Global Air Blast Freezer Market By Type (Continuous Blast Freezer, Batch Blast Freezer), By Portability (Portable, Stationary), By Capacity (Upto 300 Kg/hr, 300 to 500 Kg/hr, 500 to 700 Kg/hr, Above 700 Kg/hr), By End-User (Food Service, Transportation, Pharmaceutical, Healthcare, Bakery and Confectionery, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: March 2025

- Report ID: 141624

- Number of Pages: 312

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

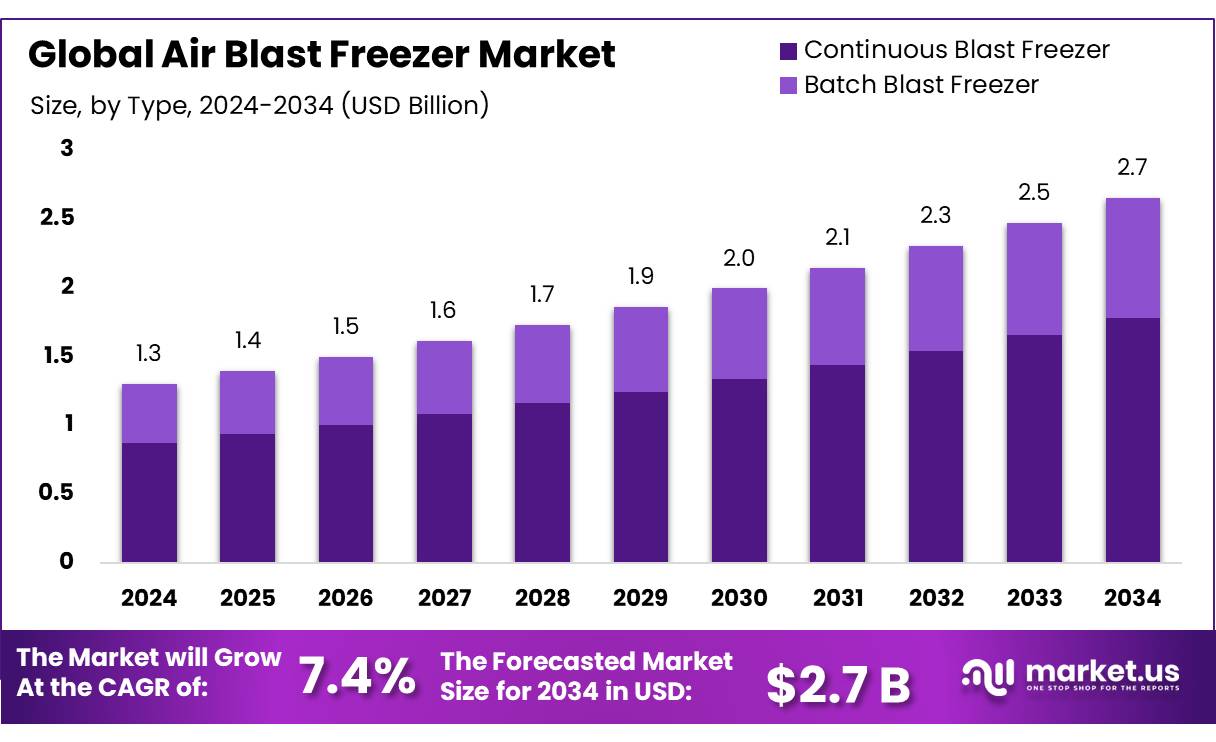

The Global Air Blast Freezer Market size is expected to be worth around USD 2.7 Bn by 2034, from USD 1.3 Bn in 2024, growing at a CAGR of 7.40% during the forecast period from 2025 to 2034.

The Air Blast Freezer market is undergoing significant transformation, driven by the rising demand for frozen food products and the increasing need for efficient cold storage solutions. These freezers play a vital role in rapidly reducing the temperature of perishable items, particularly food products, to maintain freshness and inhibit bacterial growth. Widely used across various industries, including seafood, meat processing, dairy, pharmaceuticals, and specialty chemicals, air blast freezers are becoming indispensable in ensuring product quality and safety.

