Global Ceramic Floor Tiles Market By Product (Glazed Ceramic Tiles, Porcelain Tiles, Scratch Free Ceramic Tiles, Others), By Raw Material ( Sand, Natural Clay, Feldspar, Others), By Construction Type (New Construction, Renovation), By End-use (Residential, Commercial) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 141361

- Number of Pages: 348

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

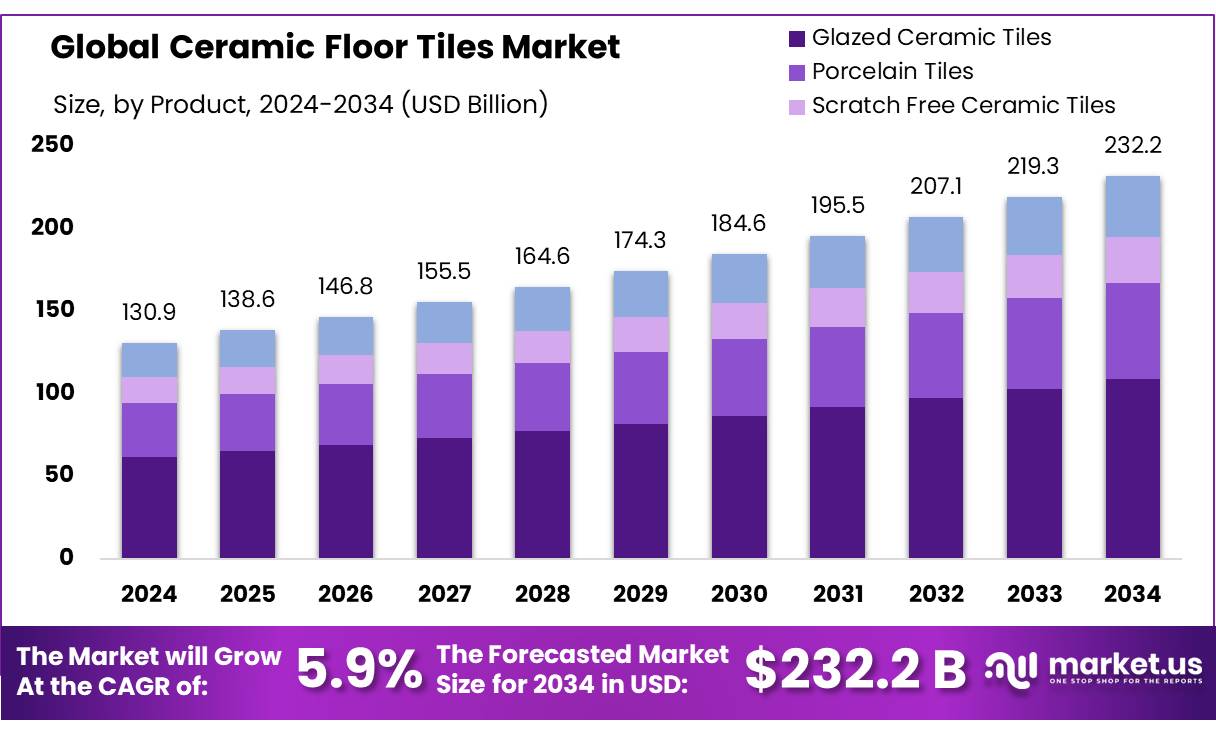

The Global Ceramic Floor Tiles Market size is expected to be worth around USD 232.2 Bn by 2034, from USD 130.9 Bn in 2024, growing at a CAGR of 5.9% during the forecast period from 2025 to 2034.

Ceramic floor tiles are thicker and more durable to withstand foot traffic and heavy furniture. There are ceramic tiles in various sizes, from small mosaic tiles to large-format ceramic tiles, allowing you to create diverse patterns and designs.

Floor tiles and wall tiles might seem similar at first glance; however, these two types of ceramics have significant differences, impacting their respective prices. Wall tiles typically have a porous body and can have a water absorption rate of up to 13%.

In contrast, floor tiles have a water absorption rate between 0.5% to 6%. Moreover, wall tiles tend to be thinner and are available in a broader range of colors and designs. Floor tiles, on the other hand, are generally thicker than wall tiles and are not suitable for wall installation.

