Global Craft Beer Market Size, Share and Industry Analysis Report By Product Type (Ale, Lager, Stout, Porter, and Other Product Types) By Type (Alcoholic and Non-Alcoholic) By Distribution Channel (On-Trade and Off-Trade), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: Oct 2024

- Report ID: 13559

- Number of Pages: 253

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

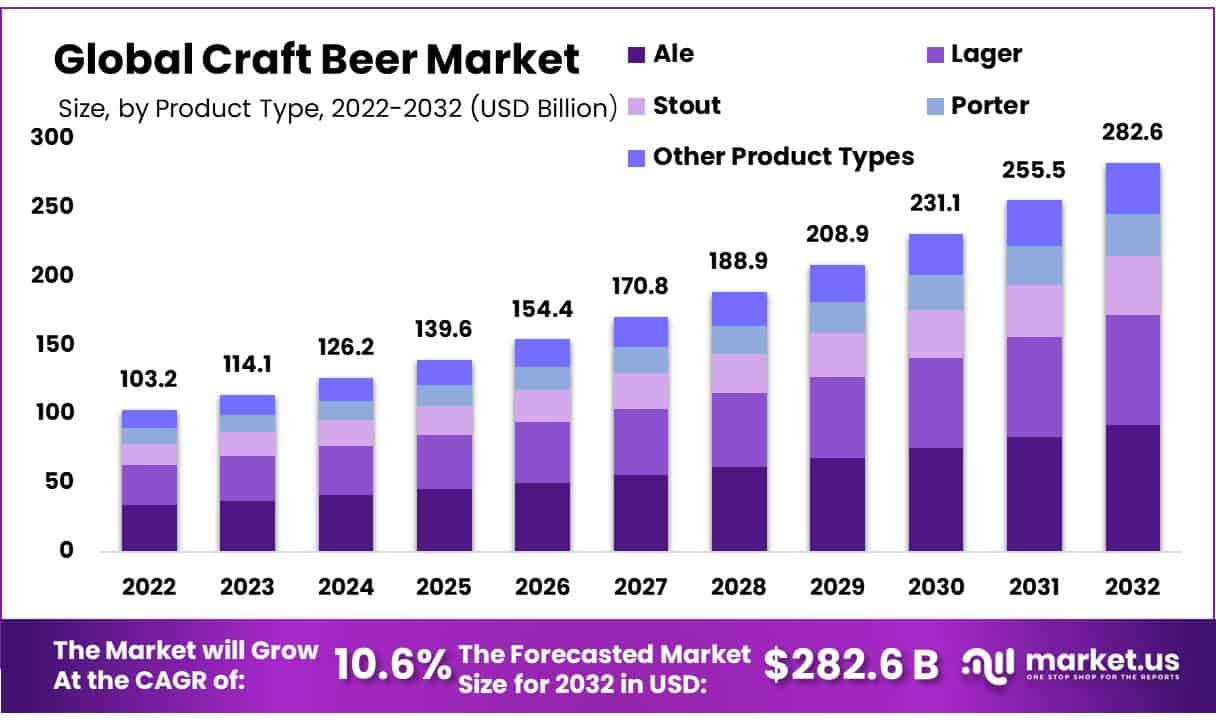

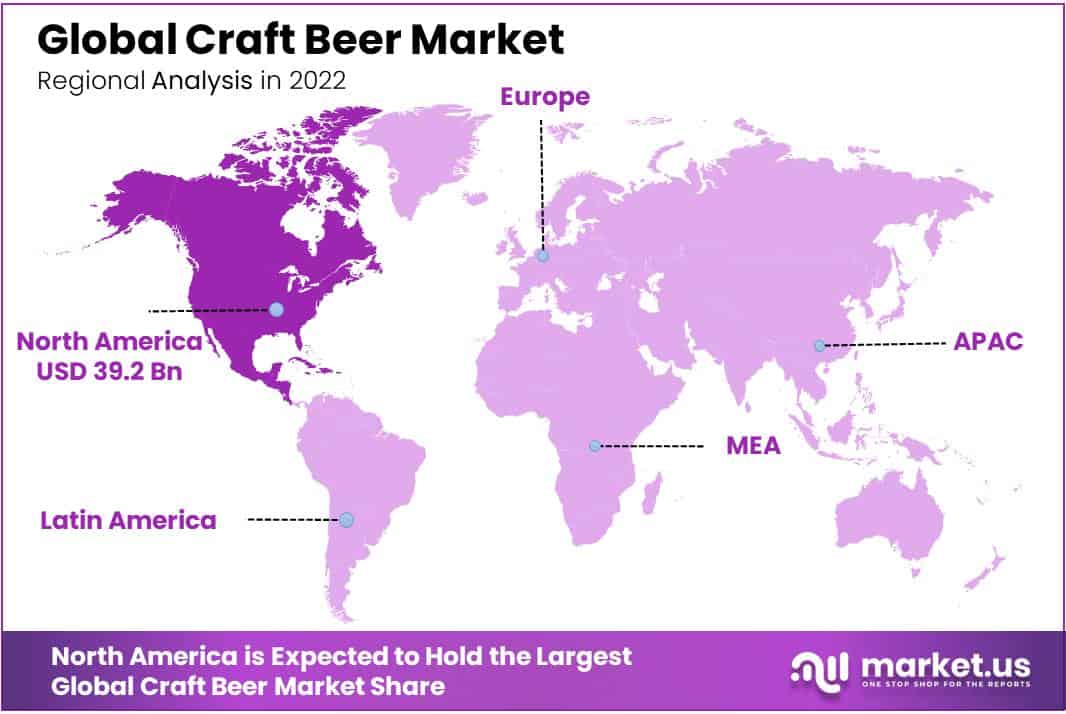

The global Craft Beer market size was valued at USD 114.1 Billion in 2023 and is expected to reach USD 282.6 Billion in 2032. It is expected to grow at a CAGR of 10.6% between 2023 and 2032. North America dominates the global craft beer market, accounting for 38% of sales in 2023, largely due to its vibrant beer culture and numerous craft breweries.

Craft beer is a type of beer that is produced by independent, small breweries that prioritize flavor, quality, and innovation over mass production. This sector has carved out a niche within the larger beer industry, offering consumers diverse and distinctive beer flavors and experiences.

According to the Brewers Association, In the US, small and independent brewers produced 24.3 million barrels of beer in 2022, while craft beer market share by volume increased to 13.2%, up from 13.1% the previous year.

Technological developments in beer brewing have led to the introduction of a diverse range of goods in the market. One of the most popular versions in the range, the aforementioned product has seen tremendous growth in popularity in recent years.

Good growth is being experienced by the market, particularly in North America because of the region’s abundance of tasty selections and ongoing taste enhancement. Since consumers are constantly looking for new and inventive drinks, the advent of flavorful options has increased the consumption of these types of beverages.

The product incorporates CBD, an innovative non-psychoactive ingredient found in cannabis plants. Breweries using hemp oil in their limited edition lineup of IPAs and APAs include The Long Trail Brewing Company in Vermont. Customers are gravitating toward beers infused with CBD because they are low in calories and the CBD lessens the bitter flavor of the hops, which is enhanced by the terpenes’ citrus undertones.

Key Takeaways

- Market Developments: The global craft beer is projected to experience compound annual over the period 2023-2032 at a CAGR of 10.6%.

- Product Categories: Ale beer market, lagers, stouts, and porters are popular categories within craft beer; each offering their own distinctive taste profile and brewing technique. Ales account for 32.6% market share while Porters and Stouts follow close behind respectively.

