Global Barley Flakes Market By Product (Conventional, Organic), By Nature (Whole Grain, Pearled), By Packaging Type (Pouches, Boxes, Bulk Packaging), By End-Use (Household, Food Processing Industry, Foodservice/HoReCa, Animal Husbandry, Others), By Distribution Channel (Convenience Stores, Supermarket/Hypermarket, Online, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Jan 2025

- Report ID: 137370

- Number of Pages: 254

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

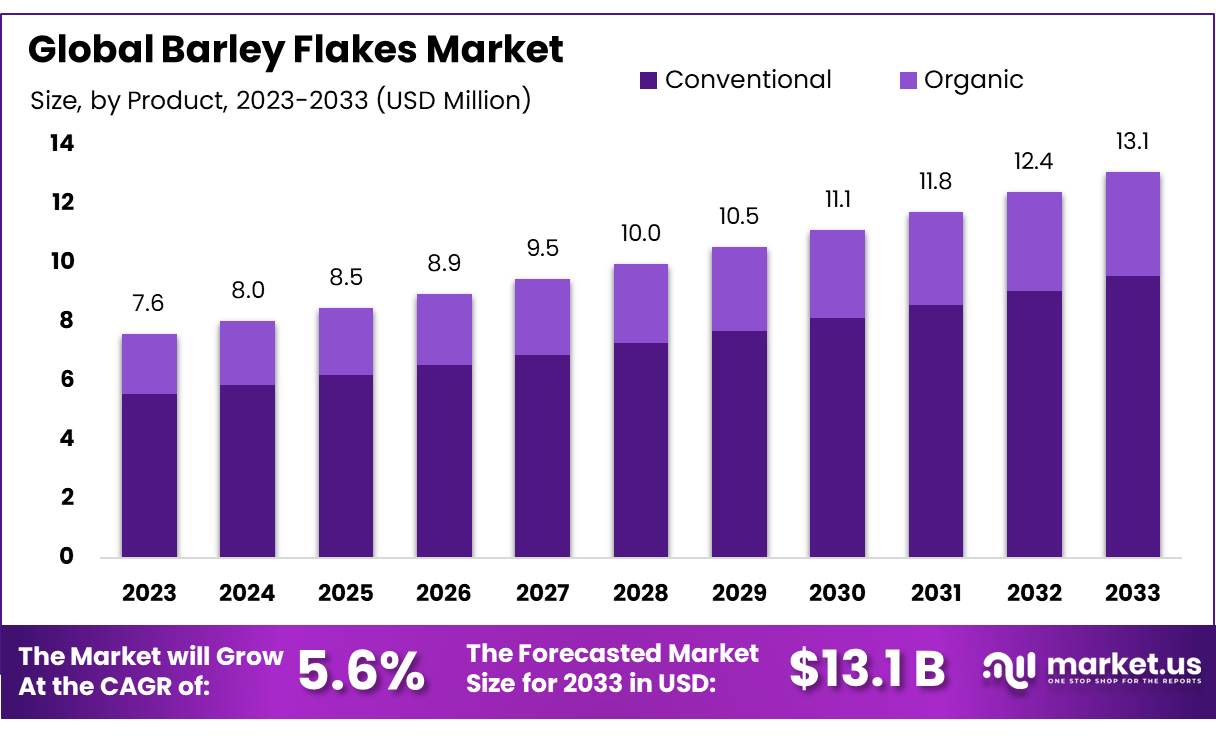

The Global Barley Flakes Market size is expected to be worth around USD 13.1 Bn by 2033, from USD 7.6 Bn in 2023, growing at a CAGR of 5.6% during the forecast period from 2024 to 2033.

The Barley Flakes Market has seen notable growth in recent years, driven by increasing consumer demand for healthy, whole grain products. Barley flakes, produced from steamed and flattened barley grains, are highly valued for their nutritional content, including high fiber, protein, and essential minerals such as magnesium and potassium. These flakes are often used in cereals, snacks, baked goods, and as an ingredient in soups and health supplements. With rising awareness about the benefits of whole grains and plant-based diets, the market for barley flakes is expanding, particularly in health-conscious consumer segments.