Several key drivers are fueling the growth of the ceramic floor tiles market. First and foremost, the ongoing growth in the global construction industry, particularly in emerging economies, is contributing significantly to market expansion. According to the World Bank, global construction output is expected to reach $10 trillion by 2030, with rapid urbanization in regions like Asia and Africa driving demand for flooring solutions.

Governments Initiatives have been taking various steps to support the construction and building materials industry. In India, for instance, the government’s Pradhan Mantri Awas Yojana (PMAY) aims to provide affordable housing, which indirectly benefits the ceramic tile market. Similarly, in Europe, strict regulations regarding the sustainability of building materials are pushing for the use of eco-friendly flooring options, which is anticipated to drive the adoption of ceramic tiles with lower carbon footprints.

Key Takeaways

- Ceramic floor tiles market size is expected to reach USD 232.2 billion by 2034, increasing from USD 130.9 billion in 2024, at a CAGR of 5.9% from 2025 to 2034

- Glazed ceramic tiles dominated the market, capturing over 47.4% of the total ceramic floor tiles market.

- Natural clay held a significant share of the market for ceramic floor tiles, capturing more than 45.3% of the market share.

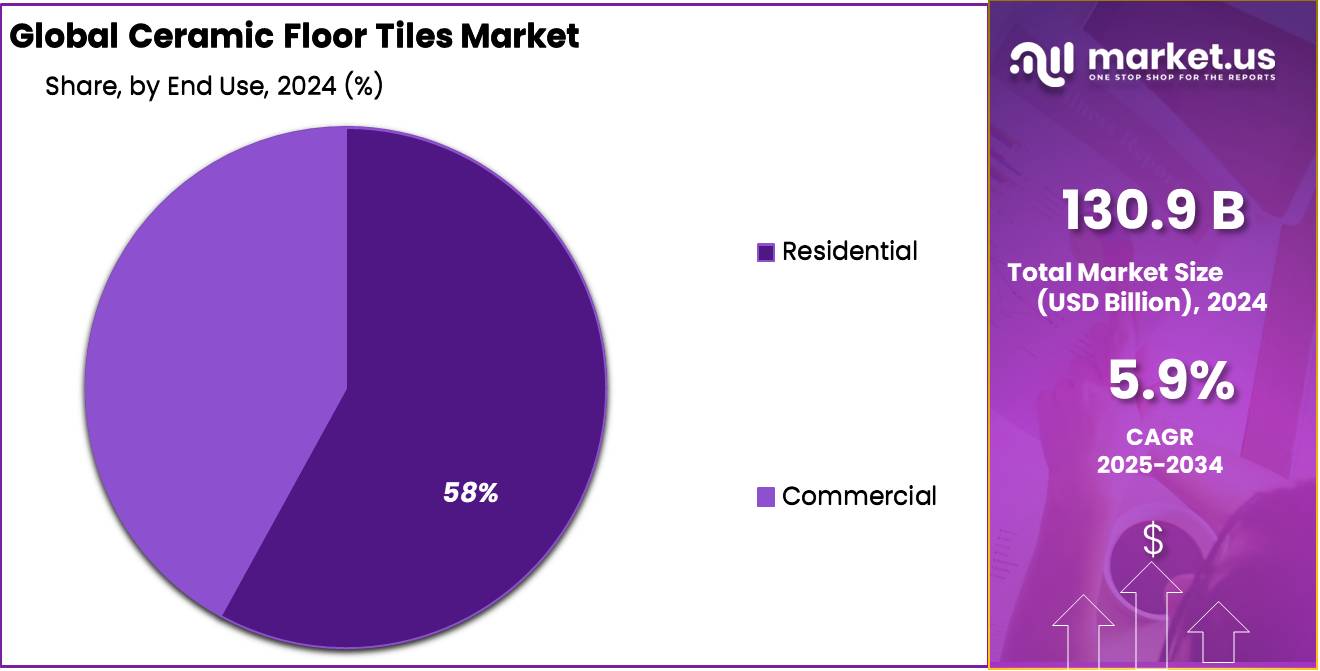

- Residential held a dominant market position, capturing more than a 58.5% share of the ceramic floor tiles market.

