Global Insect-based Pet Food Market By Nature (Organic, Monoprotein, Conventional), By Source (Crickets, Mealworms, Black Soldier Flies), By Product Type (Kibble/Dry, Dehydrated Food, Treats and Chews, Freeze-dried Raw, Wet Food, Frozen, Raw Food, Powder, Freeze-dried Food), By Pet Type (Cat, Dog, Birds, Others), By Food Type (Dry, Wet, Treats and Chews, Others), By Packaging Type (Pouches, Cans, Cartons, Others), By Distribution Channel (Hypermarkets/Supermarkets, Convenience Stores, Mom and Pop Stores, Online Retailers, Pet Stores, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: December 2024

- Report ID: 134786

- Number of Pages: 276

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Nature Analysis

- By Source Analysis

- By Product Type Analysis

- By Pet Type Analysis

- By Food Type Analysis

- By Packaging Type Analysis

- By Distribution Channel Analysis

- Key Market Segments

- Driving Factors

- Restraining Factors

- Growth Opportunity

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

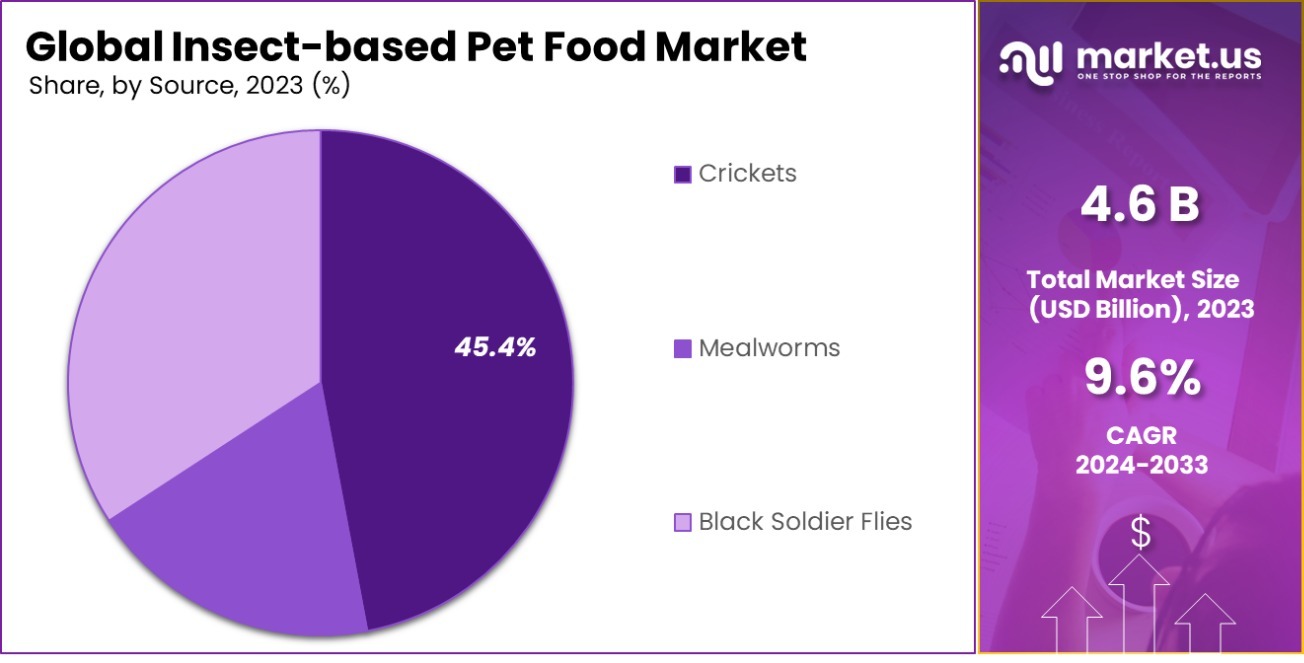

The Global Insect-based Pet Food Market is expected to be worth around USD 11.5 Billion by 2033, up from USD 4.6 Billion in 2023, and grow at a CAGR of 9.6% from 2024 to 2033.

Insect-based pet food is a type of pet food formulated using insects as the primary source of protein. This alternative protein source is gaining popularity due to its sustainability, high nutritional value, and lower environmental impact than traditional meat proteins.

