Global Baker's Yeast Market Size, Share, And Business Benefits By Form (Solid, Liquid and Cream, Dry or Powdered, Others), By Product (Active Dry Yeast, Inactive Dry Yeast), By Application (Cakes, Pastries, Bread, Biscuits, Others), By End Users (Bakery, Food, Feed, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: January 2025

- Report ID: 136911

- Number of Pages: 276

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

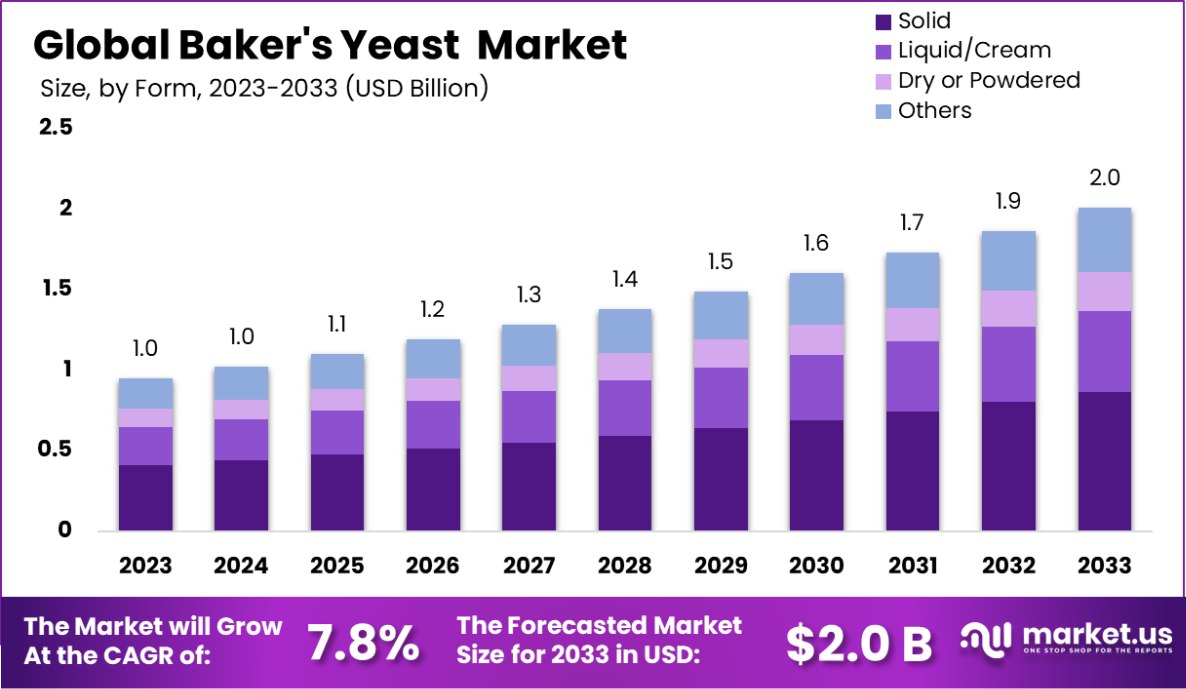

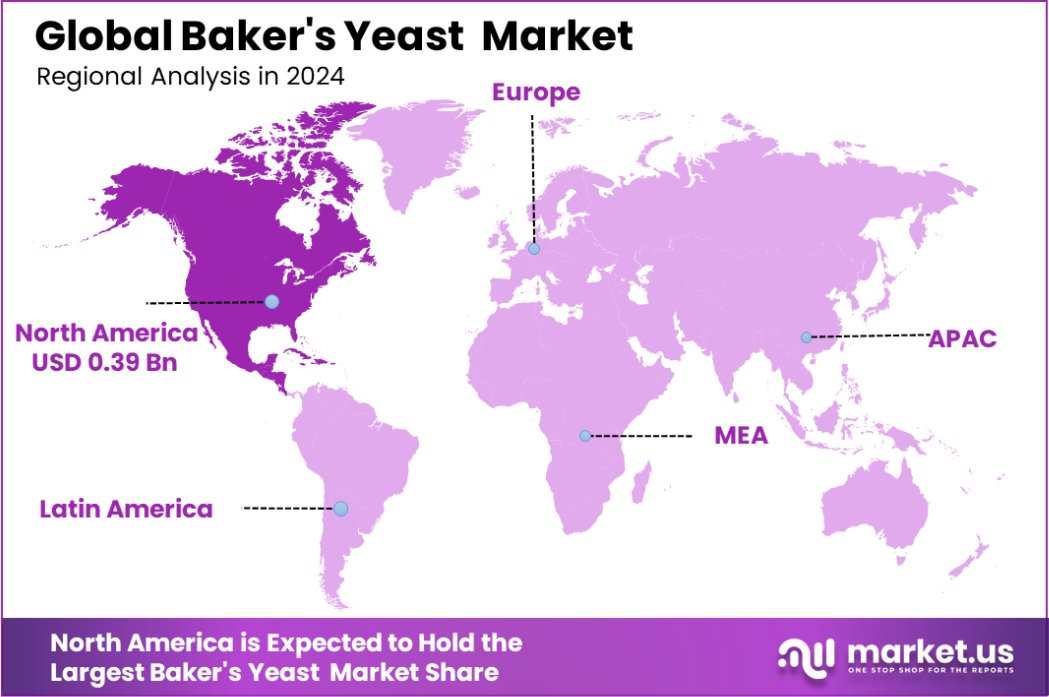

The Global Baker’s Yeast Market is expected to be worth around USD 2.0 Billion by 2033, up from USD 1.0 Billion in 2023, and grow at a CAGR of 7.8% from 2024 to 2033. North America holds 41.5% of Baker’s Yeast Market at USD 0.39 billion.

Baker’s yeast is a type of yeast predominantly used as a leavening agent in baking bread and bakery products, where it converts the fermentable sugars present in the dough into carbon dioxide and ethanol. Baker’s yeast is available in various forms such as active dry, instant, and fresh.

The Baker’s Yeast Market refers to the global industry centered around the production and distribution of baker’s yeast. It caters to the needs of bakeries, food service providers, and households for various baking processes.

Growth factors for the Baker’s Yeast Market include the rising popularity of bakery products among consumers, advancements in yeast fermentation technologies, and the increasing trend of home baking spurred by consumer interest in healthy, artisanal foods.

The demand is driven by the consistent need for yeast in bread-making, expanding bakery product varieties, and the growing consumer preference for convenience foods. Opportunities in the market are abundant due to the rising demand for organic and natural baking ingredients and the potential for innovations in flavor and health benefits in bakery products.

