Global Plant Based Diet Market By Product Type (Plant based Dairy Products, Plant based Meat Products, Others), By Source (Seeds and Nuts, Whole Grains, Fruits and Vegetables, Legumes), By Distribution Channel (Supermarkets/hypermarkets, Convenience Stores, Specialty Stores, Online, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2025

- Report ID: 98842

- Number of Pages: 265

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

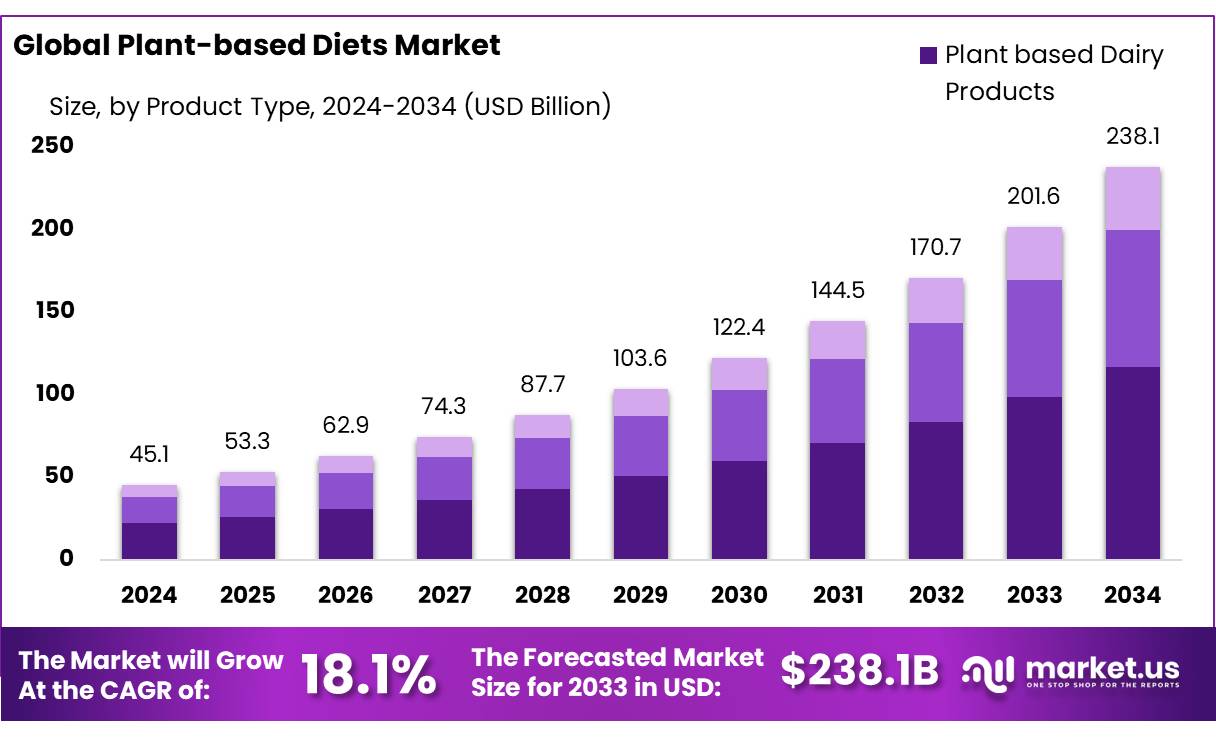

The Global Plant Based Diet Market size is expected to be worth around USD 238.1 Bn by 2034, from USD 45.1 Bn in 2024, growing at a CAGR of 18.1% during the forecast period from 2025 to 2034.

A plant-based diet consists of all minimally processed fruits, vegetables, whole grains, legumes, nuts and seeds, herbs, and spices and excludes all animal products, including red meat, poultry, fish, eggs, and dairy products.

Plant-based diets, including vegan diets, may be healthy as long as they are balanced and nutritionally adequate. When followed consistently, a well-balanced, plant-based diet that focuses on wholegrains, fruit, vegetables, legumes, nuts and seeds may provide health benefits. These include a lower BMI, lower cholesterol levels and a reduced incidence of chronic diseases including type 2 diabetes, heart disease as well as potential protection from certain cancers including prostate and breast cancer.

