Global Brewery Equipment Market Report By Equipment Type (Microbrewery Equipment, Craft Brewery Equipment), By Mode of Operation (Automatic, Semi-automatic, Manual), By Brewery Type (Microbreweries, Craft Breweries), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: October 2024

- Report ID: 47422

- Number of Pages: 316

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

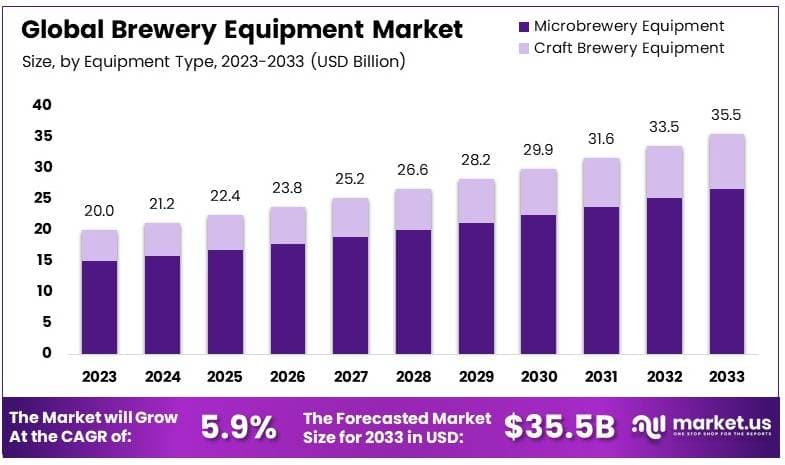

The Global Brewery Equipment Market size is expected to be worth around USD 35.5 Billion by 2033, from USD 20.0 Billion in 2023, growing at a CAGR of 5.9% during the forecast period from 2024 to 2033.

Brewery equipment includes machinery and tools used in beer production, such as fermenters, boilers, kegs, and filtration systems. These machines are crucial for commercial and craft beer brewing processes.

The brewery equipment market comprises the businesses involved in manufacturing, selling, and distributing the machinery used in brewing. Growth is driven by the rising demand for craft beers, as well as innovations in brewing technology and sustainable production processes.

The brewery equipment market is growing, driven by the expanding craft beer industry and increasing consumer interest in diverse and specialty brews. In 2023, the U.S. beer industry shipped 192 million barrels, showing the high demand for beer production and, consequently, brewery equipment.

The rise in the number of operational craft breweries, reaching 9,683 in 2023, according to the Brewers Association, demonstrates a strong market for brewing technology and infrastructure. However, the market also shows signs of maturity, as evidenced by the 418 closures alongside 495 new openings, highlighting competitive pressures and market challenges.

Several growth factors influence the brewery equipment market. The rising population of legal drinking age consumers, which accounts for 75% of the U.S. population (approximately 249 million people), indicates a stable base for beer consumption and alcoholic drinks.

The market for brewery equipment shows signs of saturation, especially in regions with a high concentration of breweries, such as the U.S. and parts of Europe. The number of breweries continues to grow, but at a slower rate compared to previous years.

With over 9,600 breweries operating in the U.S., competition is high, and businesses must differentiate through unique offerings or improved efficiencies. Companies that manufacture brewery equipment must innovate to keep pace with this evolving landscape and focus on providing solutions that cater to automation, efficiency, and scalability to support new and existing breweries.

On a broader scale, the U.S. brewery equipment market impacts both domestic and international beer production. The U.S. Department of Commerce reported that imported beer made up 18% of total U.S. beer consumption in 2022, while exports are rising as American breweries expand globally.

Locally, the expansion of breweries supports local economies through job creation and investment in infrastructure. As more breweries open, the demand for equipment suppliers and technicians also rises, boosting local industries. This has a ripple effect on related sectors, such as transportation and hospitality, which benefit from increased brewery activity.

Key Takeaways

- The Brewery Equipment Market was valued at USD 20.0 billion in 2023, expected to reach USD 35.5 billion by 2033, with a CAGR of 5.9%.

- Microbrewery Equipment dominated with 75% market share in 2023, due to rising craft beer production and microbrewery establishments.

- Automatic equipment held 55% of the market share in 2023, as breweries seek to enhance efficiency and reduce manual labor.