Baker’s yeast, scientifically known as Saccharomyces cerevisiae, is a cornerstone of the baking industry, facilitating the fermentation process that leavens bread and imparts characteristic flavors. In the United States, the production of baker’s yeast is concentrated in 13 facilities across 10 states, with an annual output of approximately 223,500 megagrams (245,000 tons).

Of this production, about 85% is compressed (cream) yeast, primarily supplied to wholesale bakeries, while the remaining 15% is dry yeast, catering mainly to consumer markets.

The baker’s yeast industry is influenced by several driving factors. The consistent demand for bakery products, both from commercial bakeries and home bakers, ensures a steady need for yeast.

Additionally, the versatility of Saccharomyces cerevisiae extends beyond baking; it is utilized in the production of alcoholic beverages and as a bio-catalyst in various industrial fermentations. Advancements in biotechnology have further expanded its applications, including engineered yeast strains capable of metabolizing plant fats, potentially opening new market avenues.

Looking ahead, the baker’s yeast market is poised for growth, driven by increasing consumer interest in artisanal and home baking, as well as the expanding applications of yeast in biotechnology. The global shift towards sustainable and bio-based products presents opportunities for yeast-derived innovations.

Key Takeaways

- The Global Baker’s Yeast Market is expected to be worth around USD 2.0 Billion by 2033, up from USD 1.0 Billion in 2023, and grow at a CAGR of 7.8% from 2024 to 2033.

- In the Baker’s Yeast Market, solid forms dominate, accounting for 43.1% of the market share.

