Global Alcoholic Beverages Market Size, Share, And Business Benefits By Product Type (Beer, Distilled Spirits, Wine), By Category (Plain, Flavored), By Packaging Type ( Bottles, Cans, Others), By Age Group (18-25 Years, 26-35 Years, 36-45 Years, Above 46 Years), By Distribution Channel (On-trade, Off -trade), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: Jan 2025

- Report ID: 136776

- Number of Pages: 263

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Business Benefits of Alcoholic Beverages

- By Type Analysis

- By Alcoholic Content Analysis

- By Product Type Analysis

- By Category Analysis

- By Packaging Type Analysis

- By Age Group Analysis

- By Distribution Channel Analysis

- Key Market Segments

- Driving Factors

- Restraining Factors

- Growth Opportunity

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

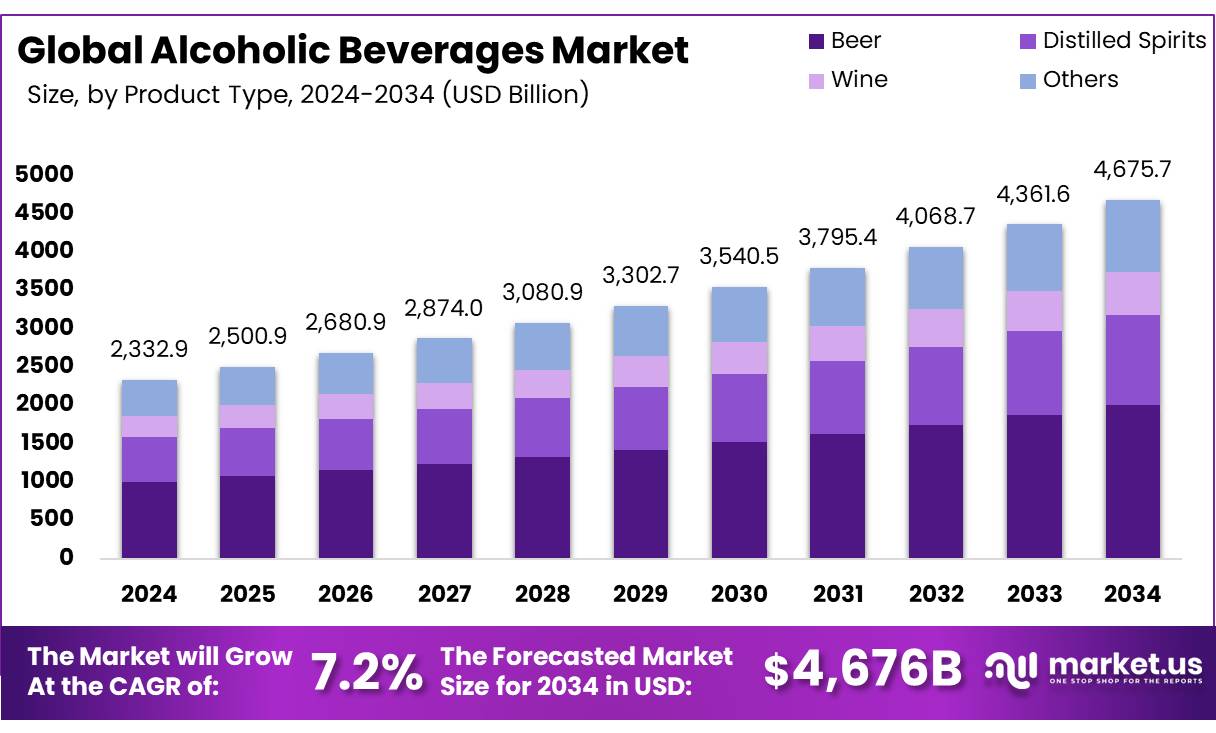

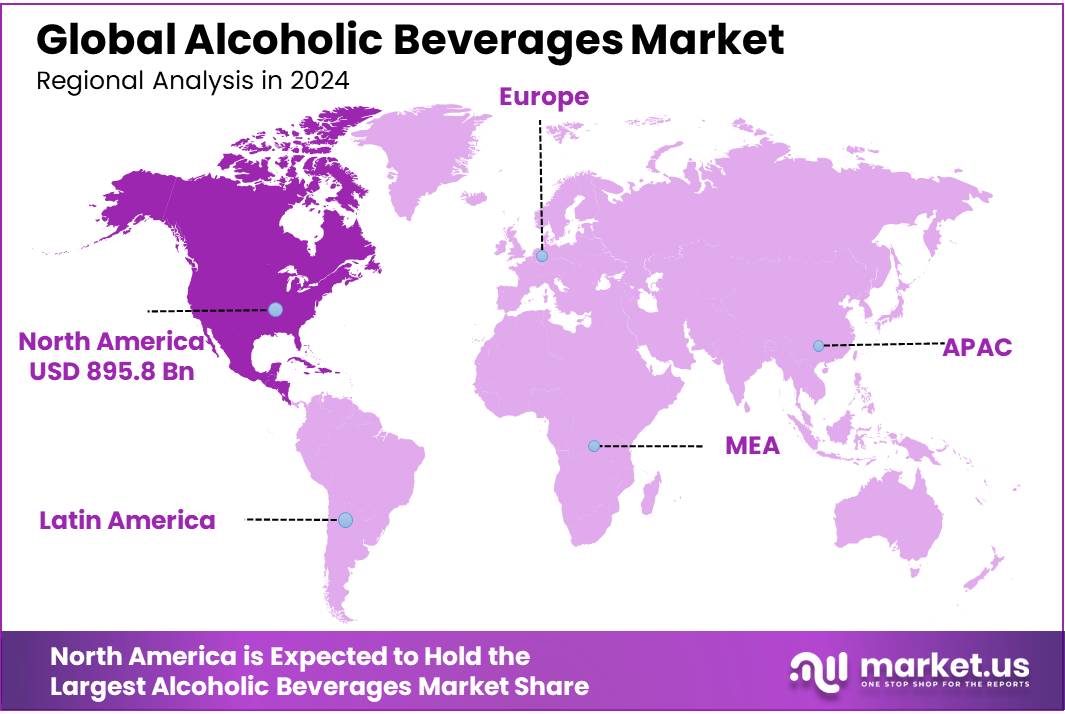

The Global Alcoholic Beverages Market is expected to be worth around USD 4675.7 Billion by 2034, up from USD 2332.9 Billion in 2024, and grow at a CAGR of 7.2% from 2025 to 2034. North America holds 38.40%, valued at USD 895.8 billion.

The global alcoholic beverages market is a vital segment of the food and beverage industry, characterized by its diverse product offerings, including beer, wine, spirits, and other liquors. Alcoholic beverages have been an integral part of cultural traditions and social occasions worldwide, contributing significantly to economic growth and employment.

