Global Plant-based Milk Market Size, Share, Business Environment Analysis By Product Type (Soy Milk, Almond Milk, Coconut Milk, Cashew Milk, Hemp Seed Milk, Rice Milk, Oat Milk, Peanut Milk, Pea Milk, Hazelnut Milk, Macadamia Milk), By Form (Liquid, Powder), By Category (Organic, Conventional), By Flavor (Original/Unflavored, Flavored), By End Use (Infant Formula, Dairy Products, Bakery and Confectionary, Milk and Milk-Based Beverages, Retail Sales), By Sales Channel (Convenience Store, Departmental Store, Traditional Store, Specialty Store, Online Retailers), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Jan 2025

- Report ID: 137703

- Number of Pages: 344

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

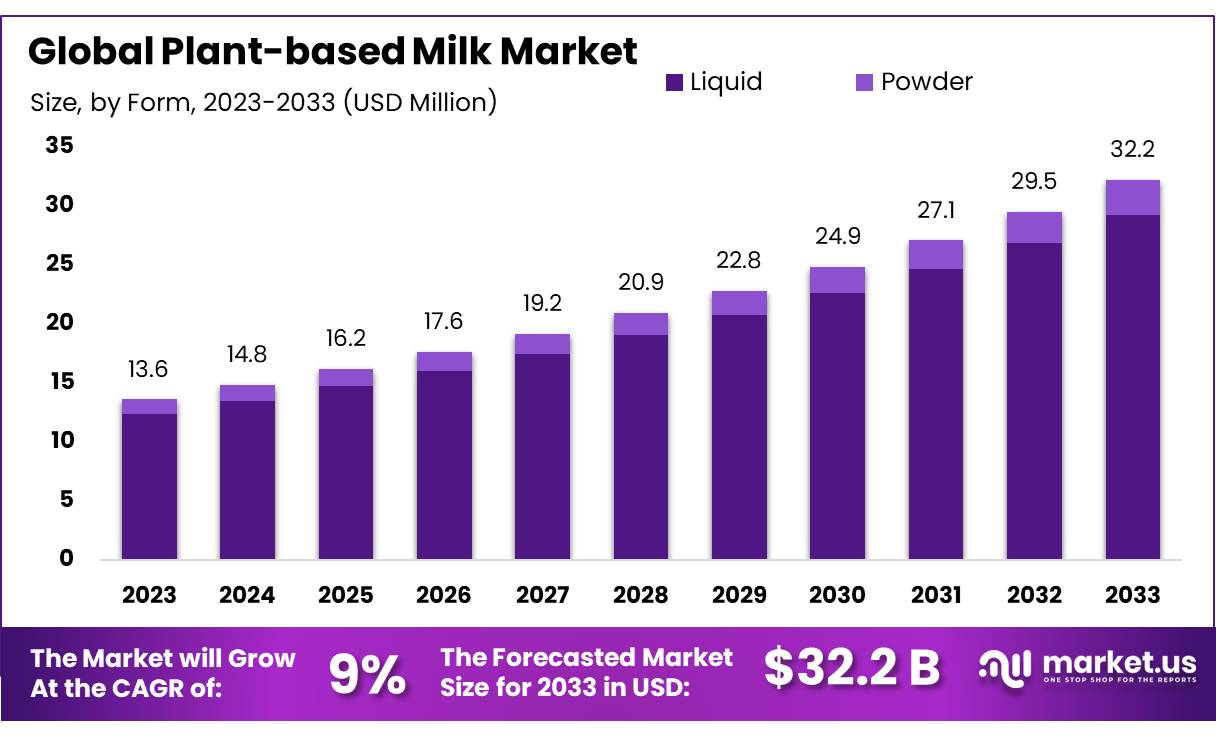

The Global Plant-based Milk Market size is expected to be worth around USD 32.2 Bn by 2033, from USD 13.6 Bn in 2023, growing at a CAGR of 9.0% during the forecast period from 2024 to 2033.

