Global Betanin Food Colors Market By Nature (Organic, Conventional), By Product Form (Powder, Liquid), By Source (Red Beet, Yellow Beet, Prickly Peer, Swiss Chard, Grain Amaranth, Cactus Fruits, Others), By Application (Bakery and Confectionery Products, Beverages, Fruit Preparations/Fillings, Dairy Food Products, Potatoes, Pasta, and Rice, Soups, Sauces, and Dressings, Meat, Poultry, Fish, and Eggs, Seasonings, Others), By End Use (Food & Beverages, Cosmetics and Personal Care, Paint Industry, Healthcare, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: December 2024

- Report ID: 134620

- Number of Pages: 258

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

The Global Betanin Food Colors Market is expected to be worth around USD 276.4 Million by 2033, up from USD 171.3 Million in 2023, and grow at a CAGR of 4.9% from 2024 to 2033.

Betanin is a natural red pigment derived from beets, widely used as a food coloring agent in a variety of products such as beverages, confectioneries, and dairy items. It’s valued for its vibrant hue and health benefits, including antioxidant properties.

The global betanin food colors market is driven by increasing demand for natural, clean-label products, with consumers preferring plant-based ingredients. The market is expanding as regulatory bodies approve natural colorants and as food manufacturers seek alternatives to synthetic dyes.

Rising consumer awareness about healthy eating, the shift towards natural ingredients, and regulations limiting synthetic dyes fuel the growth of betanin food colors. As demand for organic and clean-label foods increases, betanin’s use in processed foods rises. Manufacturers can explore untapped regions and expand product lines with clean-label offerings.

The Betanin food colors market is witnessing robust growth, driven by the increasing consumer preference for natural and clean-label ingredients over synthetic alternatives. This shift aligns with broader trends in the food and beverage industry, where demand for plant-based and health-conscious products is escalating. Betanin, a natural pigment extracted from beets, is poised to benefit from these trends due to its vibrant color, health benefits, and sustainable sourcing.

Key drivers of market growth include stringent regulations on artificial food colors and growing consumer awareness of the health risks associated with synthetic additives. As the food industry continues to evolve, manufacturers are exploring natural alternatives to meet clean-label standards and appeal to health-conscious consumers.

Recent developments underscore the investment and innovation in this space. For example, Phytolon, a startup specializing in fermentation-based plant-based colorants, secured $4.1 million in funding from investors, including Millennium Food-Tech and EIT Food. This funding will help accelerate the development of alternative natural food colorants, including betanin.

Similarly, the UK Research and Innovation (UKRI) has allocated £17.4 million (approximately $21.5 million) to 47 projects aimed at improving food quality and nutrition, which may include innovative solutions for natural food coloring.

The Bill & Melinda Gates Foundation’s $2 billion commitment to agricultural development also has the potential to support initiatives related to sustainable food color production, reinforcing the broader trend toward sustainability.

Furthermore, the USDA’s Community Food Projects Competitive Grants Program offers up to $400,000 in funding for projects designed to enhance food security, which may include natural food colorants.

These investments, coupled with an expanding portfolio of funding opportunities, provide significant market opportunities for the growth and adoption of betanin as a preferred food colorant. Manufacturers are well-positioned to capitalize on this demand, innovating in both product offerings and regional market expansion.

Key Takeaways

- The Global Betanin Food Colors Market is expected to be worth around USD 276.4 Million by 2033, up from USD 171.3 Million in 2023, and grow at a CAGR of 4.9% from 2024 to 2033.

- The market predominance of conventional products is observed at 59.2%, indicating a strong traditional preference.

- Powder-form products account for 67.4% of the market, showcasing their widespread adoption and versatility.

- Red beet as a source dominates the segment with 55.4%, highlighting its popular utilization.

- In the application segment, beverages hold a 27.1% share, reflecting their moderate market penetration.