Government initiatives aimed at bolstering food processing infrastructure have also positively impacted the market. In the European Union, funding programs for small and medium-sized enterprises (SMEs) in the food and beverage sector encourage the adoption of advanced freezing technologies to enhance export capabilities. Similarly, in the United States, support from the Department of Agriculture for technological advancements in food processing has led to increased investments in air blast freezing systems.

Looking ahead, the market holds vast growth opportunities, driven by technological innovations such as automation and energy-efficient freezing systems. The integration of Internet of Things (IoT) technologies for real-time monitoring and control of freezing processes is expected to enhance operational efficiency and product quality. Analysts project that the adoption of such advanced technologies could help the industry achieve up to 20% savings in energy costs annually, further solidifying the market’s potential for sustained expansion.

Key Takeaways

- Air Blast Freezer Market size is expected to be worth around USD 2.7 Bn by 2034, from USD 1.3 Bn in 2024, growing at a CAGR of 7.40%.

- Continuous Blast Freezers emerged as a prominent segment in the air blast freezer market, securing a substantial 67.40% share.

- Stationary air blast freezers held a dominant position in the market, capturing more than a 69.30% share.

- Air blast freezers with a capacity ranging from 300 to 500 Kg/hr held a dominant market position, capturing more than a 37.30% share.

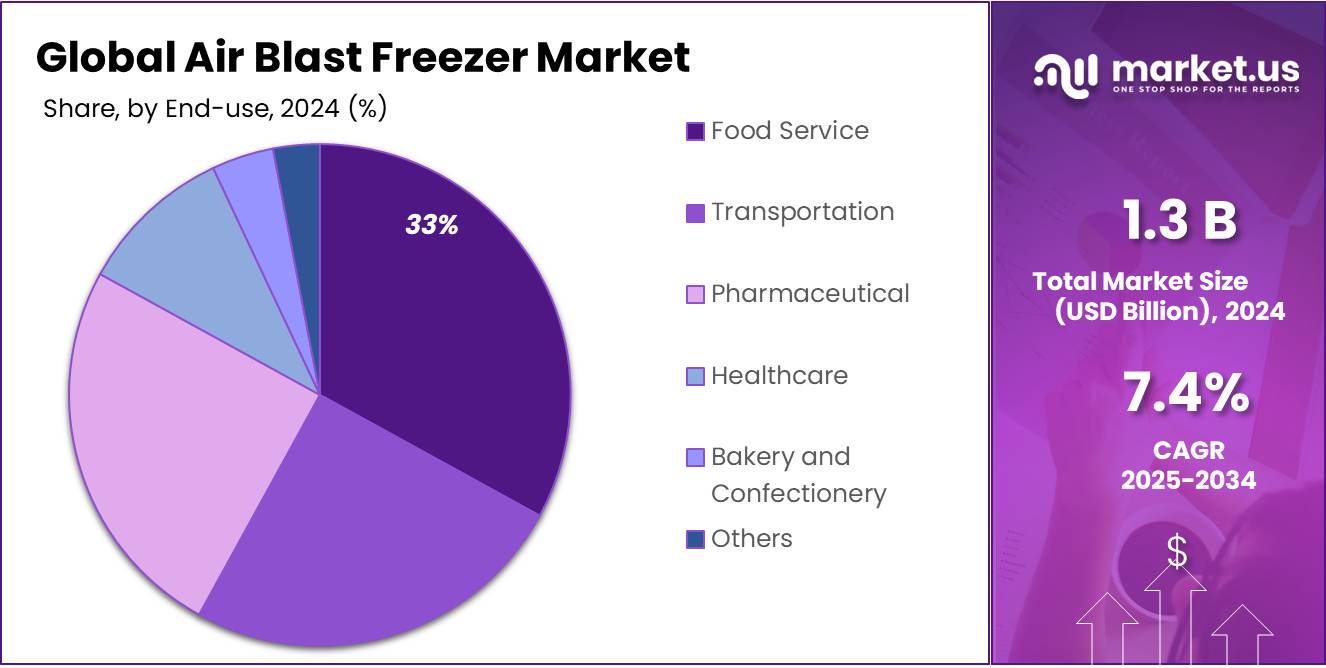

- Food Service sector held a dominant market position in the air blast freezer market, capturing more than a 33.10% share.

