Global Areca Nut Market By Type (Red Areca nut, White Areca nut), By Product (Scented Supari, Tannin, Pan Masala), By Form (Raw, Ripe, Roasted, Dried), By Age-Group (15-20 year, 21-25 year, 31-50 year), By Applications (Traditional, 2Medicinal/ Pharmaceuticals, Health Care Products, Foods, Others), , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Jan 2025

- Report ID: 137280

- Number of Pages: 301

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

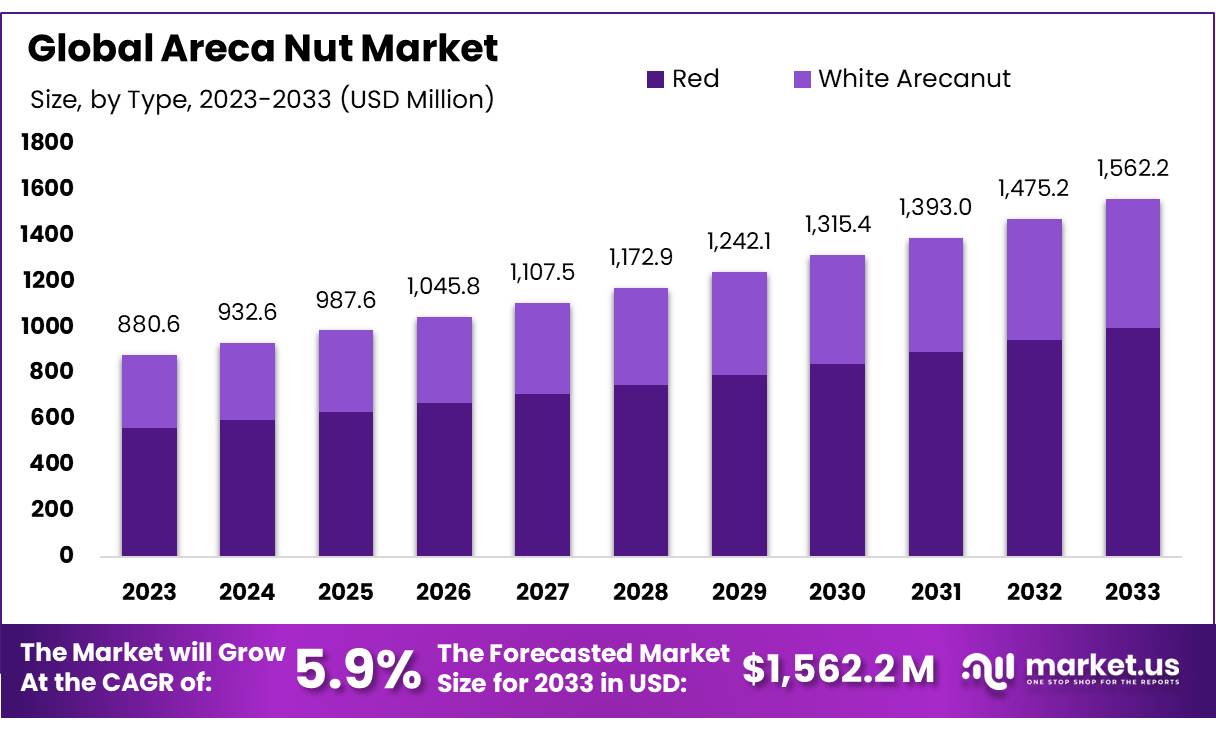

The Global Areca Nut Market size is expected to be worth around USD 1562.2 Mn by 2033, from USD 880.6 Mn in 2023, growing at a CAGR of 5.9% during the forecast period from 2024 to 2033.

