Global Energy Harvesting System Market By Technology (Thermoelectric, Piezoelectric, Photovoltaic, Others), By Component (Transducers, Power Management Integrated Circuits, Secondary Battery), By Application (Building and Home Automation, Home Appliances, Industrial, Transportation, Security, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 122091

- Number of Pages: 281

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

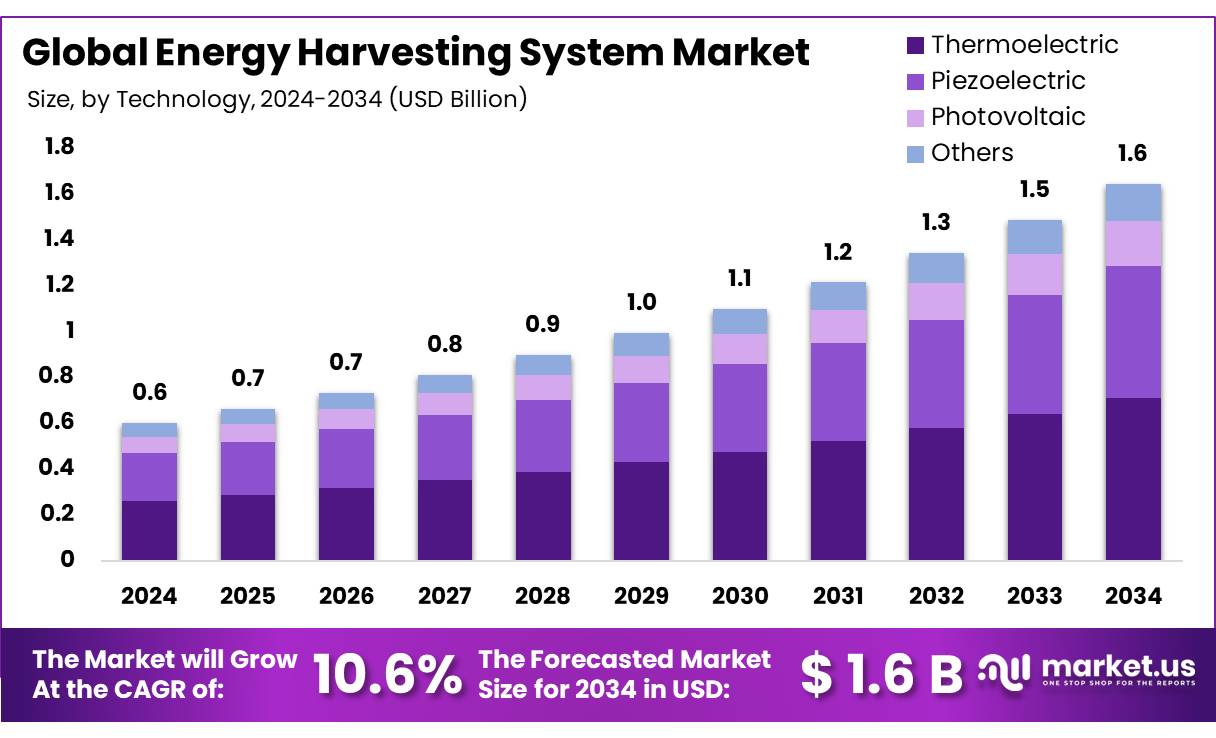

The Global Energy Harvesting System Market size is expected to be worth around USD 1.6 Billion by 2034, from USD 0.6 Billion in 2024, growing at a CAGR of 10.6% during the forecast period from 2025 to 2034.

Energy harvesting systems are rapidly evolving technologies that capture and convert ambient energy from the environment such as solar thermal, kinetic, and electromagnetic energy into usable electrical energy. These systems are designed to power electronic devices without relying on conventional batteries or grid electricity, making them highly valuable for promoting sustainability and reducing energy waste. Common applications of energy harvesting include powering wireless sensor networks, wearable electronics, medical devices, remote monitoring systems, transportation infrastructure, and smart cities.

