Global Textured Wheat Protein Market Size, Share, And Business Benefits By Nature (Organic, Conventional), By Form (Granules, Chips and Chunks, Shreds), By End use (Meat Analogues, Ready-meals, Fillings, Comminuted Meat, Emulsified Meat, Protein Snacks and Bars, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: February 2025

- Report ID: 140923

- Number of Pages: 260

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

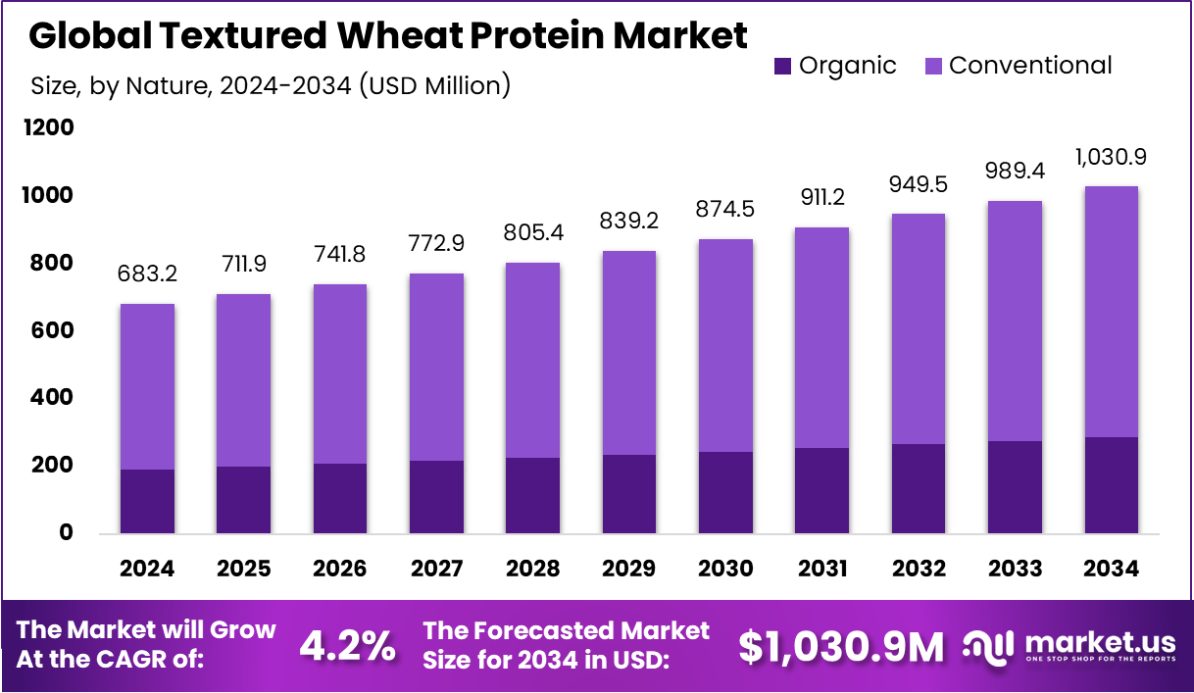

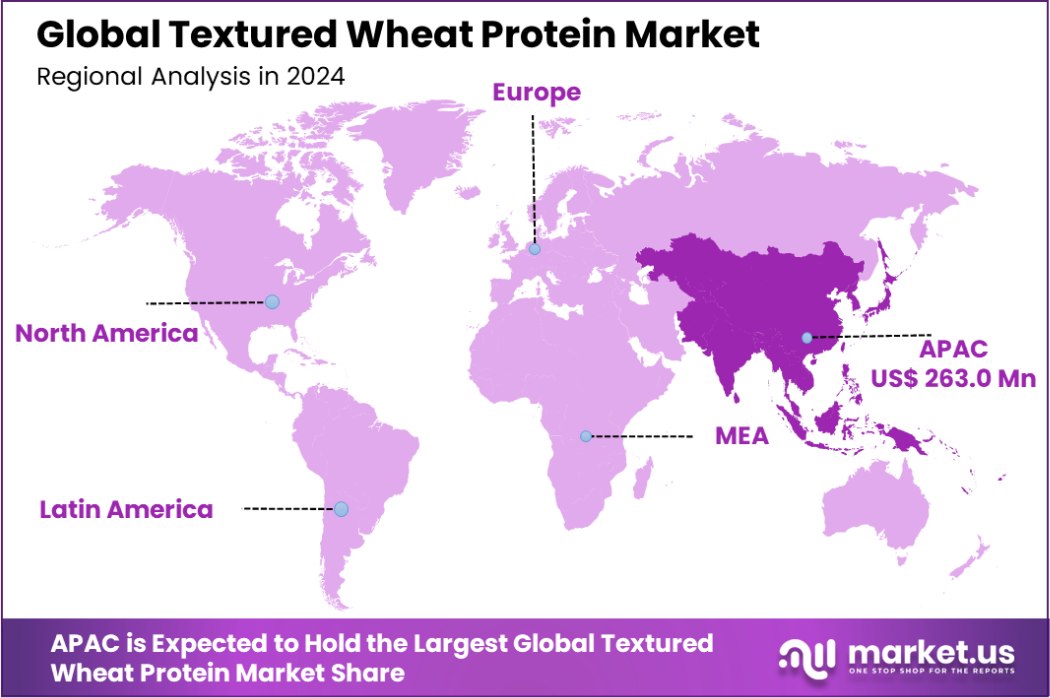

Global Textured Wheat Protein Market is expected to be worth around USD 1,030.9 Million by 2034, up from USD 683.2 Million in 2024, and grow at a CAGR of 4.2% from 2025 to 2034. Asia-Pacific leads the Textured Wheat Protein market with a 38.5% share.

Textured Wheat Protein (TWP) is a plant-based protein derived from wheat gluten. It is created through a process known as extrusion, where wheat gluten is heated, expanded, and shaped into a fibrous texture that mimics the look and feel of meat.

TWP is a popular ingredient in plant-based food products, particularly in vegetarian and vegan diets, as it provides a rich source of protein and an ideal texture for meat substitutes. It is commonly used in a variety of food applications, including sausages, burgers, nuggets, and ready-to-eat meals.

The Textured Wheat Protein Market has seen significant growth in recent years, driven by the increasing demand for plant-based alternatives to animal proteins. As more consumers opt for vegetarian, vegan, or flexitarian lifestyles, the demand for TWP continues to rise, with manufacturers innovating to create products that resemble traditional meat in both taste and texture. Additionally, TWP is gaining popularity due to its sustainability and lower environmental impact compared to animal-based proteins.

Key growth factors include the rising awareness of the health benefits of plant-based diets, concerns over animal welfare, and the environmental impact of meat production. With the growing inclination toward plant-based diets, consumers are seeking meat alternatives that are high in protein, low in fat, and nutritionally balanced.

The demand for TWP is being driven by shifting consumer preferences, especially in developed markets like North America and Europe. With increasing product availability in supermarkets and restaurants, more people are opting for plant-based alternatives. Moreover, TWP’s affordability compared to other plant proteins like soy and pea further boosts its appeal.

Opportunities in the Textured Wheat Protein market lie in expanding product offerings and innovations in taste and texture to attract a broader consumer base. By tapping into emerging markets and offering more customizable and functional products, manufacturers have the chance to establish a strong presence in the growing plant-based food industry.

Key Takeaways

- Global Textured Wheat Protein Market is expected to be worth around USD 1,030.9 Million by 2034, up from USD 683.2 Million in 2024, and grow at a CAGR of 4.2% from 2025 to 2034.

- The Textured Wheat Protein market is predominantly conventional, accounting for 72.3% of the total market share.

- Granules represent the leading form of Textured Wheat Protein, capturing 41.2% of market demand.

