Global Construction Films Market By Product Type (Gas Barrier Films, Vapor Barrier Films, Solar Films, Window Films and Others Product Type) By Resin Type (Polyolefin Films, Nylon Films, Polyester Films, Ethylene Vinyl Alcohol Films, Fluoropolymer Films, Polyvinyl Butyral Films, Polyvinylidene Chloride Films, Polyimide Films, Polyvinyl Chloride Films, Bio-based Polymer Films and Others Resin Type) By Application (Flooring, Walls & Ceilings, Windows, Doors, Roofing, Building & Enveloping, Electrical, HVAC, Plumbing and Others Application) By Function (Bonding, Protection, Insulation, Glazing, Soundproofing and Cable Management) By End Use (Residential, Commercial and Industrial) By Distribution Channel (Direct and Third-Party) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Dec 2023

- Report ID: 32809

- Number of Pages: 342

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

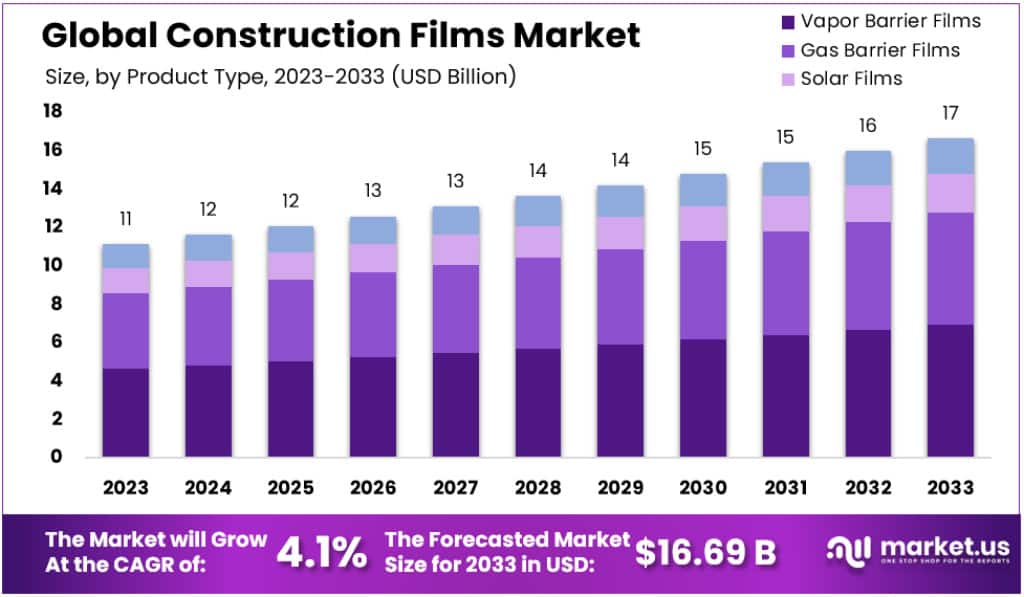

The Global Construction Films Market size is expected to be worth around USD 17 Billion by 2033, from USD 11 Billion in 2023, growing at a CAGR of 4.1% during the forecast period from 2023 to 2033.

Construction films are used in various applications in the construction industry, such as vapor barriers, UV resistance, acoustic properties, and high strength. They are manufactured using different types of polymers, including low-density polyethylene (LDPE). These films are used for protection against the elements, dust, dirt, and dampness, and can also serve as privacy screens, dust covers, or underlay for scaffolding.

Additionally, they find applications in areas such as roof underlayment, below-grade membrane carriers, and door/window flashing. Construction films are utilized in residential, commercial, industrial, and civil engineering industries.

Construction films demand has increased in many applications due to the emphasis on durability, energy efficiency, and lower service costs. Global market growth is expected to be driven by the increasing number of green buildings, strict regulations that aim to reduce carbon and Greenhouse Gas (GHG) emissions, rapid industrialization, and urbanization, particularly in emerging economies such as the Asia Pacific.

Key Takeaways

- The Global Construction Films Market is expected to reach about USD 17 billion by 2033, up from USD 11 billion in 2023.

