Global Chlorothalonil Market By Type (98% Chlorothalonil, 96% Chlorothalonil, 90% Chlorothalonil), By Product (Suspending Powder, Wettable Powder, Granules, Others), By Crop Type (Cereals and Grains, Oilseeds and Pulses, Turfs and Ornamentals, Vegetables and Fruits, Others), By Target Pest (Leaf Spot Diseases, Powdery Mildew, Botrytis, Rhizoctonia, Fusarium), By End-Use (Commercial, Residential, Industrial) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 132983

- Number of Pages: 259

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

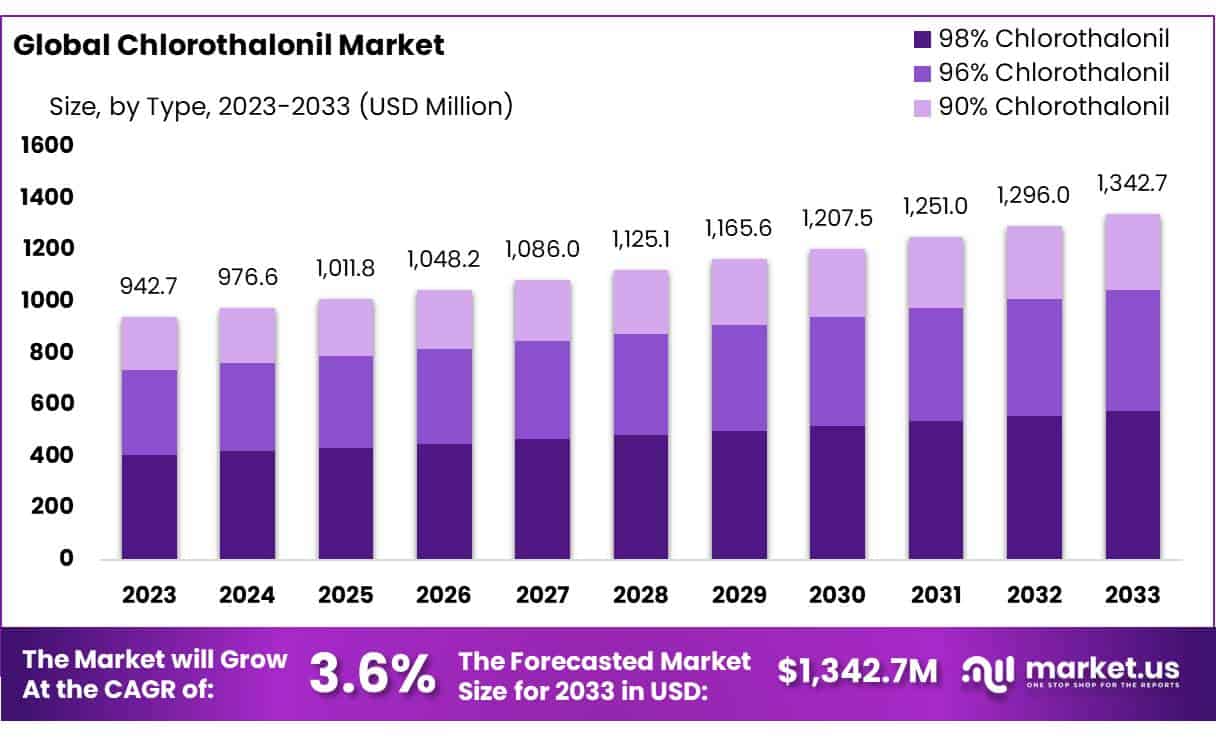

The Global Chlorothalonil Market size is expected to be worth around USD 1342.7 Mn by 2033, from USD 942.7 Mn in 2023, growing at a CAGR of 3.6% during the forecast period from 2024 to 2033.

Chlorothalonil, a widely used broad-spectrum fungicide, plays a critical role in protecting crops from fungal diseases. It is primarily used in agricultural applications for the protection of fruits, vegetables, and cereals. In 2023, the global demand for chlorothalonil was driven by the growing need for effective crop protection amidst increasing concerns over food security.

According to the Food and Agriculture Organization (FAO), global agricultural production reached an estimated value of USD 3.5 trillion in 2023, with fungicides like chlorothalonil being a key element in maintaining crop yield.