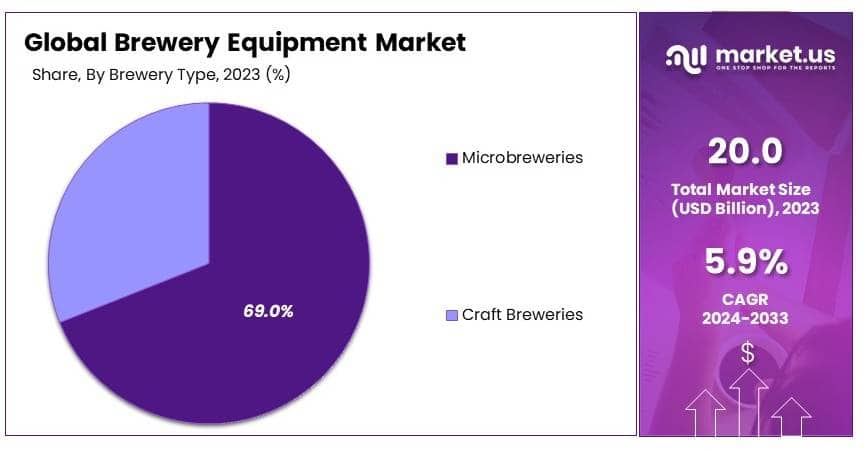

- Microbreweries accounted for 69% of the market share in 2023, driven by the increasing number of small-scale, independent breweries.

- Europe led with 47% share, generating over USD 9.4 billion in 2023, due to its rich brewing tradition and expanding craft beer market.

Equipment Type Analysis

Microbrewery Equipment dominates with 75% market share in 2023 due to rising demand for small-scale brewing and quality craft beer production.

The Brewery Equipment Market is divided into several key segments based on equipment type, including Microbrewery and Craft Brewery equipment. Microbrewery equipment holds the largest share, accounting for 75% of the market in 2023.

This segment’s dominance is driven by the growing number of microbreweries worldwide and the increasing popularity of craft beer among consumers. Microbreweries often produce small batches of high-quality beer, leading to high demand for specialized equipment. This trend has pushed investments in equipment that ensures efficiency, quality control, and sustainability.

Milling equipment is essential for preparing grains, which is the first step in the brewing process. Although its role is crucial, its market share is relatively stable compared to other segments due to the more substantial growth observed in fermentation and cooling technologies.

Brew House equipment is central to the brewing process, as it includes kettles, boilers, and mash tuns. With the expanding microbrewery industry, this sub-segment sees steady growth. Breweries are investing more in efficient and automated brew houses to enhance production while maintaining quality standards.

Cooling equipment is a vital component as it helps maintain the right temperatures during the brewing process. Its importance is increasing as breweries aim to manage energy costs efficiently while ensuring the consistent quality of their products.

Filtration and filling equipment are essential for ensuring product quality and extending shelf life. This sub-segment supports the industry’s focus on producing beer that meets high standards of purity and consistency. Breweries are investing in advanced beverage membrane filtration technologies to maintain quality control, further fueling growth in this area.

Mode of Operation Analysis

Automatic mode dominates with 55% market share in 2023 due to efficiency and demand for consistent quality.

The market is also segmented based on the mode of operation: Automatic, Semi-automatic, and Manual. The Automatic segment holds the largest market share at 55% as of 2023. The dominance of automatic systems is largely attributed to the need for consistent, high-quality production in breweries.

Automation reduces the risk of human error, ensuring product consistency and operational efficiency. Many breweries are transitioning to automated systems, aiming to cut labor costs and boost output without compromising quality.

Semi-automatic equipment balances human control and automation. This mode is popular among medium-sized breweries, where the flexibility of manual adjustments is still needed, but automation is desired for efficiency. Semi-automatic systems offer a middle ground for breweries that are expanding but not yet fully automated, contributing to steady growth in this sub-segment.

Manual equipment remains relevant, particularly among small breweries and hobbyists. These breweries prefer manual systems for their low costs and the artisanal touch they offer. Although manual equipment does not capture a large market share, it remains important in regions where microbreweries emphasize traditional brewing methods.

Brewery Type Analysis

Microbreweries dominate with 69% market share in 2023 due to the global rise in demand for diverse craft beer flavors.