- The market is projected to grow at CAGR of 4.1% between 2023 and 2033.

- In 2023, Vapor Barrier Films held a significant market share of 43% due to their role in moisture protection and energy efficiency.

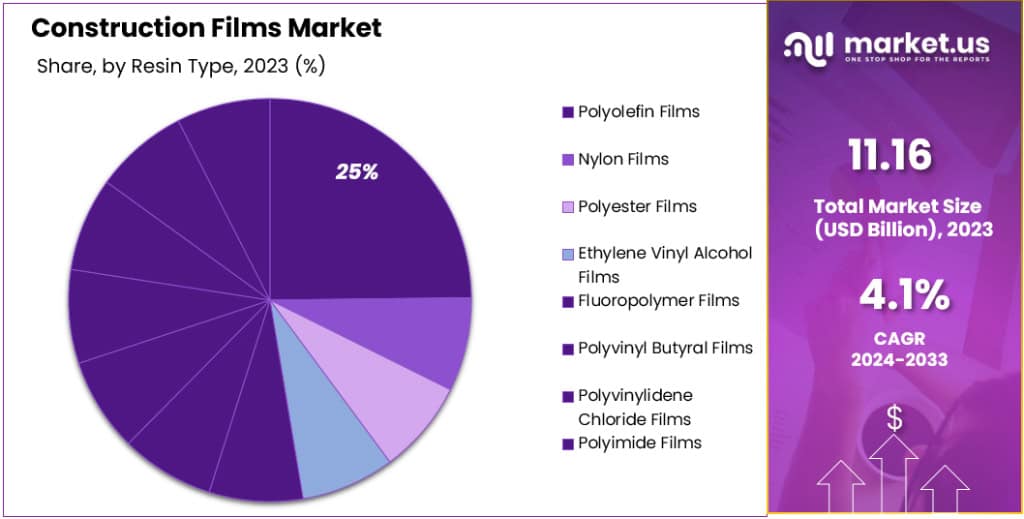

- Polyolefin Films held a dominant market share of 33.6% due to their durability and versatility.

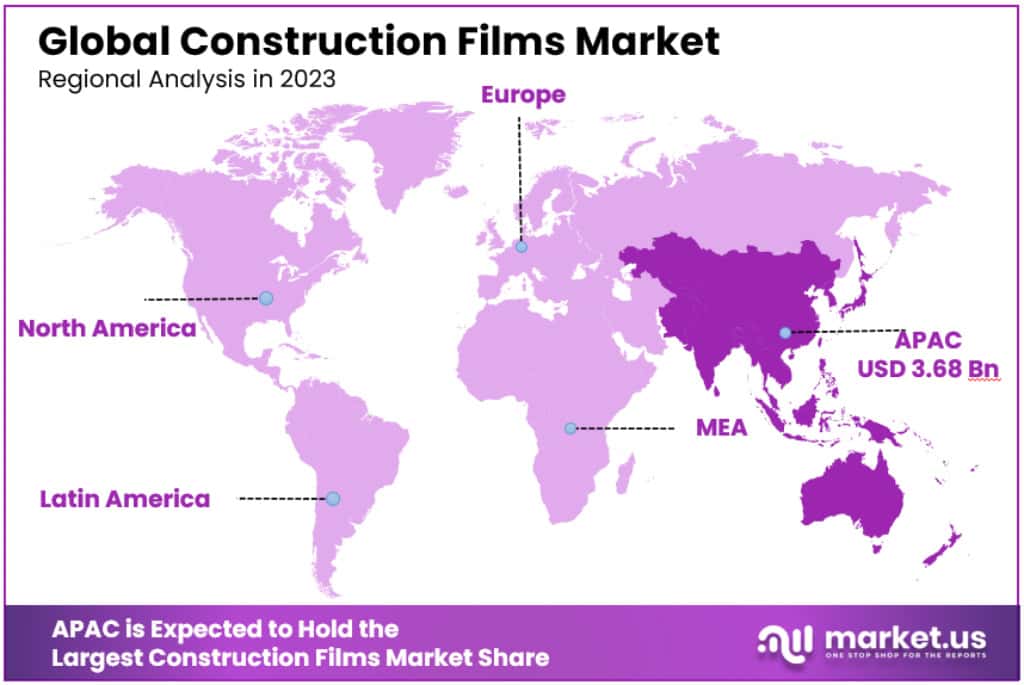

- APAC is dominating Construction Films Market with 33% share, with USD 3.68 Billion in 2023