Government regulations around pesticide use are significantly shaping the chlorothalonil market. The European Union has imposed strict regulations under the EU Pesticides Regulation (EC) No 1107/2009, requiring the re-evaluation of chlorothalonil for use in agriculture. In 2020, the European Commission decided not to renew its approval for chlorothalonil due to health concerns, especially its carcinogenic potential.

Several European countries have moved towards restricting its use, directly impacting demand in the region. On the other hand, countries like the United States and China continue to approve its use, with the U.S. Environmental Protection Agency (EPA) setting strict limits on its application in agricultural processes.

From an investment perspective, the chlorothalonil market has seen varying trends. In 2023, USD 1.2 billion was allocated to research and development in the agrochemical sector, with a portion directed toward improving fungicide formulations like chlorothalonil.

Furthermore, in the context of global trade, the export of chlorothalonil from manufacturing hubs such as China and India accounted for USD 150 million in 2023. This shows the continued reliance on chlorothalonil in markets outside the EU, especially in Asia-Pacific and Latin America, where regulatory frameworks remain more favorable for its use.

Key Takeaways

- Chlorothalonil Market size is expected to be worth around USD 1342.7 Mn by 2033, from USD 942.7 Mn in 2023, growing at a CAGR of 3.6%.

- 98% Chlorothalonil held a dominant market position, capturing more than a 43.2% share.

- Suspending Powder held a dominant market position, capturing more than a 34.4% share.

- Cereals & Grains held a dominant market position, capturing more than a 34.7% share.

- Leaf Spot Diseases held a dominant market position, capturing more than a 34.5% share.

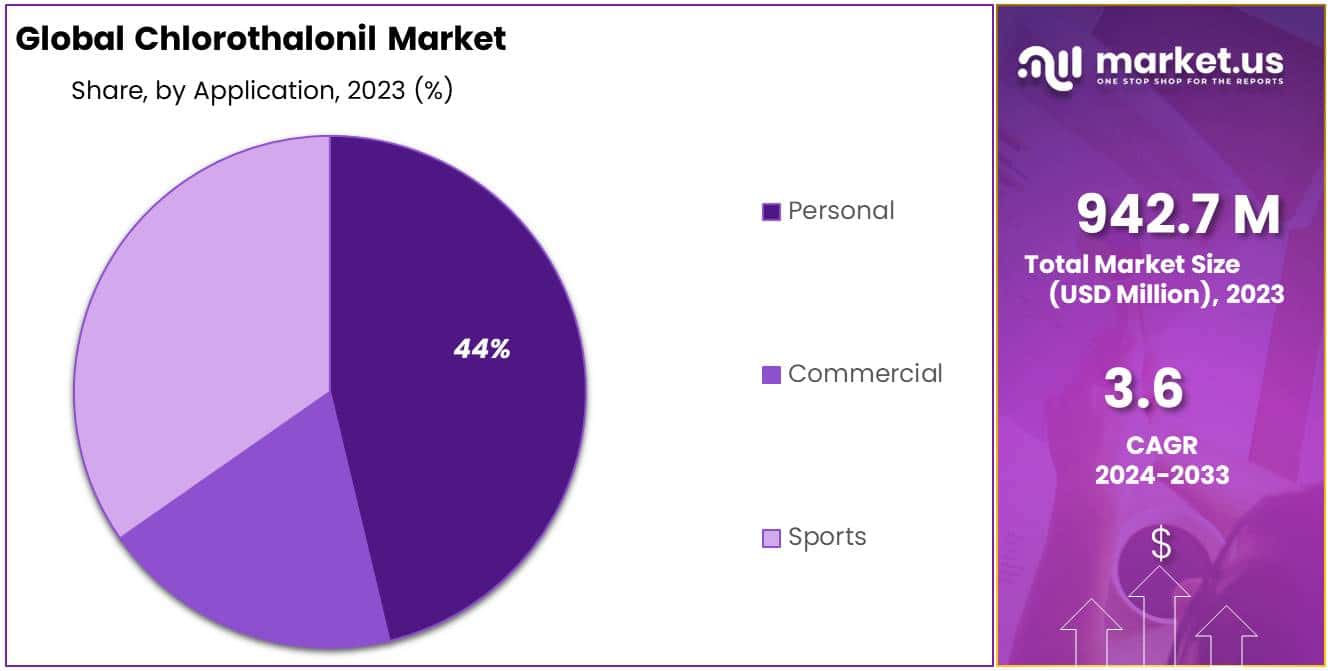

- Commercial held a dominant market position, capturing more than a 62.3% share.

