Global Liver Health Supplements Market By Dosage Form (Capsules, Tablets, Liquids, Powders, Others), By Form (Powder, Liquid), By Nature ( Organic, Conventional), By Source (Vitamins, Minerals, Botanicals, Others), By End-Users (Hospitals, Specialty Clinics, Homecare, Others), By Distribution Channel (Supermarkets/Hypermarkets, Online Retailers, Specialty Stores, Others) , By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 133719

- Number of Pages: 277

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

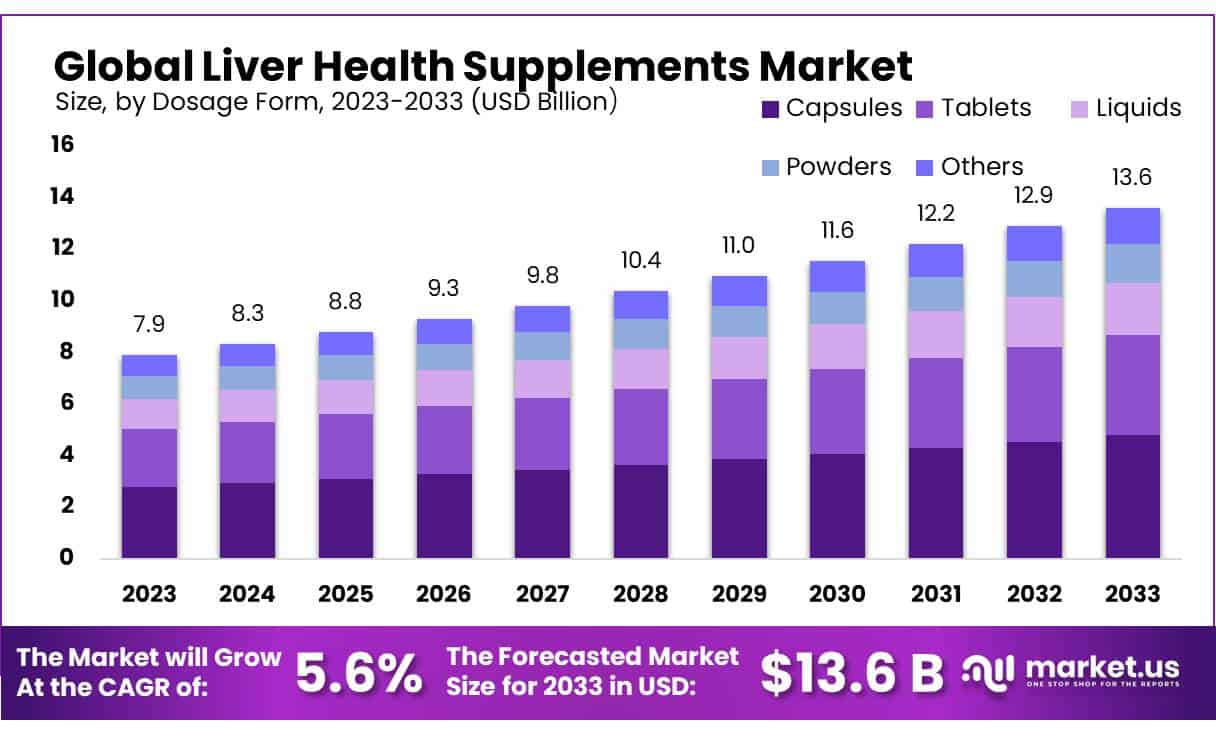

The Global Liver Health Supplements Market size is expected to be worth around USD 13.6 Bn by 2033, from USD 7.9 Bn in 2023, growing at a CAGR of 5.6% during the forecast period from 2024 to 2033.

Liver health supplements are specifically designed to support liver function and overall health. These dietary supplements typically combine a variety of ingredients, including vitamins, minerals, and herbal extracts, that are believed to have beneficial effects on the liver.

Common ingredients include milk thistle, which contains silymarin, a compound known for its antioxidant and anti-inflammatory properties that help protect liver cells. Another popular ingredient is artichoke leaf, which helps stimulate bile production, aiding digestion and the removal of toxins.

Additionally, turmeric—specifically its active compound curcumin—is used for its potent anti-inflammatory effects, which can contribute to liver health by reducing inflammation and promoting detoxification.

The need for effective liver health solutions is highlighted by the prevalence of liver-related conditions. According to the American Liver Foundation, fatty liver disease affects between 90% to 100% of heavy drinkers, underscoring the critical demand for liver support products.

Chronic liver diseases, including cirrhosis, are responsible for approximately 2 million deaths annually, with cirrhosis being the 11th leading cause of death globally. This growing health concern is reflected in the market growth for liver health supplements. The U.S. market for liver health supplements is projected to reach USD 1.2 billion by 2034, growing at a CAGR of 3.1% during this period.

