Global Sodium Ion battery Market Size, Share, And Business Benefits By Product (Sodium-Sulfur Batteries, Sodium-Salt Batteries (Zebra Batteries), Sodium-Oxygen (Sodium Air) Batteries), By Technology (Aqueous, Non-aqueous), By Application (Stationary Energy Storage, Transportation), By End-use (Energy Storage, Consumer Electronics, Automotive, Industrial, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: February 2025

- Report ID: 141337

- Number of Pages: 318

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

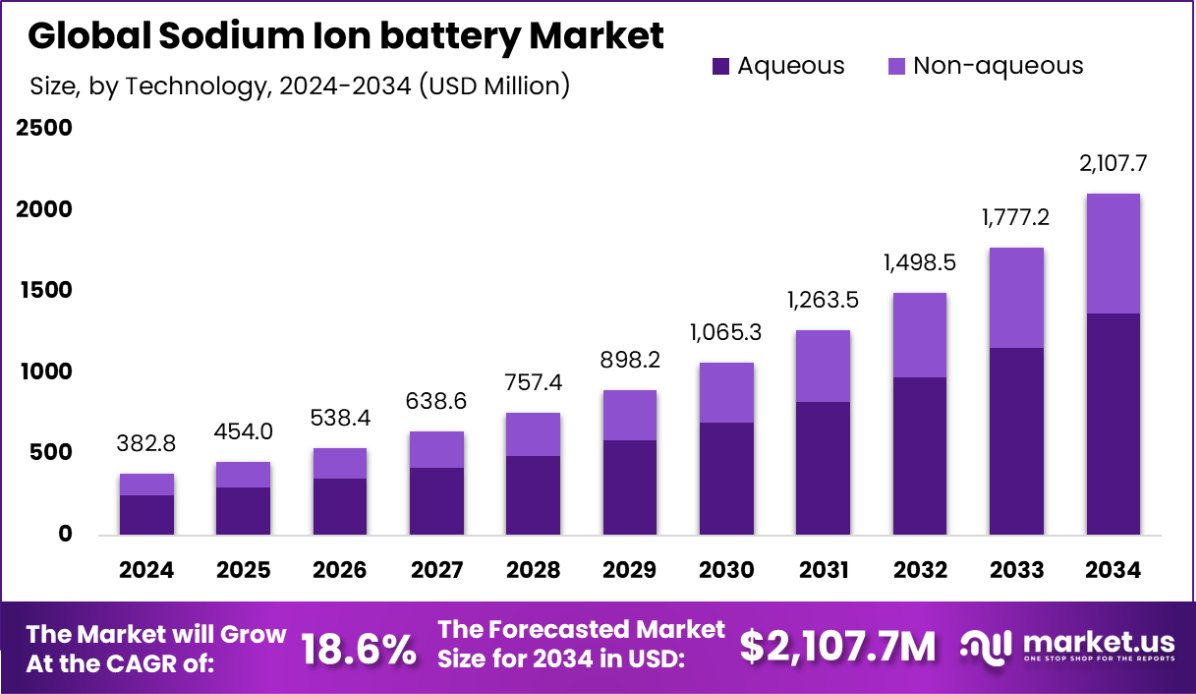

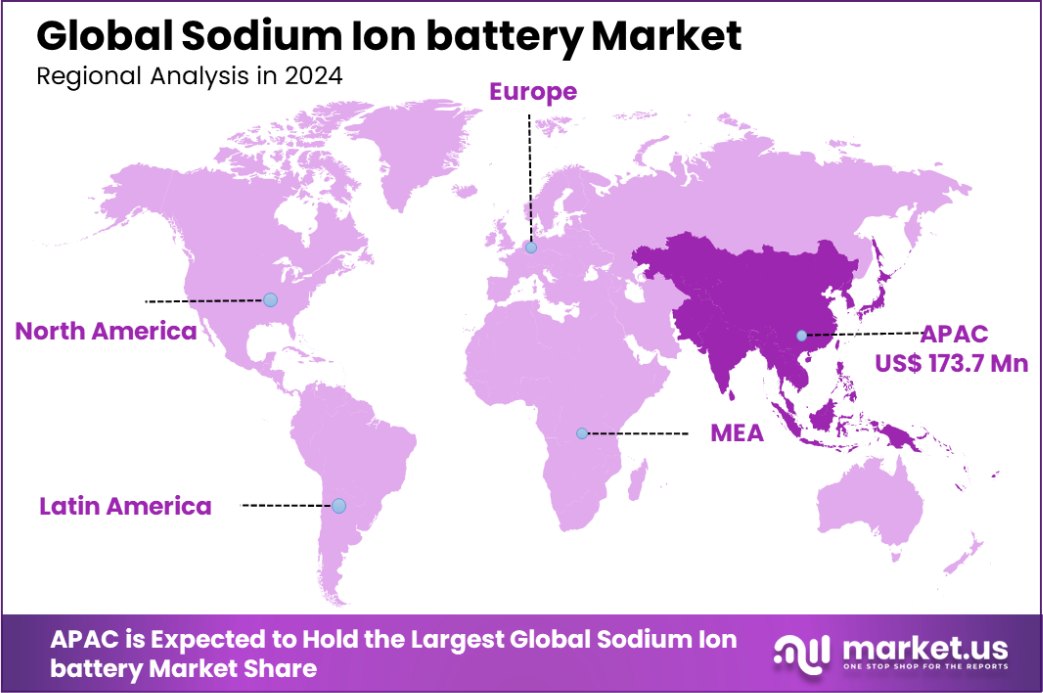

Global Sodium Ion battery Market is expected to be worth around USD 2,107.7 million by 2034, up from USD 382.8 million in 2024, and grow at a CAGR of 18.6% from 2025 to 2034. Asia-Pacific holds 45.4% of the sodium-ion battery market share, with a market value of USD 173.7 million.

Sodium-ion batteries (SIBs) are a type of rechargeable battery that use sodium ions (Na+) as the charge carriers, similar to lithium-ion batteries (LIBs), but with sodium as the primary element instead of lithium. These batteries are seen as a promising alternative due to sodium’s abundant availability and low cost compared to lithium.

Sodium-ion batteries typically have a lower energy density than lithium-ion batteries but offer potential in large-scale energy storage applications and other sectors where cost and sustainability are more critical than size or weight.

The growth of sodium-ion batteries is largely driven by the increasing demand for energy storage solutions, especially in renewable energy systems and electric vehicles (EVs). As the world transitions to more sustainable energy systems, SIBs offer a cost-effective and environmentally friendly solution to the limitations of lithium-ion batteries, including supply chain constraints and environmental concerns.

