Global Root Beer Market By Product Type (Alcoholic Root Beer, Non-alcoholic Root Beer), By Form (Carbonated, Non-Carbonated), By Flavor (Vanilla, Nutmeg, Sweet birch, Wintergreen, Molasses, Cherry tree husk, Others), By Packaging (Bottles (plastic and glass bottles, Cans), By End-use (Ayurvedic medicine, Food And Beverage, Dietary Supplements, Cosmetics), By Distribution Channel (Bars And Nightclubs, Alcohol/Liquor Stores, Hypermarket/Supermarket, Direct Selling, Online, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 132531

- Number of Pages: 290

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

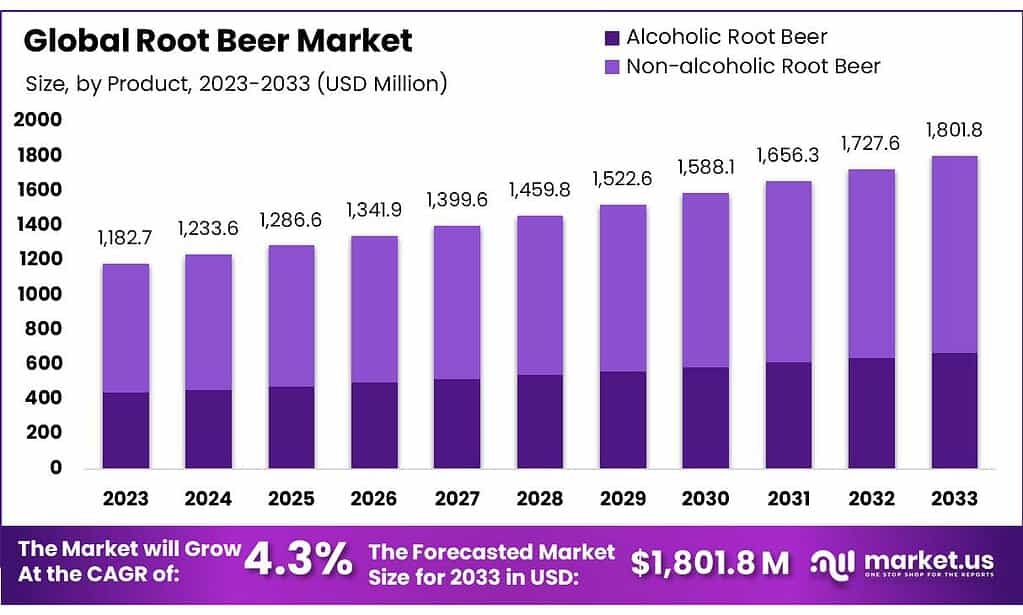

The Global Root Beer Market size is expected to be worth around USD 1801.8 Mn by 2033, from USD 1182.7 Mn in 2023, growing at a CAGR of 4.3% during the forecast period from 2024 to 2033.

Root beer, a sweet and non-alcoholic carbonated drink, is recognized for its unique flavor, often derived from natural extracts like sassafras, sarsaparilla, and wintergreen. The root beer market has gained attention for its growth in both domestic sales and export potential, though it faces regulatory and tax considerations that impact profitability and pricing.

In the United States, excise taxes on beverages like beer vary by state, which affects the cost structure for producers. For small breweries producing fewer than 2 million barrels annually, the federal excise tax rate is $3.50 per barrel on the first 60,000 barrels. Although this rate directly applies to alcoholic beer, variations in state-level taxes also influence non-alcoholic counterparts, like root beer, by setting price expectations and affecting distribution costs.

For import and export, root beer is regulated under several federal guidelines. Agencies such as the U.S. Customs and Border Protection (CBP) and the Alcohol and Tobacco Tax and Trade Bureau (TTB) require importers and exporters to adhere to specific standards, including product classification and compliance with import duties. Import duties on root beer are typically between 3% to 5%, depending on classification, which can slightly affect the product’s final price in foreign markets.