One of the main driving factors for the barley flakes market is the increasing consumer preference for functional foods, which provide health benefits beyond basic nutrition. Barley, being a rich source of beta-glucan—a soluble fiber known for its ability to lower cholesterol—has gained popularity in the context of heart health and digestive wellness.

The organic and non-GMO trends are particularly strong within the barley flakes market, with organic products growing at a rate of 6% annually. Consumers’ preference for clean label products—those free from additives and chemicals—is reshaping how manufacturers process and market barley flakes. Moreover, the versatility of barley flakes is increasing their use in diverse products, from health bars to ready meals, indicating a broadening of the market base.

The future growth of the barley flakes market looks promising, with estimated market expansion into new regions such as Southeast Asia and parts of Eastern Europe, where market penetration could grow by up to 8% in the next decade. Product innovation, such as the introduction of flavored barley flakes or combination products featuring barley with other superfoods, is expected to open new consumer segments. For instance, the introduction of barley-based snack products has already seen a 10% uptake in health-centric demographics in urban areas.

Key Takeaways

- Barley Flakes Market size is expected to be worth around USD 13.1 Bn by 2033, from USD 7.6 Bn in 2023, growing at a CAGR of 5.6%.

- Conventional barley flakes segment held a dominant position in the market, capturing more than 74.3% of the market share.

- whole grain barley flakes held a dominant position in the market, securing over 64.4% of the market share.

- pouches held a dominant market position in the barley flakes packaging sector, capturing more than 43.3% of the market share.

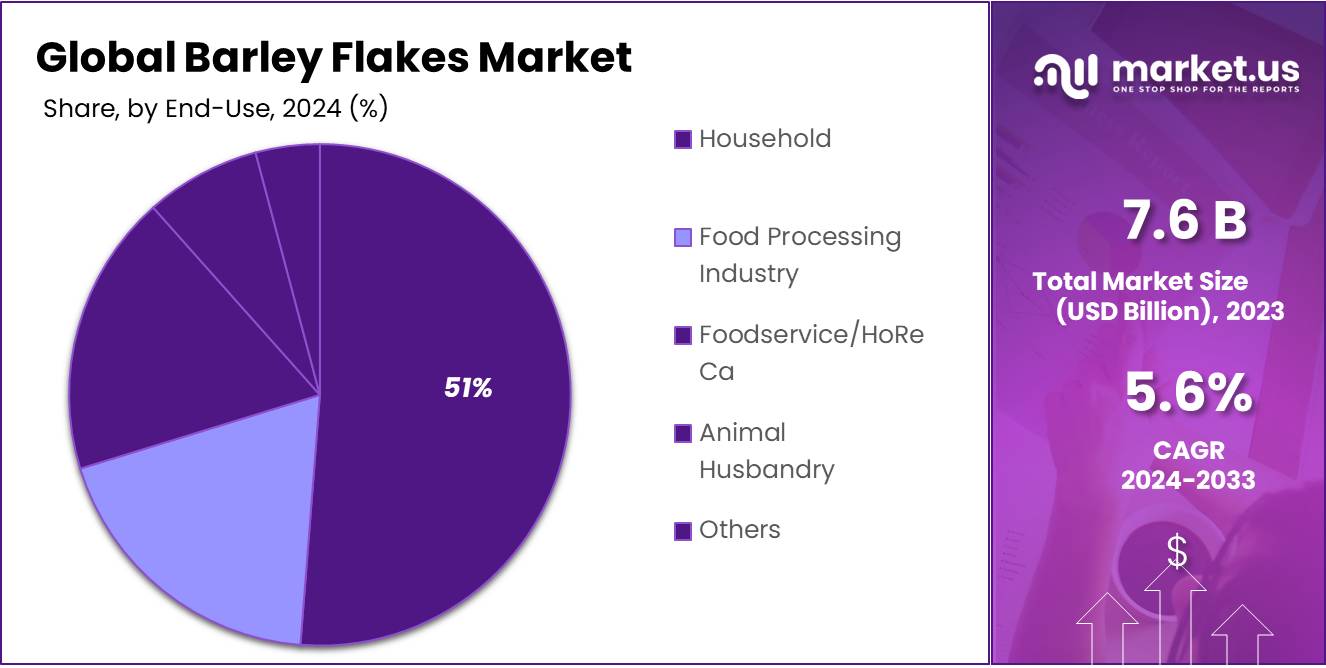

- household segment held a dominant market position in the barley flakes market, capturing more than 52.3% of the overall share.