Product Type Analysis

In 2023, Vapor Barrier Film held a dominant market position, capturing more than a significant 43% share. This segment’s prominence is attributed to its critical role in protecting buildings from moisture damage, thereby enhancing structural integrity and indoor air quality. The construction industry’s increasing emphasis on sustainable and energy-efficient buildings has further propelled the demand for these films. With a growing awareness of the importance of controlling moisture in construction, the market for Vapor Barrier Films is expected to maintain its strong position, driven by both residential and commercial construction projects.

Gas Barrier Films, holding the second-largest share, are essential in preserving the quality and longevity of construction materials. These films are particularly valued for their ability to prevent the permeation of gases and vapors, which can cause significant damage over time. Their application spans various construction needs, from foundational barriers to roofing systems. The segment is expected to witness steady growth, fueled by the ongoing trend of using advanced materials for better building performance.

Solar Films have emerged as a notable segment, driven by the surging interest in energy-efficient buildings. These films are applied to windows and other surfaces to reduce heat gain and UV radiation, contributing to lower energy costs and improved occupant comfort. As more builders and homeowners recognize the benefits of energy-efficient and comfortable indoor environments, the demand for Solar Films is anticipated to rise substantially.

Window Films are also gaining traction, particularly in retrofit projects where enhancing the energy efficiency and UV protection of existing structures is a priority. These films offer the dual benefits of energy savings and improved aesthetic appeal, making them a popular choice among both commercial and residential users. With the increasing renovation activities and the growing emphasis on energy-efficient living spaces, the market for Window Films is poised for significant expansion.

Other Product Types, including a variety of specialized films designed for specific applications, contribute to the diversity and dynamism of the Construction Films Market. These products cater to niche but vital needs in the construction sector, ranging from decorative films to those providing enhanced safety features. As the construction industry continues to evolve and incorporate innovative materials, this segment is expected to offer new opportunities and contribute to the overall growth of the market.

Resin Type Analysis

In 2023, Polyolefin Films held a dominant market position, capturing more than a significant 33.6% share. Their widespread use is primarily due to their durability, versatility, and cost-effectiveness, making them ideal for a variety of construction applications, from vapor barriers to temporary protection. The continued innovation in Polyolefin Films, aiming for even greater performance and environmental sustainability, is likely to keep this segment at the forefront.

Nylon Films are also a key segment, appreciated for their excellent strength, puncture resistance, and barrier properties. They are increasingly used in construction applications requiring long-term durability and protection. With a focus on robust and resilient building materials, the demand for Nylon Films is expected to remain strong.

Polyester Films are favored for their high tensile strength and dimensional stability. They are commonly used in applications where rigidity and resistance to various environmental factors are crucial. As the construction industry continues to demand materials that contribute to longer-lasting structures, the market for Polyester Films is poised for growth.

Ethylene Vinyl Alcohol Films are noted for their exceptional barrier properties against gases and liquids. They are typically used in applications that require a high level of protection from moisture and air, contributing to the longevity and integrity of buildings. Their market share is anticipated to increase as the construction sector seeks more advanced moisture barrier solutions.

Fluoropolymer Films, known for their high resistance to chemicals and temperature, are sought after in demanding construction environments. Their ability to withstand harsh conditions makes them suitable for protective coatings and insulation applications. The market for these films is expected to grow as the need for more durable and long-lasting construction materials rises.

Polyvinyl Butyral Films are widely used for safety and security applications, particularly in laminated glass. Their impact resistance and ability to hold glass shards upon breakage make them a critical component in safety-oriented construction designs. As safety standards in construction become more stringent, the demand for these films is likely to increase.

