Global Breakfast Cereals Market By Product Type (Corn Flakes, Rice Flakes, Wheat Flakes, Granola, Muesli, Bran Flakes, and Others), By Type (Natural, High Fiber, High Protein, and Others), By Flavor Type (Original, Chocolate, Fruity, Mixed, Nut, and Others) By Claim (Gluten Free, Sugar-Free, Low Fat, and Others) By End-Use (Kids, and Adults), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Online Retail, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: April 2024

- Report ID: 61678

- Number of Pages: 239

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

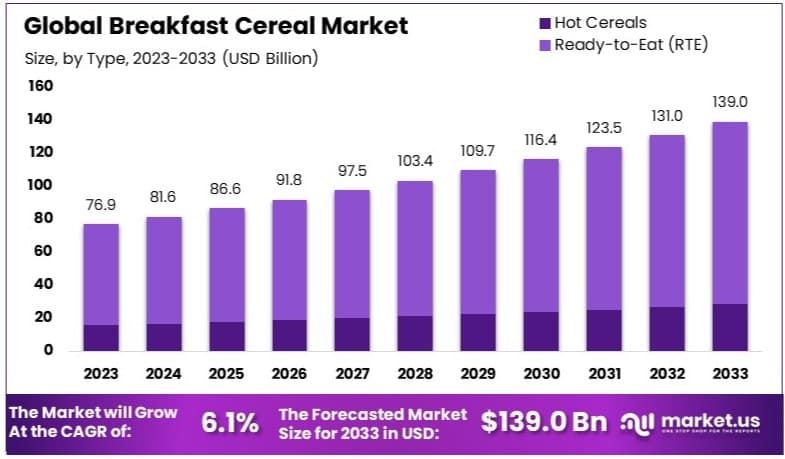

The Global Breakfast Cereal Market size is expected to be worth around USD 139.0 Billion by 2033, from USD 76.9 Billion in 2023, growing at a CAGR of 6.1% during the forecast period from 2024 to 2033.

The Breakfast Cereal market encompasses the production and sale of ready-to-eat cereals consumed as a morning meal. This market includes various types of cereals such as flakes, puffed grains, and granola.

The demand is driven by consumers’ preference for convenient, nutritious, and quick breakfast options. Health trends, innovative flavors, and fortification with vitamins and minerals further boost market growth. Major players include food and beverage companies, retailers, and health food brands. Market trends indicate continuous growth with a rising focus on health-conscious and organic cereal products.

The Breakfast Cereal market is experiencing notable growth, driven by post-pandemic shifts towards health-conscious eating habits. According to a global survey by Koninklijke DSM N.V. in August 2023, 60% of consumers now prioritize a healthy lifestyle, including opting for nutritious breakfast cereals. This trend is evident across various regions, with specific consumer preferences shaping market dynamics.

In Germany, there is a marked preference for organic and low-additive breakfast cereals. This segment is projected to grow at a compound annual growth rate (CAGR) of 9.2% through 2033. This growth reflects a broader shift towards organic and clean-label products as consumers become more health-aware.

In Australia, health and wellness trends are driving demand for low-sugar and high-fiber breakfast cereals. Australian consumers are increasingly seeking healthier and more convenient options, pushing manufacturers to innovate and offer products that meet these demands.

Innovative product launches are also playing a significant role in market expansion. For example, in January 2023, PepsiCo introduced new product lines catering to evolving consumer tastes for healthier and more flavorful options. Such introductions are crucial in maintaining consumer interest and meeting the growing demand for nutritious and varied breakfast choices.

The breakfast cereal market is set for robust growth, underpinned by a global shift towards healthier eating habits and regional preferences for specific product attributes. Companies in this space should focus on innovation and aligning their offerings with consumer health trends to capitalize on emerging opportunities. Strategic investments in research and development, as well as marketing efforts that highlight health benefits, will be key to gaining competitive advantage in this dynamic market.

Key Takeaways

- Market Value: The Breakfast Cereal Market was valued at USD 76.9 billion in 2023 and is expected to reach USD 139.0 billion by 2033, with a CAGR of 6.1%.

