Global Kombucha Market By Product Type (Hard, Conventional), By Type (Natural, Flavored, Regular, Herbs and Spices, Citrus, Berries, Apple, Coconut and Mangoes, Flowers, Others), By Nature (Organic, Inorganic), By Packaging Type (Bottle, Can), By Distribution Channels (Supermarkets/Hypermarkets, Online Retailers, Specialist Stores, Convenience Stores, Others) , By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 133260

- Number of Pages: 336

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

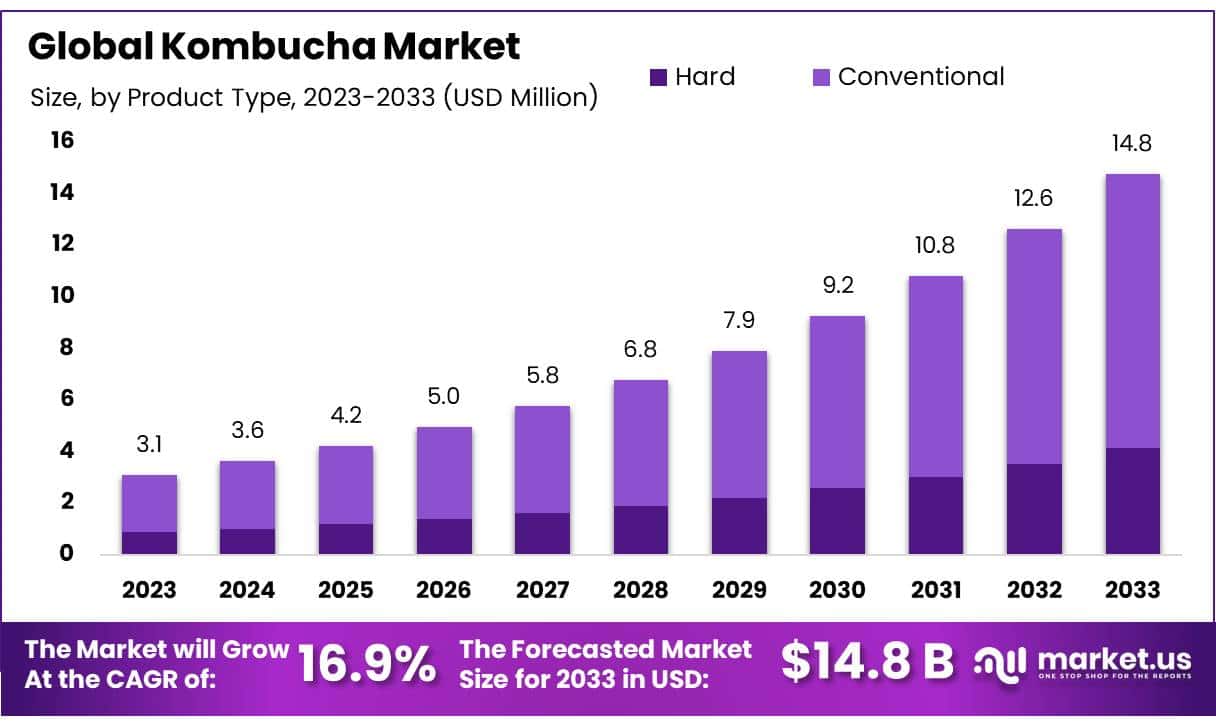

The Global Kombucha Market size is expected to be worth around USD 14.8 Bn by 2033, from USD 3.1 Bn in 2023, growing at a CAGR of 16.9% during the forecast period from 2024 to 2033.

Kombucha, a fermented beverage made from sweetened tea and a culture known as SCOBY (Symbiotic Culture of Bacteria and Yeast), has gained significant global recognition due to its purported health benefits, including digestive support, energy enhancement, and immune system stimulation. With origins tracing back to Northeast China around 220 B.C., kombucha has evolved into a popular choice among health-conscious consumers worldwide.

