Global Microparticulated Whey Protein Market By Type (Isolate, Concentrate, Hydrolysate), By Form (Powder, Liquid), Ву Туре (Food Grade, Pharma Grade), By Application (Ready-to-drink Beverages, Dairy Products, Nutritional Products, Pharmaceuticals, Cosmetics, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: December 2024

- Report ID: 134724

- Number of Pages: 320

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

The Global Microparticulated Whey Protein Market is expected to be worth around USD 462.6 Million by 2033, up from USD 218.3 Million in 2023, and grow at a CAGR of 7.8% from 2024 to 2033.

Microparticulated Whey Protein is a modified form of whey protein, produced by processing the protein particles to improve solubility, texture, and digestibility. This process enhances the protein’s functional properties, making it more versatile for use in various food and beverage applications, including dairy products, nutrition bars, and supplements.

The microparticulated Whey Protein Market is driven by increasing demand for high-protein, low-fat, and clean-label products in the food and beverage sector. As consumers seek healthier alternatives, the market is expanding rapidly.

Rising health consciousness, fitness trends, and demand for protein-rich products boost market growth. The demand is fueled by increased consumer preference for functional foods and sports nutrition. There’s a significant opportunity for innovation in product formulations and expansion in emerging markets.

The Microparticulated Whey Protein (MWP) market is experiencing significant growth, driven by increasing consumer demand for high-protein, low-fat, and functional food products. As the global health and wellness trend continues to influence dietary habits, MWP is emerging as a versatile ingredient that meets the growing need for protein-rich formulations across various sectors, including food and beverages, sports nutrition, and supplements.

The process of producing MWP typically involves optimizing production conditions, such as the application of 90°C temperature and 140 bar pressure, which enhance protein solubility, texture, and digestibility, making it ideal for a wide range of applications.

The ability to incorporate up to 15% protein content in a 2 kcal/ml solution expands the versatility of MWP in product formulations, positioning it as an ideal solution for manufacturers seeking to create high-protein, low-calorie foods and beverages. This innovation opens avenues for product differentiation, providing companies with a competitive edge in the market.

As consumer interest in clean-label and sustainable products rises, the market offers vast opportunities for companies investing in product innovation, with the potential for market expansion in emerging economies, where demand for protein supplements and functional foods is rapidly increasing.

Key Takeaways

- The Global Microparticulated Whey Protein Market is expected to be worth around USD 462.6 Million by 2033, up from USD 218.3 Million in 2023, and grow at a CAGR of 7.8% from 2024 to 2033.

- Microparticulated whey protein isolate holds a 46.4% share, favored for its purity.

- The powder form dominates with a 74.3% share, offering ease of use in formulations.

- Food-grade microparticulated whey protein accounts for 68.5%, meeting safety standards for consumable products.

