Global Lithium Titanate Batteries Market Size, Share, And Business Environment Analysis Report By Component (Electrodes, Electrolytes), By Material (Lithium Titanate, Graphite, Metal Oxides, Others), By Capacity (Below 3,000 mAh, 3,001-10,000 mAh, Above 10,000 mAh), By Voltage (Low, Medium, High), By Application (Consumer Electronics, Automotive, Aerospace, Marine, Medical Industrial, Power, Telecommunication, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: Jan 2025

- Report ID: 137484

- Number of Pages: 264

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

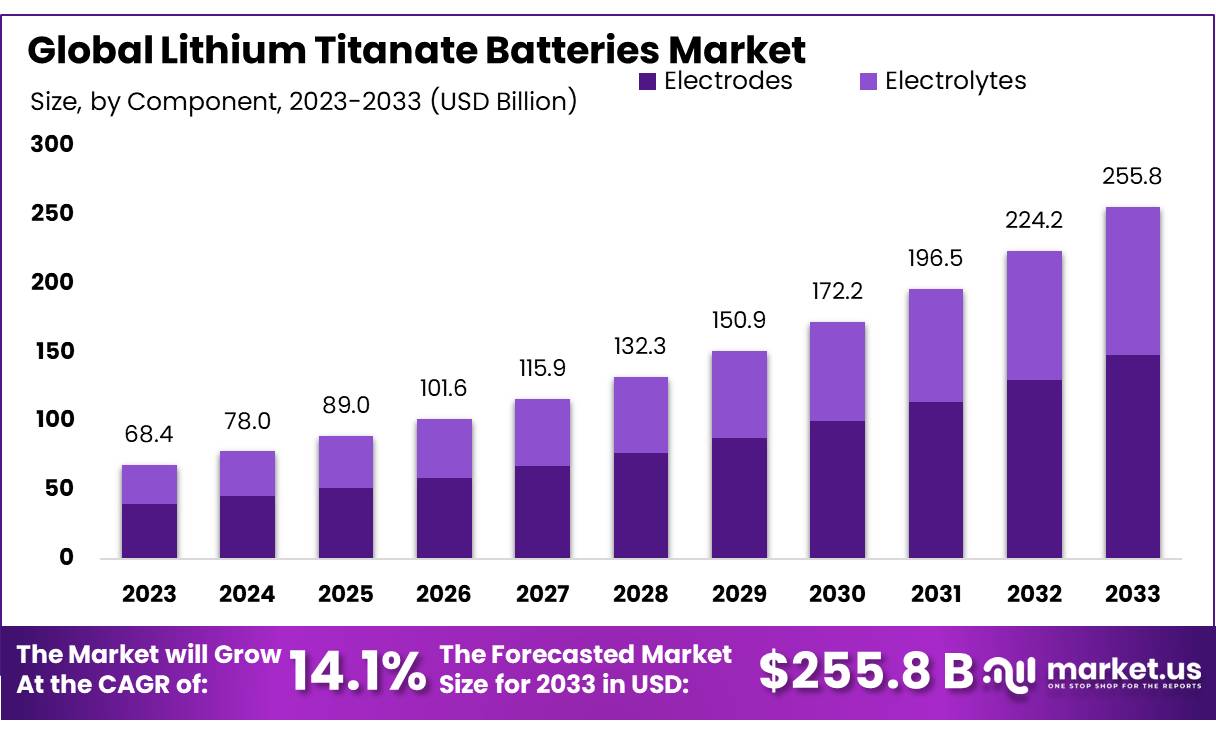

The Global Lithium Titanate Batteries Market size is expected to be worth around USD 255.8 Bn by 2033, from USD 68.4 Bn in 2023, growing at a CAGR of 14.1% during the forecast period from 2024 to 2033.

The Lithium Titanate Batteries (LTO) Market is a vibrant segment within the energy storage industry, characterized by its unique chemistry and superior performance. These batteries employ lithium titanate in the anode, allowing for ultra-fast charging, an extended cycle life exceeding 20,000 charges, and enhanced thermal stability, making them ideal for electric vehicles (EVs), energy storage systems, and industrial applications.

LTO batteries offer notable benefits over traditional lithium-ion batteries, including exceptional durability and inherent safety, which reduce risks of thermal runaway and overheating. This makes them suitable for critical and high-stress environments like public transport systems and stationary energy storage, despite their higher initial costs.

