Global Single Serve Wine Market By Type (Red Wine, White Wine, Muscat Wine, Full Bodied Wine, Riesling, Sauvignon Blanc), By Texture (Smooth, Course, Creamy, Waxy, Silky), By Container Type (Glass Bottle, Metal Can), By Shape (Burgundy, Bordeaux, Alsace, Phone Valley, Provence, Jura, Champagne), By Nature (Organic, Conventional), By Application (In-Store, Restaurant, Bar, Hotel), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Jan 2025

- Report ID: 137271

- Number of Pages: 326

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

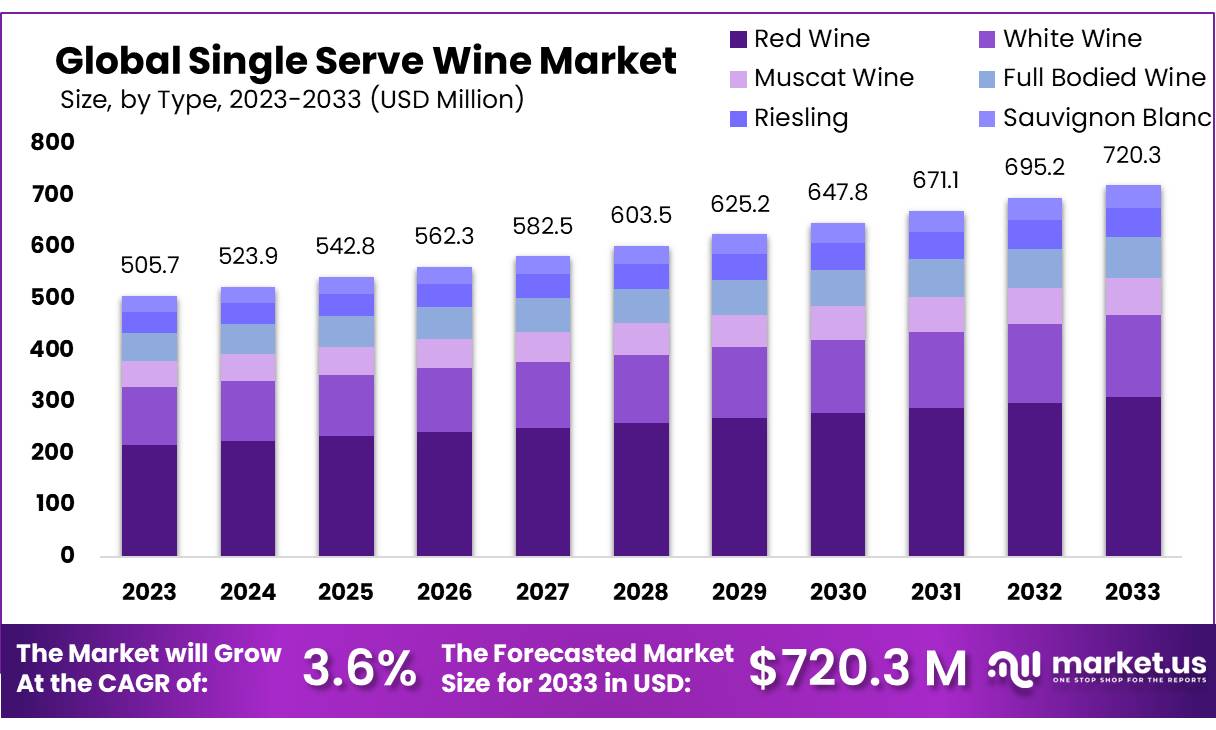

The Global Single Serve Wine Market size is expected to be worth around USD 720.3 Mn by 2033, from USD 505.7 Mn in 2023, growing at a CAGR of 3.6% during the forecast period from 2024 to 2033.

The Single-Serve Wine Market has emerged as a dynamic segment in the global wine industry, driven by changing consumer preferences and the need for convenience. Single-serve wine refers to pre-portioned packaging formats, typically ranging from 187ml to 375ml, designed for individual consumption. These offerings cater to modern lifestyles, providing portability and reducing waste. With rising demand for on-the-go beverages and premium experiences, the single-serve wine category is rapidly gaining traction among urban and millennial consumers.

