Global Potato Processing Market By Type (Chips And Snack Pellets, Dehydrated, Frozen, Others), By Category (Organic, Inorganic), By Product (Frozen potato, Potato chips, Potato flakes, Starch, Others), By Shape (Round, Shreds, Dices, Wedges, Tater Drums, Others), By Packaging (Pouches, Cans, Cardboard Boxes), By Application (Snacks, Ready-to-cook And Prepared Meals, Others),By Distribution Channel (Foodservice, Retail), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

- Published date: November 2024

- Report ID: 133117

- Number of Pages: 321

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Type Analysis

- By Category Analysis

- By Product Analysis

- By Shape Analysis

- By Packaging Analysis

- By Application Analysis

- By Distribution Channel Analysis

- Key Market Segments

- Driving factors

- Restraining Factors

- Growth Opportunity

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Development

- Report Scope

Report Overview

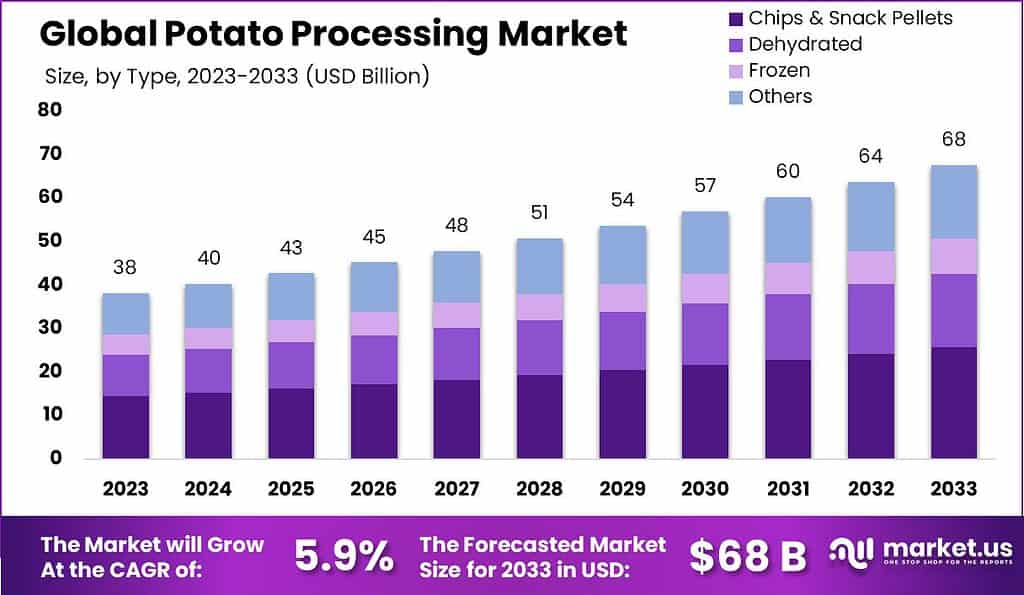

The Global Potato Processing Market size is expected to be worth around USD 68.0 Billion by 2033, from USD 38.1 Billion in 2023, growing at a CAGR of 5.9% during the forecast period from 2024 to 2033.

The “Potato Processing Market” refers to the industry focused on transforming potatoes into various products through different methods of processing. These products include frozen, dehydrated, and chilled potatoes, as well as snacks and other packaged foods.

The market encompasses all the steps from the initial handling of raw potatoes to their processing into forms that are ready for consumption or further cooking.

The demand in the potato processing market is strong and growing, reflecting global trends toward convenience and ready-to-eat food options. This market includes a wide array of products such as chips, frozen fries, and other potato-based snacks, which are especially popular in busy urban settings. As of recent estimates, the market is expanding due to the increasing number of people who prefer quick meal solutions and snacks that are both tasty and relatively easy to prepare.

The market popularity for potato processing has been growing quite a bit. This increase is because more people around the world are enjoying products like French fries, potato chips, and other processed potato items. In fact, the global market for processed potatoes is expected to keep getting bigger over the next few years.

Additionally, manufacturers are constantly coming up with new flavors and healthier options, which attract even more customers. Overall, the demand for processed potatoes is strong and shows promising signs of continued growth.

