Global Fuel Dispenser Market Size, Share, And Business Benefits By Fuel Type (Petroleum Fuels, Compressed Fuels, Biofuels, Others), By Dispenser System (Submersible System, Suction System), By Flow Meter (Mechanical, Electronic), By Distribution Channel (Aftermarket, OEMs), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: February 2025

- Report ID: 141244

- Number of Pages: 246

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

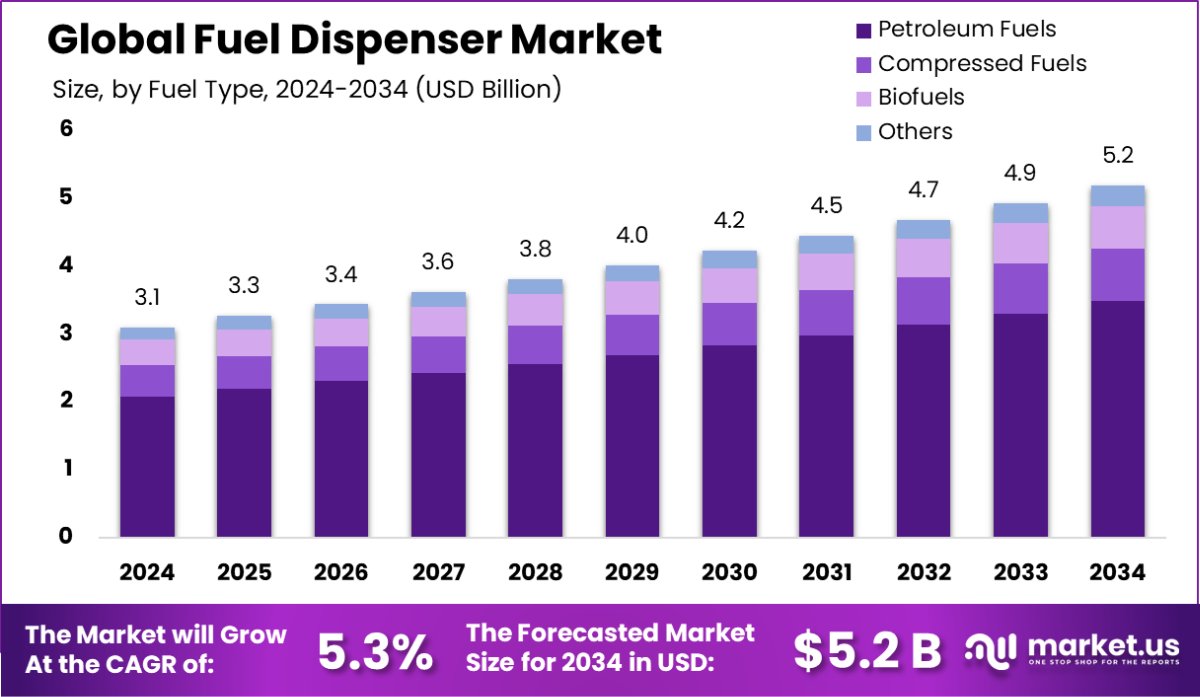

Global Fuel Dispenser Market is expected to be worth around USD 5.2 billion by 2034, up from USD 3.1 billion in 2024, and grow at a CAGR of 5.3% from 2025 to 2034. The growing infrastructure development in Asia-Pacific is driving the 46.9% share of the global fuel dispenser market.

A fuel dispenser is a device used at gas stations to pump fuel into vehicles. It consists of a pump, meter, nozzle, and display to measure and dispense various types of fuel, such as gasoline, diesel, or alternative fuels like compressed natural gas (CNG). Fuel dispensers are equipped with safety mechanisms to prevent overflows and ensure accurate readings of the fuel dispensed.

The fuel dispenser market is growing steadily, driven by increasing demand for fuel, advancements in fuel technology, and the expanding global automotive sector. As countries continue to invest in transportation infrastructure, the demand for efficient, accurate, and safe fuel dispensers rises. Moreover, the shift toward alternative fuels like electric vehicles (EVs) and hydrogen presents both challenges and opportunities for the market, pushing for innovative dispenser technologies.