One of the key driving factors for the plant-based diets market is the rising incidence of lifestyle-related health issues, such as obesity, diabetes, and heart disease. As more consumers seek healthier alternatives to traditional meat and dairy products, plant-based options are emerging as viable solutions. The market is also benefiting from heightened awareness around the ethical concerns related to animal agriculture, such as animal welfare and the environmental impact of factory farming. As consumers become more conscious of the environmental footprint of their food choices, plant-based diets offer a sustainable and eco-friendly alternative.

Key trends in the plant-based diets market include the rapid innovation and expansion of plant-based alternatives in traditionally animal-based categories. Products such as plant-based milk, plant-based meat, plant-based cheeses, and plant-based yogurts are gaining widespread adoption. The availability of high-quality, nutritious, and delicious plant-based alternatives is further fueling market growth. Additionally, consumers are increasingly seeking clean-label products that are free from artificial additives and preservatives, leading manufacturers to focus on producing natural, minimally processed plant-based foods.

The growth of e-commerce is another major trend shaping the plant-based diets market. With online retail platforms making plant-based products more accessible to a broader audience, especially in regions where such products were previously less available, e-commerce is becoming a critical channel for market expansion. Furthermore, the foodservice sector, particularly in quick-service restaurants (QSRs), casual dining, and fast food chains, is seeing a surge in plant-based offerings as these establishments cater to the growing demand for plant-based options.

Future growth opportunities in the plant-based diets market lie in the continued development of innovative products and the expansion of plant-based food offerings across different regions. The Asia-Pacific region, in particular, presents a significant growth opportunity due to its large population, rising disposable incomes, and increasing awareness of health and environmental issues. Additionally, as technology improves, manufacturers are expected to introduce more cost-effective and scalable plant-based products, which could lead to greater market penetration and widespread adoption.

Key Takeaways

- Plant Based Diet Market size is expected to be worth around USD 238.1 Bn by 2034, from USD 45.1 Bn in 2024, growing at a CAGR of 18.1%.

- Plant-Based Dairy Products held a dominant market position, capturing more than a 49.1% share of the plant-based diets market.