In 2022, global potato production amounted to approximately 375 million tons, with China and India being the top producers at about 95.5 million tons and 56 million tons, respectively. Other significant producers included Ukraine, the United States, and Russia with 20.9 million tons, 17.8 million tons, and 18.9 million tons, respectively. The total area harvested for potatoes globally was reported to be around 17.8 million hectares in 2022, indicating a slight decrease compared to the previous yea

Key Takeaways

- The Global Potato Processing Market size is expected to be worth around USD 68.0 Billion by 2033, from USD 38.1 Billion in 2023, growing at a CAGR of 5.9% during the forecast period from 2024 to 2033.

- Chips & Snack Pellets dominated the Potato Processing Market with a 37.6% share.

- The Inorganic segment dominated 81.2% of the Potato Processing Market.

- Potato Chips dominated the Potato Processing Market with a 38.7% share.

- Round dominated the Potato Processing Market’s Shape segment with a 19.1% share.

- Pouches dominated the Potato Processing Market’s packaging segment with a 46.7% share.

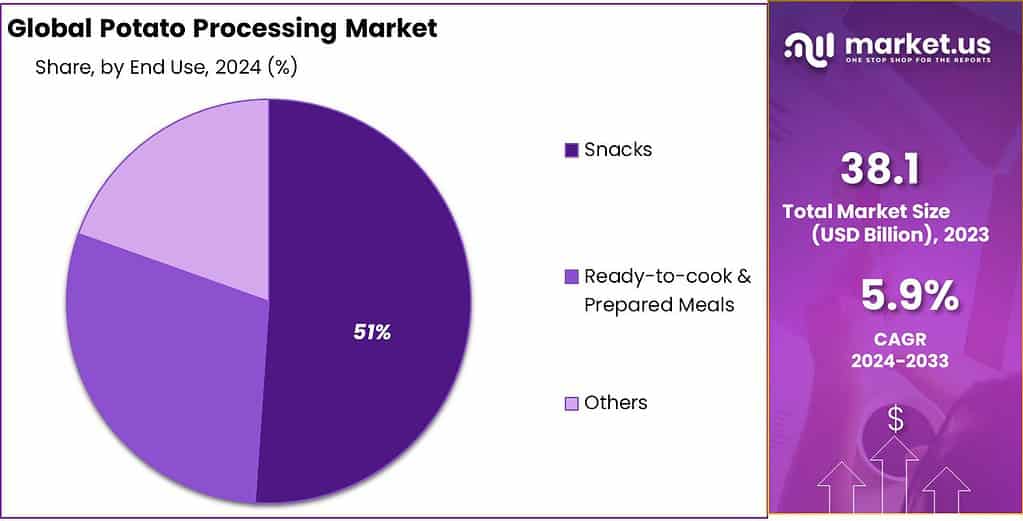

- The Snacks segment dominated the Potato Processing Market with a 51.2% share.

- Foodservice dominated the Potato Processing Market with a 61.2% share by distribution.