- The International Energy Agency (IEA) estimates that energy harvesting technologies could reduce the energy consumption of smart city sensor networks by up to 60%, supporting sustainable urban development.

The global market for energy harvesting systems has experienced steady growth, driven by increased demand for renewable energy solutions, advancements in low-power electronics, and expanding applications in IoT (Internet of Things). In addition, government initiatives for sustainable infrastructure and the proliferation of smart devices requiring autonomous energy sources further boost the growth of the energy harvesting market.

Key Takeaways

- The global energy harvesting system market was valued at US$ 0.6 billion in 2024.

- The global energy harvesting system market is projected to grow at a CAGR of 10.6 % and is estimated to reach US$ 1.6 billion by 2034.

- Among technology, thermoelectric accounted for the largest market share of 43.2%.

- Among components, power management integrated circuits accounted for the majority of the market share at 47.2%.

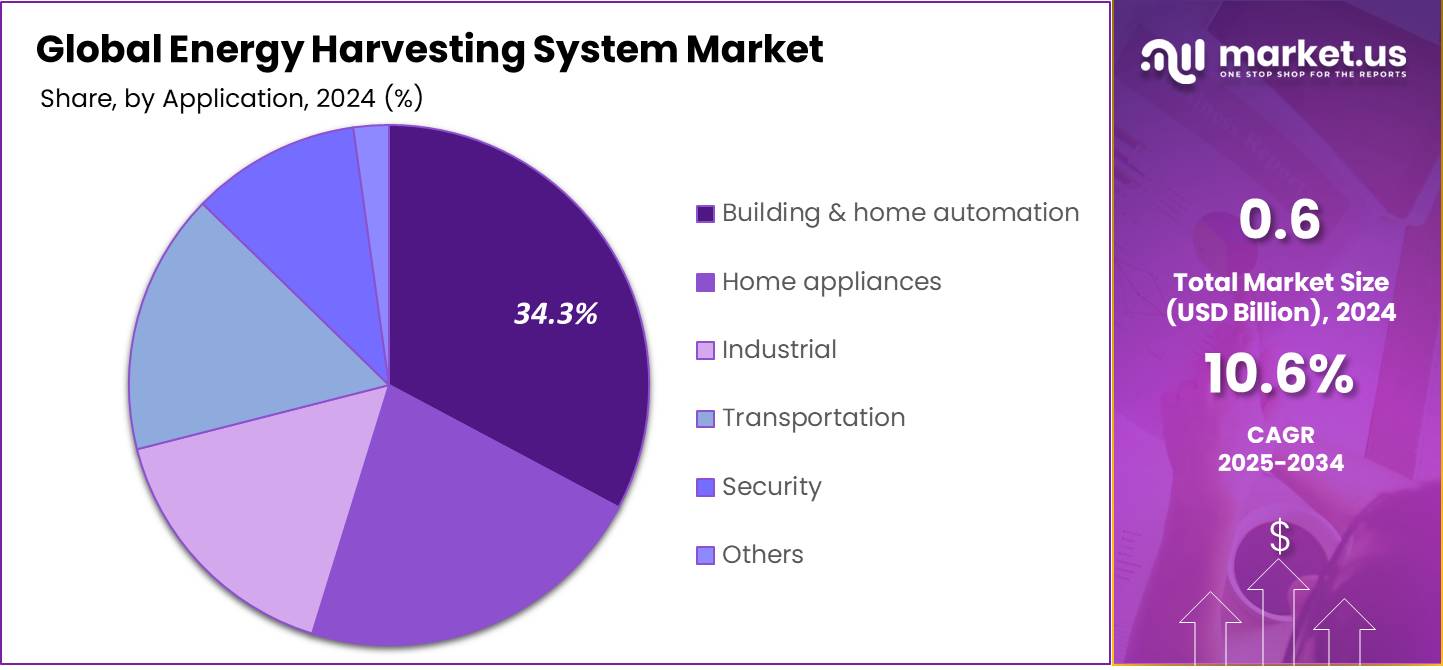

- By application, building & home automation accounted for the majority of the market share at 34.3%.