Key driving factors for the market include changing consumption patterns, with consumers preferring smaller portions due to health consciousness and a desire to avoid wastage. The growing popularity of outdoor activities, such as picnics, concerts, and festivals, has also bolstered demand for convenient, portable wine options. Additionally, the single-serve format aligns with post-pandemic trends emphasizing individual portions and hygiene. The rising influence of e-commerce platforms in alcohol sales has further supported the market, with single-serve wine products becoming popular choices for online shoppers.

Emerging trends in the market include the adoption of sustainable and recyclable packaging materials, reflecting the growing environmental consciousness among consumers. Brands are also exploring premium single-serve options, including organic and biodynamic wines, to cater to high-income segments. Innovations in wine packaging, such as resealable cans and nitrogen-flushed containers to preserve flavor, are enhancing product appeal. Marketing strategies targeting specific demographics, such as millennials and Gen Z, with vibrant branding and storytelling around provenance, are also shaping the competitive landscape.

In developed economies such as the U.S., Europe, and Australia, single-serve wine products have been embraced by consumers for their practicality and ease of use. In emerging markets, the rise of disposable income and changes in lifestyle preferences are helping to expand the market for these convenient wine options. The innovation in packaging—such as eco-friendly cans, Tetra Paks, and easy-to-carry pouches—has further augmented market growth, as these formats cater to sustainability concerns and offer portability that appeals to a wide range of consumers.

Key Takeaways

- Single Serve Wine Market size is expected to be worth around USD 720.3 Mn by 2033, from USD 505.7 Mn in 2023, growing at a CAGR of 3.6%.

- Red Wine held a dominant market position, capturing more than a 43.2% share of the Single Serve Wine Market.

- Smooth wines held a dominant market position in the Single Serve Wine Market, capturing more than a 54.2% share.

- Glass Bottle containers held a dominant market position in the Single Serve Wine Market, capturing more than a 66.1% share.

- Burgundy shaped bottles held a dominant market position in the Single Serve Wine Market, capturing more than a 43.1% share.

- Conventional wines held a dominant market position in the Single Serve Wine Market, capturing more than a 72.1% share.