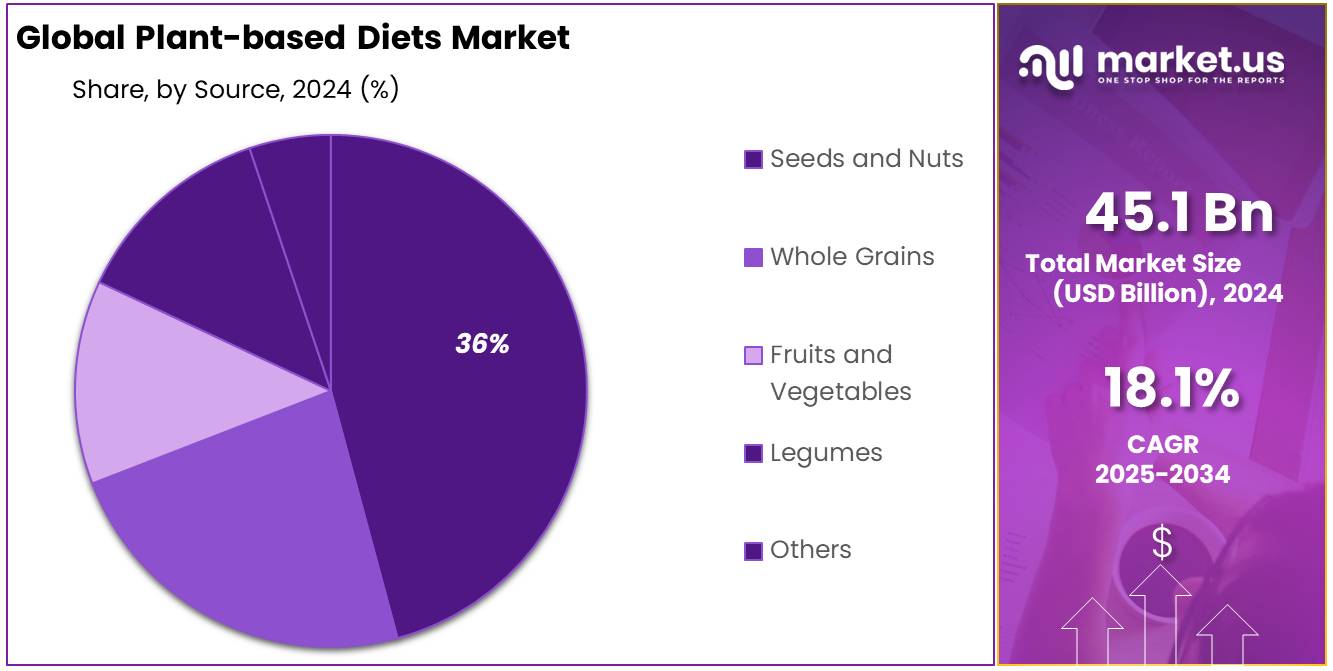

- Seeds and Nuts held a dominant market position, capturing more than a 35.7% share of the plant-based diets market.

- Supermarkets/Hypermarkets held a dominant market position, capturing more than a 46.3% share of the plant-based diets market.

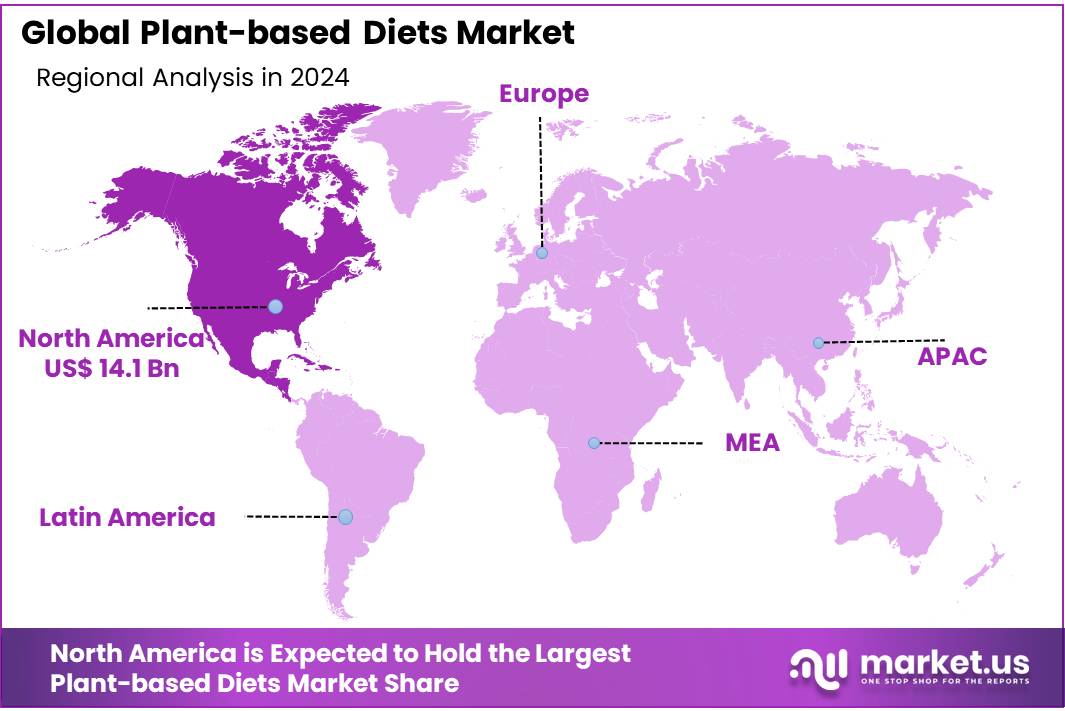

- North America dominated the plant-based diets market, holding a substantial share of 31.8%, valued at USD 14.1 billion.