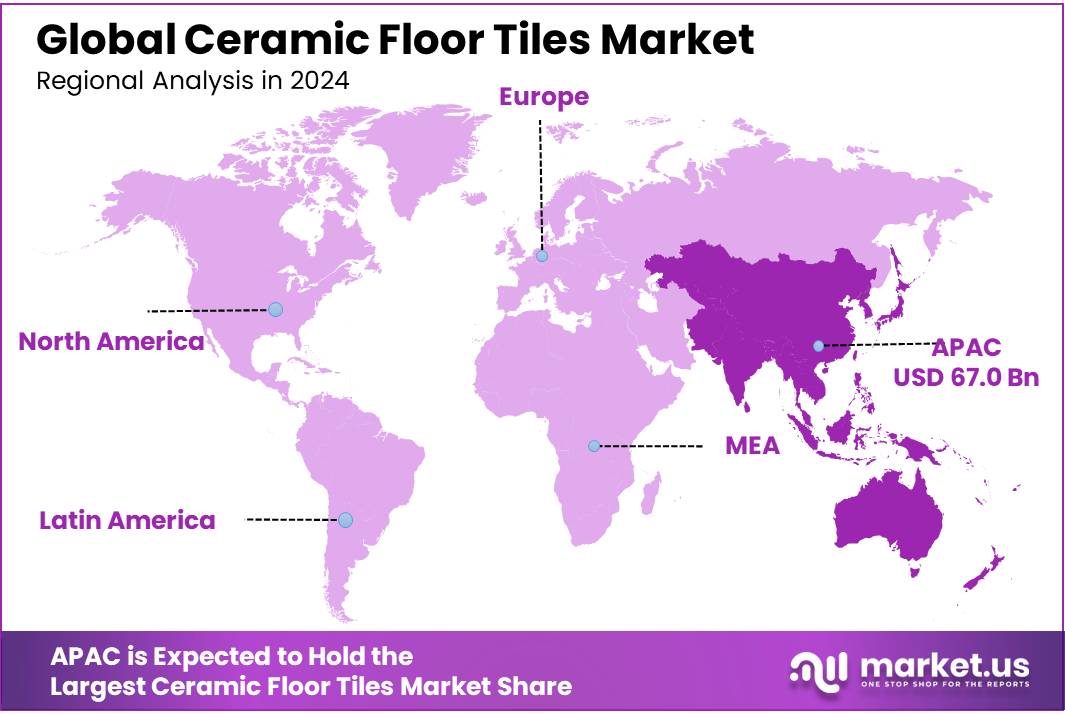

- Asia Pacific region dominates the global ceramic floor tiles market, accounting for more than 51.2% of the total market share, valued at approximately USD 67.0 billion.

By Product

In 2024, Glazed Ceramic Tiles held a dominant market position, capturing more than a 47.4% share of the ceramic floor tiles market. This segment has consistently led the market due to its combination of aesthetic appeal and durability, making it the preferred choice for both residential and commercial spaces. The polished, glossy finish of glazed tiles not only enhances the overall look of a space but also makes them easier to clean and maintain, which contributes to their widespread adoption.

The growing construction and renovation activities globally, especially in emerging markets, are expected to keep fueling the demand for glazed ceramic tiles. As home improvement trends continue to rise, the segment is poised to benefit from innovations in design and technology, including improved finishes and larger tile formats. This trend is likely to solidify the market leadership of glazed ceramic tiles through 2025 and beyond.

By Raw Material

In 2024, Natural Clay held a dominant market position, capturing more than a 45.3% share of the ceramic floor tiles market. This raw material remains a top choice for manufacturers due to its wide availability, cost-effectiveness, and excellent ability to retain color and shape after firing. Natural clay-based tiles are popular for their durability and eco-friendly characteristics, making them a preferred option for environmentally conscious consumers and builders.

The increasing demand for sustainable building materials, along with the ongoing expansion of residential and commercial construction projects, will likely support the continued use of natural clay in ceramic tile production. With advancements in manufacturing technology and the rise of eco-friendly certifications, natural clay tiles are set to maintain a strong presence in the market throughout 2025 and beyond.

By Construction Type

In 2024, New Construction held a dominant market position, capturing more than a 69.6% share of the ceramic floor tiles market. The segment’s strong performance can be attributed to the rapid growth in residential, commercial, and industrial construction worldwide. As new buildings are continuously being developed, the demand for ceramic floor tiles, known for their durability, design versatility, and ease of maintenance, remains high. Builders and developers increasingly prefer ceramic tiles for flooring due to their ability to withstand high foot traffic, moisture, and wear and tear, making them ideal for newly constructed spaces.

