Global Large-Format Ceramic Panels Market Size, Share, And Business Benefits By Type (Porcelain, Glazed, Unglazed), By Thickness (Less Than 3mm, 3mm-9mm, 9.1mm–12mm, Greater Than 12mm), By Finish (Matte, Gloss), By Construction Type(New Construction, Renovation), By Application (Flooring, Wall Cladding, Countertops, Facades, Others), By End-use (Residential, Commercial, Industrial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 47988

- Number of Pages: 342

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Type Analysis

- By Thickness Analysis

- By Finish Analysis

- By Construction Type Analysis

- By Application Analysis

- By End-use Analysis

- Key Market Segments

- Driving Factors

- Restraining Factors

- Growth Opportunity

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

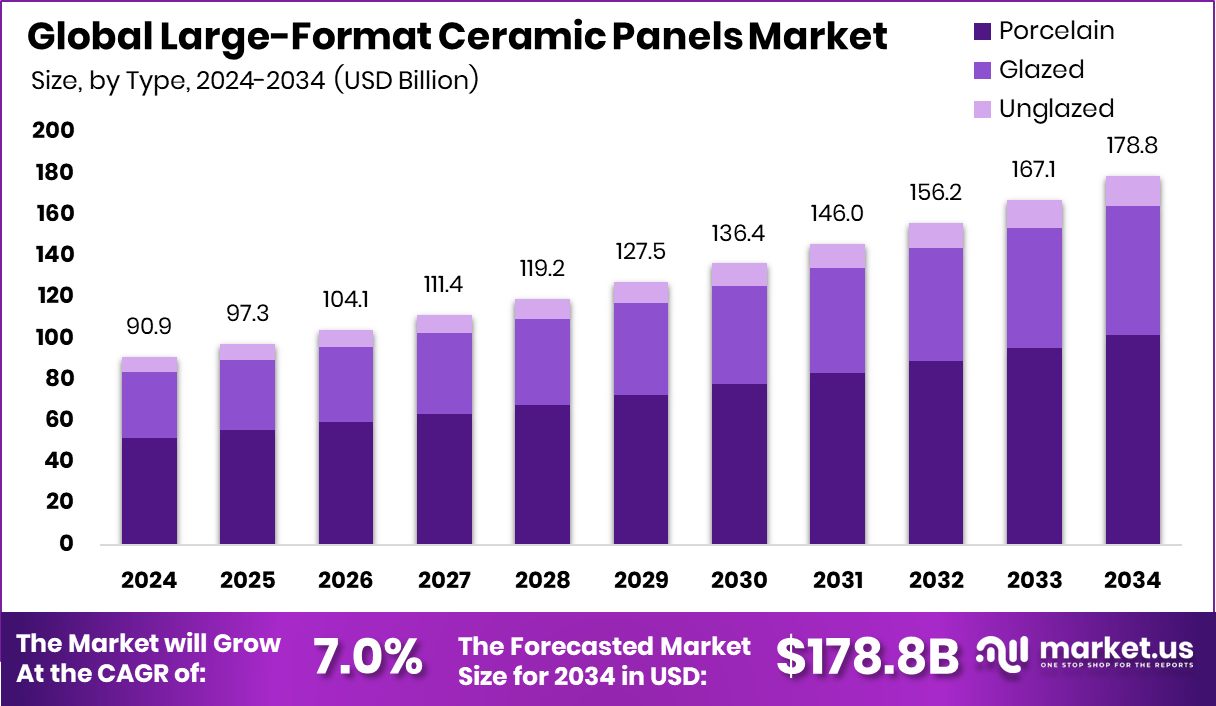

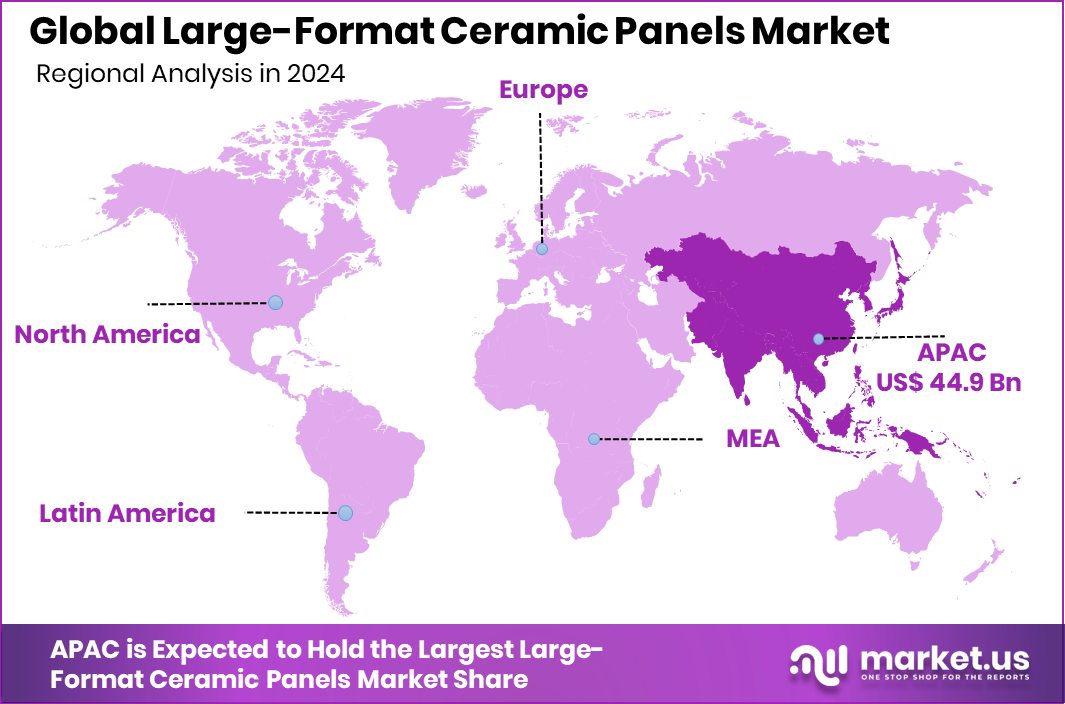

The Global Large-Format Ceramic Panels Market is expected to be worth around USD 178.8 billion by 2034, up from USD 90.9 billion in 2024, and grow at a CAGR of 7.0% from 2025 to 2034. Asia-Pacific’s 49.4% dominance reflects widespread construction activity and the adoption of modern surfacing materials.

Large-format ceramic panels are oversized ceramic or porcelain tiles typically larger than traditional tiles, often reaching dimensions of 1 meter by 3 meters or more. These panels are known for their thin yet strong structure, resistance to wear and moisture, and ability to mimic the appearance of natural materials like stone, wood, or marble. They are widely used in both residential and commercial spaces for wall cladding, flooring, kitchen countertops, and even building facades due to their seamless aesthetic and durability.

