Global Ceramic Tile Market By Product Type(Glazed Tiles, Porcelain Tiles, Uglazed Tiles), By Application (Wall, Floor, Roof, Others), By End-Use (Residential, Commercial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2033

- Published date: Nov. 2023

- Report ID: 17524

- Number of Pages: 204

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

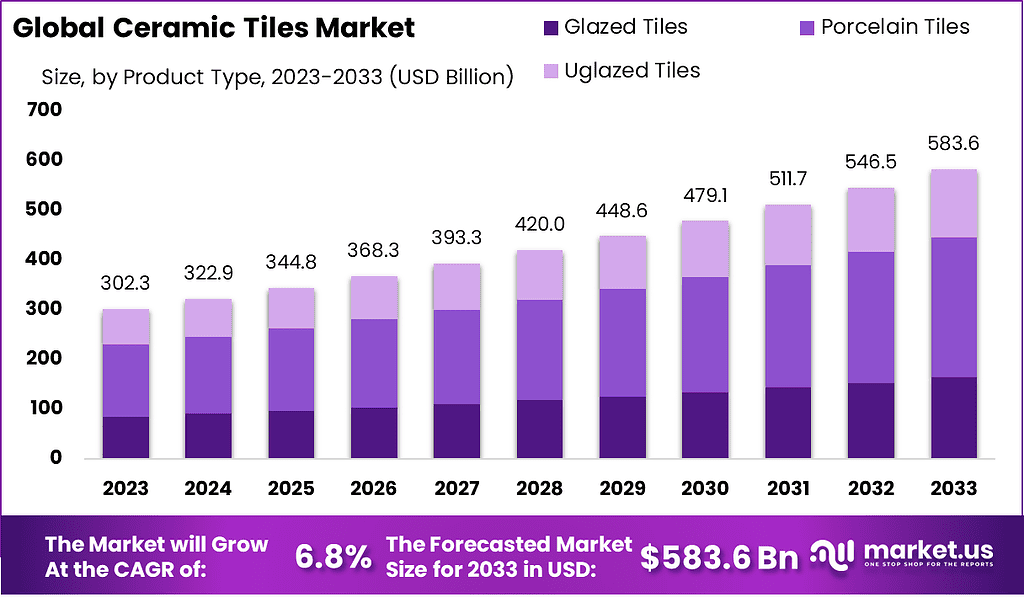

The Global Ceramic Tile Market is anticipated to be USD 583.6 billion by 2033. It is estimated to record a steady CAGR of 6.8% in the Forecast period 2023 to 2033. It is likely to total USD 302.3 billion in 2023.

Ceramic tile is durable water-resistant and easy to clean material, which is commonly employed for flooring and walls. It is made of clay as well as other natural materials which are then heated in a kiln to form a durable non-porous, non-porous surface. Ceramic tile comes in a myriad of shapes, colors and sizes, making it an flexible product that is employed to create various designs.

The Ceramic Tiles Market is a growing and vibrant business that plays an important role in the construction as well as design and construction industries. Ceramic tiles are extensively utilized for a variety of purposes such as flooring, countertops, walls and backsplashes. These tiles are constructed from natural materials, such as clay minerals, water, and other minerals which are then carefully made and then heated to high temperature to produce beautiful and long-lasting products.

Note: Actual Numbers Might Vary In The Final Report

One of the major reasons for market growth for the Ceramic Tile market is the growing emphasis on design and aesthetics in commercial and residential areas. Ceramic tiles are available in a vast selection of patterns, colors and textures, which allows designers, architects and homeowners to express their imagination and create the desired appearance and feel for their designs.

Key Takeaways

- Market Size: The Ceramic Tile Market is expected to reach USD 583.6 billion by 2033, with a steady CAGR of 6.8% from 2023 to 2033. It is estimated to be valued at USD 302.3 billion in 2023.