Regulatory frameworks have played a pivotal role in shaping the kombucha industry, particularly in the United States. The Alcohol and Tobacco Tax and Trade Bureau (TTB) requires that kombucha products containing more than 0.5% alcohol by volume be classified as alcoholic beverages.

The export market for kombucha has also witnessed substantial growth, with Canada and Australia emerging as key destinations for U.S.-based producers. In 2020, exports to these regions grew by 20%, driven by supportive regulatory environments and growing consumer familiarity with functional beverages. These favorable conditions have encouraged manufacturers to expand their global presence and leverage opportunities in international markets.

Innovation has been a cornerstone of the kombucha market’s growth. Companies are focusing on flavor development and expanding distribution networks to meet increasing consumer demand. For example, a major kombucha producer secured $30 million in private investment in 2021 to enhance production capabilities and operational efficiency.

Furthermore, strategic partnerships have enabled companies to tailor products for specific markets. In 2022, a U.S. kombucha brand collaborated with a European food tech company to develop non-alcoholic fermented beverages customized for European consumers, reflecting a growing emphasis on market-specific innovation.

Key Takeaways

- Kombucha Market size is expected to be worth around USD 14.8 Bn by 2033, from USD 3.1 Bn in 2023, growing at a CAGR of 16.9%.

- Conventional Kombucha held a dominant market position, capturing more than a 72.3% share of the global market.

- Natural Kombucha held a dominant market position, capturing more than a 63.3% share.

- Organic Kombucha held a dominant market position, capturing more than a 58.7% share.

- Bottle packaging for kombucha held a dominant market position, capturing more than a 68.5% share.