- Asia Pacific (APAC) region dominated the Chlorothalonil market, capturing more than 45.6%

By Type

In 2023, 98% Chlorothalonil held a dominant market position, capturing more than a 43.2% share. This high-purity formulation is preferred for its effectiveness in controlling a broad spectrum of fungal diseases across various crops. The demand for 98% Chlorothalonil is primarily driven by its extensive use in agriculture, particularly in regions with high incidences of fungal infections.

The 96% Chlorothalonil segment also plays a significant role in the market, favored for its cost-effectiveness and wide availability. In agricultural applications, this variant is utilized when slightly lower purity levels are acceptable, balancing cost and performance. Its market presence is reinforced by its adoption in both developed and emerging regions, where it supports sustainable agricultural practices.

The 90% Chlorothalonil segment, while smaller, addresses specific market needs where lower concentrations are sufficient or desired. This formulation is often selected for its lower environmental impact and reduced chemical usage, making it suitable for integrated pest management programs. It caters to a niche but important segment of consumers focused on environmental sustainability and regulatory compliance.

By Product

In 2023, Suspending Powder held a dominant market position, capturing more than a 34.4% share. This product type is highly valued for its ease of application and effective dispersion properties, which enhance the absorption of chlorothalonil on plant surfaces. It is especially popular in intensive agricultural practices where precise and uniform application is critical to disease management.

Wettable Powder follows closely, appreciated for its storage stability and versatility in various climatic conditions. This formulation is commonly used by farmers who require a reliable product that can be easily mixed with water and applied uniformly across crops. The adaptability of Wettable Powder to different application technologies boosts its adoption in both small-scale and commercial farming operations.

Granules are favored in scenarios where controlled-release of the active ingredient is necessary. This segment appeals to sectors seeking minimal drift during application, targeting the product directly to the soil or base of the plants. The use of Granules is particularly prevalent in row crops and orchards, where precision and long-term effectiveness are paramount.

By Crop Type

In 2023, Cereals & Grains held a dominant market position, capturing more than a 34.7% share. This segment benefits from the widespread application of chlorothalonil to manage fungal diseases and increase yield stability. The extensive cultivation of cereals and grains worldwide necessitates robust disease control measures, which drives demand for effective fungicides such as chlorothalonil.

Oilseeds & Pulses also represent a significant segment, leveraging chlorothalonil to protect crops against a variety of pathogens. This segment’s reliance on chlorothalonil stems from the need to ensure crop safety and quality, which are critical for meeting global food supply demands. The product’s efficacy in managing disease outbreaks in oilseeds and pulses supports its steady market share.

Turfs & Ornamentals are another key area of application for chlorothalonil, where it is used to maintain the aesthetic and health of ornamental plants and turf grasses. These applications are crucial in commercial landscaping and recreational areas, driving the continuous demand for chlorothalonil in this segment.

Vegetables & Fruits, with their high susceptibility to fungal infections, rely heavily on chlorothalonil for crop protection. The effectiveness of chlorothalonil in controlling a wide range of fungal diseases makes it a preferred choice for farmers aiming to reduce crop losses and ensure food quality.

By Target Pest

In 2023, Leaf Spot Diseases held a dominant market position, capturing more than a 34.5% share. This segment benefits significantly from chlorothalonil applications due to the prevalence of leaf spot diseases in a wide array of crops. Effective management of these diseases is critical for maintaining the health and productivity of crops, underscoring the demand for chlorothalonil in this segment.

Powdery Mildew is another major target for chlorothalonil usage. This fungal disease affects a broad range of plants, and controlling it is essential for ensuring the quality and yield of crops. Chlorothalonil’s ability to inhibit fungal growth makes it a staple in strategies aimed at mitigating the impact of powdery mildew in agricultural and horticultural sectors.

Botrytis, known for causing gray mold, represents a significant application area for chlorothalonil, particularly in environments with high humidity. Its use in vineyards, greenhouses, and orchards is crucial for protecting blossoms and fruits from decay, which can lead to substantial economic losses.