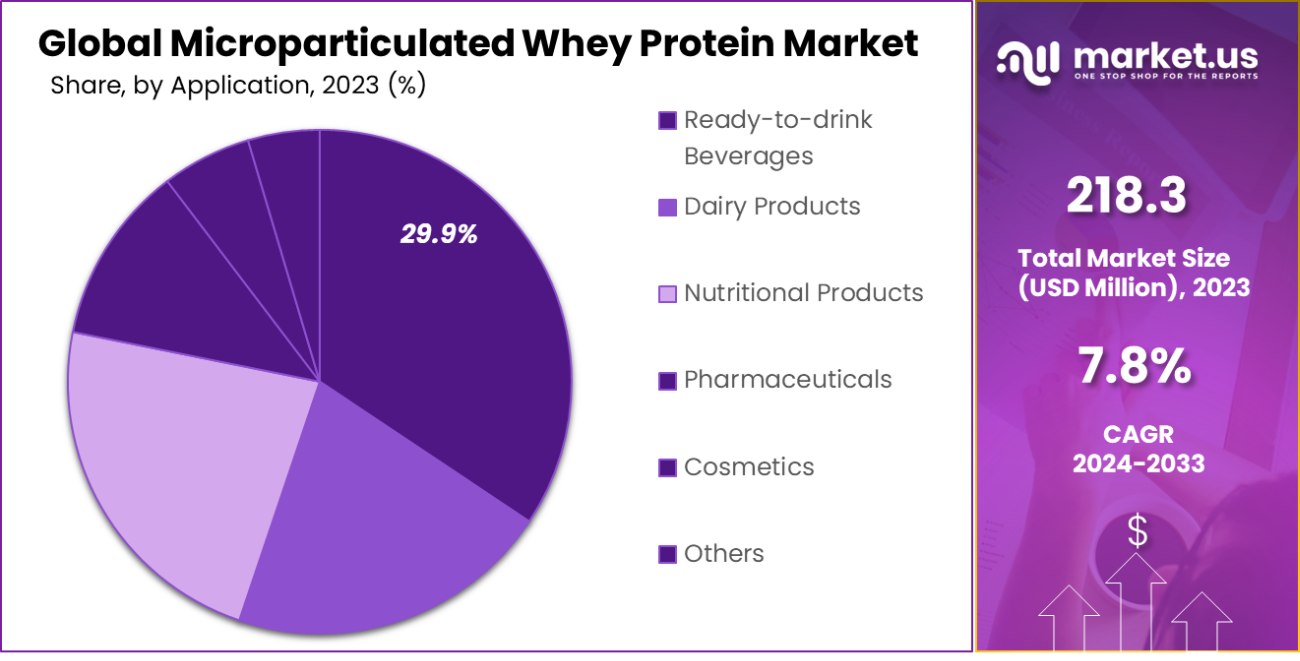

- Ready-to-drink beverages capture 29.9%, reflecting the growing demand for protein-enriched, on-the-go solutions.

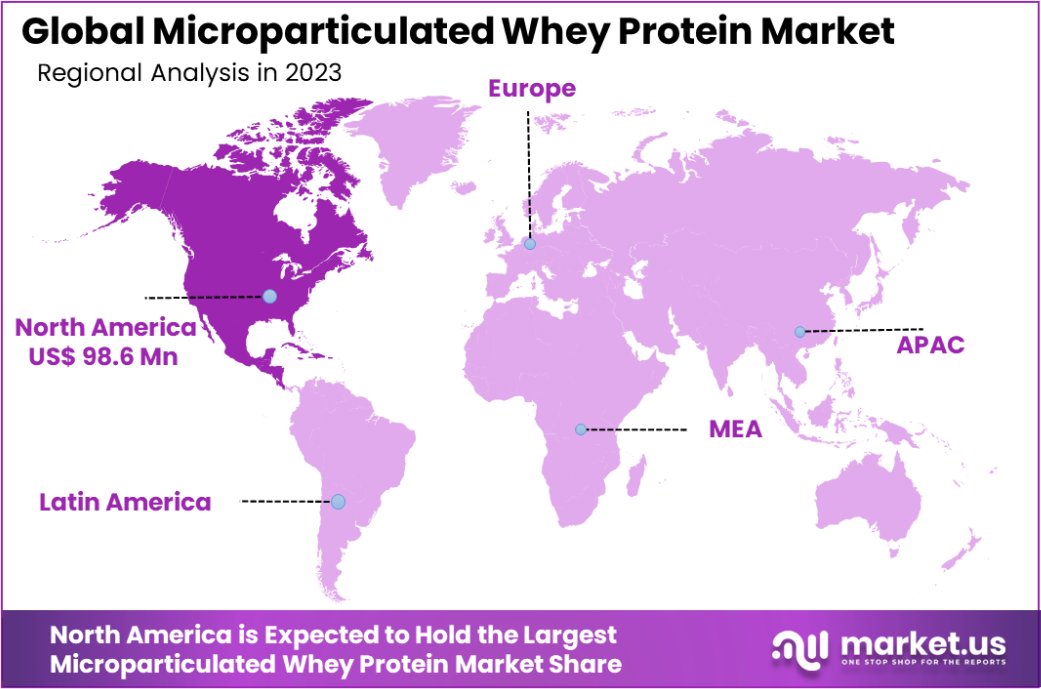

- In North America, the microparticulated whey protein market is valued at USD 98.6 million, comprising 45.4%.

By Type Analysis

Microparticulated Whey Protein Isolate holds a dominant share of 46.4% in the market.