Research advancements continue to improve the performance and energy density of sodium-ion batteries, enhancing their competitiveness in markets traditionally dominated by lithium-ion technologies.

The demand for sodium-ion batteries is growing as industries seek alternatives to lithium-ion batteries. Applications in grid storage, electric vehicles, and consumer electronics are expanding, with a focus on reducing dependency on lithium, cobalt, and nickel. Sodium is more abundant and cheaper, making sodium-ion batteries an attractive solution in regions where lithium resources are scarce or expensive.

The opportunities for sodium-ion batteries lie in scaling up production and improving battery chemistry to match or surpass the performance of lithium-ion counterparts. With technological advances, sodium-ion batteries could become a key player in large-scale energy storage solutions, supporting the widespread adoption of renewable energy.

Current sodium-ion cells offer a rated specific energy of up to 160 Wh/kg in 32 Ah pouch cells, with next-generation designs anticipated to exceed 190 Wh/kg. These batteries can achieve over 4,000 cycles with 80% capacity retention in prototype pouch cells. Additionally, sodium-ion batteries demonstrate an impressive round-trip energy efficiency of 92% at a 5-hour discharge rate, showcasing their potential for long-term, efficient energy storage solutions.

Key Takeaways

- Global Sodium Ion battery Market is expected to be worth around USD 2,107.7 million by 2034, up from USD 382.8 million in 2024, and grow at a CAGR of 18.6% from 2025 to 2034.

- Sodium-ion batteries hold 34.5% of the market share in sodium-sulfur battery products.

- Aqueous technology represents 65.3% of the sodium-ion battery market’s technological advancements.