Polyvinylidene Chloride Films offer excellent oxygen and water vapor barrier properties, making them suitable for a range of applications where preservation and protection are paramount. As the construction industry focuses on enhancing building envelopes and energy efficiency, the role of these films is set to expand.

Polyimide Films are known for their high-temperature resistance and electrical insulation properties. They are often used in specialized construction scenarios that require materials capable of withstanding extreme conditions. The niche but vital applications of Polyimide Films are expected to contribute to their steady market presence.

Polyvinyl Chloride Films are versatile and cost-effective, used in a wide array of construction applications. Their flexibility and adaptability make them a popular choice for many builders. Despite environmental concerns, ongoing improvements in production and recycling processes are likely to sustain the market for these films.

Bio-based Polymer Films represent an emerging segment, driven by the growing demand for sustainable and eco-friendly construction materials. As the industry shifts towards green building practices, the market for these films is expected to witness significant growth.

Other Resin Types encompass a variety of specialized films designed to meet specific construction needs. These include films with unique properties such as enhanced ultraviolet protection, fire resistance, or acoustic insulation. As the construction industry continues to innovate and adopt advanced materials, this segment is poised to offer a wealth of opportunities.

End Use Analysis

In 2023, the Residential sector held a dominant market position in the Construction Films Market, capturing more than a significant share. This is largely attributed to the rising global demand for housing and the increasing focus on energy-efficient and sustainable homes. Construction films are extensively used in residential buildings for moisture control, insulation, and as vapor barriers, contributing to more durable and energy-efficient living spaces. As homeowners continue to invest in improving their homes’ longevity and comfort, the demand in this segment is expected to remain robust.

The Commercial segment, encompassing offices, retail spaces, and other business facilities, also represents a substantial portion of the market. These environments require high-performance films for a variety of applications, including window films for energy savings and safety films for protection. The ongoing development and renovation of commercial infrastructure, coupled with the growing emphasis on green building practices, are driving the demand for advanced construction films in this sector.

Industrial end-use of construction films is crucial for warehouses, manufacturing plants, and other industrial facilities. These settings demand durable and specialized films for protection against harsh conditions and to ensure safety and compliance with industrial standards. As industrial activities expand and the focus on maintaining safe, efficient, and sustainable operations intensifies, the need for high-quality construction films in this sector is expected to grow.

Distribution Channel Analysis

In 2023, Direct distribution channels held a dominant market position in the Construction Films Market, capturing more than a significant share. This dominance is largely due to the preference for streamlined supply chains and closer relationships between manufacturers and end-users. Direct distribution allows for better control over quality, more personalized customer service, and often, quicker response times to market demands. As manufacturers continue to prioritize efficient, reliable delivery and customer relationships, the direct channel’s prominence is expected to be maintained.

Third-Party distribution, while holding a smaller portion of the market, plays a crucial role in reaching diverse markets and customers. These intermediaries, including distributors and retailers, provide valuable services such as broader market access, localized support, and additional value-added services. For manufacturers, third-party channels can reduce the complexity of managing widespread distribution networks, especially in geographically dispersed markets. As the construction industry continues to globalize and the demand for construction films diversifies, the role of third-party distributors is likely to grow.

Кеу Маrkеt Ѕеgmеntѕ

By Product Type

- Gas Barrier Films

- Vapor Barrier Films

- Solar Films

- Window Films

- Others Product Type

By Resin Type

- Polyolefin Films

- Nylon Films

- Polyester Films

- Ethylene Vinyl Alcohol Films

- Fluoropolymer Films

- Polyvinyl Butyral Films

- Polyvinylidene Chloride Films

- Polyimide Films

- Polyvinyl Chloride Films

- Bio-based Polymer Films

- Others Resin Type

By Application

- Flooring

- Walls & Ceilings

- Windows

- Doors

- Roofing

- Building & Enveloping

- Electrical

- HVAC

- Plumbing

- Others Application

By Function

- Bonding

- Protection

- Insulation

- Glazing

- Soundproofing

- Cable Management

By End Use

- Residential

- Commercial

- Industrial

By Distribution Channel

- Direct

- Third-Party

Drivers

- Energy Efficiency and Environmental Concerns: The rise in importance of energy consumption is a vital factor driving the global Construction Films Market. With buildings consuming a significant amount of energy and adding extra CO2 to the atmosphere, there’s an increasing demand for energy-efficient buildings. This demand is further fueled by stringent government regulations for green and energy-efficient buildings. For instance, construction films used in window tinting activities help reduce energy consumption, thereby driving market growth.

