Global Organic Cocoa Market By Product Type (Cocoa Liquor, Cocoa Powder, Cocoa Butter, Cocoa Paste, Cocoa Beans, Others), By Forms (Cubes, Spreads, Blocks, Slice, Others), By Application (Confectionery, Beverages, Bakery Products, Others), By End-use (Food And Beverages, Pharmaceuticals, Personal care, Others), By Distribution Channels (Specialty Stores, Supermarkets/Hypermarkets, Specialty Stores, Online Retail, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 136429

- Number of Pages: 312

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

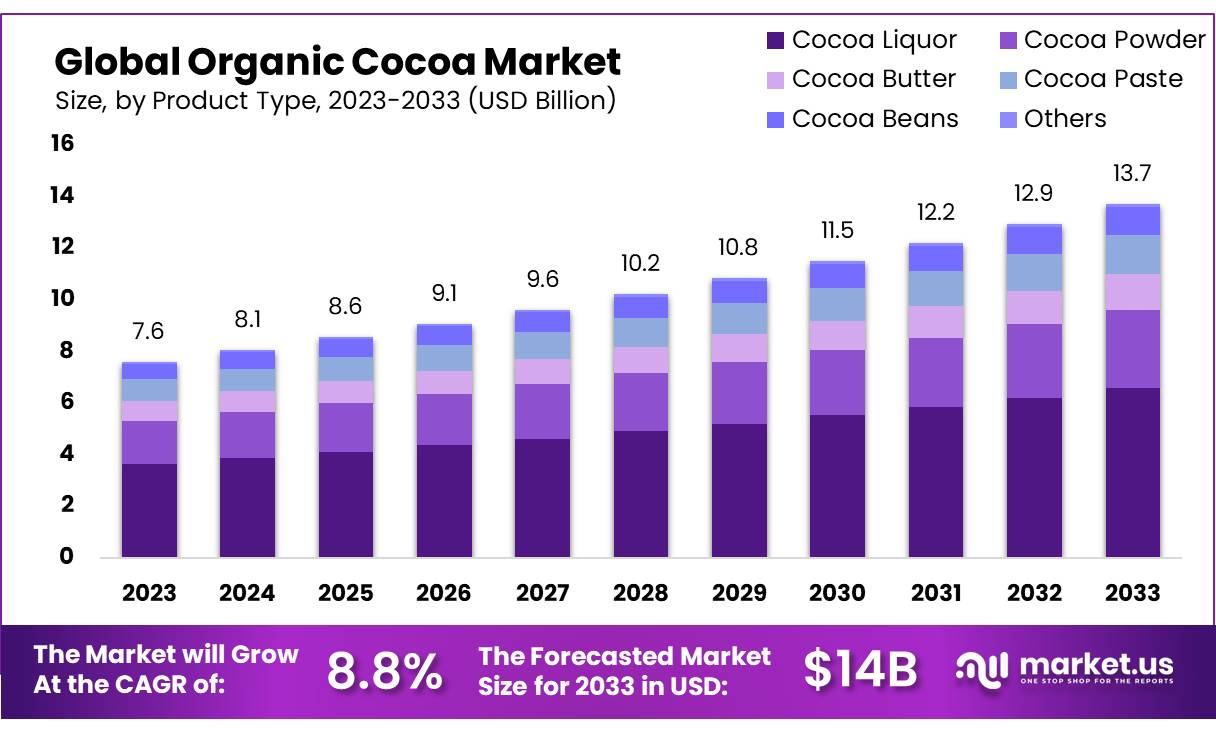

The Global Organic Cocoa Market size is expected to be worth around USD 13.7 Bn by 2033, from USD 7.6 Bn in 2023, growing at a CAGR of 6.1% during the forecast period from 2024 to 2033.

Organic Cocoa refers to cocoa beans that are grown without the use of synthetic fertilizers, pesticides, or genetically modified organisms (GMOs). The cultivation of organic cocoa follows strict regulations to maintain soil health, reduce environmental impact, and promote biodiversity.

In organic farming, practices such as crop rotation, composting, and natural pest control are used to avoid chemical inputs. The cocoa is certified by accredited organizations such as the USDA Organic or EU Organic, ensuring that it meets the standards for organic agriculture.

The organic cocoa market has been experiencing notable growth due to increasing consumer demand for sustainable, health-conscious products, particularly in the food, beverage, and cosmetic industries. In 2023, the global organic cocoa market was valued at approximately USD 1.2 billion, with Europe and North America leading the consumption.