The demand for liver health supplements is also influencing the global market dynamics. North America is expected to account for over 40% of the global market revenue in 2024, which is valued at approximately USD 4.1 billion.

This growth is driven by rising consumer awareness of liver health and the increasing popularity of natural ingredients like milk thistle and turmeric. Furthermore, U.S. exports of herbal supplements, including those used in liver health formulations, were valued at approximately USD 1.4 billion in 2022, indicating a strong global market for these products.

Investment in research and development has also surged, with companies allocating over USD 200 million annually to innovate and improve liver health supplement formulations.

Key Takeaways

- Liver Health Supplements Market size is expected to be worth around USD 13.6 Bn by 2033, from USD 7.9 Bn in 2023, growing at a CAGR of 5.6%.

- Capsules held a dominant market position in the liver health supplements market, capturing more than a 35% share.

- Powder held a dominant market position in the liver health supplements market, capturing more than a 64.1% share.

- Conventional liver health supplements held a dominant market position, capturing more than a 59.2% share.

- Vitamins held a dominant market position in the liver health supplements market, capturing more than a 37.2% share.

- Hospitals held a dominant market position in the liver health supplements market, capturing more than a 37.2% share.

- Supermarkets/Hypermarkets held a dominant market position in the liver health supplements market, capturing more than a 44.3% share.

- North America held a dominant position in the global liver health supplements market, capturing more than 39% of the market share, with a market value of approximately USD 3.1 billion.

By Dosage Form

In 2023, Capsules held a dominant market position in the liver health supplements market, capturing more than a 35% share. Capsules are widely preferred by consumers due to their convenience, ease of consumption, and longer shelf life compared to other forms.

They also allow for precise dosing, making them a popular choice for those seeking reliable and standardized liver health support. The demand for capsules has been particularly strong in North America and Europe, where consumers value the efficiency and portability of capsule-based supplements.

Tablets followed as the second most popular dosage form, holding around 30% of the market in 2023. Tablets are favored for their cost-effectiveness and widespread availability in both pharmacy chains and online retailers.

Their solid, compact form ensures long-lasting stability and ease of storage, making them a practical option for consumers who purchase liver health supplements in bulk. While tablets are also convenient, their slower dissolution rate compared to capsules has led some consumers to opt for the latter.

Liquids represented a smaller portion of the market, capturing approximately 15% in 2023. Liquid supplements are generally preferred by individuals who have difficulty swallowing pills or capsules. Additionally, liquid forms are quickly absorbed by the body, offering faster onset of effects.

They are commonly used in children’s supplements or for consumers seeking natural, herbal liver health solutions. However, their lower shelf life and need for careful storage limit their widespread adoption.

Powders and other dosage forms, including soft gels and gummies, accounted for the remaining 20% of the market. Powders are often chosen for their flexibility in dosing, especially in health-conscious communities where consumers prefer to mix supplements with smoothies or shakes.

Although they offer customization, powders are less convenient for on-the-go use compared to capsules or tablets. The gummies segment, while growing, still represents a niche in the liver health supplement market, appealing primarily to younger consumers and those seeking a more enjoyable supplement-taking experience.

By Form

In 2023, Powder held a dominant market position in the liver health supplements market, capturing more than a 64.1% share. Powdered supplements are widely popular due to their versatility and ease of use. They are typically favored by consumers who prefer to mix their supplements into drinks, smoothies, or shakes.

Powders also allow for flexible dosing, enabling consumers to adjust the amount according to their specific needs. Additionally, powdered forms tend to have a longer shelf life and better absorption rates, contributing to their strong market presence. This form is particularly popular among health-conscious individuals and athletes who incorporate liver health supplements into their daily routines for detoxification or overall wellness.

Liquids, while accounting for a smaller market share of around 35.9% in 2023, are also gaining popularity. Liquid supplements are valued for their fast absorption rates, as they do not need to be digested and are rapidly absorbed into the bloodstream. This makes them an appealing option for those seeking immediate effects.

Liquid formulations are also often preferred by consumers who have difficulty swallowing pills or powders. In addition, liquid liver health supplements are commonly used in combination with other herbal or nutritional ingredients, enhancing their appeal in the growing natural health and wellness trend.

By Nature

In 2023, Conventional liver health supplements held a dominant market position, capturing more than a 59.2% share. Conventional supplements are widely used due to their cost-effectiveness and availability. These products often contain a blend of synthetic and naturally sourced ingredients that are scientifically proven to support liver health.

The ease of mass production and lower price point compared to organic options make conventional supplements more accessible to a broader consumer base. As a result, conventional supplements remain popular across North America, Europe, and other regions with established healthcare infrastructure.