- Product Types: In 2023, the market saw distinct trends in product segments. Porcelain Tiles emerged as the leading product type, capturing over 48.3% of the market share due to their durability, low maintenance, and design versatility.

- Applications: Among the various applications, the Floor segment dominated the market, holding more than 52.0% of the market share. Ceramic tiles are highly preferred for flooring due to their durability and aesthetic options.

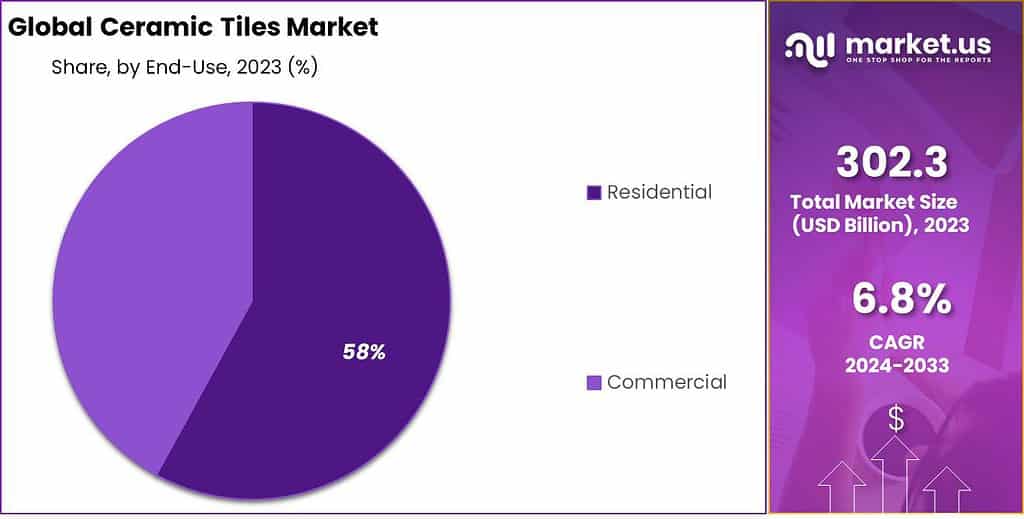

- End-Use: In 2023, the Residential segment held the largest market share, accounting for over 58% of the market. The growth in residential construction projects and the trend of using ceramic tiles for walls, backsplashes, and countertops contributed to this dominance.

- Driving Factors: Several factors contribute to the growth of the ceramic tile market, including rising construction activities, durability, low maintenance, technological advancements, and sustainability. These factors drive the demand for ceramic tiles in both residential and commercial sectors.

- Restraining Factors: Challenges in the market include high competition, fluctuating raw material prices, installation complexity, and global economic uncertainties, which can impact market growth.

- Growth Opportunities: Opportunities for market growth include rapid urbanization, innovative product development, export potential, and leveraging digital marketing and e-commerce platforms to reach a broader audience.

- Key Market Trends: Notable trends include the popularity of wood-look tiles, geometric patterns, advancements in digital printing technology, and a focus on sustainability in production.