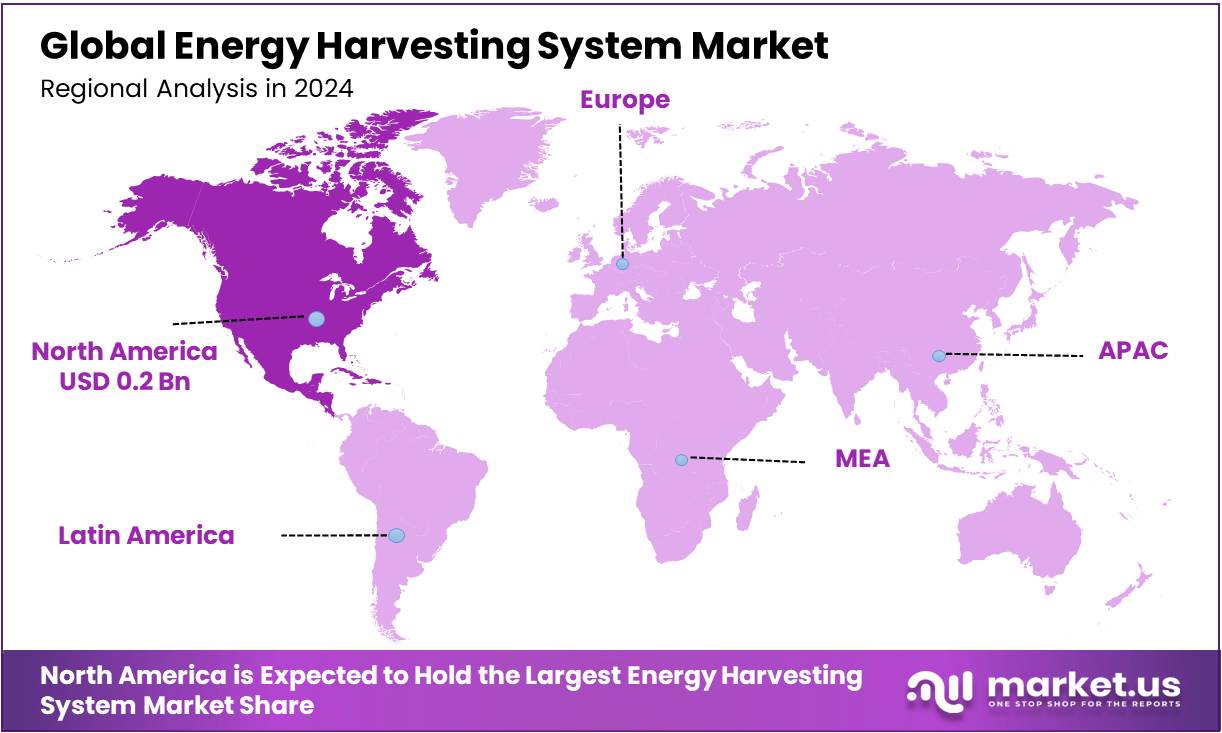

- North America is estimated as the largest market for energy harvesting systems with a share of 38.2% of the market share.

Technology Analysis

Thermoelectric Technology Dominating the Global Energy Harvesting Market in 2024.

The energy harvesting system market is segmented based on technology into thermoelectric, piezoelectric, photovoltaic, and others. In 2024, the thermoelectric segment held a significant revenue share of 43.2%. Due to its ability to conversion of waste heat into electricity, it is highly valuable across industries such as automotive, manufacturing, and consumer electronics. The technology’s ability to recover energy from heat sources and convert it into usable power supports sustainability and energy efficiency goals. Additionally, increasing demand for autonomous devices and wireless sensor networks further boosts the adoption of thermoelectric systems.

Component Analysis

Power Management Integrated Circuits is an Essential Component of the Global Energy Harvesting Market in 2024.