One key growth factor is the increasing focus on automation and digital integration. As fuel stations seek to reduce operational costs and improve customer experience, smart dispensers with features like cashless payments, real-time monitoring, and connectivity are becoming more popular.

The demand for fuel dispensers is also influenced by rising vehicle ownership, particularly in emerging markets, where infrastructure is expanding rapidly. This growth is further fueled by the growing need for energy-efficient, eco-friendly fuel solutions.

An opportunity lies in the shift towards greener and cleaner fuels, which encourages the development of dispensers compatible with biofuels, hydrogen, and electric vehicle charging stations, creating a diversified market segment with high growth potential.

In 2022, the United States consumed an average of 8.78 million barrels per day of finished motor gasoline, making it the most-consumed petroleum product in the country. As the world’s largest oil consumer, the U.S. used 19,687,287 barrels per day, accounting for 20.3% of global oil consumption.

India’s petroleum demand is expected to increase by 4-6% in petrol and diesel sales for 2023-24, further driving the need for fuel dispensers. China, ranking second in global oil consumption with 12,791,553 barrels per day (13.2% global share), also contributes to the rising demand for advanced fuel dispensing technologies.

Key Takeaways

- Global Fuel Dispenser Market is expected to be worth around USD 5.2 billion by 2034, up from USD 3.1 billion in 2024, and grow at a CAGR of 5.3% from 2025 to 2034.

- The fuel dispenser market is dominated by petroleum fuels, accounting for 67.4% of global demand.

- Submersible dispenser systems lead the market, making up 67.3% of the total fuel dispensing systems.

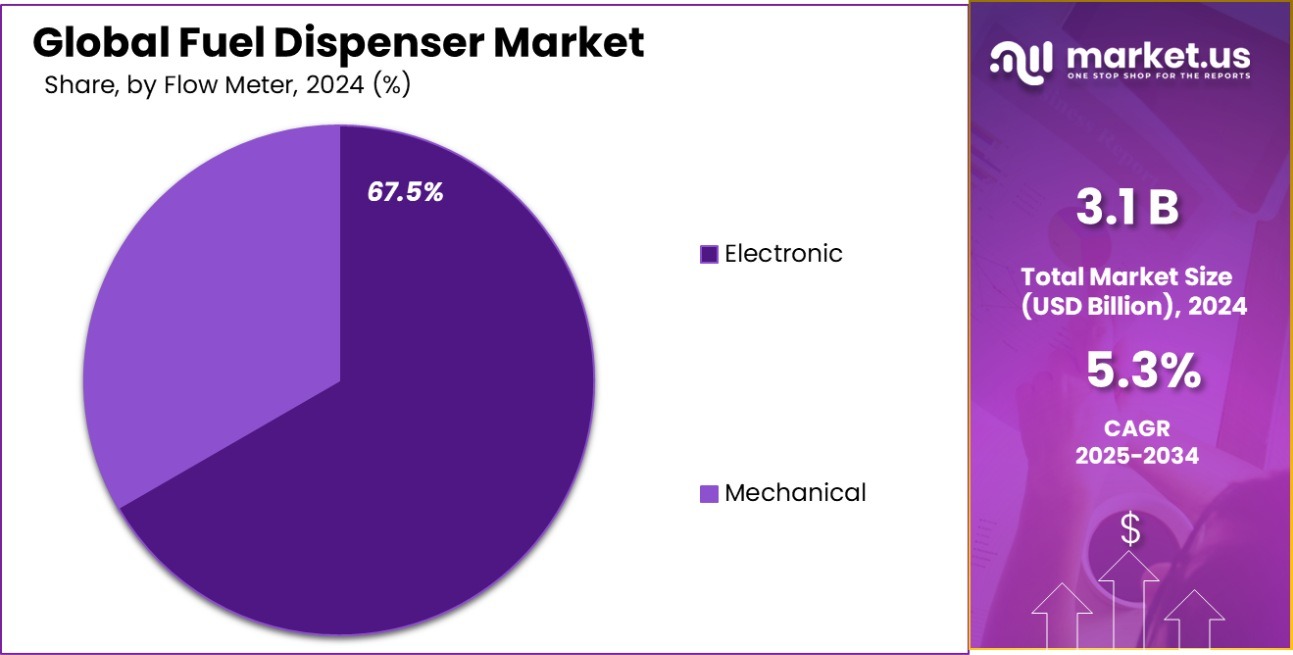

- Electronic flow meters are preferred in fuel dispensers, representing 67.5% of the global market share.

