Global Radar-Absorbing Materials Market By Type(Magnetic, Dielectric, Hybrid), By Technology(Impedance Matching, Resonant Absorbers, Circuit Analog RAM, Magnetic RAM, Adaptive RAM), By Material(Carbon, Metal, Metal Particles, Conducting Polymers, Tubules and Filaments, Chiral Materials and Shielding), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: March 2024

- Report ID: 116919

- Number of Pages: 355

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

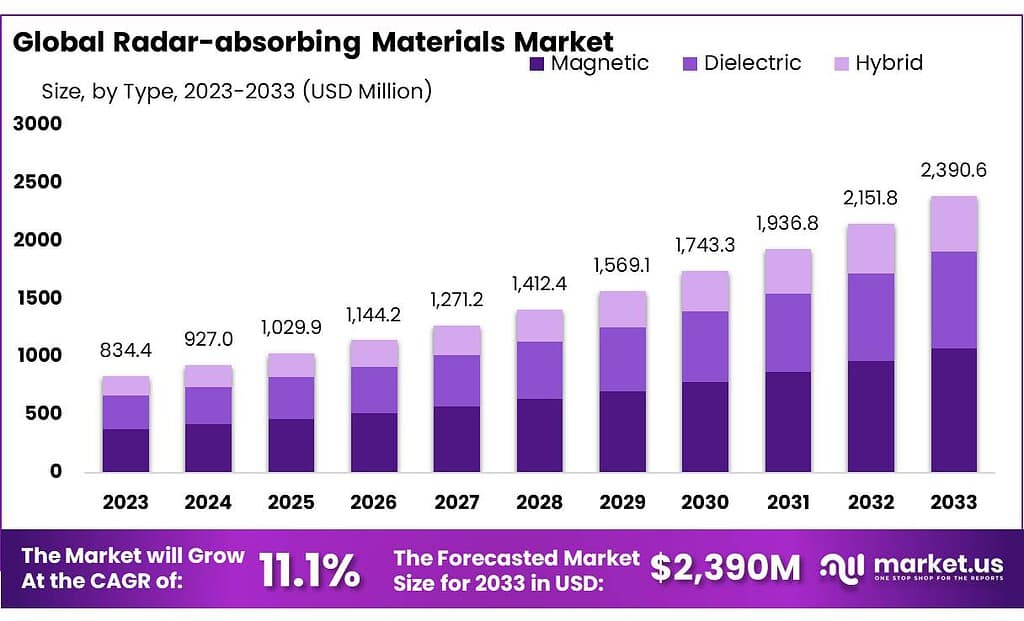

The global Radar-Absorbing Materials Market size is expected to be worth around USD 2390.6 Million by 2033, from USD 834.4 Million in 2023, growing at a CAGR of 11.1% during the forecast period from 2023 to 2033.

The Radar-Absorbing Materials (RAM) Market refers to the industry involved in the production, distribution, and application of materials designed to absorb electromagnetic radiation emitted by radar systems. These materials are engineered to reduce or eliminate the reflection of radar signals, making objects less detectable by radar systems. The market encompasses a range of sectors, including defense, aerospace, automotive, and telecommunications, where stealth and reduced radar visibility are crucial.

Manufacturers in this market develop specialized materials with properties optimized for radar absorption, catering to the diverse needs of military and civilian applications. Ongoing research and development efforts aim to enhance the performance and versatility of radar-absorbing materials to meet evolving technological requirements and security demands.

Key Takeaways

- Market Growth: Anticipated to reach USD 2390.6 million by 2033, growing at a CAGR of 11.1% from USD 834.4 million in 2023.

- Segment Leadership: Magnetic materials dominated with 45.3% market share in 2023, followed by dielectric and hybrid radar-absorbing materials.

- Top Technologies: Impedance Matching technology led with over 45.3% market share in 2023, trailed by Resonant Absorbers and Circuit Analog RAM.

- Preferred Materials: Metals, notably iron, nickel, and cobalt, secured over 35.5% market share in 2023, with carbon-based materials following closely.