Based on components, the market is further divided into transducers, power management integrated circuits, and secondary batteries. The predominance of the power management integrated circuits, commanding a substantial 47.2% market share in 2024. This is driven by their critical role in efficiently regulating and optimizing energy flow within harvesting systems, enhancing overall performance and reliability. PMICs also enable features like voltage regulation, energy storage control, and load management, which are important in applications such as IoT sensors, wearable devices, smart meters, and industrial monitoring systems.

The growing adoption of these technologies in sectors demanding energy-efficient and autonomous operation drives the demand for sophisticated power management solutions. Furthermore, ongoing advancements in PMIC designs, including miniaturization and improved efficiency, support broader market penetration and help overcome challenges related to intermittent and low-level energy sources typical of harvesting systems.

Application Analysis

Building & Home Automation Holding Largest Application Share in Global Energy Harvesting Market in 2024.

By application, the market is categorized into building & home automation, home appliances, industrial, transportation, security, and others. The building & home automation segment emerging as the dominant channel, holding 34.3 % of the total market share in 2024. This dominance is attributed to the increasing adoption of smart technologies in residential and commercial buildings, where energy harvesting is used in wireless sensors and devices for lighting control, HVAC systems, security monitoring, and energy management.

Additionally, growing awareness about sustainability and energy conservation, coupled with favorable government incentives for smart building technologies, has accelerated the integration of energy harvesting systems in this sector. The ability to deploy autonomous sensors that operate without battery replacements or external power further boosts the appeal of energy-harvesting solutions in building and home automation applications.

Key Market Segments

By Technology

- Thermoelectric

- Piezoelectric

- Photovoltaic

- Others

By Component

- Transducers

- Power Management Integrated Circuits

- Secondary Batteries

By Application

- Building & home automation

- Home appliances

- Industrial

- Transportation

- Security

- Others

Drivers

Adoption of Self-Powered Technologies Across Key Sectors

The global energy harvesting systems market is experiencing robust growth, driven by the widespread adoption of self-powered technologies across key industry sectors. These systems, which convert ambient energy from sources such as solar, thermal, vibration, electromagnetic, and biological inputs into usable electrical power, offer a sustainable and maintenance-free alternative to conventional battery-powered or wired solutions.

- The U.S. Environmental Protection Agency (EPA) recognizes energy harvesting as a sustainable alternative that helps reduce electronic and battery waste in smart infrastructure.

Additionally, Energy harvesting technologies are increasingly integrated across diverse applications, enabling autonomous, long-lasting electronic devices and wireless sensor networks (WSNs). In infrastructure, they support real-time monitoring of bridges, tunnels, and buildings, improving public safety while reducing maintenance costs sectors use energy harvesters to power sensors for predictive maintenance, detecting faults, vibrations, and temperature changes to minimize unplanned downtime.

- According to the U.S. Department of Transportation (DOT) reports energy harvesting-powered wireless sensor networks (WSNs) are being used for real-time monitoring of bridges, tunnels, and buildings, with pilot projects demonstrating up to 30% reduction in maintenance costs and enhanced early detection of structural issues.

Furthermore, the transportation industry including automotive, rail, and aviation leverages these technologies for smart diagnostics and autonomous operations by converting motion, airflow, and heat into usable energy. In addition, Healthcare benefits from wearable and implantable devices powered by body heat and motion, allowing continuous health monitoring without frequent battery replacements.

Moreover, Marine applications energy harvester uses wave, current, and solar energy to power oceanographic equipment, while aerospace employs hybrid systems to monitor aircraft and spacecraft integrity. As industries focus on energy efficiency, autonomy, and sustainability, growing demand for self-sustained power solutions is driving innovation and investment, positioning energy harvesting as a key growth driver in the smart systems and infrastructure markets of the future.

Restraints

Lack of Innovation And Research Development

The limited innovation and insufficient research and development in energy harvesting systems are key restraints hindering their widespread adoption. As an emerging field, many of these technologies remain in the early stages, facing challenges such as low efficiency, high costs, and uncertain reliability. The absence of standardized integration frameworks and scalable designs further slows commercialization. Without sustained R&D, improvements in performance, material innovation, and adaptability to various applications remain limited—making it difficult for energy harvesting to compete with conventional power sources like batteries or grid electricity.