The Areca Nut Market plays a pivotal role in the global agricultural and cultural economy, particularly in Asia-Pacific countries where the nut holds significant traditional, medicinal, and economic value. Derived from the Areca catechu tree, commonly referred to as the betel nut, areca nuts are widely consumed as part of cultural practices, often chewed with betel leaves and other additives. The market for areca nuts spans diverse applications, including traditional uses, industrial applications in food additives, pharmaceuticals, and even as biodegradable materials.One of the primary driving factors of the areca nut market is its cultural significance in many Asian countries, where it is used in religious rituals, traditional medicine, and social practices. Additionally, rising disposable incomes and urbanization in developing nations have led to increased consumption, both in traditional forms and as part of processed products. The nut’s reported health benefits, including aiding digestion and improving oral health, further support its demand. However, concerns about excessive consumption leading to health risks, such as oral cancers, have prompted some regulatory restrictions. Emerging trends in the areca nut market include the diversification of its applications. Beyond traditional consumption, areca nut derivatives are being explored in pharmaceuticals for their alkaloid content and in the cosmetics industry for natural additives. Moreover, the development of biodegradable plates and bowls from areca palm leaves has created a sustainable avenue for market growth. Governments in producer nations are also providing subsidies and support for areca nut farmers, ensuring steady supply and promoting value addition.Statistically, the Areca nut industry supports the livelihoods of over ten million people in the major producing countries. The annual production rate has been growing steadily at about 3% per annum, reflecting its stable demand. With over 700,000 tonnes produced annually in India alone, the market demonstrates substantial economic activity. Price trends have shown a gradual increase due to fluctuating supply levels affected by climatic changes, underscoring the need for sustainable farming practices to stabilize market prices and ensure future growth.

Emerging trends in the areca nut market include the diversification of its applications. Beyond traditional consumption, areca nut derivatives are being explored in pharmaceuticals for their alkaloid content and in the cosmetics industry for natural additives. Moreover, the development of biodegradable plates and bowls from areca palm leaves has created a sustainable avenue for market growth. Governments in producer nations are also providing subsidies and support for areca nut farmers, ensuring steady supply and promoting value addition.Statistically, the Areca nut industry supports the livelihoods of over ten million people in the major producing countries. The annual production rate has been growing steadily at about 3% per annum, reflecting its stable demand. With over 700,000 tonnes produced annually in India alone, the market demonstrates substantial economic activity. Price trends have shown a gradual increase due to fluctuating supply levels affected by climatic changes, underscoring the need for sustainable farming practices to stabilize market prices and ensure future growth.Key Takeaways

- Areca Nut Market size is expected to be worth around USD 1562.2 Mn by 2033, from USD 880.6 Mn in 2023, growing at a CAGR of 5.9%.

- Red Areca Nut held a dominant market position, capturing more than a 64.3% share of the overall Areca Nut Market.

- Scented Supari held a dominant market position within the Areca Nut Market, capturing more than a 56.3% share.

- Raw form of areca nuts held a dominant market position, capturing more than a 42.1% share of the market.

- 31-50 years age group held a dominant market position in the Areca Nut Market, capturing more than a 47.2% share.