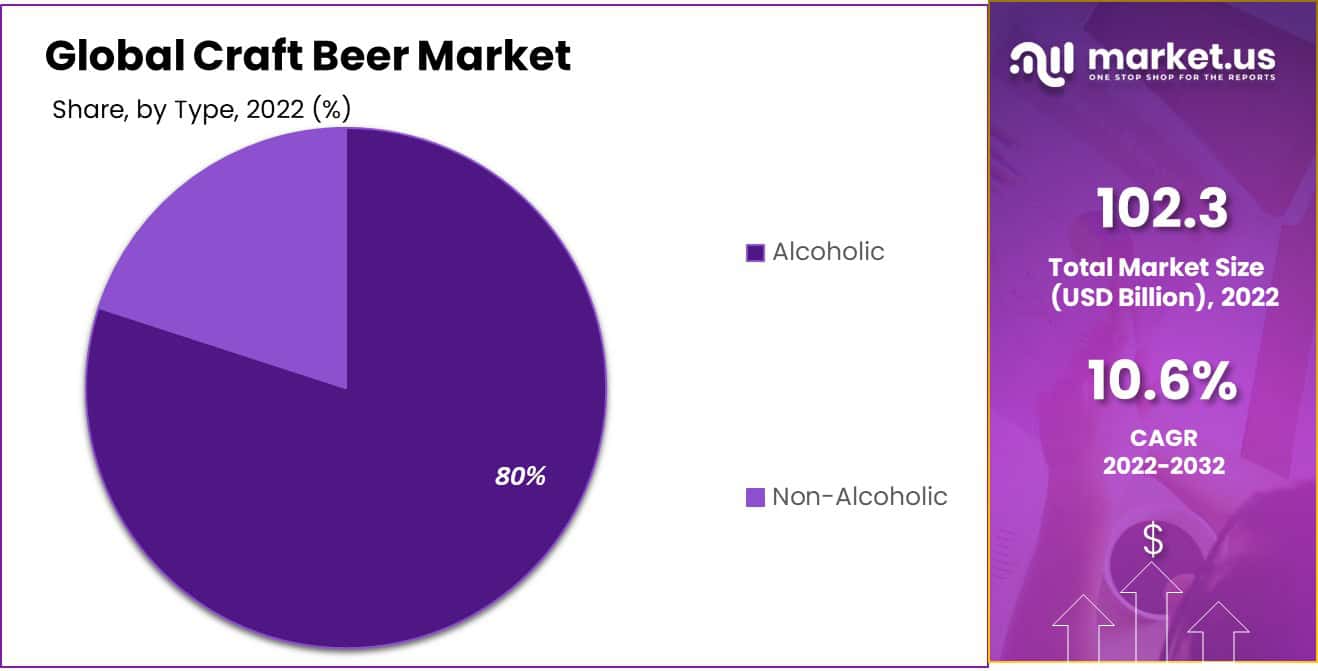

- Craft Beer Market Analysis by Types: In terms of types, craft beer can be broadly split between alcoholic and non-alcoholic segments; with alcohol making up over 80% of this global market.

- Distribution Channel Analysis: The craft beer can be divided into two main distribution channels – on-trade and off-trade – which together account for around 60% market share by 2023.

- North America: North America holds the largest market share 38% for craft beer sales worldwide.

Market Analysis

By Product Type Analysis

Ales Lead the Craft Beer Market due to its Flavorful Variety and Rapid Innovation offers.

By product type, craft beer can be divided into Ale, lager, stout, porter, and other product types. Among these, the ale segment dominates the market with a market share of 32.6% and a projected growth rate of 10.7% in the forecasted period.

The dominance of the ale segment is attributed to ales encompassing a wide range of flavors and styles, appealing to a diverse consumer base, from hoppy IPAs to rich stouts. This variety caters to evolving consumer preferences and encourages exploration within the craft beer niche.

Ales often enjoy a shorter production cycle than lagers, allowing breweries to experiment more frequently and respond swiftly to Craft Beer market trends. The craft beer movement has also emphasized the artistry and innovation of ale production, driving consumer interest and loyalty. These factors combined have positioned Ale as the leading and continually growing category in craft beer.

The larger beer segment is growing significantly due to its crisp, clean taste, appeal to a wider consumer base, and the unique flavors and ingredients craft breweries offer. Lagers are also well-suited for hot climates and outdoor activities, further driving their popularity.

Type Analysis

Alcoholic Craft Beer Dominates the Global Market, Reflecting Traditional Brewing Values

By type, the market for craft beer is further divided into alcoholic and non-alcoholic. Among these, the alcoholic segment led the global market with a more than 80% market share. Traditional craft beer is primarily alcoholic, embodying the essence of small-batch, artisanal brewing that emphasizes unique flavors and higher alcohol content.

This aligns with the core principles of craft beer enthusiasts. Secondly, alcoholic craft beers cater to a well-established consumer base of beer connoisseurs who appreciate the complexity and diversity of flavors offered by alcoholic varieties.