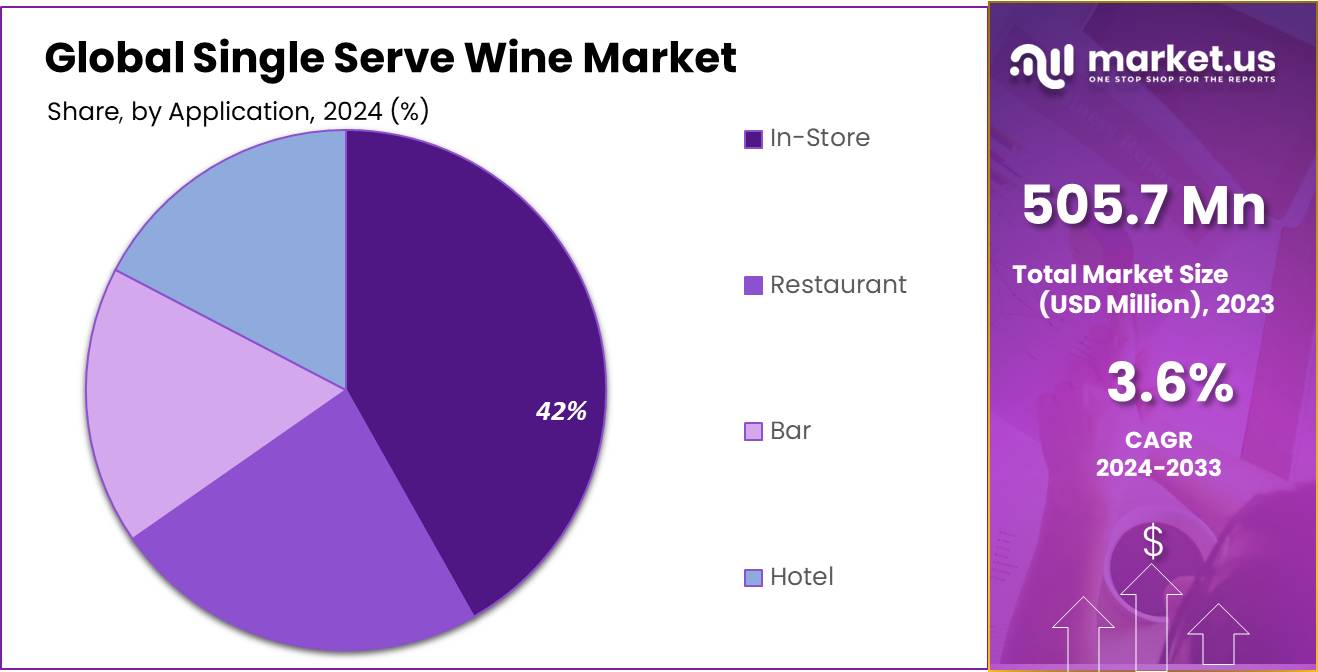

- In-Store sales held a dominant market position in the Single Serve Wine Market, capturing more than a 43.1% share.

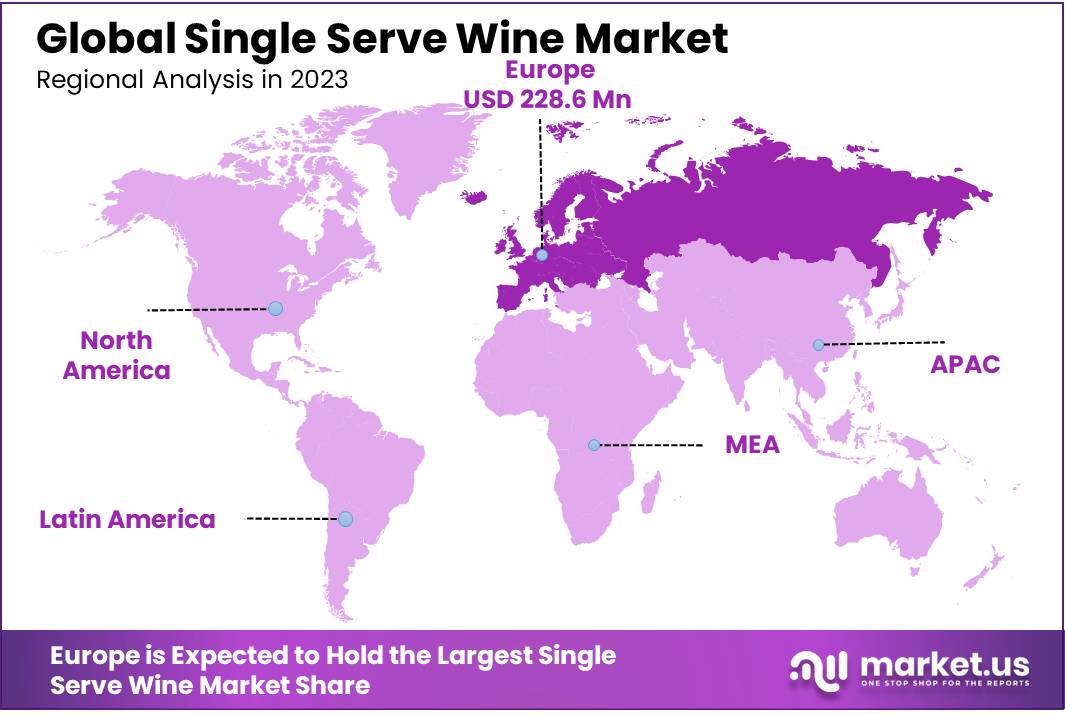

- Europe stands as the dominating region, holding a substantial 45.2% market share with a valuation of USD 228.6 million.

By Type

In 2023, Red Wine held a dominant market position, capturing more than a 43.2% share of the Single Serve Wine Market. This preference can be attributed to its widespread acceptance among wine enthusiasts who appreciate its rich flavors and potential health benefits associated with moderate consumption. Red wine continues to be favored for its versatility in pairing with various cuisines, enhancing the dining experience.