Rhizoctonia, targeting the roots and base of plants, requires targeted fungicidal action, for which chlorothalonil is often utilized. This pest is particularly destructive to seedlings and young plants, making early and effective treatment necessary to safeguard crop establishment and soil health.

Fusarium, associated with a range of diseases including wilts and rots, poses a serious threat to crops globally. Chlorothalonil plays a vital role in the integrated pest management strategies against Fusarium species, helping to maintain the structural integrity and viability of affected plants.

By End-Use

In 2023, Commercial held a dominant market position, capturing more than a 62.3% share. This segment predominantly includes agricultural applications where chlorothalonil is utilized on a large scale to protect crops from fungal diseases, ensuring productivity and profitability. The high share reflects the critical reliance on this fungicide in commercial farming operations to meet global food supply demands.

Residential use of chlorothalonil, although smaller in scale compared to commercial applications, is significant in maintaining the health of home gardens and lawns. Homeowners use chlorothalonil to combat various fungal diseases, promoting the aesthetic and health of their plantings. This segment benefits from the availability of consumer-friendly formulations that are easy to use and effective.

Industrial use of chlorothalonil includes its application in settings such as golf courses, public parks, and corporate landscapes. In these environments, the need for disease control is high to maintain the visual and functional quality of the turf and ornamentals. Chlorothalonil’s effectiveness in preventing fungal outbreaks is essential for preserving the landscaping investments of these properties.

Key Market Segments

By Type

- 98% Chlorothalonil

- 96% Chlorothalonil

- 90% Chlorothalonil

By Product

- Suspending Powder

- Wettable Powder

- Granules

- Others

By Crop Type

- Cereals & Grains

- Oilseeds & Pulses

- Turfs & Ornamentals

- Vegetables & Fruits

- Others

By Target Pest

- Leaf Spot Diseases

- Powdery Mildew

- Botrytis

- Rhizoctonia

- Fusarium

By End-Use

- Commercial

- Residential

- Industrial

Driving Factors

Growing Demand for Agricultural Productivity

One of the primary drivers for the Chlorothalonil market is the increasing need for agricultural productivity. As global populations continue to rise, there is a significant demand for effective crop protection solutions to ensure high crop yields and minimize losses due to fungal diseases. The effectiveness of Chlorothalonil in controlling a wide range of fungal infections makes it a preferred choice among farmers globally

Advancements in Formulation Technology

Innovation in product formulations, particularly in wettable powders and emulsifiable concentrates, has also propelled the market growth. These advancements enhance the application effectiveness and safety profile of Chlorothalonil, making it suitable for a broader range of crops and conditions. This adaptability helps meet the diverse needs of modern agriculture

Regulatory Approvals and Support

Despite some regional restrictions, Chlorothalonil continues to receive support from various regulatory bodies in key markets, which recognize its efficacy and economic benefits in agriculture. For instance, the partial renewal of approval for Chlorothalonil in the European Union, albeit with stricter conditions, indicates a controlled yet significant use within specified parameters. Such regulatory landscapes provide a stable environment for the continued use and development of Chlorothalonil formulations

Economic Impact and Market Growth

The economic benefits provided by Chlorothalonil, including its cost-effectiveness and the substantial return on investment through increased crop yields, further drive its adoption.

Restraining Factors

Stringent Regulatory Environment

One of the most significant challenges impacting the Chlorothalonil market is the increasingly stringent regulatory landscape. In regions such as the European Union, restrictions and outright bans have been imposed due to concerns over Chlorothalonil’s potential risks to human health and the environment. These regulatory measures have resulted in decreased demand and have compelled companies to seek alternative solutions or reformulate existing products to comply with new standards.

Environmental and Health Concerns

Chlorothalonil has been associated with various environmental and health risks, including its persistence in soil and water and its potential toxic effects on aquatic life. These concerns have not only affected its popularity among end-users but have also influenced public perception and regulatory policies. The recognition of Chlorothalonil as a potential carcinogen further exacerbates the situation, leading to increased scrutiny and hesitance in its application

Competition from Biopesticides

The rise of biopesticides and other environmentally friendly alternatives poses a considerable threat to the traditional fungicide market, including Chlorothalonil. These products, which are often perceived as safer and more sustainable, are becoming increasingly popular, particularly in developed regions where there is a strong push for organic and residue-free agricultural produce. The shift towards integrated pest management practices, which emphasize minimal chemical use, is another factor driving the preference for alternatives over conventional chemical fungicides like Chlorothalonil.

