Global Sweet Potato Starch Market Size, Share, And Business Benefits By Origin (Organic, Conventional), By Product Type (Modified Starch, Native Starch), By Type (Fresh Type, Dried Type), By End User (Food and Beverages, Textile and Paper, Feed Industry, Others), By Distribution Channel (Hypermarkets and Supermarkets, Convenience Stores, Specialty Stores, Online Retail, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: January 2025

- Report ID: 136949

- Number of Pages: 329

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Business Benefits of Sweet Potato Starch

- By Origin Analysis

- By Product Type Analysis

- By Type Analysis

- By End User Analysis

- By Distribution Channel Analysis

- Key Market Segments

- Driving Factors

- Restraining Factors

- Growth Opportunity

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

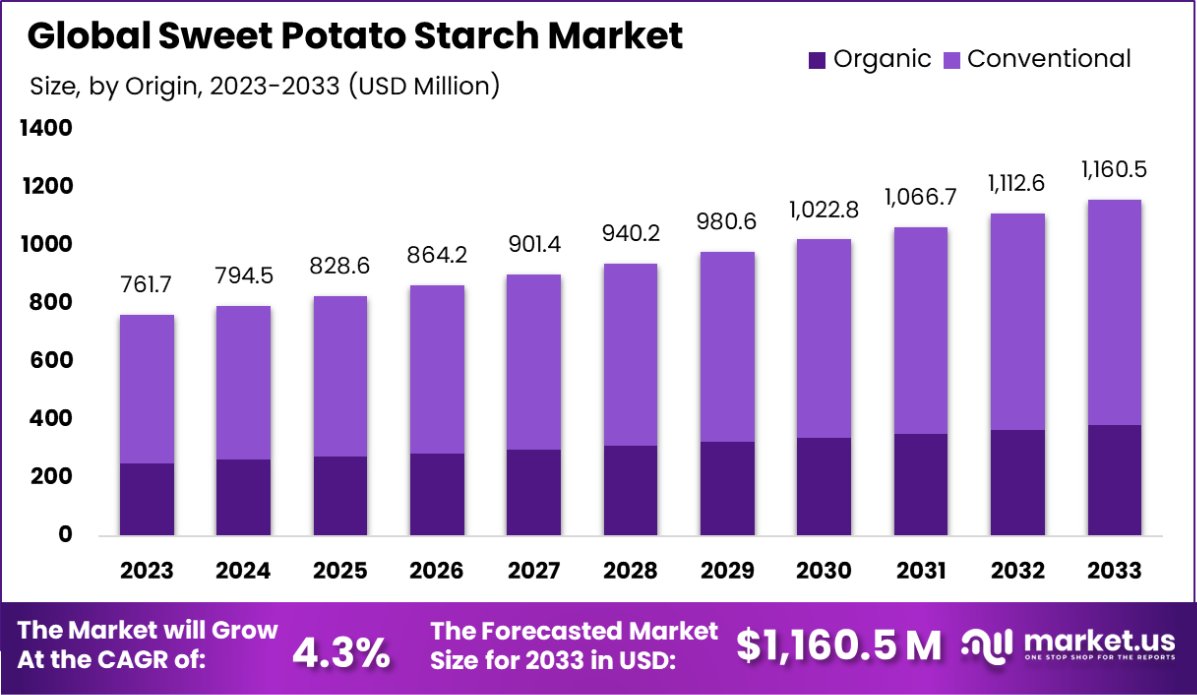

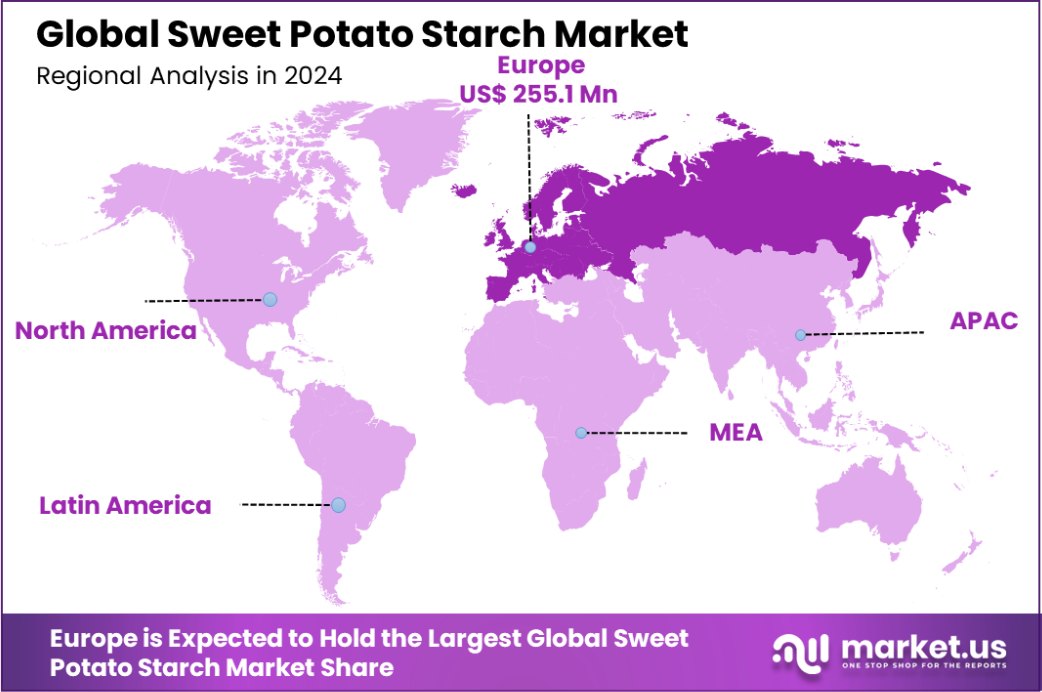

The Global Sweet Potato Starch Market is expected to be worth around USD 1,160.5 Million by 2033, up from USD 761.7 Million in 2023, and grow at a CAGR of 4.3% from 2024 to 2033. Europe’s Sweet Potato Starch Market stands at 33.5%, USD 255.1 million.

Sweet potato starch, derived from the tuberous roots of the sweet potato plant (Ipomoea batatas), is a versatile ingredient utilized in various industries, including food processing, textiles, and pharmaceuticals. Its functional properties, such as high viscosity and neutral taste, make it a preferred choice for thickening agents, and stabilizers, and a gluten-free products alternative in numerous applications.

In India, sweet potato cultivation is predominantly concentrated in states like Odisha, Uttar Pradesh, West Bengal, and Madhya Pradesh. According to the National Horticulture Board’s 2021-22 data, Odisha led production with approximately 330.39 thousand tonnes, accounting for 29.52% of the nation’s output, followed by Uttar Pradesh with 254.25 thousand tonnes (22.72%), and West Bengal with 185.33 thousand tonnes (16.56%).