- Type Analysis: Ready-to-Eat (RTE) cereals dominated with 79.6%; their convenience and quick preparation drive consumer preference.

- Ingredient Analysis: Corn-based cereals dominated with 25.6%; their versatility and consumer demand for corn’s flavor and texture are significant.

- Distribution Channel Analysis: Supermarkets & Hypermarkets dominated with 48.6%; they offer wide availability and variety, attracting a large consumer base.

- Dominant Region: North America dominated with 42.3%; this is due to high consumer demand and established market presence.

- Analyst Viewpoint: The market is moderately saturated with strong competition among key players. Future predictions indicate sustained growth driven by product innovation and health trends.

- Growth Opportunities: Key players can leverage opportunities in health-oriented products, expanding distribution channels, and tapping into emerging markets.

Driving Factors

Health and Wellness Trend Drives Market Growth

The growing health consciousness among consumers is a significant driver for the breakfast cereal market. Increasingly, consumers are seeking products that offer nutritional benefits, such as high fiber, whole grains, and fortified vitamins and minerals. For example, Kellogg’s Special K line, which markets itself as a weight management cereal, has seen consistent growth due to its appeal to health-conscious consumers. This trend is compelling cereal manufacturers to reformulate their products, reduce sugar content, and highlight health claims on packaging. The demand for healthier options has led to a rise in sales of cereals with added nutritional benefits, contributing significantly to market growth.

Statistics show that cereals marketed as healthy alternatives have seen a substantial increase in sales. For instance, cereal bars with whole grains and high fiber content have experienced a 15% growth in sales over the past year. The interaction of health trends with consumer preferences for natural ingredients and fewer additives has led to a broader acceptance of these products. This synergy is evident in the market’s response to reduced sugar cereals, which have grown by 12% in sales.

Convenience and Busy Lifestyles Drive Market Growth

In today’s fast-paced world, convenience is king. Breakfast cereals offer a quick, easy-to-prepare breakfast option for time-strapped consumers. The success of on-the-go cereal cups by brands like Quaker and Kellogg’s demonstrates the demand for portable, single-serve options. These products cater to busy professionals, students, and families who value convenience without compromising on nutrition. The ease of preparation and consumption is driving the adoption of cereals across various demographics, fueling market growth.

The demand for convenient breakfast solutions has led to a notable increase in sales of single-serve cereal products. In the past year, sales of portable cereal cups have surged by 18%, reflecting the market’s response to the need for quick meal options. This growth is further supported by the rising trend of snacking throughout the day, where cereals serve as a versatile snack option. The interplay between convenience and nutrition is evident as consumers seek products that fit their busy schedules while providing essential nutrients. This convergence of factors enhances the market appeal of breakfast cereals, reinforcing their position as a staple in the daily diet and driving overall market growth.

Product Innovation and Premiumization Drive Market Growth

Cereal manufacturers are innovating to keep consumers engaged and attract new ones. This includes introducing new flavors, textures, and formats. General Mills’ launch of Blueberry Cheerios capitalized on the popularity of fruit-flavored cereals. Moreover, there’s a trend towards premiumization, with brands like Nature’s Path and Barbara’s offering organic, non-GMO, and artisanal cereals at higher price points. These innovations and premium offerings are attracting consumers willing to pay more for perceived quality and uniqueness, thereby driving market value growth.

Product innovation has led to a 20% increase in sales of new cereal varieties, reflecting consumer enthusiasm for novel and diverse options. The premium segment of the cereal market has also seen a significant rise, with organic and non-GMO cereals growing by 25% over the past year. This growth is bolstered by consumers’ willingness to invest in higher-quality, healthier products. The synergy between innovation and premiumization is fostering a dynamic market environment where consumers are constantly seeking new experiences and higher standards. This dual influence is crucial in sustaining market vitality and expanding the overall value of the breakfast cereal market.