Following closely, White Wine accounted for a substantial portion of the market. Known for its lighter and crisper taste compared to red wine, white wine appeals particularly during warmer months and is often chosen for its ability to complement lighter meals like seafood and salads.

Muscat Wine, with its sweet and aromatic profile, also carved out a niche in the market. This wine type is particularly popular among those who enjoy dessert wines or prefer a sweeter, more fragrant wine experience. Its distinct flavor profile has helped it maintain a steady market presence.

Full Bodied Wine, recognized for its robust and rich flavors, appeals to a specific segment of wine drinkers who seek a more intense taste experience. These wines are particularly popular in settings where heavier, more flavorful dishes are served, making them a favorite during the winter season.

Riesling, a wine that varies from sweet to dry, has captured the interest of a diverse audience. Its versatility and the ability to pair well with spicy foods and sweet desserts have helped it gain a respectable share of the market.

Lastly, Sauvignon Blanc, noted for its crisp, dry, and refreshing taste, is favored during the spring and summer months. It is especially popular among those who prefer a wine that pairs well with lighter dishes such as poultry and fresh vegetables.

By Texture

In 2023, Smooth wines held a dominant market position in the Single Serve Wine Market, capturing more than a 54.2% share. These wines are favored for their easy-to-drink texture that appeals to both novice and experienced wine drinkers alike. The smooth texture makes these wines highly versatile, pairing well with a wide range of foods from light appetizers to hearty main courses.

Course textured wines, known for their robust and gritty feel, also carved out a significant presence. These wines are typically preferred by those who enjoy a more rustic wine drinking experience, often complementing rich, flavorful meats and cheeses.

Creamy wines have their own appeal, especially among those who favor a richer, more velvety wine experience. This texture is particularly popular in white and sparkling wines, where the creaminess adds a luxurious feel to the palate, making it a popular choice for celebrations and special occasions.

Waxy textured wines, while more niche, attract a dedicated following. These wines are characterized by a unique mouthfeel that can enhance the flavor profiles of complex white wines, making them a favorite among connoisseurs who appreciate depth and longevity in their wine.

Finally, Silky wines are appreciated for their smooth and lush texture, offering a gentle and elegant wine experience. This texture is often associated with high-quality red wines that are well-aged, allowing the tannins to soften and produce a silky feel on the palate.

By Container Type

In 2023, Glass Bottle containers held a dominant market position in the Single Serve Wine Market, capturing more than a 66.1% share. This preference is driven by consumers’ perception of glass as a higher-quality packaging option that preserves the taste and quality of wine better than other materials. Glass bottles are also favored for their environmental impact, as they are 100% recyclable and can be reused multiple times without losing purity or quality.

Metal Cans have been gaining traction, especially among younger consumers who value convenience and portability. Metal cans are ideal for outdoor events, festivals, and other settings where glass is impractical. They are lighter, unbreakable, and chill quickly, making them a popular choice for casual, informal wine drinking occasions.

By Shape

In 2023, Burgundy shaped bottles held a dominant market position in the Single Serve Wine Market, capturing more than a 43.1% share. This shape is traditionally associated with both red and white wines known for their depth and complexity. The Burgundy bottle, with its sloping shoulders and wider base, is particularly favored for its classic aesthetic that appeals to traditional wine consumers who appreciate the heritage and the story behind the wine.

Alsace shaped bottles, traditionally used for aromatic white wines, are slender and elongated, making them stand out on the shelves. These bottles appeal to those who enjoy lighter, crisper wines and are looking for a bottle that reflects the elegance of the wine inside.

Rhône Valley shaped bottles, similar to Burgundy but often slightly more massive, cater to consumers who favor powerful and spicy wines typically from this region. Their robust design is perfect for showcasing the bold character of Rhône wines.

Provence shaped bottles are often associated with rosé wines, reflecting the lightness and freshness typical of wines from this region. Their unique and often more decorative design appeals to a niche market looking for something different and visually appealing.

