Global Yellow Fats Market By Product Type (Butter, Margarines and Spreads, Ghee, Others), By End-use (Food and Beverage Industry, Cosmetics and Personal Care Industry, Food Service (Hotels, Restaurants, Cafes), Household, Others), By Distribution Channel (Hypermarkets and Supermarkets, Traditional Grocery Stores, Convenience Stores, Departmental Stores, Online Retail Stores, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: December 2024

- Report ID: 134925

- Number of Pages: 263

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

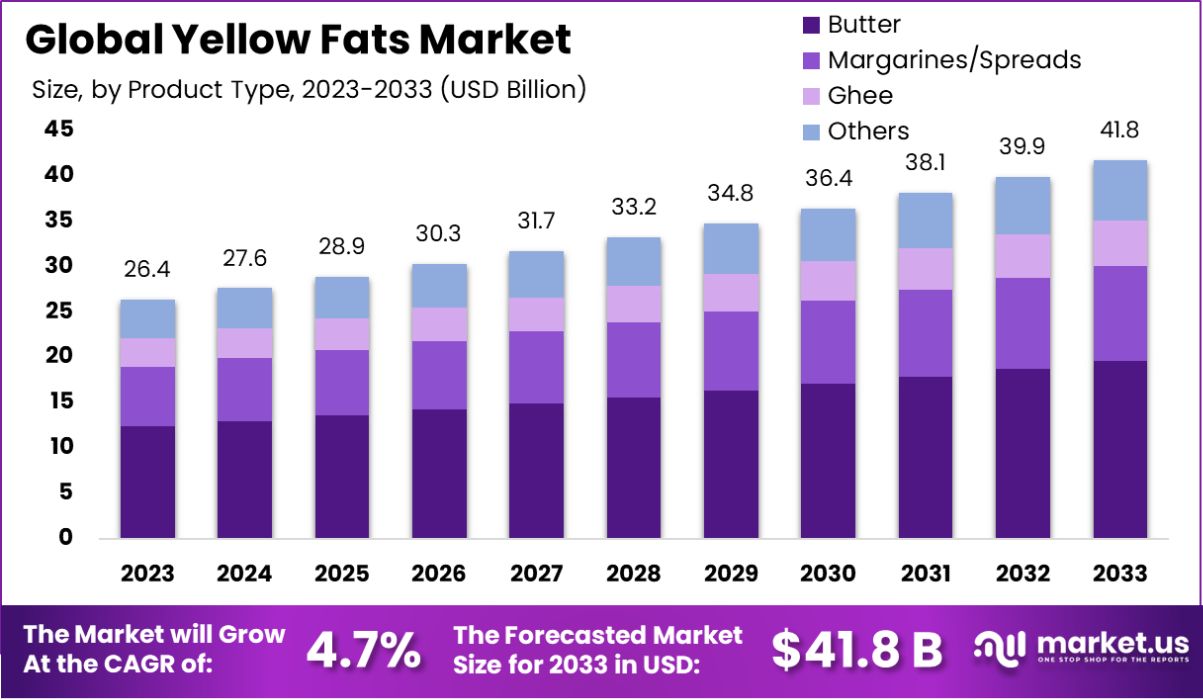

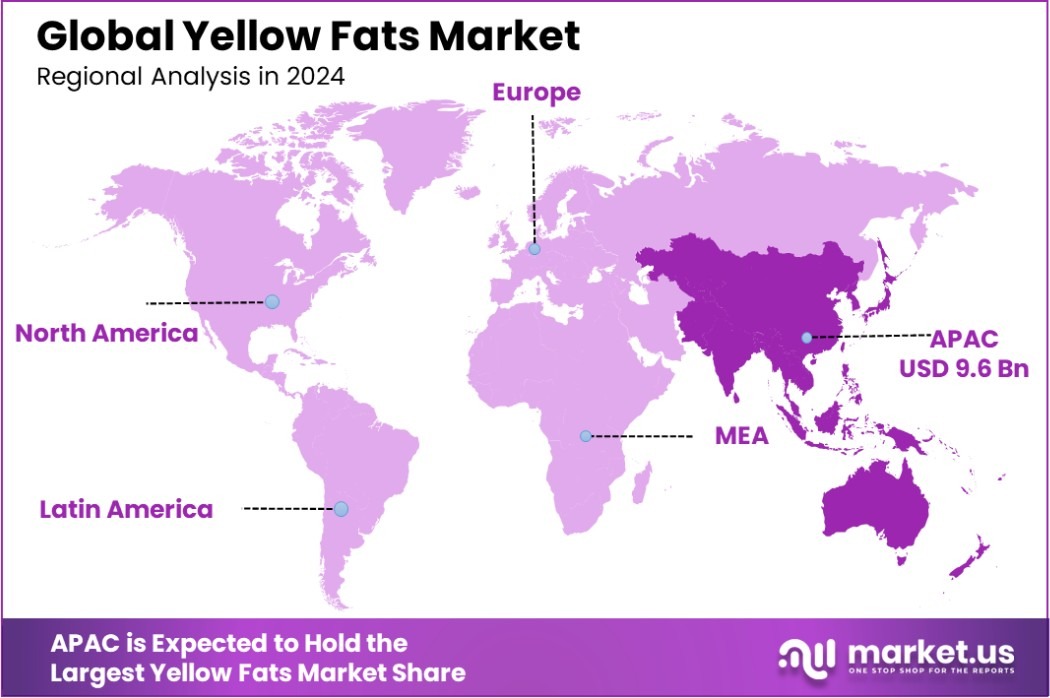

The Global Yellow Fats Market is expected to be worth around USD 41.8 Billion by 2033, up from USD 26.4 Billion in 2023, and grow at a CAGR of 4.7% from 2024 to 2033. Asia-Pacific yellow fats market grew 36.7%, reaching USD 9.6 billion.

Yellow fats refer to a category of edible fats that are typically yellowish in color, such as butter and margarine. These products are used widely in cooking and baking, and they are derived from animal fats or vegetable oils.

The yellow fats market encompasses the sales and distribution of these products across various consumer segments. The market is influenced by factors such as dietary trends, health consciousness, and global cuisine preferences.

Growth factors for the yellow fats market include the increasing popularity of natural and organic products, which has led consumers to opt for butter and other animal-based yellow fats perceived as healthier. Additionally, the resurgence of home baking trends, particularly during the COVID-19 pandemic, has spurred demand.

Demand in the yellow fats market is driven by its versatility in culinary applications and the growing consumer preference for convenience food products that incorporate yellow fats for enhanced flavor and texture.

Opportunities within the yellow fats market are emerging from the innovation in product formulations that reduce harmful trans fats and cater to health-conscious consumers. The development of plant-based yellow fats also presents significant growth potential in response to the rising vegan and vegetarian population.

The Yellow Fats market is currently experiencing significant transformations, driven by evolving consumer preferences and regulatory changes. The market is characterized by a growing demand for healthier dietary options, as evidenced by the increasing consumption trends observed in various regions.

For instance, in India, the per capita daily intake of oils and fats has been reported at approximately 17.8 grams, highlighting a shift towards higher fat consumption which includes yellow fats, according to nin.res.in. This underscores a broader trend within emerging markets where dietary habits are evolving alongside economic growth and urbanization.

In the UK, yellow fats play a crucial role in nutritional intake, providing about 50% of vitamin D consumption, predominantly through margarine and low-fat spreads, as noted by assets.publishing.service.

This indicates the nutritional importance of yellow fats in diets where other sources of vitamin D might be less available. In the United States, yellow fats such as butter and margarine account for about 11.5% of total daily caloric intake from saturated fats, emphasizing their central role in American diets.