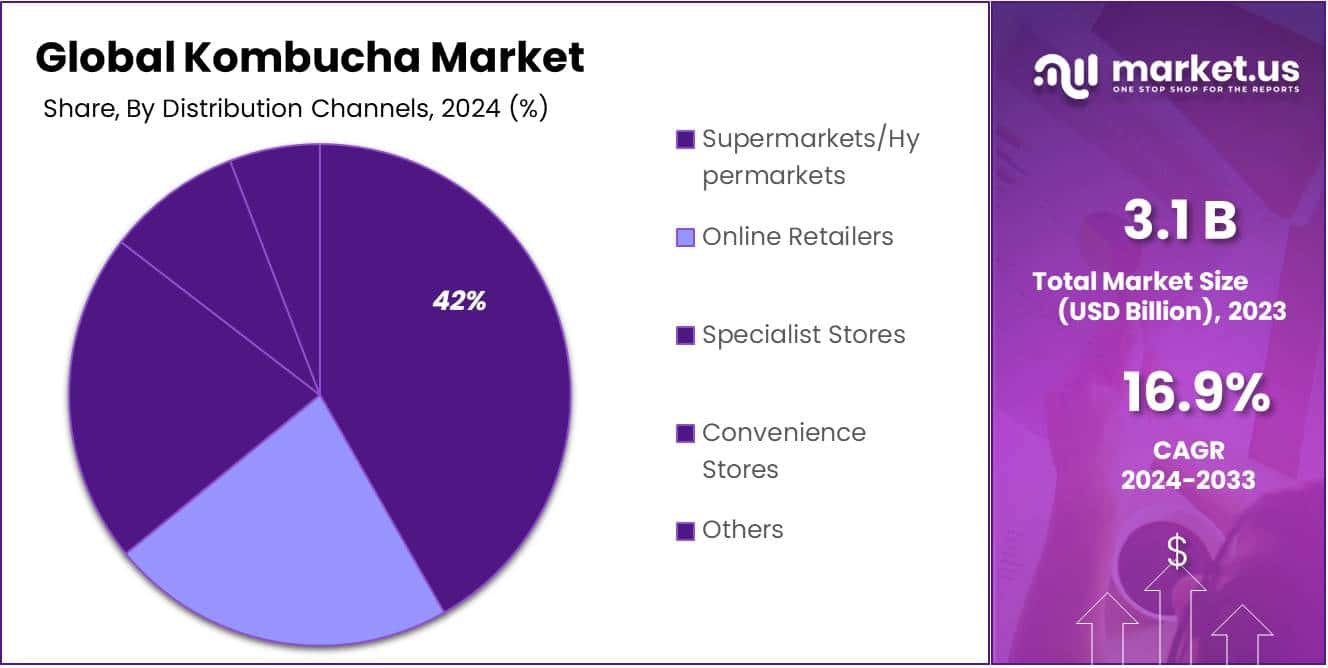

- Supermarkets/Hypermarkets held a dominant market position, capturing more than a 42.4% share.

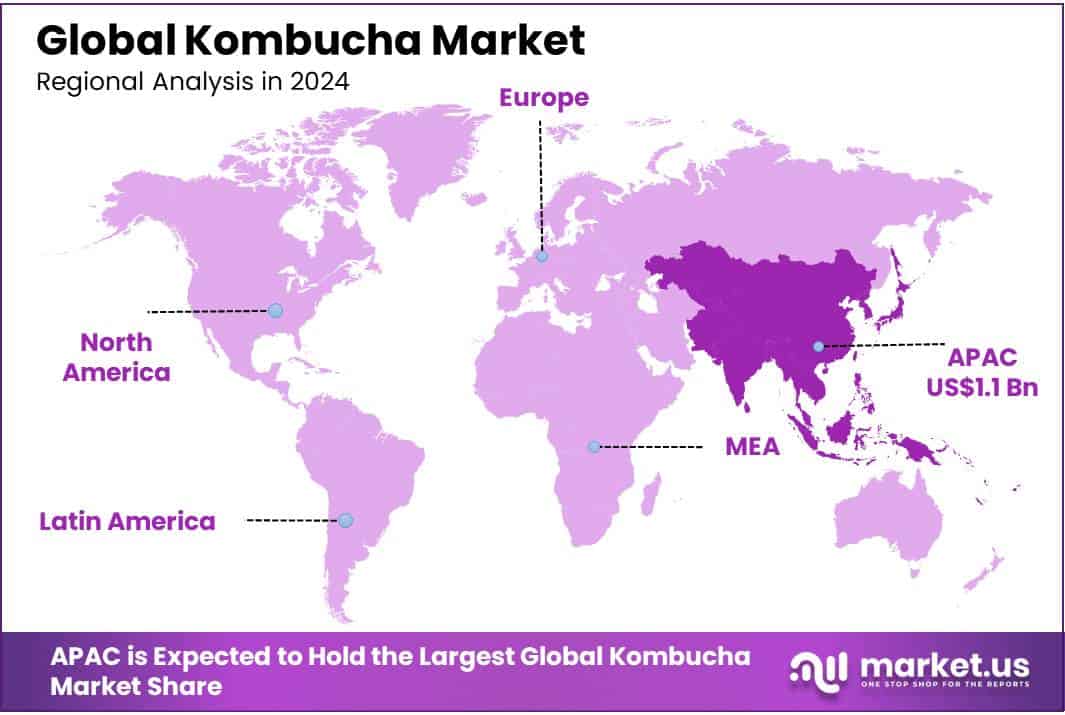

- Asia Pacific (APAC) currently dominates the global kombucha landscape, holding a significant 36.7% market share valued at approximately USD 1.1 billion.

By Product Type

In 2023, Conventional Kombucha held a dominant market position, capturing more than a 72.3% share of the global market. This segment benefits from widespread consumer acceptance due to its health benefits, including improved digestion and immune system support.

Conventional kombucha is available in a variety of flavors, which has helped it maintain a broad appeal among health-conscious consumers. The widespread availability of conventional kombucha in supermarkets, health food stores, and online platforms has facilitated its market penetration and consumer accessibility.

Hard Kombucha has emerged as a niche but rapidly growing segment within the kombucha market. Characterized by a higher alcohol content, typically above 0.5% by volume, this segment caters to consumers looking for healthier alcoholic beverage alternatives.

