Global Biofungicides Market Size, Share Analysis Report By Type (Microbial, Botanical and Others), By Formulation (Solid and Liquid), By Application Method (Foliar Spray, Soil Treatment, Seed Treatment and Others), By Crop Top (Fruits and Vegetables, Cereal and Grains, Oilseeds and Pulses, Turf and Ornamentals and Others) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 116150

- Number of Pages: 293

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

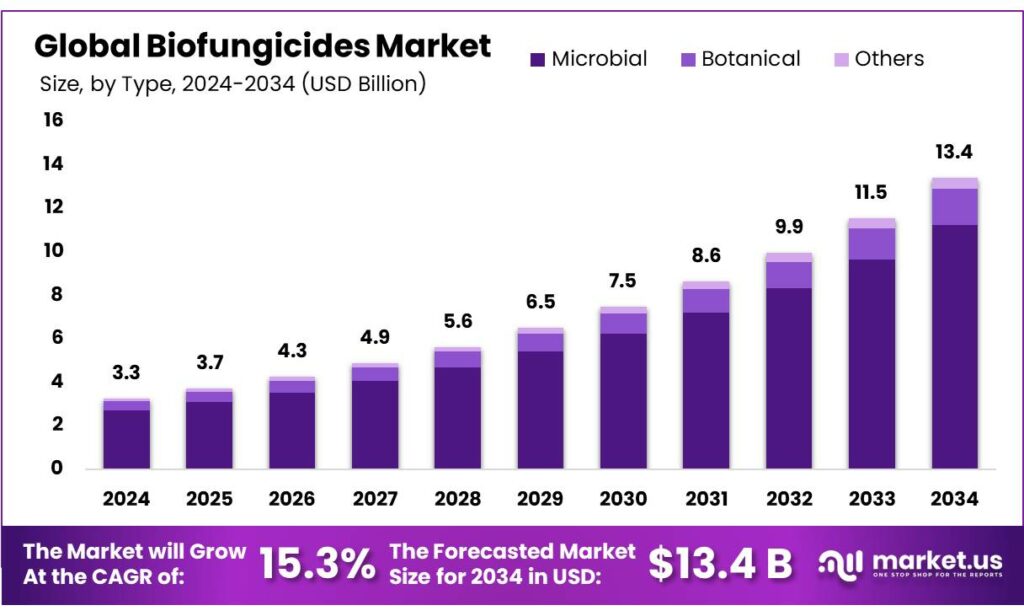

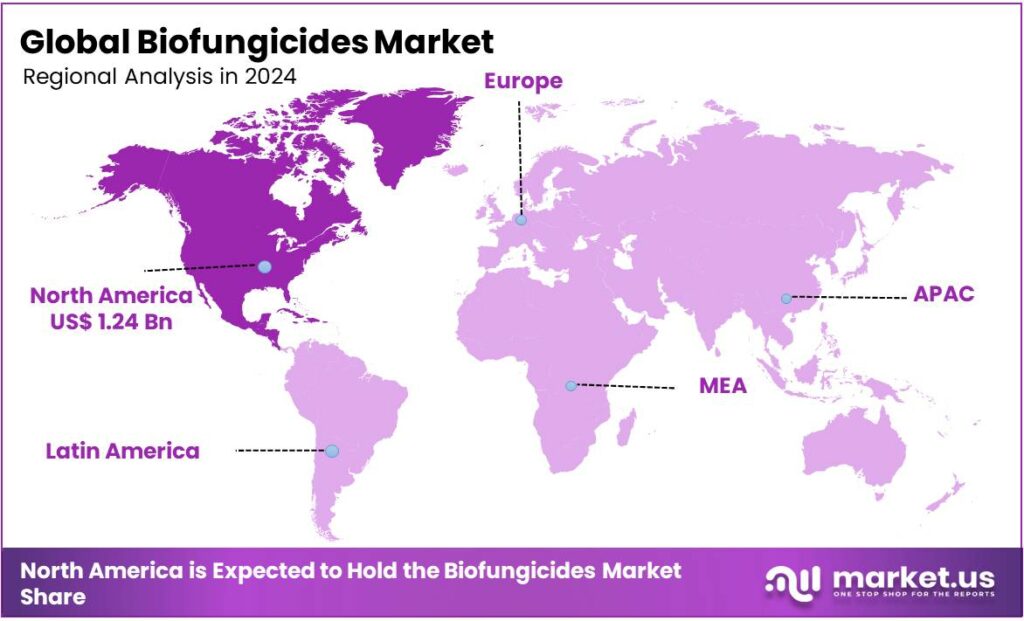

The Global Biofungicides Market size is expected to be worth around USD 13.4 Billion by 2034, from USD 3.3 Billion in 2024, growing at a CAGR of 15.3% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 38.2% share, holding USD 1.24 Billion in revenue.

Biofungicides are biological formulations composed of living organisms specifically designed to suppress plant-pathogenic fungi and bacteria. Their principle is rooted in naturally occurring processes, where beneficial microorganisms—commonly isolated from soil ecosystems—interfere with the growth and activity of plant pathogens.

These biocontrol agents, which include free-living fungi, bacteria, and actinomycetes, function effectively in diverse environments such as the rhizosphere, soil, and foliage. The market’s expansion is primarily driven by rising consumer demand for organic and residue-free food, supported by favorable government initiatives and increasing adoption of sustainable farming practices.

- Every year, up to 40% of global crop production is lost due to plant pests and diseases. These losses cost the global economy over USD 220 billion annually. Invasive pests alone cost countries at least USD 70 billion each year, and these pests are also significant drivers of biodiversity loss.