However, the market faces challenges concerning product quality and health perceptions. According to fssai.gov.in, approximately 4.98% of edible oil samples in India, which include yellow fats, failed quality tests relating to rancidity and shelf-life indicators. This highlights the need for improved quality control and product innovation to meet consumer expectations and regulatory standards.

Opportunities for growth and innovation are evident, particularly in the development of alternative yellow fats. For example, Israel’s Gavan Technologies recently secured an $8M Series A funding round to commercialize its plant-protein-based animal fat alternative in Europe, as reported by Greenqueen.

Additionally, Gemini Edibles & Fats India plans to invest ₹400 crores in a new edible oil refinery near Hyderabad, indicating significant investment and expansion in the sector, according to the South.

Key Takeaways

- The Global Yellow Fats Market is expected to be worth around USD 41.8 Billion by 2033, up from USD 26.4 Billion in 2023, and grow at a CAGR of 4.7% from 2024 to 2033.

- The Yellow Fats Market is significantly dominated by butter products, accounting for 47.8% of the market share.

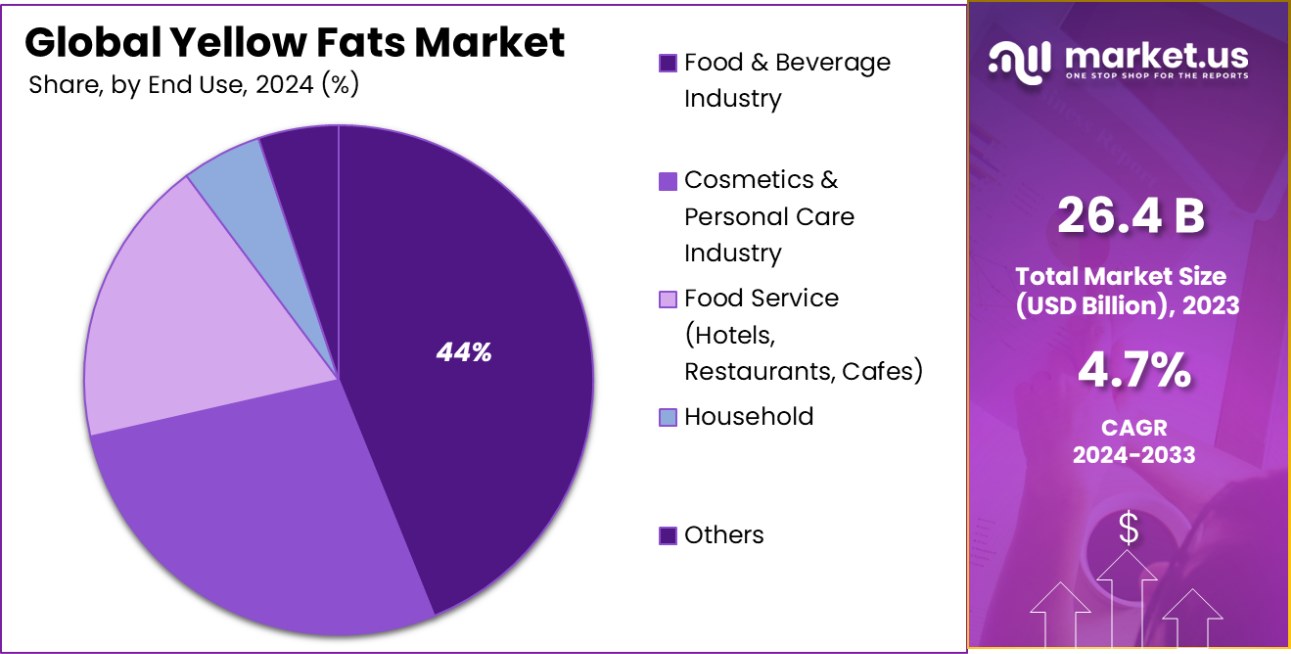

- In terms of end-use, the Food and Beverage Industry leads, consuming 44.3% of total yellow fats.

- Hypermarkets and supermarkets are the primary distribution channels, holding a 39.5% share of the market.