The increasing consumer demand for gluten-free and clean-label products has significantly propelled the sweet potato starch market. Its application as a natural thickener and stabilizer aligns with the growing health consciousness among consumers. Additionally, the food industry’s shift towards incorporating functional ingredients has further augmented the demand for sweet potato starch.

Technological advancements in extraction and processing methods have enhanced the quality and yield of sweet potato starch, making it more competitive with other starches like those from corn and fresh potatoes. Research initiatives, such as those by the Indian Council of Agricultural Research (ICAR), focus on developing high-yielding sweet potato varieties with superior starch content to meet industrial demands.

The versatility of sweet potato starch extends beyond the food industry. In textiles, it serves as a sizing agent; in pharmaceuticals, it’s a binder in tablet formulations. This multifaceted applicability opens avenues for market expansion.

Despite its potential, the sweet potato starch market faces challenges, including competition from other starch sources and the need for efficient supply chain mechanisms. However, with the increasing emphasis on sustainable and plant-based ingredients, sweet potato starch is poised for substantial growth.

Key Takeaways

- The Global Sweet Potato Starch Market is expected to be worth around USD 1,160.5 Million by 2033, up from USD 761.7 Million in 2023, and grow at a CAGR of 4.3% from 2024 to 2033.

- Conventional sweet potato starch dominates the market, holding a substantial 67.1% share of origins.

- Native starch, a primary product type in this sector, accounts for 62.2% of the market.

- Dried sweet potato starch leads by type, comprising 72.1% of the market’s offerings.