The export landscape for root beer is witnessing substantial growth. From March 2023 to February 2024, exports of root beer increased by 72% over the previous year, with 110 shipments sent by 11 exporters to 9 buyers across various regions.

Although February 2024 showed only one shipment—a drop of 89% compared to the previous February—this was an improvement of 1% over January 2024, indicating some month-to-month recovery.

Key Takeaways

By Product Type

In 2023, Non-alcoholic Root Beer held a dominant market position, capturing more than a 63.3% share of the global root beer market. This segment benefits significantly from widespread consumer preference for soft drinks that offer the unique and nostalgic flavor of root beer without the alcohol content.

Non-alcoholic root beer is particularly popular among families, as it serves as a suitable beverage option for all ages. The growing demand is also driven by the increasing availability of these products in various flavors and formulations that cater to health-conscious consumers looking for sugar-free or low-calorie alternatives.

Alcoholic Root Beer, while holding a smaller portion of the market compared to its non-alcoholic counterpart, has carved out a niche that appeals particularly to adult consumers seeking a twist on traditional beer. With an alcohol content similar to that of light beers, this segment attracts those who appreciate the creamy, rich taste of root beer combined with the enjoyable effects of alcohol.

The market for alcoholic root beer has been expanding, particularly in craft beer circles, where innovation and unique flavor combinations are highly valued. The product’s appeal in bars and among craft beer enthusiasts highlights its potential for growth, especially in regions with a strong culture of beer consumption and specialty beverages.

By Form

In 2023, Non-Carbonated Root Beer held a dominant market position, capturing more than a 72.2% share of the global root beer market. This segment’s strong market presence is attributed to the growing consumer preference for smoother, less fizzy beverage options that offer a unique tasting experience.

Non-carbonated root beer appeals particularly to those who find carbonated drinks to be too harsh or who have dietary restrictions concerning carbonation. The versatility of non-carbonated root beer also enhances its use in culinary applications, ranging from desserts to savory dishes, where the distinct flavor of root beer can be infused without the effervescence.

Contrastingly, Carbonated Root Beer, while holding a smaller market share, remains popular among traditional root beer enthusiasts who favor the classic fizzy sensation that defines sodas. This form continues to appeal to a significant consumer base that associates the bubbly texture with the nostalgic enjoyment of root beer.

Carbonated root beer is particularly prevalent in casual dining settings and fast food restaurants as a staple soft drink option. The ongoing popularity of carbonated soft drinks ensures that this segment, though smaller, maintains a steady demand in the global market.

By Flavor

In 2023, Vanilla held a dominant market position in the root beer market, capturing more than a 29.3% share. This flavor’s popularity stems from its classic, creamy taste that complements the traditional root beer profile very well, offering a smooth and familiar taste that appeals to a wide audience. Vanilla’s versatility also enhances its popularity, as it pairs well with both non-alcoholic and alcoholic root beers, making it a staple choice for manufacturers aiming at marketability and consumer preference.

Nutmeg flavor in root beer provides a warm, spicy note that differentiates it from more traditional flavors. While it captures a smaller segment of the market, its unique taste appeals to consumers looking for a root beer with a distinctive twist. Nutmeg-flavored root beer is often marketed during the winter months, capitalizing on its seasonal appeal that complements the cold-weather spice profiles popular in many holiday beverages.

Sweet birch flavor captures the essence of birch trees and is appreciated for its slightly minty and earthy tones. This flavor is particularly favored by consumers who prefer a more ‘woodsy’ taste in their beverages, aligning with trends towards natural and forest-inspired flavors in the beverage industry.

Wintergreen flavor in root beer offers a crisp, refreshing taste that brings a bright, minty element to the drink. It’s particularly popular among those who enjoy a vibrant burst of flavor that distinguishes it from the more subdued vanilla and nutmeg options.