- supermarkets and hypermarkets held a dominant market position in the distribution of barley flakes, capturing more than 53.2% of the market share.

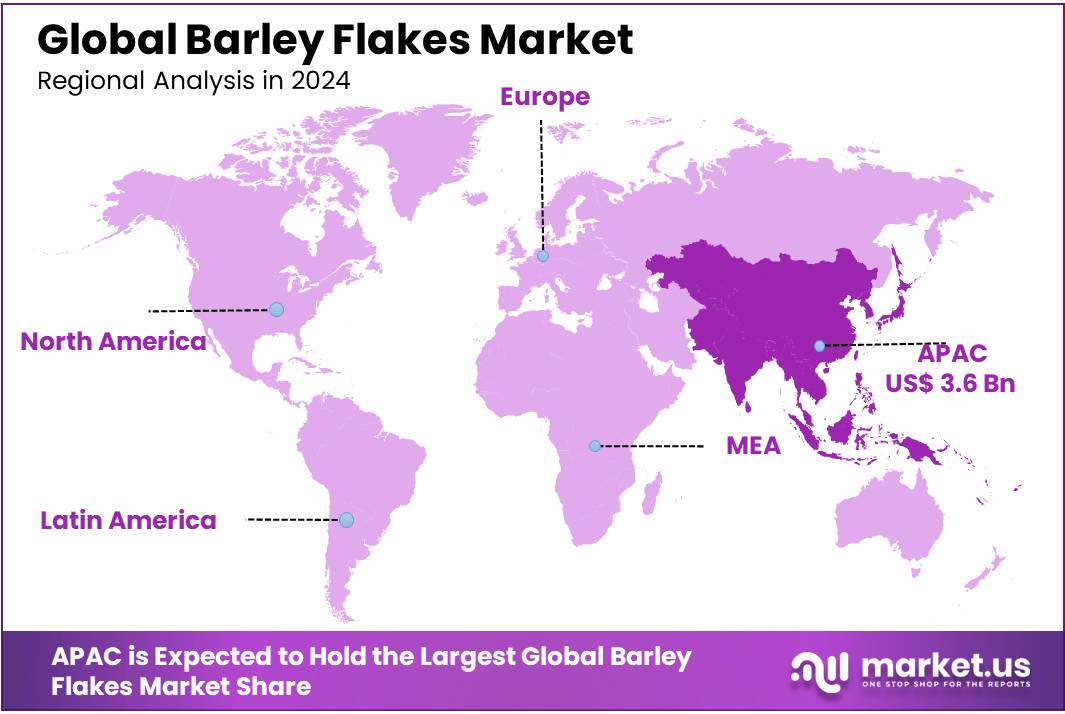

- Asia Pacific (APAC) stands out as the dominating region, holding a significant 44.5% market share, valued at USD 3.6 billion.

By Product

In 2023, the conventional barley flakes segment held a dominant position in the market, capturing more than 74.3% of the market share. This segment benefits from widespread consumer recognition and the established distribution networks of major cereal and grain producers. Conventional barley flakes are preferred due to their cost-effectiveness and broad availability in supermarkets, grocery stores, and online platforms.

The organic barley flakes segment, although smaller, has been gaining traction, driven by the growing consumer demand for organic and non-GMO food products. Organic barley flakes are often marketed as a healthier alternative to conventional barley flakes, appealing to health-conscious consumers looking to reduce their exposure to pesticides and artificial substances.

By Nature

In 2023, whole grain barley flakes held a dominant position in the market, securing over 64.4% of the market share. This preference is largely due to increasing awareness among consumers about the health benefits associated with whole grains, which include high fiber content, and the presence of essential vitamins and minerals. Whole grain barley flakes are particularly popular among health-conscious consumers looking to improve digestion and maintain a balanced diet.