Regulatory bodies across regions—particularly in Europe, the U.S., and Brazil—are accelerating the registration of bio-based inputs, reflecting a global shift toward environmentally friendly agriculture. However, the market faces restraints from competition with chemically dominant fungicides, which continue to outperform biologicals in large-scale, conventional systems due to higher reliability and established supply chains.

Technological innovation represents the next major growth wave, with biotech advancements enhancing microbial stability, formulation efficiency, and field performance. Integration of artificial intelligence (AI) is also transforming disease detection and precision agriculture, paving the way for predictive crop protection systems. Geopolitically, new U.S. tariffs on copper and agricultural imports are reshaping trade flows and production costs, indirectly promoting biofungicide adoption as farmers seek cost-stable, eco-safe alternatives.

- According to the OECD-FAO Agricultural Outlook, global food consumption is projected to grow by approximately 1.3% annually over the next decade. Much of this rise is driven by middle-income countries—especially India, Southeast Asia, and parts of Africa—where calorie intake per capita is expected to increase by 7% by 2033. This intensification in food demand directly fuels the need for agrochemicals to maintain and extend agricultural productivity.

Key Takeaways

- The global biofungicides market was valued at USD 3.3 billion in 2024.

- The global biofungicides market is projected to grow at a CAGR of 15.3% and is estimated to reach USD 13.4 billion by 2034.

- Between types, microbial accounted for the largest market share of 83.1%.

- Among formulations, liquid dominated the market with the largest share of 63.0%.

- Based on application methods, foliar spray accounted for the majority of the market share at 39.1%.