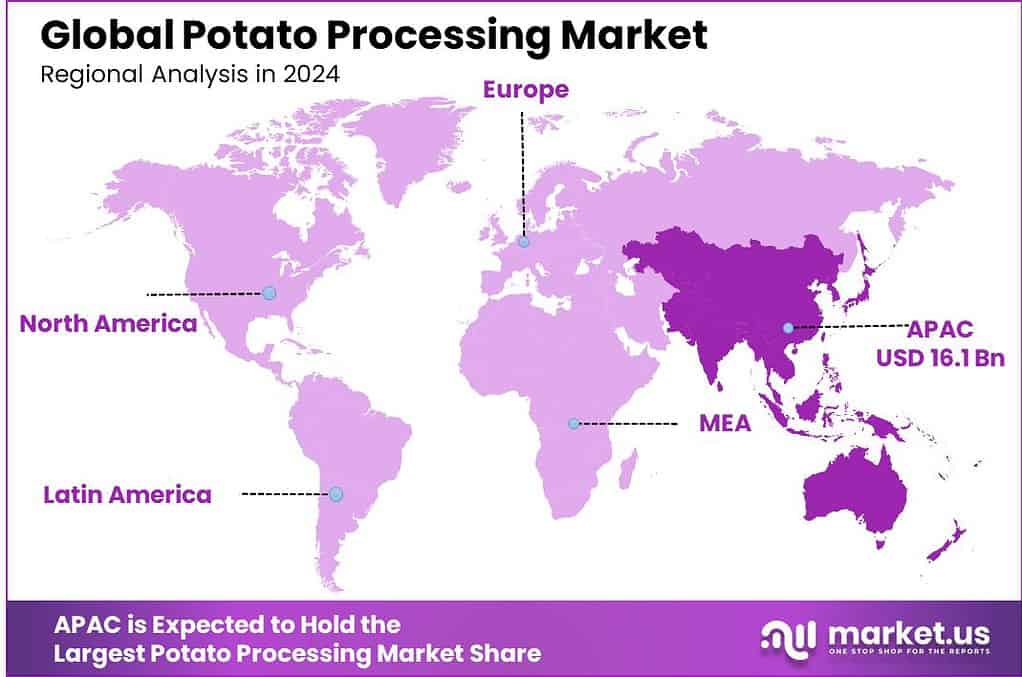

- APAC dominates the potato processing market with a 42.4% share, valued at $16.1 billion.

By Type Analysis

Chips & Snack Pellets dominated the Potato Processing Market with a 37.6% share.

In 2023, The Chips & Snack Pellets segment held a dominant market position in the By Type segment of the Potato Processing Market, capturing more than 37.6% of the market share. This segment benefits from strong consumer demand for convenient and flavorful snack options, which has driven significant investment and innovation in processing technologies. The appeal of chips and snack pellets is further augmented by the expansion of quick-service restaurants and the rising popularity of ready-to-eat foods across global markets.

Following closely, the Frozen segment also commands a substantial portion of the market. This category, which includes products such as frozen french fries and mashed potatoes, is favored for its convenience and longer shelf life, making it a preferred choice in both retail and food service sectors. The growth in this segment is supported by the increasing number of households with freezers and the growing trend of at-home cooking, spurred by recent global shifts in dining behavior.

The Dehydrated segment, comprising items like potato flakes and granules, is pivotal in markets where storage and transport stability are crucial. These products are widely utilized in the culinary industry, especially in instant meals and soups, benefiting from their extended shelf life and ease of use. The segment’s growth is propelled by the expanding quick meal solutions market and the ongoing demand in the food processing industry.

By Category Analysis

The Inorganic segment dominated 81.2% of the Potato Processing Market.

In 2023, Inorganic held a dominant market position in the By Category segment of the Potato Processing Market, capturing more than an 81.2% share. This substantial market share is indicative of established agricultural practices and extensive distribution networks favoring inorganic potato production. Inorganic processes, characterized by the use of synthetic fertilizers and pesticides, offer higher yield rates and cost efficiencies that are pivotal in large-scale operations.

Conversely, the Organic segment, though smaller, is also noteworthy. It represents a growing niche, propelled by increasing consumer preferences for health-conscious and environmentally sustainable products. The organic sector’s market presence, while constituting less than 20% of the overall category, is supported by higher price premiums and a gradually expanding consumer base willing to invest in organic credentials.

By Product Analysis

Potato Chips dominated the Potato Processing Market with a 38.7% share.

In 2023, The Potato Processing Market was segmented into several categories, reflecting a diverse range of products and their applications. Among these, Frozen Potato products, Potato Chips, Potato Flakes, Starch, and other potato-based products represent the key segments.

Frozen Potato products, utilized extensively in quick-service restaurants and ready-to-eat meals, have witnessed substantial growth due to rising consumer demand for convenience foods. This segment benefits from innovations in freezing technology that maintain the nutritional and taste profile of potatoes.

Potato Chips held a dominant market position in the “By Product” segment of the Potato Processing Market, capturing more than a 38.7% share. The popularity of potato chips can be attributed to their widespread acceptance as a snack food across various demographics and geographies. Manufacturers have been continuously innovating in terms of flavors and healthier options to attract a broader consumer base.

Potato Flakes are another significant segment, primarily used in households and by food service providers for making instant mashed potatoes. Their convenience, long shelf life, and ease of preparation drive their demand, particularly in regions where quick meal solutions are increasingly popular.

Starch derived from potatoes features prominently in both food and non-food applications, including the textile, paper, and pharmaceutical industries. The versatility and biodegradability of potato starch make it a preferred choice in various industrial applications, aligning with the growing trend toward sustainable practices.

By Shape Analysis

Round dominated the Potato Processing Market’s Shape segment with a 19.1% share.

