Global Sustainable Construction Materials Market Size, Share, Trends Analysis Report By Type (Bamboo, Reclaimed Wood, Green Insulation Materials, Structural Insulated Panels, Cross-laminated Timber, Recycled Metal, Others), By Application (Structural, Exterior Finishes, Interior Finishes, Insulation, Others), By End-use (Residential, Commercial, Offices, Institutes, Hospitality and Leisure, Industrial), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

- Published date: Oct 2024

- Report ID: 129844

- Number of Pages: 331

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

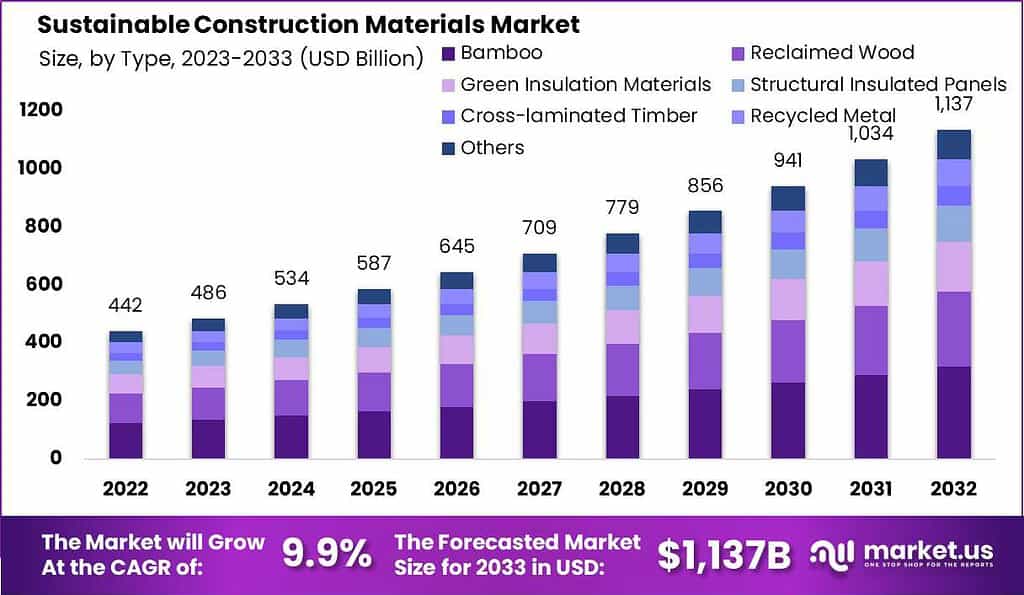

The global Sustainable Construction Materials Market size is expected to be worth around USD 1137.0 Bn by 2033, from USD 442.19 Bn in 2023, growing at a CAGR of 9.9% during the forecast period from 2023 to 2033.

Sustainable construction materials are defined as materials used in building and construction that are environmentally responsible and resource-efficient throughout their lifecycle—from extraction and processing to disposal. These materials are designed to reduce the overall environmental impact of buildings by minimizing resource depletion and enhancing energy efficiency.

According to the World Green Building Council, sustainable construction materials include recycled materials such as steel and concrete, renewable materials like bamboo and cork, and low-impact products manufactured with minimal energy consumption.

For example, green cement, which reduces the carbon footprint associated with traditional cement production by up to 30%, represented approximately 20% of the global cement market in 2022. Furthermore, the use of recycled steel has been growing steadily, with the American Iron and Steel Institute reporting that over 60% of steel used in construction is recycled.

As per the latest insights from Information from McKinsey & Company outlines that both public and private investments in sustainable construction materials have surged. Governments are channeling funds into infrastructure projects that mandate the use of sustainable materials.

For example, the U.S. government’s infrastructure plan allocates over $200 billion towards sustainability in construction. In the private sector, significant transactions include Holcim’s acquisition of Firestone Building Products for $3.4 billion in 2021, aimed at expanding its sustainable construction portfolio.

According to the United States Geological Survey (USGS), the trade of sustainable construction materials such as recycled concrete and green cement has seen a steady increase. In 2022, the US exported approximately $5 billion worth of these materials, an increase of 7% from the previous year.