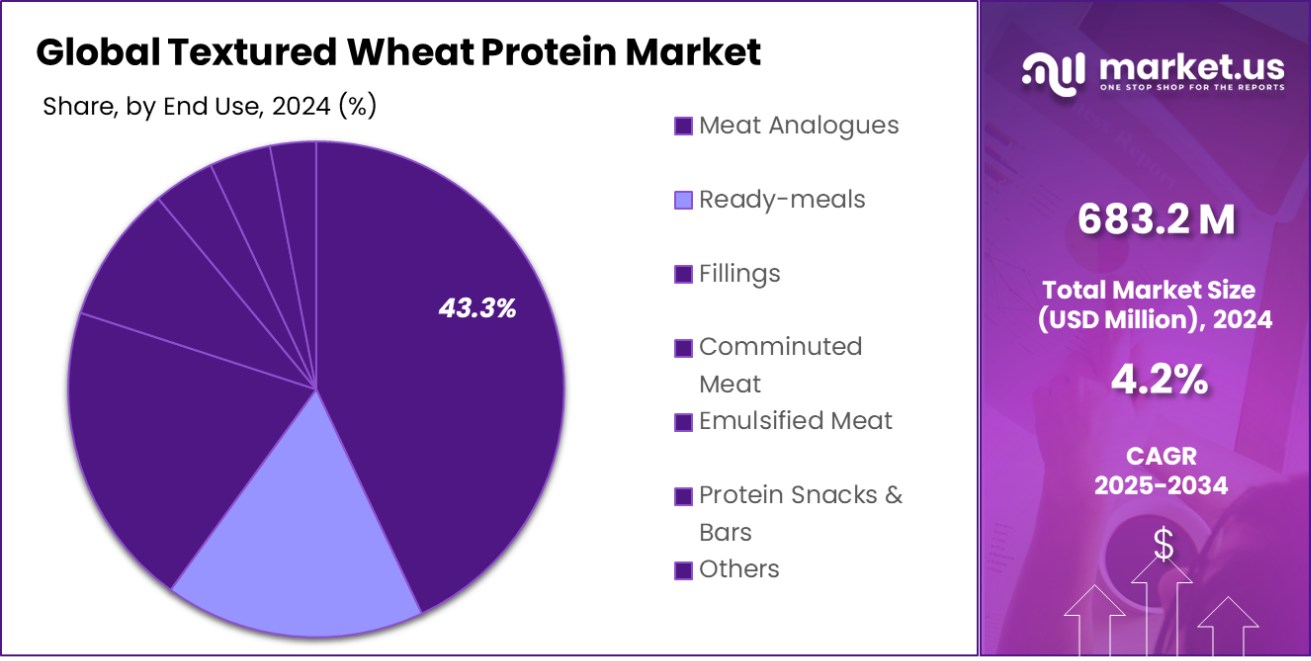

- Meat analogs are the primary end-use application, making up 43.3% of the overall market.

- Asia-Pacific leads the Textured Wheat Protein Market with a 38.5% share, valued at USD 263.0 million.

By Nature Analysis

Conventional Textured Wheat Protein holds 72.3% of the market share, dominating growth.

In 2024, Conventional held a dominant market position in the By Nature segment of the Textured Wheat Protein Market, with a 72.3% share. This dominance can be attributed to the widespread availability of conventional wheat protein in the global market, along with its established use in various food products.

Conventional Textured Wheat Protein is produced using traditional methods of extraction and processing, which have been optimized over time, resulting in a cost-effective and reliable protein source for manufacturers in the plant-based food sector.

The widespread preference for conventional options is also driven by its affordability and versatility in food applications such as plant-based meat substitutes, snacks, and processed foods.

Manufacturers have scaled production processes to meet rising consumer demand, enabling a consistent supply of conventional TWP across diverse regions. As a result, conventional TWP remains the go-to choice for many food producers aiming to offer affordable and functional plant-based protein alternatives.