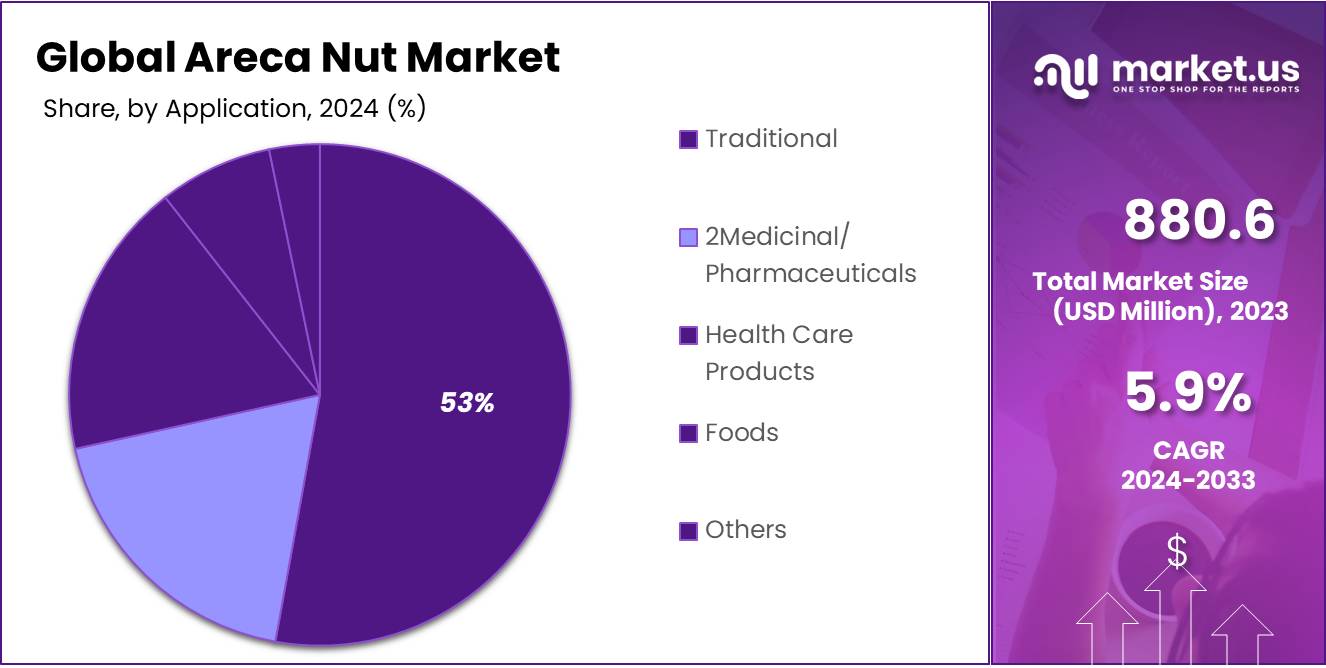

- Traditional Uses held a dominant market position in the Areca Nut Market, capturing more than a 56.1% share.

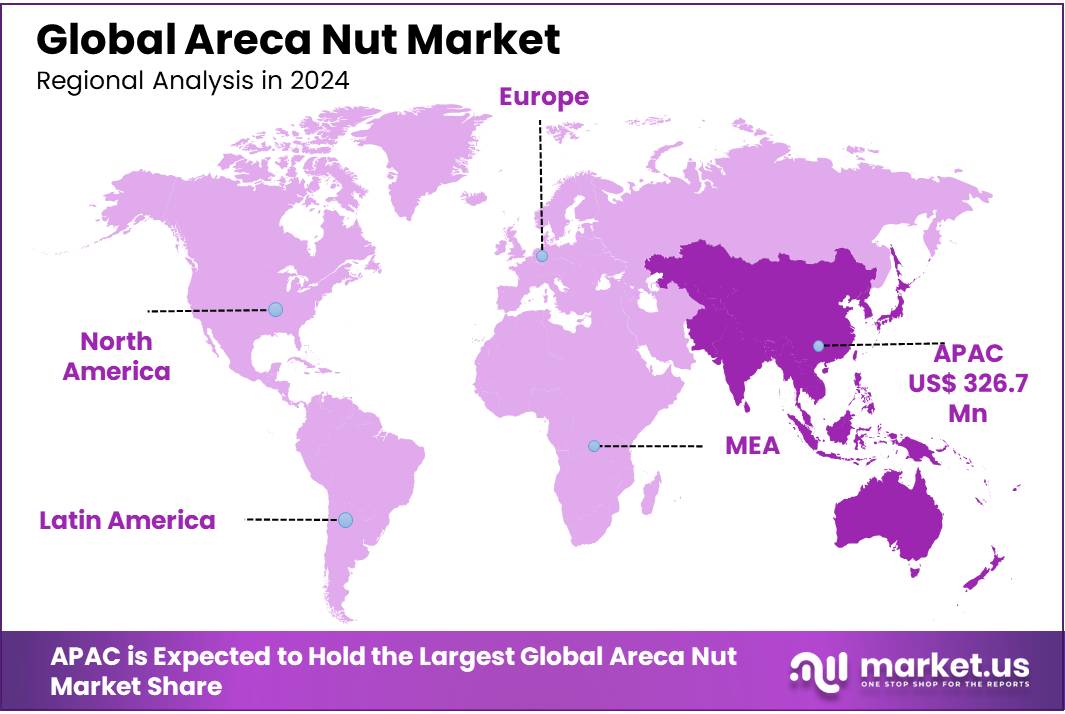

- Asia Pacific (APAC) region dominates with a significant market share of 37.3%, amounting to approximately USD 326.7 million.

