Mexico Wheat Premixes Market By Product Type (Bread, Cake, Pizza Bases, Muffins, Hamburgers, Others), By Category (Conventional Baking Premixes, Gluten-Free Baking Premixes), By Application (Bakeries, Confectionery Shops, Restaurants, Households), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: December 2024

- Report ID: 74517

- Number of Pages: 269

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

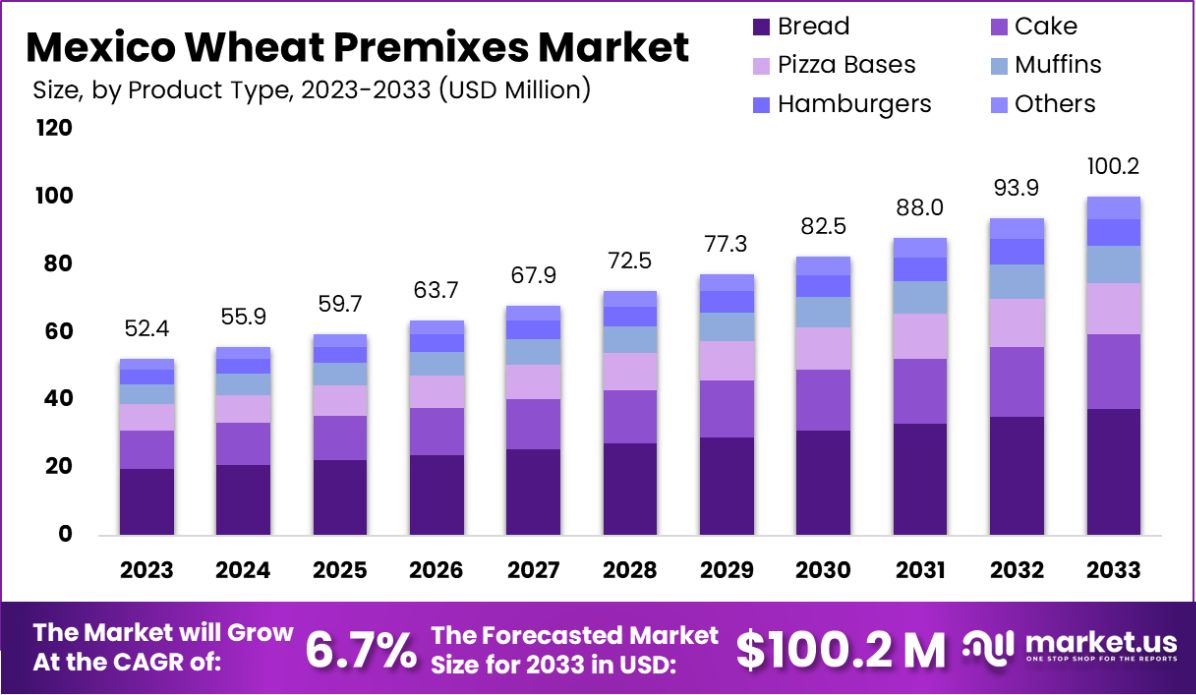

The Mexico Wheat Premixes Market is expected to be worth around USD 100.2 Million by 2033, up from USD 52.4 Million in 2023, and grow at a CAGR of 6.7% from 2024 to 2033.

Mexico wheat premixes are pre-packaged mixtures of wheat flour, ingredients, and additives, used in baking and food production to ensure consistent quality and performance in products like bread, cakes, and pastries. These premixes simplify the baking process and are widely used in industrial-scale food production.

The Mexico wheat premixes market is driven by growing demand for convenience foods, expanding bakery industries, and an increasing preference for consistent, high-quality products. The market is characterized by a rising number of commercial bakeries and food manufacturers adopting premixes to streamline operations.

Rising consumer demand for ready-to-eat baked goods and the expansion of the food processing industry are key growth factors. The convenience of premixes in meeting product quality standards plays a significant role.

Growing urbanization, changing lifestyles, and increasing disposable incomes are driving demand for processed and ready-to-eat foods. Innovation in premix formulations, including gluten-free and health-conscious options, presents significant market opportunities.

The Mexico Wheat Premixes Market is positioned for steady growth, driven by government-mandated fortification initiatives and the ongoing concern over micronutrient deficiencies in the population.

Nearly one-third of the population suffers from vitamin and mineral deficiencies, as reported by journals. sage pub, the fortification of wheat flour with essential nutrients is a crucial public health strategy.