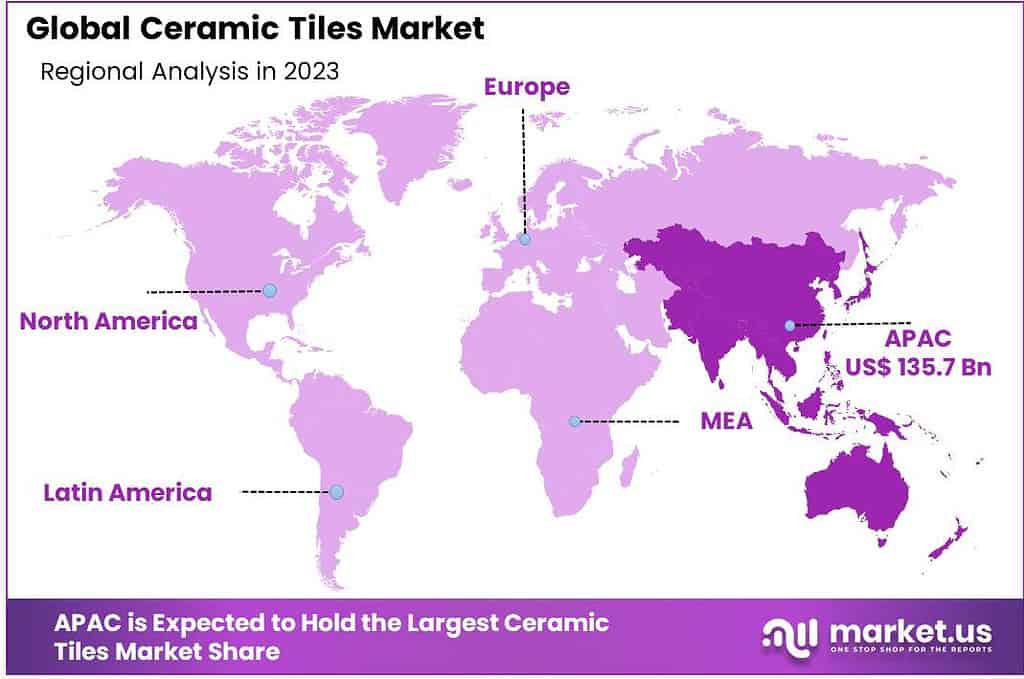

- Regional Analysis: Asia-Pacific (APAC) emerged as the dominant player in the ceramic tile market, with a market share of over 44.9% in 2023. Factors driving this include rapid urbanization and infrastructure development in countries like China and India.

- Key Players: Major key players in the industry include Mohawk Industries, Inc., ATLAS CONCORDE S.P.A., Crossville Inc., and others. Market leaders focus on low environmental impact, high durability, and cost optimization.

- Geopolitical and Recession Impact: Geopolitical factors such as trade restrictions and economic uncertainties can affect the ceramic tile market. Economic recessions can lead to reduced construction activity and consumer spending, impacting the industry.

Product Type Analysis

In 2023, the Ceramic Tile market exhibited distinct trends and dynamics across various product segments, including Glazed Tiles, Porcelain Tiles, and Unglazed Tiles. Among these segments, Porcelain Tiles emerged as the frontrunner, securing a dominant market position with a commanding share of over 48.3%. This remarkable achievement can be attributed to several factors, including the growing preference for porcelain tiles due to their durability, low maintenance requirements, and versatility in design applications.

Additionally, the increasing adoption of porcelain tiles in both residential and commercial projects has significantly bolstered their market presence. As a result, manufacturers and stakeholders in the Ceramic Tile industry have been strategically focusing on the production and promotion of porcelain tiles to capitalize on this lucrative market segment.

Application Analysis

Shifting our focus to the application aspect of the Ceramic Tile market, 2023 witnessed notable developments in segments such as Wall, Floor, Roof and Others. Among these, the Floor segment emerged as the dominant force, commanding an impressive market share of more than 52.0%. This supremacy can be attributed to the extensive utilization of ceramic tiles in flooring applications across both residential and commercial spaces. The durability, ease of maintenance, and wide range of design options offered by ceramic floor tiles have made them a preferred choice among consumers and project developers alike.

Furthermore, the emphasis on aesthetics and the increasing focus on interior design in modern construction projects have fueled the demand for ceramic tiles in the flooring segment. Consequently, manufacturers have been strategically aligning their product offerings and marketing efforts to cater to the flourishing demand for ceramic floor tiles, cementing their position as the market leaders.

End-Use Analysis

Lastly, when delving into the Ceramic Tile market by End-Use categories, namely Residential and Commercial, it becomes evident that the Residential segment claimed a dominant market position in 2023, capturing a substantial share of over 58%. This achievement underscores the significance of the residential sector as a major driver of ceramic tile consumption. The growth in residential construction projects, renovation activities, and the increasing disposable income of homeowners have all contributed to the robust demand for ceramic tiles in residential applications.