By Product Type

In 2024, Plant-Based Dairy Products held a dominant market position, capturing more than a 49.1% share of the plant-based diets market. This segment has experienced significant growth, primarily driven by the increasing consumer demand for dairy alternatives due to lactose intolerance, veganism, and health-conscious eating habits. Plant-based milk, such as almond, soy, and oat milk, continues to lead the category, with strong sales in both retail and foodservice channels.

In 2024, the Plant-Based Meat Products segment accounted for a significant portion of the market, driven by the increasing adoption of plant-based diets among flexitarians, vegetarians, and vegans. These products, such as plant-based burgers, sausages, and meatballs, provide familiar textures and flavors, making it easier for consumers to reduce meat consumption without compromising on taste.

By Source

In 2024, Seeds and Nuts held a dominant market position, capturing more than a 35.7% share of the plant-based diets market. This category has witnessed substantial growth, driven by the increasing consumer awareness about the health benefits of seeds and nuts. Rich in healthy fats, protein, and essential vitamins, these products are widely consumed as snacks, in smoothies, and as ingredients in various food items such as plant-based milks, butters, and granolas.

Whole Grains segment maintained a notable share in the plant-based diets market, benefiting from the increasing demand for whole-food ingredients. Whole grains such as oats, quinoa, and brown rice offer an excellent source of fiber, vitamins, and minerals, making them a staple in plant-based nutrition. With the growing awareness of their role in preventing chronic diseases like heart disease and diabetes, whole grains have become integral to the modern plant-based diet. Their versatility in both savory and sweet dishes continues to drive growth, particularly in ready-to-eat meals and snack options.

Fruits and Vegetables, with their essential nutrients and antioxidants, also play an important role in plant-based diets, though they captured a smaller portion of the market in comparison to seeds and nuts. As consumers look for cleaner, nutrient-dense food options, the preference for fresh, organic fruits and vegetables continues to grow.

By Distribution Channel

In 2024, Supermarkets/Hypermarkets held a dominant market position, capturing more than a 46.3% share of the plant-based diets market. These retail outlets remain the most popular distribution channel for plant-based products, thanks to their widespread accessibility and large-scale offerings. Supermarkets and hypermarkets have responded to the growing consumer demand for plant-based foods by expanding their dedicated plant-based sections, featuring everything from plant-based dairy and meat alternatives to snacks, beverages, and frozen foods.Key Market Segments

By Product Type

- Plant based Dairy Products

- Plant based Meat Products

- Others

By Source

- Seeds and Nuts

- Whole Grains

- Fruits and Vegetables

- Legumes

By Distribution Channel

- Supermarkets/hypermarkets

- Convenience Stores

- Specialty Stores

- Online

- Others

Drivers

Health and Environmental Concerns Driving the Growth of Plant-Based Diets

One of the major driving factors for the plant-based diets market is the growing awareness of the health and environmental benefits associated with plant-based foods. Consumers are increasingly adopting plant-based diets due to the rising prevalence of lifestyle-related health conditions and growing concerns about the sustainability of animal-based food production.

Health-conscious consumers are moving toward plant-based diets as they are often perceived as healthier alternatives to traditional animal products. According to a 2023 report from the American Heart Association (AHA), plant-based diets have been shown to reduce the risk of chronic conditions like heart disease, obesity, and high blood pressure. Specifically, individuals who consume plant-based diets have a 23% lower risk of coronary heart disease and a 32% lower risk of dying from heart disease compared to those who consume more animal products. With an increasing number of consumers seeking to improve their overall well-being, this health-driven demand for plant-based options continues to rise, particularly in developed markets like North America and Europe.

Environmental concerns, especially regarding the sustainability of food production systems, have also played a significant role in boosting the adoption of plant-based diets. The environmental impact of livestock farming—such as greenhouse gas emissions, deforestation, and water usage—has come under scrutiny. A 2023 report by the Food and Agriculture Organization (FAO) of the United Nations highlighted that livestock farming accounts for 14.5% of global greenhouse gas emissions. In comparison, plant-based agriculture has a far lower carbon footprint, making it a more sustainable option. As more consumers become aware of these environmental challenges, they are shifting towards plant-based products as a way to reduce their ecological footprint.