- The aftermarket distribution channel is the largest, holding a 68.4% share of the fuel dispenser market.

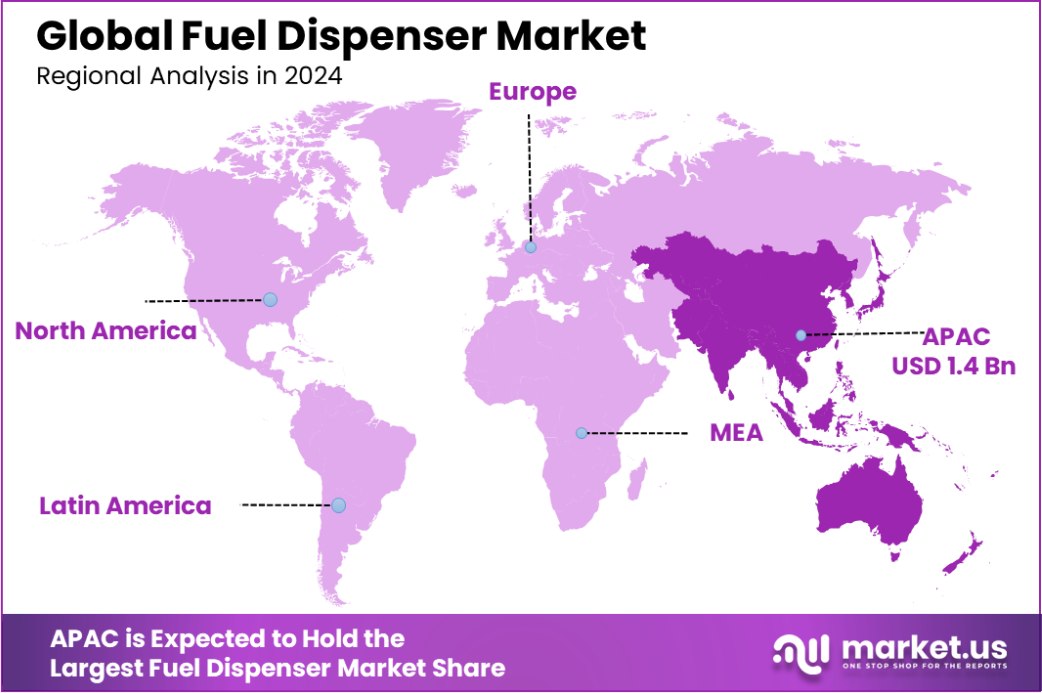

- The Asia-Pacific market generated USD 1.4 billion in revenue, reflecting robust demand for fuel dispensers.

By Fuel Type Analysis

The Fuel Dispenser Market is dominated by petroleum fuels, accounting for 67.4% market share.

In 2024, Petroleum Fuels held a dominant market position in the By Fuel Type segment of the Fuel Dispenser Market, with a 67.4% share. This can be attributed to the continued widespread use of gasoline and diesel fuels globally, driven by the large number of internal combustion engine (ICE) vehicles still in operation.

Despite the growing adoption of electric vehicles (EVs), petroleum-based fuels remain the primary energy source for transportation in many regions, especially in developing economies where EV infrastructure is still in its early stages.

The significant market share is also supported by the well-established infrastructure for petroleum fueling stations, which continues to evolve with the introduction of more efficient and technologically advanced dispensers. Additionally, advancements in fuel dispenser technology, such as improved accuracy, safety features, and digital payment integration, further enhance the appeal of petroleum fuel dispensers.

The ongoing demand for petroleum-based fuels across various industries, including transportation, logistics, and agriculture, continues to drive the growth of this segment. However, the increasing focus on sustainability and the gradual shift toward cleaner fuels and energy sources may impact the growth trajectory of the petroleum fuel dispenser segment in the long term.

By Dispenser System Analysis

Submersible systems hold the largest share of fuel dispenser systems, reaching 67.3%.