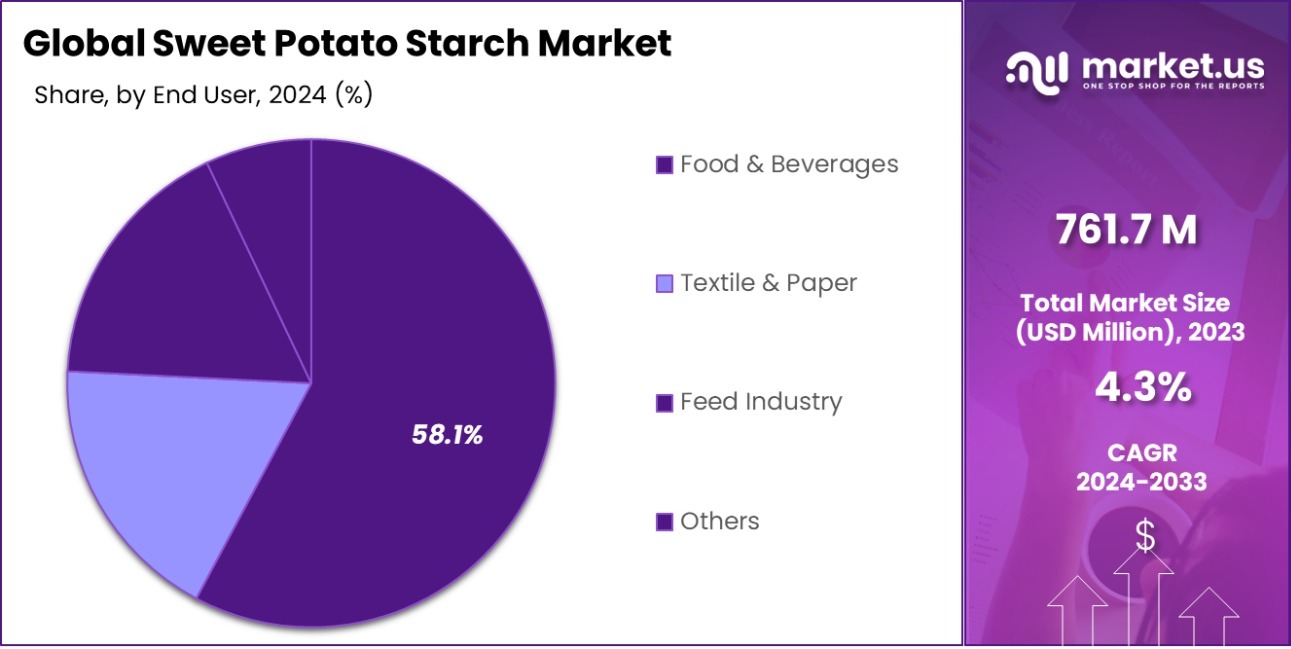

- The food and beverage sector is the largest end-user, consuming 58.1% of the product.

- Hypermarkets and supermarkets are key distribution channels, distributing 48.1% of sweet potato starch.

- In Europe, the Sweet Potato Starch Market is valued at USD 255.1 million, holding a 33.5% share.

Business Benefits of Sweet Potato Starch

Sweet potato starch, derived from the tubers of sweet potatoes, offers several significant business benefits that are recognized in various government agricultural and economic reports. This natural product, primarily composed of carbohydrates, has been gaining traction in the food industry due to its gluten-free property, making it an excellent alternative for those with gluten sensitivities or celiac disease.

Government data often highlights the economic impact of sweet potato cultivation and processing, which can bolster local economies, especially in regions where sweet potatoes are a native crop. The production of sweet potato starch supports agricultural employment and contributes to a diversification strategy in farming, thereby enhancing food security and rural development.

Moreover, sweet potato starch is versatile and can be used in a wide range of applications, from food products like noodles and bread to industrial uses such as bioplastics and adhesives. This versatility opens new market opportunities for businesses looking to innovate or expand their product lines.

Additionally, sweet potato starch is valued for its functional benefits in food processing, including as a thickener and binder, which adds to its appeal in the global market. Government reports also suggest that its low glycemic index makes it a healthier choice, aligning with consumer trends towards healthier eating habits, and further driving its market potential.

By Origin Analysis

Conventional sweet potato starch dominates the market, holding a 67.1% share.

In 2023, Conventional held a dominant market position in the “By Origin” segment of the Sweet Potato Starch Market, with a 67.1% share. Organic varieties, while growing in popularity, accounted for the remainder of the market share at 32.9%.