Conversely, the pearled barley flakes segment, while smaller, caters to a different set of consumer preferences, focusing on those who favor quicker cooking times and a softer texture in their cereal products. Pearled barley flakes, with the outer bran layer removed, offer a milder flavor and are often used in processed foods and ready-to-eat cereals.

By Packaging Type

In 2023, pouches held a dominant market position in the barley flakes packaging sector, capturing more than 43.3% of the market share. The popularity of pouches can be attributed to their convenience and the protection they offer against moisture and contaminants, which is crucial for maintaining the freshness of barley flakes. Additionally, pouches are lightweight and cost-effective, making them a favored choice among both manufacturers and consumers for their lower shipping costs and ease of use.

Boxes, as another significant segment, cater to consumers looking for sturdy packaging options that are easy to stack and store. This type of packaging is especially popular in households with larger consumption rates and in markets where bulk purchasing is common. Though boxes hold a smaller share compared to pouches, they remain a steady presence in the market due to their traditional appeal and the substantial protection they provide during transportation.

Bulk packaging is typically targeted towards institutional buyers and health-conscious consumers who prefer to purchase in large quantities, aiming for cost savings and minimal packaging waste. While this segment has a relatively smaller footprint in the market, it is expected to grow as more businesses and consumers push for eco-friendly and economical purchasing options. Moving into 2024, the trend toward sustainable packaging solutions is likely to boost the demand for bulk packaging even further, aligning with global sustainability goals.

By End-Use

In 2023, the household segment held a dominant market position in the barley flakes market, capturing more than 52.3% of the overall share. This segment’s strength is largely due to the growing popularity of barley flakes as a nutritious breakfast option and a healthy ingredient in homemade meals. Households appreciate barley flakes for their health benefits, such as high fiber content and essential nutrients, which are crucial for maintaining a balanced diet.

The food processing industry also represents a significant portion of the market, utilizing barley flakes in a variety of products such as cereals, bars, and bakery goods. This industry values barley flakes for their texture and nutritional profile, enhancing the appeal of health-focused food products.

Meanwhile, the foodservice and HoReCa (Hotel, Restaurant, and Café) sector is leveraging barley flakes more frequently in menu items to cater to health-conscious consumers looking for wholesome, nutritious meal options. This segment is expected to grow as consumer demand for healthier dining options continues to rise.

In the animal husbandry sector, barley flakes are used as a nutritional component in animal feed, particularly for horses and livestock. This use stems from the high-energy content and digestibility of barley flakes, making them a preferred choice in animal nutrition.

By Distribution Channel

In 2023, supermarkets and hypermarkets held a dominant market position in the distribution of barley flakes, capturing more than 53.2% of the market share. This prominence is due to their ability to offer a wide range of products under one roof, coupled with the convenience of one-stop shopping that appeals to a broad consumer base. Supermarkets and hypermarkets also benefit from strategic locations and the capacity to stock large quantities, which ensures availability and variety, key factors that attract regular customers.

Convenience stores also play a crucial role in the distribution of barley flakes, especially in urban areas where consumers seek quick and easy shopping options. Although they hold a smaller market share, convenience stores are valued for their accessibility and extended operating hours, making them an essential channel for impulse purchases and emergency needs.

The online segment has seen significant growth, driven by the shift towards e-commerce and the increasing comfort of consumers with online shopping. Online platforms offer the advantage of home delivery, often with competitive pricing and the convenience of easy comparison shopping. This channel is expected to grow further as more consumers turn to the internet for their grocery shopping, attracted by the ease of use and time-saving aspects.

Key Market Segments

By Product

- Conventional

- Organic

By Nature

- Whole Grain

- Pearled

By Packaging Type

- Pouches

- Boxes

- Bulk Packaging

By End-Use

- Household

- Food Processing Industry

- Foodservice/HoReCa

- Animal Husbandry

- Others

By Distribution Channel

- Convenience Stores

- Supermarket/Hypermarket

- Online

- Others

Drivers

Growing Awareness of Health Benefits Drives Demand for Barley Flakes

One of the major driving factors for the growth of the barley flakes market is the increasing consumer awareness of the health benefits associated with barley. As consumers become more health-conscious, there is a notable shift towards incorporating whole grains like barley into diets. Barley flakes, known for their rich fiber content, essential vitamins, and minerals, have become a popular choice among individuals looking to improve their dietary habits.