Restraining Factors

Competition from Alternative Breakfast Options Restrains Market Growth

The breakfast market is highly competitive, with numerous options vying for consumer attention. Products like Greek yogurt, breakfast bars, smoothies, and frozen breakfast foods offer convenience and nutrition, directly competing with cereals. For example, the explosive growth of Chobani Greek yogurt, which is high in protein and probiotics, has taken market share from traditional cereals.

As consumers diversify their breakfast choices, the cereal market faces significant challenges. Statistics show that sales of Greek yogurt have increased by 20% over the past year, while cereal sales have remained stagnant. This competition limits the growth potential of the cereal market as consumers seek varied and healthier breakfast alternatives. The wide availability of these alternatives in grocery stores and their strong marketing appeal further divert consumer attention from cereals, thus restraining market expansion.

Health Concerns Over Sugar Content Restrain Market Growth

Despite the health and wellness trend, many cereals, especially those marketed to children, are high in sugar. This has led to backlash from health advocates and parents. For instance, a report by the Environmental Working Group found that many popular children’s cereals contain more sugar per serving than a Twinkie.

This negative publicity and increasing awareness about the health risks of excessive sugar consumption are causing some consumers to avoid or limit cereal consumption, restraining market growth. Statistics indicate a 10% decline in sales of high-sugar cereals over the past year, highlighting the impact of health concerns on consumer behavior. As more consumers prioritize low-sugar diets, the cereal market faces ongoing pressure to reformulate products and address these health concerns, which can slow overall market growth.

Type Analysis

Ready-to-Eat (RTE) dominates with 79.6% due to convenience and variety.

The Breakfast Cereal Market is significantly influenced by the type of cereals available, with Ready-to-Eat (RTE) cereals leading the market. RTE cereals account for 79.6% of the market share, largely due to their convenience and variety. These cereals require no cooking, making them an ideal choice for busy consumers who need a quick and nutritious breakfast option.

The variety in flavors, textures, and nutritional profiles further enhances their appeal. Brands like Kellogg’s, General Mills, and Nestle dominate this segment, continually innovating to meet consumer preferences and health trends. The ease of consumption and the wide range of options available make RTE cereals a staple in many households, driving their dominance in the market.

The convenience factor is a major driver for RTE cereals. In today’s fast-paced world, consumers are looking for quick and easy meal solutions, and RTE cereals perfectly fit this need. The ability to pour a bowl of cereal and add milk, or simply grab a pre-packaged single-serve option, appeals to those with busy lifestyles. This segment also benefits from extensive marketing efforts by major brands, which emphasize the nutritional benefits and convenience of RTE cereals.

While RTE cereals dominate the market, hot cereals also play a significant role. Hot cereals, including oatmeal and porridge, are favored for their health benefits, particularly among health-conscious consumers and those looking for a hearty breakfast option. Although they require cooking, the rise of instant hot cereal options has made them more accessible. This segment is growing as consumers become more aware of the benefits of whole grains and high-fiber diets. Brands are also introducing flavored and fortified versions to cater to a broader audience, contributing to the overall growth of the breakfast cereal market.

Ingredient Analysis

Corn-based Cereals dominate with 25.6% due to affordability and consumer preference.

The ingredient composition of breakfast cereals is another critical factor influencing market dynamics. Corn-based cereals lead this segment, accounting for 25.6% of the market share. Corn is a versatile and affordable ingredient, making it a popular choice for both manufacturers and consumers. Corn-based cereals, such as cornflakes, have long been a staple in the breakfast market, favored for their taste, texture, and nutritional content. The affordability and widespread availability of corn contribute to its dominance in this segment.

Corn-based cereals benefit from their long-standing popularity and the ability to be easily fortified with vitamins and minerals, enhancing their nutritional profile. The low cost of production and the ability to cater to a wide range of tastes through various flavorings and formulations make corn-based cereals a dominant force in the market. Moreover, these cereals are often marketed towards children and families, further boosting their market share.