The non-alcoholic segment is rapidly growing due to shifting consumer preferences. Health-consciousness is a significant driver, with more individuals seeking low or zero-alcohol alternatives. Non-alcoholic craft beers offer the same unique flavors, artisanal quality, and variety as traditional craft beers, appealing to consumers who wish to enjoy the craft beer experience without the alcohol content.

Distribution Channel Analysis

Off-trade dominates Global Craft Beer Market, Fueled by Convenience and Home Enjoyment.

The global craft beer is further segmented based on distribution channels into on-trade and off-trade. The off-trade segment dominates the market, with a market share of more than 60% in 2023. Off-trade channels, such as liquor stores, supermarkets, and online retail, provide consumers with convenience and a wide selection of craft beer options.

This ease of access encourages consumers to explore and purchase craft beer for home consumption. The COVID-19 pandemic accelerated the shift towards off-trade as lockdowns and social distancing measures limited on-trade opportunities. Furthermore, consumers increasingly prefer the flexibility of enjoying craft beer in the comfort of their homes, where they can savor and experiment with various craft beer offerings, bolstering the off-trade market share.

Market Segmentation

Based on Product Type

- Ale

- Lager

- Stout

- Porter

- Other Product Types

Based on Type

- Alcoholic

- Non-Alcoholic

Distribution Channel Analysis

- On-Trade

- Off-Trade

Driving Factors

Craft Beer’s Unique Flavors and Brewery Tourism is Fueling the Growth of the Global Craft Beer Market Growth.

One of the primary drivers fueling the global craft beer is craft brewers’ remarkable array of unique flavor profiles. In a world where homogenous, mass-produced beers have long dominated the market, consumers are increasingly drawn to diverse and distinctive taste experiences.

Craft breweries stand at the forefront of this revolution, consistently pushing the boundaries of brewing by experimenting with innovative ingredients, brewing techniques, and regional influences. This dedication to crafting unique and flavorful beers has garnered a dedicated and discerning consumer base passionate about exploring the myriad of tastes craft beer offers.

Furthermore, the integration of craft breweries into tourism has emerged as another significant driver. Craft breweries have transformed into more than just places of production; they have become vibrant tourist attractions.

People flock to these breweries for immersive experiences, including tours, tastings, and engaging events. These brewery-related tourism activities provide memorable experiences and contribute significantly to local economies.

Restraining Factors

Regulatory Hurdles And Market Competition Hinders The Global Craft Beer Growth

Craft beer faces significant restraints due to varying, and often stringent regulations governments impose worldwide. These regulations encompass labeling requirements, alcohol content limits, distribution restrictions, and taxation policies.

Compliance with these diverse regulations can be costly and time-consuming for craft breweries, particularly those seeking to expand into multiple markets. Navigating the complex web of regulations presents a barrier to market entry and growth, hindering the craft beer industry growth potential expansion.

Craft beer is fiercely competitive, with small breweries vying for market share and larger beverage companies consolidating through acquisitions. This presents challenges for new and smaller breweries to maintain profitability. Differentiation, branding, and distribution are essential for success, necessitating innovative strategies to stand out in a crowded market.

Growth Opportunities

Embracing Diversity and Expanding into Emerging Markets Presents Growth Opportunities in the Global Craft Beer Market

The global craft beer presents an opportunity for continued growth by capitalizing on the expanding craft beer culture. As consumers increasingly seek unique and high-quality brews, craft breweries can innovate with diverse flavors and styles, attracting a broader customer base and fostering brand loyalty.

Craft breweries have opportunities to expand their presence in emerging markets. These regions offer untapped potential as more consumers develop a taste for craft beer. Strategic partnerships, exports, and localized marketing can help craft beer brands establish a strong foothold in these markets.

Embracing sustainability practices and promoting health-conscious brewing attracts environmentally and health-conscious consumers. Breweries can invest in eco-friendly production methods, reduce waste, and offer low-alcohol or non-alcoholic craft beer options to tap into this growing market segment.

Trending Factors

Microbreweries Revolutionize and Experimentation with Flavors are the Recent Trends in the Craft Beer Market.