Market Shifts and Consumer Preferences

Growing consumer awareness about the impacts of chemical pesticides on health and the environment is leading to a shift towards sustainable farming practices. This shift influences market dynamics by reducing the demand for traditional chemical solutions like Chlorothalonil in favor of greener alternatives. As the market evolves, Chlorothalonil producers are faced with the dual challenge of innovating safer, more effective products while contending with the broadening spectrum of competitive products that cater to the new consumer ethos

Growth Opportunity

Expansion in Developing Markets

The Chlorothalonil market is witnessing a significant opportunity for growth in developing regions, especially in Asia Pacific. This region is experiencing a rapid increase in agricultural activities due to a growing population and the need for substantial crop protection. The demand for effective disease control solutions is high in countries with tropical and subtropical climates, which are prone to a variety of fungal diseases affecting crops such as rice, wheat, sugarcane, and various fruits and vegetables. Government initiatives promoting agricultural productivity are also bolstering the market growth in these areas.

Innovations in Product Formulation

There is a growing opportunity in the development of new formulations of Chlorothalonil that meet stringent regulatory standards and consumer demand for more environmentally friendly products. The wettable powder formulation of Chlorothalonil, for instance, remains a market leader due to its ease of use, storage stability, and effectiveness. Innovations that enhance these formulations’ efficiency and reduce their environmental impact are crucial in maintaining and expanding market presence, especially in regions with strict pesticide residue regulations.

Integration with Sustainable Agricultural Practices

As global awareness and regulatory frameworks lean towards sustainable agriculture, Chlorothalonil’s role in integrated pest management (IPM) strategies presents a significant growth avenue. The product’s compatibility with other agrochemicals and its efficacy in low doses make it suitable for sustainable farming practices, which aim to balance crop protection with environmental health. This compatibility is crucial for meeting both the immediate needs of effective disease control and the long-term goals of sustainable agricultural practices.

Regulatory Re-approvals and Market Adaptations

While regulatory challenges exist, the partial renewal of approvals in regions like the European Union, under more controlled use conditions, presents an opportunity for the Chlorothalonil market to adapt and continue its presence in these markets. Companies are encouraged to innovate and reformulate products to meet these new standards, which could allow them to maintain a foothold in lucrative markets despite previous restrictions.

Latest Trends

Rising Demand for Sustainable Crop Protection

One of the most notable trends in the Chlorothalonil market is the increasing shift toward sustainable agricultural practices. With rising consumer demand for organic and low-residue food, there is an increased focus on reducing the use of chemical pesticides while still ensuring high crop yields. Chlorothalonil, being effective in low doses and with relatively low toxicity to non-target organisms, fits into the broader trend of Integrated Pest Management (IPM).

Governments across the globe are supporting these practices, with initiatives aimed at reducing pesticide residues in food. For example, the U.S. Environmental Protection Agency (EPA) continues to implement guidelines promoting safer and more sustainable pesticide use, aligning with the broader industry push for eco-friendly solutions

Shift Toward Bio-Based Alternatives and Integrated Pest Management (IPM)

While Chlorothalonil is still widely used, there is a clear trend toward the use of biopesticides and natural alternatives to reduce dependency on synthetic chemicals. This is part of a global push toward sustainability. Biopesticides, often derived from plant-based sources or naturally occurring organisms, are gaining market share, particularly in regions with strict pesticide regulations like the EU.

However, Chlorothalonil remains crucial in many regions due to its broad-spectrum efficacy against fungal diseases, particularly in high-value crops like fruits and vegetables. According to industry data, the global biopesticides market is expected to grow at a CAGR of 14.8%, signaling increasing competition for conventional chemicals like Chlorothalonil

Technological Advancements in Formulation Another emerging trend is the development of advanced formulations that improve the efficiency and environmental compatibility of Chlorothalonil. Innovations in formulation, such as controlled-release products and microencapsulated versions, are designed to reduce the environmental impact and enhance the precision of application.