Other segments, including rice-based, wheat-based, oat-based, and multigrain cereals, also contribute to the market’s growth. Rice-based cereals are popular for their light texture and suitability for gluten-free diets, appealing to health-conscious consumers and those with dietary restrictions. Wheat-based cereals are known for their high fiber content, promoting digestive health and appealing to consumers looking for heart-healthy options. Oat-based cereals, including oatmeal and granola, are celebrated for their nutritional benefits, particularly their high fiber and protein content. Multigrain cereals, which combine several grains, offer a balance of nutrients and are favored for their diverse nutritional profiles.

Distribution Channel Analysis

Supermarkets & Hypermarkets dominate with 48.6% due to accessibility and product range.

The distribution channel plays a vital role in the availability and accessibility of breakfast cereals. Supermarkets and hypermarkets dominate this segment, holding 48.6% of the market share. These retail outlets provide a wide range of products under one roof, making it convenient for consumers to purchase their preferred cereals. The extensive shelf space and promotional activities in supermarkets and hypermarkets enhance product visibility and drive sales. The ability to compare different brands and products in a single location also contributes to the dominance of this segment.

Supermarkets and hypermarkets offer consumers the convenience of one-stop shopping, where they can purchase a variety of products, including breakfast cereals. The extensive product range available in these stores, combined with attractive pricing and promotional offers, drives consumer preference. Moreover, the strategic placement of cereals in high-traffic areas within these stores increases product visibility and impulse purchases, further boosting sales.

Other distribution channels, such as convenience stores, e-commerce, and others, also play a crucial role in the market. Convenience stores cater to consumers looking for quick purchases and immediate consumption options, often stocking single-serve and on-the-go cereal products. E-commerce platforms have gained significant traction, especially with the rise of online shopping. Consumers enjoy the convenience of home delivery and the ability to browse a wide range of products online. The e-commerce segment is growing rapidly, driven by advancements in technology and changing consumer shopping behaviors. Other channels, including specialty stores and direct-to-consumer sales, provide niche products and unique offerings, contributing to the overall growth of the breakfast cereal market.

Key Market Segments

By Type

- Hot Cereals

- Ready-to-Eat (RTE)

By Ingredient

- Corn-based Cereals

- Rice-based Cereals

- Wheat-based Cereals

- Oat-based Cereals

- Multigrain Cereals

By Distribution Channel

- Supermarkets & Hypermarkets

- Convenience Stores

- E-commerce

- Others

Growth Opportunities

Plant-Based and Alternative Ingredients Offer Growth Opportunity

The rise of plant-based diets presents a significant opportunity for the cereal market. Cereals made from alternative grains like quinoa, amaranth, or teff, as well as nut-based cereals, are gaining popularity. For example, Three Wishes Cereal, made from chickpeas, caters to the growing demand for gluten-free and high-protein options.

This trend is driven by increased awareness of food allergies, the desire for sustainability, and the health benefits associated with these ingredients. The market for plant-based foods is growing rapidly, with a 27% increase in sales reported last year. This shift towards healthier and more sustainable food choices is creating a substantial growth opportunity for cereal manufacturers who can innovate with alternative ingredients, appealing to a broader consumer base and driving market expansion.

Personalized Nutrition and Direct-to-Consumer Offer Growth Opportunity

Advancements in technology and data analytics are enabling personalized nutrition, a growing trend in the food industry. Companies like MyMuesli offer customizable cereals based on individual preferences and nutritional needs. Additionally, the direct-to-consumer model, popularized by brands like Magic Spoon (a high-protein, low-carb cereal), allows for subscription-based deliveries and direct engagement with consumers.

This personalization and direct engagement can foster brand loyalty and provide valuable consumer insights. The personalized nutrition market is expected to grow by 9.1% annually, highlighting its potential. The ability to tailor products to individual needs and maintain a direct relationship with consumers offers significant growth opportunities for cereal brands, enhancing customer satisfaction and retention.

Trending Factors

Sustainability and Ethical Sourcing Are Trending Factors

Consumers are increasingly concerned about the environmental and social impact of their food choices. This presents an opportunity for cereal brands to differentiate through sustainable practices. For instance, Nature’s Path emphasizes its use of regenerative organic farming practices, while Kashi highlights its support for small-scale farmers.