- Active dry yeast leads product segmentation with a significant 72.1% share in the market.

- The bread application is paramount in the market, making up 52.1% of usage statistics.

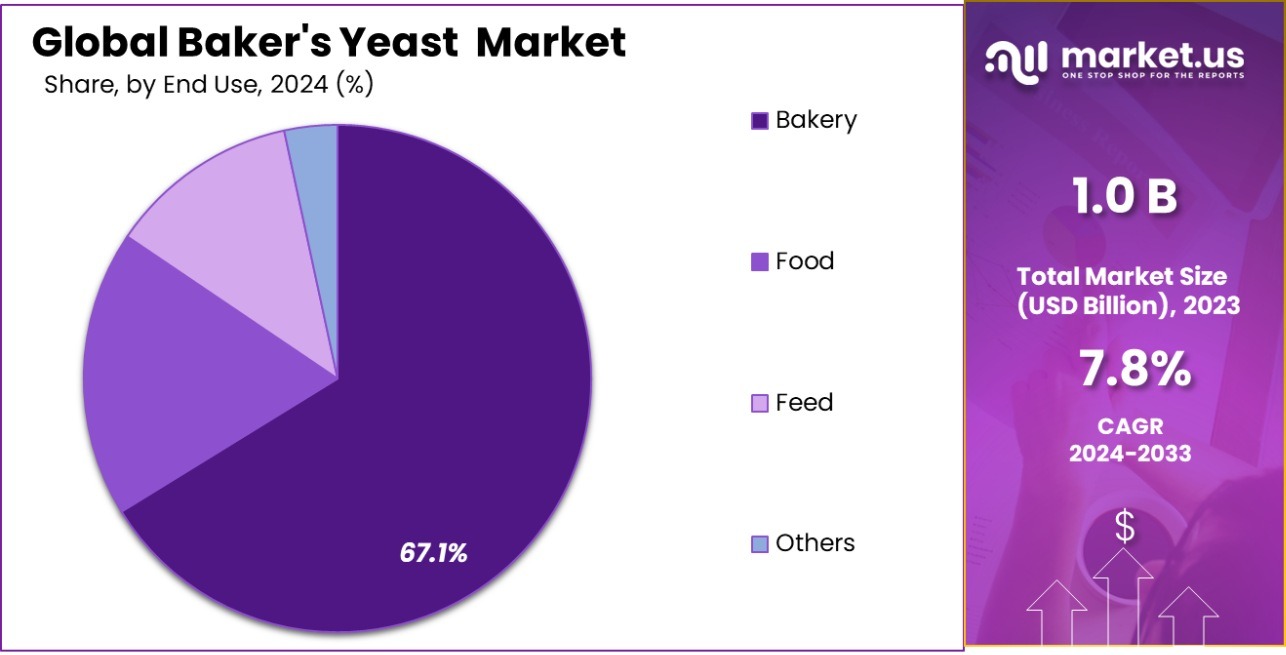

- Bakeries are the largest end users, consuming 67.1% of all baker’s yeast sold globally.

- In North America, the Baker’s Yeast Market holds a 41.5% share, valued at USD 0.39 billion.

Business Benefits of Baker’s Yeast

Baker’s yeast offers numerous business benefits, making it a valuable asset in various industries, particularly food and beverage production. Known for its role in baking, it is a key ingredient in producing bread, pastries, and other baked goods by facilitating fermentation. This process not only leavens dough but also enhances texture and flavor, contributing to higher product quality and consumer satisfaction.

In addition to baking, baker’s yeast plays a significant role in alcoholic beverage production, such as beer and wine, by aiding fermentation and ensuring consistency in flavor profiles. It can also be utilized in producing bioethanol, showcasing its versatility beyond food applications.

From a business perspective, baker’s yeast promotes cost efficiency. It is widely available, easy to cultivate, and requires minimal resources for production. This affordability helps businesses maintain competitive pricing while ensuring high margins.

Moreover, baker’s yeast aligns with the growing demand for clean-label and natural products. As a natural ingredient, it appeals to health-conscious consumers, providing businesses an edge in the marketplace.