The European Union alone imported more than 30% of global organic cocoa in 2023, driven by demand in countries like Germany, France, and the UK. These markets are seeing strong consumer preference for organic chocolate, confectionery, and beverages, with annual growth rates of around 6-8%.

Governments are increasingly supporting the organic cocoa sector with regulations to promote sustainability and ethical sourcing. For example, the European Union has stringent regulations in place for organic certification, with EU Organic certification ensuring that cocoa is free from synthetic pesticides and fertilizers.

The U.S. Department of Agriculture (USDA) organic certification is also gaining popularity, with the U.S. importing over 20% of the world’s organic cocoa in 2023. These certifications ensure that farmers use sustainable practices and promote soil health, directly benefiting cocoa producers and the environment.

Investments in the organic cocoa market have been growing, particularly in the form of private-public partnerships. In 2023, companies like Mars, Inc., Nestlé, and Barry Callebaut announced strategic investments aimed at increasing their organic cocoa supply.

For instance, Mars committed to sourcing 100% of its cocoa from sustainable sources by 2025, including organic cocoa, which aligns with increasing consumer demand for traceability and sustainability. These companies have also been forming partnerships with farmers and local cooperatives in key producing countries such as the Ivory Coast, Ghana, and Ecuador.

The market has also witnessed innovations such as the development of organic cocoa powders, chocolates, and beverages. In 2023, Barry Callebaut, a major player in the cocoa industry, expanded its product line to include new organic chocolate variants, catering to growing consumer demand for clean-label products.

Key Takeaways

- Organic Cocoa Market size is expected to be worth around USD 13.7 Bn by 2033, from USD 7.6 Bn in 2023, growing at a CAGR of 6.1%.

- Cocoa Powder held a dominant market position, capturing more than a 48.4% share of the global organic cocoa market.

- Cubes held a dominant market position in the organic cocoa market, capturing more than a 38.2% share.

- Confectionery held a dominant market position in the organic cocoa market, capturing more than a 56.5% share.

- Food & Beverages held a dominant market position in the organic cocoa market, capturing more than a 72.3% share.

- Supermarkets/Hypermarkets held a dominant market position in the organic cocoa market, capturing more than a 54.5% share.

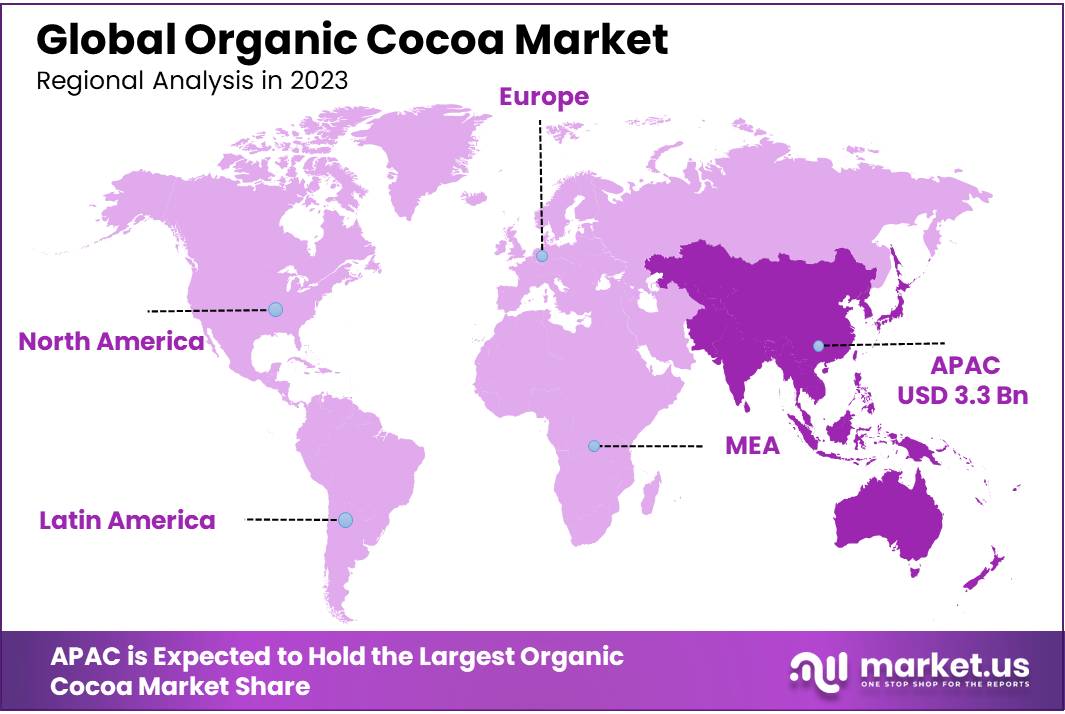

- Asia Pacific (APAC) held the dominant position in the global organic cocoa market, capturing more than 43.4% of the market share, valued at approximately USD 3.3 billion.