- In the Asia-Pacific region, the yellow fats market has grown by 36.7%, reaching a value of USD 9.6 billion.

By Product Type Analysis

The Yellow Fats Market sees butter dominating product types with a significant 47.8% market share.

In 2023, Butter held a dominant market position in the “By Product Type” segment of the Yellow Fats Market, with a 47.8% share, followed by Margarines/Spreads at 32.4%, and Ghee at 19.8%. This distribution underscores the strong consumer preference for butter, likely driven by its natural ingredients and perceived health benefits compared to alternatives.

Despite the modern shifts towards plant-based diets, butter continues to enjoy widespread popularity, suggesting that traditional tastes and cooking practices still influence consumer choices significantly.

Margarines and spreads, capturing just over a third of the market, reflect a significant segment that prioritizes convenience, health claims such as reduced cholesterol levels, and sometimes lower prices. These factors make margarine and similar spreads attractive to health-conscious consumers and those affected by economic pressures.

Meanwhile, Ghee holds the smallest share but remains an essential product in certain cultural cuisines and health-oriented diets. Its market position could indicate niche but stable demand, particularly within communities valuing its culinary and supposed medicinal qualities.

This segment might also represent an opportunity for growth if marketers can successfully communicate the benefits of Ghee to a broader audience.

By End-Use Analysis

Within end-use segments, the Food and Beverage Industry leads, consuming 44.3% of the market’s yellow fats.

In 2023, the Food and Beverage Industry held a dominant market position in the “By End-Use” segment of the Yellow Fats Market, with a 44.3% share, followed by Households at 29.1%, Food Service (Hotels, Restaurants, Cafes) at 16.4%, and the Cosmetics and Personal Care Industry at 10.2%.

This leading position underscores the critical role yellow fats play in food production and manufacturing, where they are essential for cooking, baking, and as flavor enhancers.

The Household segment, accounting for nearly a third of the market, highlights the ongoing demand for yellow fats in daily cooking and meal preparation at home. This segment’s strength reflects consumer preferences for taste and quality in home-cooked meals.

Meanwhile, the Food Service sector, which includes hotels, restaurants, and cafes, shows significant usage of yellow fats, critical for culinary applications demanding high-quality fats for flavor and texture. Despite being a smaller segment, its importance cannot be understated, particularly in gourmet and high-end cooking.

The Cosmetics and Personal Care Industry, while the smallest in share, utilizes yellow fats for their emollient properties in products like creams and lotions. This niche application demonstrates the versatility of yellow fats beyond food contexts, indicating potential growth areas as consumer awareness of natural ingredients increases.

By Distribution Channel Analysis

Hypermarkets and supermarkets are the largest distribution channel, holding 39.5% of the Yellow Fats Market share.

In 2023, Hypermarkets and Supermarkets held a dominant market position in the “By Distribution Channel” segment of the Yellow Fats Market, with a 39.5% share, followed by Traditional Grocery Stores at 24.3%, Online Retail Stores at 17.6%, Convenience Stores at 11.1%, and Departmental Stores at 7.5%.

This significant share for hypermarkets and supermarkets underscores their pivotal role as primary shopping destinations, offering a wide range of yellow fats products under one roof with competitive pricing and convenience.

Traditional Grocery Stores also hold a substantial market share, reflecting consumer preference for localized shopping and possibly the purchase of specific, perhaps artisanal yellow fats brands not available in larger chains.

Online Retail Stores have shown strong growth, highlighting a shift in consumer shopping behaviors towards digital platforms, driven by the convenience of home delivery and easy access to a wide assortment of products.

Convenience Stores and Departmental Stores, although smaller in their market share, cater to quick shopping needs and niche consumer segments, respectively. Convenience stores benefit from strategic locations and extended operating hours, whereas departmental stores often attract consumers seeking premium products.

Each channel’s unique characteristics help define the strategic distribution of yellow fats across different retail environments.