In 2024, the Submersible System held a dominant market position in the Dispenser System segment of the Fuel Dispenser Market, with a 67.3% share. This can be attributed to the widespread use of submersible pumps in fuel dispensing stations due to their efficiency and reliability.

Submersible systems are designed to operate underwater, allowing for the pumping of fuel directly from storage tanks to dispensers with minimal risk of leakage or contamination. Their ability to function in various environmental conditions and reduce the need for complex above-ground piping systems makes them particularly popular in both high-volume and remote fueling stations.

The submersible system’s market dominance is also driven by its relatively lower installation and maintenance costs compared to other dispenser systems. Furthermore, the ongoing advancements in pump technology and automation, such as real-time monitoring and integrated fuel management systems, have further enhanced the appeal of submersible systems in fueling infrastructure.

As fuel stations increasingly adopt automation and digital technologies, submersible systems continue to benefit from their ability to integrate seamlessly with these innovations, supporting efficient and streamlined fuel dispensing operations. While alternative systems, such as suction pumps, are gaining traction, the reliability and cost-effectiveness of submersible systems ensure their continued market leadership.

By Flow Meter Analysis

Electronic flow meters are preferred in fuel dispensers, contributing to 67.5% market share.

In 2024, Electronic held a dominant market position in the By Flow Meter segment of the Fuel Dispenser Market, with a 67.5% share. This significant market share is primarily due to the high accuracy and advanced features offered by electronic flow meters, which are essential for ensuring precise fuel measurement and efficient dispensing at fueling stations.

Electronic flow meters are equipped with digital displays and advanced sensors, allowing for real-time monitoring and improved control over the dispensing process, which enhances operational efficiency and minimizes the risk of errors.

The growing adoption of electronic flow meters is driven by increasing demand for automation and digital integration in fueling infrastructure. These meters offer advantages such as automatic calibration, enhanced reliability, and ease of integration with other fueling station systems, such as payment processing and inventory management systems. Furthermore, they provide enhanced customer experience by ensuring accurate readings and reducing wait times.

With stricter regulations on fuel quality and environmental impact, the need for precise fuel measurement has become more critical. Electronic flow meters help meet these regulatory requirements by offering greater accuracy and compliance with industry standards. As fuel stations continue to modernize, electronic flow meters are expected to maintain their dominance, especially in regions with high demand for advanced fueling technologies.

By Distribution Channel Analysis

Aftermarket sales drive growth in the fuel dispenser market, capturing 68.4% of distribution.

In 2024, Aftermarket held a dominant market position in the By Distribution Channel segment of the Fuel Dispenser Market, with a 68.4% share. The strength of the aftermarket segment is attributed to the growing need for replacement parts, upgrades, and maintenance services for existing fuel dispensing systems. Fuel station owners and operators prefer aftermarket products due to their cost-effectiveness and the ability to extend the operational life of their existing equipment.

The continued expansion of fuel station networks, particularly in emerging markets, also drives the aftermarket segment’s dominance. As older fuel dispensers require regular maintenance or upgrades to comply with new regulations or to enhance operational efficiency, aftermarket suppliers play a key role in providing the necessary components and services. Additionally, the increasing complexity of fuel dispensers, with advanced features like digital integration and automated systems, further supports the demand for aftermarket products that ensure optimal performance.

The aftermarket segment benefits from a well-established network of suppliers and service providers who offer a wide range of replacement parts, such as nozzles, pumps, and electronic components. As fuel station operators seek to maintain or enhance the performance of their dispensers without the expense of full replacements, the aftermarket segment is expected to continue holding a leading position in the market.

Key Market Segments

By Fuel Type

- Petroleum Fuels

- Compressed Fuels

- Biofuels

- Others

By Dispenser System

- Submersible System

- Suction System

By Flow Meter

- Mechanical

- Electronic

By Distribution Channel

- Aftermarket

- OEMs

Driving Factors

Growing Fuel Demand Across Emerging Markets

One of the key driving factors for the Fuel Dispenser Market is the growing fuel demand across emerging markets. As economies in regions like Asia-Pacific, Latin America, and parts of Africa continue to develop, vehicle ownership is increasing rapidly. This rise in vehicle numbers leads to greater demand for fuel and, consequently, for fuel dispensers to efficiently service these vehicles.