Global craft beer has seen a significant increase in microbreweries in recent years, driven by a discerning consumer base seeking unique, locally brewed flavors. These small-scale breweries are known for their dedication to quality, experimentation, and personalized offerings, challenging established brands.

They cater to diverse tastes and artisanal craftsmanship, offering limited-edition seasonal brews and adventurous flavor profiles.

Health-conscious trends have also impacted craft beer, with consumers prioritizing well-being and preferring craft beers with lower alcohol content and distinctive ingredients like fruits and spices.

Brewers focus on creating healthier options within the craft beer portfolio, offering refreshing alternatives to traditional beer and aligning with evolving tastes and preferences for a harmonious blend of flavor and wellness.

Regional Analysis

The Combination Of Historical Legacy, Innovation, And Strong Consumer Culture Has Solidified North America’s Global Craft Beer Market Leadership Position

North America is the dominant region in the global craft beer, with a market share of 38% of global craft beer market revenue. This region’s dominance boasts a rich historical brewing tradition, with craft beer culture deeply rooted in countries like the United States and Canada. Pioneering breweries like Sierra Nevada and Anchor Steam were pivotal in laying the foundation for the craft beer movement.

This early start allowed North American craft breweries to establish credibility, fine-tune their recipes, and cultivate a loyal customer base. Secondly, the North American market’s sheer size and diversity contribute to its dominance. The continent houses many craft breweries, from small local establishments to larger, well-established players.

This diversity in brewery sizes and offerings caters to a wide spectrum of consumer preferences, ensuring a craft beer for every taste. Furthermore, the “drink local” ethos has become a powerful driver, with consumers actively seeking out and supporting neighborhood breweries.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The competitive landscape in craft beer is characterized by a dynamic interplay of established breweries and an ever-growing number of small, innovative players. Larger, well-established craft breweries like Sierra Nevada, Sam Adams, and New Belgium Brewing maintain a strong presence and a loyal customer base, leveraging their brand recognition and distribution networks.

Market Key Players

- Anheuser-Busch InBev

- Beijing Enterprises Holdings Limited

- Carlsberg Group

- Diageo PLC

- Dogfish Head Craft Brewery Inc.

- Heineken Holding NV.

- Squatters Pub and Beers

- Sierra Nevada Brewing Co.

- The Boston Beer Company Inc.

- United Breweries Limited

- Kove USA, Inc.

- Other Key Players

Recent Developments

In September 2023, The Appalachian Mountain Brewery merges with Green Man Brewery.

In August 2023, Anheuser-Busch BUD entered a definitive agreement to sell eight of its beer and beverage brands, including Shock Top, Breckenridge Brewery, Blue Point Brewing Company, 10 Barrel Brewing Company, Redhook Brewery, Widmer Brothers Brewing, Square Mile Cider Company, and HiBall Energy, to Tilray Brands, Inc.

In August 2023, Anheuser-Busch announced a $22.5 million investment in its Houston brewery.

In July 2023, Craft beer maker Lone Wolf expanded its portfolio by launching two new beer variants, Alpha and Maverick. The launch of these new beers is aimed at introducing customers to more flavors and aromas via their expanding portfolio.

Report Scope

Report Features Description Market Value (2022) USD 103.2 Bn Forecast Revenue (2032) USD 282.6 Bn CAGR (2023-2032) 10.6% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Ale, Lager, Stout, Porter, and Other Product Types), By Type (Alcoholic and Non-Alcoholic), By Distribution Channel (On-Trade and Off-Trade), Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC- China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- GCC, South Africa, &Rest of MEA Competitive Landscape Anheuser-Busch InBev, Beijing Enterprises Holdings Limited, Carlsberg Group, Diageo PLC, Dogfish Head Craft Brewery Inc., Heineken Holding NV., Squatters Pub and Beers, Sierra Nevada Brewing Co., The Boston Beer Company Inc., United Breweries Limited, Kove USA, Inc., and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Anheuser-Busch InBev

- Beijing Enterprises Holdings Limited

- Carlsberg Group

- Diageo PLC

- Dogfish Head Craft Brewery Inc.

- Heineken Holding NV.

- Squatters Pub and Beers

- Sierra Nevada Brewing Co.

- The Boston Beer Company Inc.

- United Breweries Limited

- Kove USA, Inc.

- Other Key Players