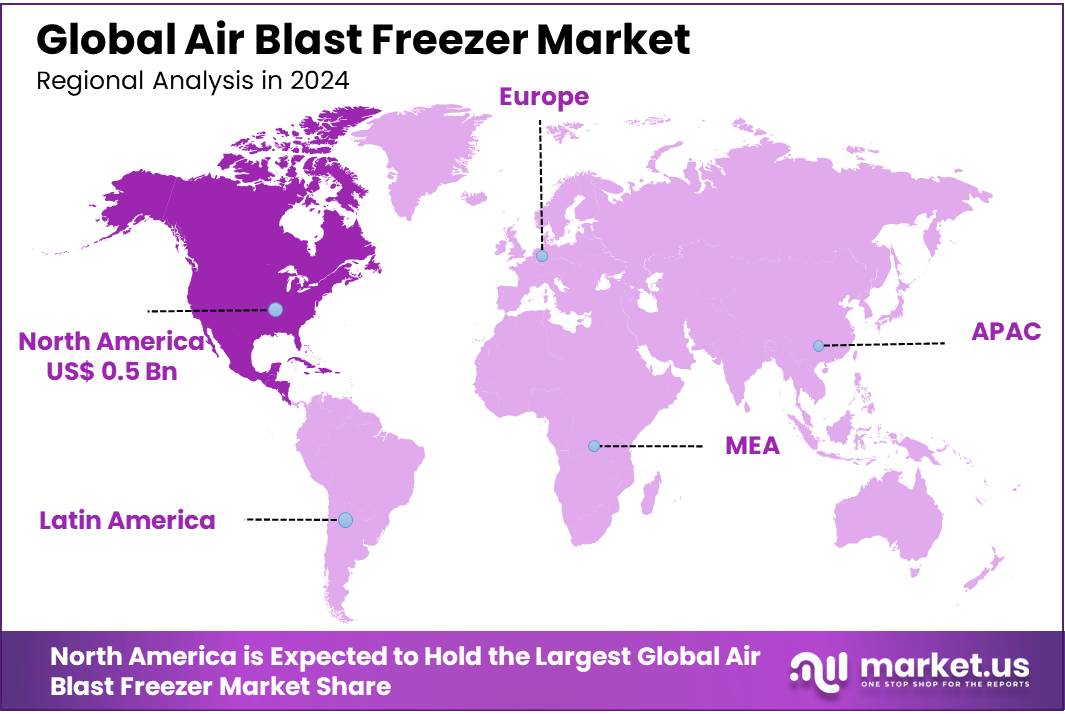

- North America stands out as a dominant region, holding a substantial 42.10% market share, valued at approximately USD 0.5 billion.

By Type

In 2024, Continuous Blast Freezers emerged as a prominent segment in the air blast freezer market, securing a substantial 67.40% share. This type of freezer is favored for its efficiency in cooling and freezing large quantities of products rapidly, making it an essential asset in industries that require quick freezing to maintain the quality and safety of perishable goods.

The design and operational features of continuous blast freezers facilitate a streamlined workflow, allowing for the uninterrupted processing of items on a large scale, which significantly contributes to their dominant position in the market. The ability to maintain a consistent temperature and speed throughout the freezing process not only enhances product quality but also increases overall productivity, making these systems highly sought after in sectors such as food processing and pharmaceuticals.

By Portability

In 2024, Stationary air blast freezers held a dominant position in the market, capturing more than a 69.30% share. This type of freezer is preferred primarily for its stability and capacity to handle large volumes, which is essential in settings where high throughput and consistent cooling are priorities. The stationary design is particularly advantageous in industrial environments where mobility is not required, such as large food processing plants or distribution centers.