The market growth for LTO batteries is propelled by the global shift towards electric mobility, supported by government incentives and stringent emission standards. Their fast-charging properties are particularly beneficial for electric buses and commercial fleets. Additionally, the shift towards renewable energy sources boosts demand for LTO batteries, ideal for grid stabilization and renewable integration due to their ability to manage rapid charge-discharge cycles effectively.

Current trends include advancements in material science aimed at reducing costs and enhancing performance, and the integration of LTO batteries with other chemistries in hybrid applications. The development of ultra-fast charging stations and smart grid technology also underscores the increasing importance of LTO batteries in modern energy systems.

Looking ahead, the LTO battery market is poised for substantial growth driven by investments in renewable energy, grid modernization, and rising demand from emerging markets in the Asia-Pacific region, especially China and India. Technological improvements and increased production are expected to catalyze significant market expansion in the near future.

Key Takeaways

- Lithium Titanate Batteries Market size is expected to be worth around USD 255.8 Bn by 2033, from USD 68.4 Bn in 2023, growing at a CAGR of 14.1%.

- Electrodes component of the Lithium Titanate Batteries market held a dominant position, capturing more than a 58.2% share.

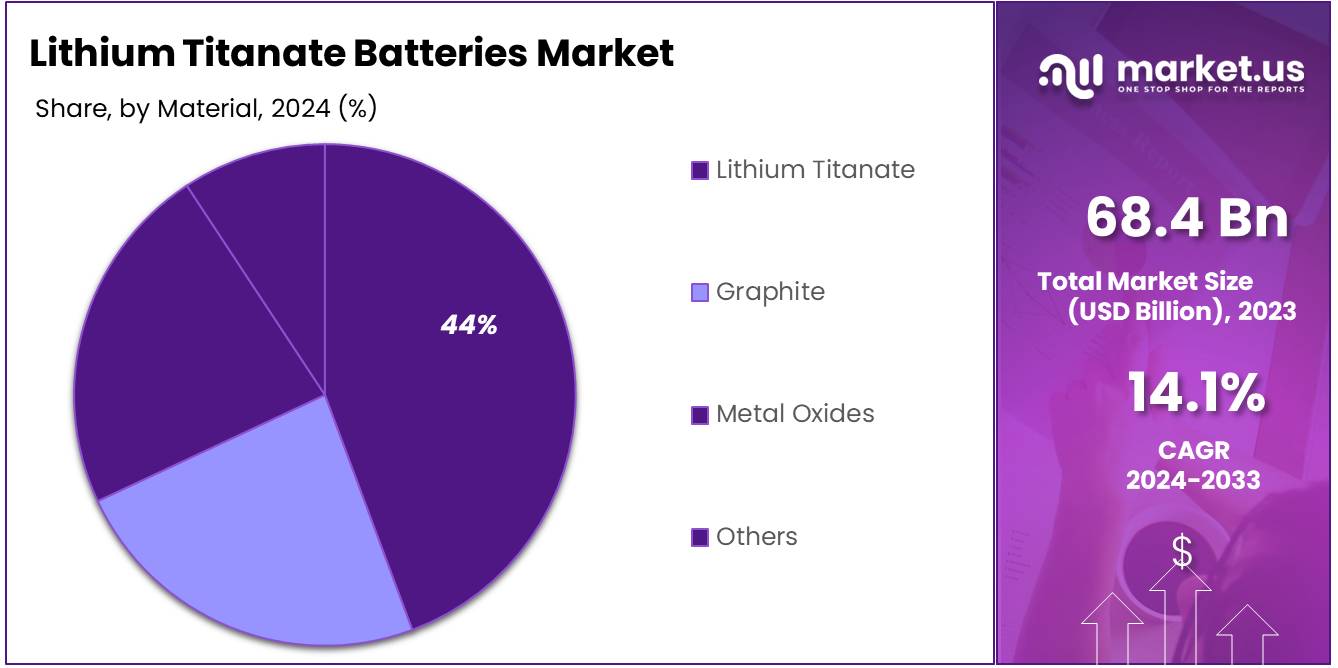

- Lithium Titanate held a dominant market position in the Lithium Titanate Batteries sector, capturing more than a 43.1% share.