The growth of Hard Kombucha is driven by the trend towards low-alcohol beverages among younger demographics, particularly millennials and Gen Z consumers who prioritize wellness and social drinking experiences. Despite its smaller base, the Hard Kombucha segment is expected to expand significantly, bolstered by innovations in flavor and marketing strategies that align with lifestyle-oriented branding.

By Type

In 2023, Natural Kombucha held a dominant market position, capturing more than a 63.3% share. This type of kombucha is favored for its minimal processing and absence of added flavors, appealing to consumers seeking pure, unadulterated versions of health beverages. Its market strength is bolstered by a growing consumer inclination towards products perceived as ‘clean’ and ‘whole-food-based’.

Flavored Kombucha also occupies a significant portion of the market, with consumers drawn to a variety of taste profiles. Among flavored options, Citrus, Berries, and Apple varieties are particularly popular, offering refreshing alternatives to traditional tea tastes. These flavors cater to a broader audience, including those new to kombucha, by providing familiar fruity notes.

Herbs & Spices, and Coconut & Mangoes Kombucha types are gaining traction, reflecting consumer interest in exotic and diverse flavor combinations. These segments benefit from the trend towards culinary diversity and experimentation with global palates in beverages.

Additionally, Flowers flavored kombucha, such as those infused with hibiscus or jasmine, represents a smaller but growing niche. This segment appeals to consumers looking for botanical tastes and the added aesthetic and wellness benefits associated with floral ingredients.

By Nature

In 2023, Organic Kombucha held a dominant market position, capturing more than a 58.7% share. This segment has thrived due to increasing consumer preference for organic products, which are perceived as healthier and more environmentally friendly. The growth of organic kombucha is supported by its alignment with sustainable agriculture practices and the rising awareness of the benefits of organic ingredients among health-conscious consumers. This trend is bolstered by certifications that reassure consumers about the quality and origin of the ingredients used.

Inorganic Kombucha occupies a smaller market share. It is typically priced lower than its organic counterpart, making it accessible to a broader audience. This segment appeals to consumers who are either less concerned about organic certification or are seeking more affordable options. Despite its smaller market share, inorganic kombucha remains relevant in markets where price sensitivity and availability of organic options are significant factors in consumer purchasing decisions.

By Packaging Type

In 2023, Bottle packaging for kombucha held a dominant market position, capturing more than a 68.5% share. This preference for bottles is driven by both consumer perception and practicality; glass bottles are often associated with premium quality and are believed to better preserve the taste and efficacy of kombucha. Moreover, bottles are recyclable and considered more eco-friendly, aligning with the environmental values of health-conscious consumers.

Can packaging is gaining popularity as a convenient option for kombucha. Cans are lightweight, unbreakable, and cost-effective for both manufacturers and consumers. They appeal to a younger demographic that values convenience, especially for outdoor activities and on-the-go consumption. Although cans currently hold a smaller portion of the market, their share is expected to grow as manufacturers invest in marketing campaigns that highlight the practical benefits of canned beverages.

By Distribution Channels

In 2023, Supermarkets/Hypermarkets held a dominant market position, capturing more than a 42.4% share in the kombucha market. This channel benefits from high consumer traffic and the convenience of one-stop shopping for a variety of goods, including kombucha. The wide visibility and availability of kombucha in these outlets have made them key players in promoting the beverage to a mainstream audience.

Online Retailers are also a significant channel, providing easy access to a wide assortment of kombucha brands, including niche and premium products not always available in physical stores. This channel has grown particularly during the rise of e-commerce shopping trends, appealing to tech-savvy consumers looking for home delivery convenience.

Specialist Stores, such as health food stores, have a critical role in the distribution of kombucha, catering to health-conscious consumers who seek expert advice and high-quality products. These stores often offer a range of organic and specialty kombuchas that attract a discerning clientele.

Convenience Stores, while holding a smaller share, provide quick access to kombucha for consumers on the go. This channel has been expanding its range of healthier beverage options to meet the demand of busy, health-aware individuals.