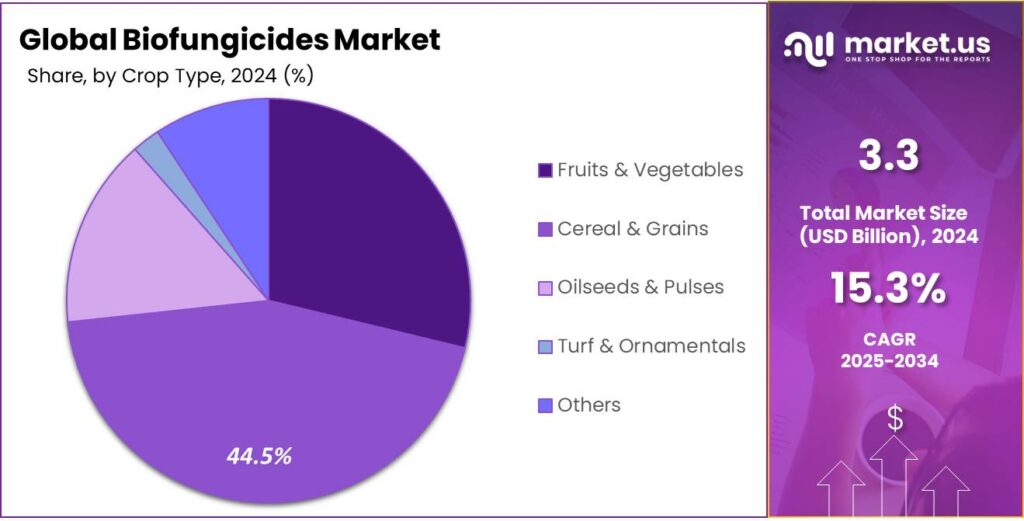

- Among crop types, cereal & grains held a market share of 44.5%.

- North America is estimated as the largest market for Biofungicides with a share of 38.2% of the market share.

- Asia Pacific is estimated second largest growing market with a CAGR of 16.4%

Type Analysis

Microbial Biofungicides Dominated the Global Market

Based on type, the market is further divided into microbial, botanical & others. As of 2024, microbial biofungicides dominated the biofungicides market with an 83.1% share due to their proven effectiveness, broad-spectrum activity, and compatibility with sustainable agricultural practices. Microbial products, derived from beneficial bacteria, fungi, and actinomycetes, are highly effective in controlling a wide range of plant pathogens through mechanisms such as competition, antibiosis, and induced systemic resistance. Their adaptability to diverse crops, soils, and climatic conditions has made them the preferred choice for farmers seeking reliable alternatives to synthetic fungicides.

Additionally, microbial biofungicides often improve soil health and plant vigor, offering dual benefits of disease management and crop productivity enhancement. Regulatory support and consumer demand for residue-free produce further accelerate their adoption, particularly in organic and integrated pest management systems. Compared to botanical and other categories, microbial biofungicides also benefit from greater commercialization, established product portfolios, and ongoing R&D investments, solidifying their leading position in the global market.

Global Biofungicides Market, By Type, 2020-2024 (USD Mn)

Type 2020 2021 2022 2023 2024 Microbial 1,632.4 1,844.1 2,088.8 2,369.2 2,703.5 Bacteria 925.0 1,045.1 1,183.6 1,342.3 1,531.5 Fungi 511.7 578.6 656.4 745.7 852.3 Others 195.7 220.4 248.7 281.2 319.7 Botanical 255.1 287.0 323.7 365.5 415.2 Others 83.2 93.8 106.0 120.0 136.4 Formulation Analysis

The bio-fungicides market, segmented by formulation, is classified into solid and liquid types. Among these, the liquid formulation dominates the market, owing to its ease of application, higher absorption efficiency, and suitability for diverse crops and climatic conditions. In 2024, the liquid form accounted for 63.0% of the total market share, reflecting its widespread adoption in modern agriculture. Liquid bio-fungicides are particularly preferred in foliar sprays, seed treatments, and soil applications, as they provide uniform coverage, enhanced shelf stability, and quicker action against fungal pathogens.

The rising adoption of precision farming techniques, combined with the increasing demand for sustainable crop protection inputs, further accelerates the use of liquid formulations compared to solid counterparts. This dominance highlights the pivotal role of liquid bio-fungicides in supporting integrated pest management practices and promoting eco-friendly disease control solutions across global agricultural systems.