Its applications in developing innovative products, such as plant-based alternatives and functional foods, further expand revenue streams. Overall, baker’s yeast serves as a critical component for quality, innovation, and profitability in diverse industries.

By Form Analysis

Baker’s Yeast Market, Solid form dominates with 43.1% market share.

In 2023, Solid held a dominant market position in the By Form segment of Baker’s Yeast Market, capturing a 43.1% share. This segment’s strength is largely attributed to its widespread use in commercial baking and its longer shelf life compared to other forms. Solid yeast is preferred for its consistency in production and ease of storage, making it a staple in large-scale baking operations.

Following closely, the Liquid and Cream form accounted for 29.4% of the market. This type is favored for its quick activation time, enhancing the efficiency of baking processes in industrial and artisanal settings. Its ability to integrate seamlessly into various recipes without prior rehydration appeals to bakers seeking convenience and speed.

Dry or Powdered yeast, with a market share of 27.5%, is valued for its extended shelf life and stability. This form is particularly popular among home bakers and small-scale commercial establishments.

It offers flexibility in storage and transportation, making it an economical option for those with limited access to refrigeration facilities. Each form caters to specific needs within the baking industry, driven by factors like convenience, cost, and application specifics.

By Product Analysis

Active Dry Yeast leads the product segment, capturing 72.1% of the market.

In 2023, Active Dry Yeast held a dominant market position in the By Product segment of the Baker’s Yeast Market, with a 72.1% share. Its prominence is primarily due to its versatility and efficacy in various baking processes, making it a preferred choice for both commercial and domestic bakers.

Active Dry Yeast is celebrated for its long shelf life and stability, which allows it to be stored at room temperature for extended periods without losing its leavening power. This feature is particularly beneficial in regions with limited refrigeration resources, bolstering its global accessibility and popularity.

On the other hand, Inactive Dry Yeast, which accounted for the remaining 27.9% of the market, is utilized differently. Unlike its active counterpart, this form of yeast is not used for leavening bread. Instead, it serves as a nutritional supplement and flavor enhancer in food products and health foods.

The demand for inactive dry yeast is driven by the growing consumer awareness regarding dietary supplements and the increasing popularity of health-centric diets. Its application in pet foods and as a flavoring agent in plant-based products also contributes to its market share, though it remains less favored compared to active dry yeast for baking purposes.

By Application Analysis

In applications, bread commands 52.1% of the Baker’s Yeast Market.

In 2023, Bread held a dominant market position in the By Application segment of the Baker’s Yeast Market, capturing a 52.1% share. The significant reliance on baker’s yeast in bread making, primarily due to its essential role in dough leavening, underpins this dominance. Bread, as a staple food product globally, consistently drives high volumes, with yeast being crucial for achieving the desired texture, taste, and volume, thereby maintaining its lead in the market.

Following Bread, Pastries accounted for 19.7% of the market share. The demand in this segment is propelled by the rising popularity of gourmet and artisanal pastry products, which often require specific types of yeast to enhance flavor and texture. Cakes followed closely with a 16.2% share, where yeast is particularly valued in traditional and specialty cakes that require natural leavening for a distinct taste profile.

Biscuits, holding a 12% market share, utilize less yeast compared to other baked goods but still rely on it for specific varieties where a slight rise is desired. The use of yeast in biscuits is typically seen in recipes that aim for a lighter texture and subtle flavor enhancements, catering to evolving consumer preferences for healthier, less processed snack options.

By End Users Analysis

Bakeries are major end users, holding 67.1% of the market share.

In 2023, Bakery held a dominant market position in the By End Users segment of the Baker’s Yeast Market, with a 67.1% share. This substantial market share is attributed to the central role that baker’s yeast plays in the production of a wide array of bakery products, from bread and pastries to pizzas and rolls.

The consistent demand for fresh, high-quality baked goods drives the use of baker’s yeast, with innovations in yeast varieties further bolstering its adoption in bakeries aiming to differentiate their product offerings.