The production of insect-based pet food typically involves farming insects like crickets, mealworms, and black soldier flies, which are then processed into various forms suitable for pet consumption.

The Insect-based Pet Food Market refers to the commercial sector involved in producing, distributing, and selling pet foods that utilize insects as the main protein source. This market is driven by the growing consumer awareness of environmental sustainability and animal welfare, alongside the nutritional benefits of insect proteins for pets.

The market is expanding due to the increasing recognition of insects as a sustainable and efficient protein source. Their lower greenhouse gas emissions, reduced land use, and high feed conversion efficiency make them appealing in light of global sustainability goals.

Demand is driven by pet owners seeking alternative, hypoallergenic protein sources due to the rise in pet allergies and sensitivities. Additionally, the trend toward premium pet nutrition supports the growth of this niche market as consumers look for innovative and health-focused products.

There is a significant opportunity to expand consumer acceptance and education about the benefits of insect-based pet foods. Innovations in flavor and product variety, alongside strategic partnerships with veterinarians and pet food retailers, can further penetrate mainstream markets and drive growth.

The insect-based pet food market is a rapidly evolving segment within the pet care industry, poised for strong growth over the next decade. Driven by increasing consumer awareness of sustainability, animal welfare, and the environmental impact of traditional protein sources, insect-based pet foods are gaining traction as a viable and nutritious alternative.

The market is seeing a surge in investment, with approximately $480 million raised globally by insect farm startups, signaling strong investor confidence in this sector’s scalability and future potential.

Notably, companies like Ynsect are at the forefront, planning to produce up to 20,000 tons of insect-derived protein annually for both pet food and aquaculture applications. This highlights the growing efficiency and scale of insect farming operations, which can help meet the rising demand for sustainable protein sources.

Ynsect’s impressive fundraising success—raising over $625 million, including a €160 million round in April 2023—illustrates the significant financial backing fueling innovation and expansion in this space. With the recent $125 million Series C funding, Ynsect has positioned itself as a market leader in insect-based protein production, having raised a total of over $160 million since its inception in 2011.

The rising demand for alternative proteins, driven by pet owners’ increasing concerns over allergies, sustainability, and ethical sourcing, positions the insect-based pet food market for long-term growth. Furthermore, the opportunity for innovation in product offerings and flavor profiles, coupled with the growing availability of insect protein, creates significant market potential for both new entrants and established players.

Key Takeaways

- The Global Insect-based Pet Food Market is expected to be worth around USD 11.5 Billion by 2033, up from USD 4.6 Billion in 2023, and grow at a CAGR of 9.6% from 2024 to 2033.

- Conventional insect-based pet foods dominate the market, holding a 53.5% share.

- Crickets are the most used source in insect-based pet foods, representing 45.4%.

- Kibble or dry products are prevalent, comprising 28.3% of the insect-based pet food market.

- Dogs are the primary consumers of insect-based pet food, accounting for 53.2%.

- Dry food types command a substantial segment, with a 45.4% market share.

- Pouches are the leading packaging type in the market, capturing 39.4%.

- Hypermarkets and supermarkets are the chief distribution channels, holding a 38.4% share.