The conventional segment’s strength is largely attributed to established agricultural practices and well-developed supply chains that facilitate mass production and distribution at competitive prices. This segment benefits from the scalability of conventional farming techniques, which often yield higher outputs at lower costs compared to organic methods.

However, the Organic segment is gaining traction, driven by increasing consumer awareness of health and environmental impacts. This shift is supported by a growing preference for organic labels, which are perceived as safer and more sustainable. Despite higher price points, the demand for organic sweet potato starch is expected to rise, influenced by trends toward healthier lifestyles and sustainable farming practices.

Market dynamics suggest a gradual shift as organic products continue to gain market acceptance and as improvements in organic farming practices reduce cost disparities. This evolving landscape indicates potential growth areas for new market entrants and existing players looking to expand their organic offerings.

By Product Type Analysis

Native starch, primarily from sweet potatoes, comprises 62.2% of the product type.

In 2023, Native Starch held a dominant market position in the “By Product Type” segment of the Sweet Potato Starch Market, with a 62.2% share. Modified Starch, on the other hand, accounted for a 37.8% market share.

The dominance of Native Starch can be attributed to its widespread use in traditional culinary applications and the food processing industry, where it is prized for its natural thickening properties and minimal processing. This type of starch is particularly popular in regions with a strong heritage of using natural and minimally processed ingredients.

Conversely, Modified Starch is increasingly used due to its enhanced functional properties such as improved solubility, thickening efficiency, and stability under various conditions, which are essential in more specialized and industrial food applications.

The growth in this segment is driven by innovations in food technology and the rising demand for processed and convenience foods, which require starches that can withstand high temperatures and acidic conditions.

As consumer preferences evolve and the push towards cleaner labels continues, the market may see a shift. However, the current preference for native starch in both home cooking and industrial food production solidifies its position as a market leader.

Companies in the modified starch segment are likely to invest in research and development to enhance the functionality of their products, aiming to capture a larger share of the market influenced by changing consumer demands.

By Type Analysis

Dried sweet potato starch leads with 72.1% market share by type.

In 2023, Dried Type held a dominant market position in the “By Type” segment of the Sweet Potato Starch Market, with a 72.1% share. Fresh Type, while less prevalent, accounted for the remaining 27.9% of the market. The strong preference for dried-type starch is primarily due to its extended shelf life and ease of transport, which make it highly suitable for both domestic and international markets.

Additionally, dried starch is versatile in its use across various industrial applications, ranging from food production to textile manufacturing, where consistency and stability are crucial.

On the other hand, fresh-type sweet potato starch is typically favored in local markets and traditional cooking practices where the freshness of ingredients is paramount. This type of starch is particularly popular in culinary traditions that value fresh, natural ingredients for their flavor and nutritional properties. However, its shorter shelf life and the logistical challenges associated with its distribution limit its use to mostly regional markets.

The market dynamics suggest that while Dried Type continues to lead due to its practical advantages, there is a niche but significant demand for fresh-type starch. This segment might see growth driven by the rising consumer interest in natural and minimally processed foods, particularly in regions where traditional cuisines emphasize fresh ingredients.

By End User Analysis

In the food and beverages sector, sweet potato starch usage is 58.1%.

In 2023, Food and Beverages held a dominant market position in the “By End User” segment of the Sweet Potato Starch Market, with a 58.1% share. The Textile Paper and Feed Industry segments accounted for 21.4% and 20.5% of the market, respectively.

The strong leadership of the Food and Beverages segment can be attributed to the broad utility of sweet potato starch in this sector, where it is extensively used as a thickener, binder, and stabilizer in products ranging from baked goods to soups and sauces. The natural origin and gluten-free properties of sweet potato starch also make it highly appealing in the formulation of health-oriented and allergen-free food products.

The Textile and Paper industry utilizes sweet potato starch in processing to enhance the finish and strength of products, which underscores its functional versatility. Meanwhile, the Feed Industry incorporates this starch as a nutritional additive in animal feed, benefiting from its energy-rich composition and digestibility.

As consumer preferences lean towards natural and sustainable ingredients, the Food and Beverages segment is likely to maintain its dominance. However, innovations in textile processing and rising awareness of livestock nutrition could drive greater demand in the Textile and Paper Feed Industry segments, potentially reshaping market dynamics in the coming years.