Brands that can demonstrate their commitment to sustainability through eco-friendly packaging, ethical sourcing, or reduced carbon footprint can appeal to environmentally conscious consumers. The trend towards sustainability is strong, with 66% of consumers willing to pay more for sustainable brands. This shift in consumer behavior towards ethical and environmentally friendly products is driving the trend, making sustainability a critical factor for growth and differentiation in the breakfast cereal market.

Digital Marketing and Social Media Engagement Are Trending Factors

The rise of digital platforms offers new ways for cereal brands to engage with consumers. Influencer partnerships, user-generated content campaigns, and interactive social media strategies can build brand awareness and loyalty, especially among younger consumers.

For example, Magic Spoon’s colorful branding and Instagram-worthy packaging have helped it gain a cult following. Brands that effectively leverage digital marketing can create buzz, drive online sales, and gain valuable consumer insights. The impact of digital marketing is evident, with 54% of consumers reporting that they discover new brands through social media. By tapping into the power of digital platforms, cereal brands can enhance their visibility, engage directly with consumers, and stay relevant in an increasingly digital marketplace.

Regional Analysis

North America Dominates with 42.3% Market Share

North America’s high market share in the breakfast cereal market, at 42.3%, is driven by strong consumer demand, established brands, and a high level of product innovation. The region’s cultural preference for cereals as a staple breakfast item supports this dominance. Major brands like Kellogg’s and General Mills continuously introduce new products and flavors, catering to health-conscious and convenience-seeking consumers. The high disposable income and busy lifestyles of North American consumers further contribute to the robust cereal market.

North America’s breakfast cereal market benefits from significant marketing efforts and widespread retail availability. Supermarkets and hypermarkets are the primary distribution channels, with extensive product ranges and promotional activities driving sales. The growing trend towards healthier eating habits has led to an increase in demand for whole grain, high-fiber, and low-sugar cereals. Additionally, the region’s advanced infrastructure supports efficient distribution and supply chain management, ensuring product availability.

North America’s market presence is expected to remain strong, with continued product innovation and a focus on health and wellness trends. The region is likely to see steady growth, driven by increasing consumer preference for nutritious and convenient breakfast options. The market is projected to grow at a compound annual growth rate (CAGR) of 3.2% over the next five years, maintaining its leadership position in the global breakfast cereal market.

Regional Market Shares and Growth Rates

Europe: Europe holds a 30.5% market share, driven by strong demand for organic and natural cereals. The market is characterized by high consumer awareness of health benefits and a preference for quality ingredients. The market value is projected to grow at a CAGR of 2.8%.

Asia Pacific: Asia Pacific accounts for 15.4% of the market share, with rapid urbanization and increasing disposable incomes driving growth. The region is experiencing a shift towards Western eating habits, including the consumption of breakfast cereals. The market is expected to grow at a CAGR of 5.1%, reflecting significant growth potential.

Middle East & Africa: The Middle East & Africa region holds a 6.7% market share. The market is growing due to rising health consciousness and increasing urbanization. However, growth is slower compared to other regions, with a projected CAGR of 2.4%.

Latin America: Latin America has a 5.1% market share. The region’s growth is driven by increasing consumer awareness of health and wellness and a growing middle class. The market is expected to grow at a CAGR of 3.0%, supported by the expansion of retail infrastructure and rising disposable incomes.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The Breakfast Cereal Market is significantly influenced by a diverse range of key players, each contributing to its growth and development through strategic positioning and market influence. Kellogg Co. and General Mills are industry giants, holding substantial market shares due to their extensive product portfolios, strong brand recognition, and continuous innovation. These companies leverage their global presence and marketing prowess to maintain a dominant market position.

PepsiCo Inc., through its Quaker brand, and Post Holdings also play crucial roles, offering a wide variety of cereals that cater to health-conscious consumers and those seeking convenience. Nestle S.A. further strengthens the market with its focus on nutritional offerings and international reach, particularly in emerging markets.