By Type

In 2023, Red Areca Nut held a dominant market position, capturing more than a 64.3% share of the overall Areca Nut Market. This segment’s strong performance is largely attributed to traditional preferences in key consumer regions, where red areca nuts are favored for their robust flavor and longer-lasting freshness compared to their counterparts. These nuts are primarily used in cultural and ceremonial practices across various countries in Asia, further bolstering their market dominance.

Conversely, White Areca Nut, while holding a smaller share of the market, has its own dedicated consumer base. Known for its milder taste and lighter color, white areca nut is often chosen for different ceremonial uses, where its appearance and subtler flavor profile are preferred. Though less popular than the red variety, the white areca nut has seen a steady demand, particularly in regions where it is used in specific traditional practices or as a less intense alternative to the red nut.

By Product

In 2023, Scented Supari held a dominant market position within the Areca Nut Market, capturing more than a 56.3% share. This substantial market share reflects the product’s widespread popularity, particularly in South Asia, where it is commonly used as a mouth freshener after meals. Scented Supari is often preferred for its variety of flavors and the added freshness it provides, making it a staple in daily consumption as well as in social and festive occasions.

Tannin, extracted from areca nuts, occupies a niche but significant segment of the market. It is primarily used in the tanning industry to process leather, contributing to the durability and color quality of leather goods. Although it represents a smaller portion of the market compared to Scented Supari, tannin’s importance in industrial applications ensures a steady demand.

Pan Masala, another product derived from areca nuts, also holds a notable share of the market. It is especially popular in regions where chewing tobacco mixtures are culturally ingrained. Despite facing regulatory challenges in various markets due to health concerns associated with tobacco products, Pan Masala continues to be consumed by a significant portion of the population, driven by traditional usage patterns and its status as a lifestyle product in certain demographics.

By Form

In 2023, the Raw form of areca nuts held a dominant market position, capturing more than a 42.1% share of the market. This form is favored for its natural qualities and is commonly purchased by consumers looking to process the nuts according to their specific preferences, whether for personal use or commercial sale. Raw areca nuts are especially popular in traditional practices where they are used in their natural form for various cultural rituals and ceremonies.

Ripe areca nuts also have a significant share in the market, appreciated for their maturity and enhanced flavor profile, which is preferred in certain regional cuisines and traditional uses. These nuts are typically consumed directly or used in the preparation of areca nut-based products like betel quids, which are popular in many Asian cultures.

Roasted areca nuts form another market segment and are valued for their crisp texture and intensified taste. The roasting process not only improves the flavor but also extends the shelf life of the nuts, making them a convenient choice for prolonged storage and easier retail distribution.

Dried areca nuts represent a crucial segment as well, utilized extensively in various commercial products. Drying the nuts reduces their moisture content, preventing decay and making them suitable for export to regions where areca nuts are not locally available, thus broadening their market reach.

By Age-Group

In 2023, the 31-50 years age group held a dominant market position in the Areca Nut Market, capturing more than a 47.2% share. This age demographic is pivotal because it typically includes established adults with stable purchasing power, which makes them a key consumer segment for areca nut products. Individuals within this age range are often habitual users, integrating areca nuts into their daily routines either for personal use or within cultural practices, which contributes to sustained demand.

The 21-25 years age group also represents a significant portion of the market, though their usage tends to be influenced heavily by social trends and peer influence. This younger demographic is more likely to experiment with areca nut products, such as flavored pan masala or scented supari, as part of social interactions or as an entry into traditional practices.

Conversely, the 15-20 years age group has a smaller market share. This is likely due to limited disposable income and the influence of public health campaigns aimed at younger people, which deter the use of areca nut products due to health concerns associated with their consumption.

By Applications

In 2023, Traditional Uses held a dominant market position in the Areca Nut Market, capturing more than a 56.1% share. This significant portion of the market is driven by the longstanding cultural and ceremonial roles of areca nuts in many Asian societies. Traditionally, areca nuts are used in social and religious rituals, often combined with betel leaves to create a symbolic offering or chewed during community gatherings, which sustains their high demand in these segments.