The new construction is expected to remain robust, although the renovation and remodeling sector may experience slight growth, driven by the rising trend of home improvement. However, new construction is still forecast to lead the market as urbanization continues to accelerate, particularly in emerging economies. This will keep the demand for ceramic tiles in new buildings at the forefront, especially in residential and commercial sectors where aesthetics, performance, and cost-effectiveness are key considerations.

By End-use

In 2024, Residential held a dominant market position, capturing more than a 58.5% share of the ceramic floor tiles market. This segment continues to be the largest contributor, driven by the growing demand for high-quality flooring solutions in new homes, as well as renovation and remodeling projects. Ceramic floor tiles are favored for their aesthetic appeal, durability, and easy maintenance, making them a popular choice among homeowners. Additionally, the variety of designs, patterns, and finishes available allows for customization, which further drives their popularity in residential settings.

The residential segment is expected to maintain its leading position, although competition from other flooring options such as hardwood and vinyl may increase slightly. However, the continued rise in home construction and home improvement projects is likely to ensure that ceramic floor tiles remain the go-to choice for residential spaces. This will be especially true in regions where there is an emphasis on sustainable and long-lasting materials, as ceramic tiles are known for their environmental benefits.

Key Market Segments

By Product

- Glazed Ceramic Tiles

- Porcelain Tiles

- Scratch Free Ceramic Tiles

- Others

By Raw Material

- Sand

- Natural Clay

- Feldspar

- Others

By Construction Type

- New Construction

- Renovation

By End-use

- Residential

- Commercial

Drivers

Increasing Demand for Sustainable and Eco-friendly Building Materials

One of the major driving factors for the growth of the ceramic floor tiles market is the increasing demand for sustainable and eco-friendly building materials. As the global awareness of environmental issues grows, both consumers and developers are increasingly looking for flooring solutions that offer durability, low environmental impact, and long-term sustainability. Ceramic tiles, made primarily from natural raw materials like clay, sand, and feldspar, are known for being an eco-friendlier choice compared to other flooring options such as vinyl or carpet.

A significant driver in this trend is the push for green building certifications and government regulations that encourage sustainable construction. In many regions, the demand for LEED (Leadership in Energy and Environmental Design) or BREEAM (Building Research Establishment Environmental Assessment Method) certified buildings is rising, and ceramic floor tiles are frequently specified due to their low environmental footprint. According to the U.S. Green Building Council, more than 100,000 projects worldwide are LEED certified, underscoring the growing emphasis on sustainable construction.

Additionally, ceramic tiles are naturally resistant to moisture, making them a healthier option for indoor environments, as they help maintain better indoor air quality by not trapping allergens or bacteria. With the global construction industry also focusing on reducing its carbon footprint, many governments are offering incentives to encourage the use of sustainable building materials. For instance, in Europe, the EU has been increasingly focusing on policies aimed at reducing carbon emissions, with the European Commission setting ambitious climate targets for 2030. These initiatives help drive the adoption of sustainable materials like ceramic tiles, which align with these broader environmental goals.

Restraints

High Production Costs of Ceramic Floor Tiles

One of the key restraining factors for the ceramic floor tiles market is the high production cost, which can make the final product expensive for consumers. Ceramic tiles are made from natural raw materials like clay, sand, and minerals, which need to be processed, molded, and fired at high temperatures. This energy-intensive manufacturing process not only increases operational costs but also requires significant investment in specialized equipment and technology.

The global price volatility of raw materials, especially due to geopolitical factors and supply chain disruptions, has added to the challenge. For instance, the cost of natural gas, which is essential for firing ceramic tiles, has been on the rise in many regions. In 2022, the price of natural gas surged by over 150% in Europe due to the energy crisis, as reported by the International Energy Agency (IEA).

Additionally, ceramic tiles require significant transportation logistics, as many manufacturers are based in specific regions, while demand is often global. Shipping costs, which have risen in recent years due to disruptions in global supply chains, further add to the price of the finished product. These increased production and logistical costs could make ceramic tiles less attractive compared to alternative flooring options like vinyl, which are generally cheaper to produce and install.