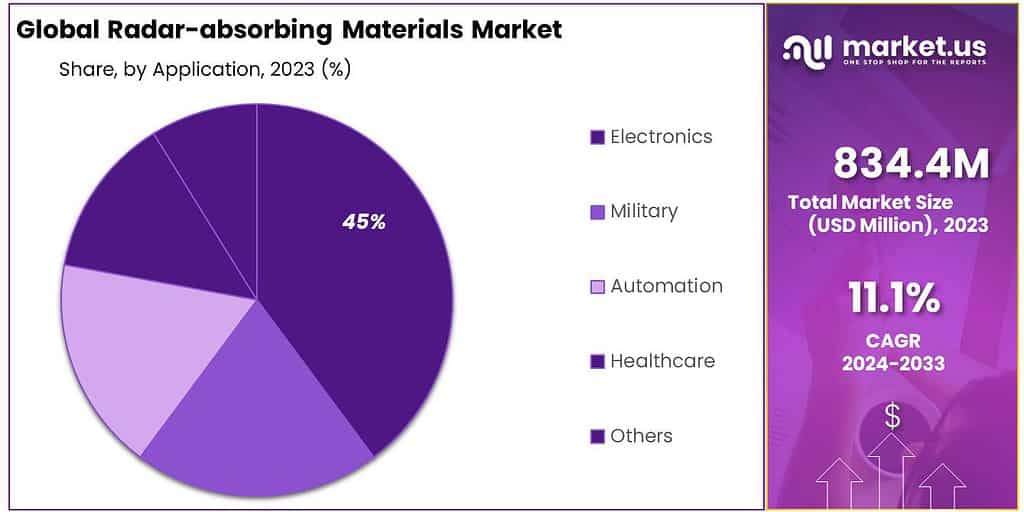

- End-User Applications: Electronics sector held over 45.5% market share in 2023, driven by demand for radar-absorbing materials in electronic devices.

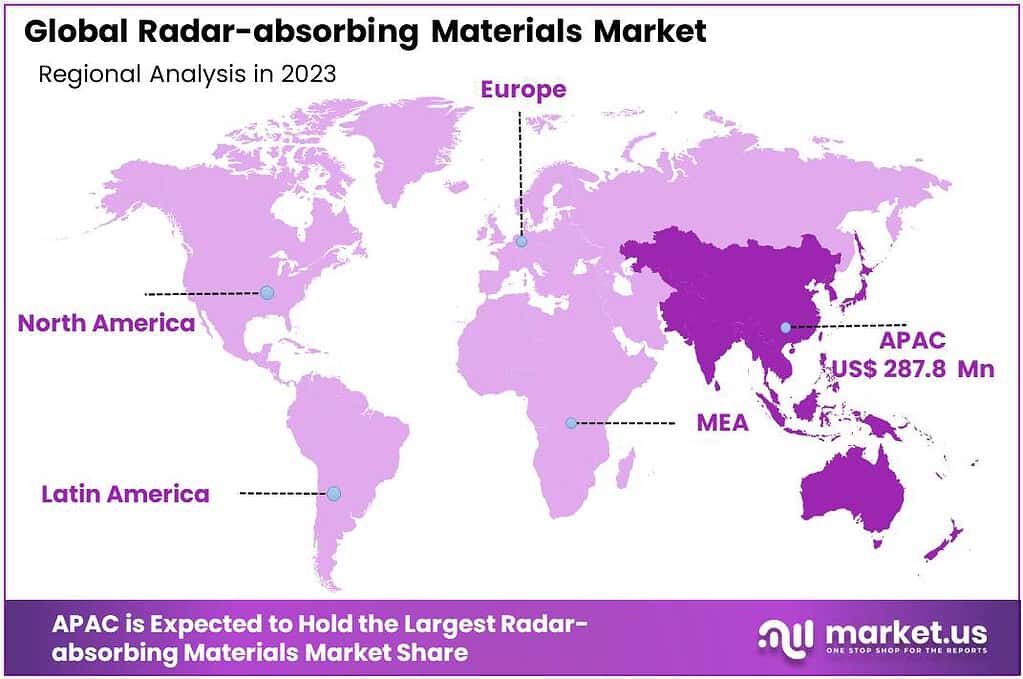

- Regional Dominance: Asia Pacific captured 34.6% market share in 2023, fueled by defense modernization initiatives and radar system advancements.

- As of 2023, there are over 50 different types of radar-absorbing materials commercially available, ranging from ferrites and composites to conductive polymers and metamaterials.

- In 2023, the U.S. Navy announced the successful testing of a radar-absorbing coating for naval vessels, which reduced their radar cross-section by up to 75%.