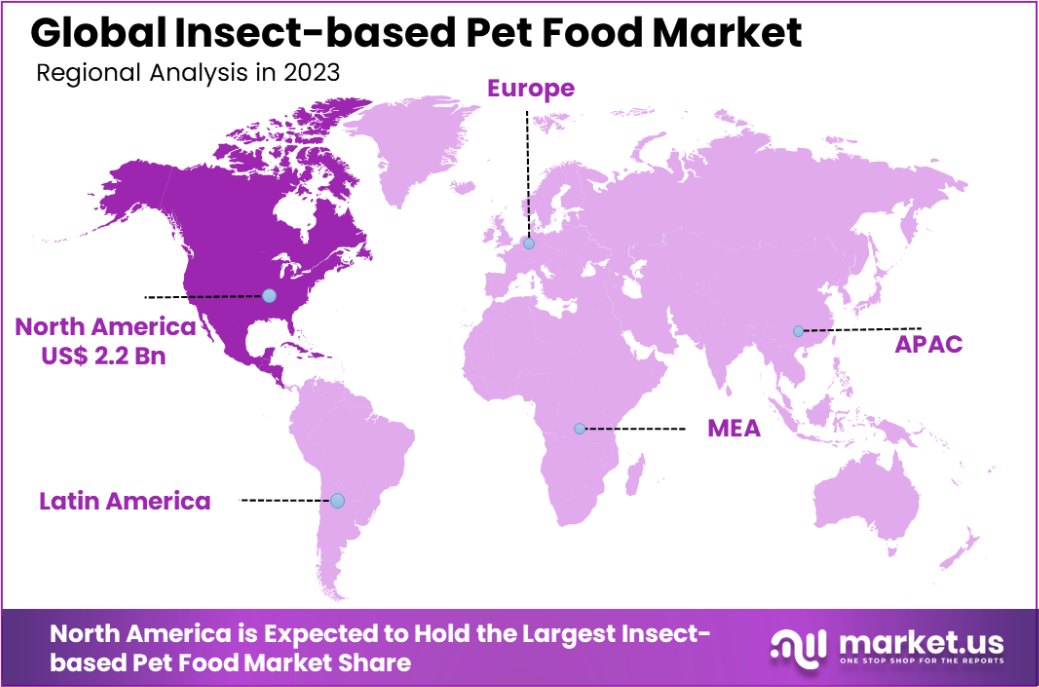

- In North America, the insect-based pet food market is valued at USD 2.2 billion, holding a 47.8% share.

By Nature Analysis

Conventional insect-based pet foods dominate the market, holding a 53.5% share.

In 2023, Conventional held a dominant market position in the “By Nature” segment of the Insect-based Pet Food Market, with a 53.5% share. Organic and Monoprotein variants accounted for smaller portions of the market, with 29.7% and 16.8% respectively.

This distribution highlights a strong consumer preference for traditional formulations, reflecting a broader trust and familiarity within this category.

The market dynamics suggest that while there is an increasing interest in organic products, driven by a growing consumer awareness of health and sustainability issues, conventional products continue to lead due to their established presence and typically lower price points.

Monoprotein products, though holding the smallest share, are gradually gaining traction. This is indicative of a niche but growing interest among pet owners who are seeking specialized dietary options for their pets, driven by concerns over allergies and food sensitivities.

Investment in expanding the range of conventional insect-based pet food products can be justified by the current market share, however, the rising trends toward organic and monoprotein suggest potential growth areas.

Companies are advised to monitor shifts in consumer preferences closely, potentially increasing offerings in organic and monoprotein variants to capture emerging market segments.

By Source Analysis

Crickets are a popular source of insect-based pet foods, accounting for 45.4%.

In 2023, Crickets held a dominant market position in the “By Source” segment of the Insect-based Pet Food Market, with a 45.4% share. Mealworms and Black Soldier Flies also featured prominently, capturing 32.1% and 22.5% of the market respectively. This hierarchy underscores the robust demand for crickets as a primary source of protein, favored for their high nutritional content and sustainability credentials.

The preference for crickets can be attributed to their well-established market presence and widespread acceptance among consumers who are increasingly seeking sustainable and ethical alternatives to traditional pet food sources. Mealworms, occupying the second-largest share, are appreciated for their protein quality and ease of farming, which make them a practical choice for manufacturers looking to scale operations sustainably.

Black Soldier Flies, though currently the smallest segment, are showing significant growth potential due to their efficient nutrient recycling abilities and lower greenhouse gas emissions. As regulatory landscapes evolve and consumer awareness increases, Black Soldier Flies could see an upsurge in market share.

Companies within the sector may consider strategic investments in expanding cricket-based product lines while also exploring the untapped potential of Black Soldier Flies to diversify their offerings and capitalize on emerging consumer trends toward more sustainable pet food options.

By Product Type Analysis

Kibble or dry formats are preferred in insect-based pet food, making up 28.3%.

In 2023, Kibble/Dry held a dominant market position in the “By Product Type” segment of the Insect-based Pet Food Market, with a 28.3% share. Following closely were Dehydrated pet Food and Treats and Chews, which accounted for 18.6% and 14.7% of the market, respectively.

Freeze-dried Raw, Wet Food, and Frozen types also made significant contributions, with shares of 10.2%, 9.8%, and 7.2% respectively. Lesser shares were held by Raw Food at 5.6%, Powder at 3.4%, and Freeze-dried Food at 2.2%.