These freezers are built to offer robust performance and durability, making them a key asset for businesses that need reliable long-term freezing solutions. Their ability to operate continuously without the need for movement also reduces wear and tear, further enhancing their appeal to industries that demand efficiency and longevity in freezing technology.

By Capacity

In 2024, air blast freezers with a capacity ranging from 300 to 500 Kg/hr held a dominant market position, capturing more than a 37.30% share. This segment caters effectively to medium-sized businesses that require a balance between volume capacity and spatial efficiency. These freezers are particularly popular in sectors like specialty food manufacturing, where moderate batches of high-quality products are the norm.

The 300 to 500 Kg/hr capacity is sufficient to meet the demands of businesses that need to process significant quantities of product without the extensive space and energy requirements of larger systems. This makes them a practical choice for companies looking to optimize their freezing processes while keeping operational costs in check. Their popularity is reflective of a market trend towards versatile, cost-effective solutions in food preservation and storage.

By End-User

In 2024, the Food Service sector held a dominant market position in the air blast freezer market, capturing more than a 33.10% share. This segment’s strong performance is largely due to the critical role these freezers play in maintaining the safety, quality, and flavor of food in various service settings, from small diners to large-scale catering operations. Food service businesses rely on air blast freezers to rapidly cool and freeze perishable items, which helps extend shelf life and reduces waste.

The ability of these freezers to bring down the temperature of cooked foods quickly also aids in meeting stringent food safety standards, making them indispensable in commercial kitchens. Their prominence within the food service industry underscores the ongoing need for efficient, reliable freezing solutions that can handle the fast-paced environment of food preparation and storage.

Key Market Segments

By Type

- Continuous Blast Freezer

- Batch Blast Freezer

By Portability

- Portable

- Stationary

By Capacity

- Upto 300 Kg/hr

- 300 to 500 Kg/hr

- 500 to 700 Kg/hr

- Above 700 Kg/hr

By End-User

- Food Service

- Transportation

- Pharmaceutical

- Healthcare

- Bakery and Confectionery

- Others

Drivers

Increasing Demand for Frozen Foods

One of the major driving factors for the growth of the air blast freezer market is the increasing consumer demand for frozen foods. This trend is supported by changing lifestyle patterns, where convenience and quick meal preparation are highly valued. According to data from the Food and Agriculture Organization (FAO), the global frozen food market has seen substantial growth, with the demand expected to continue rising at a significant pace.

The shift towards frozen foods can be attributed to their extended shelf life, which allows consumers to store food for longer periods without a loss in quality. This is particularly appealing in urban areas where work schedules can be unpredictable and shopping frequency is lower. Additionally, the improvement in freezing technology has helped maintain the nutritional content of frozen products, making them a healthier choice than traditionally perceived.

Governments are also playing a crucial role in promoting the use of technologies like air blast freezers through various initiatives. For instance, food safety regulations in numerous countries now recommend rapid cooling of food products as a standard practice to inhibit bacterial growth and ensure food safety. These regulatory frameworks are pushing food service providers and processors to adopt advanced freezing solutions.

Moreover, during the COVID-19 pandemic, there was a notable surge in the stocking of frozen food products as consumers prepared for lockdowns and restricted access to fresh food supplies. This behavior underscored the importance of frozen foods in modern dietary habits and contributed significantly to the accelerated adoption of air blast freezing technology in the food industry.

The combination of consumer preferences, technological advancements, and supportive government policies is expected to continue driving the market for air blast freezers, ensuring they remain an integral part of food preservation and safety processes in the coming years.

Restraints

High Initial Investment Costs

A significant restraining factor impacting the growth of the air blast freezer market is the high initial investment required for the installation and operation of these systems. Air blast freezers, particularly those designed for industrial use, involve substantial upfront costs related to acquisition, installation, and the necessary infrastructure modifications to accommodate these large units.