In 2023, Isolate held a dominant market position in the By Type segment of the Microparticulated Whey Protein market, with a 46.4% share. This form of whey protein is preferred due to its high protein content and minimal fat and carbohydrate levels, making it a popular choice in the sports nutrition, health supplements, and functional food industries.

Concentrate, on the other hand, also holds a significant share but is typically used in applications where a lower protein percentage is acceptable, offering a cost-effective alternative. Hydrolysate is gaining traction as it offers improved digestibility and faster absorption, particularly in specialized formulations for post-workout recovery or infant nutrition.

However, its share remains smaller compared to Isolate and Concentrate due to its relatively higher production costs. In the By Type segment, the preference for Isolate is driven by the increasing consumer demand for high-protein, low-carb products, particularly among fitness enthusiasts and athletes.

This demand is expected to fuel sustained growth in the Isolate category in the coming years. While Concentrate remains a staple in cost-sensitive applications, the market for Hydrolysate is gradually expanding due to the growing need for specialized, high-performance protein products.

By Form Analysis

The powdered form of Microparticulated Whey Protein leads with a significant share of 74.3%.

In 2023, Powder held a dominant market position in the By Form segment of the Microparticulated Whey Protein market, with a 74.3% share.

The powdered form of Microparticulated Whey Protein remains the preferred choice due to its long shelf life, ease of storage, and versatility in various applications, including food and beverages, sports nutrition, and supplements.

Powdered whey protein is highly valued for its convenience and stability, making it the go-to option for manufacturers in the health and wellness industry. Liquid forms, while accounting for a smaller share, are gaining traction in ready-to-drink (RTD) applications, where convenience and immediate consumption are key factors.

The liquid segment is particularly popular in the production of functional beverages, protein shakes, and sports drinks, where fluid consistency and easy consumption are essential. As consumer demand for on-the-go nutrition continues to rise, the liquid form of Microparticulated Whey Protein is expected to see steady growth.

The dominance of powdered whey protein can be attributed to its extensive use in the formulation of protein bars, snacks, and powdered beverages. However, the increasing demand for RTD and functional beverages presents an opportunity for the liquid form to gain market share, particularly in the growing health-conscious and fitness-driven consumer segments.

By Type Analysis

Food-grade Microparticulated Whey Protein comprises 68.5% of the total market, highlighting its broad use.

In 2023, Food Grade held a dominant market position in the By Type segment of the Microparticulated Whey Protein market, with a 68.5% share. Food-grade Microparticulated Whey Protein is primarily used in a wide range of applications, including functional foods, beverages, snacks, and dietary supplements, making it the most sought-after form in the market.

The increasing demand for clean-label, high-protein food products, driven by rising health consciousness among consumers, continues to drive the growth of this segment. Food-grade proteins are designed to meet the stringent safety standards required for consumption and are favored for their versatility in formulating protein-enriched food products.

Pharma Grade, while holding a smaller share, is gaining importance in specialized applications such as nutraceuticals, pharmaceutical formulations, and medical nutrition. Pharma-grade Microparticulated Whey Protein is typically used in the development of therapeutic products, offering benefits such as faster digestion and higher bioavailability.

The growth of the aging population, increasing prevalence of chronic health conditions, and rising demand for personalized nutrition are factors contributing to the expanding use of pharma-grade proteins in medical and healthcare applications.

The dominance of Food Grade protein in 2023 is largely driven by the broader consumer base and its adoption in mainstream food and beverage industries. However, the Pharma Grade segment presents significant growth opportunities, especially in the growing medical nutrition sector.

By Application Analysis

Ready-to-drink beverages account for 29.9% of Microparticulated Whey Protein’s market application, reflecting growing demand.

In 2023, Ready-to-drink Beverages held a dominant market position in the By Application segment of the Microparticulated Whey Protein market, with a 29.9% share. The growing consumer demand for convenient, on-the-go protein-enriched beverages, such as protein shakes and sports drinks, has fueled the strong performance of this application.

Microparticulated Whey Protein is favored in the ready-to-drink segment due to its excellent solubility, digestibility, and ability to enhance the nutritional profile of beverages without compromising taste or texture. The increasing popularity of fitness, health, and wellness trends is expected to further propel growth in this category.