Several driving factors are fueling the growth of the global alcoholic beverages market. One of the primary drivers is the rising trend of socializing and increased alcohol consumption among younger demographics, particularly in urban areas. The premiumization trend has also gained momentum, as consumers increasingly seek high-quality and craft beverages.

The Alcoholic Beverages Market experienced a subtle downturn in 2022, evidenced by a decrease in per capita ethanol consumption, down from 2.53 gallons in 2021 to 2.50 gallons, a 1.2% decline according to the National Institute on Alcohol Abuse and Alcoholism.

Innovations in product offerings, such as non-alcoholic and low-alcohol alternatives, are also expected to contribute to market growth. These products cater to the increasing demand for healthier lifestyle choices, attracting consumers who seek moderation without compromising taste and experience.

Despite this nationwide decrease, regional variations were significant; 18 states along with the District of Columbia reported consumption levels exceeding 10% above the national average. Financially, the Alcohol and Tobacco Tax and Trade Bureau (TTB) observed a 2% reduction in alcohol tax revenues, gathering $8.3 billion in fiscal year 2022.

This constituted 42% of the TTB’s total tax collections for the year, a slight decrease in comparison to the 44% contribution noted in the fiscal year 2023. In a regional context, the Virginia Alcoholic Beverage Control Authority declared revenues reaching $1.4 billion in the same period, including taxes on distilled spirits and wine.