- In 2024, the European Union announced plans to invest USD 50 million in research and development projects focused on advanced radar-absorbing materials for defense and commercial applications.

By Type

In 2023, Magnetic radar-absorbing materials dominated the market, accounting for over 45.3% of the market share. These materials utilize magnetic properties to absorb electromagnetic radiation emitted by radar systems, making them essential for stealth applications in defense and aerospace industries.

Dielectric radar-absorbing materials held a significant market share in 2023. These materials rely on dielectric properties to attenuate radar signals, offering effective radar invisibility and signal suppression for various applications, including military aircraft and naval vessels.

Hybrid radar-absorbing materials emerged as a promising segment in 2023. Combining the strengths of both magnetic and dielectric materials, hybrid solutions offer enhanced radar absorption capabilities and versatility, catering to the evolving needs of defense and security applications.

The radar-absorbing materials market is characterized by a diverse range of material types, each offering unique advantages and applications in stealth technology and electromagnetic interference mitigation. Ongoing research and development efforts aim to further improve the performance and efficiency of these materials to meet the increasing demand for radar invisibility and electronic warfare capabilities.

By Technology

In 2023, Impedance Matching technology dominated the radar-absorbing materials market, securing over 45.3% of the market share. This technology focuses on adjusting the electrical properties of materials to match those of the surrounding medium, effectively minimizing radar reflections and enhancing stealth capabilities in military and aerospace applications.

Resonant Absorbers technology held a significant market share in 2023. These materials are designed to resonate at specific frequencies, absorbing and dissipating electromagnetic energy to reduce radar detection and improve the survivability of military platforms.

Circuit Analog RAM (Radar Absorbent Material) emerged as a promising segment in 2023. This technology utilizes complex circuitry and conductive materials to absorb and redirect radar signals, providing effective stealth capabilities for aircraft, ships, and ground vehicles.

Magnetic RAM technology captured a notable market share in 2023. These materials leverage magnetic properties to attenuate radar waves, offering enhanced radar invisibility and electronic warfare capabilities for military platforms operating in hostile environments.

Adaptive RAM technology emerged as a growing segment in 2023. This technology incorporates adaptive features that enable real-time adjustments to radar-absorbing properties, providing dynamic stealth capabilities and improved survivability for military assets in dynamic operational scenarios.

The radar-absorbing materials market offers a range of technologies tailored to meet the diverse needs of defense and aerospace applications. Ongoing advancements in material science and technology innovation aim to further enhance the performance and versatility of these materials, driving continued growth and adoption in the global market.

By Material

In 2023, Metal emerged as the dominant material in the radar-absorbing materials market, securing over 35.5% of the market share. Metals such as iron, nickel, and cobalt are widely used for their high electrical conductivity and magnetic properties, making them effective in absorbing and dissipating electromagnetic waves, thereby reducing radar detection.

Metal Particles accounted for a significant portion of the market share in 2023. These materials consist of tiny metallic particles dispersed within a matrix, enhancing their radar-absorbing properties while maintaining structural integrity. Metal particles offer versatility and can be incorporated into various composite materials for stealth applications.

Carbon materials held a notable market share in 2023. Carbon-based materials, including carbon fibers, carbon nanotubes, and graphene, exhibit high electrical conductivity and are lightweight, making them ideal for radar-absorbing applications in aerospace and defense.

Conducting Polymers emerged as a promising segment in 2023. These polymers possess unique electrical properties that enable them to absorb and dissipate electromagnetic radiation, providing effective radar stealth capabilities for military platforms.

Tubules and Filaments represented a growing segment in 2023. These materials, including carbon nanotubes and metal filaments, offer enhanced radar-absorbing properties due to their unique nanostructure, making them suitable for next-generation stealth technologies.

Chiral Materials and Shielding materials comprised a smaller portion of the market share in 2023. Chiral materials exhibit asymmetry in their molecular structure, enabling them to interact selectively with specific polarizations of electromagnetic waves. Shielding materials, on the other hand, provide physical barriers to electromagnetic radiation, reducing radar reflections and enhancing stealth capabilities.

The radar-absorbing materials market offers a diverse range of materials tailored to meet the stringent requirements of military and aerospace applications. Ongoing research and development efforts aim to further improve the performance and versatility of these materials, driving continued growth and innovation in the market.