- Construction Industry Growth in Developing Countries: According to a study by ICIS, the global construction industry is expected to grow rapidly by 2030, with major contributions from the US, China, and India. The Asia Pacific region, in particular, is leading due to the growth of residential, commercial, and industrial projects in countries like China and India. The ASEAN countries are also expected to witness phenomenal growth, further boosting the demand for construction films.

- Widespread Applications: Construction films are used below concrete floors as water barriers and in roofing applications for resistance against water and frost. Their easy application and maintenance-free solution contribute significantly to their rising demand.

Restraints

- Lack of Universal Directives: The dearth of universal directives pertaining to the applications of construction films makes compliance challenging. Companies find it difficult to meet country-wise directives and legislations, which can discourage investment and adversely affect the market.

- Awareness and Adoption Issues: Despite their benefits, there’s a lack of awareness and less adoption of construction films in many developed and underdeveloped countries, projected to restrain the market during the forecast period.

Opportunities

- Increase in Use of Recycled Products: The recycling of plastic wastes offers a huge potential for film producers. For example, China, which imports most of the global plastic wastes, presents an alluring opportunity for converting recycled plastics into construction films, considering the growing demand in the APAC region.

- Rapid Urbanization and Disposable Income: Fast urbanization in emerging economies and the rise of the middle class with increasing disposable income are driving the global construction industry and, consequently, the market for construction films.

Challenges

- Environmental and Health Concerns: The rising awareness regarding the health hazards and environmental issues caused by plastics has impacted the construction films market in recent years. Consumers are opting for alternative films that are less likely to harm the environment. Additionally, the implementation of stringent laws on the use of plastics across the world is likely to impact market growth over the forecast period.

- Recycling Challenges: Most plastic products, including films, are not designed for recycling, posing significant challenges in their disposal and reuse. The industry faces issues with storage, segregating plastics for recycling, and lack of incentives for manufacturers to promote the use of recycled plastics.

Trends

- LDPE & LLDPE Dominance: According to market analysis, LDPE & LLDPE segments accounted for the largest market share, in terms of value and volume. These films are widely used in construction for various purposes, including concrete structure masking and foundation lining.

- Residential Sector’s Predominance: The residential sector accounted for the largest share in the global construction films market, driven by increasing investments and government-launched housing projects worldwide.

Regional Analysis

The Asia-Pacific region is dominating the Construction Films Market with a commanding 33% share, valued at USD 3.68 billion in 2023. This region’s growth is propelled by a combination of factors including rapid urbanization, rising disposable income, and supportive government initiatives. China and India are particularly notable, with their construction industries booming due to increased infrastructure investments and a growing demand for housing. For instance, the International Trade Administration estimates that China’s construction industry reached sales of USD 1.1 trillion in 2021, marking a significant increase from previous years.

Despite the well-established markets in developed countries like Japan and South Korea, these nations are expected to witness slower growth compared to their burgeoning neighbors. However, Japan’s construction industry has seen a recent uptick due to increased spending on restoring civil structures. Similarly, developing countries like Vietnam are on the rise, fueled by government spending on civil works and a thriving local construction sector.

Latin America is set to grow in line with the global GDP, with countries such as Chile, Colombia, and Mexico presenting new opportunities. In contrast, the Middle East & Africa regions are anticipated to experience steady growth as they diversify their economies away from oil and gas, focusing more on construction and corporate infrastructure development.

North America, particularly the southern United States, is expected to drive growth in the Construction Films Market due to an increase in infrastructure and construction projects. Europe’s market is predicted to see modest growth with a slight increase over the mid-term forecast, especially in Central & Eastern Europe, driven by a rise in residential construction activities.