The preference for Kibble/Dry products underscores their convenience, affordability, and long shelf life, making them a favored choice among pet owners for daily feeding. The significant market presence of Dehydrated Food highlights a growing consumer interest in foods that retain most of the natural flavors and nutrients while ensuring ease of storage and preparation.

Treats and Chews continue to perform well, reflecting an ongoing trend where pet owners are looking for nutritious, engaging ways to supplement their pets’ diets. However, emerging categories like Freeze-dried Raw and Wet Food are gaining traction as consumers become more aware of the benefits of high-moisture and minimally processed diets.

Considering these trends, companies may benefit from diversifying their product offerings to include a broader range of insect-based products across various categories, tapping into the shifting consumer preferences towards health-oriented pet food solutions.

By Pet Type Analysis

Dogs are the leading consumers of insect-based pet foods, with a 53.2% share.

In 2023, Dogs held a dominant market position in the “By Pet Type” segment of the Insect-based Pet Food Market, with a 53.2% share. Cats and Birds also contributed to the market, holding 34.1% and 12.7% shares respectively.

This distribution emphasizes the strong preference among dog owners for insect-based diets, which can be attributed to the increasing awareness of the nutritional benefits these diets offer, such as high protein content and hypoallergenic properties.

The market’s orientation towards dogs is supported by a broader range of product offerings and targeted marketing efforts aimed at dog owners, who are typically more receptive to innovative and specialized dietary solutions for their pets. Cat owners are gradually embracing insect-based options, reflecting a growing acknowledgment of their potential health benefits, which include aiding digestion and reducing allergenic reactions.

Birds, while representing the smallest market share, demonstrate a niche yet important segment, as pet owners seek more natural and sustainable food sources for avian diets. The demand in this category is expected to grow as manufacturers expand their product lines to cater specifically to the nutritional needs of different bird species.

Strategic development in formulating and marketing insect-based pet foods tailored to the distinct dietary requirements and preferences of each pet type could significantly enhance market penetration and customer satisfaction across all segments.

By Food Type Analysis

Dry food types, including insect-based options, represent 45.4% of the market.

In 2023, Dry held a dominant market position in the “By Food Type” segment of the Insect-based Pet Food Market, with a 45.4% share. Wet and Treats and Chews also accounted for significant portions of the market, capturing 30.3% and 24.3% respectively.

The predominance of Dry food in the market can be attributed to its convenience, longer shelf life, and general affordability, which align with the practical needs of pet owners.

The substantial market share of Wet food highlights its appeal due to higher moisture content, which is beneficial for pet hydration and often preferred for pets with dietary issues such as kidney problems or lower palatability to dry food.

Meanwhile, Treats and Chews have carved out a considerable niche, driven by pet owners’ desires to provide their pets with occasional indulgences or nutritional supplements that also serve as tools for training and behavioral encouragement.

The strong performance of Dry food suggests it is a foundational diet choice for many pet owners, yet the notable shares of Wet food and Treats and Chews indicate diverse consumer needs and preferences. Companies may see potential in exploring product innovations across these types, especially by integrating unique insect-based ingredients that can differentiate their offerings in a competitive market.

By Packaging Type Analysis

Pouch packaging is common in insect-based pet foods, comprising 39.4% of sales.

In 2023, Pouches held a dominant market position in the “By Packaging Type” segment of the Insect-based Pet Food Market, with a 39.4% share. Cans and Cartons also played significant roles, securing 33.1% and 27.5% of the market, respectively. The preference for Pouches can be attributed to their convenience, resealability, and lightweight nature, which appeal to consumer preferences for practical and sustainable packaging solutions.

Cans, holding the second-largest share, are favored for their long shelf life and ability to preserve food freshness, making them a reliable choice for wet pet foods. Meanwhile, Cartons are increasingly popular due to their environmental benefits, as they are often made from renewable resources and are recyclable.

The dominance of Pouches in the market underscores a shift towards packaging that offers ease of use and reduces the environmental impact. However, the substantial shares of Cans and Cartons reflect a diverse consumer base that values both tradition and sustainability.

To capitalize on these trends, companies might consider innovations in packaging design that enhance the user experience and further the appeal of sustainable practices, potentially increasing market share in these essential segments.