The complexity and efficiency of air blast freezers also lead to higher manufacturing costs, which are ultimately passed on to the consumer. For many small and medium-sized enterprises (SMEs), these costs can be prohibitive, limiting their ability to adopt this technology despite the operational benefits. This economic barrier is particularly challenging in regions where businesses operate on thin margins and where frozen products are less integrated into local diets and food preparation practices.

Government initiatives aimed at supporting small businesses in technology adoption have been crucial but are often limited in scope. For example, subsidies and grants may be available, but they might not cover significant portions of the costs involved, which includes not just the purchase but also the maintenance and energy consumption of the freezers. Furthermore, the return on investment (ROI) can vary widely depending on the specific application and usage intensity, making some businesses hesitant to commit to such large initial expenditures.

The high energy requirements of air blast freezers also contribute to ongoing operational costs, which need to be factored into the total cost of ownership. While these systems are highly effective at rapidly reducing temperatures, they require substantial amounts of energy to do so, which can increase utility bills and impact long-term profitability.

Opportunity

Expanding Markets in Developing Countries

A significant growth opportunity for the air blast freezer market lies in expanding into developing countries. These regions are witnessing rapid urbanization and economic growth, leading to increased demand for processed and frozen foods. According to the United Nations, urbanization combined with overall population growth could add another 2.5 billion people to urban areas by 2050, with nearly 90% of this increase taking place in Asia and Africa. This shift is creating a burgeoning market for frozen food products, which require efficient storage solutions to maintain quality and nutritional value.

The growing middle class in these regions is more inclined towards convenience food options due to their increasingly busy lifestyles, further driving demand for frozen products. However, the penetration of advanced freezing technology like air blast freezers is still relatively low in these markets due to the high setup costs and lack of infrastructure. This presents a unique opportunity for manufacturers and suppliers of air blast freezers to invest in these emerging markets by establishing local production facilities or partnerships with local firms to reduce costs and enhance market reach.

Government initiatives across these regions support the growth of food processing industries by improving infrastructure, providing incentives for technology adoption, and enforcing food safety regulations that require efficient freezing technologies. For instance, several governments are implementing policies to boost their food processing sectors as a part of economic diversification plans and to enhance food security.

By capitalizing on these initiatives, companies can not only expand their operational footprint but also contribute to local economies by bringing advanced technologies, thereby fostering a more robust food supply chain. This strategic expansion can result in a win-win situation, where local markets gain access to superior food preservation methods, and companies tap into new revenue streams.

Trends

Integration of Smart Technology in Air Blast Freezers

A prevailing trend in the air blast freezer market is the integration of smart technology to enhance operational efficiency and food safety. The adoption of advanced sensors and Internet of Things (IoT) connectivity in air blast freezers is transforming how food processing industries manage their cooling and freezing processes. These technologies enable real-time monitoring and control of internal temperatures, humidity levels, and other critical parameters, directly from a smartphone or computer.

This trend is driven by the increasing emphasis on food safety regulations and energy efficiency in the food industry. Smart air blast freezers can automatically adjust settings to optimize energy use and maintain precise temperature control, significantly reducing the risk of product spoilage and energy waste. For instance, according to a report by a leading industry organization, the use of smart freezers can reduce operational costs by up to 30% through improved energy efficiency alone.

Governments and regulatory bodies are also supporting this trend through initiatives that promote the adoption of energy-efficient technologies in industrial applications. For example, several countries have implemented energy-saving grants and tax incentives for businesses that invest in smart technology to meet sustainability targets and reduce greenhouse gas emissions.

Additionally, the ability to integrate with broader food safety management systems allows companies to ensure compliance with international food safety standards, such as HACCP (Hazard Analysis and Critical Control Points). This integration facilitates better data recording and analysis, making it easier for companies to pass safety audits and maintain high standards of food quality.

Regional Analysis

North America stands out as a dominant region, holding a substantial 42.10% market share, valued at approximately USD 0.5 billion. This significant market presence is primarily driven by the robust food processing industry in the United States and Canada, where there is a high demand for frozen food products due to consumer preferences for convenience and quality.