Jura shaped bottles, less common but distinctive with their traditional and sometimes antique look, are preferred by those interested in unique varietal wines from the Jura region known for their authenticity and history.

Champagne shaped bottles, with their thick glass and deep punt, are designed to handle the pressure of sparkling wines. They are preferred for their association with celebration and luxury, capturing the essence of festivity and premium quality.

By Nature

In 2023, Conventional wines held a dominant market position in the Single Serve Wine Market, capturing more than a 72.1% share. This segment’s strength is largely due to its widespread availability and typically lower price point compared to organic options. Conventional wines benefit from established vineyard practices and economies of scale, which often translate into a broader variety of choices for consumers across different price ranges.

The Organic wine segment, while smaller, has been steadily gaining momentum as consumers become more health-conscious and environmentally aware. These wines are made from grapes grown without synthetic pesticides or fertilizers and often appeal to those seeking a more natural and sustainable option. Organic wines are particularly popular among younger consumers and those who are dietary and environmentally conscious, willing to pay a premium for products that align with their values.

By Application

In 2023, In-Store sales held a dominant market position in the Single Serve Wine Market, capturing more than a 43.1% share. This segment benefits from the widespread availability of single serve wines in supermarkets, wine shops, and other retail outlets, where consumers enjoy the convenience of exploring a diverse array of options. The ability to purchase these wines off the shelf caters to impulse buying and the growing trend of at-home consumption, particularly appealing to those who prefer enjoying a glass of wine without the commitment to an entire bottle.

Restaurants also represent a significant application of single serve wines, offering patrons the flexibility to sample different wines without purchasing a full bottle. This is especially attractive in fine dining environments where customers may seek to pair different wines with different courses.

Bars and hotels have similarly embraced single serve wines, with bars offering them as an approachable option for patrons looking to experiment with new varieties without significant expense. Hotels find them advantageous for service in minibars and at events, providing a touch of luxury and personalization to guest experiences.

Key Market Segments

By Type

- Red Wine

- White Wine

- Muscat Wine

- Full Bodied Wine

- Riesling

- Sauvignon Blanc

By Texture

- Smooth

- Course

- Creamy

- Waxy

- Silky

By Container Type

- Glass Bottle

- Metal Can

By Shape

- Burgundy

- Bordeaux

- Alsace

- Phone Valley

- Provence

- Jura

- Champagne

By Nature

- Organic

- Conventional

By Application

- In-Store

- Restaurant

- Bar

- Hotel

Drivers

Rising Consumer Demand for Convenience and Portability

One of the primary driving factors for the growth of the Single Serve Wine Market is the rising consumer demand for convenience and portability. This trend is particularly evident among millennials and Gen Z consumers, who value ease of use and practicality, especially in their beverage choices. According to data from the Food and Agriculture Organization (FAO), there has been a noticeable increase in alcohol consumption in single-serving formats, with wine seeing a significant shift towards these smaller, more convenient packaging options.

The popularity of single serve wines is also bolstered by changing lifestyles, where consumers frequently prefer drinking wine at home or in smaller groups rather than at large social gatherings. This shift has been particularly pronounced due to the global health crisis, which has altered social habits significantly. The convenience of not having to open a full bottle to enjoy a single glass is a strong appeal that aligns with the contemporary focus on moderate and responsible drinking.

Moreover, government initiatives aimed at reducing waste have indirectly supported the market for single serve wines. For instance, the European Union’s action plan for the Circular Economy has encouraged packaging innovations that reduce environmental impact, which aligns well with the single serve format’s advantages of reducing leftover wine and packaging waste. This has encouraged wine producers to innovate in both product and packaging, leading to a proliferation of eco-friendly single serve options that appeal to environmentally conscious consumers.

Additionally, the growth in travel and tourism has played a crucial role. Hotels and airlines, seeking to provide personalized and hygienic options, have increasingly adopted single serve wines. This trend is supported by industry reports from major hospitality and tourism organizations, noting a rise in consumer satisfaction when offered tailored and individualized beverage options.