Global Biofungicides Market, By Formulation, 2020-2024 (USD Mn)

Formulation 2020 2021 2022 2023 2024 Solid 723.6 818.0 927.7 1,053.6 1,203.8 Liquid 1,247.2 1,407.0 1,590.8 1,801.0 2,051.3 Application Method Analysis

Foliar Spray Role In Widely Preferred, Hence Animal Feed Dominates the Market

Based on the application method, the global biofungicides market is segmented into foliar spray, soil treatment, seed treatment, and others, with foliar spray emerging as the dominant category, accounting for 39.2% of the total market share. Foliar spray application is widely preferred because it allows direct and immediate contact of the biofungicide with the plant surface, ensuring rapid protection against fungal pathogens that typically attack leaves, stems, and other aerial parts. This method enhances absorption efficiency and provides a faster curative effect, making it especially effective in high-value crops such as fruits, vegetables, and ornamentals, where leaf and stem diseases are most prevalent. Foliar sprays are also relatively easy to apply using conventional spraying equipment, which further drives their adoption among both smallholder farmers and large-scale agricultural producers. Additionally, advancements in formulation technologies, such as the development of biofungicides with greater adhesion and rainfastness, have increased the effectiveness of foliar sprays, reinforcing their market leadership.

Global Biofungicides Market, By Application Method, 2020-2024 (USD Mn)

Application Method 2020 2021 2022 2023 2024 Foliar Spray 789.9 887.0 998.0 1,124.6 1,276.7 Soil Treatment 576.0 652.8 742.3 845.2 968.1 Seed Treatment 389.6 440.4 498.9 565.9 645.2 Others 215.2 244.8 279.2 318.9 365.1 By Crop Type

Based on the crop type, the market is further divided into fruits & vegetables, cereal & grains, oilseeds & pulses, turf & ornamentals & others. Cereal & grains dominated the biofungicides market with a 44.5% share primarily due to their large-scale cultivation area, high susceptibility to fungal infections, and rising demand for sustainable crop protection solutions. Cereals such as wheat, rice, and maize are staple crops that form the backbone of global food security, covering the majority of the world’s arable land. These crops are highly prone to fungal diseases such as rusts, smuts, blights, and mildews, which can significantly reduce yield and grain quality if not effectively managed.

Consequently, farmers are increasingly adopting biofungicides as an environmentally friendly alternative to synthetic chemicals to combat these widespread fungal issues while ensuring long-term soil health. In addition, biofungicides play a crucial role in integrated pest management (IPM) programs for cereal and grain crops. They enhance plant resistance and improve microbial balance in the rhizosphere, reducing dependence on chemical fungicides and minimizing residue accumulation in harvested produce. The shift toward sustainable agriculture, driven by regulatory restrictions on chemical pesticide use and consumer preference for residue-free grains, further strengthens the adoption of biofungicides in this segment.

Key Market Segments

By Type

- Microbial

- Bacteria

- Fungi

- Others

- Botanical

- Others

By Formulation

- Solid

- Liquid

By Application Method

- Foliar Spray

- Soil Treatment

- Seed Treatment

- Others

By Crop Type

- Fruits & Vegetables

- Cereal & Grains

- Oilseeds & Pulses

- Turf & Ornamentals

- Others

Drivers

Consumer Demand for Organic and Residue-Free Food Is Boosting the Biofungicides Market Growth

Shifting consumer preferences toward organic, sustainable, and residue-free food have become a major driver in the global expansion of biofungicides. Across markets, there is growing scrutiny of the chemical residues in agricultural products, driven by heightened awareness of health, environmental, and ecological impacts. In Brazil, systematic studies have documented that occupational pesticide exposure among farm workers is linked to severe health effects, including hematological, endocrine, and neurological disorders, and even cancer. Such findings reinforce the societal demand to reduce dependency on synthetic pesticides and accelerate the adoption of safer alternatives.