This trend aligns with the growing demand for agricultural products that are not only effective but also reduce runoff and exposure to non-target species. The Wettable Powder (WP) form of Chlorothalonil, for example, remains dominant in the market, accounting for more than 54% of global sales, due to its ease of use and stable performance across diverse weather conditions.

Growing Focus on Regulatory Compliance

As environmental concerns increase, stricter regulations around pesticide use continue to shape the Chlorothalonil market. Several countries, especially in Europe, are imposing limits on pesticide residues in food products, which impacts the adoption of Chlorothalonil.

However, Chlorothalonil’s relatively low toxicity and efficacy in lower doses help meet these regulatory requirements, allowing it to remain a staple in crop protection. Governments and agricultural bodies, such as the European Food Safety Authority (EFSA), are pushing for greater transparency and safety in pesticide use, which benefits Chlorothalonil formulations that comply with these updated standards

Regional Analysis

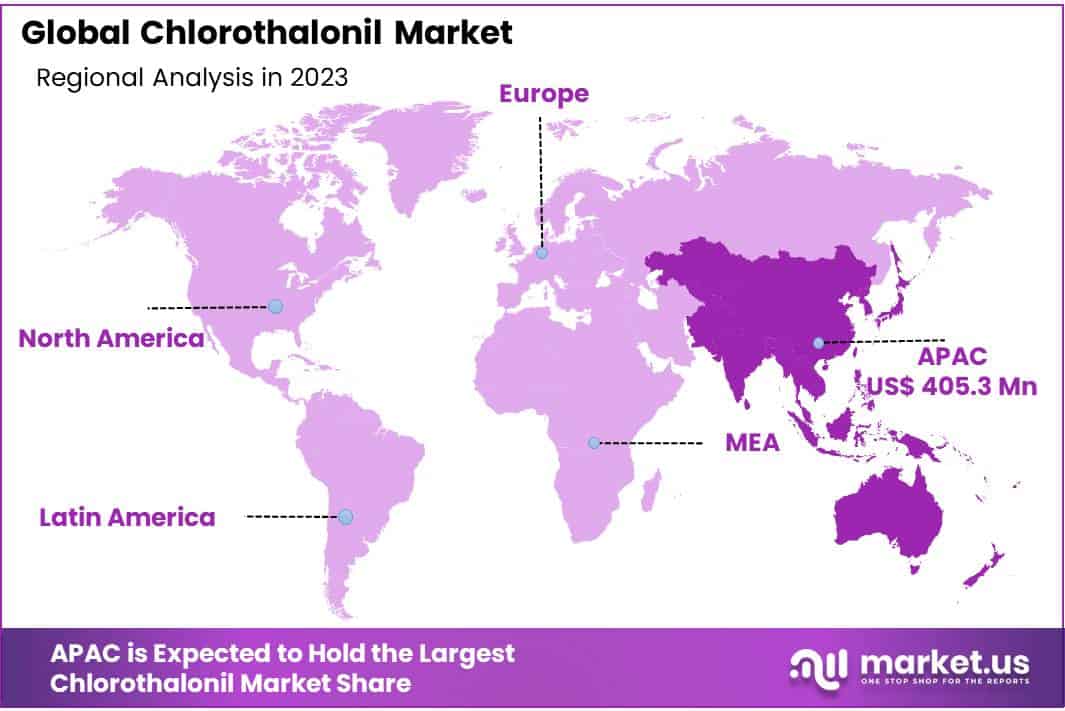

In 2023, the Asia Pacific (APAC) region dominated the Chlorothalonil market, capturing more than 45.6% of the global market share, valued at approximately USD 405.3 million. The region’s dominance is largely driven by the growing agricultural activities in countries like China, India, and Japan, where the demand for effective fungicides is high to protect a wide range of crops from fungal diseases.

The rapid expansion of the agricultural sector, coupled with the increasing need for crop protection, is expected to continue supporting market growth in the APAC region.

North America holds a substantial share of the Chlorothalonil market, with the U.S. being the major contributor due to its highly developed agricultural infrastructure. The market in North America is driven by the extensive use of Chlorothalonil in the cultivation of cereals, grains, and vegetables.

Additionally, growing adoption of integrated pest management (IPM) techniques has bolstered the demand for efficient fungicides in the region. The North American market continues to witness stable growth, though it is affected by stricter regulatory guidelines on pesticide residues.