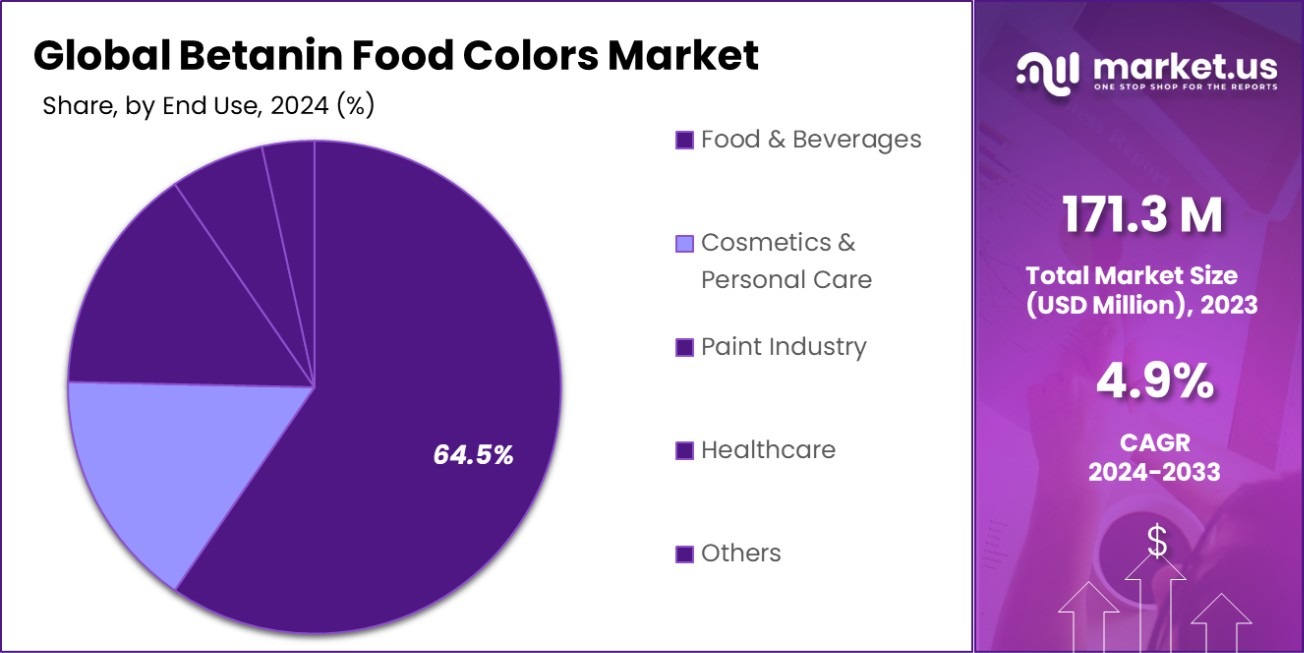

- Food and beverages as an end-use category command a significant 64.5% of the market share.