On the other hand, Organic liver health supplements accounted for approximately 40.8% of the market in 2023. The growing trend of organic products reflects increased consumer demand for natural, pesticide-free, and non-GMO ingredients.

Organic liver health supplements typically feature herbal extracts, such as milk thistle, dandelion, and turmeric, which are believed to offer liver detoxification and protection benefits without synthetic additives.

By Source

In 2023, Vitamins held a dominant market position in the liver health supplements market, capturing more than a 37.2% share. Vitamins, particularly Vitamin E and Vitamin C, are commonly used in liver health supplements due to their strong antioxidant properties, which help protect liver cells from oxidative stress and inflammation.

Vitamin E is particularly known for its ability to support liver function and reduce the risk of liver diseases like non-alcoholic fatty liver disease (NAFLD). As consumers increasingly seek supplements to boost their liver health and overall wellness, vitamin-based formulations remain a popular choice.

Minerals accounted for around 25.5% of the market share in 2023. Key minerals such as zinc, magnesium, and selenium are essential for liver detoxification and function. Zinc, for example, plays a crucial role in regulating the immune system and aiding liver cell regeneration. While the mineral segment is smaller than vitamins, it remains important due to the growing awareness of the role minerals play in overall metabolic health and liver support.

Botanicals made up approximately 30.8% of the market share in 2023. Botanicals, including popular ingredients like milk thistle, turmeric, and dandelion root, are favored for their natural, plant-based properties. These herbal ingredients are known for their detoxifying and liver-protecting effects, which have made them a central part of liver health supplements. As consumers continue to demand more natural and plant-based products, the botanical segment is expected to grow at a faster rate.

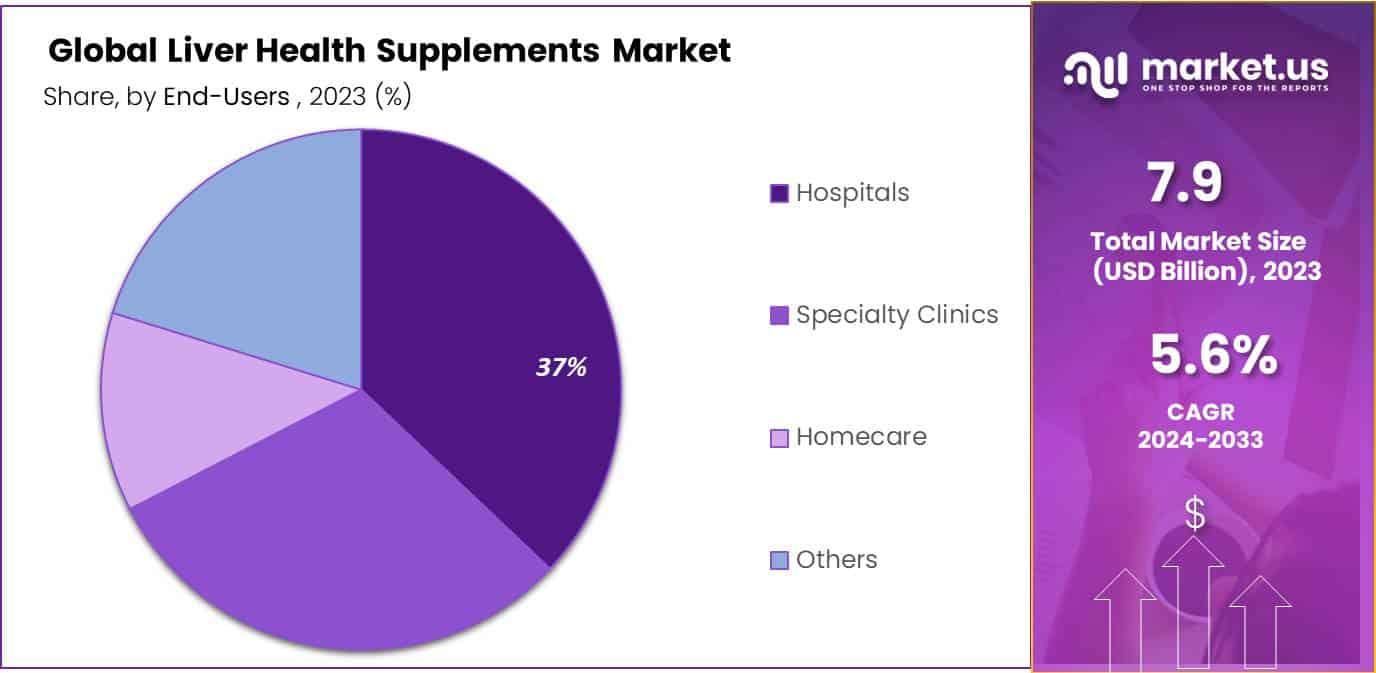

By End-Users

In 2023, Hospitals held a dominant market position in the liver health supplements market, capturing more than a 37.2% share. Hospitals play a crucial role in the treatment and management of liver diseases, and liver health supplements are often recommended as part of post-treatment care or liver disease management.

