Global Plant-based Butter Market By Source (Almond, Oat, Soy, Coconut, Others), By Type (Salted, Unsalted), By Nature (Organic, Conventional), By Flavor (Flavored Butter, Non-Flavored Butter), By Distribution Channel (Hypermarkets and Supermarkets, Specialty Stores, Convenience Stores, Online, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Jan 2025

- Report ID: 137725

- Number of Pages: 370

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

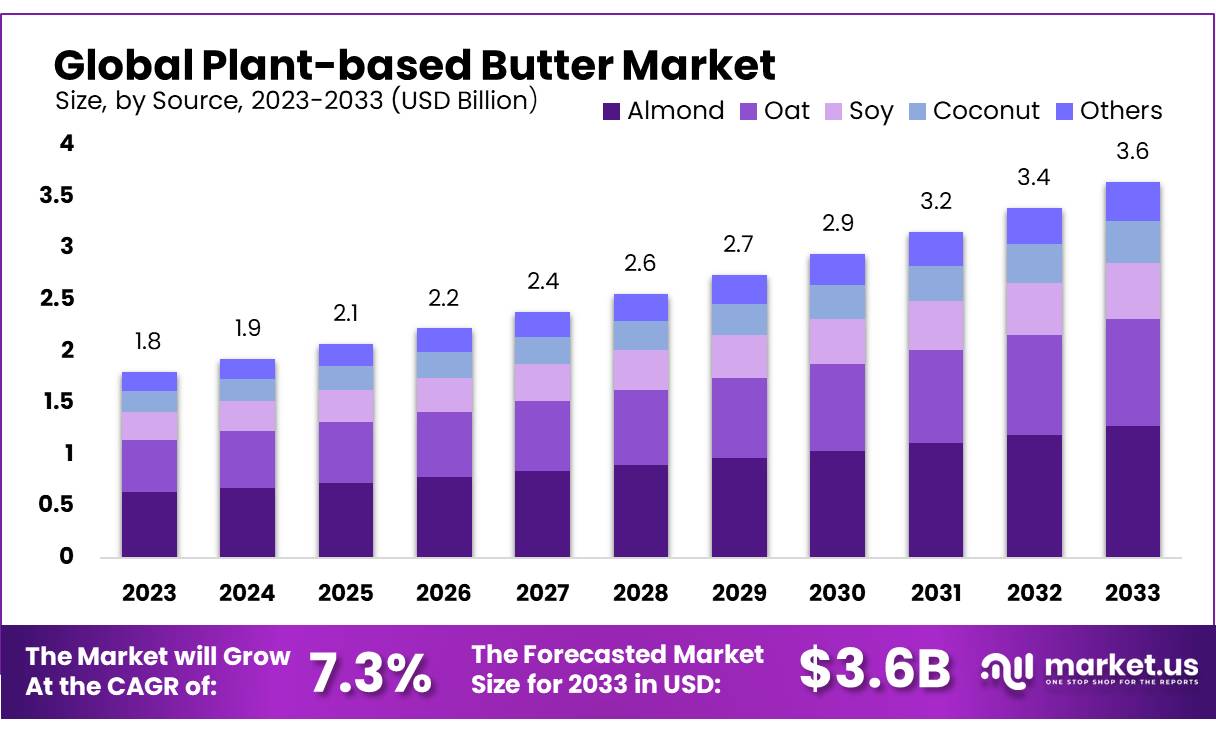

The Global Plant-based Butter Market size is expected to be worth around USD 3.6 Bn by 2033, from USD 1.8 Bn in 2023, growing at a CAGR of 7.3% during the forecast period from 2024 to 2033.

The plant-based butter market is experiencing substantial growth as consumers increasingly seek dairy-free alternatives driven by dietary preferences, health considerations, and environmental concerns. Plant-based butter is derived from ingredients such as almonds, cashews, coconut, soy, and various vegetable oils. These products cater to vegans, lactose-intolerant individuals, and those looking to reduce animal product consumption, aligning with global trends toward plant-based diets.

The rising demand for vegan and allergen-free food products, coupled with increased consumer awareness of the environmental impact of dairy farming, is driving market expansion. In regions like North America and Europe, the penetration of plant-based butter is particularly high, accounting for more than 60% of global market revenue to the well-established vegan consumer base.