The large-format ceramic panels market is experiencing strong momentum, driven by growing architectural trends that favor sleek, minimalistic surfaces with fewer grout lines. These panels are gaining popularity in interior and exterior applications alike, offering designers and architects more creative flexibility. Urbanization, rising construction activities, and an increasing preference for easy-to-maintain yet luxurious materials are further accelerating the market demand.

One of the key growth factors is the shift in consumer preference toward sustainable and long-lasting building materials. Large-format ceramic panels meet these needs by offering a long lifecycle and eco-friendly production options. They also reduce the need for frequent replacements, which appeals to homeowners and commercial developers.

Demand for large-format panels is also rising due to their adaptability. They can be installed over existing surfaces, saving time and labor costs, making them an ideal solution for renovation projects. This efficiency has expanded their appeal beyond new construction into remodeling and retrofitting markets. According to an industry report, Motilal Oswal Finvest Ltd has finalized an investment of $66 million (approximately ₹520 crore) in Simpolo Group, a leading manufacturer of premium tiles.

Key Takeaways

- The Global Large-Format Ceramic Panels Market is expected to be worth around USD 178.8 billion by 2034, up from USD 90.9 billion in 2024, and grow at a CAGR of 7.0% from 2025 to 2034.

- Porcelain dominates the large-format ceramic panels market, accounting for 57.4% of total type-based demand.

- Panels under 3mm thickness represent 48.2%, driven by lightweight needs in modern architecture designs.

- Matte finish leads the market with 56.1% share due to its elegant, non-reflective surface appeal.

- New construction projects account for 84.3%, highlighting strong demand from ongoing urban development worldwide.

- Countertops lead in application, capturing 36.1% market share, favored for seamless, durable surface solutions.