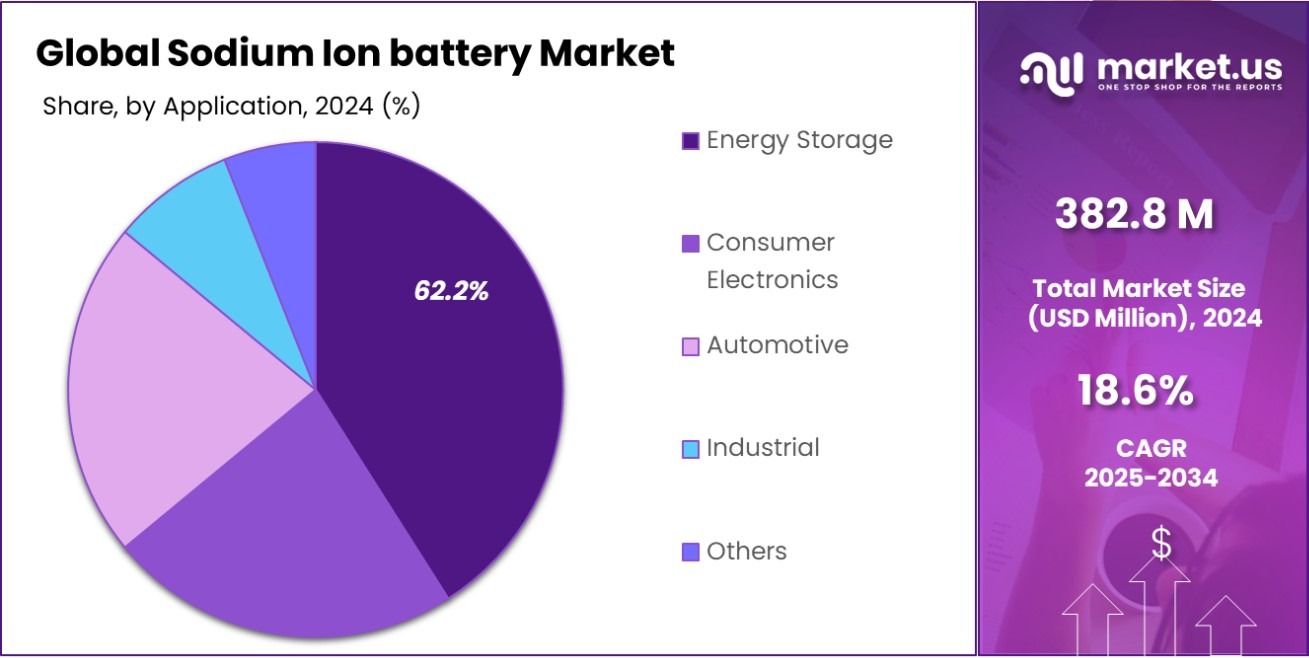

- Stationary energy storage makes up 62.2% of sodium-ion battery applications globally.

- Energy storage accounts for 41.2% of the sodium-ion battery market’s end-use demand.

- Asia-Pacific holds 45.4% of the sodium-ion battery market, valued at USD 173.7 million.

By Product Analysis

Sodium-ion batteries are gaining traction, with a market share of 34.5%, replacing traditional technologies.

In 2024, Sodium-Ion Batteries held a dominant market position in the By Product segment of the Sodium-Ion Battery Market, with a 34.5% share. This leadership can be attributed to the increasing demand for energy storage systems and electric vehicle applications, where sodium-ion batteries provide a cost-effective alternative to traditional lithium-ion technologies.

The lower cost and availability of sodium, along with advancements in battery performance, are driving the widespread adoption of sodium-ion batteries across various sectors, such as grid energy storage and transportation.

The significant market share of sodium-ion batteries within the product segment reflects their growing appeal in large-scale energy storage applications. These batteries are gaining traction as a viable solution to balance the intermittency of renewable energy sources such as solar and wind. Moreover, sodium-ion batteries are increasingly being considered for use in electric vehicles, particularly in regions with limited access to lithium resources, creating an additional demand pipeline.

In terms of product innovation, ongoing research is focused on enhancing the energy density and cycle life of sodium-ion batteries, addressing one of the major limitations compared to lithium-ion counterparts. This continuous development, along with an expanding range of applications, positions sodium-ion batteries for further growth within the global energy storage and transportation markets in the coming years.

By Technology Analysis

Aqueous sodium-ion battery technology dominates, accounting for 65.3%, offering safer, more sustainable energy storage solutions.