The impact of these factors is also evident in the sales figures reported by leading food and beverage industry organizations. For example, the International Organization of Vine and Wine (OIV) has documented a steady increase in the production and distribution of single serve wine bottles, reflecting growing industry adaptation to consumer preferences.

This convergence of convenience, lifestyle changes, and supportive government and industry initiatives paints a clear picture of why the Single Serve Wine Market is expanding. It’s not just about the wine; it’s about delivering what modern consumers want—quality, convenience, and sustainability in one package.

Restraints

Environmental Concerns and Packaging Costs

One of the major restraining factors for the growth of the Single Serve Wine Market is the environmental concern associated with increased packaging waste and the higher costs of sustainable packaging solutions. As consumers become more environmentally conscious, the impact of single-use packaging on the planet has become a significant concern. According to a report from the United Nations Environment Programme (UNEP), single-use beverage containers, regardless of material, contribute substantially to global plastic waste, which has become a pressing environmental issue.

This environmental concern is compounded by the fact that the production and recycling processes for single serve wine bottles, particularly those made from glass and aluminum, are energy-intensive. The UNEP report highlights that while recycling can help mitigate these impacts, the rates of recycling for beverage containers remain less than ideal worldwide. For instance, less than 40% of glass in some regions is recycled, which points to significant inefficiencies in the lifecycle of these products.

Moreover, governments around the world are increasingly implementing stricter waste management regulations to combat environmental damage. The European Commission, for instance, has been at the forefront with its ambitious Circular Economy Action Plan, which includes directives aimed at reducing packaging waste and promoting recycling across all member states. These regulations can increase the operational costs for wine producers who package their products in single serve formats, as they are required to invest in more sustainable, but also more expensive, packaging solutions.

Additionally, the cost factor extends beyond just compliance with environmental regulations. The production costs for single serve packaging are inherently higher per unit of wine compared to traditional larger bottles. This is because each single serve container requires a proportionately larger amount of material for packaging relative to the volume of wine it holds. Industry analyses by food and beverage organizations have shown that packaging can account for up to 40% of the product cost in single serve formats, which can deter producers, especially smaller or medium-sized enterprises, from adopting this packaging style despite its growing popularity among consumers.

These economic and environmental challenges are not just theoretical but are reflected in the consumer market as well. Surveys conducted by global food and beverage market analysis firms have indicated that a significant percentage of consumers are hesitant to purchase single serve wines regularly due to perceptions of excessive packaging and higher prices.

Opportunity

Expansion into Emerging Markets

A significant growth opportunity for the Single Serve Wine Market lies in its expansion into emerging markets, where increasing disposable incomes and changing lifestyle trends are creating new consumer bases for wine products. This expansion is particularly relevant in regions such as Asia-Pacific and Latin America, where the wine culture is burgeoning amidst growing middle classes and younger populations.

Recent data from the Food and Agriculture Organization (FAO) and other local food industry bodies highlight the rapid urbanization and lifestyle shifts in these regions, which are contributing to a greater openness towards Western-style dining and drinking habits. For example, in countries like China and India, urban consumers are increasingly interested in wine as part of a broader trend towards more diverse and sophisticated beverage choices.

This interest is supported by economic growth in these countries. According to the World Bank, the GDP per capita in these regions has been growing at a rate of 5-7% annually, which translates into greater consumer spending power. This economic uptick is paralleled by a surge in interest in lifestyle products, including wine, which was previously considered a luxury.

Moreover, governments in these emerging markets are recognizing the economic benefits of a flourishing wine market, leading to more supportive policies and reduced tariffs on imported goods, including alcohol. For instance, several Southeast Asian countries have recently lowered their import duties on wine as part of broader free trade agreements, aiming to stimulate their domestic hospitality sectors and cater to the increasing tourist influx who expect international dining experiences.

The growth opportunity is also highlighted by consumer behavior studies conducted by global food and beverage consultants, which show that younger consumers in these markets are particularly drawn to the convenience and portion control offered by single serve wines. These products allow new wine drinkers to explore different varieties without the commitment of purchasing a full bottle, reducing the barriers to entry for novice consumers.