By End-User

In 2023, the Electronics sector emerged as the leading end-user segment in the radar-absorbing materials market, securing over 45.5% of the market share. Metal electronics utilize radar-absorbing materials to minimize electromagnetic interference and enhance signal integrity in electronic devices and components, such as antennas, circuit boards, and sensors.

The Military sector accounted for a significant portion of the market share in 2023. Radar-absorbing materials play a crucial role in military applications, including stealth aircraft, ships, and ground vehicles, by reducing radar detection and enhancing operational stealth capabilities.

Automation represented a growing segment in 2023. Radar-absorbing materials are increasingly utilized in automated systems and robotics to mitigate electromagnetic interference and improve signal processing, enabling reliable performance in industrial and manufacturing environments.

Healthcare comprised a smaller portion of the market share in 2023. Radar-absorbing materials find applications in medical devices and equipment to minimize electromagnetic interference and ensure accurate diagnostic imaging and patient monitoring.

Other sectors, including aerospace, telecommunications, and transportation, accounted for the remaining market share in 2023. These sectors leverage radar-absorbing materials for various applications, such as satellite communication systems, automotive radar sensors, and infrastructure protection against electromagnetic interference.

Key Market Segments

By Type

- Magnetic

- Dielectric

- Hybrid

By Technology

- Impedance Matching

- Resonant Absorbers

- Circuit Analog RAM

- Magnetic RAM

- Adaptive RAM

By Material

- Carbon

- Metal

- Metal Particles

- Conducting Polymers

- Tubules and Filaments

- Chiral Materials and Shielding

By End-User

- Electronics

- Military

- Automation

- Healthcare

- Others

Drivers

Increasing Demand for Stealth Technology

One of the primary drivers of the radar-absorbing materials (RAM) market is the growing demand for stealth technology across military and aerospace sectors. As nations focus on enhancing their defense capabilities, there is a rising need for aircraft, ships, and ground vehicles with reduced radar detectability. Radar-absorbing materials play a crucial role in stealth technology by minimizing radar reflections and signatures, making these platforms less visible to enemy radar systems.

Advancements in Radar Technology

The continuous evolution of radar systems, including the development of more sophisticated and sensitive radars, is driving the demand for high-performance radar-absorbing materials. As radar technology becomes more advanced, there is a corresponding need for RAM that can effectively attenuate radar signals across a wide range of frequencies and angles. This demand stimulates innovation in the RAM market, leading to the development of new materials with enhanced absorption capabilities and broader frequency ranges.

Growing Applications in Civilian Industries

While the military sector remains a significant driver of the RAM market, there is also increasing demand from civilian industries such as automotive, telecommunications, and infrastructure. In the automotive industry, for example, radar-absorbing materials are used in vehicle design to reduce radar reflections and improve the performance of radar-based safety systems such as collision avoidance and adaptive cruise control. Similarly, in telecommunications and infrastructure, RAM is employed to minimize electromagnetic interference and enhance signal transmission and reception.

Restraints

High Cost of Development and Implementation

One of the primary restraints affecting the radar-absorbing materials market is the high cost associated with the development and implementation of advanced RAM solutions. Research and development expenses for new materials and technologies can be substantial, and the process of integrating RAM into existing platforms or structures often requires significant investment in design, testing, and certification. The high upfront costs may deter some organizations from adopting radar-absorbing materials, particularly smaller companies or those operating under budget constraints.

Challenges in Material Performance and Durability

Another restraint facing the RAM market is the challenge of achieving consistent material performance and durability under real-world operating conditions. Radar-absorbing materials must maintain their absorption properties over a wide range of environmental factors, including temperature fluctuations, moisture exposure, and mechanical stress. Ensuring the long-term reliability and effectiveness of RAM can be challenging, especially in harsh operating environments such as aerospace and maritime applications, where materials are subjected to extreme conditions.

Regulatory and Certification Requirements

Regulatory and certification requirements pose significant challenges for manufacturers and end-users of radar-absorbing materials, particularly in highly regulated industries such as aerospace and defense. RAM used in military platforms must meet stringent performance specifications and undergo rigorous testing and validation to ensure compliance with safety and security standards. Similarly, RAM deployed in civilian applications may be subject to regulatory approval and certification processes to verify its suitability for use in specific environments. Meeting these requirements adds complexity and time to the development and deployment of radar-absorbing materials, potentially delaying market entry and increasing costs.