By Distribution Channel Analysis

Hypermarkets and supermarkets are key distribution channels, holding 38.4% of the market.

In 2023, Hypermarkets/Supermarkets held a dominant market position in the “By Distribution Channel” segment of the Insect-based Pet Food Market, with a 38.4% share. Other significant distribution channels included Online Retailers at 24.6%, Pet Stores at 18.5%, Convenience Stores at 10.7%, and Mom and Pop Stores at 7.8%.

The strong performance of Hypermarkets/Supermarkets is driven by their ability to offer a wide range of products under one roof, coupled with the advantage of immediate availability, which appeals to the everyday consumer.

Online Retailers, capturing the second largest share, highlight the growing trend of e-commerce, propelled by convenience, the breadth of available information, and often competitive pricing. Pet Stores remain a vital channel, offering specialized products and expertise that are highly valued by pet owners seeking tailored nutrition solutions for their pets.

Convenience Stores and Mom and Pop Stores, while holding smaller shares, play crucial roles in local and easily accessible shopping options, especially in under-served areas or for quick purchases.

The distribution landscape indicates that while traditional retail remains strong, there is significant growth potential in online sales, suggesting that companies should enhance their online presence and digital marketing efforts to capture this expanding customer base.

Key Market Segments

By Nature

- Organic

- Monoprotein

- Conventional

By Source

- Crickets

- Mealworms

- Black Soldier Flies

By Product Type

- Kibble/Dry

- Dehydrated Food

- Treats and Chews

- Freeze-dried Raw

- Wet Food

- Frozen

- Raw Food

- Powder

- Freeze-dried Food

By Pet Type

- Cat

- Dog

- Birds

- Others

By Food Type

- Dry

- Wet

- Treats and Chews

- Others

By Packaging Type

- Pouches

- Cans

- Cartons

- Others

By Distribution Channel

- Hypermarkets/Supermarkets

- Convenience Stores

- Mom and Pop Stores

- Online Retailers

- Pet Stores

- Others

Driving Factors

Increasing Demand for Sustainable Pet Food Options

The global rise in environmental awareness has significantly influenced pet owners’ purchasing decisions, leading to a surge in demand for sustainable pet food products. Insect-based pet food, recognized for its low environmental footprint compared to traditional meat-based options, offers a viable solution.

This shift is driven by the need to reduce carbon emissions and conserve natural resources, making insect-based products increasingly popular among environmentally conscious consumers.

Health Benefits Attracting Pet Owners

Pet owners are increasingly seeking healthier diet options for their pets, with a focus on nutrition and wellness. Insect-based pet foods are rich in proteins and nutrients while being hypoallergenic, which makes them ideal for pets with food sensitivities or allergies.

This nutritional advantage positions insect-based products as premium options in the pet food market, attracting buyers looking to improve their pets’ health and well-being.

Expansion of Specialized Pet Retail Outlets

The growth of specialized pet retail outlets has made it easier for consumers to access a variety of pet food products, including those based on insects. These outlets often offer extensive information and personalized customer service, which helps educate pet owners about the benefits of insect-based diets.

This increased availability and supportive shopping experience are critical drivers in the adoption and popularity of insect-based pet food across diverse markets.

Restraining Factors

High Production Costs Limit Market Expansion

Insect-based pet food often faces higher production costs compared to traditional pet food, primarily due to the specialized farming and processing required for insects. These increased costs can translate into higher retail prices, making these products less accessible to a broader market.

As cost is a significant factor for many consumers when choosing pet food, the premium pricing of insect-based options can restrain their widespread adoption and limit market growth.

Consumer Skepticism and Lack of Awareness

Despite the benefits, there remains a considerable level of consumer skepticism regarding the use of insects as a pet food source. Many consumers are unfamiliar with the nutritional value insects offer and may have preconceived notions about their safety and appeal as pet food.

his lack of awareness and the ‘ick factor’ associated with eating insects can significantly hinder market penetration and acceptance of insect-based pet foods.

Regulatory and Logistical Challenges

The insect-based pet food industry faces various regulatory and logistical hurdles that can impede growth. These include stringent food safety regulations, which vary by region and can complicate production and distribution.