Opportunity

Expansion of Road-Based Energy-Harvesting System

The expansion of road-based energy harvesting solutions presents a significant opportunity for the growth of the global energy harvesting market by leveraging existing infrastructure to capture a currently untapped energy source—vehicles’ waste energy. Vehicles produced substantial amounts of kinetic energy as heat, friction, and mechanical pressure, especially during deceleration.

Integrating energy harvesting technologies into roads, such as photovoltaic panels, piezoelectric sensors, thermoelectric generators, and geothermal systems, enables the conversion of mechanical vibrations from traffic and solar-induced heat into usable electrical energy. Commercial and industrial facilities adjacent to busy roadways, including parking garages, distribution centers, port terminals, and toll plazas, stand to benefit from considerable cost savings by harnessing this free and sustainable energy resource.

- For instance, the International Energy Agency (IEA) states that replacing diesel generators with renewable energy harvesting solutions in transportation infrastructure can reduce carbon emissions by up to 30% in targeted pilot projects.

Additionally, road-based energy harvesting provides an eco-friendly alternative to conventional distributed power generation methods like diesel generators, which are costly and environmentally damaging. By transforming roads into multifunctional energy platforms, this technology not only optimizes infrastructure utility but also contributes to reducing carbon emissions and energy costs, thereby fueling further adoption and market expansion in the energy harvesting sector.

Trends

Rise of Hybrid energy harvesting technology

The rise of Hybrid energy harvesting technology is rapidly becoming a key trend in the global energy harvesting market. This technology combines multiple energy sources and different methods to convert energy into electricity, making it much more efficient than using a single energy source or mechanism. Hybrid systems can capture both Vibration and heat simultaneously, reducing wasted energy and increasing power output. Hybrid harvesters fall into two groups: those that collect energy from multiple sources at once, and those that use different conversion methods for a single energy source.

This flexible approach leads to better use of space and higher efficiency. With the growing demand for reliable, self-powered devices, hybrid energy harvesting is opening new opportunities across many sectors, including infrastructure monitoring, industrial maintenance, smart transportation, healthcare devices, marine systems, and aerospace. As the Internet of Things (IoT) expands, the adoption of hybrid energy harvesters is expected to drive significant growth in the global energy harvesting market by providing sustainable, high-performance power solutions.

Geopolitical Impact Analysis

The U.S. 25% Semiconductor Tariff Is Disrupting Energy Harvesting Markets By Raising Costs And Delaying Innovation.

The recent implementation of global tariffs ranging from 10% to 25% by U.S. President Trump on imports from major trade partners—including China, Canada, and Mexico—has had a notable impact on the global energy harvesting systems market.

- The imposition of a 25% or higher tariff on semiconductors by the United States is poised to significantly disrupt the global energy harvesting systems market, increasing component costs, straining international supply chains, limiting innovation, and reshaping geopolitical trade dynamics.

These tariffs have had a significant impact on the energy harvesting systems market, which relies heavily on components such as batteries, transducers, and power management integrated circuits. These components are primarily made using semiconductors, sensors, lithium-ion batteries, and rare earth elements materials that are critical to the development and deployment of energy harvesting technologies. In addition, these tariffs have increased the cost of imported transducers and sensors, leading to increased project expenses and delays in implementation, especially for large-scale deployments in smart grid infrastructure and industrial IoT applications.

These increased costs and supply chain disruption have forcing many companies to move away from cost-effective Chinese suppliers, opting instead for alternative sources that often come with higher prices and longer lead times. This transition has placed additional pressure on supply chains, limiting innovation, and slowed the overall adoption of energy harvesting systems.

Moreover, additionally, retaliatory tariffs from other countries have limited export opportunities for U.S. firms, particularly in fast-growing markets in Asia, further challenging the competitiveness of American energy harvesting technologies. The uncertainty created by trade policy shifts has also deterred investment in R&D and new manufacturing facilities, with some companies stopping planned projects due to unclear long-term incentives and risks.