In Mexico, the government has enforced specific fortification standards, including mandatory additions of zinc (40 mg/kg), iron (40 mg/kg), folic acid (2 mg/kg), niacin (35 mg/kg), riboflavin (3 mg/kg), and thiamine (5 mg/kg) to wheat flour. These regulations ensure a minimum standard of micronutrient levels in the country’s wheat flour supply, addressing widespread nutritional deficiencies.

The market is primarily driven by large-scale industrial roller mills in Mexico, which process over 20 metric tons of wheat flour daily. This focus on fortification is vital to improving the health of the population, as evidenced by a reported iron concentration of 60.3 ppm in one mill’s fortified flour.

Furthermore, the standardized target for micronutrient premix addition is set at 250 grams per metric ton of flour, ensuring consistency in nutrient concentrations across the supply chain, according to the National Library of Medicine.

The market’s growth prospects are closely tied to the continued emphasis on nutrition-focused initiatives by the government, which is anticipated to fuel the demand for wheat premixes.

Additionally, the rise in consumer awareness regarding the importance of fortified foods presents further opportunities for manufacturers, particularly as they align with national fortification programs aimed at reducing the burden of micronutrient deficiencies.

Key Takeaways

- The Mexico Wheat Premixes Market is expected to be worth around USD 100.2 Million by 2033, up from USD 52.4 Million in 2023, and grow at a CAGR of 6.7% from 2024 to 2033.

- The Mexico Wheat Premixes Market is dominated by bread, contributing 37.5% of the market share.

- Conventional baking premixes lead the market with a 73.4% share of Mexico’s wheat premixes.

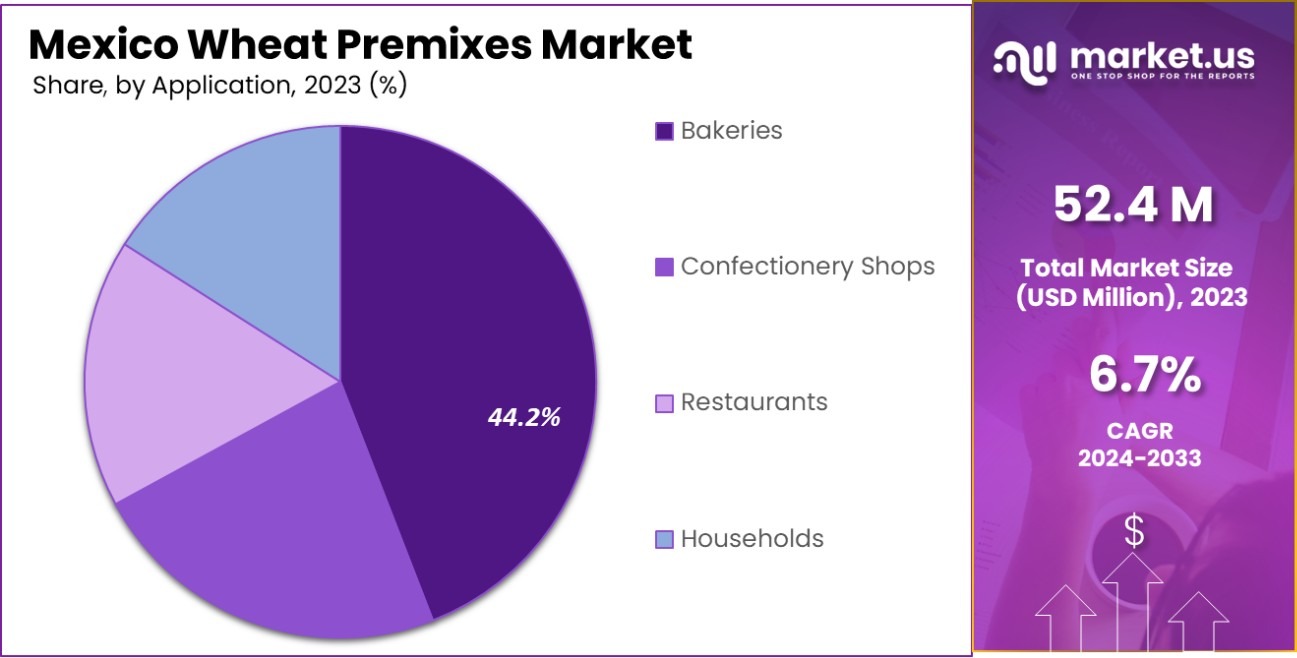

- Bakeries represent the largest application segment, accounting for 44.2% of the wheat premixes market.