In 2024, Aqueous held a dominant market position in the By Technology segment of the Sodium-Ion Battery Market, with a 65.3% share. This substantial market share is primarily driven by the advantages of aqueous sodium-ion battery technologies, including their cost-effectiveness, safety, and environmental benefits.

Aqueous sodium-ion batteries utilize a water-based electrolyte, which significantly reduces the risk of flammability and enhances the overall safety profile of the battery, making them an attractive option for large-scale applications such as grid energy storage.

The dominance of aqueous technology is also supported by ongoing advancements in battery efficiency and performance, which have improved over recent years. These improvements have allowed aqueous sodium-ion batteries to become more competitive with other energy storage solutions, especially in applications where cost and safety are of paramount importance. Additionally, the lower manufacturing cost of aqueous sodium-ion batteries compared to non-aqueous alternatives has bolstered their widespread adoption, particularly in the renewable energy sector.

With a growing emphasis on sustainable energy storage, the aqueous technology segment is expected to continue its market lead as it provides a viable and scalable solution to meet the increasing global demand for affordable and efficient energy storage systems. This trend is anticipated to gain further momentum as research and development efforts continue to enhance the performance of aqueous sodium-ion batteries.

By Application Analysis

Stationary energy storage is the largest application for sodium-ion batteries, capturing 62.2% of the market.

In 2024, Stationary Energy Storage held a dominant market position in the By Application segment of the Sodium-Ion Battery Market, with a 62.2% share. This market leadership is primarily driven by the increasing demand for reliable and cost-effective energy storage solutions for grid applications.

Stationary energy storage systems play a critical role in balancing supply and demand, especially in renewable energy integration, where they store excess energy generated from solar or wind sources and release it during periods of high demand or low generation.

The significant market share of stationary energy storage applications reflects the growing focus on enhancing grid stability and energy security, particularly in regions with a high penetration of renewable energy. Sodium-ion batteries, with their lower cost and safer operating characteristics, are becoming an attractive option for utility-scale energy storage projects, further driving their adoption in this segment.

Furthermore, the scalability of sodium-ion batteries makes them particularly well-suited for long-duration storage applications, which is essential for optimizing grid performance and supporting the global transition to cleaner energy sources.

As renewable energy installations continue to expand, the demand for stationary energy storage solutions is expected to rise, solidifying sodium-ion batteries’ role in the energy storage market.

By End-Use Analysis

Energy storage systems utilize sodium-ion batteries significantly, representing 41.2% of the overall market demand.

In 2024, Energy Storage held a dominant market position in the By End-Use segment of the Sodium-Ion Battery Market, with a 41.2% share. This dominant position is largely due to the growing demand for efficient and scalable energy storage solutions to support the transition to renewable energy sources.

Sodium-ion batteries, with their cost-effectiveness and enhanced safety features, are becoming increasingly popular in utility-scale energy storage systems. These systems are crucial for balancing energy supply and demand, particularly in the context of intermittent renewable energy generation from solar and wind power.

The substantial share of energy storage applications in the end-use segment highlights the rising importance of large-scale storage systems that can store excess energy and discharge it when needed, thus ensuring grid stability and reliability. Sodium-ion batteries offer several advantages over traditional lithium-ion batteries, including lower material costs and a more abundant supply of raw materials, making them a more sustainable option for long-term energy storage solutions.

As global energy consumption continues to shift toward cleaner sources, the demand for efficient energy storage technologies is expected to rise. The energy storage sector, therefore, is anticipated to remain a key growth driver for sodium-ion batteries, with ongoing technological advancements enhancing their performance and cost-efficiency over time.

Key Market Segments

By Product

- Sodium-Sulfur Batteries

- Sodium-Salt Batteries (Zebra Batteries)

- Sodium-Oxygen (Sodium Air) Batteries

By Technology

- Aqueous

- Non-aqueous

By Application

- Stationary Energy Storage

- Transportation

By End-use

- Energy Storage

- Consumer Electronics

- Automotive

- Industrial

- Others

Driving Factors

Cost-Effectiveness and Abundant Raw Materials

One of the primary driving factors for the growth of the Sodium-Ion Battery market is their cost-effectiveness, coupled with the abundance of raw materials like sodium. Unlike lithium, which is more expensive and has limited sources, sodium is widely available and more affordable. This significantly lowers the overall cost of sodium-ion batteries compared to lithium-ion counterparts, making them an attractive choice for large-scale applications such as grid energy storage.