Key Takeaways

- Alcoholic Beverages Market is expected to be worth around USD 4675.7 Billion by 2034, up from USD 2332.9 Billion in 2024, and grow at a CAGR of 7.2%

- Beer held a dominant market position in the “By Type” segment of the Alcoholic Beverages Market, with a 42.2% share.

- Medium held a dominant market position in the “By Alcoholic Content” segment of the Alcoholic Beverages Market, with a 53.5% share.

- beer segment held a dominant market position within the alcoholic beverages market, capturing more than a 42.40% share.

- plain segment of the alcoholic beverages market held a dominant market position, capturing more than a 68.60% share.

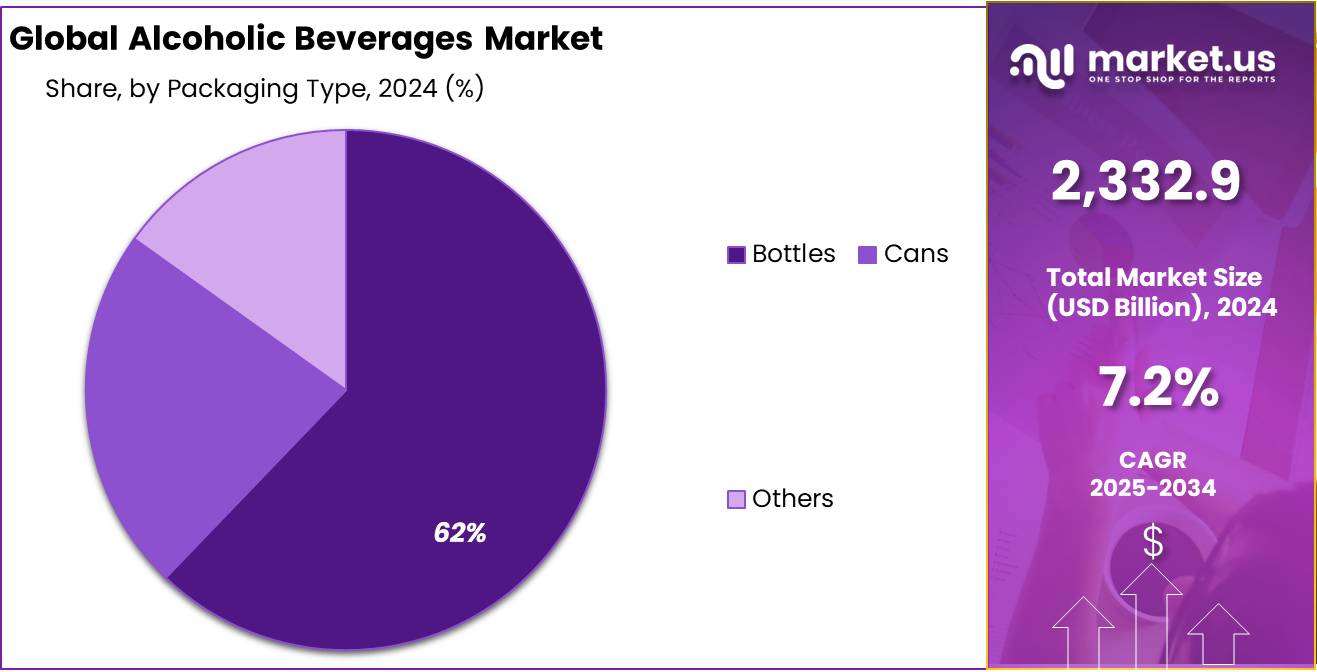

- bottles held a dominant market position in the packaging types segment of the alcoholic beverages market, capturing more than a 62.40% share.

- 26-35 years age group held a dominant market position in the alcoholic beverages market, capturing more than a 32.20% share.

- off-trade channel held a dominant market position in the distribution of alcoholic beverages, capturing more than a 62.20% share.

- North America holds a 38.40% share of the alcoholic beverages market, valued at USD 895.8 billion.

Business Benefits of Alcoholic Beverages

The alcoholic beverage industry significantly contributes to the economy through employment, tax revenues, and consumer spending. In 2020, the United States had approximately 21,745 businesses producing craft beverages, generating roughly $32 billion in annual sales. These craft businesses accounted for about 8% of total U.S. alcohol sales.