Governments, especially in Asia-Pacific, are encouraging Public-Private Partnership (PPP) programs to bolster infrastructure development, further fueling the demand for construction films. In North America, investments in liquefied natural gas terminals and new power plants are expected to boost the industrial sector, increasing the demand for solar control films, particularly in commercial constructions. Europe continues to innovate, with developments in products like bomb blast protection films and UV protection coatings expected to positively influence the market.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

The global Construction Films market is fragmented. Major players are involved in product development, this industry is highly competitive, and many large and medium-sized businesses dominate it. New entrants have many lucrative opportunities due to the growing product demand in emerging countries. To gain greater market share, market players rely on product differentiation and innovation along with cost-effective pricing.

Маrkеt Кеу Рlауеrѕ

- EP Film Industries Sdn Bhd.

- Climax Synthetic Pvt. Ltd.

- Great Cosmo Industries

- Dow Polyethylene Asia Pacific

- Asia Polymer Corporation

- GECO Industrial Co. Ltd

- Other Key Players

Recent Developments

Acquisitions:

- October 2023: Raven Industries, a major player in protective films, acquired Advanced Film Solutions, a company specializing in window films and decorative films, expanding their product portfolio and market reach.

New Trends:

- November 2023: Growing emphasis on sustainable construction practices fueled the development of bio-based and recyclable construction films. Eco-conscious companies like Saint-Gobain launched new lines of films made from recycled materials.

- December 2023: Smart films with integrated sensors and digital displays emerged as a new trend, enabling real-time monitoring of temperature, humidity, and air quality in buildings. Companies like Eastman Chemical Company are leading the charge in this innovation.

Company News:

- October 2023: Berry Global Group, another major player, announced a significant investment in expanding their production capacity for high-performance construction films in Asia to meet the growing demand in the region.

- November 2023: A startup called NanoTech Films secured funding to develop self-cleaning construction films coated with nanoparticles that repel dirt and dust, reducing maintenance costs for buildings.

- December 2023: Researchers at MIT unveiled a prototype of a construction film that can generate solar energy, potentially revolutionizing green building technology.

Report Scope

Report Features Description Market Value (2023) USD 11 Billion Forecast Revenue (2033) USD 17 Billion CAGR (2023-2032) 4.1% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Gas Barrier Films, Vapor Barrier Films, Solar Films, Window Films and Others Product Type) By Resin Type (Polyolefin Films, Nylon Films, Polyester Films, Ethylene Vinyl Alcohol Films, Fluoropolymer Films, Polyvinyl Butyral Films, Polyvinylidene Chloride Films, Polyimide Films, Polyvinyl Chloride Films, Bio-based Polymer Films and Others Resin Type) By Application (Flooring, Walls & Ceilings, Windows, Doors, Roofing, Building & Enveloping, Electrical, HVAC, Plumbing and Others Application) By Function (Bonding, Protection, Insulation, Glazing, Soundproofing and Cable Management) By End Use (Residential, Commercial and Industrial) By Distribution Channel (Direct and Third-Party) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Intenze Products Austria GmbH, Eternal Tattoo Supply, Kuro Sumi, Dynamic Tattoo Ink, Bloodline Tattoo Ink, StarBrite Colors Tattoo Ink, Fantasia Tattoo Inks, Panthera Black Tattoo Ink, Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

Q: What is the size of the construction films market in 2023?A: The Construction Films market size is estimated to be USD 11 Billion in 2023

Q: What is the projected CAGR at which the Construction Films market is expected to grow at?A: The Construction Films market is expected to grow at a CAGR of 4.1% (2024-2033).

Q: List the key industry players of the Construction Films Market?A: EP Film Industries Sdn Bhd., Climax Synthetic Pvt. Ltd., Great Cosmo Industries, Dow Polyethylene Asia Pacific, Asia Polymer Corporation, GECO Industrial Co. Ltd, and Other Key Players engaged in the Construction Films market.

-

-

- EP Film Industries Sdn Bhd.

- Climax Synthetic Pvt. Ltd.

- Great Cosmo Industries

- Dow Polyethylene Asia Pacific

- Asia Polymer Corporation

- GECO Industrial Co. Ltd

- Other Key Players