Moreover, the trend towards using ceramic tiles not only for flooring but also for walls, backsplashes, and countertops in residential spaces has further propelled the segment’s growth. The Residential segment’s dominance in 2023 highlights the sustained appeal of ceramic tiles among homeowners and the industry’s focus on catering to their evolving preferences.

Note: Actual Numbers Might Vary In The Final Report

Driving Factors

- Rising Construction Activities: The ongoing global construction boom, especially in emerging economies, is a significant driver for the ceramic tile market. Increased urbanization, infrastructure development, and demand for aesthetically pleasing interiors are fueling the use of ceramic tiles in residential and commercial buildings.

- Durability and Low Maintenance: Ceramic tiles are preferred for their durability and ease of maintenance. They can withstand heavy foot traffic, resist staining, and are easy to clean, making them a practical choice for flooring in both residential and commercial spaces.

- Technological Advancements: Continuous innovation in ceramic tile manufacturing processes, including digital printing technology, has expanded design possibilities. This has led to a surge in demand for customized and visually appealing ceramic tiles, attracting consumers looking for unique and personalized solutions.

- Sustainability and Environmental Concerns: Growing environmental awareness has prompted a shift towards eco-friendly construction materials. Ceramic tiles, often made from natural materials, are considered sustainable options. Manufacturers are also investing in energy-efficient production methods, further enhancing the eco-friendliness of ceramic tiles.

Restraining Factors

- High Competition: The ceramic tile market is highly competitive, with numerous manufacturers vying for market share. This intense competition can lead to pricing pressures, affecting profit margins for companies in the industry.

- Fluctuating Raw Material Prices: The cost of raw materials, such as clay and minerals, can fluctuate significantly. Manufacturers may face challenges in managing production costs when raw material prices rise unexpectedly.

- Installation Complexity: While ceramic tiles offer long-term benefits, their installation can be labor-intensive and require skilled professionals. Installation costs and complexities can deter some consumers from choosing ceramic tiles over easier-to-install flooring options.

- Global Economic Uncertainties: Economic fluctuations and uncertainties can impact the construction industry and, consequently, the demand for ceramic tiles. Economic downturns or slowdowns in construction activities can hinder market growth.

Growth Opportunities

- Rapid Urbanization: Continued urbanization in emerging markets presents a significant growth opportunity for the ceramic tile industry. As more people move into cities, the need for commercial and residential space and ceramic tiles is likely to increase.

- Innovative Products: Manufacturers are able to explore new opportunities by introducing unique ceramic tile designs, like large-format tiles, tile with textured surfaces and equipped with modern features such as antimicrobial properties.

- Export Potential: Ceramic tile manufacturers can tap into export markets to expand their customer base. Targeting regions with growing construction sectors or high renovation rates can open up new revenue streams.

- Digital Marketing and E-commerce: Embracing digital marketing strategies and e-commerce platforms can help ceramic tile companies reach a broader audience and facilitate direct sales to consumers, bypassing traditional distribution channels.

Key Market Trends

- Wood-Look Tiles: Ceramic tiles that mimic the appearance of wood flooring have gained popularity. These tiles offer the aesthetic appeal of wood with the durability and low maintenance of ceramics, catering to the demand for natural and warm interior designs.

- Geometric Patterns: Geometric patterns and designs on ceramic tiles have become trendy, adding a modern and artistic touch to interior spaces. These tiles are often used as decorative accents in kitchens, bathrooms, and living areas.

- Digital Printing Technology: Advancements in digital printing have enabled manufacturers to produce tiles with intricate and high-definition designs, including realistic stone and marble textures. This technology allows for a wide range of customization.