Molasses adds a rich, robust flavor to root beer, deepening its profile with hints of caramel and a slightly bitter edge. This flavor tends to attract consumers who prefer a more complex and less sweet root beer, aligning well with trends towards more adult-oriented versions of traditional sweet beverages.

Cherry tree husk introduces a fruity, slightly tart flavor to the root beer market, offering an innovative twist on the traditional root beer taste. This flavor is less common but has been gaining traction among consumers looking for a unique and different root beer experience.

By Packaging

In 2023, bottles, encompassing both plastic and glass, held a dominant market position in the root beer packaging segment, capturing more than a 65.2% share. This preference for bottled packaging can be attributed to consumer perceptions of better taste preservation and premium quality associated with glass bottles, along with the convenience and lightweight nature of plastic bottles.

The durability and reusability of glass bottles also appeal to environmentally conscious consumers, while plastic bottles offer cost-effectiveness and resilience that are valued in mass markets and outdoor settings.

Cans, while holding a smaller share compared to bottles, remain a significant packaging option in the root beer market due to their portability and ease of recycling.

Aluminum cans are particularly favored for their ability to cool quickly and protect the contents from light and air, preserving the flavor and carbonation of root beer effectively. The convenience of cans for outdoor activities and large events, along with their stackability and storage efficiency, contributes to their steady demand in the beverage market.

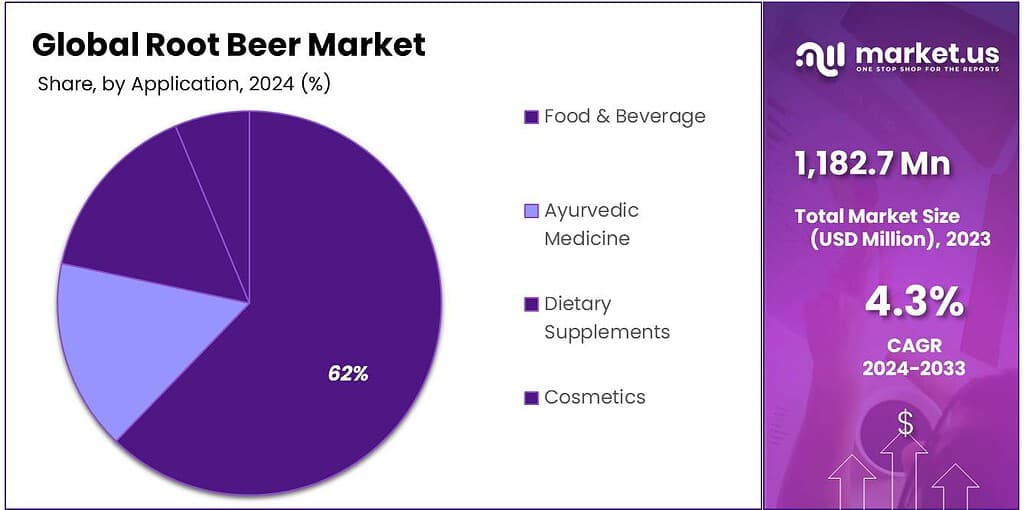

By End-use

In 2023, the Food and Beverage sector held a dominant market position within the root beer industry, capturing more than a 67.2% share. This sector’s substantial market share is driven by the widespread popularity of root beer as a beverage, both in its traditional form and as a flavoring for a variety of food products such as desserts, marinades, and sauces.

The unique flavor profile of root beer, characterized by its combination of sweetness and aromatic spices, makes it a favored choice for enhancing the taste of numerous culinary creations, further solidifying its position in the food and beverage market.

Root beer in Ayurvedic medicine, while a smaller segment, is recognized for its potential health benefits, particularly those derived from sassafras and sarsaparilla—ingredients historically used in traditional root beer recipes. These ingredients are believed to have detoxifying and anti-inflammatory properties, making root beer a niche but growing choice in the holistic health and wellness sector.