The plant-based milk market is witnessing growth, driven by increasing consumer demand for healthier and more sustainable alternatives to traditional dairy milk. Plant-based milks, including almond, oat, soy, and coconut milk, offer various nutritional benefits, such as lower fat content, lactose-free properties, and suitability for vegan and dairy-free diets. As more consumers prioritize plant-based diets for health and environmental reasons, the market is expanding across multiple regions, with North America and Europe leading the way in consumption.

plant-based milk market is the increasing number of consumers adopting lactose-free and dairy-free diets. Approximately 65% of the global population suffers from some form of lactose intolerance, particularly in Asia, where plant-based milk products are often seen as a healthier alternative. The growth of veganism and vegetarianism also contributes to this trend, with consumers seeking plant-based milk as part of a broader plant-based lifestyle. The environmental benefits of plant-based milk are appealing to eco-conscious consumers. Producing plant-based milk requires fewer natural resources, such as water and land, compared to dairy milk production.

Trends within the plant-based milk market highlight a preference for clean-label, organic, and fortified options. Consumers are increasingly looking for products with simple ingredients and added nutritional benefits, such as fortification with calcium, vitamin D, and protein. Almond milk remains the most widely consumed plant-based milk, but oat milk is gaining rapid popularity due to its creamy texture and suitability for barista-style drinks. Moreover, new entrants into the market, such as pea protein milk and rice milk, are adding further diversity to the product offerings.

The future growth opportunities for the plant-based milk market lie in expanding product varieties and improving taste and texture to match consumer preferences for dairy-like qualities. The rising adoption of plant-based diets in emerging markets such as Asia-Pacific and Latin America presents a growth opportunity. Additionally, increasing distribution channels, including supermarkets, convenience stores, and online platforms, will enhance the market reach.

Key Takeaways

- Plant-based Milk Market size is expected to be worth around USD 32.2 Bn by 2033, from USD 13.6 Bn in 2023, growing at a CAGR of 9.0%.

- Almond Milk continued to dominate the plant-based milk market, capturing more than a 42.1% share.

- Liquid form of plant-based milk maintained a dominant market position, capturing more than a 91.3% share.

- Conventional plant-based milk held a dominant market position, capturing more than a 74.3% share.

- Original/Unflavored plant-based milk continued to dominate the market, capturing more than a 63.2% share.

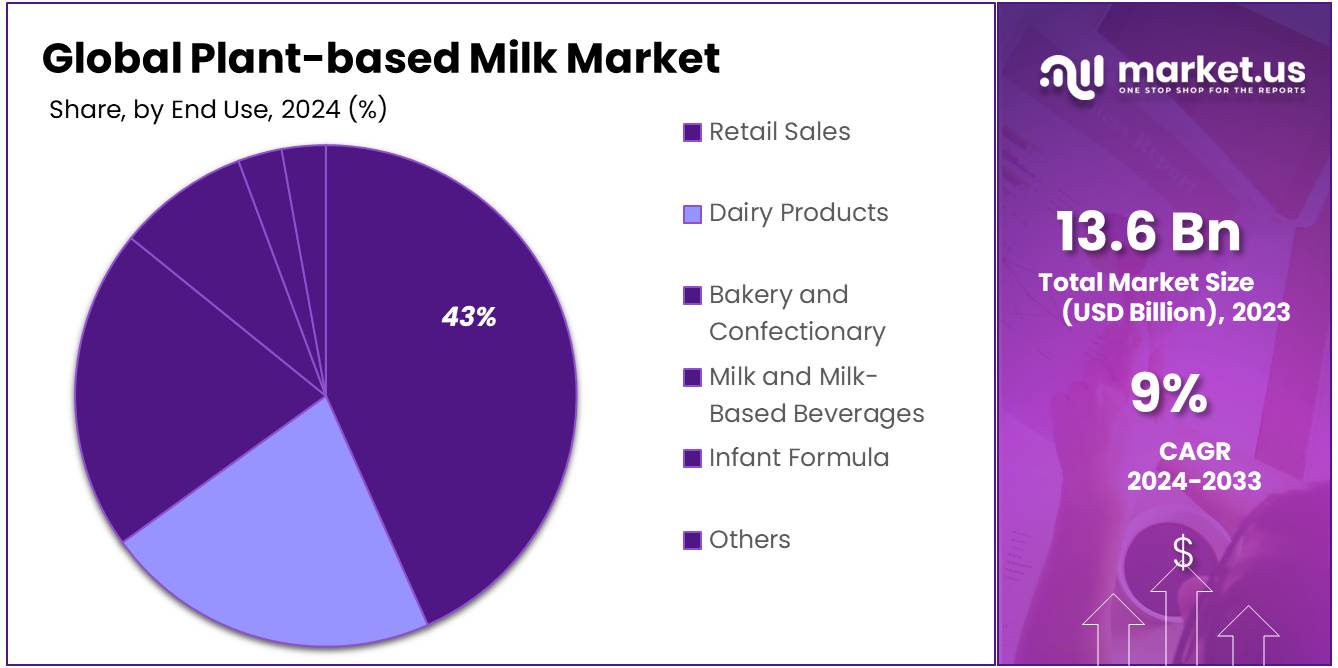

- Retail Sales of plant-based milk held a dominant market position, capturing more than a 43.1% share.