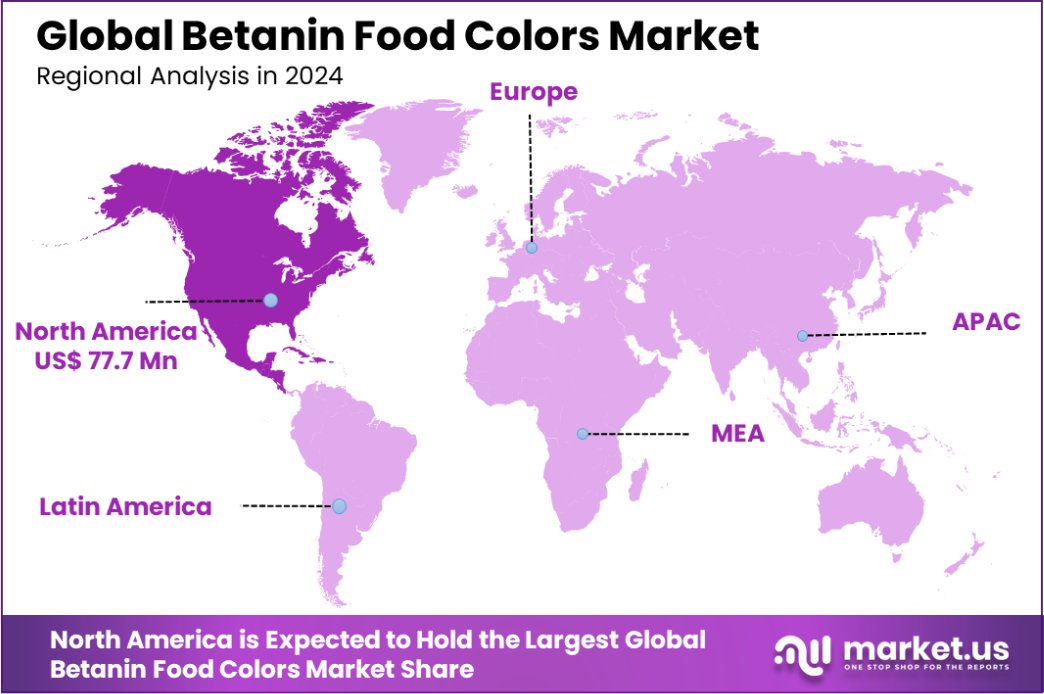

- North America holds 45.1% of Betanin market, valued at USD 77.7 million.

By Nature Analysis

Conventionally sourced natural colorants hold a significant market share at 59.2% due to their trusted origins.

In 2023, the Conventional segment held a dominant market position in the By Nature category of the Betanin Food Colors Market, commanding a 59.2% share. This substantial market share reflects established processing practices and the extensive availability of conventional sources for betanin extraction.

Conversely, the Organic segment, while smaller, represented a significant portion of the market at 40.8%. This share indicates a growing consumer preference towards organic products, driven by increasing awareness of health benefits and environmental concerns.

The market dynamics suggest that conventional betanin remains preferred due to its cost-effectiveness and scalability in production. However, the organic segment is poised for growth, bolstered by trends favoring natural and sustainable food ingredients. This shift is further supported by tightening regulations on synthetic food colorants and a noticeable consumer push towards cleaner labels.

As the market evolves, both segments are expected to witness shifts in consumer loyalty and regulatory impacts, which could redefine their market standings in the coming years. This analysis underscores the importance of monitoring both conventional and organic market segments for strategic positioning and investment decisions in the Betanin Food Colors Market.

By Product Form Analysis

Powder forms of natural colorants dominate the market, representing 67.4% of sales, favored for their ease of use.

In 2023, Powder held a dominant market position in the By Product Form segment of the Betanin Food Colors Market, with a 67.4% share. The remaining market space was occupied by the Liquid form, which accounted for 32.6%.

This distribution underscores the substantial preference for powder form, attributable to its advantages such as ease of storage, longer shelf life, and stability under varied temperature conditions. Powdered betanin is extensively utilized in dry mixes, baking goods, confections, and spice blends, where it imparts a vibrant red hue without altering the physical properties of the product.

The liquid form, while less predominant, is favored in applications requiring immediate solubility, such as beverages and dairy products. Despite its smaller share, the liquid segment benefits from the rising demand for convenient and ready-to-use solutions in fast-paced food service settings. The ongoing innovations in liquid formulation aimed at enhancing stability and color intensity could potentially increase its market share.

As the market continues to evolve, the dynamics between these two product forms are likely to be influenced by technological advancements and changing consumer preferences toward more natural and clean-label ingredients. This will play a crucial role in shaping the future trajectories of both powder and liquid forms in the Betanin Food Colors Market.

By Source Analysis

Red beet-derived colorants make up 55.4% of the market, appreciated for their vibrant hues and natural properties.

In 2023, Red Beet held a dominant market position in the By Source segment of the Betanin Food Colors Market, with a 55.4% share. Other sources such as Yellow Beet, Prickly Pear, Swiss Chard, Grain Amaranth, Cactus Fruits, and Others collectively accounted for 44.6% of the market.

The prominence of Red Beet can be attributed to its high betanin content and widespread cultivation which makes it a cost-effective source for natural red coloring. Red Beet is favored for its vibrant color and stability, which is highly sought after in the food and beverage industry for products like juices, confections, and dairy goods.