The Food sector followed, accounting for 22.4% of the market share. Within this segment, baker’s yeast is utilized beyond traditional baking, contributing to the production of alcoholic beverages, condiments, and other food preparations where fermentation is key, reflecting its versatility and the expansion of its applications in the culinary field.

Lastly, the Feed segment captured 10.5% of the market. In this sector, yeast is primarily used as a nutritional supplement in animal feeds, enhancing the nutritional value of feed products with its high vitamin, mineral, and protein content.

This use of baker’s yeast in animal nutrition underscores its importance in supporting the overall health and productivity of livestock, showcasing its broad utility across multiple industries.

Key Market Segments

By Form

- Solid

- Liquid/Cream

- Dry or Powdered

- Others

By Product

- Active Dry Yeast

- Inactive Dry Yeast

By Application

- Cakes

- Pastries

- Bread

- Biscuits

- Others

By End Users

- Bakery

- Food

- Feed

- Others

Driving Factors

Growing Demand for Baked Goods Drives Yeast Market

The increasing popularity of bakery products worldwide significantly fuels the growth of the Baker’s Yeast Market. As consumers become more interested in freshly baked goods like bread, pastries, and pizzas, the demand for baker’s yeast, essential for fermentation, has risen.

This trend is particularly noticeable in urban areas where the fast-paced lifestyle prefers quick, convenient meals. The expanding bakery section in supermarkets and the proliferation of specialty bakeries also contribute to this upward trajectory in yeast demand.

Health Trends Boost Use of Natural Leavening Agents

Health-conscious consumers are turning away from artificial additives and embracing natural ingredients, which boosts the baker’s yeast market. Baker’s yeast, known for its natural fermentation process, is increasingly preferred over chemical leaveners.

This shift is driven by the growing awareness of the health benefits associated with yeast, such as improved digestion and nutrient absorption. Additionally, the clean label movement, which advocates for minimal processing and transparent ingredient lists, further propels the popularity of baker’s yeast in baking communities.

Innovation in Yeast Production Technologies

Advancements in biotechnology have streamlined yeast production, making it more efficient and cost-effective, thus driving the growth of the Baker’s Yeast Market. Modern techniques allow for faster yeast cultivation and enhanced quality, meeting the industry’s increasing demands.

These innovations also include the development of yeast varieties with specific flavors or health benefits, catering to the diverse needs of bakers and consumers alike. As a result, these technological improvements not only increase production capacity but also enhance the overall appeal of baker’s yeast in the market.

Restraining Factors

Fluctuating Raw Material Prices Hinder Yeast Production

The cost of raw materials required for yeast production, such as molasses and sugar, is highly volatile, which significantly restricts the growth of the Baker’s Yeast Market. These fluctuations often result from changes in agricultural output influenced by weather conditions and global market dynamics.

The inconsistency in raw material prices can lead to unstable production costs for yeast manufacturers, affecting their pricing strategies and profitability, which in turn can deter investment in the sector.

Strict Regulations Impact Yeast Manufacturing Processes

Stringent regulations governing food safety and production standards pose challenges to the Baker’s Yeast Market. These regulations vary widely by region, requiring manufacturers to adhere to different standards for production, packaging, and labeling.

Compliance with such regulations incurs additional costs and requires continuous monitoring and adaptation to changing laws, which can restrain the market’s growth. This regulatory environment can also slow down the introduction of new yeast products to the market, affecting overall industry innovation.

Rising Popularity of Yeast-free Diets

The increasing trend toward yeast-free diets for health reasons, such as to avoid candida overgrowths or because of yeast allergies, is a significant restraint on the Baker’s Yeast Market. As more consumers opt for yeast-free products, the demand for traditional baker’s yeast declines.

This shift is particularly influential in markets where health and dietary trends quickly sway consumer preferences, leading to a noticeable impact on yeast sales. This trend is supported by the growing availability of alternative leavening agents that cater to these dietary restrictions.

Growth Opportunity

Expansion into Emerging Markets Boosts Yeast Sales

The Baker’s Yeast Market has significant growth opportunities in emerging markets where the consumption of baked goods is rising due to urbanization and increasing disposable incomes. Countries in Asia, Africa, and South America are witnessing a surge in demand for bakery products, providing a fertile ground for market expansion.