- Supermarkets/Hypermarkets continued to hold a dominant position in the plant-based milk market, capturing more than a 53.2% share.

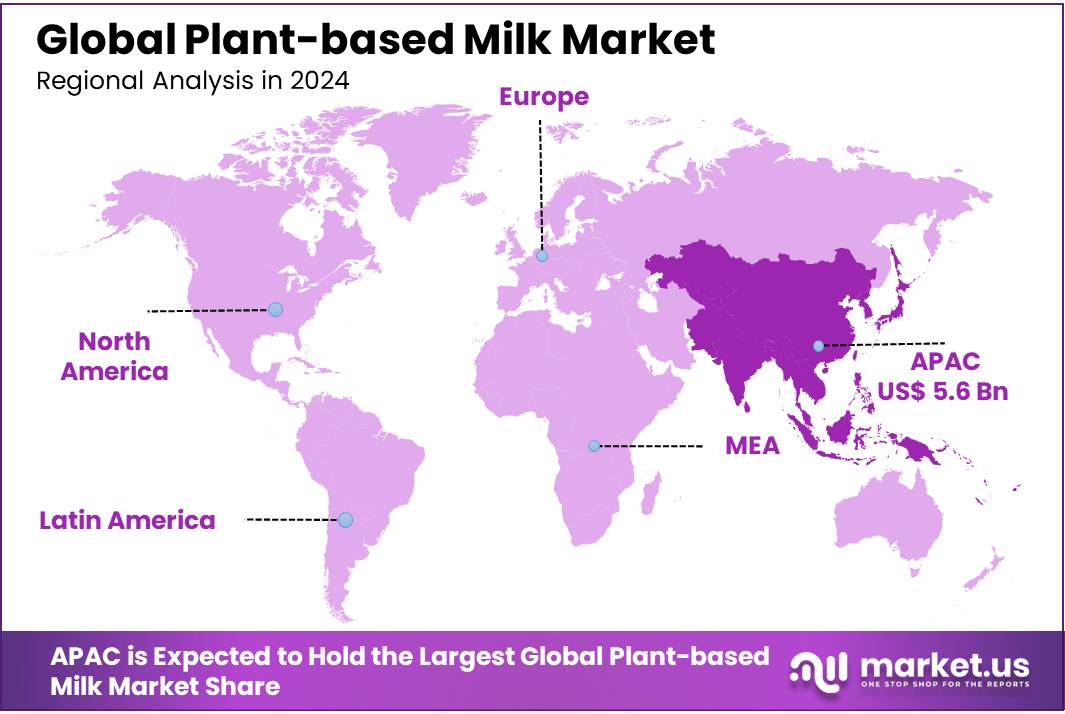

- Asia Pacific (APAC) emerged as the dominating region, capturing 41.1% of the market share with revenues amounting to USD 5.6 billion.

By Product Type

In 2023, Almond Milk continued to dominate the plant-based milk market, capturing more than a 42.1% share. This preference is largely due to its mild flavor and versatility, making it a popular choice not only for drinking but also for use in cereals, coffee, and smoothies. Consumers appreciate almond milk for its nutritional benefits, including being naturally lactose-free, low in calories, and containing beneficial fats.

Soy Milk, another staple in the plant-based milk sector, also maintained a strong market presence, appreciated for its high protein content and established position as a dairy alternative. It is particularly favored by those looking for a nutritionally equivalent alternative to cow’s milk, offering essential amino acids and being an option for cooking and baking.

Emerging varieties like Oat Milk have seen growth due to their creamy texture and eco-friendly reputation, as oats require less water and land to produce compared to almonds and soybeans. Oat milk’s popularity is rising in coffee shops and among baristas for its ability to froth and blend smoothly into espresso-based drinks.