At the same time, regulatory environments in many countries are evolving to support biological solutions. Brazil, for instance, has advanced the registration and commercialization processes for bio-inputs, leading to a surge in the number of approved biological products. By the end of 2024, the Ministry of Agriculture, Livestock, and Supply (MAPA) had already registered over 100 biofungicides, alongside hundreds of bioinsecticides and bionematicides. This regulatory facilitation has lowered barriers for producers while ensuring farmers have access to tools that align with consumer expectations for residue-free food production.

- Total organic-certified land in the U.S. has steadily trended upward since 2000, reaching 4.89 million acres in 2021. Market access for organic producers has grown significantly: in 2021, 55.6% of organic food sales occurred through conventional grocery retailers, surpassing natural food stores.

- Federal support has risen in parallel, with authorized USDA funds for the Organic Agriculture Research & Extension Initiative increasing from $3 million in 2002 to $50 million in 2023.

- In 2021, a total of 76.4 million hectares of land worldwide were managed under organic agricultural practices, representing 1.6% of the global farmland area. During the same year, the area of organic farmland grew by 1.7%, reflecting the continued expansion of organic farming systems across the globe.

Restraints

Competition With Chemically Dominant Fungicides in Conventional Agricultural Systems

Competition from chemically dominant fungicides within conventional agricultural systems constitutes a substantive restraint on the biofungicides market, owing to entrenched performance, supply-chain, and operational advantages of synthetic products that biologicals have not yet fully offset. Synthetic fungicides—ranging from multisite protectants to modern single-site systemics with preventive and curative activity—provide broad, reproducible efficacy across diverse crops, geographies, and disease pressures, and they are deeply integrated into agronomic recommendations, procurement routines, and farm operations.

By contrast, biofungicides—typically microbial or biologically derived agents—exhibit efficacy that is highly contingent upon environmental and biological variables, yielding greater variability between laboratory/greenhouse performance and field outcomes. The predominantly preventive mode of action of several biofungicides, their pathogen- or stage-specific activity, and the need for precise timing and repeated applications limit their reliability during acute, high-pressure epidemics or in systems facing mixed-pathogen complexes.

Opportunity

Biotech Advancements Create New Opportunities in Formulations of Biofungicides

Biotechnological advancements are revolutionizing the development of biofungicides, providing new pathways for improving efficacy, stability, and scalability in agricultural disease management. Traditional microbial biofungicides, while environmentally safe and target-specific, have long faced challenges related to inconsistent field performance, limited shelf life, and difficulties in mass production. However, modern biotechnology—including genetic engineering, synthetic biology, metagenomics, and advanced fermentation processes—is now addressing these barriers and creating opportunities for next-generation formulations.

One of the most significant developments is the use of genetic engineering and synthetic biology to enhance the traits of beneficial microorganisms. Through genome editing, researchers can improve stress tolerance, spore viability, and metabolite production of microbial strains, making them more robust under diverse field conditions. For instance, bioengineered Trichoderma and Bacillus strains are being optimized to withstand variations in temperature and humidity, ensuring more consistent disease suppression in open-field environments.

- One of the most significant impacts of biotechnology in agrochemicals is the rise of bio-based crop protection products, including bio-pesticides and bio-stimulants. According to the U.S. Department of Agriculture (USDA), the bio-pesticides market has seen double-digit growth in recent years, with microbial-based formulations making up more than 50% of new pesticide registrations in the U.S. since 2015. These products offer a natural and less toxic alternative to synthetic chemicals, often with highly specific modes of action that reduce harm to beneficial insects, soil organisms, and surrounding ecosystems. Biotechnology also supports the development of genetically engineered (GE) crops that require fewer chemical inputs.

Trends

Integration of Artificial Intelligence is Shaping the Future of the Biofungicides Industry

The integration of Artificial Intelligence (AI) is increasingly shaping the future of the biofungicides industry by enabling smarter, data-driven approaches to disease management, precision application, and sustainability. Traditionally, biofungicides have faced challenges such as inconsistent field performance, limited persistence, and difficulties in achieving targeted application; however, AI-driven technologies are addressing these barriers and opening new avenues for growth.