Excise taxes on alcoholic beverages are a substantial revenue source for governments. In fiscal year 2023, U.S. federal revenues from alcohol taxes were $11 billion, representing 0.25% of total tax revenues. Distilled spirits contributed 60% of this revenue, followed by beer at 30% and wine at 10%.

The industry also supports employment across various sectors, including production, distribution, and retail. For instance, the legalization of 3.2% alcohol beer in 1933 created 81,000 jobs within three months, highlighting the industry’s capacity to generate employment opportunities.

However, it’s important to acknowledge the economic burden associated with excessive alcohol consumption. In 2010, alcohol misuse cost the United States $249 billion, with three-quarters of this total attributed to binge drinking.

By Type Analysis

Beer dominates the Alcoholic Beverages Market, accounting for a 42.2% share.

In 2023, Beer held a dominant market position in the “By Type” segment of the Alcoholic Beverages Market, with a 42.2% share. Followed closely, Wine captured a 26.5% share, reflecting a stable consumer preference for both traditional and innovative wine offerings.

Champagne, often associated with luxury and celebrations, maintained a market share of 16.1%, driven by rising global demand for premium alcoholic beverages. Distilled Spirits, including whiskey, vodka, rum, and gin, accounted for 15.2% of the market, underscored by a growing cocktail culture and the increasing popularity of craft distilleries.

These segments reveal diverse consumer preferences and market dynamics. Beer’s leading position is bolstered by its wide acceptance across various demographics and regions, driven by its versatility and the proliferation of craft beer varieties. Wine’s significant market share is supported by health-conscious consumers who prefer wine for its perceived health benefits.

Champagne enjoys a niche appeal that aligns with luxury consumption trends, while Distilled Spirits benefits from innovations in flavor and heritage branding, appealing to both traditional consumers and millennials seeking new drinking experiences.

By Alcoholic Content Analysis

Medium alcohol content beverages lead with 53.5% market dominance.

In 2023, Medium held a dominant market position in the “By Alcoholic Content” segment of the Alcoholic Beverages Market, with a 53.5% share. This category typically encompasses beverages with alcohol content ranging from 5% to 12%, such as most wines and beers, which are favored for their balanced flavor and moderate intoxicating effects.

The Low alcoholic content segment, which includes light beers and low-alcohol wines, secured a 28.3% market share, appealing to health-conscious consumers and those preferring lower alcohol intake. Meanwhile, High alcoholic content beverages, including spirits like vodka, rum, and whiskey, represented 18.2% of the market, driven by consumer preferences in settings that favor stronger drinks, such as bars and social gatherings.

The segmentation by alcoholic content reflects consumer trends towards moderation and health consciousness, with Medium alcoholic content beverages leading due to their versatility and broad appeal. They are preferred for casual drinking occasions and can cater to a wide range of taste preferences and dining experiences.

Low-alcoholic content beverages continue to rise in popularity due to growing health awareness and stricter drink-driving regulations. Conversely, High alcoholic content products maintain a significant, albeit smaller, market share, buoyed by traditional spirit consumption and the premiumization of certain brands.

By Product Type Analysis

In 2024, the beer segment held a dominant market position within the alcoholic beverages market, capturing more than a 42.40% share. This category includes various sub-types such as ale, lager, and hybrid beers, each appealing to diverse consumer preferences due to their unique flavors and brewing techniques. The popularity of craft beers and the expansion of microbreweries have significantly contributed to the growth of this segment, reflecting a trend towards premiumization and variety.

Distilled spirits also represent a significant portion of the market, with products like rum, whiskey, and vodka showing robust sales. Each type caters to different consumption patterns and cultural preferences, influencing their market dynamics. For instance, whiskey has seen a resurgence in popularity due to its craft production and aging process, which appeals to consumers looking for high-quality, artisanal products.

Wine, including sub-categories like sparkling and fortified wines, continues to hold its appeal among consumers who prefer a sophisticated drinking experience. The demand for sparkling wine is expected to grow, particularly driven by increasing consumption in social settings and during celebrations. Meanwhile, fortified wines maintain a niche audience, focusing on traditional consumers who value the historical and regional significance of these beverages.