The diverse use of other sources such as Prickly Pear and Swiss Chard, though smaller in share, highlights an expanding palette of natural colors derived from various botanicals, each offering unique hues and health benefits. These alternative sources are gradually gaining traction, driven by innovative extraction technologies and growing consumer interest in exotic and sustainable ingredients.

The competitive landscape of the Betanin Food Colors Market suggests potential growth in the utilization of lesser-known sources, reflecting a broader trend towards natural and specialty ingredients in food applications. As regulatory frameworks continue to favor natural additives, the market is expected to see increased diversification and innovation in sourcing strategies.

By Application Analysis

In the beverages sector, natural colorants contribute to 27.1% of applications, enhancing visual appeal naturally.

In 2023, Beverages held a dominant market position in the By Application segment of the Betanin Food Colors Market, with a 27.1% share. The remaining market was distributed among Bakery & Confectionery Products, Fruit Preparations/Fillings, Dairy Food Products, Potatoes, Pasta, and Rice, Soups, Sauces, and Dressings, Meat, Poultry, Fish, and Eggs, Seasonings, and Others.

The prominence of Beverages as a leading application area for betanin is driven by the increasing consumer demand for natural and visually appealing drink options, ranging from soft drinks to alcoholic drinks beverages and functional drinks.

The versatility of betanin in providing natural color with nutritional benefits has also catalyzed its adoption in other sectors. Bakery and confectionery products are significant users, leveraging betanin for its vibrant red and pink hues. Additionally, dairy products and fruit preparations, which require consistent and appealing coloration, are increasingly incorporating betanin to meet clean label standards.

As health-conscious consumers continue to influence market trends, the demand for betanin in natural food coloring is expected to grow across diverse food applications. Innovations in the stabilization and formulation of betanin will further enhance its applicability and attractiveness to food manufacturers, shaping future market dynamics in the food coloring industry.

By End Use Analysis

The food and beverages industry heavily relies on natural colorants, utilizing them in 64.5% of end products.

In 2023, Food & Beverages held a dominant market position in the By End Use segment of the Betanin Food Colors Market, with a 64.5% share. The remaining market was segmented among Cosmetics & Personal Care, Paint Industry, Healthcare, and Others, which collectively accounted for 35.5%.

The substantial share held by the Food & Beverages sector can be attributed to the escalating demand for natural and clean-label ingredients. Betanin, known for its vibrant hues and health-promoting properties, is increasingly favored in this sector for its ability to meet consumer expectations for both aesthetic appeal and wellness benefits.

The Cosmetics & Personal Care sector also utilizes betanin, particularly in products that require natural coloring, such as lipsticks and blushes. In the Healthcare sector, betanin is explored for its antioxidant properties, contributing to the formulation of health supplements. Although smaller in market share, these segments highlight the versatility and expanding applications of betanin across diverse industries.

The market’s growth trajectory is expected to continue, driven by consumer preferences for sustainable and ethically sourced materials. As industries adapt to these consumer trends, the potential for betanin extends beyond traditional food coloring, promising further expansion into new and innovative applications.

Key Market Segments

By Nature

- Organic

- Conventional

By Product Form

- Powder

- Liquid

By Source

- Red Beet

- Yellow Beet

- Prickly Peer

- Swiss Chard

- Grain Amaranth

- Cactus Fruits

- Others

By Application

- Bakery & Confectionery Products

- Beverages

- Fruit Preparations/Fillings

- Dairy Food Products

- Potatoes, Pasta, and Rice

- Soups, Sauces, and Dressings

- Meat, Poultry, Fish, and Eggs

- Seasonings

- Others

By End Use

- Food & Beverages

- Cosmetics & Personal Care

- Paint Industry

- Healthcare

- Others

Driving Factors

Health Awareness Increases Demand for Natural Food Colors

The growth of the Betanin food colors market is significantly influenced by the rising consumer awareness regarding health and wellness. As people become more health-conscious, there is a notable shift towards natural ingredients in their diets.