Coconut Milk and Cashew Milk are celebrated for their rich textures and flavors, making them ideal for culinary applications such as baking and creating creamy sauces. These options cater to a segment of consumers looking for richer, more flavorful dairy alternatives.

By Form

In 2023, the Liquid form of plant-based milk maintained a dominant market position, capturing more than a 91.3% share. This overwhelming preference for liquid plant-based milk is primarily due to its convenience and versatility, aligning with consumer habits of using milk for drinking, cooking, and baking. Liquid plant-based milk is readily available in various flavors and formulations, catering to a broad spectrum of dietary preferences and needs. It is particularly favored for its ease of use in coffee, smoothies, and cereal, which has made it a staple in many households.

Powdered plant-based milk, while holding a smaller segment of the market, offers unique benefits that appeal to specific consumer groups. This form is valued for its long shelf life and portability, making it an excellent option for travelers and those with limited storage space. It is also a popular choice among those looking to control portions or reduce waste, as it can be mixed with water as needed. Powder forms of plant-based milk are gaining traction in the fitness and outdoor activities market, where lightweight and non-perishable food items are essential.

By Category

In 2023, Conventional plant-based milk held a dominant market position, capturing more than a 74.3% share. This category includes plant-based milks that are produced without strict adherence to organic standards, often making them more accessible and affordable to the average consumer. Conventional plant-based milks are widely available in supermarkets, grocery stores, and other retail outlets, offering a variety of flavors and fortified options that appeal to a broad consumer base. Their lower price point compared to organic alternatives is a factor in their market dominance, as it meets the needs of budget-conscious consumers looking to explore dairy-free alternatives.

Organic plant-based milk, while holding a smaller portion of the market, is steadily gaining popularity, especially among health-conscious consumers who prefer products free from pesticides, herbicides, and synthetic fertilizers. Organic plant-based milks are often perceived as healthier and more sustainable, appealing to those who prioritize environmental and ethical considerations in their purchasing decisions. This segment benefits from the growing trend towards organic and natural food products, driven by increasing consumer awareness of health and environmental issues.

By Flavor

In 2023, Original/Unflavored plant-based milk continued to dominate the market, capturing more than a 63.2% share. This preference is largely driven by consumers who appreciate the versatility and purity of unflavored milks in their daily diets. Original plant-based milks, such as soy, almond, and oat, are often sought after for their ability to blend seamlessly into culinary applications without altering the taste profile of dishes. They are favored for use in everything from morning cereals to cooking sauces and baking, where the natural flavor of the main ingredients should not be compromised by the addition of flavored milks.

Flavored plant-based milks also hold a portion of the market and are popular among consumers looking for variety and enhanced taste experiences in their beverages. Flavored varieties, including chocolate, vanilla, and strawberry, cater especially to younger demographics and those new to plant-based diets who may be looking for tastier alternatives to dairy milk. These products are not only used as beverages but are also popular in desserts, smoothies, and other sweet treats where additional flavoring is beneficial.

By End Use

In 2023, Retail Sales of plant-based milk held a dominant market position, capturing more than a 43.1% share. This segment’s strength is largely attributed to the widespread consumer accessibility and convenience offered by supermarkets, grocery stores, and online platforms where a variety of plant-based milk options are available. The availability of diverse brands and formulations at retail venues has made it easier for consumers to incorporate these alternatives into their daily routines, boosting sales.

Infant Formula is another important segment where plant-based milk is making inroads. Soy and almond-based infant formulas are becoming popular choices for parents seeking dairy-free, hypoallergenic options for their infants due to allergies or other health-related issues. This segment’s growth is encouraged by a broader acceptance and trust in plant-based nutrition for early childhood development.

In the sectors of Bakery and Confectionery, and Milk and Milk-Based Beverages, plant-based milks are valued for their functional properties such as frothability, flavor profile, and ability to act as a dairy substitute without compromising on texture or taste. Bakers and beverage makers are increasingly using almond, oat, and coconut milks to cater to the growing demand for vegan and lactose-free products.

Dairy Products alternatives, such as cheese, yogurt, and cream made from plant-based milks, are also seeing increased demand as consumers look for comprehensive dairy-free diets. This trend is supported by innovations in food technology that enhance the taste and texture of these products, making them more palatable and similar to their dairy counterparts.