The Medicinal/Pharmaceuticals segment also accounts for a noteworthy share of the market. Areca nuts are recognized in various traditional medicine systems, including Ayurveda and Chinese medicine, for their supposed benefits in treating ailments ranging from digestion issues to detoxification. The bioactive compounds found in areca nuts, such as arecoline, underpin their continued use in health treatments, although usage is controversial due to health risks associated with prolonged consumption.

In the Health Care Products sector, areca nuts are incorporated into products aimed at dental care, such as certain types of toothpaste and mouth fresheners, owing to their antibacterial properties. However, this application is less widespread due to the health concerns linked to areca nut use.

The Foods segment utilizes areca nuts in various culinary processes, particularly in flavoring agents or as components of spice mixes in some regional cuisines. Though this is a smaller segment, it reflects the nut’s versatility and historical culinary importance.

Key Market Segments

By Type

- Red Areca nut

- White Areca nut

By Product

- Scented Supari

- Tannin

- Pan Masala

By Form

- Raw

- Ripe

- Roasted

- Dried

By Age-Group

- 15-20 year

- 21-25 year

- 31-50 year

By Applications

- Traditional

- 2Medicinal/ Pharmaceuticals

- Health Care Products

- Foods

- Others

Drivers

Cultural Traditions Driving the Areca Nut Market

A significant driving factor for the Areca Nut market is its deep-rooted cultural importance in many Asian societies. In countries like India, Indonesia, and Bangladesh, areca nuts are not just agricultural products but integral elements of social and religious customs. These nuts are traditionally consumed in the form of betel quid, a mixture of areca nut, betel leaf, and lime, often with added tobacco, which is chewed for its stimulant effects and as part of cultural hospitality.

The ritualistic use of areca nuts in weddings, religious ceremonies, and daily life ensures a stable demand within these regions. For instance, chewing areca nut is an age-old tradition associated with hospitality and auspiciousness in Indian culture, often presented to guests at the beginning of significant events. This cultural significance sustains a high baseline demand for areca nuts despite global health concerns about their consumption.

Government initiatives in major producing countries like India have also supported the areca nut industry by implementing policies that protect domestic growers and regulate trade. For example, government support in terms of minimum support prices and export assistance has bolstered the market’s stability, making it a reliable source of income for millions of farmers.

Moreover, the economic impact of areca nut cultivation is profound. It supports the livelihoods of millions of people in the rural areas of these countries, where alternative employment opportunities may be limited. The areca nut industry not only provides direct employment through cultivation and processing but also stimulates local economies by generating related jobs in transport, retail, and market sales.

Despite the health risks associated with areca nut use, which have led to regulatory challenges and public health campaigns aimed at reducing its consumption, the cultural fabric of areca nut use remains strong. This enduring cultural relevance combined with supportive government policies and significant economic impact suggests that the areca nut market will continue to thrive in its traditional strongholds.

Restraints

Health Concerns and Regulatory Challenges

One of the major restraining factors for the Areca Nut market is the increasing global awareness and scientific validation of the health risks associated with its consumption. Areca nuts contain arecoline, a compound classified by the International Agency for Research on Cancer (IARC) as a Group 1 carcinogen. This classification is due to substantial evidence linking areca nut chewing to severe health issues, including oral cancer, esophageal cancer, and a precancerous condition known as oral submucous fibrosis.

The health implications of areca nut consumption have led to significant public health campaigns aimed at reducing its use, particularly in countries where chewing areca nut is a prevalent cultural practice. For instance, governments in South and Southeast Asia, where areca nut use is widespread, have begun implementing stricter regulations on the sale and advertising of areca nuts and related products. These measures often include mandatory health warnings on packaging and restrictions on sales to minors.

In addition to health-related regulations, international health organizations like the World Health Organization (WHO) actively promote research and awareness programs aimed at educating the public about the dangers of areca nut use. These initiatives often receive substantial media coverage, further influencing public perception and gradually decreasing the cultural acceptance of areca nut consumption.

The economic impact of these health concerns is also significant, as the areca nut industry faces potential declines in demand, particularly in markets where public health education is effective. This is compounded by international trade restrictions and potential sanctions on areca nut products, which pose additional challenges for major producers and exporters in Asia.