By Product Type

In 2023, Cocoa Powder held a dominant market position, capturing more than a 48.4% share of the global organic cocoa market. This segment’s leadership is primarily driven by the increasing demand for cocoa powder in the food and beverage industry, particularly in the production of chocolates, bakery products, and beverages.

Cocoa powder is favored for its versatility, being used in both sweet and savory applications. The 2023 market saw a year-on-year growth in cocoa powder consumption, reflecting the rising demand for organic, clean-label products. In addition to its widespread use in the food industry, the growth in demand for plant-based beverages and snacks has further supported the cocoa powder segment’s dominance, as many of these products use cocoa powder as a key ingredient.

The Cocoa Butter segment followed closely, accounting for a significant share of the organic cocoa market in 2023. Cocoa butter is highly sought after in the cosmetic and personal care industries, especially for its moisturizing properties in skincare products. The growth of organic cosmetics has led to increased demand for natural and organic cocoa butter. The demand for cocoa butter in chocolate production also remained strong, as it is a key ingredient for producing smooth, high-quality chocolate.

Cocoa Liquor and Cocoa Beans segments also contributed significantly to the market, with Cocoa Liquor being widely used in the manufacturing of chocolates and confectionery. In 2023, cocoa liquor experienced a moderate growth rate of 4%, driven by the rise in premium chocolate consumption. Meanwhile, organic cocoa beans were primarily sourced from regions like West Africa and South America, where farmers continue to adopt organic farming practices, benefiting from increasing consumer preference for ethically sourced products.

The Cocoa Paste segment, while smaller, saw growing interest in 2023, driven by innovations in the beverage and dessert sectors that require cocoa paste as a base ingredient. Other products such as cocoa-based health supplements also contributed to the organic cocoa market, but at a smaller scale.

By Forms

In 2023, Cubes held a dominant market position in the organic cocoa market, capturing more than a 38.2% share. This segment’s leading position can be attributed to the increasing demand for organic cocoa products in premium chocolate and confectionery markets. Organic cocoa cubes are favored for their convenience and versatility, making them ideal for both direct consumption and as an ingredient in various food products. Their usage has been growing steadily due to their ease of incorporation into chocolate-making processes, as well as their popularity in baking and beverages.

The Spreads segment, which includes cocoa-based spreads like organic chocolate spreads, has also experienced strong growth. In 2023, this segment contributed significantly to the market, driven by the rising consumer preference for organic and healthier spreads as alternatives to conventional processed spreads. The popularity of organic spreads in breakfast items and snacks continued to rise, particularly among health-conscious consumers.

The Blocks segment followed closely, seeing increased demand as well. Cocoa blocks are widely used in the production of high-quality chocolate bars and are a favorite in artisanal and gourmet chocolate-making. With consumer interest in premium, organic, and fair-trade chocolates growing, the demand for cocoa blocks in 2023 saw a steady uptick, particularly in the North American and European markets.

The Slice segment, though smaller, showed promising growth in 2023. Organic cocoa slices are often used in specific confectionery and baking products where a smoother texture or specific form is required. While not as large as cubes or blocks, the slice form is gaining traction in the premium dessert industry.

By Application

In 2023, Confectionery held a dominant market position in the organic cocoa market, capturing more than a 56.5% share. This segment’s dominance can be attributed to the growing consumer demand for premium chocolate and gourmet confectioneries made with organic cocoa. The rising preference for healthier, ethically sourced products, including organic and fair-trade chocolate, has fueled the growth of this segment.

In 2023, confectionery manufacturers focused on launching new, innovative products that catered to the increasing consumer demand for organic and clean-label chocolates. The demand for organic cocoa in confectionery continued to rise, particularly in North America and Europe, where health-conscious consumers are more inclined to opt for products free from artificial additives and preservatives.