In 2023, Round held a dominant market position in the By Shape segment of the Potato Processing Market, capturing more than a 19.1% share. This shape, popular for its versatile use across various culinary applications from home kitchens to fast food chains leads due to its widespread acceptance and familiarity among consumers.

Following closely, Shreds form another significant portion of the market. Preferred for their quick cooking time and crisp texture once cooked, they are a favorite in breakfast dishes and as toppings in casual dining settings, representing a market trend towards convenience and speed in meal preparation.

Dice is also a notable segment, favored for its uniformity in cooking and ease of use in a diverse range of dishes such as soups, stews, and pre-packaged meals. Their regular shape and size help maintain consistent quality and taste, making them a staple in both residential and commercial food preparation.

Wedges hold a unique market niche, often chosen for their rustic appeal and substantial feel. They are particularly popular in sit-down restaurants and pubs where a more home-cooked meal experience is desired. This segment benefits from the rising consumer preference for hearty, comfort foods that offer a more satisfying eating experience.

Tater Drums, often marketed as tater tots in various regions, enjoy a robust presence in the market due to their popularity in school cafeterias, fast food outlets, and as a frozen product for home use. Their playful shape and ease of cooking make them a hit among younger demographics, aligning with market trends that favor fun, kid-friendly food products that are also easy for parents to prepare.

By Packaging Analysis

Pouches dominated the Potato Processing Market’s packaging segment with a 46.7% share.

In 2023, The Potato Processing Market’s “By Packaging” segment saw significant segmentation, with “Pouches” leading as the predominant packaging form, securing a substantial 46.7% market share. This dominant position can be attributed to the consumer preference for convenient, lightweight, and durable packaging options that ensure product freshness and extend shelf life.

Following Pouches, “Cans” represented the next significant category, appreciated for their robustness and long-term preservation capabilities. This packaging type is particularly favored for its ability to maintain the nutritional integrity of processed potatoes over extended periods, making it a preferred choice for supply chains requiring long storage durations.

Cardboard Boxes also held a notable position within the market. These are primarily utilized for bulk and industrial shipping purposes rather than direct consumer sales. Their eco-friendly nature and cost-effectiveness, coupled with the increasing demand for sustainable packaging solutions from environmentally conscious consumers and regulators, have bolstered their usage in the potato processing industry.

By Application Analysis

The Snacks segment dominated the Potato Processing Market with a 51.2% share.

In 2023, The Snacks segment held a dominant market position in the “By Application” category of the Potato Processing Market, capturing more than 51.2% share. This significant market presence can be attributed to the increasing consumer preference for convenience foods and the expansion of quick-service restaurants globally.

The segment’s growth is further bolstered by innovations in flavor, health-oriented formulations, and the introduction of organic and non-GMO ingredients, catering to a broader consumer base seeking healthier snack options.

Following Snacks, the Ready-to-Cook & Prepared Meals segment also demonstrated notable growth. This segment benefits from the rising demand for easy-to-prepare food solutions among urban dwellers and working professionals. The convenience of these products, coupled with their extended shelf life and improved taste profiles, supports their expanding market footprint.

By Distribution Channel Analysis

Foodservice dominated the Potato Processing Market with a 61.2% share by distribution.

In 2023, Foodservice held a dominant market position in the By Distribution Channel segment of the Potato Processing Market, capturing more than a 61.2% share. This substantial market share underscores the pivotal role of food service outlets, including restaurants and fast-food chains, in the distribution of processed potato products such as French fries, mashed potatoes, and potato chips. The food service channel benefits from high volume purchases and a consistent demand driven by consumer preferences for quick and convenient meal options.

Conversely, the Retail channel, which includes supermarkets, grocery stores, and online platforms, also plays a crucial role but with a smaller share of the market. This channel primarily caters to home consumers looking for ready-to-cook or easy-to-prepare potato products, reflecting a growing trend towards convenience cooking at home. The dynamics between these channels are influenced by factors such as changing consumer eating habits, the rise of online food retail, and the increasing importance of quick-service restaurants in daily food consumption.