The demand for liver health supplements in hospitals is driven by the increasing incidence of liver-related conditions such as fatty liver disease, hepatitis, and cirrhosis. Hospitals are also increasingly integrating nutritional therapies into treatment plans, which include the use of liver health supplements to support liver function and improve recovery outcomes for patients.

Specialty Clinics accounted for approximately 29.5% of the market share in 2023. These clinics, which specialize in liver health and related disorders, represent a growing segment of the liver health supplements market.

As awareness of liver diseases rises, more patients are seeking specialized care for chronic liver conditions, leading to an increased demand for targeted supplements that can aid in detoxification and liver repair. Specialty clinics often provide personalized recommendations for liver health, making them an important end-user for liver health supplements.

Homecare usage was significant, capturing around 23.3% of the market in 2023. Many consumers are increasingly turning to liver health supplements as part of their daily wellness routines, often for detoxification or to manage mild liver conditions.

Homecare represents a growing trend in self-care, where individuals seek preventive health solutions outside of a clinical setting. The rising popularity of online retail and direct-to-consumer options has further boosted the accessibility of liver health supplements for home use.

By Distribution Channel

In 2023, Supermarkets/Hypermarkets held a dominant market position in the liver health supplements market, capturing more than a 44.3% share. These retail channels remain the most widely used distribution point for liver health supplements, largely due to their convenience and broad consumer reach.

Supermarkets and hypermarkets offer a wide range of products, making it easy for consumers to find liver health supplements alongside other health and wellness products. The presence of in-store promotions and the ability to see and compare various brands in person further enhance their appeal. Additionally, many consumers prefer purchasing supplements from physical stores where they can consult with pharmacists or store staff for recommendations.

Online Retailers accounted for around 32.1% of the market share in 2023. The growing preference for online shopping has been a key driver for the increasing sales of liver health supplements through digital platforms. Consumers appreciate the convenience of shopping from home, comparing prices, and reading customer reviews.

Major e-commerce platforms like Amazon, eBay, and dedicated health websites have become primary sources for liver health supplements. The ability to deliver directly to the consumer’s doorstep, along with subscription services, has made online retail an increasingly popular choice, particularly among tech-savvy and younger consumers.

Specialty Stores captured 18.4% of the market share in 2023. These stores, often dedicated to natural and health-focused products, cater to a niche but loyal customer base looking for high-quality, often organic, liver health supplements.

Specialty stores tend to offer more curated selections, including premium, herbal, and alternative formulations that appeal to consumers who prefer natural ingredients or have specific dietary preferences. These stores are particularly popular in regions with a strong wellness culture, such as North America and Europe.

Key Market Segments

By Dosage Form

- Capsules

- Tablets

- Liquids

- Powders

- Others

By Form

- Powder

- Liquid

By Nature

- Organic

- Conventional

By Source

- Vitamins

- Minerals

- Botanicals

- Others

By End-Users

- Hospitals

- Specialty Clinics

- Homecare

- Others

By Distribution Channel

- Supermarkets/Hypermarkets

- Online Retailers

- Specialty Stores

- Others

Drivers

Increasing Prevalence of Liver Diseases and Health Awareness

One of the major driving factors behind the growth of the liver health supplements market is the rising prevalence of liver diseases globally, along with increasing consumer awareness about liver health and wellness. The World Health Organization (WHO) has highlighted that liver diseases are among the leading causes of morbidity and mortality worldwide.

According to the Global Health Data Exchange, liver disease-related deaths in 2020 accounted for over 2 million deaths globally, with chronic liver diseases like non-alcoholic fatty liver disease (NAFLD) and cirrhosis seeing significant increases. This growing disease burden has sparked greater interest in liver health supplements as preventive measures or adjuncts to traditional medical treatments.

As a result, consumers are increasingly turning to liver health supplements, which often contain natural ingredients like milk thistle, turmeric, and dandelion root, known for their detoxifying and liver-supporting properties. The demand for these products is further fueled by a rising focus on self-care and holistic health solutions.

According to a 2019 study by the American Liver Foundation, approximately 25% of the U.S. population has NAFLD, highlighting the growing need for effective liver health management options. As more people seek solutions to mitigate the risks of liver diseases, supplements are becoming a prominent part of preventive health routines.