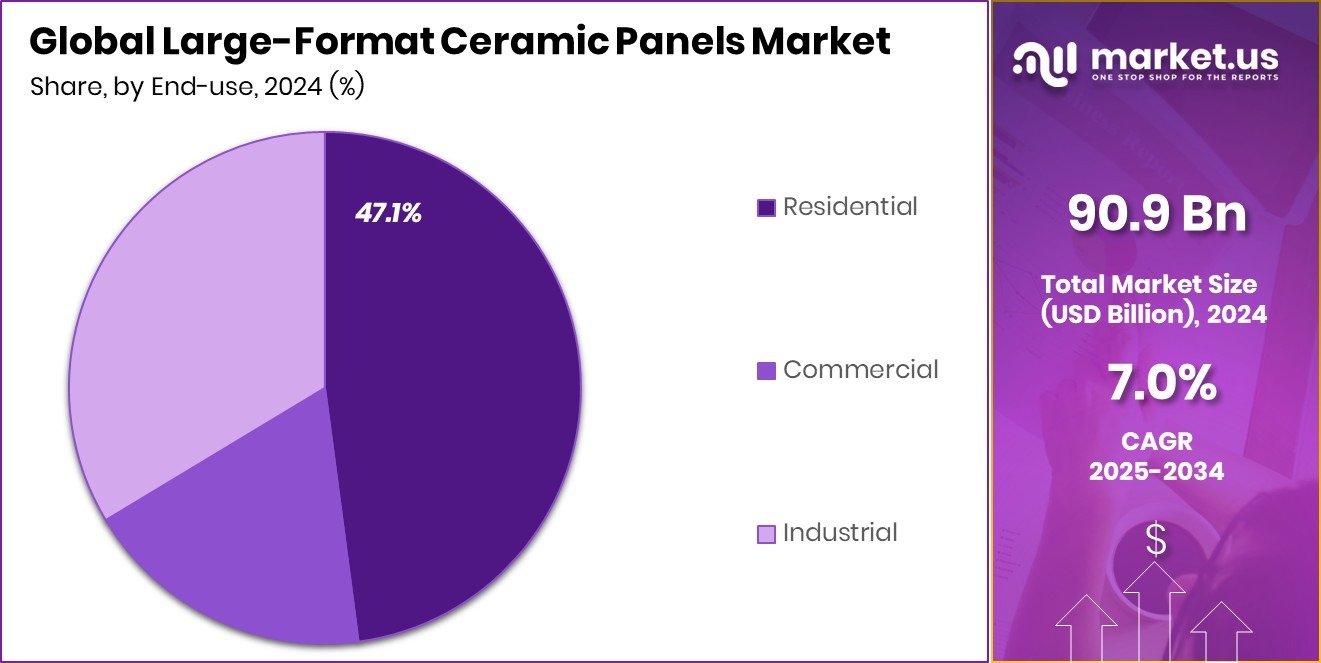

- The residential sector holds a 47.1% share, supported by rising premium housing and interior remodeling trends.

- The market size in Asia-Pacific reached USD 44.9 billion, showing strong demand growth.

By Type Analysis

Porcelain dominates the Large-Format Ceramic Panels Market with a 57.4% share globally.

In 2024, Porcelain held a dominant market position in the By Type segment of the Large-Format Ceramic Panels Market, with a 57.4% share. This dominance was primarily attributed to porcelain’s superior mechanical strength, aesthetic versatility, and moisture resistance. Its non-porous nature and ability to replicate natural materials such as stone or wood make it a preferred choice among architects and interior designers for both commercial and residential installations.

Porcelain panels offered enhanced performance under varying environmental conditions, making them particularly suited for high-traffic zones and outdoor applications. Their lightweight properties, despite large dimensions, facilitated ease of handling and installation, which further strengthened their market position. The growing preference for seamless, low-maintenance surfaces in luxury and modern construction projects continued to push porcelain’s adoption.

Additionally, the product’s alignment with sustainable design practices, including long life span and low emissions during manufacturing, played a role in increasing its demand. The 57.4% market share reflected not only consumer trust but also industry-wide confidence in porcelain as the most reliable and versatile material in the large-format ceramic panels segment.

By Thickness Analysis

Panels below 3mm thickness account for 48.2% of the total market demand.

In 2024, <3mm held a dominant market position in the By Thickness segment of the Large-Format Ceramic Panels Market, with a 48.2% share. This leading share was largely driven by the increasing preference for ultra-thin panels in modern construction and interior design applications. Panels with a thickness below 3mm offer a significant advantage in terms of weight reduction, making them easier to handle, transport, and install, particularly in renovation projects where overlaying existing surfaces is often required without adding bulk.