Key Market Segments

By Product Type

- Hard

- Conventional

By Type

- Natural

- Flavored

- Regular

- Herbs & Spices

- Citrus

- Berries

- Apple

- Coconut & Mangoes

- Flowers

- Others

By Nature

- Organic

- Inorganic

By Packaging Type

- Bottle

- Can

By Distribution Channels

- Supermarkets/Hypermarkets

- Online Retailers

- Specialist Stores

- Convenience Stores

- Others

Drivers

Increasing Health Consciousness and Demand for Functional Beverages

One of the primary drivers propelling the kombucha market is the increasing consumer awareness of health and wellness, especially concerning gut health and immunity. The probiotic nature of kombucha makes it a popular choice among health-conscious consumers. This trend is reflected in the substantial market growth across various regions, with a notable increase in demand for kombucha as a functional beverage that offers health benefits beyond basic nutrition.

Government and Regulatory Support

Regulatory developments also play a crucial role in the market dynamics of kombucha. For instance, legislative measures like the Kombucha Act in the United States aim to amend taxation policies on fermented beverages, potentially exempting kombucha from certain federal taxes if it contains alcohol levels below 0.5%. Such regulations could lower the cost of production and market entry for new players, fostering further growth in the industry.

Strategic Industry Movements and Innovations

The market is also witnessing a surge in strategic initiatives such as mergers, acquisitions, and product innovations. Major companies are continually expanding their product lines to include new and exotic flavors of kombucha, responding to the evolving consumer preferences. These innovations not only enhance the product appeal but also help in capturing a broader market base. For example, GT’s Living Foods and Brew Dr. Kombucha are actively introducing new flavors and engaging in branding refreshes to attract more consumers.

Market Expansion and Global Reach

The global reach of kombucha is expanding, with significant growth observed in the Asia Pacific, driven by traditional consumption patterns in countries like China, where kombucha is revered as the “elixir of life”. Similarly, the European market is seeing robust growth due to the rising popularity of probiotic and functional beverages, positioning kombucha as a healthy alternative to alcoholic and carbonated drinks

Restraints

Regulatory Challenges and Alcohol Content Management

One of the primary constraints in the kombucha market is the regulatory challenge associated with the alcohol content produced during fermentation. Kombucha naturally produces alcohol, and if the levels exceed 0.5% alcohol by volume, it must comply with stricter regulations applicable to alcoholic beverages. This requirement can complicate production and distribution logistics, particularly for smaller producers who may find the additional compliance efforts burdensome.

Product Stability and Shelf Life

Another significant challenge is the limited shelf life of kombucha, which can impact its freshness and quality over time. Maintaining the stability of kombucha during transportation and storage requires sophisticated logistical solutions, which can increase the overall cost and affect market penetration, especially in regions with less developed infrastructure.

High Production Costs

The cost of producing kombucha can also be a restraint. The process requires specific strains of yeast and bacteria and conditions that must be carefully controlled to ensure a consistent and safe product. These production demands contribute to higher operational costs, which can deter new entrants to the market and limit the expansion of existing players.

Consumer Perception and Market Saturation

Consumer perception regarding the health benefits of kombucha can vary, and skepticism about the drink’s purported benefits may limit its mainstream adoption. Additionally, the kombucha market is becoming increasingly crowded, with many brands competing for market share. This saturation can make it difficult for newer brands to establish themselves and for existing brands to maintain or increase their market presence

Opportunity

Expanding Health and Wellness Trends

One of the most promising opportunities in the kombucha market is the continued consumer shift towards health and wellness products. Kombucha, known for its probiotic benefits, aligns well with the increasing demand for functional beverages that promote gut health and overall well-being.

Strategic Collaborations and Market Expansion

There are significant opportunities for growth through strategic collaborations and expansions. For instance, partnerships between kombucha brands and large beverage companies or other industries can help kombucha reach a wider audience. An example of this is Borécha’s partnership with Akasa Air to introduce kombucha as an in-flight beverage, a move that helps tap into new consumer segments.