Regional Analysis

North America Held the Largest Share of the Global Energy Harvesting System Market

In 2024, North America dominated the global Energy Harvesting System market, accounting for 38.2% of the total market share, Driven by Strong government support through policies and incentives encourages the adoption of clean energy technologies, making it easier for businesses and communities to invest in energy harvesting solutions. The rise of Internet of Things (IoT) devices and wireless sensors that need reliable, battery-free power sources is also a major driver.

Additionally, increasing investments in smart infrastructure such as smart buildings and smart cities boost demand for energy harvesting systems to improve energy efficiency. The growth of industrial automation and wearable technology further fuels the need for these self-powered devices. Moreover, the region’s expanding renewable energy projects, like solar and wind farms, create new opportunities for integrating energy harvesting technologies to support critical infrastructure. These trends are fueling strong and sustained growth in North America’s energy harvesting market.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Key Players In The Energy Harvesting System Market Dominate The Market Through Strategic Innovation, Premium Positioning, And Global Reach.

The global energy harvesting system market has seen significant contributions from a diverse array of key players in 2023, each implementing innovations and strategic advancements. EnOcean GmbH continues to excel in providing energy-efficient solutions, particularly in the building automation sector. Cymbet Corporation remains a leader in thin-film battery technology, enabling longer life cycles for wireless sensors. ABB Ltd is enhancing its portfolio through sustainable energy management systems, solidifying its presence in industrial applications.

Powercast Corporation and STMicroelectronics N.V. have made notable strides in the market with their pioneering wireless power technologies and comprehensive semiconductor solutions, respectively. Fujitsu Limited emphasizes its commitment to developing high-performance computing solutions that incorporate energy harvesting technologies, aiming for minimal environmental impact.

Similarly, Honeywell International Inc. leverages its expertise in automation and control technologies to integrate energy harvesting in more robust, interconnected systems. As the market evolves, these companies are positioned not only to drive growth but also to shape the future of energy efficiency in various industries worldwide.

Major Players in the Industry

- STMicroelectronics NV

- Microchip Technology Inc.

- Texas Instruments Incorporated

- Analog Devices, Inc.

- Renesas Electronics Corporation

- EnOcean GmbH

- Qorvo, Inc

- E-Peas SA

- Powercast Corporation

- Advanced Linear Devices, Inc.

- Honeywell International Inc.

- Advanced Linear Devices Inc

- Asahi Kasei Microdevices Corp.

- Other Key Players

Recent Development

- In April 2025 – Asahi Kasei Microdevices launched the AP4413 series of ultra-low current power management ICs, targeting energy harvesting applications with enhanced battery charging efficiency and minimal power consumption for IoT and portable devices.

Report Scope

Report Features Description Market Value (2024) USD 0.6 Bn Forecast Revenue (2034) USD 1.6 Bn CAGR (2025-2034) 10.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Technology (Thermoelectric, Piezoelectric, Photovoltaic, Others), By Component (Transducers, Power Management Integrated Circuits, Secondary Battery), By Application (Building & home automation, Home appliances, Industrial, Transportation, Security, Others), Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC- China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- GCC, South Africa, & Rest of MEA Competitive Landscape STMicroelectronics NV, Microchip Technology Inc., Texas Instruments Incorporated, Analog Devices, Inc., Renesas Electronics Corporation, EnOcean GmbH, Qorvo, Inc, E-Peas SA, Powercast Corporation, Advanced Linear Devices, Inc., Honeywell International Inc., Advanced Linear Devices Inc, Asahi Kasei Microdevices Corp., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Energy Harvesting System MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Energy Harvesting System MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- STMicroelectronics NV

- Microchip Technology Inc.

- Texas Instruments Incorporated

- Analog Devices, Inc.

- Renesas Electronics Corporation

- EnOcean GmbH

- Qorvo, Inc

- E-Peas SA

- Powercast Corporation

- Advanced Linear Devices, Inc.

- Honeywell International Inc.

- Advanced Linear Devices Inc

- Asahi Kasei Microdevices Corp.

- Other Key Players