- 3,001-10,000 mAh segment of the Lithium Titanate Batteries market held a dominant position, capturing more than a 53.3% share.

- Medium Voltage segment of the Lithium Titanate Batteries market held a dominant position, capturing more than a 52.3% share.

- Automotive sector held a dominant position in the Lithium Titanate Batteries market, capturing more than a 38.4% share.

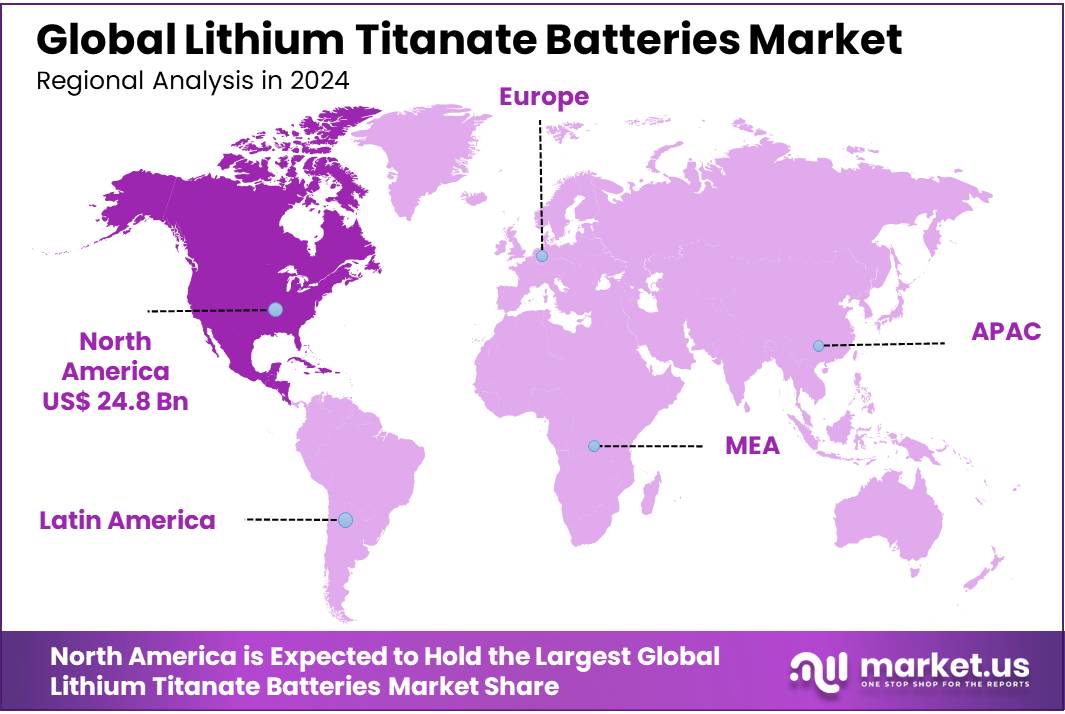

- North America emerged as the dominant region, capturing 36.3% of the global market, with revenues reaching approximately USD 24.8 billion.

Business Environment Analysis

The Lithium Titanate Batteries (LTO) Market is experiencing significant growth, driven by the increasing demand for efficient and durable energy storage solutions across various industries. LTO batteries utilize lithium titanate as the anode material, offering advantages such as rapid charging capabilities, extended cycle life, and enhanced safety features. These attributes make them suitable for applications in electric vehicles (EVs), renewable energy storage systems, and industrial equipment.

One of the standout features of LTO batteries is their exceptional cycle life. They can endure over 20,000 charging cycles, significantly surpassing the 2,000 to 3,000 cycles typical of conventional lithium-ion batteries. This longevity reduces the need for frequent replacements, offering cost savings over time, despite higher initial costs.

The safety profile of LTO batteries is another critical factor contributing to their growing adoption. Unlike other lithium-ion batteries, LTO batteries are less prone to overheating and thermal runaway, making them safer options for various applications. This makes them reliable choices for critical infrastructure and applications requiring high safety standards.

Challenges in the market include the high initial cost of LTO batteries and competition from other advanced battery technologies like lithium iron phosphate (LFP) and nickel manganese cobalt (NMC), which are also improving in terms of performance and cost. Additionally, raw material supply issues, particularly the availability of titanium, which is crucial for LTO battery production, poses a risk to market stability and growth. The price volatility of titanium, influenced by global mining output and trade policies, directly impacts the production cost of LTO batteries.