By Category Analysis

In 2024, the plain segment of the alcoholic beverages market held a dominant market position, capturing more than a 68.60% share. This segment typically includes traditional beverages such as unflavored beers, spirits, and wines, which continue to enjoy widespread popularity due to their long-standing presence in the market and established consumer base. The preference for plain alcoholic beverages is largely driven by consumers who appreciate the authentic tastes and heritage associated with these drinks.

On the other hand, the flavored segment, while smaller, is rapidly gaining traction. This category includes alcoholic beverages enhanced with additional flavors, such as fruit-infused beers, spiced rums, and aromatic wines. The growth in this segment is propelled by younger consumers and innovation-driven brands looking to expand their market reach by offering unique and experimental flavors. These products cater to a more adventurous audience seeking variety and new experiences in their beverage choices.

By Packaging Type Analysis

In 2024, bottles held a dominant market position in the packaging types segment of the alcoholic beverages market, capturing more than a 62.40% share. This preference for bottles is deeply rooted in tradition, as they are widely regarded for preserving the flavor and quality of beverages like beer, wine, and spirits. Glass bottles, in particular, are favored for their ability to maintain product integrity and offer a premium presentation.

Cans, however, are gaining popularity due to their convenience and innovation in design. They are seen as a practical choice for outdoor and casual settings, where portability is essential. Additionally, cans provide an excellent canvas for creative branding, which appeals to younger demographics and can help brands stand out in a competitive market.

By Age Group Analysis

In 2024, the 26-35 years age group held a dominant market position in the alcoholic beverages market, capturing more than a 32.20% share. This demographic is particularly influential, as it includes young professionals and early family starters who tend to have disposable incomes and a propensity to socialize. Their beverage preferences often influence market trends, with a noticeable inclination towards premium and craft alcoholic beverages that offer a unique drinking experience.

The 18-25 years segment, while not holding the majority, is significant for its role in shaping future market directions. This age group is often more open to experimental and flavored alcoholic products, driven by trends and social media influence. They are key targets for new product launches, especially in categories like flavored spirits and ready-to-drink cocktails.

Individuals aged 36-45 years also represent a substantial portion of the market. This group typically prefers more established brands and drinks that align with a more settled lifestyle, often opting for high-quality wines and premium spirits.

The above 46 years age group, while having the smallest market share, tends to consume alcohol less frequently but places a high emphasis on quality over quantity. Their preferences can significantly impact the segments of fine wines and aged spirits.

2025, the 26-35 years age group is expected to maintain its dominance, while the 18-25 years segment might see a faster growth rate as marketers increasingly target this age group with innovative products and digital marketing strategies. The older age groups will continue to demand high-quality products, influencing the market towards premium offerings.

By Distribution Channel Analysis

In 2024, the off-trade channel held a dominant market position in the distribution of alcoholic beverages, capturing more than a 62.20% share. This channel encompasses supermarkets/hypermarkets, specialty stores, convenience stores, and online stores, offering consumers the convenience of purchasing drinks for consumption at home. Supermarkets and hypermarkets lead within this category due to their wide range of products and competitive pricing, making them popular choices for regular purchases.

The on-trade channel, which includes pubs, bars, cafes, hotels, and restaurants, while having a smaller share, plays a crucial role in the market by providing venues for social interactions and immediate consumption. This sector was particularly influenced by trends towards premiumization, with consumers preferring higher-quality beverages in social settings.

The off-trade channel is expected to continue its dominance as consumers appreciate the convenience and variety it offers. However, the on-trade channel may see a rebound in growth as social activities normalize post-pandemic, with an emphasis on experiential dining and drinking experiences. This balance between convenience and experience will define the dynamics of the market moving forward.