Despite the cultural significance of areca nut in many regions, the global shift towards health-conscious consumer behaviors and the strengthening of regulatory frameworks are likely to continue restraining market growth. The industry’s response, focusing on safer product alternatives or diversifying into less controversial products, might mitigate some negative impacts but the core issue remains a potent market restraint.

Opportunity

Expansion into Value-Added Products

The Areca Nut market is witnessing a promising growth opportunity through the development and expansion of value-added products. As consumer preferences shift globally, manufacturers are exploring innovative ways to utilize areca nuts beyond traditional consumption. This includes producing value-added goods such as tannin extracts, bio-friendly tableware, and even natural insecticides, all of which open new revenue streams and diversify market applications.

Tannin, derived from areca nuts, is increasingly used in the leather and wine industries. According to reports from food and agricultural organizations, tannins play a critical role in leather processing and wine aging, making it a sought-after compound. The global tannin market itself is projected to grow at a compound annual growth rate (CAGR) of 6.7% from 2023 to 2030, presenting a lucrative opportunity for areca nut producers to supply this vital ingredient.

Another significant opportunity lies in the growing demand for eco-friendly and sustainable products. Areca nut-based bio-degradable tableware, such as plates and bowls, has gained traction, especially in environmentally conscious markets in Europe and North America. These products cater to a rising consumer base seeking alternatives to plastic, driven by government regulations aimed at reducing plastic waste. For instance, the European Union’s single-use plastic ban, implemented in 2021, has fueled demand for such sustainable options.

Additionally, the medicinal properties of areca nuts, particularly in traditional medicine systems like Ayurveda, provide opportunities for growth in the pharmaceutical and nutraceutical sectors. Areca nut extracts are believed to aid digestion and boost immunity, making them attractive for health-focused products. With the global nutraceutical market projected to reach USD 1 trillion by 2030, leveraging areca nut’s medicinal attributes could significantly boost its market presence.

Governments in key producing countries, such as India, are also supporting the growth of the areca nut industry by promoting value-added production. Initiatives like financial subsidies for small-scale manufacturers and export incentives for bio-degradable products are helping manufacturers tap into international markets. For example, India exported 17,000 metric tons of areca nuts to Bhutan in 2022 under a regulated trade agreement, indicating the growing cross-border trade potential.

Trends

Latest Trends in the Areca Nut Market

The areca nut market is currently experiencing several dynamic trends that promise to shape its future landscape significantly. One of the key trends is the diversification of areca nut products into innovative and value-added forms, aimed at expanding market reach and enhancing product appeal. Manufacturers are increasingly focusing on the development of specialized products that cater to specific consumer needs and preferences, such as health-oriented products that leverage the traditional medicinal properties of areca nuts.

Another significant trend is the growing emphasis on sustainable and environmentally friendly practices in the cultivation and processing of areca nuts. With global consumers becoming more environmentally conscious, there is a notable shift towards organic farming methods and the use of natural, less harmful pesticides in areca nut cultivation. This not only helps in meeting consumer demands for ‘greener’ products but also aligns with global environmental regulations that aim to reduce the ecological footprint of agricultural practices.

Furthermore, there is an increased focus on the use of areca nuts in various cultural and religious practices across Southeast Asia, which continues to drive demand within these regions. The cultural significance of areca nuts in social ceremonies and traditional rituals ensures a steady consumer base, supporting market stability even amidst fluctuating global economic conditions.

The market is also witnessing strategic moves by major players who are engaging in partnerships and collaborations to enhance their market presence and operational efficiencies. These strategies are crucial in navigating the competitive landscape and ensuring sustained growth in a market characterized by both opportunities and challenges.

Regional Analysis

In the global Areca Nut Market, the Asia Pacific (APAC) region dominates with a significant market share of 37.3%, amounting to approximately USD 326.7 million. This dominance is due to the deep cultural integration of areca nut consumption in countries like India, Indonesia, and Bangladesh, where it is commonly used in various social and religious practices. The region’s tropical climate also favors the cultivation of areca palms, ensuring abundant production.

North America and Europe have smaller market shares due to limited cultural relevance and stringent regulations regarding areca nut consumption, primarily due to health concerns linked to its carcinogenic properties. However, these regions exhibit niche markets driven by immigrant communities from Asia, where the use of areca nut remains a preserved cultural practice.