By Product Type Analysis

Bread constitutes 37.5% of the Mexico Wheat Premixes Market, driving strong consumer demand for baked goods.

In 2023, Bread held a dominant market position in the By Product Type segment of the Mexico Wheat Premixes Market, with a 37.5% share. This significant presence highlights its foundational role in the diets of Mexican consumers, where bread remains a staple for various meals throughout the day.

Following closely, Cakes captured a 25% market share, reflecting a strong preference for sweet baked goods among consumers, which is evident in both urban and rural settings. Pizza Bases came in third, securing a 15% share of the market. This indicates a growing trend towards Western-style fast foods, particularly among the younger demographic.

Muffins, with a 12.5% market share, showed moderate popularity. This segment benefits from the rising demand for convenient, on-the-go breakfast options, as well as an increase in coffee culture across Mexico, where muffins are often paired with coffee.

Lastly, Hamburgers, though traditionally not associated with wheat premixes, have started to make a mark with a 10% share. This reflects a diversification in the use of wheat premixes as consumers look for more varied and high-quality bun options. Overall, these trends underscore a dynamic shift in consumer preferences and open new avenues for market growth within the Mexican food industry.

By Category Analysis

Conventional Baking Premixes dominate with 73.4%, reflecting the preference for traditional baking methods in Mexico.

In 2023, Conventional Baking Premixes held a dominant market position in the By Category segment of the Mexico Wheat Premixes Market, with a 73.4% share. This substantial market share underscores the strong preference for traditional baking methods and ingredients among Mexican consumers, who value the familiar tastes and textures associated with conventional wheat-based products.

The robust presence of these premixes highlights their integral role in everyday culinary practices, ranging from bread and pastries to other staple bakery items.

On the other hand, Gluten-Free Baking Premixes accounted for a 26.6% share of the market. This segment, while smaller, is gaining traction as consumer awareness of dietary sensitivities and health-oriented eating increases. The growth in this category reflects a significant shift towards health-conscious consumption patterns, particularly among urban populations who are more exposed to dietary trends.

As more consumers seek out alternatives to conventional wheat products, the demand for gluten-free options is expected to rise, presenting potential growth opportunities for manufacturers to innovate and expand their product lines in this evolving market landscape.

By Application Analysis

Bakeries account for 44.2%, indicating a large share of the market driven by commercial production.

In 2023, Bakeries held a dominant market position in the By Application segment of the Mexico Wheat Premixes Market, with a 44.2% share. This prominent position underscores the central role that bakeries play in the Mexican food landscape, serving as primary outlets for daily bread consumption and other baked goods.

The preference for freshly baked, artisanal, and preservative-free bread has reinforced the strong performance of this segment, reflecting traditional consumer tastes and baking practices.

Confectionery Shops accounted for a 22.1% share, indicating a solid consumer base that frequents these establishments for specialty baked goods, pastries, and desserts. These shops cater to the growing demand for premium, customized baking experiences, particularly in urban centers where culinary diversity is celebrated.

Restaurants followed closely with a 20.3% market share, showcasing their reliance on wheat premixes for a variety of menu items, from bread baskets to dessert offerings. This segment benefits from the broad appeal of wheat-based products in enhancing dining experiences.

Lastly, Households represented a 13.4% share of the market. This segment’s smaller share reflects a trend towards convenience and time-saving cooking solutions in domestic settings, where consumers increasingly opt for ready-to-use mixes for home baking, driven by lifestyle shifts and a renewed interest in home-cooked meals.

Key Market Segments

By Product Type

- Bread

- Cake

- Pizza Bases

- Muffins

- Hamburgers

- Others

By Category

- Conventional Baking Premixes

- Gluten-Free Baking Premixes

By Application

- Bakeries

- Confectionery Shops

- Restaurants

- Households

Driving Factors

Growing Demand for Nutritious Bakery Products

In Mexico, there is a rising trend among consumers towards healthier eating habits, which includes a preference for nutritious bakery products. Wheat premixes, which often include added vitamins and minerals, cater to this demand by offering a convenient solution for baking healthier breads, pastries, and other baked goods.

This consumer shift is driving the growth of the wheat premixes market, as both home bakers and commercial enterprises seek to meet the growing expectations for healthier food options without compromising on taste or quality.

Expansion of Retail and Distribution Channels

The expansion of retail and distribution networks across Mexico significantly influences the accessibility and availability of wheat premixes. As supermarkets and hypermarkets widen their reach, they create more opportunities for product placement and consumer access.