By Distribution Channel Analysis

Hypermarkets and supermarkets are key, distributing 48.1% of sweet potato starch.

In 2023, Hypermarkets and Supermarkets held a dominant market position in the “By Distribution Channel” segment of the Sweet Potato Starch Market, with a 48.1% share. Convenience Stores, Specialty Stores, and Online Retail accounted for 22.3%, 19.6%, and 10% of the market respectively.

The prominence of Hypermarkets and Supermarkets can be attributed to their ability to offer a wide range of products under one roof, including diverse food staples like sweet potato starch, which caters to the convenience-seeking behavior of consumers. These retail giants are typically favored for their competitive pricing strategies and the availability of both niche and mainstream food products.

Convenience Stores also play a significant role due to their accessibility and extended operating hours, offering quick shopping solutions for everyday items. Specialty Stores are preferred by consumers looking for specific high-quality and organic products, providing a targeted selection that appeals to health-conscious shoppers.

Meanwhile, Online Retail is gradually expanding its market share, driven by the increasing consumer preference for the convenience of home shopping and the rising penetration of e-commerce platforms offering grocery deliveries.

As shopping patterns evolve, Online Retail may see significant growth, leveraging advancements in technology and changing consumer behaviors towards more digital engagements.

Key Market Segments

By Origin

- Organic

- Conventional

By Product Type

- Modified Starch

- Native Starch

By Type

- Fresh Type

- Dried Type

By End User

- Food and Beverages

- Textile and Paper

- Feed Industry

- Others

By Distribution Channel

- Hypermarkets and Supermarkets

- Convenience Stores

- Specialty Stores

- Online Retail

- Others

Driving Factors

Increasing Demand for Gluten-Free Products

The surge in consumer preference for gluten-free products significantly drives the sweet potato starch market. As awareness of celiac disease and gluten sensitivity grows, more consumers are seeking gluten-free alternatives.

Sweet potato starch is a popular choice for this demographic due to its natural gluten-free properties, making it an ideal ingredient for baking and cooking applications that cater to health-conscious consumers. This factor is crucial in driving its adoption in both home kitchens and commercial food production.

Expanding Applications in the Food and Beverage Industry

Sweet potato starch is becoming a staple in the food and beverage industry due to its versatility and functional benefits, such as thickening and texturizing properties. Its utility spans various products, including soups, sauces, noodles, and baked goods.

As food manufacturers continue to innovate and expand their product lines with healthier and more natural ingredients, the demand for sweet potato starch is expected to rise. This growing application range supports market expansion and opens new avenues for market growth.

Rise in Clean Label Trends

Consumers are increasingly favoring products with fewer and more recognizable ingredients, known as clean-label products. Sweet potato starch fits well into this trend, offering food producers a way to simplify their ingredient lists while maintaining product quality and appeal.

This clean label movement is prompting manufacturers to reformulate existing products and develop new ones using natural ingredients like sweet potato starch, thereby propelling market growth. This shift towards transparency and naturalness is reshaping purchasing behaviors, boosting the demand for sweet potato starch.

Restraining Factors

High Costs of Production and Processing

The production and processing costs for sweet potato starch are relatively high, which can restrain market growth. These costs are driven by the need for specialized equipment and processes to extract and refine the starch efficiently.

Additionally, the cultivation of sweet potatoes requires specific climate conditions and soil types, which can limit production to certain regions, further driving up costs. These economic barriers can make sweet potato starch less competitive against more commonly used and cheaper starches, affecting its market penetration and adoption.

Limited Consumer Awareness Outside Health Circles

While sweet potato starch is popular among health-conscious consumers, its awareness and acceptance outside these circles remain limited. Many consumers are either unaware of the benefits of sweet potato starch or do not know how to use it in cooking.

This limited consumer awareness can slow market growth as the product’s potential is not fully realized in the mainstream market. Increasing awareness through marketing and education is crucial but represents a significant challenge and cost to producers.

Strong Competition from Other Starch Sources

Sweet potato starch faces stiff competition from other starch sources like corn, potato, and tapioca, which are already well-established in the market. These alternatives often offer similar functional properties at a lower cost and are available more widely, making it difficult for sweet potato starch to capture a larger market share.

The entrenched position of these competing starches in both industrial and culinary applications presents a significant barrier to the growth of the sweet potato starch market.