The appeal of single serve wines in these contexts is not just about affordability or economic accessibility; it’s about fitting wine into a modern, urban lifestyle that values convenience, quality, and variety. This alignment with emerging consumer trends presents a lucrative opportunity for wine producers looking to expand their geographic footprint.

Trends

Eco-Friendly Packaging Innovations in Single Serve Wine

A notable trend in the Single Serve Wine Market is the increasing adoption of eco-friendly packaging solutions. As global awareness of environmental issues grows, both consumers and producers are shifting towards sustainable practices, especially in packaging. This trend is particularly prominent in the wine industry, where traditional single serve options like glass bottles and aluminum cans have faced criticism for their environmental impact.

Recent initiatives by food and beverage organizations highlight a significant push towards innovative, sustainable packaging alternatives. For example, biodegradable plant-based plastics and recycled materials are being used increasingly to reduce the carbon footprint associated with wine packaging. The International Organisation of Vine and Wine (OIV) reports that several leading wine producers have begun implementing these sustainable practices, aiming to cut down on waste and appeal to environmentally conscious consumers.

These eco-friendly packaging solutions not only resonate with the green values of modern consumers but also align with global regulatory trends towards sustainability. For instance, the European Union’s Circular Economy Action Plan encourages the use of recyclable and sustainable materials across all sectors, including food and beverage. This plan includes specific targets for reducing packaging waste and enhancing recycling rates, which directly influence packaging decisions in the wine industry.

The market response to these innovations has been overwhelmingly positive. Surveys conducted by consumer research firms indicate that a significant proportion of wine drinkers are willing to pay a premium for wines that use sustainable packaging, seeing this as a way to contribute to environmental conservation. This willingness is particularly pronounced among younger consumers, who often drive market trends towards sustainability.

Moreover, the shift towards eco-friendly packaging is not just a matter of environmental responsibility but also economic sense. Producers who adopt green packaging solutions often benefit from reduced costs over time, as recycled and biodegradable materials become more cost-effective at scale. Additionally, these practices can enhance brand reputation and loyalty among consumers, creating a competitive edge in the crowded wine market.

For detailed information on how the wine industry and regulatory bodies are supporting sustainable packaging initiatives, resources like the OIV’s annual reports or the EU’s public documents on the Circular Economy Action Plan can be accessed online. These documents provide comprehensive insights into how sustainability is being integrated into industry practices and regulations.

Regional Analysis

In the Single Serve Wine Market, regional dynamics vary significantly, reflecting diverse consumer behaviors and economic conditions across different geographies. Europe stands as the dominating region, holding a substantial 45.2% market share with a valuation of USD 228.6 million. This prominence is driven by a strong wine culture and high consumer preference for premium wine products, coupled with the rising trend of convenient and eco-friendly packaging solutions.

North America also represents a significant market segment, characterized by a robust increase in demand for single serve wines, particularly in urban areas with a younger demographic. This region’s growth is propelled by consumers’ growing interest in wine tasting and preference for diverse wine varieties without the commitment to full-sized bottles. Innovations in packaging and marketing strategies tailored to the North American lifestyle have further fueled market expansion.

The Asia Pacific region is emerging as a fast-growing market for single serve wines, thanks to rising disposable incomes and the increasing westernization of consumption habits, particularly in countries like China and India. Wine producers are tapping into this market by aligning their products with local consumer preferences for quality and convenience, often incorporating traditional flavors and ingredients to appeal to the regional palate.

The Middle East & Africa and Latin America are experiencing gradual growth in this market. In Latin America, the development is somewhat moderated by economic fluctuations but sustained by a deep-rooted wine culture in countries like Argentina and Chile. The Middle East & Africa region shows potential due to an expanding expatriate population and increasing tourism, which supports a broader acceptance and demand for diverse wine offerings.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Single Serve Wine Market features a dynamic mix of key players ranging from established wine giants to innovative boutique firms, each contributing to the sector’s growth and diversity. Among the prominent names, E&J Gallo Winery and Constellation Brands stand out for their extensive portfolios and significant market penetration, driving trends and setting industry standards. These companies are known for their strategic marketing and broad distribution networks, which enable them to reach a vast consumer base across multiple regions.