However, while conventional TWP holds the majority market share, there is a growing interest in organic and specialized alternatives. As consumer demand for clean-label and sustainable products increases, the market for organic Textured Wheat Protein is expected to gain traction in the coming years, offering opportunities for diversification and innovation within the segment.

The Textured Wheat Protein Market is benefiting from significant investments in the protein sector. The Canadian government committed CAD 353 million (USD 260 million) to Protein Industries Canada from 2018 to 2028, supporting the growth of plant-based protein industries.

In the U.S., the Department of Agriculture provided a USD 25 million loan guarantee to Liberation Labs for a commercial-scale precision fermentation facility. Additionally, David, a platform focused on muscle growth and fat reduction, raised $10 million in seed funding to develop science-based, high-protein food products, highlighting the growing interest in protein innovations.

By Form, Analysis

Granules account for 41.2% of the Textured Wheat Protein market share.

In 2024, Granules held a dominant market position in the By Form segment of the Textured Wheat Protein Market, with a 41.2% share. The granules form of Textured Wheat Protein is widely favored due to its ease of use in various food applications, especially in the production of meat analogs such as plant-based sausages, burgers, and nuggets. Granules offer a desirable texture and are easily rehydrated, making them a preferred choice for manufacturers aiming to replicate the fibrous, meaty texture in plant-based products.

The dominance of granules can be attributed to their versatility, as they can be used in a wide range of food formulations, from ready-to-eat meals to snacks. This form of Textured Wheat Protein also provides cost-effective solutions for large-scale production while maintaining the necessary nutritional profile for plant-based diets. Granules are also more convenient for handling and processing, which adds to their appeal to food producers.

While granules continue to lead the market, there is potential for growth in other forms, such as flakes and powders, driven by evolving consumer preferences and the increasing demand for more customizable product formulations. However, granules are expected to remain the preferred choice due to their widespread applications and established production infrastructure.

By End-Use Analysis

Meat analogues represent 43.3% of the Textured Wheat Protein market demand.

In 2024, Meat Analogues held a dominant market position in the By End Use segment of the Textured Wheat Protein Market, with a 43.3% share. This growth can be attributed to the increasing consumer demand for plant-based meat substitutes as part of the global shift toward healthier and more sustainable diets.

Meat analogues, such as plant-based burgers, sausages, and nuggets, are among the most common applications of Textured Wheat Protein, as they provide a satisfying, meat-like texture while offering a rich source of plant-based protein.

The demand for meat analogues has been fueled by growing awareness of the environmental and health impacts of meat consumption, particularly in developed markets like North America and Europe. Additionally, the improvement in taste and texture of plant-based products has played a key role in driving consumer acceptance. As more consumers adopt vegetarian, vegan, or flexitarian diets, meat analogues are becoming an increasingly popular choice, further propelling the demand for Textured Wheat Protein.

While the meat analogues segment currently leads the market, there are emerging opportunities in other end-use categories such as bakery products and snacks, where Textured Wheat Protein is gaining traction. However, the meat analogues segment is expected to maintain its dominant share due to its central role in the plant-based protein trend.

Key Market Segments

By Nature

- Organic

- Conventional

By Form

- Granules

- Chips and Chunks

- Shreds

By End use

- Meat Analogues

- Ready-meals

- Fillings

- Comminuted Meat

- Emulsified Meat

- Protein Snacks and Bars

- Others

Driving Factors

Growing Demand for Plant-Based Meat Alternatives

One of the key driving factors of the Textured Wheat Protein (TWP) market is the growing demand for plant-based meat alternatives. As more consumers adopt vegetarian, vegan, and flexitarian diets, the need for protein-rich meat substitutes has surged.

Textured Wheat Protein, with its ability to mimic the texture and appearance of meat, has become a preferred ingredient in products like plant-based burgers, sausages, and nuggets.