Europe represents a significant but gradually declining share due to increasingly stringent regulations on pesticide usage. Despite this, Chlorothalonil is still used in certain agricultural sectors, such as in vineyards and orchards, where fungal diseases pose considerable risks.

Latin America and the Middle East & Africa are emerging markets for Chlorothalonil, with growth driven by agricultural development in countries like Brazil and South Africa. However, these regions face challenges related to economic instability and regulatory hurdles that may limit faster market adoption.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Chlorothalonil market is characterized by the presence of several leading players who contribute significantly to the production and distribution of this widely used fungicide. BASF SE, Bayer AG, and Syngenta are among the key global players with a strong foothold in the agrochemical industry. These companies have robust research and development (R&D) capabilities that drive the innovation of new formulations and applications of Chlorothalonil.

BASF SE continues to strengthen its position with an extensive portfolio of crop protection solutions, while Bayer AG, through its subsidiary Bayer CropScience, maintains a dominant presence, focusing on sustainable farming practices and regulatory compliance. Syngenta, known for its strong presence in crop protection, also contributes to the growth of the Chlorothalonil market with advanced product formulations aimed at increasing crop yield and reducing environmental impact.

Other significant players include Corteva Agriscience, Dow Chemical Company, and FMC Corporation, which continue to expand their agricultural portfolios, leveraging strategic mergers and acquisitions, and focusing on innovative agricultural technologies.

Companies like Cheminova A/S and Isagro S.p.A. specialize in offering tailored chemical solutions to specific agricultural needs, including Chlorothalonil formulations that target particular pests and crops. Regional players such as Rallis India Limited, Dacheng Pesticide, and Xinhe Agricultural Chemical are also contributing to the market’s growth, capitalizing on localized agricultural trends in emerging markets.

Top Key Players in the Market

- ABI Chemicals

- BASF SE

- Bayer AG

- Bayer Cropscience

- Cheminova A/S

- Corteva Agriscience

- Dacheng Pesticide

- Dow Chemical Company

- FMC Corporation

- GFS Chemicals

- Isagro S.p.A.

- LANXESS

- Rallis India Limited

- Riverdale Chemical Company Inc.

- SDS Biotech

- Sipcam Oxon

- Suli Chemical

- Syngenta

- Xinhe Agricultural Chemical

Recent Developments

In 2023 ABI Chemicals is recognized for its engagement in the Chlorothalonil market, contributing to the sector with its chemical expertise and production capabilities.

In 2023, BASF SE has been actively involved in the development and distribution of Chlorothalonil, catering to a global market that demands effective and environmentally sustainable agricultural products.

Report Scope

Report Features Description Market Value (2023) USD 942.7 Mn Forecast Revenue (2033) USD 1342.7 Mn CAGR (2024-2033) 3.6% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (98% Chlorothalonil, 96% Chlorothalonil, 90% Chlorothalonil), By Product (Suspending Powder, Wettable Powder, Granules, Others), By Crop Type (Cereals and Grains, Oilseeds and Pulses, Turfs and Ornamentals, Vegetables and Fruits, Others), By Target Pest (Leaf Spot Diseases, Powdery Mildew, Botrytis, Rhizoctonia, Fusarium), By End-Use (Commercial, Residential, Industrial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape ABI Chemicals, BASF SE, Bayer AG, Bayer Cropscience, Cheminova A/S, Corteva Agriscience, Dacheng Pesticide, Dow Chemical Company, FMC Corporation, GFS Chemicals, Isagro S.p.A., LANXESS, Rallis India Limited, Riverdale Chemical Company Inc., SDS Biotech, Sipcam Oxon, Suli Chemical, Syngenta, Xinhe Agricultural Chemical Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- ABI Chemicals

- BASF SE

- Bayer AG

- Bayer Cropscience

- Cheminova A/S

- Corteva Agriscience

- Dacheng Pesticide

- Dow Chemical Company

- FMC Corporation

- GFS Chemicals

- Isagro S.p.A.

- LANXESS

- Rallis India Limited

- Riverdale Chemical Company Inc.

- SDS Biotech

- Sipcam Oxon

- Suli Chemical

- Syngenta

- Xinhe Agricultural Chemical