Several factors are propelling the growth of the plant-based butter market. Increasing rates of lactose intolerance, affecting nearly 65% of the global population, are prompting consumers to switch to dairy-free alternatives. The adoption of plant-based diets is also gaining momentum, with nearly 10% of U.S. adults identifying as vegan or vegetarian in 2023, up from 5% a decade ago. Additionally, the environmental benefits of plant-based butter are attracting eco-conscious consumers. For instance, plant-based butter production emits fewer greenhouse gases and uses less water compared to dairy butter.

Key trends in the market include innovation in ingredients and flavors, as well as the development of healthier options. Manufacturers are focusing on creating plant-based butter with enhanced nutritional profiles, such as reduced saturated fat and added omega-3 fatty acids. Additionally, organic and non-GMO plant-based butter products are gaining traction as consumers seek clean-label and sustainable food options. Advances in technology have also improved the texture and taste of plant-based butter, making it a viable substitute for dairy butter in cooking and baking.

Future growth opportunities lie in the expansion of plant-based butter into untapped markets, particularly in Asia-Pacific and Latin America, where plant-based product adoption is rising. Increased investment in marketing and the expansion of distribution channels, including e-commerce, are expected to enhance product accessibility. Furthermore, the introduction of plant-based butter targeted at food service industries, such as bakeries and restaurants, is poised to drive additional demand.

Key Takeaways

- Plant-based Butter Market size is expected to be worth around USD 3.6 Bn by 2033, from USD 1.8 Bn in 2023, growing at a CAGR of 7.3%.

- Almond emerged as the dominant source in the plant-based butter market, capturing more than a 36.1% share.

- Salted plant-based butter held a dominant market position, capturing more than a 62.1% share.

- Conventional plant-based butter held a dominant market position, capturing more than a 71.1% share.