The Beverages segment also saw significant growth in 2023, driven by the rising popularity of plant-based drinks and organic hot chocolate products. Organic cocoa is increasingly being used in both hot and cold beverages, as more consumers choose organic, dairy-free, and healthier options.

The growth in the popularity of organic cocoa in the beverage market is also linked to the rising demand for organic coffees, teas, and smoothies. In 2023, the global market for organic cocoa-based beverages saw a surge, particularly in the United States, where organic food and beverage sales grew by 9% according to the Organic Trade Association.

The Bakery Products segment, while smaller in comparison, also experienced growth in 2023. Organic cocoa is increasingly being used in the production of cakes, cookies, and other baked goods, as consumers look for organic ingredients in everyday food products. The demand for organic bakery products grew steadily in 2023, with health-conscious consumers preferring organic cocoa for its clean-label appeal and its ability to offer a rich, natural flavor.

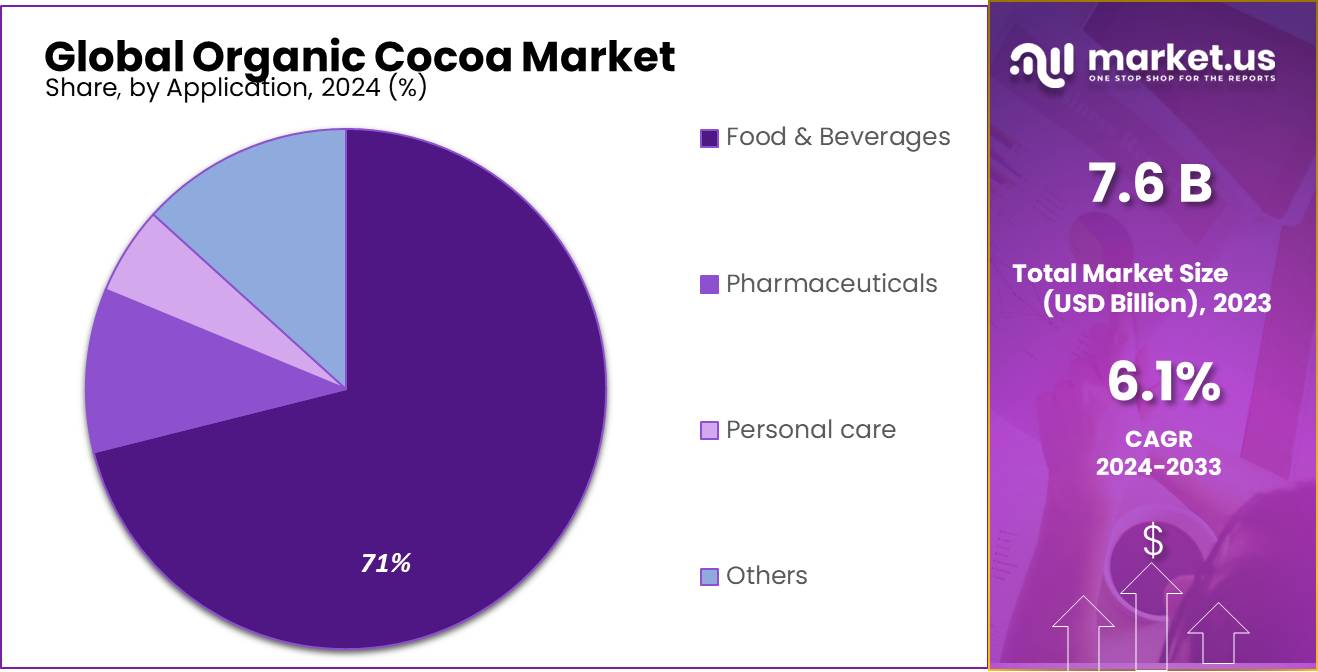

By End-use

In 2023, Food & Beverages held a dominant market position in the organic cocoa market, capturing more than a 72.3% share. This segment’s significant share is primarily driven by the increasing demand for organic and premium food products. Organic cocoa is widely used in the production of chocolates, confectioneries, beverages, and bakery items.

The rising preference for organic, healthy, and ethically sourced food options has made organic cocoa a key ingredient for both gourmet and mass-market products. In 2023, the growing popularity of plant-based and clean-label foods, along with an increasing consumer focus on health and wellness, contributed to the continued dominance of this segment.

The global demand for organic cocoa-based chocolate and beverages, particularly in North America and Europe, remained strong, with consumers willing to pay a premium for products made with organic and ethically sourced ingredients.