By Sales Channel

In 2023, Supermarkets/Hypermarkets continued to hold a dominant position in the plant-based milk market, capturing more than a 53.2% share. This dominant share is attributed to their ability to offer a wide range of plant-based milk brands and types under one roof, catering to the convenience and diverse preferences of consumers. These large retail formats are instrumental in driving the accessibility of plant-based milk to a wide audience, providing visibility and trial opportunities for new and established brands alike.

Specialty Stores also play a critical role, particularly for consumers seeking niche products such as organic, non-GMO, or uniquely flavored plant-based milks. These stores often provide a curated selection that appeals to health-conscious consumers or those with specific dietary needs, such as vegan or allergy-friendly options.

Online Retailers have seen substantial growth in the plant-based milk sector, driven by the convenience of home delivery and the availability of extensive product information that helps consumers make informed choices. Especially in the wake of the COVID-19 pandemic, more consumers have turned to online shopping to fulfill their grocery needs, including the purchase of plant-based milks.

Convenience Stores, Departmental Stores, and Traditional Stores also contribute to the market, each serving different consumer needs and preferences. Convenience stores are vital for on-the-go purchases, departmental stores often cater to premium products, and traditional stores may appeal to consumers who value a more personal shopping experience or reside in less urban areas.

Key Market Segments

By Product Type

- Soy Milk

- Almond Milk

- Coconut Milk

- Cashew Milk

- Hemp Seed Milk

- Rice Milk

- Oat Milk

- Peanut Milk

- Pea Milk

- Hazelnut Milk

- Macadamia Milk

- Others

By Form

- Liquid

- Powder

By Category

- Organic

- Conventional

By Flavor

- Original/Unflavored

- Flavored

By End Use

- Infant Formula

- Dairy Products

- Bakery and Confectionary

- Milk and Milk-Based Beverages

- Retail Sales

- Others

By Sales Channel

- Convenience Store

- Departmental Store

- Traditional Store

- Specialty Store

- Online Retailers

- Others

Drivers

Health Consciousness and Sustainability

A pivotal driving factor propelling the growth of the plant-based milk market is the rising health consciousness among consumers coupled with increasing environmental awareness. In 2023, the global plant-based milk market continued to expand as consumers increasingly opted for lactose-free, lower-calorie milk alternatives that also offer environmental benefits such as reduced greenhouse gas emissions and lower water usage compared to traditional dairy farming.

Consumers are becoming more aware of the health risks associated with high cholesterol and saturated fats found in cow’s milk, which has boosted the popularity of plant-based milks like almond, soy, and oat. These alternatives not only cater to those with dietary restrictions, such as lactose intolerance and allergies, but also appeal to those seeking to reduce their ecological footprint. The environmental advantages of plant-based milk production, which requires less land and water than dairy milk production, resonate well with environmentally conscious consumers.

Technological innovations in food processing have enabled manufacturers to enhance the taste and nutritional content of plant-based milks, making them more palatable to a broader audience. This includes fortification with essential nutrients such as calcium, vitamin D, and B vitamins, which are crucial for bone health and overall well-being.

The market’s expansion is also driven by a variety of available flavors and options that cater to a wide range of taste preferences and dietary needs, further making plant-based milks a popular choice among health-conscious consumers. As the market continues to grow, the diversity in product offerings and improvements in product quality are likely to attract even more consumers to plant-based alternatives.

Restraints

Price Sensitivity Among Consumers

One of the primary challenges facing the plant-based milk market is the price sensitivity among consumers. Despite the growing popularity and demand for plant-based milk options, their higher price point compared to traditional dairy milk remains a barrier. The production of plant-based milk involves complex processes and sourcing of specific raw materials like almonds, soy, or oats, which can drive up costs. As a result, plant-based milks are often priced higher than their dairy counterparts, making them less accessible to a broader audience, particularly in price-sensitive markets.

This price disparity can deter consumers who are curious about plant-based alternatives but are not willing to pay a premium, especially in regions where economic conditions make affordability a priority. The perception of plant-based milk as a ‘premium’ product could slow down its adoption rate among mainstream consumers who consider price a major factor in their purchasing decisions.

Furthermore, while plant-based milk offers benefits such as being lactose-free and lower in cholesterol, some consumers are hesitant to switch due to taste preferences and the cultural prominence of dairy milk. Overcoming these hurdles requires not only addressing the cost issues but also enhancing consumer awareness about the health and environmental benefits of plant-based milk to justify the price differential.