Through computer vision and image recognition, AI-powered drones and ground-based robots can continuously monitor crop health in real time, analyzing high-resolution images to identify early signs of fungal infections, classify disease types based on visual cues such as color, texture, or lesion patterns, and track the spread of pathogens across entire fields. This early detection capability ensures that biofungicides can be applied preventively, at the most effective timing, rather than reactively when infections are already severe. Coupled with automation and robotics, AI further enhances the precision of fungicide delivery.

Geopolitical Impact Analysis

China Export Effect on the EU Market & US Tariff Impact On The Biofungicides Market.

The implementation of new U.S. agricultural and metal tariffs in 2025, particularly those affecting copper and imported agricultural products, is expected to have a mixed impact on the global biofungicides market. On one hand, tariffs on refined copper—a critical raw material in conventional fungicides—will likely raise input costs for synthetic fungicide manufacturers.

As the tariff raises copper prices by $2.50–$3.00 per pound, the cost of high-copper-load fungicides such as Kocide 3000, Champ WG, and Cuprofix Ultra is projected to increase by 5–10%, while low-load products such as Cueva or Mastercop may rise 3% or less. This price inflation could push both distributors and farmers, especially organic and small-scale producers, to seek biofungicide alternatives such as Bacillus subtilis, Trichoderma harzianum, and Streptomyces-based products. Consequently, the biofungicides market may benefit positively, as growers aim to maintain crop protection efficacy while managing costs and aligning with sustainable agricultural standards.

However, broader agricultural trade disruptions triggered by tariffs on imported crops such as soybeans, corn, fruits, and vegetables pose potential challenges. The 53% decline in U.S. agricultural exports to China during previous tariff rounds reshaped trade flows and hurt farm incomes, reducing growers’ purchasing power.

A similar pattern in 2025 could dampen short-term biofungicide adoption, as higher production costs and volatile commodity prices limit farmers’ ability to invest in new technologies. While U.S. tariffs may initially strain agricultural input markets and cause price volatility, they are expected to create a long-term positive shift toward biofungicides, driven by the need for cost-stable, eco-friendly, and non-metal-based crop protection solutions that align with global sustainability trends.

Regional Analysis

North America Dominated the Global Biofungicides Market

In 2024, North America led the global biofungicides market with a dominant 38.2% share, driven by the region’s accelerating transition toward sustainable, eco-friendly agriculture and heightened awareness of soil health and climate resilience. The United States remains the primary contributor, supported by its expansive agricultural base exceeding 900 million acres and the strong presence of fruit, vegetable, and specialty crop sectors that demand residue-free disease management solutions.

Government initiatives, including the USDA’s support for conservation and organic farming programs, have further encouraged growers to adopt microbial-based fungicides as part of integrated pest management (IPM) systems. These factors, combined with rising consumer demand for organic produce and increasing investments from leading agrochemical companies in biocontrol innovation, have positioned North America as a global leader in biofungicide adoption.

- The U.S. agricultural economy extends well beyond traditional farming to encompass a wide array of farm-related industries. Agriculture, food, and related sectors collectively contributed 5.5% to the U.S. gross domestic product (GDP) in 2023, equating to approximately $1.537 trillion, according to data from the Bureau of Economic Analysis. Within this, America’s farms accounted for $222.3 billion—roughly 0.8% of total GDP. Furthermore, the agriculture sector provided 10.4% of U.S. employment, and food expenditures accounted for 12.9% of average household budgets, underscoring the sector’s broad economic and social significance.

Global Biofungicides Market, By Region, 2020-2024 (USD Mn)

Region 2020 2021 2022 2023 2024 North America 467.5 700.4 1,050.7 1,577.2 2,368.9 Europe 1,207.4 1,851.1 2,841.9 4,366.4 6,713.5 Asia Pacific 602.5 902.2 1,353.5 2,032.9 3,056.8 Middle East & Africa 62.5 89.9 129.4 186.5 269.0 Latin America 160.0 235.8 347.9 513.6 758.9 Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Product Innovation, Strategic Partnerships, And Geographic Expansion Are The Key Strategies Of Major Players In the Biofungicides Market.