In the dietary supplements market, root beer is utilized for its flavoring properties to enhance the palatability of various supplements. This use is relatively minor compared to its consumption as a beverage but is growing as manufacturers seek to make their products more appealing to a broader audience, especially in markets like protein shakes and herbal tonics where flavor differentiation can be a key selling point.

The cosmetics industry leverages the aromatic qualities of root beer for products such as lip balms, moisturizers, and other topical applications. Although this is a niche application, the demand is slowly increasing as consumers look for novelty and diversity in scented personal care products, with root beer providing a unique and nostalgic scent profile.

By Distribution Channel

In 2023, Hypermarket/Supermarket held a dominant market position in the distribution of root beer, capturing more than a 38.1% share. This segment’s strength is attributed to the extensive reach and convenience these outlets offer, providing consumers with easy access to a wide range of root beer options under one roof. The ability of hypermarkets and supermarkets to offer competitive pricing and frequent promotions has further solidified their position as key players in the root beer market.

Bars and nightclubs serve as significant venues for the distribution of alcoholic root beer, catering to an adult demographic seeking novel and gourmet beverage options. While this channel commands a smaller share compared to hypermarkets and supermarkets, it is crucial for brand visibility and consumer engagement, particularly in urban areas where trends often take root.

Alcohol/liquor stores are pivotal in distributing alcoholic varieties of root beer. These specialized stores attract consumers looking specifically for alcoholic beverages, making them ideal points for introducing new root beer products that cater to enthusiasts and connoisseurs.

Direct selling remains a niche but vital distribution channel, especially for local and craft root beer producers. This method allows manufacturers to build direct relationships with consumers, offering personalized services and fostering brand loyalty. Direct selling is often employed at local events, breweries, or through subscription services.

The online distribution channel has seen significant growth, driven by the convenience of home delivery and the increasing digitization of shopping habits. Online platforms allow for a broader reach, especially for specialty products like craft root beers, which might not be available in traditional retail settings.

Key Market Segments

By Product Type

- Alcoholic Root Beer

- Non-alcoholic Root Beer

By Form

- Carbonated

- Non-Carbonated

By Flavor

- Vanilla

- Nutmeg

- Sweet birch

- Wintergreen

- Molasses

- Cherry tree husk

- Others

By Packaging

- Bottles (plastic & glass bottles)

- Cans

By End-use

- Ayurvedic medicine

- Food And Beverage

- Dietary Supplements

- Cosmetics

By Distribution Channel

- Bars And Nightclubs

- Alcohol/Liquor Stores

- Hypermarket/Supermarket

- Direct Selling

- Online

- Others

Driving Factors

Increasing Popularity Among Millennials and Health-Conscious Consumers

The root beer market has seen significant growth due to its rising popularity among younger demographics, particularly millennials, who are drawn to unique and artisanal beverage options. Additionally, the trend towards healthier lifestyles has boosted the demand for root beer, perceived as a healthier alternative to traditional sodas due to its natural ingredients and lower sugar content. This shift is particularly pronounced in North America, which dominates the market, largely due to these evolving consumer preferences.

Expansion of Distribution Channels

The expansion of distribution channels, particularly through supermarkets, convenience stores, and online platforms, has significantly contributed to the root beer market’s growth. Supermarkets and convenience stores collectively account for a major share of the market, providing wide reach and easy consumer access. Online retail platforms are also seeing increased traction, driven by the convenience they offer and the broader selection of root beer products, including premium and craft varieties, which are not always available in traditional retail settings.

Innovation in Product Offerings

Manufacturers are increasingly focusing on product innovation, experimenting with new flavors and types of root beer, including alcoholic variants, which cater to an adult audience looking for novel beverage experiences. This innovation extends to packaging and marketing strategies to appeal to a broader audience, including the introduction of limited edition flavors and eco-friendly packaging solutions, which resonate with environmentally conscious consumers.