Emerging players like Wander + Ivy and Union Wine Co. bring innovative approaches to packaging and branding, catering to niche markets and the preferences of younger consumers looking for convenience and sustainability. These brands often emphasize organic and biodynamic practices, as seen with Bonterra Organic Vineyards, which resonates with the growing demand for environmentally friendly and health-conscious products. Similarly, Domaine Chandon Brut Rose and Kim Crawford Sauvignon Blanc appeal to consumers through distinct branding that highlights quality and region-specific attributes, enhancing their visibility and appeal in the crowded market.

Companies like Changyu Pioneer Wine Co. Inc. and Viña Concha y Toro SA represent significant international influence, with their roots in burgeoning wine regions in China and Chile, respectively. These players leverage local grape varieties and wine-making traditions to offer unique products that appeal to both local and international consumers. The diverse strategies and geographic footprints of these companies underscore the competitive yet interconnected nature of the Single Serve Wine Market, highlighting a complex interplay of tradition, innovation, and consumer engagement driving the sector forward.

Top Key Players

- Grote Company

- Wander + Ivy Kim Crawford Sauvignon Blanc

- Domaine Chandon Brut Rose

- 19 Crimes Red Blend

- Union Wine Co.

- Pacific Rim Eufloria

- Bonterra Organic Vineyards

- Changyu Pioneer Wine Co. Inc.

- Constellation Brands

- E&J Gallo Winery

- Viña Concha y Toro SA

- Caviro

- Grupo Penaflor S.A.

- The Wine Group

- Accolade Wines Australia Limited

- Casella Family Brands

- Treasury Wine Estates

- Carlyle Group

- Brown- Forman

- Campari Group

- Castel Winery plc.

Recent Developments

In 2023, Grote Company reported an annual revenue of $430 million, employing approximately 1,000 individuals.

In 2023, Domaine Chandon was recognized with the Best US Sparkling award at the Champagne & Sparkling Wine World Championships, highlighting the quality of their Brut Rosé. The winery offers their Brut Rosé in various sizes, including 750ml bottles and 187ml minis, catering to the growing demand for single-serve wine options.

Report Scope

Report Features Description Market Value (2023) USD 505.7 Mn Forecast Revenue (2033) USD 720.3 Mn CAGR (2024-2033) 3.6% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Red Wine, White Wine, Muscat Wine, Full Bodied Wine, Riesling, Sauvignon Blanc), By Texture (Smooth, Course, Creamy, Waxy, Silky), By Container Type (Glass Bottle, Metal Can), By Shape (Burgundy, Bordeaux, Alsace, Phone Valley, Provence, Jura, Champagne), By Nature (Organic, Conventional), By Application (In-Store, Restaurant, Bar, Hotel) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Grote Company, Wander + Ivy Kim Crawford Sauvignon Blanc, Domaine Chandon Brut Rose, 19 Crimes Red Blend, Union Wine Co., Pacific Rim Eufloria, Bonterra Organic Vineyards, Changyu Pioneer Wine Co. Inc., Constellation Brands, E&J Gallo Winery, Viña Concha y Toro SA, Caviro, Grupo Penaflor S.A., The Wine Group, Accolade Wines Australia Limited, Casella Family Brands, Treasury Wine Estates, Carlyle Group, Brown- Forman, Campari Group, Castel Winery plc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Grote Company

- Wander + Ivy Kim Crawford Sauvignon Blanc

- Domaine Chandon Brut Rose

- 19 Crimes Red Blend

- Union Wine Co.

- Pacific Rim Eufloria

- Bonterra Organic Vineyards

- Changyu Pioneer Wine Co. Inc.

- Constellation Brands

- E&J Gallo Winery

- Viña Concha y Toro SA

- Caviro

- Grupo Penaflor S.A.

- The Wine Group

- Accolade Wines Australia Limited

- Casella Family Brands

- Treasury Wine Estates

- Carlyle Group

- Brown- Forman

- Campari Group

- Castel Winery plc.