Efforts to reduce production costs and increase scale could help lower prices over time, making plant-based milk more competitive with dairy milk. Additionally, continuous product innovation to improve taste and nutritional content could further encourage consumer acceptance and help overcome these challenges.

Opportunity

Expanding Market in Emerging Regions

The growth opportunity for the plant-based milk industry lies in its expansion into emerging markets, particularly in Asia-Pacific regions such as India and China. The demand for plant-based milk in India is rapidly increasing, driven by a growing awareness of health benefits associated with these products and a rise in disposable income among consumers. This growth is characterized by an increasing preference for vegan products that are free from artificial flavors and stabilizers, appealing to health-conscious consumers.

These trends suggest a broadening consumer base and a shift towards healthier dietary options, which are less reliant on traditional dairy products. The market’s expansion in these regions is also supported by innovations in product offerings, which now include a wide variety of tastes and fortified options to meet local preferences and nutritional requirements.

The strategic focus on these high-growth regions, supported by ongoing product innovation and adaptation to local tastes, presents a opportunity for manufacturers to capitalize on the increasing popularity of plant-based diets globally. The growth in these markets is indicative of a larger global shift towards plant-based foods, driven by a combination of health, environmental, and ethical factors influencing consumer choices.

Trends

Diversification and Nutritional Enhancement of Plant-Based Milks

A trend in the plant-based milk industry is the diversification of product offerings and the enhancement of their nutritional profiles. As of 2023, the industry has seen a surge in the variety of plant-based milks available, driven by consumer demand for both flavor and nutritional variety. This includes a notable rise in oat milk popularity, which is favored for its mild flavor and versatility in various culinary applications. Oat milk is particularly appealing because of its nutritional benefits, such as high levels of dietary fiber and protein, which cater to health-conscious consumers looking for wholesome dairy alternatives.

Moreover, the industry is witnessing an expansion in the range of flavors and fortified options available. Plant-based milk producers are not only focusing on traditional flavors like almond and soy but are also introducing innovative options like macadamia and potato milks. These new varieties are designed to meet specific dietary preferences and nutritional requirements, enriching the consumer choice pool.

The growth in this sector is also supported by technological advancements in food processing, which improve the taste, texture, and nutritional value of plant-based milks. These innovations make plant-based milks more comparable to traditional dairy in terms of taste and nutritional benefits, thereby increasing their appeal to a broader audience.

Furthermore, there’s a growing trend towards incorporating high-quality, traceable ingredients, which resonates well with consumers who value transparency and sustainability in their food choices. This shift is supported by a broader consumer inclination towards products that are not only good for health but also for the environment.

Regional Analysis

In 2023, the plant-based milk market witnessed varied growth across different global regions, each presenting unique trends and challenges. Asia Pacific (APAC) emerged as the dominating region, capturing 41.1% of the market share with revenues amounting to USD 5.6 billion. This dominance is largely attributed to the increasing adoption of vegan and vegetarian diets, coupled with rising health awareness among consumers in countries like China, India, and Australia. The regional market is bolstered by a robust supply chain and local production facilities, making plant-based options more accessible to the growing middle class.

North America followed closely, with a strong preference for plant-based milk due to dietary trends and a growing preference for lactose-free alternatives among the population. The U.S. and Canada have seen innovation in this sector, with companies frequently launching new products to cater to a health-conscious consumer base. This region benefits from well-established distribution networks and high consumer purchasing power, which facilitate the wide availability and adoption of diverse plant-based milk options.

In Europe, the market is driven by environmental concerns and the popularity of sustainable diets, particularly in Western European countries such as Germany, the UK, and the Netherlands. The European market is also seeing an increase in government support for sustainable agriculture practices, which indirectly favors the growth of the plant-based milk industry.

The Middle East & Africa and Latin America regions exhibit slower growth but show promising potential. These markets are gradually warming up to plant-based diets, influenced by global trends and the gradual expansion of international and local companies into these regions. In these areas, the market growth is expected to accelerate as consumer awareness rises and distribution improves.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The plant-based milk market is characterized by a dynamic and diverse array of key players, each contributing to the sector’s growth and innovation. Companies like Blue Diamond Growers, Inc. and Califia Farms, LLC have established themselves as leaders in the market, known for their wide range of almond and other nut-based milks. Blue Diamond, in particular, is renowned for its ‘Almond Breeze’ product line, which has become synonymous with almond milk globally.