Key Market Segments

By Product Type

- Beer

- Ale

- Lager

- Hybrid

- Distilled Spirits

- Rum

- Whiskey

- Vodka

- Others

- Wine

- Sparkling Wine

- Fortified Wine

- Others

By Category

- Plain

- Flavored

By Packaging Type

- Bottles

- Cans

- Others

By Age Group

- 18-25 Years

- 26-35 Years

- 36-45 Years

- Above 46 Years

By Distribution Channel

- On-trade

- Pubs, Bars & Cafe’s

- Hotels & Restaurants

- Others

- Off -trade

- Supermarkets/Hypermarkets

- Specialty Stores

- Convenience Stores

- Online Stores

Driving Factors

Growing Urbanization Boosting Alcoholic Beverage Demand

Urbanization has led to a rise in disposable incomes and lifestyle changes, encouraging people to adopt a social drinking culture. With more people moving to cities, access to bars, pubs, and restaurants has increased significantly.

This trend is especially prominent among young adults and working professionals, who seek alcohol as part of their leisure and socializing activities. Moreover, the introduction of innovative flavors and premium alcohol choices has further captured consumer interest, driving steady growth in the alcoholic beverages market worldwide.

Rising Popularity of Premium and Craft Beverages

Consumers are increasingly seeking unique drinking experiences, which has fueled the demand for premium and craft alcoholic beverages. These products often emphasize high-quality ingredients, artisanal production methods, and innovative flavors. Craft beers, small-batch whiskeys, and boutique wines have particularly gained traction among discerning drinkers.

The willingness to pay more for superior quality and exclusivity has encouraged market players to expand their premium offerings, ensuring robust growth. This shift also aligns with consumers valuing authenticity and the story behind the beverages.

Expanding E-Commerce Channels for Alcoholic Beverages

Online platforms have revolutionized the way alcoholic beverages are purchased, offering convenience and a wide variety of options. With advancements in digital technology, consumers can explore and order their favorite drinks from the comfort of their homes.

E-commerce platforms often provide tailored recommendations, discounts, and seamless delivery options, making them highly attractive. The COVID-19 pandemic accelerated this trend, and now even traditional retailers are investing in online sales strategies. This shift is expected to continue driving growth in the alcoholic beverages market.

Restraining Factors

Stringent Government Regulations Limiting Alcoholic Sales

Strict government regulations and policies surrounding alcohol production, distribution, and advertising significantly restrain market growth. Many countries impose high taxes on alcoholic beverages, making them less affordable for consumers. Additionally, age restrictions and strict licensing laws limit market accessibility. Advertising restrictions further hinder promotional efforts, reducing brand visibility.

Health campaigns against alcohol consumption also discourage potential buyers. These regulations are designed to address public health concerns, but they simultaneously create substantial challenges for manufacturers and retailers in the alcoholic beverages market.

Rising Awareness of Health Risks from Alcohol Consumption

Increasing awareness about the health risks associated with alcohol consumption is discouraging consumers from indulging in alcoholic beverages. Health campaigns highlighting issues like liver diseases, addiction, and impaired mental health have gained traction globally. Younger generations are particularly inclined toward healthier lifestyle choices, often opting for non-alcoholic alternatives.

This trend has led to a growing preference for sober living, reducing the demand for traditional alcoholic products. As consumers become more health-conscious, manufacturers face challenges in maintaining market share and adapting to evolving preferences.

High Competition from Non-Alcoholic and Low-Alcohol Alternatives

The rise of non-alcoholic and low-alcohol beverages is posing significant competition to traditional alcoholic products. Consumers seeking healthier or socially responsible options are gravitating toward these alternatives. Brands offering non-alcoholic beverages beers, wines, and spirits are gaining popularity due to their innovation and focus on inclusivity.

This shift is especially evident among millennials and Gen Z, who prioritize wellness and moderation. As these alternatives continue capturing consumer interest, traditional alcoholic beverage manufacturers face challenges in retaining market relevance and sustaining growth.

Growth Opportunity

Expanding Demand for Alcoholic Beverages in Emerging Markets

Emerging markets, especially in Asia-Pacific, Latin America, and Africa, present significant growth opportunities for the alcoholic beverages industry. Rising disposable incomes, urbanization, and changing lifestyles in these regions are driving increased alcohol consumption. Younger populations in these areas are showing a growing interest in social drinking culture.

Additionally, market players are introducing localized flavors and affordable options to attract consumers. As these economies continue to develop, the demand for alcoholic beverages is expected to rise, offering substantial growth potential for industry stakeholders.