By establishing production facilities and distribution channels in these regions, yeast manufacturers can tap into new consumer bases, driving overall market growth and diversification.

Organic and Natural Yeast Varieties Gain Popularity

As consumers increasingly seek healthier and more sustainable products, there is a growing opportunity for organic and natural yeast variants in the Baker’s Yeast Market. These products, which are free from synthetic additives and GMOs, cater to the rising demand for clean-label ingredients.

By focusing on the development and marketing of organic yeast, manufacturers can differentiate their offerings and capture a niche yet rapidly growing segment of health-conscious bakers and consumers.

Innovative Yeast Applications in Non-Baking Sectors

Exploring non-traditional applications of baker’s yeast presents a novel growth opportunity. Beyond baking, yeast can be utilized in the production of alcoholic beverages, nutritional supplements, and even biofuels. Developing specialized yeast strains for these industries could open new revenue streams.

Furthermore, leveraging biotechnology to enhance yeast functionalities, such as improved tolerance to various environmental conditions and substrates, can broaden its application scope, appealing to a wider range of industrial sectors beyond traditional baking.

Latest Trends

Gluten-Free and Specialty Breads Influence Yeast Demand

The rising demand for gluten-free and specialty breads is a prominent trend in the Baker’s Yeast Market. As more consumers adopt gluten-free diets due to health concerns or personal preferences, bakers are responding by creating breads that use specific types of yeast compatible with gluten-free flour.

This trend is not only expanding the market for existing yeast products but also prompting the development of new yeast strains that enhance texture and flavor in gluten-free baking, meeting consumer demands for both health and taste.

Enhanced Focus on Sourdough and Artisanal Products

There is a growing consumer interest in artisanal and sourdough breads, known for their unique flavors and natural fermentation processes. This trend is driving the Baker’s Yeast Market toward products that can replicate traditional baking methods or enhance them.

Manufacturers are now focusing on marketing yeasts that are suited for slow-fermentation processes, which are essential for crafting such specialty breads. This not only caters to the artisanal segment but also aligns with the broader consumer shift towards gourmet, high-quality bakery products.

Yeast as a Nutritional Supplement

Yeast is increasingly being recognized for its nutritional benefits, particularly as a source of vitamins, minerals, and proteins. This has led to its enhanced use as a dietary supplement. The trend extends beyond baking, with yeast being incorporated into various health and wellness products, including nutritional bars, drinks, and vegan substitutes.

This functional aspect of yeast is gaining traction, positioning it as a versatile ingredient that transcends its traditional role in baking, thereby broadening its market potential.

Regional Analysis

The North American Baker’s Yeast Market holds a 41.5% share, valued at USD 0.39 billion.

The Baker’s Yeast Market exhibits varied growth dynamics across global regions, influenced by local consumption patterns, economic conditions, and culinary trends. North America dominates the market, holding a substantial 41.5% share, valued at USD 0.39 billion, driven by robust demand in commercial baking and increasing preferences for specialty and artisan breads.

Europe follows closely, leveraging its rich baking traditions and heightened consumer interest in healthier, organic baking options that necessitate high-quality yeast. The market in Asia Pacific is rapidly expanding due to urbanization and growing per capita income, which are increasing the consumption of baked goods.

This region shows promising growth potential with rising investments in bakery infrastructure and technological advancements in yeast production. Meanwhile, the Middle East & Africa, and Latin America are emerging as significant growth areas due to changing dietary habits and the gradual adoption of Western eating practices.

These regions are witnessing an increase in demand for convenience food products, including bakery items, which supports the growth of the baker’s yeast market. Overall, North America’s significant market share illustrates its pivotal role in the global baker’s yeast industry landscape.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global Baker’s Yeast Market in 2023 is highly competitive, with key players focusing on innovation, geographical expansion, and sustainable practices to maintain their market positions. ADM and Angel Yeast Co., Ltd. lead the market, leveraging their extensive R&D capabilities and diversified product portfolios. Angel Yeast’s significant presence in Asia and ADM’s stronghold in North America contribute to their dominance.