Innovation and Diversification

Innovation in product offerings, such as the development of new flavors and kombucha blends with functional ingredients like adaptogens or superfoods, opens up new niches and broadens consumer appeal. The market is seeing an increase in the availability of hard kombucha, which caters to consumers looking for healthier alcoholic beverage alternatives.

Trends

Rising Popularity of Hard Kombucha

One significant trend is the increasing popularity of hard kombucha, which offers a healthier alternative to traditional alcoholic beverages. With a higher alcohol content compared to regular kombucha, hard kombucha is appealing to consumers looking for gut-friendly, innovative drink options with the benefits of probiotics.

Flavor Innovation and Consumer Demand

Innovation in flavors continues to be a key trend, with kombucha brands introducing a variety of new flavors to attract consumers. These include exotic combinations like elderflower, lemongrass, grapefruit & hibiscus, and coffee, which cater to a growing consumer base seeking novelty and health benefits in their beverage choices. This trend is not only enhancing the consumer appeal of kombucha but also broadening its market reach.

Expansion into New Markets

Geographic expansion represents a major opportunity, with the Asia Pacific region identified as the fastest-growing market for kombucha. This growth is fueled by increased health awareness, rising disposable incomes, and cultural acceptance of fermented beverages. Brands are actively entering markets like China, Japan, and India, where there is a notable demand for health-centric, probiotic-rich products.

Focus on Health and Wellness

The health and wellness trend is profoundly influencing the kombucha market. Consumers are increasingly selecting beverages that offer health benefits, such as improved digestion and immune support, driving demand for kombucha known for its probiotic properties. This shift is supported by an increasing preference for natural and organic ingredients, making kombucha a preferred choice among health-conscious consumers

Regional Analysis

Asia Pacific (APAC) currently dominates the global kombucha landscape, holding a significant 36.7% market share valued at approximately USD 1.1 billion. This region’s prominent growth is fueled by an established cultural acceptance of fermented beverages, rising health consciousness, and increasing disposable incomes. Countries like China, Japan, and Australia are driving regional demand, with consumers increasingly drawn to kombucha’s health benefits, such as improved gut health and immune system support.

North America follows closely, characterized by a mature kombucha market with high consumer awareness and an established wellness industry. The U.S. leads in innovation and product availability, making North America a critical player in global market dynamics. This region benefits from extensive distribution networks across supermarkets, health food stores, and online platforms, which facilitate easy access to a wide array of kombucha products.

Europe is witnessing robust growth in kombucha consumption, driven by rising health awareness and the increasing popularity of organic and natural products. Countries like Germany and the U.K. are key markets, where kombucha is increasingly perceived as a healthy alternative to sugary soft drinks and alcoholic beverages. Regulatory support for healthier products further complements the market growth in this region.

Latin America and the Middle East & Africa (MEA), though smaller in market size compared to APAC, North America, and Europe, are emerging as potential growth areas. Increasing urbanization and the influence of western dietary habits are propelling the demand for kombucha. In these regions, the market is gradually evolving with the entry of new players and the introduction of locally adapted flavors.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The kombucha market features a dynamic competitive landscape with both established giants and emerging players contributing to the sector’s growth. Key players like GT’s Living Foods, Health-Ade Kombucha, and Molson Coors Beverage Company have been instrumental in popularizing kombucha on a global scale through extensive marketing, wide distribution networks, and continuous product innovation.

These companies have expanded their portfolios to include a variety of flavors and formulations that appeal to a broad consumer base, seeking health benefits and new taste experiences.

Emerging players such as København Kombucha, Læsk, and VIGO KOMBUCHA are distinguishing themselves by focusing on local preferences and artisanal production methods. They often emphasize organic ingredients, sustainability, and unique local flavors, which resonate well with health-conscious consumers who prefer products with a clear ethical and environmental focus.