Innovations in Flavors and Product Customization Driving Sales

Consumers are increasingly drawn to unique and personalized alcoholic beverage options, creating a lucrative growth avenue. Innovative flavors, infused spirits, and craft-style products are resonating with younger audiences who seek novelty. Market players are leveraging technology to develop customized drink options and cater to specific taste preferences.

This trend is also supported by collaborations with mixologists and chefs to create unique offerings. With the growing desire for experimentation and customization, companies that prioritize innovation are well-positioned to capitalize on this opportunity.

Growth of Sustainable and Eco-Friendly Alcoholic Beverages

The rising consumer focus on sustainability is creating a new wave of opportunities in the alcoholic beverages market. Brands that adopt eco-friendly packaging, source ingredients sustainably, and reduce carbon footprints are gaining favor with environmentally conscious consumers.

Organic and biodynamic wines, sustainably brewed beers, and ethically sourced spirits are becoming popular choices. This trend is also aligned with the increasing demand for transparency in production processes. Companies that invest in sustainable practices can enhance brand loyalty while contributing to a greener future, ensuring long-term market growth.

Latest Trends

Growing Popularity of Ready-to-Drink (RTD) Alcoholic Beverages

Ready-to-drink (RTD) alcoholic beverages are rapidly gaining traction due to their convenience, portability, and innovative flavors. These beverages, including canned cocktails, hard seltzers, and pre-mixed spirits, cater to on-the-go lifestyles and appeal to younger consumers. They are particularly popular for outdoor events, casual gatherings, and travel.

The low-alcohol content of many RTDs also aligns with the rising demand for moderation. With continuous product innovation and premiumization, RTDs are becoming a dominant trend, reshaping the way people consume alcoholic beverages.

Increasing Demand for Low-Alcohol and Non-Alcoholic Alternatives

The trend toward mindful drinking has sparked a surge in demand for low-alcohol and non-alcoholic beverages. Consumers, particularly millennials and Gen Z, are prioritizing health and wellness, seeking options that fit their balanced lifestyles.

Brands are responding with a variety of low-alcohol beers, wines, and zero-proof spirits that mimic traditional alcoholic beverages. This shift is not just a temporary fad but reflects a long-term change in consumer preferences, creating a new segment of the market with tremendous growth potential.

Enhanced Focus on Digital Marketing and E-Commerce

Digital marketing and e-commerce are revolutionizing the alcoholic beverages industry, enabling brands to engage directly with consumers. Social media platforms, influencer collaborations, and targeted advertising are driving brand awareness and loyalty.

At the same time, online sales platforms are providing seamless shopping experiences, with features like product recommendations and doorstep delivery. The pandemic accelerated these digital trends, and they remain key to market strategies. Brands investing in digital innovations are better positioned to connect with tech-savvy consumers and expand their reach.

Regional Analysis

North America holds a 38.40% share of the alcoholic beverages market, valued at USD 895.8 billion.

In 2024, North America emerged as the dominant region in the global alcoholic beverages market, commanding a substantial 38.40% share with a market value of USD 895.8 billion. This significant market size is driven largely by the U.S., which hosts a diverse range of consumers with a strong inclination towards premium alcoholic beverages such as craft beers, fine wines, and artisanal spirits. The region’s robust regulatory environment and established distribution channels further facilitate the widespread availability and consumption of alcoholic beverages.

Europe also holds a key position in the market, characterized by its deep-rooted drinking cultures, particularly in countries like Germany, the UK, and France. The region is renowned for its historic breweries, vineyards, and distilleries, which cater extensively to both local and global demands. Consumer preferences in Europe often lean towards regional specialties, including Scotch whisky, German beer, and French wine, which continue to see stable growth.

Asia Pacific is the fastest-growing region in the alcoholic beverages market, spurred by increasing disposable incomes and the westernization of consumer lifestyles, especially in countries like China, India, and Japan. The region is witnessing a rapid expansion in both production and consumption, with local players rising to prominence by adapting traditional Western beverages to local tastes.