The Brewery Equipment Market is categorized into Microbreweries and Craft Breweries. Microbreweries held a 69% share of the market in 2023. The microbrewery segment’s growth is fueled by the global trend of consumers seeking diverse and unique beer flavors.

Microbreweries, typically small-scale operations, offer distinctive flavors that appeal to a growing consumer base, especially in regions like North America and Europe. The increasing popularity of local and premium beer varieties has pushed the need for specialized equipment that supports small-scale, high-quality production.

As more microbreweries emerge, the demand for customized and efficient brewing solutions continues to rise, cementing this segment’s dominant position.

Craft breweries are also growing but at a slower rate compared to microbreweries. They focus on artisanal and specialty beers, often produced in slightly larger volumes than those of microbreweries. This segment supports the market with demand for equipment that accommodates creative and experimental brewing processes, contributing to overall market growth.

Both segments—microbreweries and craft breweries—play a significant role in promoting local economies, and their expansion supports the growth of the brewery equipment industry. As consumers look for authentic and high-quality products, these breweries will continue to invest in advanced brewing solutions.

Key Market Segments

By Equipment Type

- Microbrewery Equipment

- Milling Equipment

- Brew House

- Cooling Equipment

- Fermentation Equipment

- Filtration & Filling Equipment

- Others

- Craft Brewery Equipment

- Mashing Equipment

- Fermentation Equipment

- Cooling Equipment

- Storage Equipment

- Compressors

- Others

By Mode of Operation

- Automatic

- Semi-automatic

- Manual

By Brewery Type

- Microbreweries

- Craft Breweries

Drivers

Increasing Investments in Craft Breweries Drives Market Growth

The brewery equipment market is significantly influenced by increasing investments in craft breweries, which is a major driver of market growth. As consumers seek diverse and artisanal beer experiences, there has been a surge in the number of craft breweries opening globally.

Additionally, the rising popularity of microbreweries complements this growth, as they require smaller, flexible brewing systems that allow for experimentation and innovation. These microbreweries attract a loyal consumer base by offering exclusive products, further boosting the need for compact and efficient brewing equipment.

Furthermore, the adoption of advanced brewing technologies, such as automation and precision control systems, supports market growth by enabling breweries to increase efficiency and maintain consistent quality.

Lastly, the growth in premium and specialty beer segments pushes the demand for high-end brewery equipment. Consumers are willing to pay a premium for unique, high-quality beer products, which requires breweries to invest in advanced equipment that ensures consistent taste and quality across batches.

Restraints

High Initial Investment Costs Restraints Market Growth

One of the key restraining factors in the brewery equipment market is the high initial investment required for setting up breweries, especially small and independent ones. This significant financial barrier limits market entry for many aspiring brewers and slows the expansion of existing breweries.

Another challenge is the strict environmental regulations that breweries must adhere to, which can result in additional costs for compliance. These regulations often mandate the installation of specialized equipment to reduce emissions and waste, further increasing operational expenses.

Volatile raw material prices also impact the brewery equipment market. Fluctuations in the cost of materials like steel and copper, essential for manufacturing brewing systems, affect overall equipment pricing, making it difficult for breweries to plan long-term investments.

Competition from low-cost suppliers in emerging markets pressures established equipment manufacturers. These suppliers often offer cheaper alternatives, which can be appealing to breweries with limited budgets, despite potential compromises in quality.

Opportunity

Expansion into Emerging Markets Provides Opportunities

The brewery equipment market has significant opportunities for growth through expansion into emerging markets like Asia-Pacific and Latin America. As these regions experience economic growth, rising disposable incomes, and urbanization, there is an increasing demand for diverse beer products, presenting lucrative opportunities for brewery equipment manufacturers.

The rising demand for organic and sustainable beers also offers growth potential. Breweries that focus on sustainability appeal to environmentally conscious consumers, and equipment providers can capitalize on this trend by offering eco-friendly brewing solutions.

Additionally, the adoption of customizable brewing solutions creates opportunities for equipment providers. Many breweries are seeking flexible and scalable systems that can adapt to different brewing processes, allowing them to cater to varied consumer tastes.

