Global Renewable Energy Market Size, Share, And Business Benefits By Product (Hydropower, Wind Power, Solar Power, Bioenergy, Others), By Deployment (On-Grid, Off-Grid), By Application (Industrial, Residential, Commercial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2025

- Report ID: 137872

- Number of Pages: 204

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

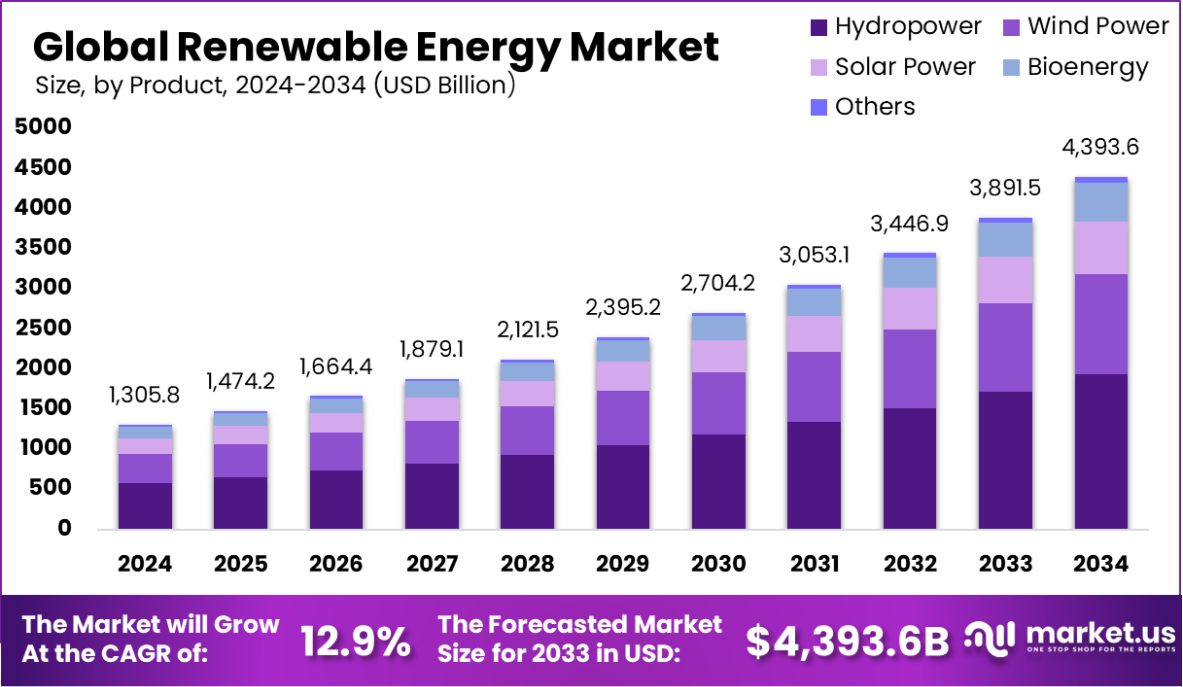

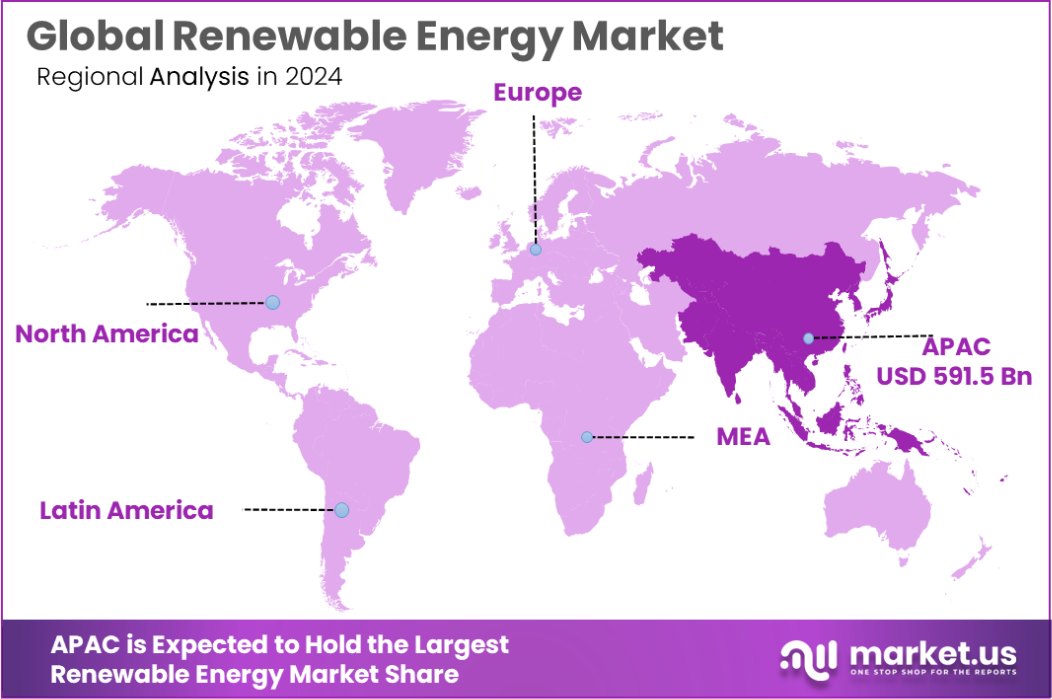

The Global Renewable Energy Market is expected to be worth around USD 4,393.6 Billion by 2034, up from USD 1305.8 Billion in 2024, and grow at a CAGR of 12.9% from 2025 to 2034. Asia-Pacific dominated Renewable Energy Market with 45.2%, USD 591.5 Bn.

Renewable energy refers to energy derived from natural sources that are replenished on a human timescale, such as sunlight, wind, water (hydropower), geothermal heat, and biomass. Unlike fossil fuels, renewable energy sources produce minimal greenhouse gas emissions, making them a sustainable and environmentally friendly alternative for power generation.

The renewable energy market encompasses the production, distribution, and utilization of renewable energy technologies. It includes sectors such as smart solar, wind, hydro, bioenergy, and geothermal. Market growth is driven by factors like government policies, technological advancements, and rising environmental concerns. Increasing investments and global energy transition initiatives further accelerate its expansion.

The renewable energy sector has experienced remarkable growth, driven by technological advancements, supportive policies, and increasing environmental awareness. As of 2024, global renewable energy capacity reached approximately 3,000 gigawatts (GW), with Asia contributing significantly by adding a record 450 GW of new capacity in 2024.