The Middle East & Africa and Latin America regions, although smaller in comparison, are experiencing growth due to urbanization and the relaxing of regulations regarding alcohol consumption. In Latin America, spirits like tequila and rum are particularly popular, whereas non-traditional markets in the Middle East are gradually opening up, primarily in luxury and tourist sectors.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The alcoholic beverages market is characterized by a diverse range of global players that drive competition and innovation within the industry. Among the key players, Anheuser-Busch InBev SA/NV and Heineken Holding NV stand out due to their extensive portfolio of brands and global reach.

Diageo and Bacardi Limited are leaders in the spirits segment, offering popular brands of rum, whiskey, and other distilled spirits. Diageo is known for its wide range of premium spirits and active engagement in promoting responsible drinking, which resonates well with today’s health-conscious consumers. Similarly, Bacardi leverages its long-standing heritage to market its products effectively across generations. On the wine front, Constellation Brands Inc., E & J Gallo Winery, and Treasury Wine Estates lead with their strong portfolios of wine brands that appeal to both casual drinkers and connoisseurs.

Thai Beverage, HiteJinro Co., Ltd., and Asahi Group Holdings, Ltd. are significant players, reflecting regional tastes and preferences in their product offerings. These companies have successfully capitalized on the local market’s growth potential by aligning their products with regional drinking cultures, which often differ markedly from Western trends. Overall, the alcoholic beverages market continues to evolve, driven by these key players who not only compete on a global scale but also continually adapt to changing consumer preferences and regulatory landscapes across different regions.

Top Key Players in the Market

- Anheuser-Busch InBev SA/NV

- Heineken Holding NV

- Diageo

- Bacardi Limited

- Constellation Brands Inc.

- Pernod Ricard

- Radico Khaitan Ltd.

- Carlsberg Group

- Thai Beverage

- HiteJinro Co., Ltd.

- Molson Coors

- E & J Gallo Winery

- Beam Suntory

- Brown-Forman Corporation

- Campari Group

- Asahi Group Holdings, Ltd.

- The Wine Group

- Treasury Wine Estates

- Castel Group

- Accolade Wines

- Allied Blenders & Distillers

- Other key Players

Recent Developments

- In 2024, Carlsberg Breweries A/S, a leading producer of beer and beverages, expanded in 2024 by acquiring Britvic for £3.3 billion and Marston’s stake for £206 million, enhancing its non-alcoholic portfolio and strengthening its UK beer market presence.

- In 2023, Heineken reported a 6.6% organic growth in net revenue per hectolitre, despite a 5.6% decline in beer volume. The Heineken® brand itself saw a 1.7% volume increase, excluding Russia. The company also completed the acquisition of Distell and Namibia Breweries, forming Heineken Beverages.

Report Scope

Report Features Description Market Value (2024) USD 2332.9 Billion Forecast Revenue (2034) USD 4675.7 Billion CAGR (2025-2034) 7.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Beer, Distilled Spirits, Wine), By Category (Plain, Flavored), By Packaging Type ( Bottles, Cans, Others), By Age Group (18-25 Years, 26-35 Years, 36-45 Years, Above 46 Years), By Distribution Channel (On-trade, Off -trade) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Anheuser-Busch InBev SA/NV, Heineken Holding NV, Diageo, Bacardi Limited, Constellation Brands Inc., Pernod Ricard , Radico Khaitan Ltd., Carlsberg Group, Thai Beverage, HiteJinro Co., Ltd., Molson Coors, E & J Gallo Winery , Beam Suntory, Brown-Forman Corporation, Campari Group, Asahi Group Holdings, Ltd., The Wine Group , Treasury Wine Estates , Castel Group, Accolade Wines , Allied Blenders & Distillers, Other key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Anheuser-Busch InBev SA/NV

- Heineken Holding NV

- Diageo

- Bacardi Limited

- Constellation Brands Inc.

- Pernod Ricard

- Radico Khaitan Ltd.

- Carlsberg Group

- Thai Beverage

- HiteJinro Co., Ltd.

- Molson Coors

- E & J Gallo Winery

- Beam Suntory

- Brown-Forman Corporation

- Campari Group

- Asahi Group Holdings, Ltd.

- The Wine Group

- Treasury Wine Estates

- Castel Group

- Accolade Wines

- Allied Blenders & Distillers

- Other key Players