Betanin, derived naturally from beets, is favored for its non-toxic and bio-degradable properties, making it a preferred choice over synthetic colors. This trend is further supported by increasing governmental regulations that encourage the use of natural additives in the food industry, thereby driving the demand for betanin-based colors.

Expanding Applications in Beverages and Confectioneries

Betanin food colors are experiencing heightened demand due to their expanding applications in various food sectors, particularly beverages and confectioneries. These sectors seek ingredients that offer vibrant, visually appealing colors without compromising on safety and quality.

Betanin is highly effective in acidic environments, which makes it ideal for flavoring and coloring drinks and sweets. This versatility not only enhances product appeal but also aligns with consumer preferences for natural ingredients, thereby boosting the market growth of betanin colors in these industries.

Innovations in Extraction and Processing Technologies

Technological advancements in extraction and processing methods are crucial drivers for the betanin food colors market. These innovations have improved the stability and consistency of betanin, making it more attractive to food manufacturers who require reliable and effective natural coloring solutions.

Enhanced extraction techniques have also made the production process more efficient and environmentally friendly, reducing waste and lowering costs. As a result, these technological improvements are pivotal in meeting the growing demand for high-quality, sustainable natural food colors.

Restraining Factors

Stability Concerns Limit Use in Diverse Food Products

One of the main challenges facing the betanin food colors market is the limited stability of betanin under various environmental conditions. Betanin’s color integrity can be compromised by factors such as light, heat, and pH variations, which restricts its application in a wide range of food products.

This sensitivity requires manufacturers to implement additional measures to preserve the color quality during processing and storage, potentially increasing production costs and limiting its use in broader applications where long-term color stability is essential.

High Costs of Natural Extraction and Production

The extraction and production processes for betanin are more complex and costlier compared to synthetic color production. Natural extraction involves specific, controlled conditions to maintain the integrity and effectiveness of the color.

These processes often require advanced technology and significant investment in both equipment and research, leading to higher prices for natural colors like betanin. This cost disparity can make betanin less attractive to manufacturers looking for cost-effective coloring solutions, thus restraining its market growth.

Regulatory Challenges in Global Markets

Navigating the regulatory landscapes in different countries poses significant challenges for the betanin food colors market. Each country has its own set of regulations regarding the use of food additives, including natural colors, which can vary widely.

These regulatory barriers can delay product launches, limit market entry, and increase compliance costs for producers of betanin colors. This complex regulatory environment can deter companies from expanding their reach into new markets, ultimately restraining the global adoption and growth of betanin-based food colors.

Growth Opportunity

Growing Organic Food Market Enhances Betanin Demand

The expanding global market for organic foods presents a significant growth opportunity for the betanin food colors market. As consumers increasingly prefer organic and natural products due to health and environmental concerns, the demand for natural food colorants like betanin is expected to rise.

Betanin, with its natural origin from beets, aligns perfectly with the organic label requirements, offering manufacturers a competitive advantage in this rapidly growing sector. This trend is anticipated to drive substantial market growth as more food producers adopt betanin to meet consumer preferences for natural ingredients in organic food products.

Technological Innovations in Color Stability and Solubility

Advancements in technology that enhance the stability and solubility of natural colors open new avenues for the betanin food colors market. Innovations in microencapsulation and other stabilization techniques can significantly extend the applicability of betanin in a wider range of food products, including those subjected to extreme processing conditions.

These technological improvements not only increase the functional attributes of betanin but also its marketability as a reliable and versatile natural colorant. This creates opportunities for increased usage in industries that have previously relied on synthetic alternatives.

Emerging Markets Offer Expansive Consumer Base

Emerging markets represent a formidable growth opportunity for the betanin food colors market due to their rapidly expanding consumer bases and increasing economic prosperity. As these markets develop, there is a growing middle class with disposable income and a heightened awareness of health and wellness, which drives the demand for natural and safer food additives like betanin.

Entering these markets with strategic partnerships and localized marketing efforts could significantly boost the global reach and consumption of betanin, capitalizing on the trend toward natural products in diverse geographical regions.