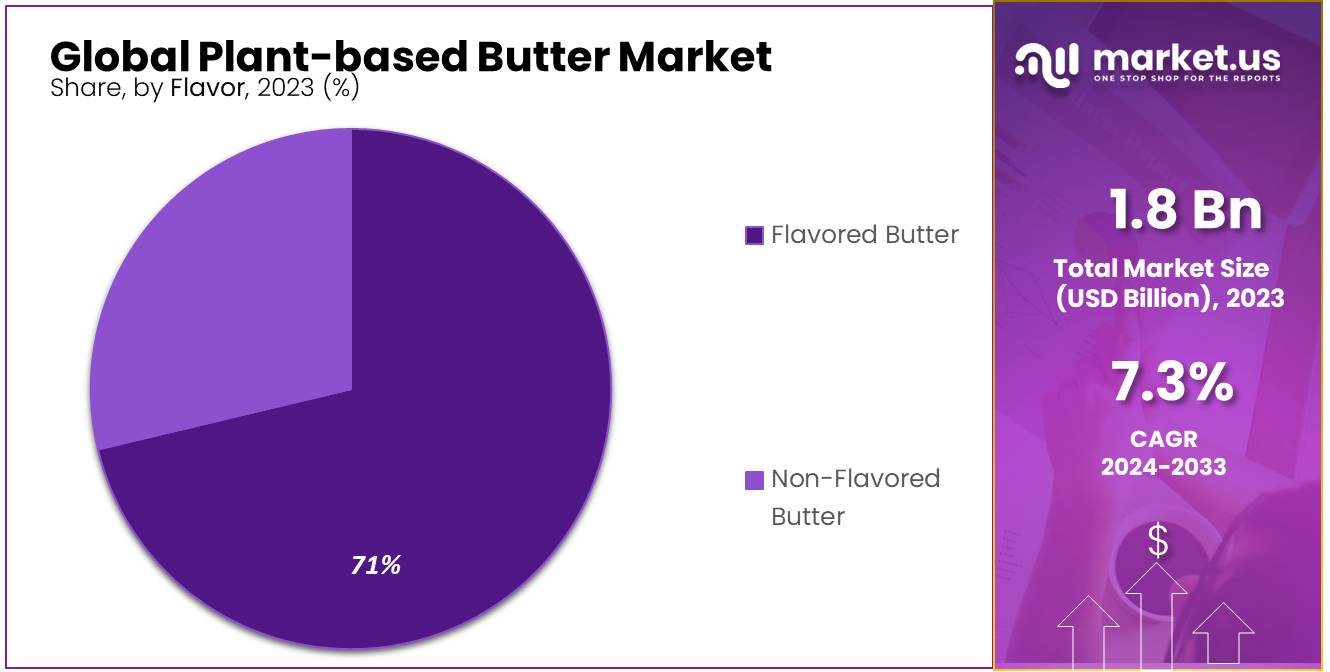

- Non-Flavored Butter held a dominant market position in the plant-based butter sector, capturing more than a 78.1% share.

- Hypermarkets & Supermarkets continued to hold a dominant position in the distribution of plant-based butter, capturing more than a 48.1% share.

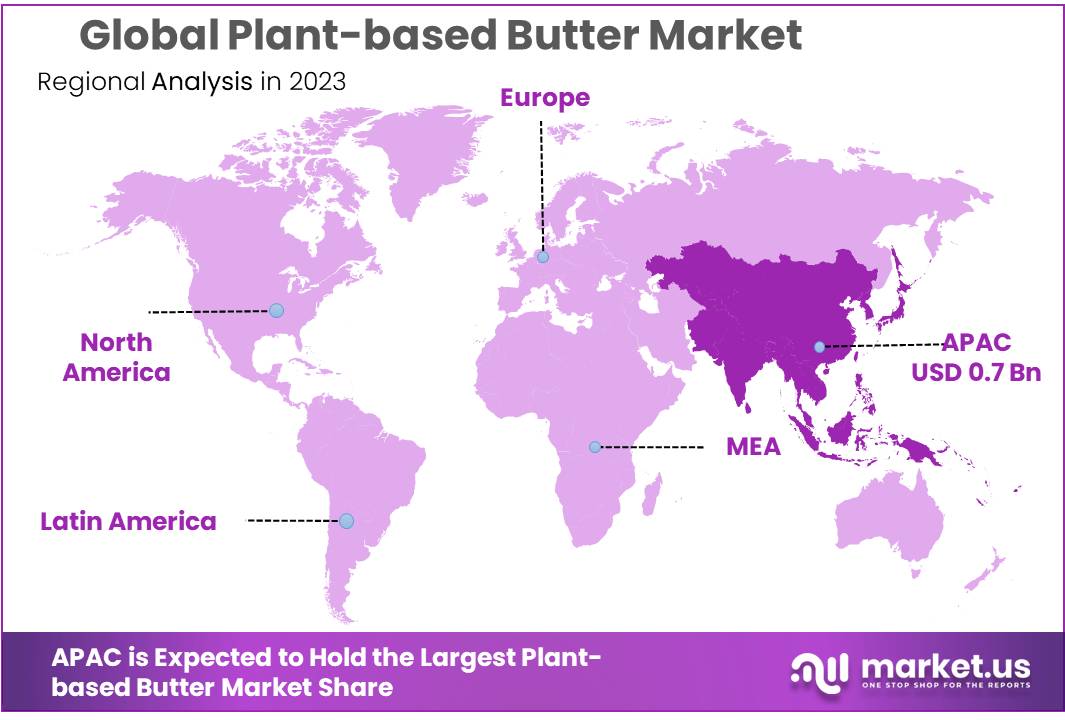

- Asia Pacific (APAC) emerging as the dominant region, capturing a substantial 38.2% market share and generating USD 0.7 billion in revenue.

By Source

In 2023, Almond emerged as the dominant source in the plant-based butter market, capturing more than a 36.1% share. Almond-based butter is highly favored for its creamy texture and mild, nutty flavor that complements various culinary applications without overpowering other tastes. This preference is bolstered by almond butter’s nutritional profile, which includes healthy fats, vitamins, and minerals, making it a popular choice among health-conscious consumers.

Soy, which has long been a staple in plant-based alternatives to its versatility and high protein content. Soy-based butter offers a taste and consistency that is similar to traditional dairy butter, making it an easy switch for consumers looking to reduce animal products in their diets without sacrificing the familiar cooking and baking qualities of butter.