Government Initiatives Supporting Liver Health

Governments worldwide are increasingly recognizing the importance of liver health, leading to various initiatives and policies aimed at raising awareness and promoting preventive healthcare. For instance, in the U.S., the National Institute of Diabetes and Digestive and Kidney Diseases (NIDDK) has been actively involved in research and funding programs related to liver diseases, with a particular focus on early detection and lifestyle changes that can prevent liver damage.

In 2021, the U.S. government allocated approximately $30 million to support liver disease-related research and public health campaigns. This governmental backing encourages consumers to take a more proactive approach to their liver health, driving the demand for supplements that promote liver function.

Shift Towards Preventive Healthcare and Natural Supplements

Another key factor driving the demand for liver health supplements is the increasing consumer preference for preventive healthcare, as well as a shift towards natural and plant-based products. A growing body of research suggests that lifestyle factors such as poor diet, alcohol consumption, and obesity contribute significantly to liver damage, prompting many consumers to seek preventive solutions.

According to a 2022 survey by HealthLine, 62% of respondents stated that they are more likely to choose natural supplements over synthetic alternatives to support their health, especially in the context of liver and detoxification.

Restraints

Lack of Regulatory Oversight and Quality Control in the Liver Health Supplements Market

One of the major restraining factors for the liver health supplements market is the lack of consistent regulatory oversight and quality control. Unlike pharmaceuticals, dietary supplements, including liver health products, are not subject to the same rigorous testing and approval processes in many regions. This regulatory gap has led to concerns over product safety, efficacy, and consistency.

According to the U.S. Food and Drug Administration (FDA), while the agency monitors the safety of dietary supplements, it does not approve them before they are sold to consumers. The Dietary Supplement Health and Education Act (DSHEA) of 1994, which governs the U.S. supplement market, allows manufacturers to market their products without providing proof of safety or efficacy to the FDA. As a result, consumers may be exposed to liver health supplements that do not meet quality standards, which could potentially lead to adverse health effects.

Consumer Awareness and Skepticism Around Supplement Efficacy

A related restraining factor is consumer skepticism regarding the efficacy of liver health supplements. Many consumers remain uncertain about whether these supplements deliver the promised benefits or whether they are merely a placebo.

According to the National Institutes of Health (NIH), while certain supplements, such as milk thistle, have shown potential in supporting liver function, large-scale clinical studies are still limited. A 2021 study by the National Institute on Aging (NIA) found that out of the 67% of adults who reported using dietary supplements, only 29% expressed confidence that these products would lead to improved health outcomes.

Competing Alternatives and Consumer Preferences for Conventional Medicine

Another factor restraining the growth of the liver health supplements market is the strong preference for conventional medicine among certain consumer groups. Many individuals still rely heavily on prescribed medications and treatments from licensed healthcare providers for liver-related issues.

The use of liver health supplements as a complementary or alternative therapy is not always accepted by mainstream medical professionals. According to a 2018 survey by the American Medical Association (AMA), 56% of healthcare providers expressed skepticism about the effectiveness of dietary supplements for managing liver diseases, citing a lack of scientific backing for many claims.

Opportunity

Rising Consumer Demand for Preventive Healthcare and Natural Liver Support

According to a 2019 survey by the American Journal of Preventive Medicine, 68% of adults in the U.S. reported taking dietary supplements for preventive health, with liver health products being among the most commonly sought-after. This shift towards preventive care is particularly strong in regions such as North America, where lifestyle-related liver diseases like non-alcoholic fatty liver disease (NAFLD) and fatty liver disease are on the rise due to poor diets and sedentary lifestyles.

Additionally, there is increasing consumer preference for natural and organic supplements. According to a 2022 report from the Organic Trade Association, sales of organic dietary supplements in the U.S. grew by 9.2%, reaching a market value of USD 4.1 billion in 2022, driven by rising consumer awareness of the risks of synthetic additives and chemicals.

Government Initiatives Promoting Liver Health and Wellness

Governments across the globe are increasingly focused on liver health due to the growing burden of liver diseases. Many governments are implementing initiatives to raise awareness and encourage liver disease prevention, which creates a conducive environment for the growth of liver health supplements.

For example, the National Institute of Diabetes and Digestive and Kidney Diseases (NIDDK) in the U.S. allocated USD 80 million in 2021 to fund liver disease research and public health programs, including initiatives to address non-alcoholic fatty liver disease (NAFLD).

As part of these efforts, the U.S. government is also promoting lifestyle changes to prevent liver diseases, encouraging the adoption of healthier diets and exercise routines. This focus on liver health prevention directly benefits the liver health supplements market, as more consumers seek supplements to complement lifestyle changes that support liver function.