This awareness has been further fueled by government initiatives promoting sustainability. For instance, the European Union has implemented policies aimed at reducing meat consumption and promoting plant-based food production as part of its Farm to Fork Strategy, which aims to make food systems fair, healthy, and environmentally-friendly. According to the European Commission, these initiatives are expected to drive an increase in plant-based food production and consumption across member states by 2030.

Additionally, plant-based food brands are capitalizing on these shifting trends by offering a wide variety of innovative products that cater to health-conscious and environmentally-aware consumers. For example, the launch of plant-based meats, dairy alternatives, and snacks has made it easier for consumers to replace traditional animal-based products with plant-based options without sacrificing taste or convenience. According to The Good Food Institute, the market for plant-based foods has seen an annual growth rate of 27% in recent years, demonstrating the increasing consumer demand for plant-based alternatives

Restraints

High Cost and Limited Accessibility: Barriers to Widespread Adoption of Plant-Based Diets

Despite the growing popularity of plant-based diets, one of the major restraining factors in the market is the relatively high cost of plant-based products and their limited accessibility in certain regions. The higher price points of plant-based alternatives to traditional meat and dairy products remain a significant barrier for many consumers, particularly in emerging markets and lower-income demographics.

According to the Food and Agriculture Organization (FAO), the price of plant-based meat products can be up to 30% higher than conventional meat products, largely due to the cost of production and supply chain challenges. This cost disparity makes it difficult for many consumers, especially those with limited disposable income, to fully embrace plant-based options. While the market for plant-based foods has grown rapidly in developed markets, this price barrier remains a significant challenge for widespread adoption, particularly in developing regions.

Moreover, the availability and accessibility of plant-based products are limited in certain regions, especially in rural or less-developed areas. Despite the growing demand for plant-based foods in urban centers, many consumers still face difficulties in finding a diverse range of plant-based options. For example, according to the United Nations Environment Programme (UNEP), access to plant-based alternatives is often restricted to large cities, with rural areas having far fewer plant-based product offerings in supermarkets or restaurants. This uneven distribution hampers the ability of individuals outside urban centers to easily incorporate plant-based diets into their daily lives.

Government support and initiatives have made some strides in addressing these challenges. In certain developed countries, subsidies and incentives for plant-based product manufacturers have been introduced to lower the cost of production. The European Union, for instance, has been implementing policies aimed at promoting sustainable agriculture, including initiatives that support plant-based food innovation and the expansion of plant-based food supply chains. However, such initiatives are still in the early stages, and more comprehensive programs are needed to make plant-based foods more affordable and accessible to the broader population.

Opportunity

Increasing Health Consciousness and Environmental Awareness: Key Drivers for the Growth of Plant-Based Diets

Health-conscious consumers are becoming increasingly aware of the benefits of plant-based eating, which is often associated with lower risks of heart disease, diabetes, and certain types of cancer. According to the World Health Organization (WHO), a plant-based diet, rich in fruits, vegetables, whole grains, and legumes, is linked to a reduced risk of non-communicable diseases (NCDs) such as cardiovascular diseases and obesity. This growing awareness is prompting more people to explore plant-based options, particularly among younger populations who are more open to adopting new food trends. The plant-based food market is benefiting from a shift in consumer preferences, with a rising number of people seeking healthier, more sustainable alternatives to traditional animal-based products.

Environmental concerns also play a pivotal role in the growth of plant-based diets. With the United Nations (UN) highlighting the environmental impact of meat production, including its contribution to greenhouse gas emissions, deforestation, and water usage, many consumers are opting for plant-based foods as a way to reduce their environmental footprint.

According to a report by the UN Food and Agriculture Organization (FAO), the livestock sector is responsible for more than 14.5% of global greenhouse gas emissions, making it a significant driver of climate change. By choosing plant-based options, consumers are aligning their dietary choices with their values around sustainability, which has created strong demand for plant-based food products.

Government initiatives and policies further support the growth of plant-based diets. In several countries, there has been a push for plant-based eating to address both health and environmental concerns. For example, the UK government has implemented initiatives to promote plant-based diets, including encouraging schools to provide plant-based meals and reducing the environmental impact of food production. Similarly, the European Union has launched campaigns aimed at increasing the adoption of plant-based diets as part of its broader sustainability goals. These initiatives, alongside increasing availability and variety of plant-based products, are encouraging more consumers to make the shift toward plant-based eating.