This shift towards plant-based diets is driven by health-conscious consumers seeking to reduce their intake of animal products, concerns about the environmental impact of meat production, and rising awareness of animal welfare.

As a result, the plant-based meat alternative market, where TWP plays a significant role, continues to grow rapidly, propelling the demand for TWP in food applications.

Restraining Factors

Limited Consumer Awareness of Textured Wheat Protein

A key restraining factor in the Textured Wheat Protein (TWP) market is the limited consumer awareness surrounding this ingredient. While TWP is gaining traction in plant-based food products, many consumers are still unfamiliar with its benefits and applications.

This lack of awareness can slow the adoption of TWP, particularly in regions where plant-based diets are not as widespread.

Despite its versatility and nutritional benefits, such as being a high-protein, low-fat alternative to animal-based proteins, TWP faces competition from more well-known ingredients like soy and pea protein.

To overcome this challenge, manufacturers must invest in educating consumers about the advantages of TWP, highlighting its sustainability, versatility, and role in enhancing plant-based food offerings. Raising awareness can help expand its market presence.

Growth Opportunity

Expansion of Product Offerings in Emerging Markets

A significant growth opportunity for the Textured Wheat Protein (TWP) market lies in expanding product offerings in emerging markets. As disposable incomes rise and the adoption of healthier, plant-based diets increases in regions such as Asia-Pacific, Latin America, and the Middle East, there is a growing demand for protein-rich, sustainable alternatives to meat.

In these regions, TWP can be introduced in new formats like snacks, ready-to-eat meals, and traditional food products, catering to local tastes and dietary preferences. By diversifying product types and focusing on regional flavors, manufacturers can tap into this expanding market.

Additionally, introducing affordable, high-quality TWP options can help drive penetration in emerging markets, capitalizing on the rising interest in plant-based eating.

Latest Trends

Increased Innovation in Textured Wheat Protein Products

A key trend in the Textured Wheat Protein (TWP) market is the increased innovation in product formulations and applications. Manufacturers are constantly enhancing the texture, taste, and nutritional profile of TWP to make it more appealing to a broader consumer base.

This includes developing TWP that more closely mimics the texture and flavor of traditional meats and improving its versatility in plant-based meat alternatives like burgers, sausages, and meatballs.

There’s also growing innovation in combining TWP with other plant-based proteins, such as pea and soy, to enhance functional properties and meet consumer demands for more protein-rich products. This trend is critical for driving the market forward, as it helps manufacturers cater to evolving consumer preferences for better-tasting, healthier, and more sustainable plant-based food options.

Regional Analysis

In Asia-Pacific, the Textured Wheat Protein Market dominates with a 38.5% share, valued at USD 263.0 million.

In 2024, Asia-Pacific dominated the Textured Wheat Protein Market, holding a substantial share of 38.5%, valued at USD 263.0 million. The region’s dominance is driven by the increasing adoption of plant-based diets, rising disposable incomes, and growing awareness of health and sustainability. Countries like China and India are at the forefront of this trend, where the demand for plant-based protein alternatives is rapidly growing due to the rise of vegetarian and vegan populations.

North America followed with a strong market presence, supported by the region’s growing preference for plant-based meat alternatives. In the U.S., the shift towards more sustainable and healthier food choices has significantly contributed to the market’s growth. North America holds a significant portion of the market share, driven by high demand for food applications such as meat substitutes and protein-rich snacks.

Europe is also a major player in the market, with an increasing number of consumers opting for plant-based proteins, particularly in countries like the UK, Germany, and France. Europe’s market is driven by the rising awareness of the environmental impact of meat production and an established vegan community.

In Latin America and the Middle East & Africa, the market is still in a developing phase but shows promise due to changing dietary habits and growing interest in plant-based proteins, especially among health-conscious consumers. However, these regions are expected to experience slower growth compared to Asia-Pacific and North America in the near term.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, the global Textured Wheat Protein Market is characterized by the strong presence of key industry players that continue to shape the market dynamics through innovation, production capacity, and regional expansion.