Future outlooks for the LTO battery market are generally positive, buoyed by technological advancements and increasing applicability in diverse industries. Research into enhancing the energy density and reducing costs continues to progress, which could mitigate some of the current limitations and expand the market reach of LTO batteries. The push towards sustainable and green energy solutions globally ensures ongoing investment and interest in developing safer and more efficient battery technologies.

By Component

In 2023, the Electrodes component of the Lithium Titanate Batteries market held a dominant position, capturing more than a 58.2% share. This significant market share underscores the critical role that electrodes play in the performance and efficiency of these batteries. Electrodes in lithium titanate batteries are key to facilitating rapid charge and discharge cycles, thereby enhancing the longevity and reliability of the batteries. The high conductivity and stability of lithium titanate electrodes contribute to their broad adoption in applications requiring quick energy storage and release, such as electric vehicles and grid storage systems.

The Electrolytes component, while essential, accounted for a smaller share of the market. Electrolytes in lithium titanate batteries are crucial for the movement of lithium ions between the cathode and anode during charging and discharging processes. The development of advanced electrolyte solutions aims to increase the ionic conductivity and reduce the internal resistance, which can significantly improve the overall battery performance. Innovations in electrolyte compositions are continuously being researched to enhance the safety and operational temperature range of lithium titanate batteries, which could increase their applicability in more diverse environments and applications as we move into 2024.

By Material

In 2023, Lithium Titanate held a dominant market position in the Lithium Titanate Batteries sector, capturing more than a 43.1% share. This material is prized for its ability to enhance the safety and lifespan of batteries, making it a cornerstone of the lithium titanate battery market. Its high stability and rapid charging capabilities make it highly suitable for applications in electric vehicles and renewable energy storage systems, where quick charging is crucial.

Graphite, another key material, is widely used as an anode in lithium titanate batteries and also plays a significant role. Its conductivity and ability to withstand numerous charge cycles make it a reliable choice for prolonging battery life and enhancing performance. Metal oxides, used in the cathode side, also contribute significantly to the overall efficiency and capacity of the batteries. These materials help in achieving higher energy densities and are continuously being developed to improve their performance in various battery applications.

By Capacity

In 2023, the 3,001-10,000 mAh segment of the Lithium Titanate Batteries market held a dominant position, capturing more than a 53.3% share. This capacity range is particularly popular in consumer electronics like portable power banks, laptops, and advanced cameras that require a balance between longevity and compact size. The ability of these batteries to provide a substantial amount of energy without the bulkiness of larger batteries makes them a preferred choice in the consumer electronics sector, which demands both portability and durability.

For batteries with a capacity of below 3,000 mAh, their use is common in smaller devices such as wearables and some medical devices. These applications benefit from the battery’s rapid charging capabilities and long cycle life, which are characteristic of lithium titanate technology, making it ideal for gadgets that need frequent charging through daily use.

On the higher end, batteries with a capacity of above 10,000 mAh cater to more demanding applications such as electric vehicles (EVs) and industrial energy storage systems. These applications leverage the high durability and safety profile of lithium titanate batteries, making them suitable for energy-intensive environments where battery stability and longevity are critical. As we look into 2024, advancements in lithium titanate technology may further enhance the performance of these batteries, broadening their application scope across various industries.

By Voltage

In 2023, the Medium Voltage segment of the Lithium Titanate Batteries market held a dominant position, capturing more than a 52.3% share. This voltage range is highly favored in the automotive and industrial sectors where moderate energy density and high safety levels are critical. Medium voltage lithium titanate batteries offer an optimal balance between energy capacity and safety, making them ideal for applications such as commercial electric vehicles and stationary energy storage systems, where reliability and endurance are paramount.

The Low Voltage segment also plays a significant role in the market, particularly in consumer electronics and smaller-scale applications. These batteries are preferred for devices such as personal electronics and backup power supplies that require safe, long-lasting power solutions at lower voltage requirements. Their ability to charge quickly and withstand numerous charging cycles without significant degradation makes them attractive for frequent use in daily life gadgets.

High Voltage lithium titanate batteries are increasingly used in larger energy applications that require robust power outputs, such as grid storage solutions and large electric vehicles. These batteries are capable of delivering high power for extended periods, making them suitable for demanding applications that rely on long-term energy provision and high-performance criteria.