LALLEMAND Inc. and Lesaffre International, renowned for their technological expertise, emphasize developing specialized yeast strains catering to health-conscious consumers, including organic and non-GMO variants.

Associated British Foods PLC and Aryzta AG focus on large-scale commercial baking solutions, enabling cost efficiencies for their clients, while General Mills Inc. integrates baker’s yeast into its broader food product lines to ensure consistent quality.

Companies like Conagra Brands Inc. and Danone SA are innovating within niche segments, such as plant-based and gluten-free baked goods, aligning with shifting consumer preferences. Emerging players like Fadayeast.Com and Oriental Yeast India Pvt Ltd are leveraging regional advantages to penetrate untapped markets in the Middle East, Africa, and Asia.

Grupo Bimbo S.A.B. de C.V. and Vandemoortele NV are expanding their global footprints through acquisitions, while Europasty S.A. and London Dairy Co. Ltd. emphasize premium bakery solutions. The strategic collaborations and technological advancements by these players indicate a robust market poised for growth, with sustainability and innovation as key driving forces.

Top Key Players in the Market

- ADM

- AGRANO Gmbh & Co. KG

- Angel Yeast Co. Ltd

- Aryzta AG

- Associated British Foods PLC

- Cole’s Quality Food Inc.

- Conagra Brands, Inc.

- Daiya Foods Inc.

- Danone SA

- Dun and Bradstreet, Inc

- Europastry S.A.

- Fadayeast.Com

- General Mills Inc.

- Goodrich Group

- Grupo Bimbo S.A.B.de C.V.

- Kothari Fermentation And Biochem Ltd

- LALLEMAND Inc.

- Lantmännen Unibake

- Lesaffre International

- London Dairy Co. Ltd

- Oriental Yeast India Pvt Ltd

- Vandemoortele NV

Recent Developments

- In 2024, ADM excelled in plant-based innovation, winning awards for its postbiotic-infused drink and protein bar. These advancements highlight ADM’s commitment to creating health-focused, functional products, enhancing gut health, protein content, and taste in plant-based nutrition.

- In 2024, Agrano GmbH & Co. KG expanded its Bioreal® organic yeast line by introducing Vitamin B12-enriched yeast flakes, showcasing innovation in health-focused organic products and reinforcing its leadership in sustainable and consumer-centric yeast solutions.

Report Scope

Report Features Description Market Value (2023) USD 1.0 Billion Forecast Revenue (2033) USD 2.0 Billion CAGR (2024-2033) 7.8% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Solid, Liquid and Cream, Dry or Powdered, Others), By Product (Active Dry Yeast, Inactive Dry Yeast), By Application (Cakes, Pastries, Bread, Biscuits, Others), By End Users (Bakery, Food, Feed, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape ADM, AGRANO Gmbh & Co. KG, Angel Yeast Co. Ltd, Aryzta AG, Associated British Foods PLC, Cole’s Quality Food Inc., Conagra Brands, Inc., Daiya Foods Inc., Danone SA, Dun and Bradstreet, Inc, Europastry S.A., Fadayeast.Com, General Mills Inc., Goodrich Group, Grupo Bimbo S.A.B.de C.V., Kothari Fermentation And Biochem Ltd, LALLEMAND Inc., Lantmännen Unibake, Lesaffre International, London Dairy Co. Ltd , Oriental Yeast India Pvt Ltd, Vandemoortele NV Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- ADM

- AGRANO Gmbh & Co. KG

- Angel Yeast Co. Ltd

- Aryzta AG

- Associated British Foods PLC

- Cole's Quality Food Inc.

- Conagra Brands, Inc.

- Daiya Foods Inc.

- Danone SA

- Dun and Bradstreet, Inc

- Europastry S.A.

- Fadayeast.Com

- General Mills Inc.

- Goodrich Group

- Grupo Bimbo S.A.B.de C.V.

- Kothari Fermentation And Biochem Ltd

- LALLEMAND Inc.

- Lantmännen Unibake

- Lesaffre International

- London Dairy Co. Ltd

- Oriental Yeast India Pvt Ltd

- Vandemoortele NV