The reduced thickness also contributes to lower raw material usage, aligning with sustainable building practices and helping to minimize environmental impact. This feature is particularly appealing to designers seeking minimalistic aesthetics with maximum efficiency. Additionally, <3mm panels are often selected for their flexibility, allowing for easier adaptation to curved surfaces and complex architectural forms.

In commercial settings such as retail stores, office interiors, and hospitality spaces, the lightweight characteristic of <3mm panels supports faster installation and reduces structural load, translating into time and cost savings. The 48.2% market share reflects the growing demand for efficient, lightweight, and versatile surfacing solutions, with <3mm thickness panels standing out as the ideal choice in projects prioritizing both aesthetics and performance.

By Finish Analysis

Matte finish panels lead the market with 56.1% preference among buyers.

In 2024, Matte held a dominant market position in the By Finish segment of the Large-Format Ceramic Panels Market, with a 56.1% share. This strong performance was supported by the rising preference for subtle, non-reflective surfaces in modern architectural and interior design trends. Matte finishes offer a sophisticated and natural appearance that complements contemporary aesthetics, particularly in residential, commercial, and hospitality environments where minimalism and understated elegance are valued.

The matte surface provides enhanced slip resistance compared to glossier finishes, making it suitable for high-traffic areas such as hallways, bathrooms, and public spaces. Moreover, its ability to conceal fingerprints, smudges, and dust contributes to reduced maintenance and cleaning efforts, which is a key consideration in both home and commercial settings.

Designers and project developers also favor matte finishes for their compatibility with a wide range of textures, patterns, and color schemes. The tactile quality of matte panels adds depth and warmth to interiors, while still maintaining a clean and modern look. The 56.1% market share highlights the growing consumer inclination toward refined, low-gloss finishes that offer both aesthetic value and practical performance across varied architectural applications.

By Construction Type Analysis

New construction contributes 84.3% of total consumption in this panel segment.

In 2024, New Construction held a dominant market position in the By Construction Type segment of the Large-Format Ceramic Panels Market, with an 84.3% share. This substantial share reflected the growing integration of large-format ceramic panels into modern architectural planning right from the design phase. In newly built structures, architects and developers are increasingly specifying these panels for both interior and exterior applications due to their aesthetic appeal, durability, and suitability for large, continuous surfaces.

The high adoption rate in new construction projects is also driven by the flexibility to incorporate panels during the structural design stage, ensuring efficient alignment, load distribution, and seamless installations. Builders value the reduced need for grout lines, which not only enhances visual uniformity but also minimizes long-term maintenance.

Furthermore, the use of large-format panels in new commercial, residential, and institutional buildings allows for quicker installation processes, helping meet tight project timelines. The lightweight nature of the panels—particularly when installed during the initial construction phase—reduces structural load and supports energy efficiency goals.

By Application Analysis

Countertops represent 36.1% application share in the Large-Format Ceramic Panels Market.

In 2024, Countertops held a dominant market position in the By Application segment of the Large-Format Ceramic Panels Market, with a 36.1% share. This leading share was primarily supported by the increasing demand for high-performance, aesthetically appealing countertop surfaces in both residential kitchens and commercial food preparation areas. Large-format ceramic panels provide a seamless, hygienic, and stain-resistant solution, which is particularly beneficial for countertop applications where cleanliness and durability are critical.

The minimal joint lines achievable with large-format panels enhance not only the visual appeal but also improve ease of maintenance by reducing areas where dirt and bacteria can accumulate. Their resistance to heat, moisture, and chemical agents makes them an ideal surface for cooking, preparation, and daily utility tasks.

Homeowners and designers are increasingly selecting ceramic panels for countertops due to their ability to mimic natural stone, concrete, or wood textures without the associated maintenance issues. This, combined with the ease of fabrication and installation, contributes to their growing popularity. The 36.1% market share reflects the ongoing shift toward advanced, long-lasting materials in countertop design, positioning large-format ceramic panels as a favored choice for durable, elegant, and functional surface solutions in modern construction.

By End-use Analysis

The residential sector holds a 47.1% share in total end-use market consumption.

In 2024, Residential held a dominant market position in the By End-use segment of the Large-Format Ceramic Panels Market, with a 47.1% share. This strong position was driven by the growing preference for modern, seamless surfaces in home interiors, including living areas, kitchens, and bathrooms. Homeowners increasingly opted for large-format ceramic panels to achieve a clean, minimalistic aesthetic that requires less maintenance compared to traditional tiles with multiple grout lines.