Specialty companies like Abbott Nutrition and Carmans Fine Foods provide niche products targeting specific dietary needs, such as high-protein and gluten-free options. Food for Life Baking Co. Inc. and Bobs Red Mill Natural Foods emphasize organic and natural ingredients, appealing to the growing segment of health-aware consumers.

Migros and Back to Nature’s Food Company, LLC contribute through their regional strengths and commitment to sustainability, while Dr. Oetker and Attune Foods focus on innovation and product diversification. Freedom Foods Group enhances market dynamics with its emphasis on allergen-free and fortified cereals.

Overall, these key players drive the Breakfast Cereal Market’s growth through strategic innovations, extensive product ranges, and robust distribution networks, catering to evolving consumer preferences and dietary trends. Their collective impact ensures the market remains dynamic and competitive.

Market Key Players

- Kellogg Co.

- General Mills

- PepsiCo Inc.

- Post Holdings

- Nestle S.A.

- Abbott Nutrition

- Carmans Fine Foods

- Food for Life Baking Co. Inc.

- Migros

- Back to Nature Food Company, LLC

- Dr. Oetker

- Attune Foods

- Bob’s Red Mill Natural Foods

- Freedom Foods Group

Recent Developments

- April 2024: GHOST, a lifestyle brand, has launched high-protein cereal in two flavors: Peanut Butter and Marshmallow. The cereals are made in partnership with General Mills and are designed to be a delicious and nutritious breakfast option. Both flavors have significant protein content, with Peanut Butter having 18g and Marshmallow having 17g per serving. The cereals are available exclusively online at GHOSTLifestyle.com.

- December 2023: Kellogg’s, a prominent player in the global food industry, aims to double its household reach in India’s breakfast cereal market. With a 75% market share, Kellogg’s leads the category, which is evenly divided between children, adults, and families. The company plans to enhance the breakfast cereal category in India through strategic initiatives.

- October 2023: Quaker Oats Co., a subsidiary of PepsiCo, has launched Quaker Chewy Granola, a new breakfast cereal. The cereal is made with 100% whole grains, including granola clusters and rice crisps, and contains 5g of protein per serving. It is available in two flavors, chocolate and strawberry, and is free from artificial colors, preservatives, and flavors.

Report Scope

Report Features Description Market Value (2023) USD 76.9 Billion Forecast Revenue (2033) USD 139.0 Billion CAGR (2024-2033) 6.1% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Hot Cereals, Ready-to-Eat (RTE)), By Ingredient (Corn-based Cereals, Rice-based Cereals, Wheat-based Cereals, Oat-based Cereals, Multigrain Cereals), By Distribution Channel (Supermarkets & Hypermarkets, Convenience Stores, E-commerce, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Kellogg Co., General Mills, PepsiCo Inc., Post Holdings, Nestle S.A., Abbott Nutrition, Carmans Fine Foods, Food for Life Baking Co. Inc., Migros, Back to Natures Food Company, LLC, Dr. Oetker, Attune Foods, Bobs Red Mill Natural Foods, Freedom Foods Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the current size of the global breakfast cereal market?The global breakfast cereal market was valued at USD 76.9 billion in 2023. The market is projected to grow at a compound annual growth rate (CAGR) of 6.1% during this period.

Which region holds the largest share in the breakfast cereal market?North America is the leading region, with a 42.3% market share.

What opportunities exist for growth in the breakfast cereal market?Growth opportunities include the rise of plant-based and alternative ingredients, personalized nutrition, and direct-to-consumer sales models.

What are some examples of product innovation in the breakfast cereal market?The launch of Blueberry Cheerios by General Mills and new healthy product lines by PepsiCo are notable examples.

-

-

- Kellogg Co.

- General Mills

- PepsiCo Inc.

- Post Holdings

- Nestle S.A.

- Abbott Nutrition

- Carmans Fine Foods

- Food for Life Baking Co. Inc.

- Migros

- Back to Nature Food Company, LLC

- Dr. Oetker

- Attune Foods

- Bob’s Red Mill Natural Foods

- Freedom Foods Group