The key strategies of major players in the Biofungicides Market center around product innovation, strategic partnerships, and geographic expansion to meet growing demand for sustainable crop protection solutions. Leading companies such as Bayer AG, BASF SE, Syngenta AG, UPL Limited, and Corteva Agriscience are heavily investing in R&D to develop next-generation biofungicides based on advanced microbial strains, botanicals, and RNA-based technologies that offer broader spectrum control and improved field stability. Several players are pursuing collaborations and acquisitions with biotech startups to strengthen their biological portfolios and accelerate regulatory approvals.

Additionally, firms are expanding into emerging markets in Asia-Pacific and Latin America, where sustainable agriculture initiatives are rapidly evolving. Digital agriculture platforms and precision farming tools are being integrated to optimize biofungicide use, enhancing efficacy and return on investment. Collectively, these strategies reflect a shift toward sustainable innovation and data-driven crop protection ecosystems in the global biofungicides landscape.

The major players in the industry

- BASF SE

- Bayer AG

- Bioworks Inc.

- Corteva Agriscience

- Seipasa SA

- Nufarm

- UPL Ltd.

- Koppert B.V.

- Novonesis Group

- FMC Corporation

- Certis USA L.L.C.

- Andermatt Group AG

- Lallemand Inc.

- Gowan Company

- AgriLife

- Other Key Players

Key Development

In October 2025, Gowan Company acquires Ceradis B.V., a Netherlands-based biocontrol innovator specializing in sustainable disease management solutions. This acquisition expands Gowan’s biocontrol formulations and enhances its global biological crop protection portfolio, positioning the company as a leading player in sustainable fungicide alternatives.

In April 2024, UPL Ltd. completed the acquisition of Corteva’s Dithane mancozeb business, strengthening its crop protection footprint and bio-based product offerings. Concurrently, UPL launched Thiopron biofungicide in Australia, targeting grapevine diseases as part of its NPP BioSolutions expansion.

In March 2024, Certis Biologicals (USA) acquired Howler and Theia biofungicides from AgBiome, expanding its biofungicide product line and ensuring production continuity to meet rising demand for biological disease control solutions.

In February 2023, Bayer AG partnered with Kimitec Group to co-develop two next-generation biological products—Ambition Complete Gen2 and Ambition Secure Gen2—under its biologicals innovation program. These biofungicides represent Bayer’s ongoing strategy to expand its sustainable crop protection portfolio and reduce chemical dependency.

Report Scope

Report Features Description Market Value (2024) USD 3.3 Bn Market Volume (2024) XX Tons Forecast Revenue (2034) USD 13.4 Bn CAGR (2025-2034) 15.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Microbial, Botanical & Others), By Formulation (Solid & Liquid), By Application Method (Foliar Spray, Soil Treatment, Seed Treatment & Others), By Crop Top (Fruits & Vegetables, Cereal & Grains, Oilseeds & Pulses, Turf & Ornamentals & Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape BASF SE, Bayer AG, Bioworks Inc., Corteva Agriscience, Seipasa SA, Nufarm, UPL Ltd., Koppert B.V., Novonesis Group, FMC Corporation, Certis USA L.L.C., Andermatt Group AG, Lallemand Inc., Gowan Company, AgriLife & Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- BASF SE

- Bayer AG

- Bioworks Inc.

- Corteva Agriscience

- Seipasa SA

- Nufarm

- UPL Ltd.

- Koppert B.V.

- Novonesis Group

- FMC Corporation

- Certis USA L.L.C.

- Andermatt Group AG

- Lallemand Inc.

- Gowan Company

- AgriLife

- Other Key Players