Furthermore, partnerships with local breweries for market penetration can accelerate growth. By collaborating with regional players, equipment providers can gain insight into local preferences and regulations, ensuring their products meet market needs effectively.

Challenges

Regulatory Compliance and Licensing Issues Challenges Market Growth

The brewery equipment market faces several challenges, including regulatory compliance and licensing issues. Strict regulations in various countries require breweries to follow specific standards, which can be time-consuming and costly to navigate.

Fluctuating consumer preferences also pose challenges. With an ever-changing market, breweries must continuously adapt their products, making it difficult for equipment manufacturers to anticipate demand and maintain consistent sales.

Supply chain disruptions, often due to global events or logistical issues, impact the availability of raw materials needed for brewery equipment manufacturing. These disruptions can delay production timelines, causing uncertainties for both equipment suppliers and breweries planning expansions.

Moreover, competition from established market players presents a challenge for new entrants. Large, well-established companies have the advantage of brand recognition, making it difficult for smaller manufacturers to gain market share.

Growth Factors

Increase in Disposable Incomes Globally Is Growth Factor

The brewery equipment market benefits from the global increase in disposable incomes, which drives the demand for premium beer products. As consumers have more spending power, they are willing to pay for high-quality and craft beer varieties, leading to growth opportunities for breweries and equipment providers.

The expansion of the hospitality and tourism industry further boosts this market. Breweries, pubs, and restaurants are investing in on-site brewing systems to enhance customer experiences, pushing demand for brewery equipment tailored for such applications.

The influence of beer festivals and cultural events also contributes to market growth. These events showcase diverse beer varieties, encouraging breweries to invest in advanced equipment capable of producing experimental and seasonal products, thus expanding their product range.

The growth of e-commerce platforms for beer distribution allows breweries to reach a wider audience. Equipment manufacturers that provide systems adaptable for small-batch production can support breweries in scaling their operations to meet online demand, ensuring consistent growth and market expansion.

Emerging Trends

Automation and Smart Brewing Technologies Is Latest Trending Factor

Automation and smart brewing technologies are among the latest trends driving innovation in the brewery equipment market. Breweries increasingly adopt automated systems to optimize brewing processes, reduce labor costs, and ensure consistent product quality.

Sustainable brewing practices are also trending, with breweries integrating eco-friendly solutions into their production lines. This trend reflects growing consumer demand for environmentally responsible products, pushing equipment manufacturers to innovate in sustainable technologies.

The rise of non-alcoholic and low-alcohol beers presents another trend. As consumers become health-conscious, the demand for such products grows, prompting breweries to adapt their equipment to produce these varieties efficiently. Equipment providers that cater to this niche can capitalize on this expanding segment.

The shift towards direct-to-consumer sales channels is shaping market dynamics. Breweries are using e-commerce platforms to reach customers directly, reducing reliance on traditional distribution networks. Equipment manufacturers that support these channels by providing scalable and adaptable systems have an opportunity to tap into this growing market trend.

Regional Analysis

Europe Dominates with 47.0% Market Share

Europe leads the brewery equipment market with a 47.0% market share, equating to USD 9.4 billion. This dominance is driven by a long-established beer culture, increasing demand for craft breweries, and advanced technological innovations in brewing. Strong investments in automation and sustainability practices in production also play a key role in Europe’s market leadership.

The region’s regulatory framework, which promotes high standards in product quality and safety, combined with a focus on energy-efficient equipment, has further supported its growth. Additionally, the rise of microbreweries and local breweries across Europe has fueled equipment demand.

Europe’s market dominance is expected to persist, given the increasing focus on green technologies and continued support for local breweries. Growing consumer interest in premium and craft beers will likely sustain the region’s strong market presence in the future.

Regional Mentions:

- North America:

North America holds a strong presence in the brewery equipment market, driven by its craft beer revolution and investment in advanced brewing technologies. The region’s focus on sustainability and innovation supports the steady growth of its market share. - Asia Pacific:

Asia Pacific is seeing rapid growth in the brewery equipment market, fueled by rising consumer demand for beer and significant investments in production capacity. Countries like China and India are becoming key players, boosting regional equipment sales. - Middle East & Africa:

The brewery equipment market in the Middle East & Africa is emerging, with growth driven by increasing demand for non-alcoholic beverages and ongoing investments in industrial equipment. Governments are supporting brewery expansions in key markets. - Latin America:

Latin America is gradually expanding its brewery equipment market presence, led by an increasing demand for local craft beers and a focus on modernizing production facilities. Countries like Brazil and Mexico are playing pivotal roles in this regional market growth.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The brewery equipment market is driven by technological advancements, increasing demand for craft beer, and the expansion of breweries worldwide. Key players in this market focus on innovative solutions to improve brewing efficiency, reduce costs, and enhance product quality.