- Sustainable Practices: Sustainability is a growing trend in the ceramic tile industry. Manufacturers are increasingly adopting sustainable production methods, using recycled materials, and promoting energy-efficient kiln technologies to meet eco-conscious consumer demands.

Kеу Маrkеt Ѕеgmеntѕ

By Product Type

- Glazed Tiles

- Porcelain Tiles

- Uglazed Tiles

By Application

- Wall

- Floor

- Roof

- Others

By End-Use

- Residential

- Commercial

Geopolitical and Recession Impact Analysis

Geopolitical Impact:

- Trade Import and Tariff Restrictions: Trade disputes and geopolitical tensions between nations could lead to the enactment of tariffs and limitations on imports of ceramic tile. This can cause disruption to this supply chain and raise the cost of production, and eventually result in increased prices for consumers.

- Supply Chain Disruptions: Geopolitical conflicts or disruptions in key ceramic tile manufacturing regions can affect the supply chain. For example, if a major ceramic tile-producing country faces political instability, it may lead to delays in raw material shipments and production interruptions.

- Market Access Challenges: Geopolitical tensions can create challenges for companies trying to enter new markets. Restrictions on market access or unfavorable trade policies can hinder the expansion of ceramic tile manufacturers into certain regions, impacting their growth potential.

- Currency Exchange Rate Fluctuations: Geopolitical events can lead to currency exchange rate fluctuations. These fluctuations can impact the cost of raw materials and the competitiveness of ceramic tile exports, affecting both domestic and international markets.

Recession Impact:

- Reduced Construction Activity: During economic recessions, there is often a decrease in construction activity, including residential, commercial, and infrastructure projects. This reduced demand for construction materials, including ceramic tiles, can lead to a decline in sales and production.

- Consumer Spending Constraints: Economic downturns can result in decreased consumer spending, including on home improvement projects. Homeowners may postpone renovations or remodeling projects that involve ceramic tile installations, leading to a slowdown in demand.

- Cost-Cutting Measures: Ceramic tile manufacturers may implement cost-cutting measures during recessions, such as reducing workforce or scaling back production. This can impact the availability of certain tile varieties and affect the competitiveness of the market.

- Innovation and Product Development: Recessions can also drive innovation and product development in the ceramic tiles industry. Manufacturers may focus on creating more cost-effective and sustainable tile options to meet changing consumer preferences and budget constraints.

Regional Analysis

In 2023, the Ceramic Tile market displayed distinct regional variations, each with its own unique dynamics and contributions to the global market landscape. Among these regions, the Asia-Pacific (APAC) region emerged as the dominant player, capturing an impressive market share of over 44.9%. The demand for Ceramic Tile in Asia Pacific was valued at USD 135.7 billion in 2023 and is anticipated to grow significantly in the forecast period.

APAC’s supremacy can be attributed to several factors, including rapid urbanization, robust construction activities, and a burgeoning middle-class population with an increasing preference for modern housing solutions. Countries like China and India, in particular, witnessed a surge in infrastructure development and residential construction projects, driving substantial demand for ceramic tiles. Additionally, the availability of skilled labor and cost-effective manufacturing processes in the region further bolstered the ceramic tile industry’s growth.

In contrast, North America and Europe showcased more mature markets. North America maintained a steady presence in the ceramic tile market, driven by renovation and remodeling activities, particularly in the residential sector. The market in Europe, while stable, experienced a slower growth rate due to economic factors and the saturation of certain segments.

Latin America displayed potential for growth, primarily fueled by increasing investments in commercial spaces and hospitality projects, while the Middle East and Africa region exhibited promising growth in response to expanding construction projects and the hospitality industry.

These regional dynamics underscore the significance of understanding the unique market conditions and consumer preferences in each area, allowing industry stakeholders to tailor their strategies effectively to maximize opportunities in the global Ceramic Tile market.