Governments and organizations are attempting to mitigate some of these issues through incentives for energy-efficient production methods and the promotion of local manufacturing. However, despite these efforts, the high cost of production remains a key barrier for many consumers, especially in price-sensitive markets. Until manufacturers can find ways to reduce energy consumption and raw material costs, the high production expenses will continue to restrain market growth.

Opportunity

Expansion in Emerging Markets

One of the major growth opportunities for the ceramic floor tiles market lies in the expansion of the construction industry in emerging markets. Countries in regions such as Asia-Pacific, Latin America, and Africa are witnessing rapid urbanization, which is driving a surge in both residential and commercial construction projects. This growing demand for new buildings presents a significant opportunity for ceramic tile manufacturers to tap into these markets, where the need for affordable, durable, and aesthetically pleasing flooring options is rising.

In particular, Asia-Pacific is projected to be a key growth region for ceramic floor tiles, with countries like India and China seeing substantial growth in their construction sectors. According to a report from the Asian Development Bank (ADB), the construction market in Asia is expected to grow by 5.8% annually between 2021 and 2025, driven largely by urbanization and infrastructure development.

As these emerging economies continue to industrialize, there is an increasing demand for both residential housing and commercial spaces like malls, hotels, and offices. Ceramic tiles, known for their durability and ability to withstand varying climates, are well-suited for these environments. Additionally, with the rising middle class in many of these regions, there is a growing desire for high-quality and aesthetically pleasing flooring options, further boosting the demand for ceramic tiles.

Government initiatives and investments in infrastructure development also play a critical role in this growth. For example, India’s Smart Cities Mission and affordable housing schemes have helped propel demand for building materials, including ceramic tiles. As more governments prioritize urban development and sustainable construction practices, the need for ceramic floor tiles will continue to rise, providing significant growth opportunities for manufacturers to explore.

Trends

Trend Towards Larger and Customized Tile Designs

One of the latest trends in the ceramic floor tiles market is the increasing demand for larger tile formats and customized designs. Homeowners and builders alike are moving away from traditional smaller tiles in favor of larger, more modern formats, which create a sense of space and enhance the visual appeal of interiors. Large-format tiles, such as those sized 24×24 inches or even 36×36 inches, are becoming more popular in both residential and commercial projects. These tiles not only offer a sleek, contemporary look but also reduce the number of grout lines, creating a cleaner, more uniform appearance.

According to the Tile Council of North America (TCNA), large-format tile sales in North America have been growing steadily, with these tiles now accounting for over 30% of total ceramic tile sales in the region. This shift is particularly noticeable in high-end residential homes and commercial spaces like hotels, restaurants, and retail stores, where aesthetics and design flexibility are key considerations.

Moreover, customization is also a growing trend in the ceramic tile market. Manufacturers are increasingly offering options for personalized designs, including custom colors, patterns, and textures, allowing consumers to create unique and personalized spaces. This customization trend has been bolstered by advances in digital printing technology, which makes it easier and more cost-effective to produce tailored designs in smaller batches.

Government initiatives supporting home renovation and green building practices are also fueling this trend. For instance, various countries in Europe and North America are pushing for sustainable, energy-efficient designs in residential and commercial buildings. The adoption of large-format tiles fits well within this context, as it reduces the amount of material needed for a project while offering durability and sustainability.

Regional Analysis

In 2024, the Asia Pacific region dominates the global ceramic floor tiles market, accounting for more than 51.2% of the total market share, valued at approximately USD 67.0 billion. This significant market share is primarily driven by the rapid urbanization, booming construction industry, and rising middle-class population across key countries such as China, India, and Southeast Asian nations. The region has become a major hub for both production and consumption of ceramic tiles due to the availability of low-cost labor and raw materials, as well as robust manufacturing capabilities.

China is the leading contributor to the Asia Pacific ceramic tile market, with the country not only being one of the largest consumers of ceramic tiles but also a major exporter. The demand for ceramic tiles in China is primarily fueled by ongoing infrastructure development and high residential construction activity. Similarly, India’s growing population, rapid urbanization, and government initiatives to improve housing and infrastructure under programs like “Housing for All” have significantly bolstered the demand for ceramic tiles.