Coconut and Oat sources are also gaining traction in the market. Coconut butter is appreciated for its rich flavor and high-fat content, ideal for baking and as a spread. Meanwhile, oat butter is rising in popularity to its environmental sustainability and hypoallergenic properties, catering to consumers with specific dietary restrictions or preferences.

By Type

In 2023, Salted plant-based butter held a dominant market position, capturing more than a 62.1% share. This preference for salted butter is driven by its versatility in cooking and baking, where the added salt enhances flavor, making it a preferred choice in kitchens worldwide. Consumers appreciate the ability of salted plant-based butter to provide a taste experience similar to that of traditional dairy butter, making it an easier substitute for those transitioning to plant-based diets without wanting to compromise on taste in their favorite recipes.

Unsalted plant-based butter also holds a place in the market, particularly favored by those who are mindful of their sodium intake or prefer to control the salt content in their dishes. Unsalted varieties offer the same creamy texture and richness as their salted counterparts but allow for greater flexibility in seasoning, particularly important in baking where precise flavor control is necessary. This type is also popular among health-conscious consumers who are looking to reduce their overall salt consumption.

By Nature

In 2023, Conventional plant-based butter held a dominant market position, capturing more than a 71.1% share. This segment’s substantial market share can be attributed to its widespread availability and typically lower price point compared to its organic counterpart. Conventional plant-based butters are accessible in most grocery stores, making them a convenient choice for consumers not specifically seeking organic certification. These products meet the basic requirements of consumers looking to switch from dairy butter to a plant-based option without the premium cost associated with organic products.

The Organic segment of the plant-based butter market, though smaller, is gaining traction as consumer awareness of environmental and health issues increases. Organic plant-based butters are made from ingredients that are free from synthetic pesticides and fertilizers, appealing to health-conscious consumers who prioritize clean eating habits. The demand for organic plant-based butter is also driven by those who value animal welfare and sustainable agricultural practices, which are often integral to the production of organic products.

By Flavor

In 2023, Non-Flavored Butter held a dominant market position in the plant-based butter sector, capturing more than a 78.1% share. This substantial market preference is largely to its versatility in both cooking and baking, where consumers seek a butter alternative that behaves like traditional dairy butter without adding any distinct flavors that could alter the taste of their dishes. Non-flavored plant-based butter is favored for its ability to blend seamlessly into recipes, providing the desired texture and moisture to dishes without overpowering other ingredients.

Flavored Butter, while holding a smaller share of the market, offers a unique appeal with varieties that include herbs, garlic, and even sweet options like cinnamon and honey. This segment caters to consumers looking to enhance their meals with additional flavors through their choice of butter. Flavored plant-based butters are particularly popular for use in direct applications like spreading on breads and toasts, where they add a distinctive taste and richness.

By Distribution Channel

In 2023, Hypermarkets & Supermarkets continued to hold a dominant position in the distribution of plant-based butter, capturing more than a 48.1% share of the market. This dominance can be attributed to their extensive reach and the convenience they offer, providing consumers with a wide selection of plant-based butter varieties under one roof. These retail giants are instrumental in introducing new plant-based products to a broad audience, aided by strategic shelf placements and promotions that appeal to health-conscious shoppers.

Specialty Stores also play a role, particularly for consumers seeking gourmet or specialized varieties of plant-based butter. These stores often cater to niche markets with a focus on organic, non-GMO, or locally-sourced products, providing options that might not be available in larger retail settings.

Convenience Stores are crucial for on-the-go consumers who prioritize quick and easy access to food products, including plant-based butter. Although they offer a smaller selection, the convenience they provide, especially in urban areas, makes them a valuable segment of the market.

Online sales channels have seen substantial growth, driven by the convenience of home shopping and the ability to easily compare prices and product reviews. The rise of e-commerce in the food sector provides a platform for brands to reach a wider audience, including those in areas not served by major supermarkets or specialty stores.