Additionally, the industry lacks a standardized supply chain, which can lead to inconsistencies in product quality and availability. Overcoming these challenges is crucial for the industry to ensure stable growth and gain consumer trust.

Growth Opportunity

Innovative Product Development Opens New Market Segments

There is significant growth potential for companies that innovate within the insect-based pet food market. By developing unique product offerings such as specialized diets for different breeds or age-specific formulations, companies can tap into niche markets that have not yet been fully explored.

This approach not only differentiates brands in a competitive space but also caters to the specific health needs of diverse pet populations, potentially increasing market share and consumer loyalty.

Expansion into Emerging Markets with Rising Pet Ownership

Emerging markets present a substantial growth opportunity for the insect-based pet food industry, driven by increasing pet ownership and a growing middle class. As awareness of pet health and nutrition rises in these regions, there is a clear pathway for introducing sustainable and health-focused pet food options.

Companies that can effectively navigate these markets and adapt their offerings to local tastes and preferences are likely to see significant returns.

Strategic Partnerships with Global Retailers

Forming strategic partnerships with large, global retailers can provide insect-based pet food companies with vast distribution networks and increased visibility. These collaborations can help overcome some of the barriers to entry into new regions and enhance brand recognition.

By aligning with retailers that are committed to sustainability and innovative products, companies can more effectively reach environmentally conscious consumers and capitalize on the growing trend of sustainable living.

Latest Trends

Rising Popularity of Hypoallergenic Pet Food Options

A notable trend in the pet food industry is the increasing demand for hypoallergenic options, with insect-based pet foods emerging as a leading choice. These products offer an alternative protein source that is less likely to cause allergic reactions in pets compared to traditional edible meats like chicken and beef.

As pet owners become more aware of their pets’ dietary sensitivities, the demand for such specialized products grows, positioning insect-based foods as a preferred choice for health-conscious consumers.

Integration of Functional Ingredients for Enhanced Nutrition

There is a growing trend towards incorporating functional ingredients into pet foods to enhance nutritional benefits. Insect-based pet foods are increasingly being fortified with superfoods and supplements such as omega fatty acids, probiotics, and antioxidants.

This integration aims to support overall pet health, targeting specific wellness issues like digestion, immunity, and coat condition. This trend not only makes these foods more appealing to pet owners looking for premium options but also enhances the perceived value and effectiveness of insect-based diets.

Sustainable and Eco-Friendly Product Claims

Sustainability is becoming a pivotal factor in consumer purchasing decisions, and this is reflected in the pet food market. Insect-based pet foods are gaining traction as eco-friendly alternatives to conventional pet food due to their lower environmental impact in terms of resource use, carbon footprint, and waste production.

Brands that effectively communicate these benefits through clear and credible eco-friendly claims are well-positioned to attract environmentally conscious consumers, making sustainability a significant trend in the industry’s growth.

Regional Analysis

In 2023, North America held 47.8% of the Insect-based Pet Food Market, valued at USD 2.2 billion.

In the global landscape, the Insect-based Pet Food Market is segmented into key regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. Dominating the market, North America holds a substantial 47.8% share, valued at USD 2.2 billion, reflecting the region’s advanced pet care ecosystem and heightened consumer awareness towards sustainable pet nutrition.

Europe follows closely, embracing sustainable practices with a strong focus on eco-friendly and innovative pet food solutions, driven by stringent EU regulations on pet food quality and safety. The market here is bolstered by high consumer willingness to adopt alternative proteins for pets.

The Asia Pacific region is experiencing rapid growth due to increasing pet ownership and rising awareness of pet health. The market is seeing a shift towards premiumization, with insect-based options viewed as high-quality alternatives to traditional pet foods.

Meanwhile, the Middle East & Africa, and Latin America regions, though smaller in market size, are emerging as potential growth areas. These regions benefit from urbanization and changing perceptions towards pet care, slowly adapting to more sustainable and health-conscious food choices for pets, setting the stage for future expansion in the insect-based pet food sector.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, the global Insect-based Pet Food market witnessed notable contributions from key companies, each playing a pivotal role in shaping industry trends and dynamics. Among these, Mars Incorporated and Nestlé S.A. stand out due to their expansive market reach and established brand presence.

These corporations have effectively utilized their extensive distribution networks to promote insect-based pet food as a viable and sustainable alternative, catering to a growing segment of eco-conscious consumers.