Trends

Innovation in Plant-Based Food Products: A Growing Trend

In recent years, innovation in plant-based food products has become one of the most prominent trends in the market, with an increasing variety of options now available to consumers. These innovations are driven by advancements in food technology, improved product formulations, and a deeper understanding of consumer preferences. As plant-based diets continue to grow in popularity, manufacturers are expanding their product offerings to meet the demands of diverse consumer tastes and needs, making it easier for individuals to adopt plant-based lifestyles.

One of the key drivers of this trend is the development of plant-based meat and dairy alternatives. Companies are now offering products that closely mimic the taste and texture of animal-based products, making it easier for consumers to transition to plant-based eating without compromising on taste or texture. In particular, plant-based meat substitutes, such as those made from soy, peas, or mushrooms, are gaining traction in both developed and emerging markets. According to Euromonitor International, the global plant-based meat market has seen significant growth, with sales projected to reach USD 27.9 billion by 2025, driven by innovations in plant-based formulations that enhance flavor, texture, and nutritional content.

The dairy substitute segment is also experiencing significant innovation, with companies producing plant-based milks, cheeses, yogurts, and butter from ingredients like oats, almonds, and coconuts. These products cater to consumers who are lactose intolerant or those who are choosing plant-based options for ethical or environmental reasons.

The increased demand for plant-based products has prompted significant investments in research and development (R&D), with companies looking for new ways to improve the nutritional profile and sustainability of plant-based alternatives. This includes efforts to enhance the protein content of plant-based products and make them more nutrient-dense to compete with animal-based products. For example, Beyond Meat and Impossible Foods, two leading brands in the plant-based meat space, have focused on improving the nutritional value of their products, adding nutrients like iron, calcium, and vitamin B12, which are often found in animal products but can be lacking in plant-based diets.

Additionally, the rise of plant-based snack foods is a notable trend. Consumers are increasingly seeking healthier, plant-based options in snack foods such as chips, protein bars, and frozen desserts. This is reflected in the expansion of plant-based snacks across major retail chains, which now offer a wide variety of choices. The increasing popularity of snacking, especially in urban populations, has led to the proliferation of plant-based snack products designed to cater to the growing demand for health-conscious and sustainable food choices.

Government initiatives have also played a role in fostering the growth of the plant-based foods sector. For instance, several governments have introduced policies that promote plant-based eating as a healthier, more sustainable alternative. The UK’s National Food Strategy and Denmark’s plant-based food initiatives aim to encourage people to reduce meat consumption and adopt more sustainable, plant-based diets. The European Commission has also backed initiatives supporting plant-based food production, aligning with the growing trend toward sustainable and healthy eating.

The global trend towards plant-based diets is further supported by increasing awareness of environmental sustainability, particularly the reduction of carbon footprints associated with food production. According to a United Nations Environment Programme (UNEP) report, plant-based diets are among the most effective ways to reduce the environmental impact of food systems, which has further driven consumer interest in plant-based products. This awareness has not only influenced consumers but also governments and corporations, leading to an acceleration in the development of plant-based alternatives.

Regional Analysis

In 2024, North America dominated the plant-based diets market, holding a substantial share of 31.8%, valued at USD 14.1 billion. The region has experienced significant growth driven by high consumer demand for plant-based alternatives in food and beverages, particularly in the U.S. and Canada. Increasing health consciousness, environmental concerns, and a growing number of flexitarians have contributed to this expansion.

Europe follows as a prominent player, with increasing adoption rates of plant-based diets, driven by factors such as a rising number of vegan and vegetarian consumers. The market is expected to maintain a steady growth trajectory, bolstered by regulatory support and innovations in plant-based formulations by leading companies. The growth rate in Europe is accelerated by government initiatives promoting sustainability and reducing carbon footprints, with countries like the UK, Germany, and France leading the trend.