ADM stands as a leader, leveraging its extensive experience in plant-based food ingredients and its robust distribution network to drive growth in the Textured Wheat Protein segment. Their continuous investment in research and development ensures they remain at the forefront of new product formulations and sustainable production methods.

AGRANA Beteiligungs-AG and Cargill also hold significant positions, driven by their vast agricultural and food processing capabilities. Both companies focus on enhancing the functionality and texture of wheat proteins to meet the evolving demand for plant-based meat alternatives.

BASF SE and BENEO GmbH, with their strong portfolios in food ingredients and plant-based proteins, are focusing on expanding the range of applications for Textured Wheat Protein, particularly in meat analogs and health-oriented products.

Anhui Reapsun Food and Crespel & Deiters Group are increasingly tapping into the growing demand in emerging markets like Asia-Pacific. Their ability to offer cost-effective solutions while maintaining high product quality positions them as strong contenders in the regional markets.

Foodchem International Corporation and GLICO NUTRITION CO., LTD., both key players from Asia, are making substantial inroads by focusing on local production and meeting the unique requirements of regional consumers, particularly in price-sensitive markets. Their innovation in flavor and texture customization is helping to fuel the growth of Textured Wheat Protein in Asia-Pacific, a dominating region in the market.

Top Key Players in the Market

- ADM

- AGRANA Beteiligungs-AG

- Anhui Reapsun Food

- BASF SE

- BENEO GmbH

- Cargill

- Crespel & Deiters Group

- Foodchem International Corporation

- GLICO NUTRITION CO., LTD.

- Incorporated

- Kerry and Givaudan

- Kröner -Starke GmbH

- Manildra Group

- MGP Ingredients, Inc.

- ROBERTET

- Roquette Frères

- TEREOS

- Wuhan Golden Wing Industry & Trade Co., Ltd

Recent Developments

- In November 2024, BENEO showcased new cost-effective plant-based solutions at Fi Europe 2024, demonstrating how producers can streamline their hybrid and fully plant-based development processes using textures from Meatless® and faba bean protein concentrate.

- In January 2024, Cargill launched a new textured protein solution called Cargill™ plant protein TEX PW80 M, made from peas and wheat. This product aims to mimic meaty textures in plant-based alternatives like burgers and meatballs.

Report Scope

Report Features Description Market Value (2024) USD 683.2 Million Forecast Revenue (2034) USD 1,030.9 Million CAGR (2025-2034) 4.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Nature (Organic, Conventional), By Form (Granules, Chips and Chunks, Shreds), By End use (Meat Analogues, Ready-meals, Fillings, Comminuted Meat, Emulsified Meat, Protein Snacks and Bars, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ADM, AGRANA Beteiligungs-AG, Anhui Reapsun Food, BASF SE, BENEO GmbH, Cargill, Crespel & Deiters Group, Foodchem International Corporation, GLICO NUTRITION CO., LTD., Incorporated, Kerry and Givaudan , Kröner -Starke GmbH, Manildra Group, MGP Ingredients, Inc., ROBERTET, Roquette Frères, TEREOS, Wuhan Golden Wing Industry & Trade Co., Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Textured Wheat Protein MarketPublished date: February 2025add_shopping_cartBuy Now get_appDownload Sample

Textured Wheat Protein MarketPublished date: February 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- ADM

- AGRANA Beteiligungs-AG

- Anhui Reapsun Food

- BASF SE

- BENEO GmbH

- Cargill

- Crespel & Deiters Group

- Foodchem International Corporation

- GLICO NUTRITION CO., LTD.

- Incorporated

- Kerry and Givaudan

- Kröner -Starke GmbH

- Manildra Group

- MGP Ingredients, Inc.

- ROBERTET

- Roquette Frères

- TEREOS

- Wuhan Golden Wing Industry & Trade Co., Ltd