By Application

In 2023, the Automotive sector held a dominant position in the Lithium Titanate Batteries market, capturing more than a 38.4% share. This substantial market share reflects the growing reliance on lithium titanate batteries in electric vehicles (EVs) and hybrid electric vehicles (HEVs) due to their rapid charging capabilities and high cycle life, making them highly suitable for automotive applications. As the automotive industry continues to shift towards more sustainable solutions, the demand for batteries that offer longer life spans and faster charging times is increasing, and lithium titanate batteries are well-positioned to meet these needs.

Consumer Electronics is another significant segment, leveraging lithium titanate batteries in applications such as portable devices and smart electronics. These batteries are prized for their safety and longevity, which are crucial in enhancing user experience and device reliability.

In sectors like Aerospace and Marine, lithium titanate batteries are valued for their robustness and ability to operate under extreme conditions, offering reliable power solutions for critical applications. Similarly, the Medical and Industrial sectors benefit from the batteries’ quick recharge rates and high energy densities, facilitating their use in medical devices and industrial equipment.

Additionally, the Power and Telecommunication sectors utilize lithium titanate batteries for energy storage and backup power solutions to support grid stability and continuous communication services.

Key Market Segments

By Component

- Electrodes

- Electrolytes

By Material

- Lithium Titanate

- Graphite

- Metal Oxides

- Others

By Capacity

- Below 3,000 mAh

- 3,001-10,000 mAh

- Above 10,000 mAh

By Voltage

- Low

- Medium

- High

By Application

- Consumer Electronics

- Automotive

- Aerospace

- Marine

- Medical Industrial

- Power

- Telecommunication

- Others

Drivers

Rapid Growth in Electric Vehicle (EV) Market

A significant driving factor for the growth of the Lithium Titanate Batteries market is the rapid expansion of the electric vehicle (EV) sector. Governments worldwide are implementing various initiatives and policies to promote the adoption of electric vehicles, aiming to reduce carbon emissions and combat climate change. For instance, the European Union has set ambitious targets to decrease greenhouse gas emissions, promoting the shift towards electric mobility with substantial investments and incentives for both manufacturers and consumers.

Lithium titanate batteries are particularly well-suited for use in electric vehicles due to their fast charging capabilities and long cycle life. These batteries can be charged up to 80% capacity in just 10 to 20 minutes, which is a significant advantage over other types of lithium batteries. This feature is crucial for the usability and convenience of electric vehicles, making them more appealing to consumers who are concerned about charging times.

The global electric vehicle market has seen exponential growth, with sales numbers continually breaking records. According to the International Energy Agency (IEA), the global electric car stock surpassed 10 million units in 2020, a 43% increase over the previous year. This trend is expected to continue as more governments set deadlines for phasing out internal combustion engines. For example, the UK government has announced plans to ban the sale of new petrol and diesel cars by 2030, which is expected to boost demand for electric vehicles and, by extension, for advanced battery technologies like lithium titanate.

Moreover, lithium titanate batteries offer high safety levels, which is a critical requirement in the automotive industry. They are less prone to overheating and are more stable at high temperatures compared to other lithium-ion batteries, reducing the risk of fire accidents. This safety feature is particularly important for consumer confidence in electric vehicles.

Restraints

High Cost and Availability of Alternatives

A major restraining factor for the growth of the Lithium Titanate Batteries market is their relatively high cost compared to other lithium-ion battery technologies. Lithium titanate batteries feature advanced technology that offers quick charging times and high cycle durability, which come at a higher production cost. The materials and manufacturing processes involved in producing lithium titanate anodes are more complex and expensive, making these batteries less competitive in terms of price.

Additionally, the availability of alternative technologies, such as lithium iron phosphate (LiFePO4) and traditional lithium-ion batteries with nickel manganese cobalt (NMC) or nickel cobalt aluminum (NCA) cathodes, poses a significant challenge. These alternatives often provide a better balance between cost, energy density, and safety, making them more appealing for a broad range of applications, from consumer electronics to electric vehicles. For example, LiFePO4 batteries are increasingly preferred in electric vehicles and stationary storage applications due to their lower cost and excellent safety profile.

Another aspect contributing to the restraining factor is the energy density of lithium titanate batteries, which is generally lower than that of other lithium-ion batteries. This lower energy density can limit the use of lithium titanate batteries in applications where space and weight are critical factors, such as in electric vehicles and portable electronic devices.