Growth Opportunity

Expansion into Emerging Markets with Rising Health Trends

The sweet potato starch market has significant growth opportunities in emerging markets, where health trends and dietary shifts towards natural and gluten-free products are increasing. Countries in Asia, Africa, and Latin America are experiencing a surge in middle-class populations who are becoming more health-conscious and have more disposable income.

By targeting these regions, manufacturers can tap into new consumer bases eager for health-oriented food products, potentially boosting market share and revenue for sweet potato starch.

Innovation in Food Technology and Product Development

There is a growing opportunity for innovation within the food technology sector, specifically in developing new and enhanced applications for sweet potato starch. As consumers demand more functional and specialized food products, manufacturers can explore using sweet potato starch in non-traditional ways, such as in biodegradable packaging materials or as a fat substitute in low-calorie products.

These innovations not only broaden the market for sweet potato starch but also align with global sustainability trends, adding value to the product.

Strategic Partnerships and Collaborations

Forming strategic partnerships and collaborations with local and international food and beverage companies can open new avenues for the sweet potato starch market. By partnering with companies that prioritize clean labels and natural ingredients, sweet potato starch manufacturers can gain access to broader distribution networks and integrate their products into a wider range of consumer goods.

Such collaborations can enhance market visibility and consumer trust, driving further adoption of sweet potato starch in diverse market segments.

Latest Trends

Rising Popularity of Plant-Based and Vegan Diets

The increasing adoption of plant-based and vegan diets is a significant trend impacting the sweet potato starch market. As consumers seek healthier, more ethical dietary options that exclude animal products, sweet potato starch emerges as an appealing ingredient due to its plant-based nature and versatility in recipes.

It can serve as a thickener, binder, or texture enhancer in a variety of vegan dishes, supporting the market’s expansion as dietary preferences evolve globally.

Integration of Sweet Potato Starch in Functional Foods

Sweet potato starch is gaining traction as a functional food ingredient, thanks to its nutritional benefits, including high dietary fiber content and essential vitamins. Manufacturers are incorporating it into functional foods aimed at improving gut health, boosting immunity, and providing energy.

This trend of enriching foods with beneficial ingredients positions sweet potato starch as a key component in health-focused food products, thereby driving its demand in a market increasingly oriented towards wellness.

Technological Advancements in Starch Extraction and Processing

Technological advancements in the methods of extracting and processing sweet potato starch are shaping market trends. New technologies that enhance the efficiency, yield, and purity of starch extraction are making sweet potato starch more commercially viable.

These innovations reduce production costs and improve the quality of the final product, making it more competitive against other starch sources. Such technological improvements are crucial for expanding the use and application of sweet potato starch in both food and industrial sectors.

Regional Analysis

In 2023, Europe’s Sweet Potato Starch Market was valued at USD 255.1 million, representing 33.5%.

In the global landscape of the Sweet Potato Starch Market, regional dynamics display distinct market penetrations and growth trajectories. Europe emerges as the dominant region, commanding 33.5% of the market share with a valuation of USD 255.1 million, driven by a strong consumer preference for natural and gluten-free products. This market strength is bolstered by robust food safety regulations and a burgeoning organic food sector.

North America also presents a significant market share, capitalizing on the rising trend of clean-label and plant-based diets, which has accelerated the adoption of sweet potato starch in various food applications. The region’s focus on health-conscious consumption patterns continues to support market growth.

In contrast, Asia Pacific is witnessing the fastest growth rate, attributed to increasing urbanization, changing lifestyles, and the expanding food and beverage industry. The region benefits from a vast agricultural base, facilitating ample production and availability of sweet potatoes, making it a key player in both the production and consumption of sweet potato starch.

Meanwhile, the Middle East & Africa, and Latin America are still developing markets with smaller shares but are expected to grow due to increasing awareness and the gradual shift towards healthier food ingredients. These regions offer new avenues for market expansion as they explore traditional and innovative uses of sweet potato starch in local cuisines and industrial applications.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, the global Sweet Potato Starch Market is influenced significantly by diverse key players, each contributing uniquely to the industry’s dynamics. Among these, companies like Baijia Food, Guang You, Liuxu Food, Rich Moon, and Sunkeen stand out due to their direct involvement in the production and distribution of sweet potato starch.