The Pharmaceuticals segment also showed promising growth in 2023. Organic cocoa is increasingly being used for its antioxidant and anti-inflammatory properties, which are beneficial in the formulation of various health supplements and nutraceuticals. Cocoa-based ingredients are known for their ability to promote cardiovascular health and improve mood, making them popular in the wellness and pharmaceutical industries.

In 2023, the use of organic cocoa in functional foods and supplements continued to rise as consumers sought natural alternatives to support their health goals. Organic cocoa’s role in the pharmaceutical industry is expected to grow as the market for natural and plant-based supplements expands.

The Personal Care segment also experienced growth in 2023. Organic cocoa butter, known for its moisturizing and skin-nourishing properties, is increasingly being used in cosmetics and skincare products.

In particular, organic cocoa butter is found in lotions, creams, and lip balms, as consumers continue to seek out natural ingredients for their personal care routines. The market for organic personal care products made with cocoa butter is projected to grow as consumers become more aware of the benefits of using natural and organic ingredients in skincare.

By Distribution Channels

In 2023, Supermarkets/Hypermarkets held a dominant market position in the organic cocoa market, capturing more than a 54.5% share. This large share can be attributed to the widespread consumer preference for one-stop shopping, where supermarkets and hypermarkets offer a wide variety of organic products, including cocoa-based items. The convenience of purchasing organic cocoa products in large retail outlets has driven their popularity.

Consumers are increasingly seeking organic and clean-label foods, and supermarkets and hypermarkets cater to this demand by offering a wide range of organic cocoa products, including chocolates, cocoa powders, and beverages. These retail giants are also supported by robust distribution networks, ensuring consistent availability of organic cocoa products in different regions. In 2023, the trend of health-conscious consumerism continued to boost sales in these large retail outlets, with supermarkets and hypermarkets benefiting from the growing demand for premium, organic food products.

Online Retail also saw significant growth in 2023, driven by the increasing trend of online shopping. As more consumers turn to e-commerce for convenience and better access to a wider range of products, online retailers have become important distribution channels for organic cocoa products.

The Online Retail segment captured a substantial share, as more people preferred purchasing organic cocoa-based items like chocolates and beverages from the comfort of their homes. E-commerce platforms have capitalized on the growing demand for organic food and beverage products by offering home delivery options, product reviews, and special discounts. According to recent data, online retail for organic food products grew by 15% in 2023, contributing to the overall rise in organic cocoa sales through digital channels.

In addition, Specialty Stores also played a key role in the distribution of organic cocoa products in 2023, particularly among health-focused and organic food enthusiasts. These stores, which specialize in organic and natural products, continued to attract consumers looking for high-quality, ethically sourced cocoa products. Although their market share remained smaller compared to supermarkets and online retail, specialty stores experienced steady growth due to the increasing demand for specialized organic products.

Key Market Segments

By Product Type

- Cocoa Liquor

- Cocoa Powder

- Cocoa Butter

- Cocoa Paste

- Cocoa Beans

- Others

By Forms

- Cubes

- Spreads

- Blocks

- Slice

- Others

By Application

- Confectionery

- Beverages

- Bakery Products

- Others

By End-use

- Food & Beverages

- Pharmaceuticals

- Personal care

- Others

By Distribution Channels

- Specialty Stores

- Supermarkets/Hypermarkets

- Specialty Stores

- Online Retail

- Others

Drivers

Rising Demand for Healthier and Ethical Products

One of the major driving factors for the Organic Cocoa market is the rising demand for healthier, sustainable, and ethically sourced food products. Consumers are becoming increasingly conscious of the health benefits associated with organic food, particularly in terms of reducing exposure to pesticides and chemicals. This shift towards healthier living has been a key driver for the growth of the organic cocoa market.

According to a report by the USDA (United States Department of Agriculture), the organic food market in the U.S. alone reached USD 62 billion in 2023, growing at a rate of 5% year-over-year. This growth has been particularly significant in the chocolate industry, where consumers are seeking products made with organic cocoa due to concerns about both health and environmental sustainability.

The increasing awareness of the harmful effects of conventional farming methods, such as pesticide use, is pushing consumers to favor organic cocoa over traditional cocoa. For instance, organic cocoa products are perceived to be free of synthetic chemicals, making them more attractive to health-conscious buyers.

Further bolstering this trend is the rising demand for fair trade and ethically sourced ingredients. In recent years, consumers have placed more emphasis on the social and environmental impact of their purchases.