Import activity also reflects a robust market, with major imports coming from Canada and Mexico, highlighting North America as a critical hub for sustainable construction material trade.

According to the findings from International Energy Agency (IEA), government regulations focusing on reducing carbon emissions and enhancing building efficiency are pivotal drivers for the adoption of sustainable construction materials.

For instance, the European Union’s regulations under the European Green Deal aim to achieve ‘net zero’ buildings by 2050, necessitating significant investment in sustainable building materials. The EU has committed to renovating up to 2% of its buildings annually to meet these targets, significantly influencing market dynamics.

Key Takeaways

- The global Sustainable Construction Materials Market size is expected to be worth around USD 1137.0 Bn by 2033, from USD 442.19 Bn in 2023, growing at a CAGR of 9.9% during the forecast period from 2023 to 2033.

- Reclaimed Wood dominated Sustainable Construction Materials with a 23.3% share.

- Structural dominated the Sustainable Construction Materials Market with a 37.3% share.

- Residential dominated the Sustainable Construction Materials Market with a 34.5% share.

- Asia-Pacific led the global Aluminum Castings Market in 2023, capturing 41% market share, valued at USD 182.6 Bn.

By Type Analysis

Reclaimed Wood Leads 2023 Holds over 23.3% in the sustainable materials segment.

In 2023, Reclaimed Wood held a dominant market position in the By Type segment of the Sustainable Construction Materials Market, capturing more than a 23.3% share. This segment showcases the increasing prioritization of sustainability within the construction industry. Reclaimed Wood is followed closely by Bamboo, which is favored for its rapid renewability and minimal environmental impact. Bamboo’s integration into modern architectural designs underscores its rising popularity and viability as a sustainable construction material.

Green Insulation Materials, ranking third, are pivotal in reducing energy consumption in buildings, thereby supporting the sustainability goals of reducing carbon footprints. These materials, including sheep’s wool and recycled cotton, are gaining traction due to their low thermal conductivity and superior environmental performance.

Structural Insulated Panels and Cross-laminated Timber are also significant contributors to the market. These materials are celebrated for their energy efficiency and strength, facilitating faster construction times and reduced waste. Their ability to sequester carbon over their lifecycle further enhances their market appeal.

Recycled Metal, used in structural frameworks and facades, represents a critical recycling loop within the industry, turning scrap into valuable construction materials without compromising structural integrity.

By Application Analysis

Dominance of Structural Applications in 2023 with Structural segment leads with over 37.3%

In 2023, Structural held a dominant market position in the By Application segment of the Sustainable Construction Materials Market, capturing more than a 37.3% share. This segment primarily includes materials that are integral to the construction’s load-bearing framework and overall stability, highlighting a robust demand for sustainable options that contribute to long-term environmental benefits and energy efficiency.

Exterior Finishes accounted for significant traction, driven by the increasing consumer and regulatory push for green building certifications that emphasize the use of materials reducing environmental impact. These finishes, including eco-friendly paints and sustainably sourced cladding, play a critical role in enhancing building aesthetics while contributing to thermal regulation.

Interior Finishes also saw a noteworthy adoption rate, as more builders and homeowners seek out low-emission materials that improve indoor air quality. This category includes products like recycled glass countertops and low-VOC adhesives and paints, aligning well with health-conscious market trends.

Insulation, critical for reducing energy consumption in buildings, embraced advancements in bio-based and recycled materials. The shift towards materials that offer superior thermal performance without compromising environmental integrity underpins the growth in this sub-segment.

By End-use Analysis

Sustainable Construction Materials MarketPublished date: Oct 2024add_shopping_cartBuy Now get_appDownload Sample

Sustainable Construction Materials MarketPublished date: Oct 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Alumasc Group Plc

- Amvic Inc.

- AECOM

- Bauder Ltd.

- Balfour Beatty

- Binderholz GmbH

- Clark Group

- CEMEX

- Florbo International SA

- Gilbane Building company

- Gensler

- Hensel Phelps

- Johnson Controls

- LafargeHolcim

- Saint-Gobain

- Skanska

- Siemens AG

- Sika AG

- The Whiting- Turner Contracting Company

- The Turner Corp.

- Veolia Environnement S.A.

- WSP Global Inc.