Similarly, in Europe, the European Association for the Study of the Liver (EASL) has been actively raising awareness about liver diseases, particularly in light of the increasing prevalence of liver conditions like cirrhosis and liver cancer.

Expanding Market for Plant-Based and Vegan Liver Health Supplements

The rising popularity of plant-based and vegan diets is another significant growth opportunity for the liver health supplements market. According to the Plant Based Foods Association, the market for plant-based food products in the U.S. grew by 27% from 2020 to 2021, indicating a shift toward plant-based diets.

As more consumers embrace vegan and vegetarian lifestyles, there is an increasing demand for vegan liver health supplements made from plant-derived ingredients. These products are appealing to individuals who are looking for plant-based alternatives to support liver detoxification and health.

Vegan liver health supplements, which often contain ingredients like milk thistle, artichoke extract, and dandelion root, are becoming increasingly popular among health-conscious consumers who prioritize sustainable and cruelty-free products.

The global plant-based supplements market, which includes liver health products, is expected to grow at a compound annual growth rate (CAGR) of 7.9% from 2023 to 2030. This trend presents a key opportunity for companies to expand their product offerings to meet the rising demand for vegan liver health solutions.

Rising Demand in Emerging Markets

Emerging markets, particularly in Asia-Pacific (APAC) and Latin America, present untapped growth potential for liver health supplements. In India, liver diseases like hepatitis and NAFLD are becoming increasingly prevalent due to urbanization and changing dietary patterns.

According to the World Health Organization (WHO), the prevalence of hepatitis B and C in India is estimated to be around 3-4% of the population. This has led to a growing demand for liver health supplements in the region as consumers become more aware of liver diseases and seek preventive solutions.

Similarly, the Chinese market is witnessing a rise in liver health awareness, with reports suggesting that over 300 million people in China suffer from liver-related conditions. The growing middle class in these regions is also driving the adoption of health supplements as part of a broader wellness trend. As disposable incomes rise and consumer awareness improves, the liver health supplements market in APAC is expected to see significant growth in the coming years.

Trends

Rising Popularity of Natural and Plant-Based Liver Health Supplements

A major trend shaping the liver health supplements market is the increasing consumer preference for natural and plant-based solutions. As consumers become more health-conscious and environmentally aware, there is a clear shift toward supplements that contain organic and plant-derived ingredients.

According to the Organic Trade Association, organic food sales in the U.S. grew by 12.8% in 2020, with organic supplements representing a significant portion of this growth. This trend reflects a broader movement toward cleaner, plant-based products, which is now extending to liver health supplements.

Popular natural ingredients used in liver health supplements include milk thistle, dandelion root, artichoke extract, and turmeric. These ingredients are praised for their detoxification and liver-supporting properties. For instance, milk thistle has been shown to have protective effects on liver cells, and it remains one of the most commonly used herbs in liver health formulations.

The growing consumer trust in the efficacy of plant-based supplements is driving an uptick in demand for natural liver health products. The global market for plant-based supplements is expected to grow at a CAGR of 7.9% from 2023 to 2030, further emphasizing this shift.

This trend aligns with the broader shift toward clean label products, where consumers are increasingly seeking transparency in ingredient sourcing and formulation. The clean-label trend has contributed to a surge in demand for products that are free from artificial additives, preservatives, and synthetic chemicals.

In fact, a 2019 report by Mintel revealed that 71% of U.S. consumers prefer supplements that are free from artificial ingredients and contain natural, plant-based components. As awareness of the potential health risks associated with synthetic chemicals grows, more consumers are turning to natural alternatives for liver health.

Government Initiatives and Regulations Supporting Natural Products

Government initiatives and regulations are also supporting the growing demand for natural and organic liver health supplements. For example, the European Commission has been actively working to improve the transparency of food and dietary supplements, ensuring that they meet high safety and quality standards.

In 2020, the European Commission announced stricter regulations for herbal supplements, ensuring that only those with verified efficacy and safety could be marketed. This push towards regulation has provided a foundation for the growth of high-quality, natural liver health supplements, giving consumers greater confidence in these products.

In the U.S., the Food and Drug Administration (FDA) also regulates supplements, including those made with natural ingredients, to ensure they are safe and meet quality standards. Although the FDA does not pre-approve supplements before they are sold, it does monitor the market for unsafe or misleading products.

The growing focus on ensuring that plant-based liver health supplements are both effective and safe is encouraging further development in the market. Governments are also providing funding for research into the effectiveness of natural remedies, which is fueling innovation in the space. This trend is likely to continue, as consumers increasingly demand products that are both effective and in line with sustainable, plant-based lifestyles.

Integration of Liver Health Supplements in Holistic Wellness Programs

Another prominent trend is the integration of liver health supplements into broader wellness and lifestyle programs. As part of a growing awareness of the link between liver health and overall well-being, more consumers are adopting supplements as part of holistic wellness strategies.