The Fair Trade Certification and Rainforest Alliance certification programs, which promote sustainable farming practices and better wages for farmers, are gaining traction in the organic cocoa market. As of 2023, over 30% of the global chocolate market is certified as fair trade or organic, according to Fairtrade International. These certifications not only appeal to consumers but also ensure a more sustainable cocoa supply chain, which is vital in the context of climate change and deforestation concerns.

The demand for organic cocoa is also being driven by increased investments in organic farming. Governments and private organizations are supporting organic farming through subsidies, grants, and training programs.

For example, in 2023, the European Union announced plans to increase its organic farming area to 25% of total agricultural land by 2030, which will have a direct positive impact on the supply of organic cocoa. The EU’s investment in organic farming has been supported by various policies, such as the EU Organic Action Plan, which promotes the expansion of organic farming and the adoption of sustainable practices across the agricultural sector.

The global market for plant-based foods grew by 11.4% in 2023, with vegan chocolates made from organic cocoa leading the way in terms of growth. As more consumers seek out plant-based options, the demand for organic cocoa continues to rise, especially in markets like North America and Europe.

Restraints

Limited Supply and High Production Costs

A significant restraining factor for the Organic Cocoa market is the limited supply and high production costs associated with organic cocoa farming. While the demand for organic cocoa is growing globally, the supply is constrained due to several challenges in organic farming practices, including the higher cost of cultivation and the limited number of certified organic cocoa farms.

In 2023, the global demand for organic cocoa increased significantly, especially in regions like North America and Europe, driven by consumer preference for organic and fair-trade products. However, the area under organic cocoa cultivation has remained relatively small compared to conventional cocoa farming.

According to the International Cocoa Organization (ICCO), as of 2023, organic cocoa represents only about 3-5% of the global cocoa production, despite the increasing demand for organic products in the market.

The cost of organic cocoa farming is considerably higher than conventional cocoa farming. Organic cocoa farmers need to invest in more labor-intensive methods, as they avoid the use of synthetic fertilizers, pesticides, and herbicides. Instead, they rely on natural farming practices such as crop rotation and organic composting.

According to the FAO (Food and Agriculture Organization), the cost of organic farming can be up to 30-50% higher than conventional farming, primarily due to labor costs and the longer time it takes to certify organic cocoa farms. This higher production cost is then passed on to the consumers, making organic cocoa products more expensive than their conventional counterparts. In fact, organic cocoa prices can be 20-30% higher than traditional cocoa, which may limit the accessibility of these products to a wider range of consumers.

Another major challenge is the lack of skilled labor in organic cocoa farming. While conventional cocoa farming has a long-established workforce in key cocoa-producing countries such as Ivory Coast, Ghana, and Indonesia, organic farming requires specialized knowledge and training.

According to the Cocoa Farming Program (CFP), organic cocoa farmers require extensive training on sustainable farming practices, pest management, and soil fertility techniques. However, access to training programs is often limited, especially in rural regions where cocoa farming is most prevalent.

The limited availability of certified organic cocoa also impacts the supply chain. Certification is a lengthy and expensive process, and many farmers are either unable or unwilling to pay the costs associated with organic certification. In 2023, less than 10% of cocoa farmers in top cocoa-producing countries were certified organic. This limits the supply of certified organic cocoa, leading to price fluctuations and inconsistent product availability in the market.

Opportunity

Rising Demand for Organic and Fair-Trade Products

A key growth opportunity for the Organic Cocoa market is the increasing consumer demand for organic and fair-trade certified products. As awareness around sustainability, ethical sourcing, and health benefits rises, more consumers are opting for products made from organic cocoa, especially in regions like North America and Europe. The surge in demand for organic and ethically sourced cocoa is expected to drive market expansion in the coming years.

In 2023, the global organic cocoa market was valued at approximately USD 6.7 billion, and it is projected to grow at a compound annual growth rate (CAGR) of 8.4% between 2023 and 2028, according to data from the FAO (Food and Agriculture Organization).

This growth is largely fueled by the rising consumer preference for organic products, driven by the growing awareness about the environmental and health benefits of organic agriculture. According to the World Cocoa Foundation, consumers are increasingly prioritizing products that support sustainable farming practices, with organic cocoa being a primary choice.