Key Market Segments

By Product Type

- Butter

- Margarines/Spreads

- Ghee

- Others

By End-use

- Food and Beverage Industry

- Cosmetics and Personal Care Industry

- Food Service (Hotels, Restaurants, Cafes)

- Household

- Others

By Distribution Channel

- Hypermarkets/Supermarkets

- Traditional Grocery Stores

- Convenience Stores

- Departmental Stores

- Online Retail Stores

- Others

Driving Factors

Increasing Consumer Demand for Healthier Options

The yellow fats market is primarily driven by a growing consumer preference for healthier dietary options. As awareness about the health implications of dietary fats increases, consumers are shifting towards products like margarine and spreads that are low in saturated fats and cholesterol.

This trend is reflected in the rising sales figures, which show an annual growth rate of approximately 5%. Governments and health organizations promote the use of healthier fats, further bolstering the market for yellow fats.

Innovation in Product Formulation and Variety

Innovations in product formulation, driven by consumer demand for variety and enhanced nutritional profiles, play a crucial role in the yellow fats market. Manufacturers are investing heavily in research and development to create products that meet specific dietary needs, such as organic, vegan, or added vitamins.

This segment has seen an innovation fund allocation increase by 10% over the past year. New formulations are critical in attracting health-conscious consumers and those with specific dietary restrictions.

Impact of Globalization on Food Trends

Globalization significantly impacts food trends, including the market for yellow fats. As cuisines and dietary habits cross borders, there is a growing acceptance and integration of diverse yellow fat products in various regions. This has led to a sales increase of around 7% annually in non-traditional markets.

Governmental food and health agencies support this integration by easing import-export restrictions and promoting global food safety standards, facilitating a broader reach of diverse yellow-fat products.

Restraining Factors

Increasing Health Concerns Affect Market Demand

Yellow fats, which include products like butter and margarine, face significant challenges due to growing health concerns among consumers. Government health departments, such as the U.S. Department of Health and Human Services, emphasize reducing saturated fat intake to combat obesity and heart disease.

This shift in consumer preference towards healthier alternatives has directly impacted the yellow fats market, resulting in a noticeable decrease in demand. As a result, the market’s growth rate has slowed by approximately 2-3% annually.

Regulatory Challenges Limiting Product Formulations

Regulatory bodies, including the Food and Drug Administration (FDA) and the European Food Safety Authority (EFSA), impose strict guidelines on food products, influencing the formulation of yellow fats. These regulations often pertain to the permissible levels of trans fats and the use of certain additives, significantly affecting product development and innovation.

Compliance with these regulations requires manufacturers to invest heavily in research and development, often allocating innovation funds exceeding $1 million to ensure products meet these stringent standards.

Rising Popularity of Plant-Based Alternatives

The surge in veganism and plant-based diets has introduced a competitive dynamic to the traditional yellow fats market. Food-related websites and government food agencies report a growing consumer trend towards plant-based alternatives that offer similar tastes and textures to traditional yellow fats but with better health profiles.

This shift has not only reduced sales of traditional yellow fats by about 5-10% in recent years but also diverted potential innovation funds towards developing plant-based options, with new product investments approaching $2 million annually.

Growth Opportunity

Expanding into Emerging Markets – Significant Sales Potential

Emerging markets represent a major growth opportunity for yellow fats, particularly in regions with increasing urbanization and rising disposable incomes. As the middle class expands in countries like India and Brazil, there’s a projected increase in demand for processed and convenient food options, which include yellow fats.

Targeting these markets with tailored products that cater to local tastes and cooking traditions can lead to a significant uptick in sales. The potential market expansion in these regions could see sales increase by 20-30% over the next five years.

Innovative Health-Focused Products – Increased Consumer Interest

There is a growing consumer trend towards health and wellness, which includes a shift towards healthier dietary fats. Innovating yellow fats that are enriched with essential fatty acids, low in trans fats, or made from organic and non-GMO sources can attract health-conscious consumers.