As the demand for energy storage continues to grow, particularly in renewable energy systems, the lower cost of sodium-ion batteries positions them as a more economically viable alternative. This trend is expected to accelerate as technological advancements continue to improve the performance and efficiency of sodium-ion battery technologies.

Restraining Factors

Lower Energy Density Compared to Lithium-Ion Batteries

A major restraining factor for the Sodium-Ion Battery market is their lower energy density compared to lithium-ion batteries. Energy density refers to the amount of energy a battery can store relative to its size and weight. While sodium-ion batteries are cost-effective and environmentally friendly, they typically offer less energy storage per unit, which makes them less efficient for applications that require high energy outputs, such as electric vehicles.

This limitation in energy density means that sodium-ion batteries may not be suitable for certain high-performance applications where space and weight are critical. As a result, until advancements in technology can improve energy density, sodium-ion batteries face challenges in competing directly with lithium-ion batteries in high-demand sectors.

Growth Opportunity

Growing Demand for Renewable Energy Storage Solutions

A significant growth opportunity for the Sodium-Ion Battery market lies in the rising demand for renewable energy storage solutions. As more countries shift towards renewable energy sources like solar and wind, the need for efficient, scalable, and cost-effective energy storage systems increases. Sodium-ion batteries, with their lower cost and safer design, present a promising alternative to lithium-ion batteries, especially in large-scale grid storage applications.

These batteries can store excess energy generated from renewable sources and release it when demand is high or when generation is low. As renewable energy adoption accelerates globally, the demand for reliable energy storage solutions will continue to grow, positioning sodium-ion batteries as a key player in the energy transition.

Latest Trends

Advancements in Sodium-Ion Battery Efficiency and Performance

One of the latest trends in the Sodium-Ion Battery market is the ongoing advancement in battery efficiency and overall performance. Manufacturers and researchers are focusing on improving the energy density, cycle life, and charging speed of sodium-ion batteries. These enhancements are essential for making sodium-ion batteries more competitive with lithium-ion batteries, particularly in applications such as electric vehicles and high-performance energy storage systems.

With significant investments in research and development, the technology behind sodium-ion batteries is rapidly evolving. As performance improves, sodium-ion batteries are expected to play an increasingly important role in large-scale storage solutions, offering a safer and more affordable alternative to traditional lithium-based technologies. This trend is expected to drive greater adoption across various sectors.

Regional Analysis

Asia-Pacific holds 45.4% of the sodium-ion battery market, valued at USD 173.7 million in 2025.

The sodium-ion battery market is experiencing significant growth across various regions, driven by the increasing demand for energy storage solutions. Asia-Pacific holds a dominant share in the market, contributing 53.8% of the global market share. This region benefits from a strong presence of key manufacturers, favorable government policies, and substantial investments in renewable energy and electric vehicles (EVs).

In China, one of the leading countries in the Asia-Pacific region, the growing demand for energy storage applications and advancements in sodium-ion battery technology are propelling market growth. North America is also witnessing robust growth, with significant investments in research and development and increasing adoption of renewable energy technologies.

The U.S. is expected to play a pivotal role in expanding the sodium-ion battery market, driven by its focus on energy storage systems and sustainable energy solutions. Europe follows closely, with countries like Germany and France heavily investing in clean energy technologies and grid modernization.

The Middle East & Africa, though still emerging, are poised for growth, supported by growing energy demands and investments in green technologies. Lastly, Latin America is seeing gradual adoption, driven by increasing awareness of sustainable energy solutions and advancements in battery technologies. Asia-Pacific remains the dominating region, accounting for over half of the global market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, the global sodium-ion battery market is witnessing significant competition, with several key players driving innovation and growth. Altris AB, a notable player, continues to lead in developing high-performance sodium-ion batteries, leveraging its proprietary technology to offer energy solutions for large-scale applications. Similarly, AMTE Power Plc has emerged as a strong contender, focusing on providing energy storage solutions for electric vehicles and grid systems, with an emphasis on sustainable technology.

Aquion Energy, despite previous financial challenges, remains a key player in the development of aqueous sodium-ion batteries, providing environmentally friendly solutions with a focus on affordability and safety. Contemporary Amperex Technology Co. Limited (CATL), one of the largest players in the market, is expanding its reach into sodium-ion battery production as part of its broader diversification strategy in the energy storage sector.