Danone S.A. and The Hain Celestial Group, Inc. are other major players, with Danone’s acquisition of Silk and So Delicious brands bolstering its presence in the soy and specialty plant-based milk categories. Hain Celestial complements its portfolio with a variety of organic and non-GMO beverages that cater to health-conscious consumers. Oatly AB, originating from Sweden, has impacted the market with its oat-based milk, appealing particularly to consumers in Europe and North America due to its sustainability and nutritional profile.

Ripple Foods, PBC and SunOpta Inc. are also noteworthy for their innovative approaches, focusing on pea protein and organic ingredients, respectively, to differentiate their offerings. Elden Foods Inc. and Elmhurst Milked Direct, LLC emphasize minimal processing with their plant-based milks, using fewer ingredients to appeal to the clean label trend.

Top Key Players

- Blue Diamond Growers, Inc.

- Califia Farms, LLC

- Daiya Foods Inc.

- Danone S.A.

- Döhler GmbH

- Earth’s Own Food Company Inc.

- Elden Foods Inc.

- Elmhurst Milked Direct, LLC

- Freedom Foods Group Ltd

- Goya Foods

- Groupe Danone

- Alpina Foods

- Hain Celestial Group, Inc.

- Horizon Organic

- Kaslink Foods Oy Ltd

- Living Harvest Foods Inc.

- Liwayway Holdings Company Limited

- Mc Cormick & Co.

- Natura Foods

- Nutriops SL

- Oatly AB

- Pacific Foods of Oregon, LLC

- Ripple Foods, PBC

- SunOpta Inc.

- The Hain Celestial Group, Inc

Recent Developments

In 2023 Blue Diamond Growers, Inc., this company successfully maintained a strong market presence, with its commitment to quality and innovation in almond milk production.

In 2023 Califia Farms, LLC, the company continued to enhance its market presence through the expansion of its dairy-free product line, introducing USDA-certified organic oats and almond milk, which cater to the growing consumer demand for organic and health-conscious alternatives.

Report Scope

Report Features Description Market Value (2023) USD 13.6 Bn Forecast Revenue (2033) USD 32.2 Bn CAGR (2024-2033) 9.0% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Soy Milk, Almond Milk, Coconut Milk, Cashew Milk, Hemp Seed Milk, Rice Milk, Oat Milk, Peanut Milk, Pea Milk, Hazelnut Milk, Macadamia Milk, Others), By Form (Liquid, Powder), By Category (Organic, Conventional), By Flavor (Original/Unflavored, Flavored), By End Use (Infant Formula, Dairy Products, Bakery and Confectionary, Milk and Milk-Based Beverages, Retail Sales, Others), By Sales Channel (Convenience Store, Departmental Store, Traditional Store, Specialty Store, Online Retailers, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Blue Diamond Growers, Inc., Califia Farms, LLC, Daiya Foods Inc., Danone S.A., Döhler GmbH, Earth’s Own Food Company Inc., Elden Foods Inc., Elmhurst Milked Direct, LLC, Freedom Foods Group Ltd, Goya Foods, Groupe Danone, Alpina Foods, Hain Celestial Group, Inc., Horizon Organic, Kaslink Foods Oy Ltd, Living Harvest Foods Inc., Liwayway Holdings Company Limited, Mc Cormick & Co., Natura Foods, Nutriops SL, Oatly AB, Pacific Foods of Oregon, LLC, Ripple Foods, PBC, SunOpta Inc., The Hain Celestial Group, Inc Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Blue Diamond Growers, Inc.

- Califia Farms, LLC

- Daiya Foods Inc.

- Danone S.A.

- Döhler GmbH

- Earth's Own Food Company Inc.

- Elden Foods Inc.

- Elmhurst Milked Direct, LLC

- Freedom Foods Group Ltd

- Goya Foods

- Groupe Danone

- Alpina Foods

- Hain Celestial Group, Inc.

- Horizon Organic

- Kaslink Foods Oy Ltd

- Living Harvest Foods Inc.

- Liwayway Holdings Company Limited

- Mc Cormick & Co.

- Natura Foods

- Nutriops SL

- Oatly AB

- Pacific Foods of Oregon, LLC

- Ripple Foods, PBC

- SunOpta Inc.

- The Hain Celestial Group, Inc