Latest Trends

Clean Label Movement Boosts Natural Colorant Adoption

The clean label movement, which emphasizes minimal processing and transparency in ingredient lists, is a key trend driving the betanin food colors market. As consumers demand food products with recognizable and natural ingredients, the appeal of betanin as a food colorant increases.

This trend encourages manufacturers to replace synthetic colors with natural alternatives like betanin, which is derived from beetroot and perceived as safer and healthier. The movement not only boosts consumer trust but also aligns with regulatory trends towards fewer artificial additives, positioning betanin as a preferred choice in food coloring.

Rise of Vegan and Vegetarian Diets Increases Betanin Use

The increasing adoption of vegan and vegetarian diets globally is a trend that significantly impacts the betanin food colors market. Betanin, being a plant-based colorant, aligns perfectly with the dietary restrictions of vegans and vegetarians, who avoid animal-derived substances.

As the number of people adopting these diets continues to grow, so does the demand for suitable food colorants that meet their ethical and dietary standards. This trend provides a robust platform for the expansion of betanin in food products catering to this demographic, further accelerating its market growth.

Sustainability and Eco-Friendliness Drive Betanin Popularity

Environmental sustainability and eco-friendly manufacturing processes are increasingly important to consumers, influencing their purchasing decisions. Betanin’s natural extraction from beetroot, a renewable resource, makes it an eco-friendly choice in food colorants.

This trend towards sustainability supports the growth of the betanin market as food manufacturers and consumers look for products that minimize environmental impact. Additionally, the biodegradability and non-toxic nature of betanin enhance its appeal, aligning with global efforts to reduce chemical use and promote sustainability in food production.

Regional Analysis

In North America, the betanin food colors market holds a 45.1% share, valued at USD 77.7 million.

The Betanin Food Colors market is witnessing significant growth across various regions, driven by increasing consumer preference for natural and clean-label food ingredients.

North America holds a dominant share of the global Betanin Food Colors market, accounting for 45.1% of the market value, which equates to USD 77.7 million. This dominance is primarily driven by the growing demand for plant-based and natural colorants in the food and beverage industry, along with stringent regulatory frameworks that emphasize the use of non-synthetic additives.

Europe is another key market for Betanin food colors, contributing significantly due to the region’s stringent regulations on food safety and growing consumer inclination towards natural additives. With increasing investments in sustainable food production and growing consumer awareness about the harmful effects of synthetic food colors, Europe is forecasted to maintain a robust market growth trajectory.

The Asia Pacific market is also expanding rapidly, supported by rising disposable incomes, an evolving food & beverage industry, and a growing preference for natural ingredients in emerging economies like India and China. The region’s adoption of Betanin as an alternative to synthetic dyes is expected to witness substantial growth.

The Middle East & Africa and Latin America regions are relatively smaller markets but are anticipated to experience steady growth due to increasing demand for natural food ingredients, though they still lag behind in market share compared to other regions.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global Betanin Food Colors Market is marked by the active participation of several key players, each contributing to the market’s evolution through strategic innovation, expanding production capabilities, and increasing the application of natural colorants across diverse industries.

LAECO Corp. and GNT Group are recognized for their strong focus on providing high-quality, natural food colors, with both companies leveraging cutting-edge extraction and processing techniques to enhance the stability and appeal of Betanin-derived colorants. GNT Group, in particular, stands out with its wide portfolio of plant-based colors, positioning it as a dominant player in the clean-label movement.

Döhler GmbH and DSM are also integral players, with Döhler focusing on sustainable color solutions and DSM capitalizing on its strong distribution network and innovation capabilities in the natural ingredients space. These companies are expected to see sustained growth as they broaden their product offerings and increase penetration into emerging markets.

Hunan NutraMax Inc., Kalsec Inc., and Kingherbs Limited represent the growing influence of regional players in the Asia Pacific and Middle Eastern markets. Their strategic partnerships and expanding operations in these high-growth regions allow them to capitalize on the increasing demand for natural food colorants.

Top Key Players in the Market

- AECO Corp.

- Bakels Worldwide

- Döhler GmbH

- DSM

- Food Ingredient Solutions

- GNT Group

- Henningsen

- Hunan NutraMax Inc.