Key Market Segments

By Type

- Chips & Snack Pellets

- Dehydrated

- Frozen

- Others

By Category

- Organic

- Inorganic

By Product

- Frozen potato

- Potato chips

- Potato flakes

- Starch

- Others

By Shape

- Round

- Shreds

- Dices

- Wedges

- Tater Drums

- Others

By Packaging

- Pouches

- Cans

- Cardboard Boxes

By Application

- Snacks

- Ready-to-cook & Prepared Meals

- Others

By Distribution Channel

- Foodservice

- Retail

Driving factors

Rising Demand for Convenience Foods

The growth of the potato processing market can be largely attributed to the rising demand for convenience foods. As lifestyles become increasingly fast-paced, consumers seek quick, nutritious, and easy-to-prepare meal options. Potato-based products such as frozen fries, potato chips, and instant mashed potatoes cater to this need, offering a blend of convenience and taste.

The global market for convenience foods has been expanding, reflecting a broader consumer shift towards meals that require minimal preparation time. This trend directly fuels the demand for processed potato products, which are integral components of the convenience food sector.

Urbanization and Changing Food Habits

Urbanization acts as a significant catalyst for the transformation of food consumption patterns. As more individuals migrate to urban areas, there is a noticeable shift in dietary habits towards Westernized food cultures, which prominently feature potato-based dishes. This urban shift is coupled with an increase in disposable income, allowing consumers to explore diverse food options, including those offered by the potato processing industry.

The urban consumer’s preference for fast, versatile, and culturally diverse food choices contributes substantially to the expansion of the potato processing market. This factor, intertwined with the rising demand for convenience foods, underscores a dynamic where urban lifestyles bolster the consumption of processed potato products.

Expansion of Quick-Service Restaurants (QSRs)

The expansion of quick-service restaurants (QSRs) globally is another pivotal factor driving the growth of the potato processing market. QSRs, known for their fast food operations, heavily utilize processed potatoes in various forms french fries, hash browns, and potato wedges, to name a few. The proliferation of QSRs in both developed and emerging markets has led to an increased demand for high-quality, pre-prepared potato products that can be served quickly and efficiently to customers.

This surge in QSR outlets not only enhances the visibility and accessibility of potato-based dishes but also stimulates the demand for potato processing at a larger scale. The symbiotic relationship between the rise of QSRs and urbanization further intensifies the demand within the potato processing industry, as urban centers often host a higher concentration of these restaurants.

Restraining Factors

Impact of Stringent Food Safety and Quality Regulations on the Potato Processing Market

Stringent food safety and quality regulations have a dual impact on the potato processing market. On one hand, they necessitate additional compliance costs for manufacturers, as they must invest in better processing equipment, training for staff, and implementation of comprehensive quality control systems to meet these regulations. This can increase operational costs and reduce profit margins for businesses within the sector.

On the other hand, stringent regulations can also serve as a market driver by boosting consumer confidence in processed potato products. When consumers trust that the products they are buying meet high safety and quality standards, they are more likely to purchase them. This increased consumer confidence can lead to greater demand, potentially offsetting the increased costs of compliance.

The introduction of stricter regulations often leads to market consolidation, where only the most compliant and financially robust companies survive, potentially increasing the market share for these remaining players.

Seasonal Dependency of Raw Material Supply and Its Effects

The potato processing market heavily depends on the availability of potatoes, which are subject to seasonal variations. This seasonal dependency can lead to fluctuations in raw material costs and availability, impacting production schedules and profitability. During off-peak seasons when raw materials are scarce, potato processors might face increased prices or a need to import potatoes at a higher cost, which can squeeze the margins.

This seasonal variability also forces companies to enhance their supply chain management and invest in storage technologies to ensure a steady supply of raw materials throughout the year. Advanced forecasting and strategic partnerships with potato growers can mitigate some of these challenges, but they also add to operational complexity and costs. This factor significantly influences pricing, production planning, and even market stability, potentially affecting market growth during certain periods of the year.

Health Concerns Over Processed Foods and Market Dynamics

Health concerns regarding processed foods can significantly impact the potato processing market. As consumers become more health-conscious, their preference shifts towards fresher and less processed options. This trend poses a challenge for the potato processing industry, which often relies on additives and preservatives to extend the shelf life and enhance the flavor of products such as chips and fries.

However, this challenge also presents an opportunity for innovation. There is a growing niche market for potato products that are marketed as healthier alternatives, such as those with reduced sodium, no added preservatives, or even organic. Companies that innovate and adapt their product lines to meet these health-centric demands can capture new market segments and drive growth.