Note: Actual Numbers Might Vary In The Final Report

Key Regions and Countries Covered in this Report

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

To attract consumers’ attention, market leaders are constantly introducing products that have a low environmental impact and high durability. To remain competitive in the market, major key players in the industry focus on optimizing operational costs, improving product quality, maximizing production output, and acquiring small additional market players. These are the major key factors in the ceramic tiles market growth.

Top Key Рlауеrѕ

- Mohawk Industries, Inc.

- ATLAS CONCORDE S.P.A.

- Crossville Inc.

- Cerámica Saloni, Florida Tile, Inc.

- Guangdong Newpearl Ceramics Group Co.

- RAK Ceramics

- Kajaria Ceramics Ltd.

- China Ceramics Co., Ltd.

- Porcelanosa Group

- Ricchetti Group

- Other Key Players

Recent Developments

- June 2022, Kajaria Ceramics Limited approved the purchase of equity shares representing 51% from South Asian Ceramic Tiles Private Limited, Hyderabad, Telangana (South Asia) in the amount of INR 28.50 crore (USD 3.46 million) In turn, South Asia is expected to be an affiliate of the company.

- June 2022, Mohawk Industries, Inc. announced it had reached an agreement to acquire its Vitromex Ceramic Tile business of Grupo Industrial Saltillo (GIS) for approximately USD 293 million cash.

Report Scope

Report Features Description Market Value (2023) US$ 302.3 Bn Forecast Revenue (2032) US$ 583.6 Bn CAGR (2023-2032) 6.8% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2023-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type(Glazed Tiles, Porcelain Tiles, Uglazed Tiles), By Application (Wall, Floor, Roof, Others), By End-Use (Residential, Commercial) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Mohawk Industries, Inc., ATLAS CONCORDE S.P.A., Crossville Inc., Cerámica Saloni, Florida Tile, Inc., Guangdong Newpearl Ceramics Group Co., RAK Ceramics, Kajaria Ceramics Ltd., China Ceramics Co., Ltd., Porcelanosa Group, Ricchetti Group, Other Key Players Customization Scope Customization for segments and region/country level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

How big is Ceramic Tile Market?The Global Ceramic Tile Market is anticipated to be USD 583.6 billion by 2033. It is estimated to record a steady CAGR of 6.8% in the Forecast period 2023 to 2033. It is likely to total USD 302.3 billion in 2023.

Who is the leading company in the ceramic tile market?Identifying a single market leader can change over time and by region. Key players such as Mohawk Industries, Inc., ATLAS CONCORDE S.P.A., Crossville Inc., Cerámica Saloni, Florida Tile, Inc., Guangdong Newpearl Ceramics Group Co., RAK Ceramics, Kajaria Ceramics Ltd., China Ceramics Co., Ltd., Porcelanosa Group, Ricchetti Group, Other Key Players

Which country is the largest producer of ceramic tiles worldwide?China is the largest producer of ceramic tiles globally. Notable Chinese companies include China Ceramics, Marco Polo, and New Pearl Ceramics.

What factors drive the growth of the ceramic tile industry?The ceramic tile industry is driven by factors such as increasing construction activities, aesthetic preferences in interior design, and the durability and low maintenance of ceramic tiles.

Are there any emerging trends in the ceramic tile market?Emerging trends in the ceramic tile market include the adoption of digital printing technology for intricate designs, a growing focus on eco-friendly and sustainable production methods, and the development of large-format tiles.

What are the main applications of ceramic tiles?Ceramic tiles find applications in residential and commercial construction, as well as in sectors such as healthcare, hospitality, and transportation due to their versatility, durability, and aesthetic appeal.

-

-

- Mohawk Industries, Inc.

- ATLAS CONCORDE S.P.A.

- Crossville Inc.

- Cerámica Saloni, Florida Tile, Inc.

- Guangdong Newpearl Ceramics Group Co.

- RAK Ceramics

- Kajaria Ceramics Ltd.

- China Ceramics Co., Ltd.

- Porcelanosa Group

- Ricchetti Group

- Other Key Players