Restraining Factors

Stringent Health Regulations and Changing Consumer Preferences

A major restraining factor for the root beer market is the increasingly stringent health regulations related to sugar and calorie content in beverages. Governments and health organizations worldwide are imposing stricter guidelines to combat obesity and health issues associated with high sugar consumption. This shift has prompted consumers to gravitate towards healthier alternatives, impacting the demand for traditional, sugar-laden root beer varieties.

High Competition from Other Beverage Segments

Root beer faces significant competition from a broad range of beverage options, including other soft drinks, craft beverages, and alcoholic drinks. The availability of numerous alternatives has diluted market share, as consumers have diverse tastes and preferences that can shift rapidly due to trends or health considerations. The competition is not just in flavor but also in product innovation, where companies continually evolve to capture consumer interest, further straining root beer’s traditional market.

Supply Chain Disruptions

The global supply chain disruptions, notably those caused by events like the COVID-19 pandemic, have also posed challenges to the root beer market. These disruptions impact everything from the procurement of raw materials to the distribution of finished products. For root beer, which relies on specific ingredients and packaging materials, such disruptions can lead to production delays, increased costs, and inventory issues, ultimately affecting market growth.

Growth Opportunity

Expanding Health-Conscious Consumer Base

One of the significant growth opportunities for the root beer market stems from the increasing consumer focus on health and wellness. As more consumers opt for healthier beverage choices, the demand for diet root beers, including sugar-free and low-calorie options, is on the rise. This trend is supported by the growing popularity of beverages that offer health benefits without sacrificing taste, providing a substantial market opportunity for root beer manufacturers to innovate with healthier formulations.

Growth in Online and Off-Trade Sales Channels

Another major growth area is the expansion of distribution channels, particularly online and off-trade venues like supermarkets and hypermarkets. The convenience and wide reach of these channels have already proven to be a strong growth driver, as evidenced by their significant share in root beer sales. The ongoing shift towards online shopping and the increasing effectiveness of digital marketing strategies are expected to further propel sales, tapping into the convenience-driven purchasing habits of modern consumers.

Increasing Demand in Non-Traditional Markets

The root beer market also stands to gain from expanding into non-traditional markets, especially within the Asia Pacific and Latin American regions. These areas are experiencing a surge in consumer spending power and a growing interest in Western-style beverages. The cultural intrigue and novelty associated with root beer in these markets present a unique opportunity for market penetration and expansion, driven by both rising disposable incomes and evolving consumer tastes

Latest Trends

Rising Popularity of Craft and Artisanal Beverages

The root beer market is significantly benefiting from the global trend towards craft and artisanal beverages. Consumers are increasingly seeking out unique, premium-quality beverages that offer distinctive taste experiences. This trend is particularly strong in North America, which holds a dominant market share and has a long-established tradition of root beer production. The demand for craft root beer, often brewed in small batches with natural ingredients and unique flavor profiles, is on the rise, presenting a lucrative opportunity for market expansion.

Health-Conscious Consumer Shifts

There’s a growing demand for healthier beverage options, which includes the rise of diet root beers that are low in sugar, calories, and are often gluten-free. This shift is driven by an increase in health awareness among consumers who still want to enjoy flavorful beverages without the guilt. Manufacturers are responding by developing new root beer varieties that cater to this health-conscious trend, ensuring they meet the consumer desire for both health and taste.

Expansion of Online and Direct-to-Consumer Sales

E-commerce and direct-to-consumer sales channels are witnessing significant growth within the root beer market. The convenience of online shopping, ability to compare prices, read reviews, and have products delivered directly to homes is driving this trend. Subscription services and the growth of online retail platforms are making it easier for consumers to access a wide selection of root beer brands, including those not available in local stores. This trend is expected to continue, driven by the increasing penetration of e-commerce and consumer preference for online shopping.