This development not only boosts the visibility of wheat premix products but also encourages new entrants and existing players to innovate and diversify their offerings. Consequently, the market is experiencing growth spurred by better distribution logistics and heightened consumer exposure to diverse product ranges.

Increase in Home Baking Activities

The trend of home baking has seen a considerable rise in Mexico, fueled by the increasing popularity of DIY baking and cooking shows, as well as social media platforms showcasing baking recipes and techniques.

This movement has led more consumers to explore baking at home, driving up the demand for convenient and easy-to-use ingredients like wheat premixes. These products appeal to home bakers by simplifying the baking process and ensuring consistent results, thus supporting the growth of the wheat premixes market in the region.

Restraining Factors

High Costs of Raw Materials Impact Market Growth

The wheat premixes market in Mexico faces significant challenges due to the rising costs of raw materials. Ingredients such as enriched flour and vitamins, crucial for making premixes, have seen price increases, driven by agricultural volatility and inflation.

This escalation in input costs makes wheat premixes more expensive for manufacturers to produce and for consumers to buy, potentially slowing down market expansion as customers look for cheaper alternatives.

Stringent Food Safety Regulations Limit Market Entry

Mexico’s strict food safety standards and regulatory requirements pose hurdles for new entrants and existing players in the wheat premixes market. These regulations, designed to ensure the safety and quality of food products, require significant compliance efforts, including certifications and routine inspections.

This rigorous regulatory environment can increase operational costs and prolong the time to market for new products, discouraging innovation and limiting the number of new players entering the market.

Competition from Whole Grain and Organic Products

There is a growing consumer preference for whole grain and organic products in Mexico, which competes directly with wheat premixes. These products are perceived as healthier and more natural, aligning with the trend towards clean and transparent labeling.

This shift in consumer preferences challenges the wheat premix market, as consumers increasingly opt for alternatives that they believe offer better health benefits and align more closely with their lifestyle choices.

Growth Opportunity

Expanding Urbanization Drives Demand for Convenient Baking Solutions

With urbanization on the rise in Mexico, there’s a growing demand for convenient and quick meal solutions among the working population. Wheat premixes, offering a fast and easy way to prepare baked goods, align perfectly with the needs of time-constrained consumers.

Companies can capitalize on this trend by marketing premixes as an ideal solution for busy lifestyles, thereby boosting product uptake. Introducing a variety of flavors and health-conscious options could further appeal to urban dwellers seeking both convenience and quality in their diet.

Rising Health Awareness Enhances Whole Grain Premix Sales

As Mexican consumers become more health-conscious, there’s a notable shift towards whole-grain and multi-grain products, which are perceived as healthier. Wheat premix manufacturers can leverage this trend by developing and promoting premixes enriched with superfoods, fibers, and additional nutrients.

Offering gluten-free products and organic options would also attract health-focused customers. By emphasizing the health benefits in their marketing campaigns, companies can differentiate their products and meet the evolving preferences of health-aware consumers in Mexico.

Strategic Partnerships with Local Bakeries and Restaurants

Creating strategic partnerships with local bakeries, restaurants, and cafes could serve as a significant growth opportunity for wheat premix suppliers in Mexico. By collaborating with these businesses, premix companies can secure a stable outlet for their products, while bakeries and eateries can offer consistently high-quality baked goods with reduced preparation time.

These partnerships could include co-branding efforts and customized product developments, tailored to local tastes and preferences, further driving the visibility and adoption of premixes in the professional sector.

Latest Trends

Increasing Popularity of Gluten-Free and Organic Options

Consumers in Mexico are becoming more health-conscious, leading to a rise in demand for gluten-free and organic wheat premixes. This trend reflects a broader shift towards healthier eating habits and the avoidance of allergens.

Manufacturers are responding by expanding their product lines to include premixes that cater to these specific dietary needs. These new offerings are designed to not only provide health benefits but also to meet the taste preferences of Mexican consumers who prefer natural and minimally processed food options.

Expansion of Ready-to-Use Mixes in Retail

Ready-to-use wheat premixes are gaining traction in Mexico’s retail sectors as busy lifestyles drive demand for convenience foods. These premixes, which include ingredients for bread, cakes, and other bakery products, offer time-saving solutions for both amateur and professional bakers.

The trend towards more convenient cooking solutions is influencing companies to innovate in their packaging and product range, ensuring that these mixes provide consistently high-quality results, which is key to attracting and retaining customers.