Government initiatives and subsidies in various countries have been more favorable towards other types of energy storage solutions, which further limits the growth potential of lithium titanate batteries. For instance, some regions offer incentives specifically tailored to technologies that meet certain energy density or cost criteria, which can exclude lithium titanate from qualifying for these benefits.

Despite these challenges, the lithium titanate battery market is exploring opportunities to overcome these barriers through technological advancements that could reduce costs and enhance performance. As research continues and production scales up, there is potential for cost reductions that could make lithium titanate batteries more competitive in the global market.

Opportunity

Expansion into Renewable Energy Storage

A significant growth opportunity for Lithium Titanate Batteries lies in the renewable energy storage sector. As the global push towards sustainable energy sources intensifies, the need for reliable and efficient energy storage solutions becomes paramount. Lithium titanate batteries, with their exceptional cycle life and rapid charging capabilities, are well-suited to meet the demands of storing energy from intermittent renewable sources such as solar and wind.

Governments around the world are implementing policies and incentives to promote renewable energy adoption, which directly benefits the energy storage market. For instance, the United States’ federal policies include investment tax credits for energy storage, which make deploying new technologies like lithium titanate batteries more financially viable. These incentives are crucial as they lower the initial investment costs associated with energy storage systems, thereby accelerating their adoption.

The unique attributes of lithium titanate batteries, such as their ability to charge quickly and withstand a high number of charge cycles without significant degradation, make them ideal for applications where frequent charging is required. This is particularly relevant in solar energy systems, where energy availability can fluctuate significantly throughout the day. The ability to quickly store and release energy helps maximize the utilization of generated solar power, enhancing overall system efficiency.

Moreover, the growing trend towards microgrids and decentralized energy systems in remote or underserved regions presents another lucrative avenue for lithium titanate batteries. These systems often rely on a combination of renewable energy sources and require robust storage solutions to ensure consistent energy supply without the need for extensive grid infrastructure.

Trends

Integration with Smart Grid Technology

One of the most significant recent trends in the Lithium Titanate Batteries market is their integration with smart grid technology. As the world increasingly moves towards smarter energy solutions, lithium titanate batteries are being recognized for their rapid charging capabilities and exceptional cycle stability, making them ideal for use in smart grid applications. These batteries are being deployed to enhance grid stability and manage peak load demands more efficiently, especially in areas with high penetration of renewable energy sources.

Governments and energy authorities globally are supporting initiatives to modernize the electrical grid to make it more resilient, efficient, and capable of handling increasing amounts of renewable energy. For instance, the European Commission has heavily invested in smart grid technologies as part of its goal to improve energy efficiency and increase the share of renewables in the energy mix. The U.S. Department of Energy also promotes the adoption of smart grid technologies, including advanced battery systems, through grants and funding opportunities aimed at accelerating innovation and deployment.

Lithium titanate batteries are particularly suited to these applications due to their safety profile and quick response times. They can charge and discharge at high rates, making them excellent for use in applications that require frequent cycling over short periods, such as balancing supply and demand on the grid. This capability is vital for stabilizing the grid when integrating intermittent renewable energy sources like wind and solar, which can fluctuate significantly throughout the day.

Moreover, as the shift towards decentralized energy systems continues, lithium titanate batteries are increasingly used in microgrids and as part of home energy storage systems. These systems allow for more localized control over energy production and consumption, enhancing energy security and reducing transmission losses.

Regional Analysis

In 2023, the Lithium Titanate Batteries market exhibited significant regional diversity in terms of adoption and technological integration. North America emerged as the dominant region, capturing 36.3% of the global market, with revenues reaching approximately USD 24.8 billion. This leadership is largely attributed to the region’s robust automotive sector, aggressive investments in renewable energy storage, and supportive government policies promoting clean energy technologies.

Europe also displayed strong market activity, driven by stringent environmental regulations and high consumer awareness about sustainability. The region’s push towards reducing carbon emissions has significantly fueled the adoption of electric vehicles and, by extension, advanced battery technologies including lithium titanate batteries.

Asia Pacific is another key player, with a rapidly growing electric vehicle market and substantial investments in smart grid technologies. Countries like China, Japan, and South Korea are at the forefront, leveraging their technological expertise and substantial manufacturing capabilities to enhance the development and deployment of lithium titanate batteries.