Innovafeed SAS and Ynsect (SAS), on the other hand, have specialized in optimizing the production and nutritional quality of insect protein, positioning themselves as leaders in the supply chain for high-quality insect-based ingredients. Their focus on sustainability and technological innovation in insect farming has set new standards for the industry, contributing to both environmental benefits and the circular economy.

Emerging players like Jiminy’s, LLC, and Protix have carved out niche markets by focusing on unique product offerings and marketing strategies that emphasize the health benefits of insect proteins for pets, such as hypoallergenic properties and high digestibility.

Bühler AG and Entobel Holdings PTE have excelled in advancing the processing technologies essential for expanding the insect-based pet food industry. Their innovations in processing equipment and techniques have enabled the production of more accessible and appealing pet food products.

Agri Protein Holdings Ltd and Beta Hatch reflect the entrepreneurial spirit driving the sector, with initiatives aimed at transforming organic waste into high-value protein for pet foods, thereby supporting sustainability.

These companies, through a combination of innovation, market penetration, and strategic marketing, continue to drive forward the insect-based pet food market, meeting the demands of an increasingly sophisticated consumer base looking for sustainable, healthy, and ethical products for their pets.

Top Key Players in the Market

- Agri Protein Holdings Ltd

- Beta Hatch

- Bühler AG

- Ennoble

- Enterra

- Endocycle

- Entobel Holdings PTE

- Healy Biotech

- Innova feed

- Innovafeed SAS

- Jiminy’s, LLC

- Mars Incorporated

- Nestlé S.A.

- Next Protein

- nextProtein SA

- Protix

- Purina

- Scout & Zoe’s

- Symply Pet Foods Limited

- Ynsect

- Ynsect (SAS)

Recent Developments

- In 2023, Beta Hatch opened North America’s largest regenerative mealworm hatchery in Washington State. This facility, leveraging waste heat from a co-located data center, transforms organic waste into valuable animal feed proteins and oils, significantly reducing energy use and smart greenhouse gas emissions by up to 80%, compared to traditional sources.

- In 2023, Bühler AG partnered with Agroloop to launch a plant in Hungary for producing sustainable black soldier fly larvae for pet food and other feeds. The facility, aiming to annually produce up to 25,000 tonnes of larvae by the end of 2024, underscores Bühler’s commitment to scalable, sustainable insect-based feed solutions.

Report Scope

Report Features Description Market Value (2023) USD 4.6 Billion Forecast Revenue (2033) USD 11.5 Billion CAGR (2024-2033) 9.6% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Nature (Organic, Monoprotein, Conventional), By Source (Crickets, Mealworms, Black Soldier Flies), By Product Type (Kibble/Dry, Dehydrated Food, Treats and Chews, Freeze-dried Raw, Wet Food, Frozen, Raw Food, Powder, Freeze-dried Food), By Pet Type (Cat, Dog, Birds, Others), By Food Type (Dry, Wet, Treats and Chews, Others), By Packaging Type (Pouches, Cans, Cartons, Others), By Distribution Channel (Hypermarkets/Supermarkets, Convenience Stores, Mom and Pop Stores, Online Retailers, Pet Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Agri Protein Holdings Ltd, Beta Hatch, Bühler AG, Ennoble, Enterra, Endocycle, Entobel Holdings PTE, Healy Biotech, Innova feed, Innovafeed SAS, Jiminy’s, LLC, Mars Incorporated, Nestlé S.A., Next Protein, nextProtein SA, Protix, Purina, Scout & Zoe’s, Symply Pet Foods Limited, Ynsect, Ynsect (SAS) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Insect-based Pet Food MarketPublished date: December 2024add_shopping_cartBuy Now get_appDownload Sample

Insect-based Pet Food MarketPublished date: December 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Agri Protein Holdings Ltd

- Beta Hatch

- Bühler AG

- Ennoble

- Enterra

- Endocycle

- Entobel Holdings PTE

- Healy Biotech

- Innova feed

- Innovafeed SAS

- Jiminy's, LLC

- Mars Incorporated

- Nestlé S.A.

- Next Protein

- nextProtein SA

- Protix

- Purina

- Scout & Zoe's

- Symply Pet Foods Limited

- Ynsect

- Ynsect (SAS)