Dairy Products, which include yogurt, milk drinks, and other dairy-based protein products, also hold a significant share of the market. As consumers seek higher protein content in dairy, Microparticulated Whey Protein is increasingly used to improve the nutritional quality and texture of these products.

Nutritional Products are another key segment, driven by the rising demand for protein supplements in the form of powders, bars, and functional foods. Microparticulated Whey Protein is ideal for these products due to its high protein content and digestibility.

Pharmaceuticals and Cosmetics are smaller but growing segments, where microparticulated Whey Protein is used in medical nutrition and skin-care formulations due to its beneficial amino acid profile and bioactive properties.

Key Market Segments

By Type

- Isolate

- Concentrate

- Hydrolysate

By Form

- Powder

- Liquid

Ву Туре

- Food Grade

- Pharma Grade

By Application

- Ready-to-drink Beverages

- Dairy Products

- Nutritional Products

- Pharmaceuticals

- Cosmetics

- Others

Driving Factors

Increasing Demand for High-Protein, Functional Foods

The growing trend toward health and wellness is driving the demand for high-protein foods and beverages. Consumers are more conscious about their protein intake for muscle building, weight management, and overall health. This trend is fueling the adoption of Microparticulated Whey Protein, which provides a high-quality protein source with excellent solubility and digestibility.

As consumers shift toward protein-enriched, clean-label products, Microparticulated Whey Protein is becoming a preferred ingredient in ready-to-drink beverages, nutritional products, and snacks, supporting market growth.

Increasing Demand for High-Protein, Functional Foods

The growing trend toward health and wellness is driving the demand for high-protein foods and beverages. Consumers are more conscious about their protein intake for muscle building, weight management, and overall health. This trend is fueling the adoption of Microparticulated Whey Protein, which provides a high-quality protein source with excellent solubility and digestibility.

As consumers shift toward protein-enriched, clean-label products, Microparticulated Whey Protein is becoming a preferred ingredient in ready-to-drink beverages, nutritional products, and snacks, supporting market growth.

Popularity of Sports Nutrition and Fitness Products

The increasing popularity of sports nutrition products is another key factor driving the Microparticulated Whey Protein market. Athletes and fitness enthusiasts are increasingly incorporating protein-rich products to aid muscle recovery, boost performance, and improve overall health.

Microparticulated Whey Protein, known for its rapid digestion and high bioavailability, is highly favored in post-workout supplements, protein shakes, and energy bars. As fitness culture grows worldwide, the demand for high-quality, functional protein ingredients like Microparticulated Whey Protein is expected to continue rising.

Restraining Factors

High Production Costs and Limited Cost-Effectiveness

One of the primary restraining factors for the Microparticulated Whey Protein market is its relatively high production cost. The process of microparticulating whey protein involves specialized equipment and precise conditions, such as high pressure and temperature, which can increase manufacturing expenses.

This makes the product less cost-effective compared to other protein sources like soy or pea protein. For companies operating in price-sensitive markets, the higher cost of Microparticulated Whey Protein could limit its adoption, especially in low-margin products like protein bars or beverages.

Limited Consumer Awareness and Education

Despite its growing popularity, many consumers are still unaware of the benefits and applications of Microparticulated Whey Protein. Educating the public about its advantages, such as improved solubility, digestibility, and high-quality protein content, is essential for expanding market demand.

The lack of awareness can limit the product’s reach, especially in emerging markets where consumers may not fully understand its nutritional benefits compared to traditional whey protein or other plant-based alternatives. Companies must invest in awareness campaigns to overcome this barrier.

Regulatory Challenges and Compliance Requirements

The Microparticulated Whey Protein market faces regulatory challenges, especially in regions with stringent food safety and ingredient regulations. These regulations can vary across countries and often require manufacturers to meet specific standards related to product labeling, composition, and testing.

Compliance with these regulations adds to the operational costs and can slow down product innovation or entry into new markets. Furthermore, the need to obtain approval from health authorities for specific applications, such as pharmaceuticals or medical nutrition, could limit the market’s growth potential.