In India, the renewable energy landscape has seen substantial development. The country’s total renewable energy capacity surpassed 200 GW in November 2024, accounting for more than 46.3% of the total installed power capacity. This progress is supported by significant financial commitments, with $386 billion pledged to expand renewable capacity as of September 2024.

Several factors are propelling the expansion of renewable energy. Technological innovations have led to cost reductions, making renewables more competitive with traditional energy sources.

Government policies and international agreements aimed at reducing carbon emissions have further accelerated adoption. Additionally, growing environmental consciousness among consumers and businesses has increased the demand for clean energy solutions.

Current trends indicate a shift towards diversified renewable energy portfolios. Solar and wind energy continue to dominate new installations, with India expecting to add a record 35 GW of solar and wind capacity by March 2025. Furthermore, there is a notable increase in investments in energy storage solutions and grid infrastructure to enhance the reliability and integration of renewable sources.

Looking ahead, the renewable energy market presents significant growth opportunities. The International Energy Agency (IEA) projects that renewables will account for over 90% of global electricity capacity expansion over the period 2022-2027, with an expected addition of almost 2,400 GW. In India, the government aims to achieve 500 GW of renewable energy capacity by 2030, necessitating an annual increase of approximately 30% in clean capacity additions.

Key Takeaways

- The Global Renewable Energy Market is expected to be worth around USD 4,393.6 Billion by 2034, up from USD 1305.8 Billion in 2024, and grow at a CAGR of 12.9% from 2025 to 2034.

- Hydropower dominates the renewable energy market, accounting for 44.3% share globally.

- On-grid renewable energy solutions lead, comprising 88.3% of total installations.