Growth Opportunity

Rising Demand for Plant-Based and Vegan Products

The global potato processing market is poised for significant expansion in 2024, largely propelled by the surging consumer interest in plant-based and vegan diets. As health consciousness and ethical dietary preferences gain traction worldwide, potatoes emerge as a key ingredient due to their versatility and nutritional profile.

This shift is anticipated to drive the demand for processed potato products, opening substantial growth avenues for industry players.

Innovation in Flavor Profiles

Another pivotal factor contributing to the growth of the potato processing market is the ongoing innovation in flavor profiles. Consumers’ increasing penchant for diverse and exotic flavors is pushing manufacturers to broaden their product ranges.

This trend not only caters to the evolving palate preferences but also enhances consumer engagement and market penetration in different geographical segments. Companies leveraging this innovation are likely to see an upswing in their market share and consumer loyalty.

Development of Sustainable Processing Methods

Sustainability in processing methods marks a critical focus area for the potato processing industry. Stakeholders are increasingly investing in technologies that reduce environmental impact, including water conservation techniques and energy-efficient equipment.

Such developments are not only responding to regulatory pressures but also aligning with the growing consumer demand for environmentally responsible products. This shift towards sustainability is expected to not only enhance operational efficiencies but also improve brand image and consumer trust in the long term.

Latest Trends

Shift Towards Healthier Snack Options

The potato processing market is witnessing a significant shift as consumers increasingly opt for healthier snack alternatives. This trend is driven by a growing awareness of nutritional content and a collective shift towards wellness-oriented lifestyles.

Processed potato products that highlight reduced sodium, lower fat content, and minimal artificial additives are poised to see heightened demand. This shift is compelling manufacturers to innovate and reformulate traditional offerings, potentially expanding market reach and consumer base.

Growth of Organic and Non-GMO Products

Organic and non-GMO potato products are rapidly gaining traction, reflecting a broader consumer preference for transparency and natural ingredients in food sourcing. The demand for organic potatoes is spurred by concerns over pesticide use and a preference for environmentally sustainable practices.

Customization and Personalization of Products

Customization and personalization are becoming increasingly prevalent in the potato processing industry. Consumers are seeking products that cater to their specific dietary needs and taste preferences, from gluten-free options to gourmet flavors.

Regional Analysis

APAC dominates the potato processing market with a 42.4% share, valued at $16.1 billion.

North America remains a significant player in the potato processing market, driven by robust demand for processed potato products such as french fries, chips, and flakes. The U.S. leads this regional market, reflecting high per capita consumption and well-established food processing industries. Technological advancements in processing and packaging have further propelled market growth.

In Europe, the market is characterized by the presence of major potato processing companies and high consumer preference for potato-based snacks. Western European countries, particularly the Netherlands and Germany, dominate the regional landscape due to their advanced agricultural practices and strong export capabilities. Sustainability initiatives in processing methods are increasingly adopted, enhancing long-term market growth.

Asia Pacific (APAC) is the most dominant region, commanding a 42.4% market share with a valuation of $16.1 billion. Rapid urbanization, changing dietary patterns, and growing fast food industry are key drivers for this market. Countries like China and India are pivotal, with their large populations and rising middle-class consumer base, which demands more processed potato products.

The market in the Middle East & Africa (MEA) is emerging, with growth influenced by increasing urbanization and the expansion of retail sectors. South Africa and Saudi Arabia are noteworthy markets, leveraging their developed agricultural sectors to boost local potato processing industries.

Latin America shows promising growth in the potato processing market, fueled by both local consumption and export potential. Brazil and Argentina are prominent contributors, where potatoes are a staple food. The region benefits from favorable farming conditions and is gradually adopting more sophisticated processing technologies to meet both domestic and international demand.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

In assessing the landscape of the global Potato Processing Market in 2024, several key players are pivotal in shaping industry dynamics. These companies exhibit diverse strategies and market approaches that influence their competitive positions and the broader market trends.

AGRANA Beteiligungs-AG stands out with its integrated approach to starch and sugar production, leveraging its expertise in potato starch to innovate within the processed potato segment. This strategic integration allows AGRANA to maintain stability in supply chains and pricing, which is crucial in volatile agricultural markets.

J.R. Simplot Company is another significant entity, renowned for its advanced agricultural techniques and strong distribution networks. Its focus on sustainable farming practices and technological advancements in processing has enhanced its product offerings in the frozen potato segment, resonating well with the growing consumer demand for environmentally friendly and high-quality food products.