Growth Opportunity

Expanding Fitness and Wellness Trends Boost Demand

The rising awareness and participation in fitness and wellness activities globally can be directly linked to the increased demand for microparticulated whey protein. As consumers become more health-conscious, they seek high-quality, protein-rich supplements that aid in muscle repair and overall health enhancement.

Microparticulated whey protein, known for its high digestibility and reduced allergenic potential, meets these needs effectively. This shift towards health and wellness lifestyles presents a significant growth opportunity for market players, who can capitalize on this trend by developing tailored protein formulations that appeal to health-focused consumers.

Innovation in Food and Beverage Applications

There is a notable growth opportunity in the innovation of food and beverage products incorporating microparticulated whey protein. This protein variant is especially advantageous due to its ability to enhance texture and nutritional content without impacting taste or appearance, making it ideal for use in a wide range of consumer products.

By integrating microparticulate whey protein into products like smoothies, baked goods, and snacks, manufacturers can cater to the increasing consumer demand for protein-enriched, healthier food options. This development can significantly expand market reach and consumer base.

Expansion into Plant-based and Alternative Markets

The expansion into plant-based and alternative product markets represents a lucrative growth opportunity for the microparticulated whey protein sector. As consumer preferences shift towards plant-based and lactose-free diets, there is a growing niche for microparticulated whey protein in hybrid products that combine plant and dairy proteins.

Such innovations can attract a broader audience, including those with dietary restrictions or preferences for plant-based products, while still providing the functional benefits of whey protein. Leveraging this trend can help manufacturers diversify their offerings and tap into new market segments.

Latest Trends

Enhanced Focus on Clean Label and Natural Ingredients

The microparticulated whey protein market is experiencing a significant trend towards clean label and naturally sourced ingredients. Consumers are increasingly prioritizing transparency in the sourcing and processing of dietary supplements, including whey protein.

This trend has encouraged manufacturers to adopt practices that ensure their products are free from synthetic additives and are processed using natural methods. As a result, products that can advertise ‘natural’ and ‘clean label’ claims are gaining a competitive edge, reflecting a shift in consumer preferences towards health and sustainability.

Technological Advancements in Protein Microparticulation

Recent technological advancements in the field of protein processing have led to improved methods of microparticulation, enhancing the solubility, taste, and texture of whey protein products. These innovations are crucial as they address previous consumer complaints about the graininess and flavor of whey protein supplements.

Improved technology not only enhances the consumer experience but also broadens the application of microparticulated whey protein in various food and beverage products, driving market growth by appealing to a wider audience with enhanced product qualities.

Rising Popularity of Functional and Fortified Foods

There is a growing trend in the consumption of functional and fortified foods, which is positively impacting the microparticulated whey protein market. Consumers are looking for foods that provide additional health benefits beyond basic nutrition, such as immune support, weight management, and enhanced metabolic health.

Microparticulated whey protein is an excellent ingredient for fortification due to its high protein content and essential amino acids. This has led to its increased incorporation in everyday food items, promoting dietary supplements in convenient and familiar formats, thereby meeting the nutritional demands of a diverse consumer base.

Regional Analysis

In North America, the microparticulated whey protein market holds a 45.4% share, valued at USD 98.6 million.

The global microparticulated whey protein market is segmented into several key regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America, each displaying distinct market dynamics and growth opportunities.

North America dominates the market with a significant 45.4% share, valued at USD 98.6 million. This region’s leadership can be attributed to a robust wellness culture, advanced food processing technologies, and high consumer awareness regarding dietary supplements. Europe follows, driven by increasing health consciousness and demand for high-protein diet components, especially among aging populations seeking to maintain muscle mass and overall health.

Asia Pacific is witnessing rapid growth due to rising incomes, urbanization, and the expansion of the middle class, which is more inclined towards health and wellness products, including protein-enriched foods. This region offers substantial growth opportunities due to its large population and increasing health awareness.

The Middle East & Africa, though a smaller market segment, is gradually expanding. This growth is fueled by improving economic conditions and a young population increasingly adopting Western dietary habits.

Latin America is also showing promising growth, spurred by improving health awareness and economic stability, which are increasing the consumption of dietary supplements and functional foods.