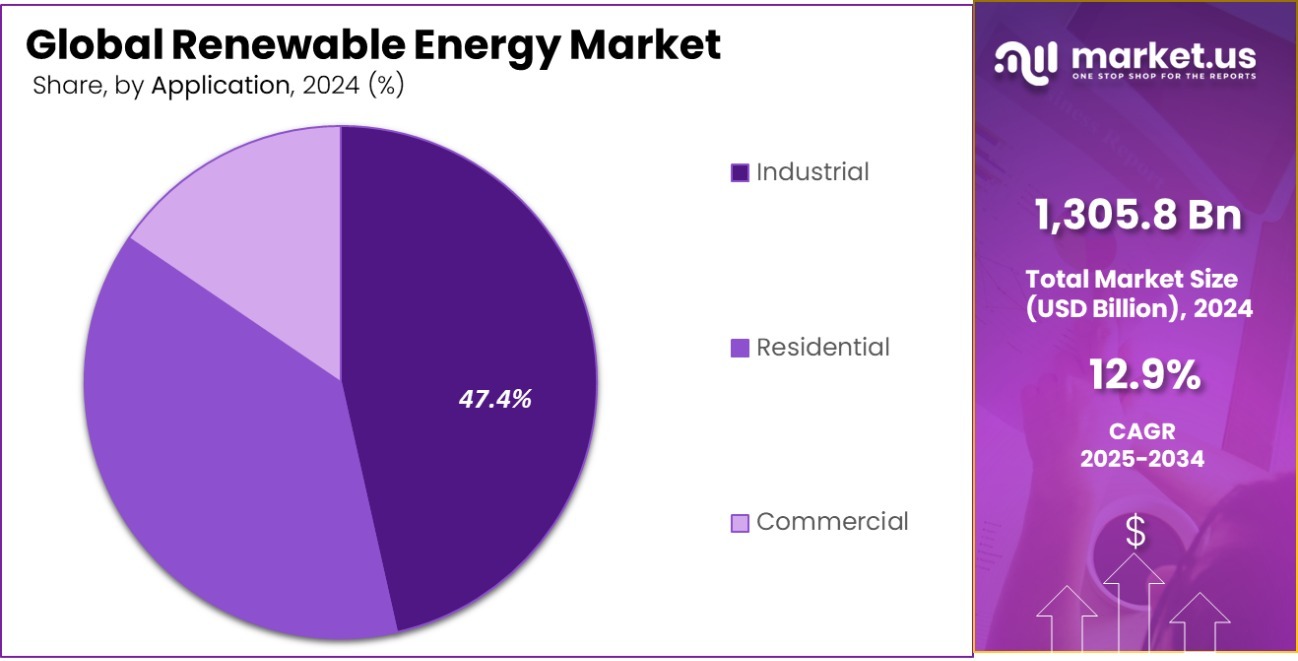

- The industrial sector drives renewable adoption, contributing 47.4% of market demand worldwide.

- In 2024, Asia-Pacific dominated the Renewable Energy Market with 45.2%, generating USD 591.5 billion.

Business Benefits of Renewable Energy Market

Investing in renewable energy offers substantial business advantages, including cost savings, job creation, and environmental benefits. In India, the installed renewable energy capacity (including large hydro) increased from 76.37 GW in March 2014 to 150.54 GW in November 2021, representing an increase of around 97%.

This expansion has been supported by government initiatives such as the Production Linked Incentive (PLI) Scheme for High-Efficiency Solar PV Modules, aiming to achieve domestic manufacturing capacity on a gigawatt scale.

The renewable energy sector also contributes significantly to employment. In 2023, India’s renewable energy sector employed approximately 1.02 million people, with hydropower and solar photovoltaic being the largest contributors

Additionally, the UK government has committed to investing heavily in renewable energy sources, with a goal of 40 GW of offshore wind by 2030, as part of efforts to achieve net zero emissions by 2050.

These developments indicate that businesses engaging in the renewable energy market can benefit from government support, and cost savings, and contribute to environmental sustainability.

By Product Analysis

Hydropower dominates the renewable energy market, accounting for 44.3% share due to its reliable electricity generation.

In 2024, Hydropower accounted for 44.3% of the Renewable Energy Market in the by-product segment, driven by its cost-effectiveness and reliability in energy generation. The segment benefited from investments in large-scale hydroelectric projects and refurbishment of aging dams, providing a steady output. Hydropower remains a preferred choice for nations focusing on sustainable energy expansion.

Wind Power held a 28.7% share in the Renewable Energy Market By Product segment, supported by advancements in offshore wind technology and declining turbine costs. Increasing adoption in coastal and high-wind regions strengthened its position. Government incentives and grid modernization initiatives further enhanced the segment’s growth and operational efficiency.

Solar Power represented 21.6% of the Renewable Energy Market By Product segment, reflecting the growing adoption of photovoltaic systems. Expanding rooftop installations and utility-scale solar farms contributed to market dominance. Enhanced efficiency in solar panel technology and supportive regulatory policies encouraged both residential and commercial deployment worldwide.