In these markets, the need for reliable and accurate fuel dispensing systems is critical to support growing transportation infrastructure. Additionally, the adoption of modern fuel dispensers, equipped with digital technologies and automation, is rising to meet consumer expectations for convenience and operational efficiency.

Restraining Factors

High Installation and Maintenance Costs for Dispensers

A major restraining factor for the Fuel Dispenser Market is the high installation and maintenance costs associated with fuel dispensers. The initial capital investment required for setting up modern dispensers, especially those with advanced features like digital payment integration, automated systems, and smart meters, can be significant. Small and medium-sized fuel stations, particularly in emerging markets, may find these costs prohibitive.

Additionally, maintaining and servicing fuel dispensers over time can incur high costs due to the need for regular calibration, spare parts, and technical expertise. These high operational expenses can limit the growth of the market, especially in regions where fuel station operators are looking for cost-effective solutions to manage their infrastructure.

Growth Opportunity

Adoption of Electric Vehicle Charging Stations

A significant growth opportunity for the Fuel Dispenser Market lies in the adoption of electric vehicle (EV) charging stations. As the global automotive industry shifts towards more sustainable transportation solutions, the growing demand for electric vehicles presents an opportunity for fuel dispensers to evolve.

Many fueling stations are expanding their services to include EV charging points, which require new infrastructure and dispenser technologies. Fuel dispensers can integrate electric vehicle charging systems alongside traditional fuel dispensers, allowing fuel stations to cater to both conventional and electric vehicle owners.

This transition is particularly promising in regions with high EV adoption, such as Europe and North America, providing fuel station operators a chance to diversify their offerings and tap into a rapidly growing market.

Latest Trends

Integration of Smart Technology in Fuel Dispensers

One of the latest trends in the Fuel Dispenser Market is the integration of smart technology into fuel dispensers. Modern dispensers are now equipped with features like digital displays, real-time monitoring, automated payment systems, and cloud-based connectivity.

These advancements not only improve the overall user experience but also enhance operational efficiency and fuel management. For example, smart dispensers can track fuel levels, monitor maintenance needs, and even provide data analytics to help fuel stations optimize their operations.

This trend towards automation and digitalization is gaining traction globally, particularly in developed markets where consumers expect faster, more seamless fueling experiences. As this technology becomes more affordable, its adoption is expected to expand, driving future growth in the market.

Regional Analysis

In 2024, the Asia-Pacific region held a significant market share of 46.9% in the Fuel Dispenser Market.

The Fuel Dispenser Market is segmented by region, with significant growth observed across Asia-Pacific, North America, Europe, Middle East & Africa, and Latin America.

Asia-Pacific dominated the global market in 2024, holding a substantial share of 46.9%, with a market value of USD 1.4 billion. This dominance is driven by rapid urbanization, growing vehicle ownership, and expanding fuel infrastructure across key economies such as China, India, and Japan. The increasing demand for both traditional and alternative fuel dispensers, along with government initiatives to upgrade fueling stations, fuels the market’s growth in this region.

In North America, the market is expected to witness steady growth, driven by the ongoing modernization of fuel dispensing systems, particularly in the United States and Canada. North America accounts for a significant portion of the market, with a growing trend toward incorporating smart technology and automation in fuel dispensers, such as integrated payment systems and real-time monitoring.

Europe also holds a substantial market share, supported by strong regulations promoting fuel quality and efficiency. Countries like Germany, France, and the UK are seeing an increasing adoption of advanced dispensers, driven by the need for precise fuel measurement and environmental compliance.

The Middle East & Africa and Latin America represent emerging markets for fuel dispensers, with growth primarily in infrastructure development and fuel station modernization. However, these regions face challenges related to cost constraints and regulatory complexities.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The global Fuel Dispenser Market in 2024 is characterized by a diverse competitive landscape, with key players leading innovation and driving market growth. Beijing Sanki Petroleum Technology Co. Ltd. and Censtar Science & Technology Corp., two of China’s largest fuel dispenser manufacturers, are maintaining strong footholds in the market. Their extensive product portfolios, including high-quality dispensers and efficient fueling solutions, support their market dominance, particularly in the Asia-Pacific region.