Technological Innovations in Premix Production

Technological advancements are revolutionizing the production of wheat premixes in Mexico. Modern processing techniques are being adopted to enhance the nutritional profile and shelf life of premixes while maintaining flavor.

Manufacturers are also using technology to ensure precise mixing of ingredients, which is critical for batch consistency. This trend is driven by the growing industrial baking sector’s demand for high-quality, consistent products that reduce preparation time and waste during the baking process.

Key Players Analysis

In 2023, the landscape of the Mexico wheat premixes market has been significantly shaped by key companies that bring diversity and innovation to the forefront. Among these, Cargill and Archer-Daniels-Midland Co. (ADM) continue to be prominent players, leveraging their extensive agricultural and supply chain networks to ensure consistent quality and availability of premixes. Their focus on sustainability and traceability appeals to the growing consumer demand for ethically sourced and environmentally friendly products.

Bunge Ltd., another major player, has enhanced its product portfolio to include specialized premixes that cater to the burgeoning demand for gluten-free and organic products. This strategic positioning not only broadens their market appeal but also aligns with health trends.

Koninklijke DSM NV and Lesaffre have been instrumental in driving technological innovations within the industry. DSM’s investment in research and development has led to advanced enzyme solutions that improve the nutritional profile and functionality of wheat premixes. Similarly, Lesaffre’s expertise in yeast and fermentation has been pivotal in developing flavor-enhancing solutions that resonate well with Mexican culinary preferences.

Companies like Bakels Worldwide and Puratos are focusing on tailor-made solutions for the bakery industry, providing a wide range of premixes that simplify the baking process while delivering artisanal quality. Their commitment to quality and customer service has helped them establish a strong foothold in the market.

Overall, these key players are not just responding to current market needs but are also shaping future trends through innovation and strategic market expansion. Their efforts are crucial in making the Mexico wheat premixes market both dynamic and competitive.

Top Key Players in the Market

- Cargill

- Archer-Daniels-Midland Co.

- Bunge Ltd.

- Koninklijke DSM NV

- Lesaffre

- Abel + Schäfer / KOMPLET

- ADM

- Bakels Worldwide

- Corbion

- DSM

- KCG Corporation Public Company Limited

- Nestle

- Nisshin Seifun Group Inc.

- Oy Karl Fazer Ab.

- Puratos

- Synova

Recent Developments

- In 2024, Cargill focused on sustainability in Mexico’s wheat premixes sector, supporting innovative projects with CIMMYT to enhance food security. Their initiatives included empowering 200 women farmers and significant achievements in water conservation, restoring 38 billion liters, and transitioning 1.1 million acres to regenerative agriculture, reflecting their commitment to environmental and community support.

- In 2023, Koninklijke DSM NV, operating under the DSM-Firmenich brand, actively pursued innovations and partnerships within Mexico’s wheat premixes sector, emphasizing consumer health and sustainable product solutions. The company highlighted its role as a collaborative partner beyond merely supplying ingredients, focusing on creating specialized, consumer-driven premix solutions that cater to diverse health and nutrition needs.

Report Scope

Report Features Description Market Value (2023) USD 52.4 Million Forecast Revenue (2033) USD 100.2 Million CAGR (2024-2033) 6.7% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Bread, Cake, Pizza Bases, Muffins, Hamburgers, Others), By Category (Conventional Baking Premixes, Gluten-Free Baking Premixes), By Application (Bakeries, Confectionery Shops, Restaurants, Households) Competitive Landscape Cargill, Archer-Daniels-Midland Co., Bunge Ltd., Koninklijke DSM NV, Lesaffre, Abel + Schäfer / KOMPLET, ADM, Bakels Worldwide, Corbion, DSM, KCG Corporation Public Company Limited, Nestle, Nisshin Seifun Group Inc., Oy Karl Fazer Ab., Puratos, Synova Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Mexico Wheat Premixes MarketPublished date: December 2024add_shopping_cartBuy Now get_appDownload Sample

Mexico Wheat Premixes MarketPublished date: December 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Cargill

- Archer-Daniels-Midland Co.

- Bunge Ltd.

- Koninklijke DSM NV

- Lesaffre

- Abel + Schäfer / KOMPLET

- ADM

- Bakels Worldwide

- Corbion

- DSM

- KCG Corporation Public Company Limited

- Nestle

- Nisshin Seifun Group Inc.

- Oy Karl Fazer Ab.

- Puratos

- Synova