Bioenergy contributed 5.4% to the Renewable Energy Market By Product segment, attributed to the rising utilization of biomass and waste-to-energy solutions. The adoption of bioenergy in rural and industrial areas supported market growth. Advancements in biogas production and liquid biofuels enabled efficient energy recovery from organic materials, reducing dependency on fossil fuels.

By Deployment Analysis

On-grid renewable energy systems lead with an 88.3% share, ensuring stable power distribution across various regions.

In 2024, On-Grid accounted for 88.3% of the Renewable Energy Market in the By Deployment segment, driven by extensive grid infrastructure and widespread adoption in urban areas. This deployment method benefits from lower installation costs and seamless energy distribution, making it an attractive option for large-scale renewable energy projects connected to national grids.

Off-grid contributed 11.7% to the Renewable Energy Market in the By Deployment segment, supported by increased adoption in remote and rural areas. This approach provided localized energy solutions, enhancing energy access in underserved regions. Off-grid deployment gained traction with advancements in battery storage systems and modular renewable energy setups.

By Application Analysis

The industrial sector utilizes 47.4% of renewable energy, driven by sustainability goals and cost-effective solutions.

In 2024, Industrial accounted for 47.4% of the Renewable Energy Market in the By Application segment, driven by large-scale energy requirements and adoption of renewable solutions in manufacturing and processing industries. Investments in clean energy infrastructure for industrial operations and stringent sustainability regulations enhanced its role in reducing carbon emissions.

Residential contributed 31.8% to the Renewable Energy Market in the By Application segment, reflecting growing installations of solar panels and small-scale wind systems. The adoption of renewable technologies for household energy needs increased with declining costs and incentives, providing homeowners with sustainable and cost-effective energy solutions.

Commercial represented 20.8% of the Renewable Energy Market in the By Application segment, supported by energy-efficient practices in office buildings, retail spaces, and hospitality sectors. Businesses increasingly adopted renewable energy to lower operational costs and meet sustainability goals, enhancing the market’s growth in this segment.

Key Market Segments

By Product

- Hydropower

- Wind Power

- Solar Power

- Bioenergy

- Others

By Deployment

- On-Grid

- Off-Grid

By Application

- Industrial

- Residential

- Commercial

Driving Factors

Government Policies and Incentives Boosting Renewable Energy Growth

Governments worldwide are actively supporting renewable energy through policies, subsidies, and tax benefits. Many countries have set clean energy targets, pushing industries to shift towards sustainable power sources. Financial incentives like feed-in tariffs, production tax credits, and investment grants make renewable projects more attractive.

Stricter environmental regulations are also encouraging businesses to reduce reliance on fossil fuels. Public funding and green bonds are further accelerating clean energy adoption. These efforts are making renewable energy a preferred choice for both businesses and consumers.

Technological Advancements Enhancing Efficiency and Cost Reduction

Innovations in solar panels, wind turbines, and battery storage are making renewable energy more efficient and affordable. Improved photovoltaic cells are increasing solar power generation, while larger and smarter wind turbines enhance energy output. Battery storage advancements help in managing supply fluctuations, ensuring steady energy availability.

Automation and AI-driven monitoring systems optimize operations, reducing maintenance costs. These breakthroughs are lowering overall project expenses, making renewable sources competitive with conventional power. As technology evolves, renewable energy solutions are becoming more reliable and widely accessible.

Growing Environmental Awareness Driving Clean Energy Adoption

Rising concerns about climate change and pollution are pushing businesses and consumers towards renewable energy. Industries are setting sustainability goals to reduce carbon footprints, while consumers prefer green energy options. Investors are prioritizing companies with strong environmental policies, influencing corporate energy choices.

Schools, universities, and organizations are also adopting clean energy initiatives. Awareness campaigns and educational programs highlight the benefits of renewables, encouraging a shift from traditional energy sources. This collective effort is playing a crucial role in increasing renewable energy adoption across sectors.

Restraining Factors

High Initial Investment Slowing Renewable Energy Expansion

Setting up renewable energy projects requires substantial upfront costs, which can be a challenge for many businesses and governments. Solar farms, wind turbines, and battery storage systems need large capital investments before they start generating returns.

Financing options like loans and grants help, but many small companies find it difficult to secure funding. Infrastructure development, including grid connections and land acquisition, adds to overall costs. Although operational expenses are lower than fossil fuels, the initial financial burden discourages rapid adoption, especially in regions with limited economic resources.