Faradion Limited is making waves with its sodium-ion battery technology, positioned as an affordable and high-performance alternative to lithium-ion batteries. Companies like HiNa Battery Technology Co., Ltd. and Jiangsu Transimage Sodium-Ion Battery Technology Co., Ltd. are focusing on mass production capabilities to cater to the growing demand in the energy storage sector, particularly for grid-scale storage.

Meanwhile, industry giants like Panasonic Corporation and Mitsubishi Corporation are gradually incorporating sodium-ion technologies into their portfolios, recognizing the growing potential of sodium-ion batteries as a more sustainable alternative to lithium-ion solutions.

Top Key Players in the Market

- Altris AB

- AMTE Power Plc

- Aquion Energy

- Contemporary Amperex Technology Co. Limited (CATL)

- Faradion Limited

- HiNa Battery Technology Co., Ltd

- Indigenous Energy Storage Technologies Pvt. Ltd. (Indi Energy)

- Jiangsu Transimage Sodium-Ion Battery Technology Co., Ltd.

- Jiangsu Zoolnasm Energy Technology Co Ltd

- Kishida Chemical

- Li-FUN Technology Corporation Limited

- Mitsubishi Corporation

- Natrium Energy

- Natron Energy

- NEI Corporation

- NGK Insulators Ltd

- Panasonic Corporation

- Ronbay Technology

- Tiamat Energy

- Zhejiang Natrium Energy Co., Ltd.

- Zoolnasm

Recent Developments

- In October 2024, Reliance New Energy Solar Ltd., a subsidiary of India’s Reliance Industries, acquired UK-based Faradion Ltd., a leading sodium-ion battery technology company, for $136 million. This acquisition aims to accelerate Faradion’s commercial rollout and integrate its technology into Reliance’s energy storage projects.

- In August 2024, Natron Energy announced plans to invest $1.4 billion in a sodium-ion battery manufacturing plant in Edgecombe County, North Carolina. The facility aims to produce 24 gigawatts of battery storage per year, significantly increasing Natron’s production capacity.

Report Scope

Report Features Description Market Value (2024) USD 382.8 Million Forecast Revenue (2034) USD 2,107.7 Million CAGR (2025-2034) 18.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Sodium-Sulfur Batteries, Sodium-Salt Batteries (Zebra Batteries), Sodium-Oxygen (Sodium Air) Batteries), By Technology (Aqueous, Non-aqueous), By Application (Stationary Energy Storage, Transportation), By End-use (Energy Storage, Consumer Electronics, Automotive, Industrial, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Altris AB, AMTE Power Plc, Aquion Energy, Contemporary Amperex Technology Co. Limited (CATL), Faradion Limited, HiNa Battery Technology Co., Ltd, Indigenous Energy Storage Technologies Pvt. Ltd. (Indi Energy), Jiangsu Transimage Sodium-Ion Battery Technology Co., Ltd., Jiangsu Zoolnasm Energy Technology Co Ltd , Kishida Chemical, Li-FUN Technology Corporation Limited , Mitsubishi Corporation, Natrium Energy, Natron Energy, NEI Corporation, NGK Insulators Ltd , Panasonic Corporation, Ronbay Technology, Tiamat Energy, Zhejiang Natrium Energy Co., Ltd. , Zoolnasm Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Sodium Ion battery MarketPublished date: February 2025add_shopping_cartBuy Now get_appDownload Sample

Sodium Ion battery MarketPublished date: February 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Altris AB

- AMTE Power Plc

- Aquion Energy

- Contemporary Amperex Technology Co. Limited (CATL)

- Faradion Limited

- HiNa Battery Technology Co., Ltd

- Indigenous Energy Storage Technologies Pvt. Ltd. (Indi Energy)

- Jiangsu Transimage Sodium-Ion Battery Technology Co., Ltd.

- Jiangsu Zoolnasm Energy Technology Co Ltd

- Kishida Chemical

- Li-FUN Technology Corporation Limited

- Mitsubishi Corporation

- Natrium Energy

- Natron Energy

- NEI Corporation

- NGK Insulators Ltd

- Panasonic Corporation

- Ronbay Technology

- Tiamat Energy

- Zhejiang Natrium Energy Co., Ltd.

- Zoolnasm