Barley is a significant source of dietary fiber, which is crucial for maintaining a healthy digestive system. According to the World Health Organization, a diet high in fiber can help prevent various health issues such as diabetes, cardiovascular diseases, and colorectal cancer. The recommended daily intake of dietary fiber is about 25 grams for women and 38 grams for men. However, studies have shown that most adults consume less than this amount. Barley flakes provide an easy and tasty solution to this dietary gap, as just one serving can contain up to 8 grams of fiber.

In addition to fiber, barley flakes are a good source of vitamins such as niacin, thiamine, and vitamin B6, which are essential for energy metabolism and nervous system health. They are also rich in minerals like magnesium, phosphorus, and selenium. The presence of these nutrients makes barley flakes not only a heart-healthy food but also beneficial for maintaining bone health and a strong immune system.

Government initiatives to promote healthy eating have also played a crucial role in boosting the market for barley flakes. For example, the U.S. Department of Agriculture (USDA) includes whole grains as a key component of a healthy diet in their Dietary Guidelines for Americans. The guidelines suggest making at least half of all grains consumed whole grains, which directly supports the consumption of barley flakes.

Moreover, the increased availability of nutritional information and health-related data through online platforms and health apps has made it easier for consumers to discover the benefits of whole grains like barley. Many health professionals and dietitians are now actively promoting barley flakes as part of a balanced diet on social media and health forums, further influencing consumer choices.

The consumer shift towards plant-based and vegan diets has additionally fueled the demand for barley flakes. As a plant-based food, barley flakes are suitable for vegan diets, providing a high-protein, high-fiber alternative to processed grains and cereals. The versatility of barley flakes makes them an excellent base for a variety of dishes, from breakfast cereals to baking recipes, appealing to a broad audience.

Retailers and food manufacturers are responding to this growing demand by expanding their range of barley-based products and incorporating barley flakes into ready-to-eat meals and snacks. This not only makes it more convenient for consumers to incorporate barley into their diets but also highlights the grain’s adaptability in various culinary applications.

Restraints

Competition from Other Whole Grains Limits Barley Flakes Market Growth

One significant restraining factor in the barley flakes market is the intense competition from other whole grains such as oats, quinoa, and brown rice. These grains also offer substantial health benefits and have established a strong market presence with considerable consumer loyalty and widespread availability, which challenges the growth potential of barley flakes.

Oats, for instance, are exceptionally well-regarded for their health benefits, particularly in lowering cholesterol and improving heart health. According to the American Heart Association, oats contain beta-glucan, a type of fiber that is especially effective in lowering cholesterol. This has led to a robust market for oats, especially in regions like North America and Europe, where heart diseases are a major health concern. Oats have become synonymous with healthy breakfast options, often overshadowing barley flakes, which offer similar benefits.

Quinoa, another competitor, has gained popularity due to its status as a superfood. It is not only high in fiber but also a complete protein, containing all nine essential amino acids – a rarity in plant-based foods. This has made quinoa particularly popular among vegetarians and vegans. Its versatility in cooking and mild, nutty flavor enhances its appeal, drawing attention away from traditional grains like barley.

Brown rice is another staple competing with barley flakes, favored for its nutritional benefits and culinary flexibility. Brown rice is a whole grain that is minimally processed, retaining its germ and bran layers that provide antioxidants, vitamins, and minerals. It’s also a hypoallergenic grain, making it a safer choice for individuals with allergies, which sometimes include barley.

Furthermore, government initiatives often promote a range of whole grains, not specifically highlighting barley, which dilutes the focus on barley flakes. For example, the U.S. Department of Agriculture’s MyPlate guidelines encourage the consumption of whole grains in general, without distinguishing between the types. This broad recommendation supports the consumption of a variety of grains, thus dispersing consumer attention across multiple options rather than concentrating it on barley flakes.

Opportunity

Expanding Market in Developing Regions Presents Major Growth Opportunities for Barley Flakes

In developing regions, rapid urbanization and the increase in working-class populations have shifted eating habits towards convenience foods that are also healthy. Barley flakes fit this niche perfectly, offering a quick and nutritious meal option that can be easily incorporated into busy lifestyles. Additionally, the rising awareness of health and wellness, driven by increased access to information through the internet and social media, has made consumers more conscious of their dietary choices.