The Middle East & Africa, similar to North America and Europe, shows moderate market activity. The consumption in these regions is primarily among the Asian diaspora. There is potential growth in these markets driven by increasing immigrant populations and the globalization of Asian cultural practices.

Latin America, much like other non-Asian regions, exhibits minimal engagement in the areca nut market. However, there is potential for growth as global trade and cultural exchanges introduce areca nut to these new markets, possibly igniting interest due to its novelty and potential use in local traditional medicines.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Areca Nut Market is characterized by a diverse range of key players who contribute to its global supply chain and market dynamics. Among these, Biotan Pharma and GM Group are notable for their significant roles in processing and distributing areca nuts. These companies are involved in high-volume production and have a strong market presence across various regions, ensuring a steady supply to meet the demands of both traditional and industrial users.

PT. Ruby Privatindo and Vietdelta Industrial Co., Ltd stand out for their export capabilities, tapping into international markets with high-quality areca nuts. Their operations are critical in facilitating the global trade of areca nuts, particularly catering to markets in Asia and beyond where there is significant cultural demand for the product. Similarly, Surya Exim specializes in the trade of areca nuts, leveraging India’s vast production capabilities to supply both domestic and international markets.

Companies like The Campco Ltd. and Sri Vinayaka Betelnut Traders focus on innovative product offerings and quality improvements to sustain their competitive edge. They engage in value-added processing, which includes the production of derivatives like tannin and areca nut-based products tailored for specific market segments such as the pharmaceutical and food industries. This strategic focus on niche markets allows these firms to maintain relevance despite the overall health concerns associated with areca nut consumption.

Top Key Players

- Biotan Pharma

- Gm Group

- GM Mallikarjunappa

- Maganlal Shivram and Company

- Marlene Traders Co., Ltd.

- Pt. Ruby Privatindo

- R. K. TRADING

- RUBY PRIVATINDO

- S. K. Associates

- SHRI GANESH PRASAD TRADERS

- Shri Ganesh Prasad Traders

- Sri Vinayaka Betelnut Traders

- SrinidhiFarm

- Surya Exim

- SWASTIKA INTERNATIONAL

- Swastika International

- The Areca Nut Company

- The Campco Ltd.

- Vietdelta Industrial Co., Ltd

Recent Developments

In 2023, Biotan Pharma has been actively expanding its market presence by offering processed areca nut products such as extracts, powders, and tannins that are used in various applications, particularly in herbal medicines.

Report Scope

Report Features Description Market Value (2023) USD 880.6 Mn Forecast Revenue (2033) USD 1562.2 Mn CAGR (2024-2033) 5.9% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Red Areca nut, White Areca nut), By Product (Scented Supari, Tannin, Pan Masala), By Form (Raw, Ripe, Roasted, Dried), By Age-Group (15-20 year, 21-25 year, 31-50 year), By Applications (Traditional, 2Medicinal/ Pharmaceuticals, Health Care Products, Foods, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Biotan Pharma, Gm Group, GM Mallikarjunappa, Maganlal Shivram and Company, Marlene Traders Co., Ltd., Pt. Ruby Privatindo, R. K. TRADING, RUBY PRIVATINDO, S. K. Associates, SHRI GANESH PRASAD TRADERS, Shri Ganesh Prasad Traders, Sri Vinayaka Betelnut Traders, SrinidhiFarm, Surya Exim, SWASTIKA INTERNATIONAL, Swastika International, The Areca Nut Company, The Campco Ltd., Vietdelta Industrial Co., Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Biotan Pharma

- Gm Group

- GM Mallikarjunappa

- Maganlal Shivram and Company

- Marlene Traders Co., Ltd.

- Pt. Ruby Privatindo

- R. K. TRADING

- RUBY PRIVATINDO

- S. K. Associates

- SHRI GANESH PRASAD TRADERS

- Shri Ganesh Prasad Traders

- Sri Vinayaka Betelnut Traders

- SrinidhiFarm

- Surya Exim

- SWASTIKA INTERNATIONAL

- Swastika International

- The Areca Nut Company

- The Campco Ltd.

- Vietdelta Industrial Co., Ltd