Additionally, collaborations and strategic partnerships, like those pursued by PepsiCo, Inc. and The Coca-Cola Company, are vital as they look to leverage their extensive distribution systems to scale new products quickly and efficiently.

Moreover, the market sees constant innovation, with companies such as Brew Dr. and Remedy Drinks pushing the boundaries of the traditional kombucha space by introducing products like hard kombucha and flavor-infused varieties.

These innovations not only cater to a growing consumer segment looking for healthier alcoholic alternatives but also help companies to stand out in a crowded market. The involvement of multinational beverage corporations has also helped in validating kombucha’s market potential and driving its integration into the mainstream beverage sector.

Top Key Players

- BB Kombucha

- Brew Dr.

- Brothers and Sisters

- Cruz Group sp. zo.o.

- Equinox Kombucha

- FedUp Foods

- GO Kombucha

- GT’s Living Foods

- Harris Freeman

- Health-Ade Kombucha

- Humm Kombucha, LLC

- København Kombucha

- Kosmic Kombucha

- Læsk

- LIVE Soda, LLC

- Lo Bros.

- Molson Coors Beverage Company

- MOMO Kombucha

- NessAlla Kombucha

- PepsiCo, Inc.

- Real Kombucha

- Reed’s Inc.

- Remedy Drinks

- Revive Kombucha

- Soulfresh Global Pty Ltd

- SYSTM Foods Inc.

- The Coca-Cola Company

- The Hain Celestial Group

- Tropicana Brands Group

- VIGO KOMBUCHA

Recent Developments

In 2023 Brew Dr. , the company focused on impactful environmental projects, such as converting over 464,364 gallons of alcohol removed from their kombucha into clean energy, in collaboration with Clean Water Services.

In 2023 BB Kombucha, while not as prominent as some of the industry leaders like GT’s Living Foods or Health-Ade, is making its mark in the kombucha market.

Report Scope

Report Features Description Market Value (2023) USD 3.1 Bn Forecast Revenue (2033) USD 14.8 Bn CAGR (2024-2033) 16.9% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Hard, Conventional), By Type (Natural, Flavored, Regular, Herbs and Spices, Citrus, Berries, Apple, Coconut and Mangoes, Flowers, Others), By Nature (Organic, Inorganic), By Packaging Type (Bottle, Can), By Distribution Channels (Supermarkets/Hypermarkets, Online Retailers, Specialist Stores, Convenience Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape BB Kombucha, Brew Dr., Brothers and Sisters, Cruz Group sp. zo.o., Equinox Kombucha, FedUp Foods, GO Kombucha, GT’s Living Foods, Harris Freeman, Health-Ade Kombucha, Humm Kombucha, LLC, København Kombucha, Kosmic Kombucha, Læsk, LIVE Soda, LLC, Lo Bros., Molson Coors Beverage Company, MOMO Kombucha, NessAlla Kombucha, PepsiCo, Inc., Real Kombucha, Reed’s Inc., Remedy Drinks, Revive Kombucha, Soulfresh Global Pty Ltd, SYSTM Foods Inc., The Coca-Cola Company, The Hain Celestial Group, Tropicana Brands Group, VIGO KOMBUCHA Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- BB Kombucha

- Brew Dr.

- Brothers and Sisters

- Cruz Group sp. zo.o.

- Equinox Kombucha

- FedUp Foods

- GO Kombucha

- GT's Living Foods

- Harris Freeman

- Health-Ade Kombucha

- Humm Kombucha, LLC

- København Kombucha

- Kosmic Kombucha

- Læsk

- LIVE Soda, LLC

- Lo Bros.

- Molson Coors Beverage Company

- MOMO Kombucha

- NessAlla Kombucha

- PepsiCo, Inc.

- Real Kombucha

- Reed's Inc.

- Remedy Drinks

- Revive Kombucha

- Soulfresh Global Pty Ltd

- SYSTM Foods Inc.

- The Coca-Cola Company

- The Hain Celestial Group

- Tropicana Brands Group

- VIGO KOMBUCHA