These companies are primarily based in Asia, particularly China, where the vast majority of sweet potato starch production occurs. Their operations capitalize on regional agricultural strengths and traditional usage of sweet potato starch in local cuisines.

Baijia Food, for instance, has expanded its market reach by innovating in product quality and packaging, appealing to both domestic and international markets looking for premium starch products.

Guang You and Liuxu Food, on the other hand, have focused on scaling production capabilities and enhancing supply chain efficiencies to meet the growing global demand, particularly from North America and Europe, where there’s a rising trend towards gluten-free and clean-label food products.

Rich Moon, based in Vietnam, leverages the country’s rich agricultural heritage and favorable climate for sweet potato cultivation, positioning itself as a key exporter in the Southeast Asian region.

Sunkeen has distinguished itself by engaging in technological advancements to improve the purity and functionality of sweet potato starch, aiming to penetrate more specialized market segments such as pharmaceuticals and cosmetics.

These companies are well-positioned to capitalize on the global shift towards healthier and more sustainable food ingredients. Their success hinges on their ability to innovate, maintain high standards of quality, and adapt to the evolving regulatory landscapes and consumer preferences that define the global food markets.

As such, their strategies, ranging from product development to international expansion, will likely influence the competitive dynamics and growth trajectories of the Sweet Potato Starch Market in the upcoming years.

Top Key Players in the Market

- Abundant States

- Aker Carbon Capture

- Aramco

- Baijia Food

- Carbon Clean Solutions

- CarbonFree

- C-Capture

- Cemvita Factory

- Dahai

- Equinor

- ExxonMobil

- Fluor Corporation

- Guang You

- Halliburton

- Honeywell

- JGC Holdings

- Linde

- Liuxu Food

- Mirreco

- Mitsubishi Heavy Industries

- Neustark

- Rich Moon

- SAI RAM

- Schlumberger

- SeeO2 Energy

- Shandong Huaqiang

- Shanxi Dongbao

- Shell

- Siemens

- SUNAS

- Sunkeen

Recent Developments

- In 2023, Carbon Clean deployed their first 10 TPD CycloneCC modular unit in the Middle East, marking a key development in their carbon capture technology. This innovation is part of their broader efforts to tackle decarbonization in hard-to-abate sectors, recognized by their fifth appearance in the 2024 Global Cleantech 100.

- In 2023, C-Capture advanced in the sweet potato starch sector by developing biotechnologies for converting sweet potato residues into bioethanol, showcasing a commitment to sustainability and innovation in utilizing agricultural by-products.

Report Scope

Report Features Description Market Value (2023) USD 761.7 Million Forecast Revenue (2033) USD 1,160.5 Million CAGR (2024-2033) 4.3% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Origin (Organic, Conventional), By Product Type (Modified Starch, Native Starch), By Type (Fresh Type, Dried Type), By End User (Food and Beverages, Textile and Paper, Feed Industry, Others), By Distribution Channel (Hypermarkets and Supermarkets, Convenience Stores, Specialty Stores, Online Retail, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Abundant States, Aker Carbon Capture, Aramco, Baijia Food, Carbon Clean Solutions, CarbonFree, C-Capture, Cemvita Factory, Dahai, Equinor, ExxonMobil, Fluor Corporation, Guang You, Halliburton, Honeywell, JGC Holdings, Linde, Liuxu Food, Mirreco, Mitsubishi Heavy Industries, Neustark, Rich Moon, SAI RAM, Schlumberger, SeeO2 Energy, Shandong Huaqiang, Shanxi Dongbao, Shell, Siemens, SUNAS, Sunkeen Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Sweet Potato Starch MarketPublished date: January 2025add_shopping_cartBuy Now get_appDownload Sample

Sweet Potato Starch MarketPublished date: January 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Abundant States

- Aker Carbon Capture

- Aramco

- Baijia Food

- Carbon Clean Solutions

- CarbonFree

- C-Capture

- Cemvita Factory

- Dahai

- Equinor

- ExxonMobil

- Fluor Corporation

- Guang You

- Halliburton

- Honeywell

- JGC Holdings

- Linde

- Liuxu Food

- Mirreco

- Mitsubishi Heavy Industries

- Neustark

- Rich Moon

- SAI RAM

- Schlumberger

- SeeO2 Energy

- Shandong Huaqiang

- Shanxi Dongbao

- Shell

- Siemens

- SUNAS

- Sunkeen