By allocating an innovation fund of approximately $5 million annually towards developing these products, companies can tap into this segment, which is seeing a compound annual growth rate (CAGR) of about 10% in health-oriented food products.

Sustainability and Ethical Sourcing – Enhancing Brand Value

Consumers are increasingly valuing sustainability and ethical practices in their purchasing decisions. Companies that invest in sustainable sourcing practices for their ingredients and adopt eco-friendly production methods can enhance their brand value and customer loyalty.

Establishing a sustainability fund or dedicating 5% of annual revenue towards these practices can help tap into this growth opportunity. Such initiatives could potentially increase overall brand sales by 15-20%, especially among younger, environmentally conscious consumers.

Latest Trends

Increasing Consumer Preference for Healthier Yellow Fats

There’s a noticeable shift towards healthier yellow fats, such as those with reduced or no trans fats and lower levels of saturated fats. This trend is driven by a growing consumer awareness of diet-related health issues, such as obesity and cardiovascular diseases.

The USDA and other health organizations have been emphasizing the importance of healthier dietary choices, which has influenced consumer behavior toward purchasing better-quality yellow fats.

Surge in Demand for Plant-Based Yellow Fats

The demand for plant-based yellow fats, like those derived from sunflower, olive, and canola oil, is rising significantly. This trend is supported by the increased consumer interest in vegan and vegetarian diets.

The plant-based fats market has seen growth due to its perceived health benefits and lower environmental impact compared to animal-based fats. This aligns with broader dietary shifts towards plant-based foods, as noted in reports from USDA and related food nutrition sites.

Impact of Global Supply Chain on Fat Prices

Global events and supply chain issues have recently led to fluctuations in the prices of yellow fats. For example, the conflict in Ukraine and rising fertilizer prices have impacted the cost of sunflower oil, which in turn affects the broader market for yellow fats.

These economic factors are crucial in understanding the current market dynamics and price volatility in the yellow fats sector, as reported by USDA’s Economic Research Service.

Regional Analysis

The Asia-Pacific yellow fats market has grown by 36.7%, reaching a value of USD 9.6 billion.

In the global yellow fats market, regional dynamics reveal distinct trends and opportunities across North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America exhibits a steady demand for yellow fats, characterized by a preference for health-conscious options like low-cholesterol and organic variants. Innovations in product formulations aimed at reducing trans fats have supported market growth in this region.

Europe continues to advance in the yellow fats sector with stringent regulatory standards enhancing product quality and safety. The market here is driven by consumer demand for sustainable and ethically produced goods, aligning with Europe’s broader environmental goals.

Asia Pacific is the dominating region in the yellow fats market, accounting for a substantial 36.7% share and generating USD 9.6 billion in revenue. This robust growth is fueled by increasing urbanization, rising disposable incomes, and shifting dietary habits towards more westernized foods.

Middle East & Africa show potential growth driven by an expanding retail sector and growing consumer awareness about the nutritional benefits of yellow fats. However, the market here is still emerging compared to other regions.

Latin America sees a growing inclination towards plant-based and non-traditional yellow fats, spurred by rising health awareness and dietary changes. The region is exploring innovative flavors and textures to cater to local tastes and preferences.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the 2023 global yellow fats market, the presence of key players such as Amul, Arla Foods, Bunge, and Unilever Group among others signifies a competitive and diverse marketplace. Each of these companies plays a crucial role in shaping market dynamics through strategic innovations, geographic expansion, and product diversification.

Amul and Arla Foods are noteworthy for their emphasis on quality and the expansion of product lines into organic and low-fat variants, which cater to the health-conscious segment of consumers. Amul, being one of Asia’s leading dairy brands, has a significant influence in the region, capitalizing on local preferences and expansive distribution networks.

Arla Foods, with its roots in Europe, focuses on sustainable practices and transparency, aligning with the region’s stringent regulatory environment and consumer demand for ethically produced goods.