Opportunities

Expanding Defense Budgets and Modernization Initiatives

One of the significant opportunities in the radar-absorbing materials (RAM) market stems from the expanding defense budgets of several nations worldwide and their focus on modernizing their military capabilities.

As countries seek to enhance their defense systems and maintain a competitive edge in the global defense landscape, there is a growing demand for advanced technologies, including stealth platforms equipped with radar-absorbing materials. This presents an opportunity for RAM manufacturers to capitalize on increased defense spending by supplying innovative and high-performance materials tailored to the specific needs of modern military applications.

Emergence of Next-Generation Radar Systems

The emergence of next-generation radar systems, characterized by advancements in radar technology and increased capabilities, presents a significant opportunity for the radar-absorbing materials market. These advanced radar systems, including active electronically scanned array (AESA) radars and synthetic aperture radar (SAR) systems, operate at higher frequencies and offer improved resolution, sensitivity, and detection capabilities.

As a result, there is a growing demand for radar-absorbing materials that can effectively attenuate signals across a broader frequency spectrum and mitigate detection by these advanced radar systems. Manufacturers have the opportunity to develop and supply RAM solutions optimized for compatibility with next-generation radar systems, catering to the evolving needs of the defense and aerospace sectors.

Rising Adoption of Unmanned Aerial Vehicles (UAVs)

The rising adoption of unmanned aerial vehicles (UAVs), also known as drones, in military, security, and commercial applications presents a significant opportunity for the radar-absorbing materials market. UAVs are increasingly being used for reconnaissance, surveillance, intelligence gathering, and tactical missions, driving the demand for stealthy and low-observable platforms equipped with radar-absorbing materials.

These materials enable UAVs to operate covertly and evade detection by enemy radar systems, enhancing their effectiveness in various mission scenarios. As UAVs continue to proliferate across defense and civilian sectors, there is a growing need for lightweight, durable, and cost-effective RAM solutions tailored to UAV applications. Manufacturers can capitalize on this opportunity by developing specialized RAM formulations optimized for integration into UAV structures, thereby expanding their market presence and revenue potential.

Trends

Development of Multifunctional RAM

A prominent trend in the radar-absorbing materials market is the development of multifunctional RAM that offers additional functionalities beyond radar absorption. Manufacturers are focusing on incorporating properties such as thermal insulation, lightweight construction, and durability into RAM formulations, allowing these materials to serve multiple purposes in various applications. This trend is driven by the desire to optimize material performance and reduce the overall complexity and weight of radar-absorbing structures.

Integration of Nanotechnology

Nanotechnology is increasingly being integrated into the design and manufacturing of radar-absorbing materials, enabling the development of highly efficient and lightweight RAM with enhanced absorption properties.

Nanomaterials such as carbon nanotubes, graphene, and nanostructured metals offer unique electromagnetic properties that make them ideal candidates for radar absorption applications. By leveraging nanotechnology, manufacturers can create RAM with superior performance characteristics, including broad-spectrum absorption, reduced thickness, and improved durability.

Focus on Environmentally Sustainable Solutions

With growing environmental concerns, there is a trend towards the development of environmentally sustainable radar-absorbing materials that minimize the use of hazardous chemicals and reduce carbon footprint.

Manufacturers are exploring bio-based and recyclable materials as alternatives to traditional synthetic RAM formulations, aiming to enhance the eco-friendliness of radar-absorbing structures. Additionally, efforts are being made to optimize production processes and reduce energy consumption and waste generation associated with RAM manufacturing.

Regional Analysis

In 2023, the Asia Pacific region emerged as a pivotal player in the global radar-absorbing materials (RAM) market, capturing a substantial share of 34.6%, driven by the rapid expansion of defense and aerospace industries in the region. The burgeoning growth of these sectors, coupled with increasing investments in radar technology, has significantly boosted the demand for RAM, which plays a crucial role in enhancing stealth capabilities and reducing radar detection.

Countries like China and India have notably influenced the Asia Pacific market’s dominance in the radar-absorbing materials industry. Their extensive defense modernization initiatives and advancements in radar systems have fueled the demand for high-performance RAM solutions. This growth is closely linked to the rising need for stealth technology in military applications, including aircraft, naval vessels, and ground-based systems, highlighting the integral role of radar-absorbing materials in ensuring operational effectiveness and survivability.