In North America, organic food sales have been on the rise, with organic products in the United States alone accounting for nearly 15% of total food sales in 2023, as reported by the Organic Trade Association. This trend is reflected in the growing popularity of organic chocolate and confectionery products, where organic cocoa is a key ingredient. Major food manufacturers are responding to this demand by expanding their organic product lines.

For instance, Mars and Nestlé, two of the world’s largest chocolate manufacturers, have committed to sourcing sustainable and organic cocoa to meet the increasing demand from eco-conscious consumers. According to the Fairtrade Foundation, global sales of fair-trade certified cocoa rose by 6.4% in 2023, underlining the increasing consumer preference for ethically sourced products.

Moreover, as governments and organizations push for more sustainable agricultural practices, the demand for organic cocoa is expected to rise. The European Union (EU) and various other governments have introduced policies supporting organic agriculture, including subsidies for organic farming transitions and certifications.

The EU, for example, allocated €500 million to support organic farming practices under its Common Agricultural Policy (CAP) in 2023, which is likely to encourage more cocoa farmers to adopt organic practices. In addition, numerous certification programs, such as Fairtrade and Rainforest Alliance, are growing in popularity, further boosting the demand for organic cocoa.

The increasing interest in health-conscious products is another driver of this growth. Organic cocoa is often seen as a healthier alternative to conventionally farmed cocoa, as it is free from synthetic chemicals and pesticides. The rise of plant-based and vegan diets is also contributing to the demand for organic cocoa, as it is a key ingredient in many plant-based and dairy-free products, including chocolates and beverages.

Trends

Increased Adoption of Sustainable and Fair-Trade Certified Cocoa

One of the most prominent trends in the organic cocoa market is the increasing adoption of sustainable and fair-trade certified cocoa. As consumers continue to prioritize ethical sourcing and sustainability, major chocolate manufacturers and food brands are aligning their sourcing practices with certifications such as Fairtrade, Rainforest Alliance, and Organic. This trend is not only driven by consumer demand but also by increasing regulatory pressures and corporate social responsibility (CSR) initiatives.

In 2023, the demand for Fairtrade certified cocoa grew by 6.4% globally, according to the Fairtrade Foundation. This surge reflects a broader consumer shift towards products that support ethical farming practices and offer better economic conditions for cocoa farmers.

More than 1.5 million cocoa farmers in West Africa alone are benefiting from Fairtrade certification, which ensures fair wages, community development funds, and access to organic farming techniques. These farmers have seen a direct benefit from this trend, as Fairtrade cocoa sales exceeded USD 2 billion in 2023. This market growth is driving the adoption of sustainable farming practices and further solidifying the role of organic cocoa in the global market.

In addition to Fairtrade, other certifications like Rainforest Alliance are gaining traction. The Rainforest Alliance, a leading certification body for sustainable agriculture, reported that the amount of Rainforest Alliance certified cocoa reached approximately 3.2 million metric tons in 2023, covering over 1.5 million hectares of cocoa farms. This certification ensures that cocoa is grown in compliance with rigorous environmental, social, and economic standards, ensuring sustainable farming practices and better working conditions for farmers.

Governments and regulatory bodies are also playing a significant role in encouraging the shift towards sustainable and organic cocoa production. In the European Union, for example, the European Green Deal aims to promote sustainability across industries, including agriculture.

In 2023, the EU announced €500 million in subsidies for organic farming transitions, encouraging cocoa farmers to adopt organic and sustainable farming practices. The EU Organic Action Plan further supports this, with a target to increase the share of organic farming in the EU to 25% by 2030. As part of these efforts, organic cocoa production is set to expand, especially in regions like West Africa and South America.

Regional Analysis

In 2023, Asia Pacific (APAC) held the dominant position in the global organic cocoa market, capturing more than 43.4% of the market share, valued at approximately USD 3.3 billion. The region’s robust growth is primarily driven by increasing demand in emerging economies like China and India, where consumer awareness about health and sustainability is on the rise. APAC is expected to continue to lead the market due to its growing chocolate consumption, especially among the younger population, and the expanding demand for organic and ethically sourced ingredients in food products.

North America follows closely as a significant player in the market, accounting for a substantial share in 2023. The United States and Canada are key contributors to this growth, driven by a surge in demand for organic food products, including organic cocoa. The organic food market in the U.S. reached USD 62 billion in 2023, with organic cocoa becoming increasingly popular due to its use in confectionery and beverages. Furthermore, consumers are increasingly favoring sustainable and fair-trade certified cocoa, propelling market growth in this region.