Intermittent Energy Supply Creating Reliability Challenges

Renewable energy sources like solar and wind depend on natural conditions, making energy generation inconsistent. Solar panels produce electricity only when sunlight is available, while wind turbines need suitable wind speeds to operate efficiently. This variability creates supply challenges, especially during peak demand hours.

Energy storage solutions like batteries can help, but they add extra costs. Grid integration requires better planning to balance supply and demand effectively. Without reliable backup systems, dependence on renewables alone remains difficult for industries and households requiring a steady power supply.

Limited Infrastructure Slowing Clean Energy Integration

Many regions lack the necessary infrastructure to support large-scale renewable energy projects. Power grids in some areas are outdated and unable to handle variable energy inputs from sources like solar and wind. Expanding transmission lines and upgrading existing networks require time and investment. Remote locations with strong renewable potential often face difficulties connecting to national grids.

Without proper infrastructure, energy storage and distribution remain a challenge. Governments and private investors need to focus on improving grid capabilities to ensure the smooth integration of renewable energy into mainstream power systems.

Growth Opportunity

Expanding Energy Storage Solutions Supporting Renewable Integration

Advancements in battery technology are creating new opportunities for renewable energy growth. Efficient energy storage systems help address supply fluctuations by storing excess energy and releasing it when needed. Lithium-ion, solid-state, and flow batteries are improving in capacity and cost-effectiveness, making renewable energy more reliable.

Governments and private companies are investing in large-scale storage projects to enhance grid stability. These developments are encouraging industries and households to adopt clean energy without concerns about intermittent supply, paving the way for greater renewable energy usage in diverse applications.

Rising Corporate Investments Accelerating Renewable Energy Projects

Businesses across various sectors are increasingly investing in renewable energy to meet sustainability goals and reduce long-term energy costs. Large corporations are signing power purchase agreements (PPAs) with renewable energy providers, ensuring a stable energy supply. Tech companies, manufacturers, and retail giants are committing to clean energy initiatives to enhance their environmental credentials.

Financial institutions are offering green loans and investment funds to support these projects. As more businesses recognize the financial and environmental benefits of renewables, corporate investments will continue driving market expansion and technological advancements.

Government Support Encouraging Decentralized Renewable Energy Systems

Governments are promoting decentralized renewable energy solutions to improve energy access and reduce reliance on traditional power grids. Small-scale solar installations, community wind farms, and microgrids are gaining popularity in urban and rural areas. These systems provide energy independence and resilience, especially in regions with unreliable grid infrastructure.

Incentives like tax benefits, grants, and reduced regulatory barriers are encouraging businesses and households to adopt decentralized energy models. This shift is opening new opportunities for renewable energy providers, fostering local economic growth, and enhancing energy security for various communities.

Latest Trends

Growing Adoption of Hybrid Renewable Energy Systems

Hybrid energy systems combining solar, wind, and battery storage are becoming more popular as they improve efficiency and reliability. These systems ensure a steady power supply by balancing energy generation from different sources.

For example, when solar power is low, wind energy can compensate, and battery storage can supply electricity when both are insufficient. Businesses and governments are investing in hybrid solutions to enhance energy security and reduce dependency on fossil fuels. This trend is driving advancements in smart grids and energy management systems for better optimization.

Increasing Use of Artificial Intelligence in Energy Management

Artificial Intelligence (AI) is playing a crucial role in optimizing renewable energy operations. AI-powered systems analyze weather patterns, energy demand, and equipment performance to improve efficiency. Smart grids use AI to balance supply and demand, reducing energy wastage and enhancing grid stability.

Predictive maintenance powered by AI helps detect faults in wind turbines and solar panels before they cause disruptions. Energy companies are integrating AI-driven solutions to maximize output and minimize costs. This trend is transforming renewable energy management, making it more reliable and cost-effective for businesses and consumers.

Expansion of Floating Solar Power Installations

Floating solar power plants are gaining traction as an innovative solution to land constraints. These systems are installed on reservoirs, lakes, and other water bodies, reducing the need for large land areas. Floating solar panels benefit from natural cooling effects, improving efficiency compared to land-based installations.

Countries with limited space for renewable projects are investing in floating solar farms to expand clean energy capacity. This trend is attracting interest from governments and private investors, offering a sustainable way to generate electricity while utilizing underused water surfaces effectively.

Regional Analysis

In 2024, the Asia-Pacific region held 45.2% of the Renewable Energy Market, valued at USD 591.5 billion.