Key Market Segments

By Source

- Almond

- Oat

- Soy

- Coconut

- Others

By Type

- Salted

- Unsalted

By Nature

- Organic

- Conventional

By Flavor

- Flavored Butter

- Non-Flavored Butter

By Distribution Channel

- Hypermarkets and Supermarkets

- Specialty Stores

- Convenience Stores

- Online

- Others

Drivers

Health and Environmental Concerns Fueling Plant-Based Butter Adoption

In recent years, a growing number of people have become more aware of how their food choices affect their health and the environment. This awareness has led many to choose plant-based foods, including plant-based butter, over traditional animal-based products.

Many consumers are choosing plant-based butter because they believe it’s healthier. Traditional dairy butter contains saturated fats, which have been linked to heart disease. In contrast, plant-based butters often have healthier fats, which can be better for heart health. However, it’s important to note that not all plant-based products are automatically healthier. Some can be highly processed and may contain high levels of sodium or unhealthy fats. The World Health Organization (WHO) has highlighted that while plant-based diets can be beneficial, the healthiness of plant-based products varies, and consumers should choose minimally processed options when possible.

The environmental impact of food production is another major reason people are turning to plant-based butter. Producing dairy butter requires a lot of resources and leads to greenhouse gas emissions, mainly to methane from cows. In contrast, plant-based butter production generally has a smaller environmental footprint. For example, making dairy butter results in substantial methane emissions from cows, while plant-based production relies only on growing crops, which typically has a lower environmental impact.

Governments and health organizations are also encouraging the shift towards plant-based diets. For instance, the U.S. Food and Drug Administration (FDA) has provided guidance on labeling plant-based alternatives to animal-derived foods. This guidance aims to help consumers understand the nature of these products, enabling them to make informed dietary choices.

This shift in consumer preferences is reflected in market trends. Sales of plant-based butter and margarine have seen growth in recent years. For example, sales of plant-based butter/margarine were $130.4 million for the 52 weeks ended Dec. 31, 2023, up 1.4% from the previous 52-week period.

Restraints

Taste and Texture Challenges in Plant-Based Butter

One of the main challenges for plant-based butter is matching the taste and texture of traditional dairy butter. Many consumers find that plant-based alternatives don’t quite capture the rich flavor and creamy feel they’re used to. This difference can make people hesitant to switch from dairy to plant-based options.

A study in the journal Foods highlights that the texture of plant-based products often doesn’t match that of their animal-based counterparts, which can affect consumer acceptance.

Similarly, research published in Frontiers in Sustainable Food Systems points out that plant-based proteins can pose challenges to the sensory characteristics of products, especially in terms of appearance, taste, and texture.

The food industry is aware of these issues and is working to improve plant-based butter. Advancements in food science have led to better flavors and textures in plant-based products, making them more appealing to consumers. For example, some plant-based butter brands are now offering products that closely mimic the taste and texture of real butter.

Despite these improvements, achieving a product that fully replicates the sensory experience of dairy butter remains a hurdle. This challenge is a key factor slowing the widespread adoption of plant-based butter. Consumers often expect plant-based alternatives to provide the same satisfaction as traditional products, and any shortcomings can lead to reluctance in making the switch.

Government agencies and health organizations recognize the importance of sensory qualities in consumer acceptance of plant-based foods. They encourage manufacturers to focus on improving these aspects to promote healthier and more sustainable eating habits. For instance, the U.S. Food and Drug Administration (FDA) provides guidance on labeling plant-based alternatives, aiming to help consumers make informed choices.

Opportunity

Innovation in Plant-Based Butter Products

Recent developments have led to the use of diverse plant-based ingredients such as nuts, seeds, and legumes to enhance the flavor and nutritional profile of plant-based butters. For instance, incorporating almond or cashew bases can provide a creamy texture, while the addition of flax or chia seeds boosts omega-3 fatty acid content, catering to health-conscious consumers.

Innovations are also focusing on fortifying plant-based butters with essential vitamins and minerals to match or surpass the nutritional benefits of dairy butter. This includes the addition of vitamin B12, calcium, and vitamin D, which are crucial for individuals following plant-based diets. Such enhancements make these products more appealing to a wider audience seeking both taste and health benefits.

Achieving a taste and texture that closely resembles dairy butter has been a focus. Advancements in food technology have enabled manufacturers to create plant-based butters that melt, spread, and bake similarly to traditional butter, reducing barriers for consumers considering a switch.