ALFA LAVAL, GEA Group Aktiengesellschaft, Krones AG, and Paul Mueller Company dominate the global brewery equipment market. These companies are recognized for their broad portfolios and expertise in delivering high-performance brewing systems. Their offerings include brewing vessels, filtration systems, automation technologies, and heat exchangers. This equipment helps breweries achieve higher productivity while ensuring energy efficiency and sustainability.

ALFA LAVAL is known for its advanced separation and fluid-handling technologies, while GEA Group specializes in customized brewing solutions and process optimization. Krones AG excels in packaging and bottling solutions, ensuring operational efficiency. Paul Mueller Company focuses on brewing vessels and stainless-steel tanks, helping breweries maintain high standards of hygiene and product quality.

These companies invest heavily in R&D to introduce energy-efficient and eco-friendly solutions. Their strong global presence and well-established customer base make them key players in shaping the future of the brewery equipment market. Additionally, partnerships with breweries, technological innovations, and a focus on sustainability help these companies maintain a competitive edge in a rapidly evolving market.

Their leadership in the market continues to influence trends, driving growth in both large-scale commercial breweries and the rising number of craft breweries globally.

Top Key Players in the Market

- Alfa Laval

- GEA Group Aktiengesellschaft

- Krones AG

- Paul Mueller Company

- Criveller Group

- Della Toffola USA

- Schulz

- Hypro

- Praj Industries

- ABE Equipment

- Ampco Pumps Company

- BrewBilt Manufacturing Inc.

- Lehui

- Deutsche Beverage Technology

- Meura

- Other Key Players

Recent Developments

- Genesee Brewery Modernization Project: In May 2024, Genesee Brewery in Rochester, NY, announced a $50 million modernization project aimed at expanding production and enhancing sustainability. The renovation includes new brewing and packaging facilities, designed to improve efficiency and support local job growth.

- Boxxtech Alcohol Vending Machine Launch: In June 2024, Boxxtech launched its alcohol vending machine, The Boxx, featuring innovative automated age verification technology. This new system, implemented at Cleveland Guardians’ stadium, utilizes AI to authenticate customer IDs, reducing the need for additional staff while ensuring compliance. Boxxtech plans to deploy 50 more units by the end of 2024 in various venues.

Report Scope

Report Features Description Market Value (2023) USD 20.0 Billion Forecast Revenue (2033) USD 35.5 Billion CAGR (2024-2033) 5.9% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Equipment Type (Microbrewery Equipment – Milling Equipment, Brew House, Cooling Equipment, Fermentation Equipment, Filtration & Filling Equipment, Others; Craft Brewery Equipment – Mashing Equipment, Fermentation Equipment, Cooling Equipment, Storage Equipment, Compressors, Others), By Mode of Operation (Automatic, Semi-automatic, Manual), By Brewery Type (Microbreweries, Craft Breweries) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Alfa Laval, GEA Group Aktiengesellschaft, Krones AG, Paul Mueller Company, Criveller Group, Della Toffola USA, Schulz, Hypro, Praj Industries, ABE Equipment, Ampco Pumps Company, BrewBilt Manufacturing Inc., Lehui, Deutsche Beverage Technology, Meura, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Brewery Equipment MarketPublished date: October 2024add_shopping_cartBuy Now get_appDownload Sample

Brewery Equipment MarketPublished date: October 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Alfa Laval

- GEA Group Aktiengesellschaft

- Krones AG

- Paul Mueller Company

- Criveller Group

- Della Toffola USA

- Schulz

- Hypro

- Praj Industries

- ABE Equipment

- Ampco Pumps Company

- BrewBilt Manufacturing Inc.

- Lehui

- Deutsche Beverage Technology

- Meura

- Other Key Players