The global renewable energy market demonstrates significant regional variations, with Asia-Pacific leading the industry, accounting for 45.2% of the total market share and valued at USD 591.5 billion. The region’s dominance is fueled by rapid industrialization, strong government initiatives, and substantial investments in solar, wind, and hydropower projects, particularly in China and India.

North America follows as a key market, driven by the United States and Canada, where increasing federal and state-level incentives, along with ambitious carbon neutrality goals, propel the adoption of renewable energy sources. The region is witnessing accelerated growth in offshore wind and solar photovoltaic (PV) installations, with the U.S. alone accounting for over 23% of global wind energy capacity.

Europe remains a major contributor, backed by stringent sustainability policies, carbon pricing mechanisms, and the EU’s Green Deal aiming for a 55% emissions reduction by 2030. Countries such as Germany, the UK, and France are aggressively expanding offshore wind and hydrogen projects.

The Middle East & Africa (MEA) is emerging as a lucrative market, leveraging abundant solar potential, with the UAE and Saudi Arabia leading large-scale solar initiatives. Lastly, Latin America sees growing adoption, particularly in Brazil and Chile, where favorable climatic conditions and government incentives are driving solar and wind energy capacity expansion.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global renewable energy market in 2024 witnessed strong participation from leading players, each leveraging technological advancements, strategic expansions, and partnerships to strengthen their market positioning.

Enel Green Power S.p.A., a subsidiary of Enel S.p.A., remained at the forefront, expanding its global footprint in solar and wind power generation. EDF Renewables continued aggressive development of offshore wind projects, aligning with net-zero commitments in Europe and North America.

Siemens Gamesa Renewable Energy, S.A. and General Electric (GE) played a crucial role in advancing wind turbine technology, with Siemens Gamesa focusing on offshore wind solutions and GE investing in next-generation turbine models. Similarly, Suzlon Energy Ltd. and Tata Power strengthened their presence in India’s renewable energy transition, supported by government incentives.

ABB and Schneider Electric remained pivotal in grid infrastructure and smart energy management, driving digitalization in renewable energy distribution. National Grid Renewables expanded solar and wind projects in the U.S., benefiting from policy support like the Inflation Reduction Act.

Innergex and Invenergy continued to develop utility-scale wind, solar, and hydro projects, capitalizing on the rising demand for clean power procurement. Meanwhile, Acciona S.A. and ACCIONA Energy leveraged vertical integration and innovation in energy storage to enhance efficiency.

Top Key Players in the Market

- ABB

- Acconia S.A.

- Enel Spa

- General Electric

- Innergex

- Invenergy

- Schneider Electric

- Siemens Gamesa Renewable Energy, S.A.

- Suzlon Energy Ltd.

- Tata Power

- ACCIONA

- EDF Renewables

- Xcel Energy Inc.

- Enel Green Power S.p.A.

- National Grid Renewables

Recent Developments

- In 2024, ABB expanded renewable energy integration by securing orders for grid stabilization in Spain’s islands and acquiring Siemens Gamesa’s power electronics business. These efforts enhance energy transition, ensuring reliable and sustainable power solutions.

- In 2024, Invenergy will develop and operate renewable energy projects like wind and solar. It provided 760MW for Meta’s clean energy goals. In 2025, its Hardin II Solar Center in Ohio started producing 150MW, supporting the transition to clean energy.

Report Scope

Report Features Description Market Value (2024) USD 1305.8 Billion Forecast Revenue (2034) USD 4,393.6 Billion CAGR (2025-2034) 12.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Hydropower, Wind Power, Solar Power, Bioenergy, Others), By Deployment (On-Grid, Off-Grid), By Application (Industrial, Residential, Commercial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape ABB, Acconia S.A., Enel Spa, General Electric, Innergex, Invenergy, Schneider Electric, Siemens Gamesa Renewable Energy, S.A., Suzlon Energy Ltd., Tata Power, ACCIONA, EDF Renewables, Xcel Energy Inc., Enel Green Power S.p.A., National Grid Renewables Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Renewable Energy MarketPublished date: January 2025add_shopping_cartBuy Now get_appDownload Sample

Renewable Energy MarketPublished date: January 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- ABB

- Acconia S.A.

- Enel Spa

- General Electric

- Innergex

- Invenergy

- Schneider Electric

- Siemens Gamesa Renewable Energy, S.A.

- Suzlon Energy Ltd.

- Tata Power

- ACCIONA

- EDF Renewables

- Xcel Energy Inc.

- Enel Green Power S.p.A.

- National Grid Renewables