- Kalsec Inc.

- Kanegrade Ltd.

- Kingherbs Limited

- Merck & Co. Inc.

- Monteloeder

- Nanjing Zelang Medical Technology Co. Ltd.

- Phytolon

- Plant Lipids

- ROHA Group

- Sai Gopal Enterprises

- San-Ei Gen F.F.I.,Inc.

- Sensient Technologies Corporation

- Symrise A.G.

- Synthite Industries Ltd.

- TIANJIN JIANFENG NATURAL PRODUCT R&D CO., LTD

- Vinayak Corporation

- JF Natural

- A.M. Todd Botanical Therapeutics

- Bakels Worldwide

- Monteloeder

- Hebei Shun Wei Biological Technology Co. Ltd.

Recent Developments

- In May 2024, GNT Group, a major player in natural food colors, introduced a new line of betanin-based products. These are designed to cater to the growing demand for natural food colorants in both food and beverage industries.

- In April 2024, Döhler GmbH announced a strategic partnership with a key supplier of raw materials to increase the production of Betanin-based colorants for the food and beverage markets. The partnership is focused on enhancing sustainability and addressing the growing demand for natural colorants.

- In March 2024, DSM, a global leader in food ingredients, expanded its partnership with suppliers to enhance its sustainable food color offerings, including betanin. This move aims to meet increasing consumer demand for plant-based and clean-label products.

Report Scope

Report Features Description Market Value (2023) USD 171.3 Million Forecast Revenue (2033) USD 276.4 Million CAGR (2024-2033) 4.9% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Nature (Organic, Conventional), By Product Form (Powder, Liquid), By Source (Red Beet, Yellow Beet, Prickly Peer, Swiss Chard, Grain Amaranth, Cactus Fruits, Others), By Application (Bakery and Confectionery Products, Beverages, Fruit Preparations/Fillings, Dairy Food Products, Potatoes, Pasta, and Rice, Soups, Sauces, and Dressings, Meat, Poultry, Fish, and Eggs, Seasonings, Others), By End Use (Food & Beverages, Cosmetics and Personal Care, Paint Industry, Healthcare, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape AECO Corp., Bakels Worldwide, Döhler GmbH, DSM, Food Ingredient Solutions, GNT Group, Henningsen, Hunan NutraMax Inc., Kalsec Inc., Kanegrade Ltd., Kingherbs Limited, Merck & Co. Inc., Monteloeder , Nanjing Zelang Medical Technology Co. Ltd., Phytolon, Plant Lipids, ROHA Group, Sai Gopal Enterprises, San-Ei Gen F.F.I.,Inc., Sensient Technologies Corporation, Symrise A.G., Synthite Industries Ltd., TIANJIN JIANFENG NATURAL PRODUCT R&D CO., LTD, Vinayak Corporation, JF Natural, A.M. Todd Botanical Therapeutics, Bakels Worldwide, Monteloeder, Hebei Shun Wei Biological Technology Co. Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Betanin Food Colors MarketPublished date: December 2024add_shopping_cartBuy Now get_appDownload Sample

Betanin Food Colors MarketPublished date: December 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- AECO Corp.

- Bakels Worldwide

- Döhler GmbH

- DSM

- Food Ingredient Solutions

- GNT Group

- Henningsen

- Hunan NutraMax Inc.

- Kalsec Inc.

- Kanegrade Ltd.

- Kingherbs Limited

- Merck & Co. Inc.

- Monteloeder

- Nanjing Zelang Medical Technology Co. Ltd.

- Phytolon

- Plant Lipids

- ROHA Group

- Sai Gopal Enterprises

- San-Ei Gen F.F.I.,Inc.

- Sensient Technologies Corporation

- Symrise A.G.

- Synthite Industries Ltd.

- TIANJIN JIANFENG NATURAL PRODUCT R&D CO., LTD

- Vinayak Corporation

- JF Natural

- A.M. Todd Botanical Therapeutics

- Bakels Worldwide

- Monteloeder

- Hebei Shun Wei Biological Technology Co. Ltd.