The economic growth in these regions also plays a critical role in the increased consumption of whole grains like barley. According to the World Bank, the global middle class is expected to grow to 5.3 billion by 2030, with most of this growth occurring in Asia. As disposable incomes rise, so does the willingness to spend on healthier food products, which include whole grains such as barley flakes.

Government initiatives across these regions further support the growth of the barley flakes market. Many governments are implementing programs to improve public health, which include promoting healthy eating habits. For example, India’s National Health Mission includes components aimed at reducing malnutrition and promoting the consumption of nutritious foods, including whole grains. Such initiatives raise public awareness about the benefits of whole grains and encourage the inclusion of barley flakes in daily diets.

Furthermore, local production of barley is being encouraged in several developing countries, which reduces the cost and increases the availability of barley-based products. For instance, agricultural development programs in African countries like Ethiopia and Kenya include support for barley farmers, which helps in keeping the market supplied with local, cost-effective raw materials for producing barley flakes.

The food industry in these regions is also innovating with barley flakes, incorporating them into traditional dishes and new snack forms, which further broadens their appeal. For instance, in India, where rice and wheat dominate, barley is starting to be recognized for its health benefits, leading to its increased use in traditional settings as well as in packaged food products.

Moreover, international health organizations like the World Health Organization (WHO) and the Food and Agriculture Organization (FAO) continue to promote whole grains as part of a healthy diet, which reinforces the message at a global level. Their guidelines and publications often provide data and recommendations that local health authorities can adapt and promote, helping to drive the consumption of products like barley flakes.

Trends

Plant-Based Diet Trend Boosts Barley Flakes Popularity

A significant trend influencing the barley flakes market is the global shift toward plant-based diets, which has been gaining momentum over recent years. As consumers increasingly prioritize health, sustainability, and ethical considerations in their dietary choices, plant-based foods have seen a surge in popularity. Barley flakes, as a plant-based whole grain, are well-positioned to benefit from this trend due to their nutritional profile and versatility in various culinary applications.

The rise of plant-based diets can be attributed to several factors, including growing concerns about the environmental impact of animal agriculture, health consciousness, and ethical considerations regarding animal welfare. According to a report by the United Nations Environment Programme, plant-based diets can significantly lower the ecological footprint, suggesting a sustainable approach to feeding the global population. This environmental angle resonates strongly with the younger demographic, particularly millennials and Gen Z consumers, who are leading the change towards plant-based eating.

Barley flakes contribute to this trend not only as a versatile and nutritious grain but also as a food that complements the dietary requirements of a plant-based lifestyle. Rich in dietary fiber, protein, and essential nutrients like B vitamins and minerals, barley flakes offer a substantial health benefit. They can easily be incorporated into diets as a substitute for less nutritious grains or as an addition to recipes to enhance nutritional content, such as in smoothies, salads, and baking.

The adaptability of barley flakes also opens up opportunities for innovation in the food industry. Companies are now using barley flakes in a range of plant-based products, from breakfast cereals to energy bars and meat substitutes, exploiting their texture and nutritional benefits. These innovations cater not only to those who follow strict plant-based diets but also to the much larger group of flexitarians, who are reducing their meat consumption without eliminating it entirely.

Government initiatives across the globe further support the trend towards plant-based diets. For example, Canada’s updated food guide recommends choosing protein foods that come from plants more often. This guidance is part of a broader governmental effort to improve public health and reduce the environmental burden of the food system. Initiatives like these not only endorse the consumption of plant-based products like barley flakes but also educate the public on the importance of incorporating more grains and cereals into their diets.

Regional Analysis

The barley flakes market exhibits varied dynamics across different regions, reflecting diverse dietary preferences, economic conditions, and levels of health awareness. Asia Pacific (APAC) stands out as the dominating region, holding a significant 44.5% market share, valued at USD 3.6 billion. This prominence is primarily due to the large population base, increasing health consciousness, and rising disposable incomes in countries like China and India, which have traditionally incorporated barley in their diets.