Europe also holds a considerable share of the organic cocoa market, with Germany, France, and the UK being leading consumers. Europe’s demand is primarily driven by high consumption of chocolate products and growing trends for organic and sustainably sourced ingredients. The European organic food market was valued at EUR 45 billion in 2023, with a significant portion attributed to organic cocoa used in confectionery and beverages.

The Middle East & Africa and Latin America are growing at a moderate pace. The demand for organic cocoa in these regions is mainly driven by the expanding chocolate market and increasing investment in sustainable cocoa farming practices. However, their contribution remains relatively smaller compared to APAC, North America, and Europe.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Organic Cocoa Market is highly competitive, with several global companies playing a key role in its growth. Leading players like Barry Callebaut AG, Cargill Incorporated, and Olam International Limited dominate the market, leveraging their extensive supply chains, strong brand presence, and expertise in the production of high-quality cocoa ingredients.

Barry Callebaut, one of the largest cocoa processors globally, has focused on expanding its organic cocoa offerings through strategic partnerships and acquisitions. The company’s commitment to sustainability, including its “Forever Chocolate” program, which aims to reduce the environmental impact of cocoa farming, has helped it maintain a strong position in the organic segment. Cargill, another prominent player, has been focusing on increasing its supply of sustainably sourced organic cocoa, collaborating with farmers and certification bodies to ensure the quality and traceability of its cocoa.

In addition to these major players, Blommer Chocolate Co., Tradin Organic Agriculture B.V., and Pascha Chocolate Co. are key players driving growth in the organic cocoa sector. Blommer, one of the largest chocolate manufacturers in North America, has been expanding its organic cocoa product line to cater to the growing demand for organic and fair-trade certified ingredients.

Tradin Organic Agriculture, based in the Netherlands, is known for its focus on sustainable sourcing and its strong portfolio of organic cocoa products. Meanwhile, Pascha Chocolate Co., a relatively newer but growing company, focuses exclusively on organic, allergen-free chocolate products and has positioned itself as a key player in the organic cocoa market by emphasizing clean and ethical sourcing.

Top Key Players

- Artisan Confections Company

- Barry Callebaut AG

- Blommer Chocolate Co.

- Cargill Incorporated

- Cargill, Inc.

- Ciranda

- Conacado Agroindustrial S.A.

- Guan Chong Berhad

- Internatural Foods Llc

- Jindal Cocoa

- Kraft Foods Inc.

- Olam International Limited

- Pascha Chocolate Co.

- Pascha Company

- The Hershey Company

- Tradin Organic Agriculture B.V.

Recent Developments

In 2023 Artisan Confections Company, the company expanded its product line by introducing new chocolate varieties made from certified organic cocoa, responding to increasing demand for organic ingredients in the confectionery sector.

In 2023 Barry Callebaut AG, the company expanded its organic cocoa range, particularly in response to rising demand in key markets such as North America and Europe.

Report Scope

Report Features Description Market Value (2023) USD 7.6 Bn Forecast Revenue (2033) USD 13.7 Bn CAGR (2024-2033) 6.1% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Cocoa Liquor, Cocoa Powder, Cocoa Butter, Cocoa Paste, Cocoa Beans, Others), By Forms (Cubes, Spreads, Blocks, Slice, Others), By Application (Confectionery, Beverages, Bakery Products, Others), By End-use (Food And Beverages, Pharmaceuticals, Personal care, Others), By Distribution Channels (Specialty Stores, Supermarkets/Hypermarkets, Specialty Stores, Online Retail, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Artisan Confections Company, Barry Callebaut AG, Blommer Chocolate Co., Cargill Incorporated, Cargill, Inc., Ciranda, Conacado Agroindustrial S.A., Guan Chong Berhad, Internatural Foods Llc, Jindal Cocoa, Kraft Foods Inc., Olam International Limited, Pascha Chocolate Co., Pascha Company, The Hershey Company, Tradin Organic Agriculture B.V. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Artisan Confections Company

- Barry Callebaut AG

- Blommer Chocolate Co.

- Cargill Incorporated

- Cargill, Inc.

- Ciranda

- Conacado Agroindustrial S.A.

- Guan Chong Berhad

- Internatural Foods Llc

- Jindal Cocoa

- Kraft Foods Inc.

- Olam International Limited

- Pascha Chocolate Co.

- Pascha Company

- The Hershey Company

- Tradin Organic Agriculture B.V.