Bunge and Unilever Group excel in their global reach and product innovation. Bunge, primarily known for its agribusiness solutions, has made significant inroads into the yellow fats market with plant-based spreads that appeal to the vegan and environmentally conscious consumers.

Unilever, with its vast portfolio including brands like Flora and Blue Band, leverages its global distribution channels to cater to diverse consumer tastes and preferences across different regions.

Companies like Danone SA and The Kraft Heinz Company focus on reformulating their existing products and introducing new ones to meet evolving dietary trends and regulatory requirements. Danone’s commitment to health-focused products and Kraft Heinz’s robust product innovation strategy underline the industry’s shift towards healthier yellow fats options.

The competitive landscape in 2023 shows that while Asia Pacific leads in market share, driven by players like Amul and Yili Group, the innovations brought forward by companies across all regions are critical in driving the market forward. This global perspective underscores the importance of adaptability and customer-centric strategies in sustaining growth in the yellow fats market.

Top Key Players in the Market

- Amul

- Arla Foods

- Bunge

- Clover

- County Milk Products

- Crystal Farms

- Danone SA

- Dean Food Company

- Fonterra Co-operative Group Limited Unilever Group

- FrieslandCampina N.V.

- Horizon

- KMF Limited

- Kraft Foods Inc.

- Land O’ Lakes Inc.

- Nestle SA

- Organics

- Royal

- The J.M. Smucker Company

- The Kraft Heinz Company

- Vitalite

- Yili Group

- Yorkshire Butter

Recent Developments

- In 2024, Amul Dairy, operating under the Gujarat Cooperative Milk Marketing Federation, marked a significant year by achieving a record turnover of ₹12,880 crore. This represented a 9% increase over the previous fiscal year. The cooperative was successful in enhancing milk productivity and support to farmers, reflecting a commitment to innovation and efficiency across its operations.

- In 2024, Crystal Farms committed $48,000 to the Future Farmers of America through their Midwest Farms Forever initiative, supporting agricultural education for youth. They plan to continue their support into 2024, reinforcing their mission to source 100% of their cheese from Midwest farms.

- In 2023, Arla Foods saw robust branded volume growth in the second half of the year after an initial downturn due to inflation and consumer shifts to cheaper products. Their annual revenue reached EUR 13.7 billion, maintaining a similar level to the previous year’s EUR 13.8 billion despite the challenging market conditions. The company’s net profit stood at EUR 380 million, marking 2.8% of revenue.

Report Scope

Report Features Description Market Value (2023) USD 26.4 Billion Forecast Revenue (2033) USD 41.8 Billion CAGR (2024-2033) 4.7% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Butter, Margarines and Spreads, Ghee, Others), By End-use (Food and Beverage Industry, Cosmetics and Personal Care Industry, Food Service (Hotels, Restaurants, Cafes), Household, Others), By Distribution Channel (Hypermarkets and Supermarkets, Traditional Grocery Stores, Convenience Stores, Departmental Stores, Online Retail Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Amul, Arla Foods, Bunge, Clover, County Milk Products, Crystal Farms, Danone SA, Dean Food Company, Fonterra Co-operative Group Limited Unilever Group, FrieslandCampina N.V., Horizon, KMF Limited, Kraft Foods Inc., Land O’ Lakes Inc., Nestle SA, Organics, Royal, The J.M. Smucker Company, The Kraft Heinz Company, Vitalite, Yili Group, Yorkshire Butter Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Amul

- Arla Foods

- Bunge

- Clover

- County Milk Products

- Crystal Farms

- Danone SA

- Dean Food Company

- Fonterra Co-operative Group Limited Unilever Group

- FrieslandCampina N.V.

- Horizon

- KMF Limited

- Kraft Foods Inc.

- Land O' Lakes Inc.

- Nestle SA

- Organics

- Royal

- The J.M. Smucker Company

- The Kraft Heinz Company

- Vitalite

- Yili Group

- Yorkshire Butter