Bennett Pump Co. and Dover Fueling Solutions continue to innovate in North America, with a focus on integrated, automated dispensers that offer enhanced user experiences. Gilbarco, known for its advanced fueling equipment and smart technology solutions, remains a leading player in North America and Europe. The company’s ongoing investments in smart dispensers and payment integration technologies contribute to its market leadership.

Jiangsu Furen Group, Korea EnE Co. Ltd., and LanFeng Co., Ltd. represent emerging players that cater to both domestic and international markets, with cost-effective, reliable dispensers aimed at fueling stations in developing regions. Similarly, Lumen Instruments and Piusi S.p.A. are making significant strides in fuel dispensing technology, with a particular emphasis on efficiency and safety features.

The European market also benefits from the presence of Scheidt & Bachmann GmbH, which leads in automation and advanced payment systems, solidifying its presence in high-demand markets. Overall, the global competitive dynamics highlight a trend toward technological advancement, with a shift towards automation, smart features, and connectivity in fuel dispensers across all regions.

Top Key Players in the Market

- Beijing Sanki Petroleum Technology Co. Ltd.

- Bennett Pump Co.

- Censtar Science & Technology Corp., Ltd

- Dover Fueling Solutions

- Gilbarco

- Jiangsu Furen Group

- Korea EnE Co. Ltd

- LanFeng Co., Ltd

- Lumen Instruments

- Neotec

- Piusi S.p.A.

- Sankipetro

- Scheidt & Bachmann GmbH

- Shenzhen Kaisai Electric Motor Co., Ltd.

- SPYRIDIS GROUP

- Tatsuno Corporation

- Tokheim Group S.A.S

- Tominaga Mfg. Co.

- Wayne Fueling Systems LLC

- Zhejiang Datian Machine Co., Ltd

- Zhejiang Lanfeng Machine Co. Ltd.

Recent Developments

- In July 2024, Wayne Fueling Systems introduced a new line of eco-friendly fuel dispensers made with recycled materials, aiming to reduce the environmental impact of gas stations.

- In April 2024, Gilbarco Veeder-Root acquired a small tech startup specializing in cloud-based fuel management software, enhancing its digital offerings for fuel retailers.

Report Scope

Report Features Description Market Value (2024) USD 3.1 Billion Forecast Revenue (2034) USD 5.2 Billion CAGR (2025-2034) 5.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Fuel Type (Petroleum Fuels, Compressed Fuels, Biofuels, Others), By Dispenser System (Submersible System, Suction System), By Flow Meter (Mechanical, Electronic), By Distribution Channel (Aftermarket, OEMs) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Beijing Sanki Petroleum Technology Co. Ltd., Bennett Pump Co., Censtar Science & Technology Corp., Ltd, Dover Fueling Solutions, Gilbarco, Jiangsu Furen Group, Korea EnE Co. Ltd, LanFeng Co., Ltd, Lumen Instruments, Neotec, Piusi S.p.A. , Sankipetro, Scheidt & Bachmann GmbH, Shenzhen Kaisai Electric Motor Co., Ltd., SPYRIDIS GROUP, Tatsuno Corporation , Tokheim Group S.A.S, Tominaga Mfg. Co., Wayne Fueling Systems LLC, Zhejiang Datian Machine Co., Ltd, Zhejiang Lanfeng Machine Co. Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Beijing Sanki Petroleum Technology Co. Ltd.

- Bennett Pump Co.

- Censtar Science & Technology Corp., Ltd

- Dover Fueling Solutions

- Gilbarco

- Jiangsu Furen Group

- Korea EnE Co. Ltd

- LanFeng Co., Ltd

- Lumen Instruments

- Neotec

- Piusi S.p.A.

- Sankipetro

- Scheidt & Bachmann GmbH

- Shenzhen Kaisai Electric Motor Co., Ltd.

- SPYRIDIS GROUP

- Tatsuno Corporation

- Tokheim Group S.A.S

- Tominaga Mfg. Co.

- Wayne Fueling Systems LLC

- Zhejiang Datian Machine Co., Ltd

- Zhejiang Lanfeng Machine Co. Ltd.