Government agencies are playing a supportive role in this innovation wave. For example, the U.S. Food and Drug Administration (FDA) has been providing guidance on the labeling of plant-based alternatives, ensuring that consumers receive clear information about these products. This regulatory clarity helps manufacturers in marketing their innovative products effectively.

Consumers are increasingly motivated by environmental and ethical concerns, driving the demand for sustainable and cruelty-free products. Plant-based butters, which generally have a lower environmental impact compared to dairy butter, align with these consumer values, further propelling market growth.

Despite the progress, challenges remain in terms of cost competitiveness and consumer education. Ongoing research and development, supported by both industry and government initiatives, are essential to address these challenges. Future innovations may include the development of plant-based butters with enhanced functional properties, such as higher heat stability for cooking, or the incorporation of probiotics for added health benefits.

Trends

Government Initiatives Supporting Plant-Based Alternatives

In recent years, there has been a noticeable shift in consumer preferences towards plant-based foods, including plant-based butter. This change is driven by health considerations, environmental concerns, and ethical reasons. Recognizing this trend, government agencies have started to implement initiatives to support and regulate the plant-based food industry, ensuring consumer safety and informed choices.

The U.S. Food and Drug Administration (FDA) is the issuance of draft guidance on the labeling of plant-based alternatives to animal-derived foods. This guidance aims to provide clear labeling practices, helping consumers make informed dietary choices. The FDA emphasizes that while plant-based products can be part of a healthy diet, it’s crucial for consumers to understand their nutritional content, especially when these products are positioned as alternatives to traditional animal-based foods.

Government agencies are also focusing on educating the public about the nutritional aspects of plant-based diets. The World Health Organization (WHO) has highlighted that not all plant-based products are inherently healthy. Some may be highly processed and could contain high levels of sodium, saturated fats, and sugars. Therefore, it’s essential for consumers to read labels carefully and choose minimally processed options when possible.

Environmental sustainability is another area where government initiatives play a role. The shift towards plant-based diets is seen as a strategy to reduce the environmental impact of food production. By promoting plant-based alternatives, governments aim to address issues like greenhouse gas emissions and resource consumption associated with animal agriculture. This support aligns with global sustainability goals and reflects a commitment to fostering healthier and more sustainable food systems.

These government initiatives have a direct impact on the plant-based butter market. Clear labeling standards and increased consumer education help build trust and transparency, encouraging more people to try plant-based butter. Additionally, the emphasis on sustainability resonates with environmentally conscious consumers, further driving market growth.

Regional Analysis

In 2023, the plant-based butter market demonstrated diverse growth patterns across regions, with Asia Pacific (APAC) emerging as the dominant region, capturing a substantial 38.2% market share and generating USD 0.7 billion in revenue. APAC’s growth is driven by the rising awareness of plant-based diets and the increasing prevalence of lactose intolerance in countries like China, India, and Japan. Urbanization, coupled with a growing middle class, has further accelerated the adoption of plant-based butter as a healthier and more sustainable alternative to dairy-based spreads.

North America remains a contributor to the market, buoyed by strong consumer demand for plant-based products. The U.S. and Canada have witnessed a robust shift towards vegan and flexitarian diets, spurred by health-conscious consumers and a well-developed retail network. These factors, combined with innovative product launches, have positioned North America as a key player in the global market.

In Europe, the market continues to grow, particularly in Western countries like Germany, the UK, and France, where sustainability and ethical eating are driving consumer preferences. The European Union’s focus on reducing carbon emissions and promoting sustainable agriculture indirectly supports the growth of plant-based alternatives, including butter.

The Middle East & Africa and Latin America are emerging as potential growth markets. While their current contributions are smaller, increasing urbanization and rising health awareness are expected to boost demand in these regions. Improvements in distribution networks and product availability will likely accelerate market growth, making these regions important to watch in the coming years.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The plant-based butter market is characterized by a diverse group of key players, each contributing to its innovation and expansion. Alpino Health Foods, Califia Farms, and Ceres Organics stand out for their dedication to offering healthier, sustainable alternatives to traditional dairy butter. These companies focus on using high-quality, plant-based ingredients to cater to a growing consumer base prioritizing health and ethical consumption. For instance, Califia Farms has expanded its portfolio with almond and oat-based spreads that align with consumer demands for clean-label and allergen-free options.