Regional Analysis

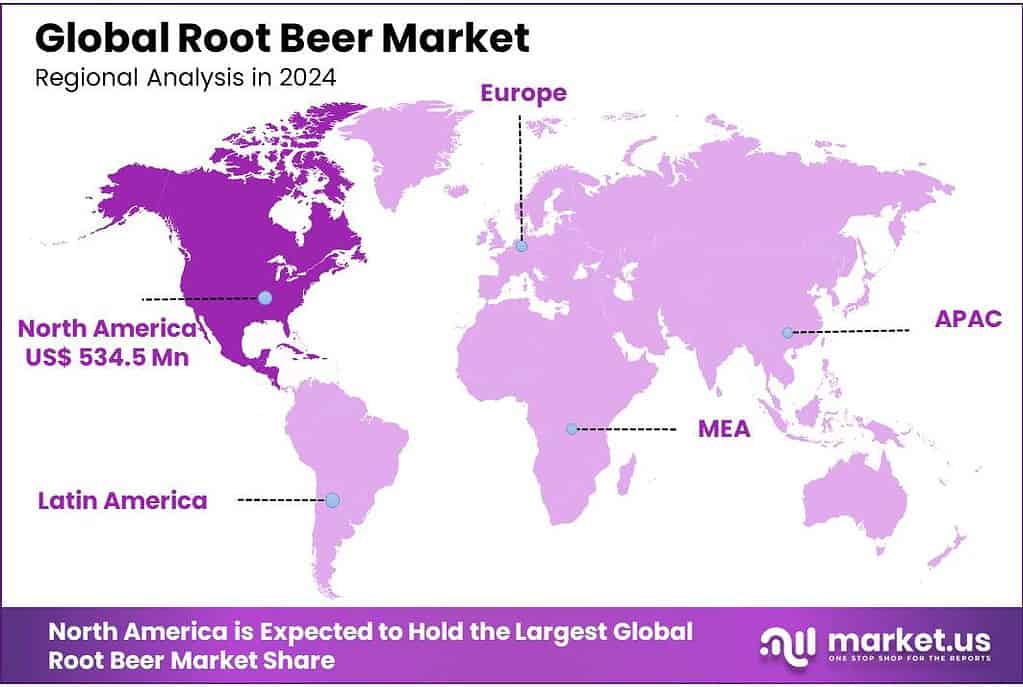

North America is the dominant force in the global root beer market, holding a commanding 45.3% share with a market value of approximately USD 534.5 million. The region’s strong market presence is bolstered by a long-standing tradition of root beer consumption, with the United States leading in both production and consumption. This region benefits from established beverage industries and a consumer base with a deep-seated familiarity and preference for root beer, which is considered a staple in American beverage culture.

Europe presents a growing market for root beer, driven by increasing consumer curiosity and the rising popularity of American cuisine. While the market share here is smaller compared to North America, countries like the United Kingdom, Germany, and France are experiencing heightened demand due to the growing craft beverage trend. European consumers are increasingly seeking unique and high-quality drink options, which root beer provides.

The Asia Pacific region shows promising growth potential in the root beer market, with increasing exposure to Western food and beverage culture. While traditional consumption has been low, the expanding middle class and rising disposable income levels are fostering a new market for unique and international flavors, making root beer an increasingly popular choice among younger consumers looking for novel beverage experiences.

In the Middle East and Africa, the root beer market is still in its nascent stages but is starting to see some growth due to globalization and the increasing presence of international food outlets. Consumer exposure to global beverage trends, combined with urbanization and youth demographic trends, suggests potential for market expansion in these regions.

Latin America’s root beer market is developing slowly with specific pockets of interest in major cities influenced by North American culture. The market here is driven by the increasing urban population and the influence of international tourism, which introduces local consumers to root beer.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The root beer market features a diverse array of key players, each contributing unique flavors and branding strategies that appeal to a broad consumer base. Major corporations such as Anheuser-Busch InBev SA/NV, Keurig Dr Pepper Inc., The Coca-Cola Company, and Pepsico Inc. dominate the market with strong distribution networks and extensive product lines. These companies are instrumental in shaping industry trends and have a significant impact on market dynamics due to their extensive reach and brand recognition.