Overall, while North America currently leads the microparticulated whey protein market, Asia Pacific regions are expected to exhibit significant growth, making them key areas to watch for future developments.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, the global microparticulated whey protein market is significantly shaped by the strategic activities of key companies such as Arla Foods Ingredients, Carbery, CP Kelco, and others. Each company brings unique strengths and strategies to the forefront, influencing market dynamics.

Arla Foods Ingredients stands out with its commitment to innovation and sustainability in whey protein solutions. The company has consistently invested in advanced processing technologies to enhance the nutritional profile and functional benefits of its whey products, making it a leader in the market.

Carbery is renowned for its focus on flavor and texture improvements, which is crucial for consumer acceptance of whey protein in various applications. Their expertise in flavor technology helps in masking the typical off-flavors of whey, thereby broadening its use across different food and beverage sectors.

CP Kelco, with its strong portfolio in specialty ingredients, leverages its capabilities in texture and stabilization to enhance the appeal of whey protein-fortified products, addressing consumer demand for both taste and health.

Fonterra Future Dairy Private Limited capitalizes on its robust dairy industry background, innovating in ways that enhance the protein content without compromising on taste or texture, particularly in the growing Asia Pacific market.

FrieslandCampina Ingredients and Leprino Foods are notable for their strategic geographic expansions and capacity enhancements, aiming to meet the growing global demand efficiently.

Makers Nutrition, LLC, MILEI GmbH, and others like Sooro Renner and NMZP focus on niche markets, offering specialized products that cater to specific consumer needs, from infant nutrition to sports nutrition.

Lastly, entities like Nutra Solutions, Sure Protein WPC550 (NZMP), and The Good Scents Company are key players due to their innovative approaches to product development and marketing, targeting emerging trends in natural and clean-label products.

Overall, these companies’ strategies not only drive their growth but also contribute to the overall expansion and evolution of the microparticulated whey protein market in 2023.

Top Key Players in the Market

- Arla Foods Ingredients

- Carbery

- CP Kelco

- Fonterra Future Dairy Private Limited

- FrieslandCampina Ingredients

- Leprino Foods

- Makers Nutrition, LLC

- MILEI GmbH

- NMZP

- Nutra Solutions

- Sooro Renner

- Sure Protein WPC550 (NZMP)

- The Good Scents Company

Recent Developments

- In September 2024, Arla Foods Ingredients launched its “Go High in Protein” campaign, introducing the Nutrilac ProteinBoost range, a patented microparticulated whey protein designed to meet consumer demands for high-quality protein in dairy products. The campaign highlights five innovative product concepts, including a 10% protein ice cream and a high-protein spoonable yogurt, to showcase their technical solutions in overcoming challenges related to taste and texture in high-protein dairy products.

- In July 2024, Leprino Foods, a major player in dairy products, entered into a significant partnership with Fooditive Group. This collaboration focuses on the commercialization of a revolutionary non-animal casein protein using precision fermentation technology, marking a notable advancement in sustainable food production.

Report Scope

Report Features Description Market Value (2023) USD 218.3 Million Forecast Revenue (2033) USD 462.6 Million CAGR (2024-2033) 7.8% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Isolate, Concentrate, Hydrolysate), By Form (Powder, Liquid), Ву Туре (Food Grade, Pharma Grade), By Application (Ready-to-drink Beverages, Dairy Products, Nutritional Products, Pharmaceuticals, Cosmetics, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Arla Foods Ingredients, Carbery, CP Kelco, Fonterra Future Dairy Private Limited, FrieslandCampina Ingredients, Leprino Foods, Makers Nutrition, LLC, MILEI GmbH, NMZP, Nutra Solutions, Sooro Renner, Sure Protein WPC550 (NZMP), The Good Scents Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Microparticulated Whey Protein MarketPublished date: December 2024add_shopping_cartBuy Now get_appDownload Sample

Microparticulated Whey Protein MarketPublished date: December 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Arla Foods Ingredients

- Carbery

- CP Kelco

- Fonterra Future Dairy Private Limited

- FrieslandCampina Ingredients

- Leprino Foods

- Makers Nutrition, LLC

- MILEI GmbH

- NMZP

- Nutra Solutions

- Sooro Renner

- Sure Protein WPC550 (NZMP)

- The Good Scents Company