Moreover, the region’s substantial demand for RAM is further amplified by its applications in commercial aerospace, telecommunications, and automotive industries. With China and India leading the way, Asia Pacific benefits from a robust manufacturing infrastructure and technological capabilities, facilitating the development and adoption of advanced RAM solutions for various defense and civilian applications.

Additionally, the strategic focus on enhancing national security and military capabilities across the region has led to an increased requirement for advanced radar-absorbing materials, driving innovation and investment in RAM technologies. This trend underscores the Asia Pacific’s position as a key hub for radar-absorbing materials innovation and production, contributing to the region’s leadership in the global market.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In the radar-absorbing materials (RAM) market, several key players stand out for their significant contributions and innovative offerings. Companies such as Lockheed Martin Corporation, Northrop Grumman Corporation, and Raytheon Technologies Corporation are among the frontrunners in this industry, known for their expertise in developing advanced radar-absorbing materials and solutions.

These industry giants leverage extensive research and development capabilities to produce RAM solutions tailored to meet the stringent requirements of defense and aerospace applications.

Market Key Players

- Arc Technologies, Inc.

- BAE Systems Plc

- Cuming Microwave Corporation

- Eeonyx

- Laird Technologies, Inc.

- M.S.M. Industries, Inc.

- Mast Technologies, Micromag

- MWT-Materials, Inc.

- Panashield

- Parker Hannifin Corp

- Soliani EMC S.R.L

Recent Developments

2024: BAE Systems announced a breakthrough in radar-absorbing material technology, achieving significant advancements in reducing radar cross-section for military aircraft and naval vessels.

2024: Eeonyx launched a new range of conductive textiles infused with radar-absorbing materials, offering lightweight and flexible solutions for stealth applications in military uniforms and equipment.

2024: Parker Hannifin Corp introduced a new line of RAM-based gaskets and seals for aerospace and automotive applications, providing enhanced protection against electromagnetic interference and environmental contaminants.

Report Scope

Report Features Description Market Value (2023) USD 834.4 Mn Forecast Revenue (2033) USD 2390.6 Mn CAGR (2024-2033) 11.1% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type(Magnetic, Dielectric, Hybrid), By Technology(Impedance Matching, Resonant Absorbers, Circuit Analog RAM, Magnetic RAM, Adaptive RAM), By Material(Carbon, Metal, Metal Particles, Conducting Polymers, Tubules and Filaments, Chiral Materials and Shielding) Regional Analysis North America: The US and Canada; Europe: Germany, France, The UK, Italy, Spain, Russia & CIS, and the Rest of Europe; APAC: China, India, Japan, South Korea, ASEAN, and the Rest of APAC; Latin America: Brazil, Mexico, and Rest of Latin America; Middle East & Africa: GCC, South Africa, and Rest of Middle East & Africa. Competitive Landscape Arc Technologies, Inc., BAE Systems Plc, Cuming Microwave Corporation, Eeonyx, Laird Technologies, Inc., M.S.M. Industries, Inc., Mast Technologies, Micromag, MWT-Materials, Inc., Panashield, Parker Hannifin Corp, Soliani EMC S.R.L Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

Name the major industry players in the Radar-Absorbing Materials Market?Arc Technologies, Inc., BAE Systems Plc, Cuming Microwave Corporation, Eeonyx, Laird Technologies, Inc., M.S.M. Industries, Inc., Mast Technologies, Micromag, MWT-Materials, Inc., Panashield, Parker Hannifin Corp, Soliani EMC S.R.L

What is the size of Radar-Absorbing Materials Market?Radar-Absorbing Materials Market size is expected to be worth around USD 2390.6 Million by 2033, from USD 834.4 Million in 2023

What CAGR is projected for the Radar-Absorbing Materials Market?The Radar-Absorbing Materials Market is expected to grow at 11.1% CAGR (2024-2033).

Radar-Absorbing Materials MarketPublished date: March 2024add_shopping_cartBuy Now get_appDownload Sample

Radar-Absorbing Materials MarketPublished date: March 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Arc Technologies, Inc.

- BAE Systems Plc

- Cuming Microwave Corporation

- Eeonyx

- Laird Technologies, Inc.

- M.S.M. Industries, Inc.

- Mast Technologies, Micromag

- MWT-Materials, Inc.

- Panashield

- Parker Hannifin Corp

- Soliani EMC S.R.L