Miyoko’s Creamery, Kite Hill, and Milkadamia have carved niches with their artisanal approaches, emphasizing premium quality and rich, dairy-like textures in their plant-based butter offerings. Miyoko’s Creamery, in particular, has gained recognition for its innovative use of cashew and coconut bases, which provide a flavor and consistency similar to traditional butter. Naturli’ Foods A/S and Upfield Foods, meanwhile, have established themselves as major players in Europe, leveraging their strong regional presence to drive market penetration.

Ripple Foods, PBC, Dhatu Organics, and Wildfriend Foods are also gaining traction, focusing on innovation and catering to niche markets such as organic, allergen-free, and fortified plant-based butter. These companies are pivotal in diversifying the market and meeting the growing demand for sustainable, health-focused products. Together, these players demonstrate the dynamic nature of the plant-based butter market, which continues to evolve in response to shifting consumer preferences and global sustainability goals.

Top Key Players

- Alpino Health Foods

- Califia Farms

- Carley’s Organic

- Ceres Organics

- Chobani LLC

- Conagra, Inc.

- Daisya Fine Food

- Dhatu Organics

- Ekogram-the real food

- Elmhurst Buttered Direct, LLC

- Fora Foods

- Kitchen Garden

- Kite Hill

- Lyrical Foods Inc.

- Milkadamia

- Miyoko’s Creamery

- Naturally Organic

- Naturli’ Foods A/S

- onagra Brands Inc.

- Pintola

- Premier Organics

- Prosperity Organic Food Inc.

- Ripple Foods, PBC

- The J.M. Smuker Co.

- The Leaviet Corp.

- Upfield Foods

- Vegan Way

- Wayfare Food

- Wildfriend Foods

Recent Developments

In March 2023 Alpino Health Foods, reported revenues of approximately $2.38 million. However, during the same period, Alpino experienced a net loss of around $291,000, indicating a phase of investment and expansion.

By 2023, Califia Farms achieved annual revenue of $100 million, reflecting its successful diversification and growth in the plant-based market.

Report Scope

Report Features Description Market Value (2023) USD 1.8 Bn Forecast Revenue (2033) USD 3.6 Bn CAGR (2024-2033) 7.3% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Almond, Oat, Soy, Coconut, Others), By Type (Salted, Unsalted), By Nature (Organic, Conventional), By Flavor (Flavored Butter, Non-Flavored Butter), By Distribution Channel (Hypermarkets and Supermarkets, Specialty Stores, Convenience Stores, Online, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Alpino Health Foods, Califia Farms, Carley’s Organic, Ceres Organics, Chobani LLC, Conagra, Inc., Daisya Fine Food, Dhatu Organics, Ekogram-the real food, Elmhurst Buttered Direct, LLC, Fora Foods, Kitchen Garden, Kite Hill, Lyrical Foods Inc., Milkadamia, Miyoko’s Creamery, Naturally Organic, Naturli’ Foods A/S, onagra Brands Inc., Pintola, Premier Organics, Prosperity Organic Food Inc., Ripple Foods, PBC, The J.M. Smuker Co., The Leaviet Corp., Upfield Foods, Vegan Way, Wayfare Food, Wildfriend Foods Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Alpino Health Foods

- Califia Farms

- Carley's Organic

- Ceres Organics

- Chobani LLC

- Conagra, Inc.

- Daisya Fine Food

- Dhatu Organics

- Ekogram-the real food

- Elmhurst Buttered Direct, LLC

- Fora Foods

- Kitchen Garden

- Kite Hill

- Lyrical Foods Inc.

- Milkadamia

- Miyoko's Creamery

- Naturally Organic

- Naturli’ Foods A/S

- onagra Brands Inc.

- Pintola

- Premier Organics

- Prosperity Organic Food Inc.

- Ripple Foods, PBC

- The J.M. Smuker Co.

- The Leaviet Corp.

- Upfield Foods

- Vegan Way

- Wayfare Food

- Wildfriend Foods