According to a 2021 survey by the National Institutes of Health (NIH), more than 70% of adults reported using dietary supplements as part of their wellness routines, with liver health supplements ranking among the most popular. Consumers are increasingly seeking natural ways to support liver health, often in conjunction with other lifestyle choices such as diet, exercise, and stress management.

Liver health supplements are often marketed as part of detoxification programs or as aids to support liver regeneration. The increasing awareness of non-alcoholic fatty liver disease (NAFLD), a condition that affects 25% of the global population according to the World Health Organization (WHO), is driving this trend.

Liver health supplements, including milk thistle and turmeric, are often marketed as part of liver detox regimens aimed at combating the effects of an unhealthy diet or environmental toxins. This trend toward holistic health programs that integrate supplements with other health practices is expected to continue to drive market demand.

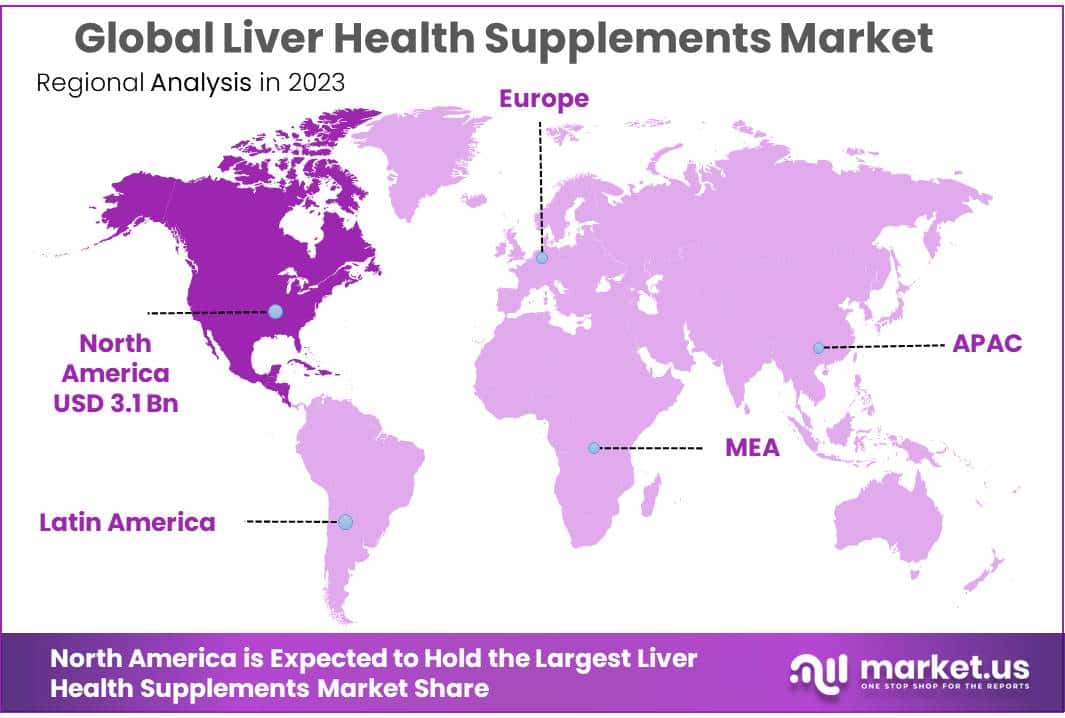

Regional Analysis

In 2023, North America held a dominant position in the global liver health supplements market, capturing more than 39% of the market share, with a market value of approximately USD 3.1 billion. This growth is primarily driven by the high awareness of liver health issues and increasing adoption of preventive healthcare measures.

The prevalence of liver diseases, such as non-alcoholic fatty liver disease (NAFLD) and alcoholic liver disease, is also a key factor. According to the American Liver Foundation, approximately 1 in 4 Americans are affected by NAFLD, which further boosts the demand for liver health supplements. Additionally, the U.S. and Canada are witnessing an increasing trend of consumers integrating liver detoxification and regeneration supplements, particularly those made from natural ingredients like milk thistle and turmeric, into their daily health regimens.

In Europe, the liver health supplements market is also expanding, driven by rising awareness of liver diseases and aging populations. The region accounted for 25% of the global market share in 2023.

European countries, particularly Germany and the UK, have seen an uptick in demand for herbal-based liver supplements, aligning with the region’s growing preference for natural and organic products. Moreover, the European Union’s strict regulations on food safety and supplement quality ensure a competitive and secure market environment for liver health products.