The residential sector favored these panels for their functional advantages, such as high durability, resistance to stains and moisture, and ease of cleaning—qualities that align with the practical needs of everyday living. Their versatility in applications ranging from flooring and wall cladding to kitchen countertops also supported their widespread adoption in new homes and renovation projects alike.

Moreover, the demand was amplified by the rise of premium housing and customized home design, where large-format ceramic panels serve as a high-end surface solution without compromising on longevity or design flexibility. The 47.1% share reflects the increasing role of large-format ceramics in redefining modern residential architecture, with end users valuing both visual sophistication and practical benefits in their living spaces.

Key Market Segments

By Type

- Porcelain

- Glazed

- Unglazed

By Thickness

- <3mm

- 3mm-9mm

- 9.1mm–12mm

- >12mm

By Finish

- Matte

- Gloss

By Construction Type

- New Construction

- Renovation

By Application

- Flooring

- Wall Cladding

- Countertops

- Facades

- Others

By End-use

- Residential

- Commercial

- Industrial

Driving Factors

Rising Demand for Seamless and Low-Maintenance Surfaces

One of the key factors driving the growth of the large-format ceramic panels market is the increasing demand for seamless and low-maintenance surfaces in modern buildings. These panels are preferred by homeowners, architects, and designers because they reduce the need for visible joints or grout lines. This creates a smooth and clean look, especially in large open spaces like kitchens, living areas, and commercial lobbies.

In addition to visual appeal, large-format ceramic panels are easy to clean, resistant to stains, and do not require frequent upkeep. This combination of style and convenience makes them ideal for both homes and commercial spaces, contributing significantly to their growing popularity in the global construction and interior design industries.

Restraining Factors

High Installation Costs and Skilled Labor Shortage

A major restraining factor for the large-format ceramic panels market is the high installation cost combined with the limited availability of skilled labor. Unlike regular tiles, large-format panels require careful handling, precise cutting, and professional installation to avoid cracks or breakage. The panels are heavy, and their size makes transportation and placement more complex.

Many construction teams lack the specific tools and training needed for proper installation, which increases overall project costs. These challenges can discourage small and mid-sized construction firms or homeowners from choosing large-format ceramic panels, even if the material offers long-term benefits.

Growth Opportunity

Expansion in Renovation and Retrofit Project Opportunities

A significant growth opportunity in the large-format ceramic panels market lies in renovation and retrofit projects. As many buildings and homes age, there is a growing need to upgrade interiors and exteriors using modern, efficient materials. Large-format ceramic panels are ideal for these projects because they can be applied over existing surfaces, reducing demolition and material waste.

This makes them not only a more sustainable option but also a time-saving one. Their durability and easy maintenance align well with the goals of refurbishment efforts. By targeting renovation sectors—especially in urban areas with older buildings—the market can unlock new demand and drive increased adoption of large-format ceramic panels across both residential and commercial settings.

Latest Trends

Increasing Use of Panels in Furniture Design

One of the latest trends in the large-format ceramic panels market is their growing use in furniture applications. Traditionally used for walls, floors, and countertops, these panels are now being applied to tables, wardrobes, kitchen islands, and cabinet surfaces. Designers and manufacturers are exploring new ways to bring ceramic’s durability and aesthetic appeal into modern furniture.

Large-format panels offer a sleek, stone-like finish while being lighter and easier to maintain than natural stone or wood. Their scratch-resistant and heat-resistant properties also make them ideal for daily use in home and office furniture. This trend reflects the shift toward multi-functional, stylish, and long-lasting materials in interior design, expanding the use of ceramic panels beyond traditional construction.

Regional Analysis

In 2024, Asia-Pacific held a 49.4% share, dominating the Large-Format Ceramic Panels market.

In 2024, Asia-Pacific emerged as the dominant region in the Large-Format Ceramic Panels Market, accounting for 49.4% of the global share, with a market value of USD 44.9 billion. This regional leadership was largely driven by the rapid pace of urbanization, infrastructure development, and rising investments in modern residential and commercial construction across countries like China, India, and Southeast Asia.

The growing demand for high-performance, visually appealing surfacing materials further supported the adoption of large-format ceramic panels in both new constructions and renovation projects.