The region’s dominance in the market is further supported by stringent food safety regulations enforced by agencies such as the U.S. Food and Drug Administration (FDA) and the Canadian Food Inspection Agency (CFIA). These regulations mandate the use of effective food preservation techniques, of which air blast freezing is a critical component.

Additionally, the North American market benefits from the presence of leading industry players who invest heavily in research and development, leading to technological advancements in freezer efficiency and energy consumption.

Moreover, North America is seeing a trend towards sustainability in the food processing industry, with both the United States and Canada implementing policies and incentives to promote energy-efficient technologies. This has encouraged the adoption of modern air blast freezers that are not only more efficient but also align with the environmental goals of reducing energy usage and minimizing carbon footprints.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Synergy Agro Tech Pvt. Ltd. is a recognized leader in the production of air blast freezers, catering primarily to the food processing industry. The company has built a reputation for delivering reliable and technologically advanced freezing solutions that enhance food safety and quality. Their commitment to innovation and customer service has positioned them as a key player in both domestic and international markets.

Cryo Systems specializes in providing comprehensive cooling and freezing systems, including air blast freezers. Known for their energy efficiency and durability, Cryo Systems’ products are designed to meet the rigorous demands of a variety of industries, from food processing to pharmaceuticals. Their focus on customizable solutions helps clients achieve optimal freezing outcomes.

Based in Spain, Sereva, SA offers a range of refrigeration and freezing technologies, with air blast freezers being one of their core products. Sereva is committed to innovation in the refrigeration sector, providing systems that are both efficient and environmentally friendly. Their products are well-regarded for their robustness and adaptability to different operational scales.

IRINOX S.p.A is renowned for its role in developing specialized air blast freezing solutions that cater to the gastronomy, pastry, and food processing sectors. Their freezers are acclaimed for rapid cooling abilities and preserving the freshness and nutritional quality of food. IRINOX continues to lead market trends with its focus on research and development, pushing the boundaries of what’s possible in food preservation technology.

Top Key Players in the Market

- Synergy Agro Tech Pvt. Ltd.

- Cryo Systems

- Sereva, SA

- IRINOX S.p.A

- MechAir.

- Kold Kraft

- Supercold Refrigeration Systems Pvt Ltd

- PatKol

- Blue Cold Refrigeration Pvt. Ltd

- KTI

- Kelvion Holding GmbH

- Linde plc

Recent Developments

Cryo Systems specializes in advanced air blast freezers, offering solutions like their containerized blast freezer, capable of freezing 4 tons of product in 8 hours using a 75HP Bitzer screw compressor.

Sereva, SA specializes in air blast freezer units, offering four ranges of blast chiller coils with capacities from 7 to 64 kW. These units are essential for rapidly lowering the internal temperature of food in cooling chambers, ensuring quality and safety.

Report Scope

Report Features Description Market Value (2024) USD 1.3 Bn Forecast Revenue (2034) USD 2.7 Bn CAGR (2025-2034) 7.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Continuous Blast Freezer, Batch Blast Freezer), By Portability (Portable, Stationary), By Capacity (Upto 300 Kg/hr, 300 to 500 Kg/hr, 500 to 700 Kg/hr, Above 700 Kg/hr), By End-User (Food Service, Transportation, Pharmaceutical, Healthcare, Bakery and Confectionery, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Synergy Agro Tech Pvt. Ltd., Cryo Systems, Sereva, SA, IRINOX S.p.A, MechAir., Kold Kraft, Supercold Refrigeration Systems Pvt Ltd, PatKol, Blue Cold Refrigeration Pvt. Ltd, KTI, Kelvion Holding GmbH, Linde plc, Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Synergy Agro Tech Pvt. Ltd.

- Cryo Systems

- Sereva, SA

- IRINOX S.p.A

- MechAir.

- Kold Kraft

- Supercold Refrigeration Systems Pvt Ltd

- PatKol

- Blue Cold Refrigeration Pvt. Ltd

- KTI

- Kelvion Holding GmbH

- Linde plc