Meanwhile, the Middle East & Africa and Latin America are relatively smaller markets for lithium titanate batteries. However, these regions are beginning to recognize the potential of energy storage solutions, especially for improving energy access and supporting renewable energy deployments. Efforts to modernize grid infrastructure and increase the resilience of power systems are expected to drive growth in these markets over the coming years.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Lithium Titanate Batteries market is marked by the presence of several influential players, each contributing to the technological advancements and market growth in unique ways. Among them, Toshiba Corporation stands out as a key innovator, known for its substantial investment in research and development to enhance the performance and safety of lithium titanate batteries. Toshiba’s batteries are particularly noted for their high charge-discharge durability, making them suitable for applications such as electric vehicles and industrial energy storage systems.

Another significant player, Altairnano, is renowned for its pioneering work in developing lithium titanate technologies that offer exceptional power handling, longevity, and safety. Their batteries are used in a wide range of applications, from transportation to grid storage, highlighting the versatility of lithium titanate technology. Similarly, Microvast Holdings, Inc., with its focus on ultra-fast charging technologies, has carved out a niche in high-performance sectors, including public transportation and other commercial vehicle markets.

Companies like Clarios and Leclanché SA are also prominent, focusing on integrating lithium titanate battery solutions in renewable energy and automotive applications, respectively. These companies are driving the push towards more sustainable energy solutions, underpinned by the reliability and efficiency of lithium titanate batteries. With ongoing advancements and growing market demand, these key players are set to expand their influence and drive further innovations in the industry, addressing both the energy needs and environmental challenges of the future.

Top Key Players

- AA Portable Power Corp.

- Altairnano

- BTR Nano Technology

- Clarios

- Fullriver

- Gree Altairnano New Energy Inc.

- GRINERGY

- HuaHui New Energy

- Leclanché SA

- LiTech Power Co., Ltd.

- Log9 Materials

- Microvast Holdings, Inc.

- Nichicon Corporation

- PICELL Electronics

- Sichuan Xingneng New Materials

- Siqi Energies

- Titan Kogyo

- Toshiba Corporation

- Vision Group

- XALT Energy

- Zenaji Pty Ltd.

Recent Developments

In 2023, Altairnano’s lithium-titanate battery systems achieved over 16,000 charge and discharge cycles at rates up to 40 times greater than common batteries, retaining up to 80% of their initial charge capacity.

In 2023, BTR Nano Technology reported a 15% increase in production capacity, enabling them to meet the growing demand for LTO batteries in electric vehicles and renewable energy storage applications.

Report Scope

Report Features Description Market Value (2023) USD 68.4 Bn Forecast Revenue (2033) USD 255.8 Bn CAGR (2024-2033) 14.1% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Component (Electrodes, Electrolytes), By Material (Lithium Titanate, Graphite, Metal Oxides, Others), By Capacity (Below 3,000 mAh, 3,001-10,000 mAh, Above 10,000 mAh), By Voltage (Low, Medium, High), By Application (Consumer Electronics, Automotive, Aerospace, Marine, Medical Industrial, Power, Telecommunication, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape AA Portable Power Corp., Altairnano, BTR Nano Technology, Clarios, Fullriver, Gree Altairnano New Energy Inc., GRINERGY, HuaHui New Energy, Leclanché SA, LiTech Power Co., Ltd., Log9 Materials, Microvast Holdings, Inc., Nichicon Corporation, PICELL Electronics, Sichuan Xingneng New Materials, Siqi Energies, Titan Kogyo, Toshiba Corporation, Vision Group, XALT Energy, Zenaji Pty Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Lithium Titanate Batteries MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample

Lithium Titanate Batteries MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- AA Portable Power Corp.

- Altairnano

- BTR Nano Technology

- Clarios

- Fullriver

- Gree Altairnano New Energy Inc.

- GRINERGY

- HuaHui New Energy

- Leclanché SA

- LiTech Power Co., Ltd.

- Log9 Materials

- Microvast Holdings, Inc.

- Nichicon Corporation

- PICELL Electronics

- Sichuan Xingneng New Materials

- Siqi Energies

- Titan Kogyo

- Toshiba Corporation

- Vision Group

- XALT Energy

- Zenaji Pty Ltd.