In North America, the market saw steady growth due to increasing awareness of sustainable building materials and preference for low-maintenance, seamless surfaces in interior design. Europe followed with notable adoption in architectural cladding and high-end residential developments, aligning with stringent building standards and aesthetic preferences.

The Middle East & Africa region witnessed emerging demand, particularly in premium hospitality and urban infrastructure segments. Latin America experienced gradual growth, supported by residential upgrades and commercial projects.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, the global large-format ceramic panels market saw notable contributions from key industry players—Mohawk Industries, ABK Group, Adila Ceramic, and Rocersa Cerámica. From an analyst’s perspective, each company has taken distinct strategic actions to strengthen its position, leveraging scale, innovation, and geographic coverage.

Mohawk Industries, Inc. continued its robust performance by integrating large-format ceramic panels into a broad product portfolio, strengthening its presence across residential and commercial segments. Emphasis on large-scale production and distribution capabilities bolstered its ability to meet diverse global demand. Backed by strong supply chain networks, the company was positioned to fulfill large project requirements efficiently.

ABK Group Industrie Ceramiche S.p.A. reinforced its competitive standing by prioritizing premium aesthetics and technological innovation. Investment in advanced digital printing and sintering techniques enhanced the visual appeal and performance of its ceramic panels. The company’s focus on design flexibility supported uptake in high-end architectural applications, particularly in Europe and North America.

Adila Ceramic expanded its market influence through cost-competitive manufacturing and targeted distribution expansion. By offering value-focused solutions tailored to renovation and retrofit segments, it captured demand in emerging markets. Its nimble operational model enabled swift adaptation to changing design trends and regional preferences.

Rocersa Cerámica, S.A. emphasized strategic differentiation via product customization and design partnerships. With a reputation for artistic finishes and bespoke panel sizes, the company appealed to architects and interior designers seeking unique surface solutions. This specialization supported strong performance in luxury residential and boutique commercial projects.

Top Key Players in the Market

- Mohawk Industries, Inc.

- ABK Group Industrie Ceramiche S.p.A.

- Adila Ceramic

- Rocersa Cerámica, S.A.

- Elemex Inc

- Florim Ceramiche S.p.A.

- GranitiFiandre S.p.A.

- Laminam S.p.a

- Levantina Group

- Neolith

- RAK Ceramics

- Pamesa Ceramica

- Lioli Ceramica

- Azteca Cerámica

- Other Key Players

Recent Developments

- In April 2024, Mohawk Industries established a Procurement Center of Excellence in Lucerne, Switzerland. This new office aims to centralize and streamline procurement operations for its full range of surface products, including advanced ceramic tile and large-format ceramic panels, enhancing global sourcing efficiency. This initiative supports cost savings and strengthens supply chain capabilities across multiple markets.

- In January 2024, ABK Group unveiled a €30 million investment plan aimed at strengthening its large-format slab offerings. The funding was directed towards product innovation—especially its FullVein 3D slabs and patented Cooking Surface Prime—as well as expanding global office and showroom presence and bolstering its workforce.

Report Scope

Report Features Description Market Value (2024) USD 178.8 Billion Forecast Revenue (2034) USD 178.8 Billion CAGR (2025-2034) 7.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Porcelain, Glazed, Unglazed), By Thickness (<3mm, 3mm-9mm, 9.1mm–12mm, >12mm), By Finish (Matte, Gloss), By Construction Type(New Construction, Renovation), By Application (Flooring, Wall Cladding, Countertops, Facades, Others), By End-use (Residential, Commercial, Industrial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Mohawk Industries, Inc., ABK Group Industrie Ceramiche S.p.A., Adila Ceramic, Rocersa Cerámica, S.A., Elemex Inc, Florim Ceramiche S.p.A., GranitiFiandre S.p.A., Laminam S.p.a, Levantina Group, Neolith, RAK Ceramics, Pamesa Ceramica, Lioli Ceramica, Azteca Cerámica, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Large Format Ceramic Panel MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Large Format Ceramic Panel MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Mohawk Industries, Inc.

- ABK Group Industrie Ceramiche S.p.A.

- Adila Ceramic

- Rocersa Cerámica, S.A.

- Elemex Inc

- Florim Ceramiche S.p.A.

- GranitiFiandre S.p.A.

- Laminam S.p.a

- Levantina Group

- Neolith

- RAK Ceramics

- Pamesa Ceramica

- Lioli Ceramica

- Azteca Cerámica

- Other Key Players