Southeast Asian countries, particularly Vietnam, Indonesia, and Thailand, are also seeing rising demand due to the expansion of residential and commercial building projects. The increasing adoption of modern and sustainable building materials in these regions further drives the growth of ceramic floor tiles.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Atlas Concorde S.p.A., an Italy-based global leader in the ceramic tile industry, specializes in high-quality porcelain and ceramic tiles for both residential and commercial applications. The company is known for its innovative designs and commitment to sustainability, offering a wide range of aesthetic options and advanced technological solutions. Atlas Concorde maintains a strong presence in Europe, North America, and emerging markets.

Ceramic Industries Group, based in South Africa, is a major player in the global ceramic tile market. It operates under the brands of Italtile and CTM and manufactures both wall and floor tiles. The company is recognized for its focus on quality, design, and customer satisfaction. Ceramic Industries Group is well-established in the Southern African market and is expanding its footprint in international markets, with an emphasis on premium and sustainable tile products.

China Ceramics Co., Ltd. is one of China’s prominent manufacturers of ceramic tiles, specializing in the production of high-quality porcelain tiles. The company’s product range includes floor tiles, wall tiles, and decorative ceramic products for both residential and commercial sectors. With a strong manufacturing base in China, the company exports its products globally, leveraging advanced production technology and competitive pricing to capture market share in both local and international markets.

Top Key Players

- Atlas Concorde S.p.A.

- Ceramic Industries Group

- China Ceramics Co., Ltd.

- Crossville, Inc.

- Dynasty Ceramic Public Company Limited

- Florida Tile, Inc.

- Florim Ceramiche S.p.A.

- GRUPPO CERAMICHE RICCHETTI S.p.A.

- Guangdong Dongpeng Ceramic Co. Ltd.

- Guangdong Newpearl Ceramics Group Co., Ltd.

- Kajaria Ceramics Limited

- Mohawk Industries Inc.

- Porcelanosa Group

- PORCELANOSA Grupo A.I.E.

- RAK Ceramics

- SCG Ceramics

- White Horse Ceramics

Recent Developments

Atlas Concorde S.p.A portfolio includes a wide range of aesthetically versatile products, with an increasing focus on sustainable production and eco-friendly designs. With over 3,000 employees, Atlas Concorde’s annual revenue is estimated to surpass €400 million in 2024.

Ceramic Industries operates under the Italtile and CTM brands, producing high-quality ceramic and porcelain tiles. The group has a network of over 150 retail outlets across Southern Africa and is projected to generate revenue exceeding ZAR 4 billion in 2024.

Report Scope

Report Features Description Market Value (2024) USD 130.9 Bn Forecast Revenue (2034) USD 232.2 Bn CAGR (2025-2034) 5.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered by Product (Glazed Ceramic Tiles, Porcelain Tiles, Scratch Free Ceramic Tiles, Others), By Raw Material (Sand, Natural Clay, Feldspar, Others), By Construction Type (New Construction, Renovation), By End-use (Residential, Commercial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Atlas Concorde S.p.A., Ceramic Industries Group, China Ceramics Co., Ltd., Crossville, Inc., Dynasty Ceramic Public Company Limited, Florida Tile, Inc., Florim Ceramiche S.p.A., GRUPPO CERAMICHE RICCHETTI S.p.A., Guangdong Dongpeng Ceramic Co. Ltd., Guangdong Newpearl Ceramics Group Co., Ltd., Kajaria Ceramics Limited, Mohawk Industries Inc., Porcelanosa Group, PORCELANOSA Grupo A.I.E., RAK Ceramics, SCG Ceramics, White Horse Ceramics Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Atlas Concorde S.p.A.

- Ceramic Industries Group

- China Ceramics Co., Ltd.

- Crossville, Inc.

- Dynasty Ceramic Public Company Limited

- Florida Tile, Inc.

- Florim Ceramiche S.p.A.

- GRUPPO CERAMICHE RICCHETTI S.p.A.

- Guangdong Dongpeng Ceramic Co. Ltd.

- Guangdong Newpearl Ceramics Group Co., Ltd.

- Kajaria Ceramics Limited

- Mohawk Industries Inc.

- Porcelanosa Group

- PORCELANOSA Grupo A.I.E.

- RAK Ceramics

- SCG Ceramics

- White Horse Ceramics