On the other hand, smaller specialty companies like Sprecher Brewing Company Inc., The Dad’s Root Beer Company LLC, and Jones Soda Co. focus on craft and artisanal root beers, which cater to niche markets looking for unique and authentic flavors. These players often emphasize traditional brewing methods and use of natural ingredients, appealing to consumers seeking premium and differentiated products. Additionally, regional favorites such as Barq’s Inc. and A&W Food Services of Canada Inc. maintain strong loyalties in their respective territories, further diversifying the competitive landscape.

Top Key Players in the Market

- A&W Food Services of Canada Inc.

- Barq’s Inc.

- Anheuser-Busch InBev SA/NV

- Keurig Dr Pepper Inc.

- The Coca-Cola Company

- Pepsico Inc.

- Caruso’s Legacy (Boylan Bottling Co.)

- The Dad’s Root Beer Company LLC

- Thomas Kemper Soda Co.

- The Pop Shoppe

- Sprecher Brewing Company Inc.

- IBC Root Beer

- Jones Soda Co.

- Sioux City Bottling Company

- Dog n Suds LLC

- Frostie Root Beer

- Double Cola Company

- Jackson Hole Soda Company

- Gale’s Root Beer

- Tower Root Beer

Recent Developments

In 2023, A&W’s system-wide sales reached $1.8 billion, showcasing the brand’s strong performance and widespread consumer appeal.

In 2023, Anheuser-Busch InBev SA/NV, commonly known as AB InBev, is a major player in the global root beer market, leveraging its extensive distribution network and brand portfolio to maintain a significant presence.

Report Scope

Report Features Description Market Value (2023) USD 1182.7 Mn Forecast Revenue (2033) USD 1801.8 Mn CAGR (2024-2033) 4.3% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Alcoholic Root Beer, Non-alcoholic Root Beer), By Form (Carbonated, Non-Carbonated), By Flavor (Vanilla, Nutmeg, Sweet birch, Wintergreen, Molasses, Cherry tree husk, Others), By Packaging (Bottles (plastic and glass bottles, Cans), By End-use (Ayurvedic medicine, Food And Beverage, Dietary Supplements, Cosmetics), By Distribution Channel (Bars And Nightclubs, Alcohol/Liquor Stores, Hypermarket/Supermarket, Direct Selling, Online, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape A&W Food Services of Canada Inc., Barq’s Inc., Anheuser-Busch InBev SA/NV, Keurig Dr Pepper Inc., The Coca-Cola Company, Pepsico Inc., Caruso’s Legacy (Boylan Bottling Co.), The Dad’s Root Beer Company LLC, Thomas Kemper Soda Co., The Pop Shoppe, Sprecher Brewing Company Inc., IBC Root Beer, Jones Soda Co., Sioux City Bottling Company, Dog n Suds LLC, Frostie Root Beer, Double Cola Company, Jackson Hole Soda Company, Gale’s Root Beer, Tower Root Beer Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- A&W Food Services of Canada Inc.

- Barq's Inc.

- Anheuser-Busch InBev SA/NV

- Keurig Dr Pepper Inc.

- The Coca-Cola Company

- Pepsico Inc.

- Caruso's Legacy (Boylan Bottling Co.)

- The Dad's Root Beer Company LLC

- Thomas Kemper Soda Co.

- The Pop Shoppe

- Sprecher Brewing Company Inc.

- IBC Root Beer

- Jones Soda Co.

- Sioux City Bottling Company

- Dog n Suds LLC

- Frostie Root Beer

- Double Cola Company

- Jackson Hole Soda Company

- Gale's Root Beer

- Tower Root Beer