesla

- Veolia

- Wärtsilä

- YSG Solar

Recent Developments

- In 2024, AES’ Alamitos BESS significantly advanced grid reliability by efficiently integrating renewable energy and reducing emissions, supporting California’s aim for 100% carbon-free electricity by 2045 through innovative lithium-ion battery technology.

- In 2023, Ameresco partnered with Atura Power to construct a 250MW/1,000MWh Battery Energy Storage System in Ontario, Canada, marking a significant development in their Energy Storage as a Service offering and enhancing regional electrical capacity needs.

Report Scope

Report Features Description Market Value (2023) USD 2.4 Billion Forecast Revenue (2033) USD 8.6 Billion CAGR (2024-2033) 13.6% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Service Type (Bulk Energy Services, Ancillary Services, Transmission Infrastructure Services, Distribution Infrastructure Services, Customer Energy Management Services, Others), By Technology (Lithium-Ion Batteries, Flow Batteries, Flywheels, Supercapacitors, Pumped Hydro Storage, Others), By Application (Grid Services, Renewable Energy Integration, Others), By End User (Utilities, Commercial, Industrial, Residential), By Ownership Model (Customer-Owned, ESCO-Owned) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape AES, Ameresco, Axium Infrastructure, Brookfield Renewable Partners, Convergent Energy + Power, Customized Energy Solutions Ltd., Enel X, ENGIE Storage Services NA LLC, Fluence Energy, Generac Power Systems, Honeywell International Inc., Hydrostor Inc., Invenergy, NextEra Energy Partners, NRStor Inc., Siemens Energy, Suntuity, Tesla, Veolia, Wärtsilä, YSG Solar Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Energy Storage As a Service MarketPublished date: January 2025add_shopping_cartBuy Now get_appDownload Sample

Energy Storage As a Service MarketPublished date: January 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- AES

- Ameresco

- Axium Infrastructure

- Brookfield Renewable Partners

- Convergent Energy + Power

- Customized Energy Solutions Ltd.

- Enel X

- ENGIE Storage Services NA LLC

- Fluence Energy

- Generac Power Systems

- Honeywell International Inc.

- Hydrostor Inc.

- Invenergy

- NextEra Energy Partners

- NRStor Inc.

- Siemens Energy

- Suntuity

- Tesla

- Veolia

- Wärtsilä

- YSG Solar