Asia Pacific (APAC), with a share of 18.5%, is witnessing rapid growth due to increasing liver disease prevalence and rising disposable incomes. Countries like China and India are experiencing a surge in the adoption of dietary supplements as part of a broader wellness movement. APAC’s expanding middle class and awareness campaigns are likely to contribute to future growth.

Latin America and Middle East & Africa collectively represent a smaller but growing portion of the market, with the demand for liver health supplements increasing due to greater consumer awareness and improving healthcare infrastructure.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Liver Health Supplements Market is characterized by the presence of several prominent players, each contributing to the market’s expansion through innovative product offerings and strategic business activities. Key players such as America’s Finest Inc., Amway Corp., GNC, Blackmore, and Nature’s Bounty are leaders in the market, offering a wide range of liver health supplements, including herbal-based formulations, vitamins, and minerals.

Amway Corp. is particularly notable for its extensive product portfolio, including supplements like Nutrilite Liver Support, which helps support liver health through a blend of natural ingredients. GNC, with its large retail presence and robust e-commerce channels, continues to be a significant player, offering products like GNC Milk Thistle and other liver detoxification supplements.

Other notable players such as Gaia Herbs, Banyan Botanicals, and Himalaya Herbal Healthcare emphasize the use of plant-based and organic ingredients in their liver health supplements, aligning with the increasing consumer demand for natural and sustainable products.

Gaia Herbs offers products like Milk Thistle Supreme for liver support, which has become popular due to its high-quality herbal formulations. Meanwhile, Swisse Wellness and Now Foods continue to strengthen their position through product innovation and expanding their global reach. Sanofi and Nestlé (through their acquisition of Nature’s Bounty) represent larger pharmaceutical and food conglomerates that have made significant investments in the supplements space, further driving market consolidation.

In addition, companies such as Enzymedica, Irwin Naturals, and Jarrow Formulas, Inc. are known for their focus on advanced formulations, combining enzyme blends, antioxidants, and liver-supporting compounds like N-Acetyl Cysteine (NAC) and Turmeric to enhance liver health. These brands benefit from strong distribution networks across supermarkets, health food stores, and online platforms.

Top Key Players in the Market

- America’s Finest Inc.

- Amway Corp.

- Balchem Corporation

- Banyan Botanicals

- Blackmore

- Enzymedica

- Enzymedica.

- Gaia Herbs

- GNC

- Himalaya Herbal Healthcare

- Integria Healthcare (Australia) Pty Ltd.

- Irwin Naturals

- Jarrow Formulas, Inc.

- Nature’s Bounty

- Nature’s Craft.

- Nestle (Nature’s Bounty)

- Now Foods

- NUTRALife

- Sanofi

- Swisse Wellness PTY LTD

- Thompson

Recent Developments

In 2023 America’s Finest Inc., they reported a 15% increase in revenue from liver health supplements, reflecting the growing consumer interest in preventative healthcare.

In 2023, Amway’s Nutrilite line contributed to 20% of the company’s overall supplement sales, reflecting its strong position in the market.

Report Scope

Report Features Description Market Value (2023) USD 7.9 Bn Forecast Revenue (2033) USD 13.6 Bn CAGR (2024-2033) 5.6% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Dosage Form (Capsules, Tablets, Liquids, Powders, Others), By Form (Powder, Liquid), By Nature ( Organic, Conventional), By Source (Vitamins, Minerals, Botanicals, Others), By End-Users (Hospitals, Specialty Clinics, Homecare, Others), By Distribution Channel (Supermarkets/Hypermarkets, Online Retailers, Specialty Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape America’s Finest Inc., Amway Corp., Balchem Corporation, Banyan Botanicals, Blackmore, Enzymedica, Enzymedica., Gaia Herbs, GNC, Himalaya Herbal Healthcare, Integria Healthcare (Australia) Pty Ltd., Irwin Naturals, Jarrow Formulas, Inc., Nature’s Bounty, Nature’s Craft., Nestle (Nature’s Bounty), Now Foods, NUTRALife, Sanofi, Swisse Wellness PTY LTD, Thompson Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Liver Health Supplements MarketPublished date: Nov 2024add_shopping_cartBuy Now get_appDownload Sample

Liver Health Supplements MarketPublished date: Nov 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- America's Finest Inc.

- Amway Corp.

- Balchem Corporation

- Banyan Botanicals

- Blackmore

- Enzymedica

- Enzymedica.

- Gaia Herbs

- GNC

- Himalaya Herbal Healthcare

- Integria Healthcare (Australia) Pty Ltd.

- Irwin Naturals

- Jarrow Formulas, Inc.

- Nature's Bounty

- Nature's Craft.

- Nestle (Nature's Bounty)

- Now Foods

- NUTRALife

- Sanofi

- Swisse Wellness PTY LTD

- Thompson