Asia Pacific is poised for rapid growth, largely due to the rising urbanization, growing disposable incomes, and shifting consumer preferences towards plant-based diets, particularly in countries such as China, India, and Japan. With a large vegetarian population, the region holds immense potential for expansion in plant-based food products. However, challenges such as local taste preferences and price sensitivity must be addressed to sustain this growth.

Latin America and the Middle East & Africa remain relatively small but promising markets. Both regions are witnessing gradual adoption, driven by increasing awareness of plant-based diets’ health benefits, but their contribution remains limited compared to North America and Europe.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Beyond Meat Inc. and Impossible Foods Inc. are two of the most prominent companies, leading the market with their range of plant-based meat products. These companies have capitalized on the growing consumer demand for plant-based alternatives, especially in North America and Europe. Beyond Meat, for example, has partnered with major fast-food chains like McDonald’s and Taco Bell, expanding its reach and solidifying its position as a market leader. Similarly, Impossible Foods has made significant strides in the retail and foodservice sectors, with products like the Impossible Burger gaining widespread popularity.

Amy’s Kitchen Inc., Conagra Brands, Inc., and Danone SA, all of which have strengthened their positions through product diversification and acquisitions. Amy’s Kitchen, known for its plant-based frozen meals, has seen strong growth as consumers seek convenience without compromising on their dietary preferences.

Conagra, through its brands like Gardein and Healthy Choice, has invested heavily in plant-based product offerings. Danone has also expanded its portfolio with plant-based dairy products, tapping into the growing demand for vegan and lactose-free options. Meanwhile, Nestlé S.A., with its Garden Gourmet line, has further intensified competition by investing in sustainable sourcing and plant-based innovations.

Top Key Players

- Above Food Inc.

- Amy’s Kitchen Inc.

- Atlantic Natural Foods LLC

- Beyond Meat Inc.

- Conagra Brands, Inc.

- Danone SA

- DSM-Firmenich AG, Nestle S.A.

- Garden Protein International Inc.

- Glanbia PLC

- Impossible Foods Inc.

- Lightlife Foods Inc. (Maple Leaf Foods Inc.)

- Maple Leaf Foods Inc.

- Nestle S.A.

- The Hain Celestial Group, Inc.

- Tyson Foods Inc.

- Vbite Food Ltd.

Recent Developments

In 2024, Above Food Inc. has positioned itself as a market leader in the plant-based protein segment, leveraging strategic partnerships, investments, and consumer-centric product development.

In 2024 Amy’s Kitchen Inc., the company recorded a year-over-year revenue growth of approximately 12%, largely driven by the increasing popularity of plant-based alternatives in the meal solutions segment.

Report Scope

Report Features Description Market Value (2024) USD 45.1 Bn Forecast Revenue (2034) USD 238.1 Bn CAGR (2025-2034) 18.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Plant based Dairy Products, Plant based Meat Products, Others), By Source (Seeds and Nuts, Whole Grains, Fruits and Vegetables, Legumes), By Distribution Channel (Supermarkets/hypermarkets, Convenience Stores, Specialty Stores, Online, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Above Food Inc., Amy’s Kitchen Inc., Atlantic Natural Foods LLC, Beyond Meat Inc., Conagra Brands, Inc., Danone SA, DSM-Firmenich AG, Nestle S.A., Garden Protein International Inc., Glanbia PLC, Impossible Foods Inc., Lightlife Foods Inc. (Maple Leaf Foods Inc.), Maple Leaf Foods Inc., Nestle S.A., The Hain Celestial Group, Inc., Tyson Foods Inc., Vbite Food Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Above Food Inc.

- Amy's Kitchen Inc.

- Atlantic Natural Foods LLC

- Beyond Meat Inc.

- Conagra Brands, Inc.

- Danone SA

- DSM-Firmenich AG, Nestle S.A.

- Garden Protein International Inc.

- Glanbia PLC

- Impossible Foods Inc.

- Lightlife Foods Inc. (Maple Leaf Foods Inc.)

- Maple Leaf Foods Inc.

- Nestle S.A.

- The Hain Celestial Group, Inc.

- Tyson Foods Inc.

- Vbite Food Ltd.