Lamb Weston Holdings, Inc. has consistently demonstrated market leadership in the innovation of frozen potato products. Their aggressive expansion strategies, through both capacity-building and strategic acquisitions, have positioned them effectively to capitalize on global demand increases, especially in emerging markets.

McCain Foods Ltd, the largest manufacturer of frozen potato products, continues to excel by focusing on consumer tastes and preferences. Their commitment to quality and extensive product range allows them to cater to various segments, reinforcing their market dominance. McCain’s global footprint and operational efficiency enable them to efficiently manage supply chain complexities, thereby enhancing their competitiveness.

Market Key Players

- AGRANA Beteiligungs-AG

- Agristo NV

- Agristo,

- AVEBE U.A.

- Aviko

- Aviko BV

- Bart’s Potato Company

- Bergia Frites S.A.S.

- Calbee, Inc.

- Cavendish Farms Corporation

- Farm Frites

- Farm Frites International B.V.

- General Mills

- Idahoan Foods, LLC

- Intersnack Group GmbH & Co. KG

- J.R. Simplot Company

- Kellogg Company

- Kraft Heinz

- Lamb Weston Holdings, Inc.

- McCain Foods Ltd

- Old Dutch Foods, Inc.

- Pepsico, Inc.

- Royal Cosun

- The Hain Celestial Group, Inc.

- The Kraft Heinz Company

Recent Development

- In March 2023, The Kraft Heinz Company, in collaboration with BEES, announced a significant expansion of their partnership to enhance their B2B marketplace across Latin America, focusing on Mexico, Colombia, and Peru. This strategic move aims to unlock approximately 1 million new potential points of sale, thereby boosting their Emerging Markets strategy.

- In February 2023, Lamb Weston Holdings Inc. completed the acquisition of the remaining equity interests in its European joint venture with Meijer Frozen Foods B.V. This acquisition, which included a substantial cash and stock transaction, aimed to strengthen Lamb Weston’s competitive position and expand its consumer base in the European market.

Report Scope

Report Features Description Market Value (2023) USD 38.1 Billion Forecast Revenue (2033) USD 68.0 Billion CAGR (2024-2032) 5.9% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Chips & Snack Pellets, Dehydrated, Frozen, Others), By Category (Organic, Inorganic), By Product (Frozen potato, Potato chips, Potato flakes, Starch, Others), By Shape (Round, Shreds, Dices, Wedges, Tater Drums, Others), By Packaging (Pouches, Cans, Cardboard Boxes), By Application (Snacks, Ready-to-cook & Prepared Meals, Others),By Distribution Channel (Foodservice, Retail) Regional Analysis North America – The US, Canada, Rest of North America, Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America – Brazil, Mexico, Rest of Latin America, Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape AGRANA Beteiligungs-AG, Agristo NV, Agristo,, AVEBE U.A., Aviko, Aviko BV, Bart’s Potato Company, Bergia Frites S.A.S., Calbee, Inc., Cavendish Farms Corporation, Farm Frites, Farm Frites International B.V., General Mills, Idahoan Foods, LLC, Intersnack Group GmbH & Co. KG, J.R. Simplot Company, Kellogg Company, Kraft Heinz, Lamb Weston Holdings, Inc., McCain Foods Ltd, Old Dutch Foods, Inc., Pepsico, Inc., Royal Cosun, The Hain Celestial Group, Inc., The Kraft Heinz Company Customization Scope We will provide customization for segments and at the region/country level. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Potato Processing MarketPublished date: November 2024add_shopping_cartBuy Now get_appDownload Sample

Potato Processing MarketPublished date: November 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- AGRANA Beteiligungs-AG

- Agristo NV

- Agristo,

- AVEBE U.A.

- Aviko

- Aviko BV

- Bart's Potato Company

- Bergia Frites S.A.S.

- Calbee, Inc.

- Cavendish Farms Corporation

- Farm Frites

- Farm Frites International B.V.

- General Mills

- Idahoan Foods, LLC

- Intersnack Group GmbH & Co. KG

- J.R. Simplot Company

- Kellogg Company

- Kraft Heinz

- Lamb Weston Holdings, Inc.

- McCain Foods Ltd

- Old Dutch Foods, Inc.

- Pepsico, Inc.

- Royal Cosun

- The Hain Celestial Group, Inc.

- The Kraft Heinz Company