In North America, the market for barley flakes is driven by a growing trend towards whole grain and plant-based diets, particularly in the United States and Canada. Consumers in this region are increasingly seeking out healthy, fiber-rich foods that support digestive health and overall wellness, positioning barley flakes as an ideal choice.

Europe also presents a robust market, with consumers favoring barley flakes for their nutritional benefits and as part of a cultural shift towards sustainable eating practices. European countries, particularly those in the Nordic region, have a long history of consuming barley, which supports the market growth in this area.

Meanwhile, the Middle East & Africa (MEA) and Latin America are smaller markets for barley flakes but are expected to grow due to increasing urbanization and the spread of Western dietary habits. In these regions, the introduction to new grain-based products is gradually gaining traction among the middle class.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The barley flakes market features a diverse range of key players, each contributing to the competitive landscape with unique strengths and market approaches. Among these, Bob’s Red Mill Natural Foods and The Quaker Oats Company are notable for their extensive product lines and strong brand recognition.

Bob’s Red Mill is renowned for offering organic and non-GMO barley flakes, catering to health-conscious consumers looking for natural food options. Meanwhile, The Quaker Oats Company, with its long-standing reputation, leverages high brand loyalty and extensive distribution networks to reach a broad consumer base.

Other significant players like Briess Malt & Ingredients and Grain Millers, Inc. focus on the quality and sourcing of their raw materials, appealing to niche markets that prioritize the provenance and processing of their grains.

Companies such as Nestlé and Post Holdings, Inc. integrate barley flakes into various breakfast cereals and snack products, benefiting from their vast operational scale and global reach. Additionally, newer entrants like Vitasana Foods Pvt Ltd and niche providers like Shiloh Farms cater to specific consumer segments, offering specialized products that emphasize organic ingredients and sustainable practices.

Top Key Players

- Bob’s Red Mill Natural Foods

- Briess Malt & Ingredients

- CEREAL FOOD MANUFACTURING CO

- Dun & Bradstreet, Inc.

- Grain Millers, Inc.

- Holland & Barrett

- Honeyville, Inc.

- Kellogg

- King Arthur Flour Company, Inc.

- Nature’s Path Foods, Inc.

- Nestlé

- Post Holdings, Inc.

- Shiloh Farms

- The Quaker Oats Company

- Vitasana Foods Pvt Ltd

- WK Kellogg Co

Recent Developments

In 2024, Briess introduced new specialty malts, Crystal Red™ and Heritage Gold™, further expanding their extensive line of products.

Bob’s Red Mill Natural Foods, a leader in whole-grain products, offers barley flakes as part of its extensive product line. The company produces more than 400 products, including a full line of certified gluten-free and organic options.Report Scope

Report Features Description Market Value (2023) USD 7.6 Bn Forecast Revenue (2033) USD 13.1 Bn CAGR (2024-2033) 5.6% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Conventional, Organic), By Nature (Whole Grain, Pearled), By Packaging Type (Pouches, Boxes, Bulk Packaging), By End-Use (Household, Food Processing Industry, Foodservice/HoReCa, Animal Husbandry, Others), By Distribution Channel (Convenience Stores, Supermarket/Hypermarket, Online, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Bob’s Red Mill Natural Foods, Briess Malt & Ingredients, CEREAL FOOD MANUFACTURING CO, Dun & Bradstreet, Inc., Grain Millers, Inc., Holland & Barrett, Honeyville, Inc., Kellogg, King Arthur Flour Company, Inc., Nature’s Path Foods, Inc., Nestlé, Post Holdings, Inc., Shiloh Farms, The Quaker Oats Company, Vitasana Foods Pvt Ltd, WK Kellogg Co Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Bob’s Red Mill Natural Foods

- Briess Malt & Ingredients

- CEREAL FOOD MANUFACTURING CO

- Dun & Bradstreet, Inc.

- Grain Millers, Inc.

- Holland & Barrett

- Honeyville, Inc.

- Kellogg

- King Arthur Flour Company, Inc.

- Nature's Path Foods, Inc.

- Nestlé

- Post Holdings, Inc.

- Shiloh Farms

- The Quaker Oats Company

- Vitasana Foods Pvt Ltd

- WK Kellogg Co