Global Industrial Hemp Market Size, Share, And Business Environment Analysis By Type (Hemp Seed, Hemp Seed Oil, CBD Hemp Oil, Hemp Bast, Hemp Hurd), By Source (Conventional, Organic), By Application (Food and Beverages, Textiles, Pharmaceuticals, Personal Care Products, Animal Nutrition, Paper, Construction Materials, Others), By Distribution Channel (B2B (Direct Sales), Retail Stores, Online Sales, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Jan 2025

- Report ID: 136656

- Number of Pages: 375

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

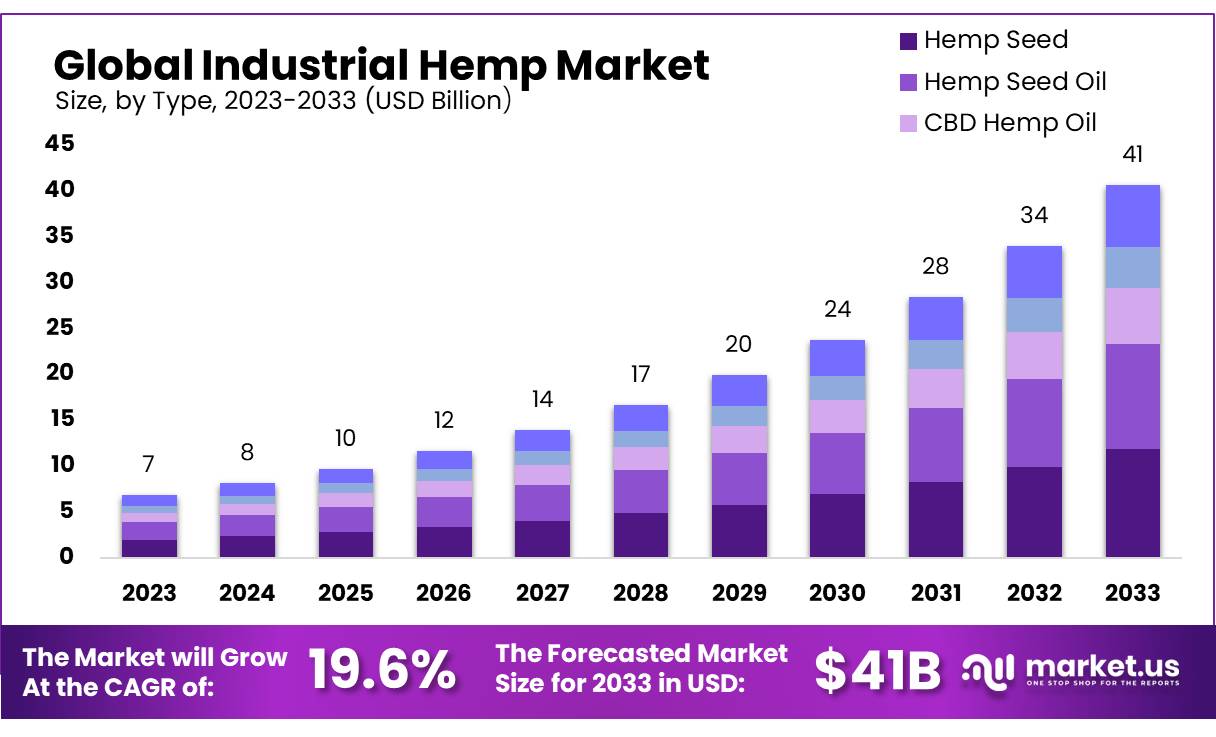

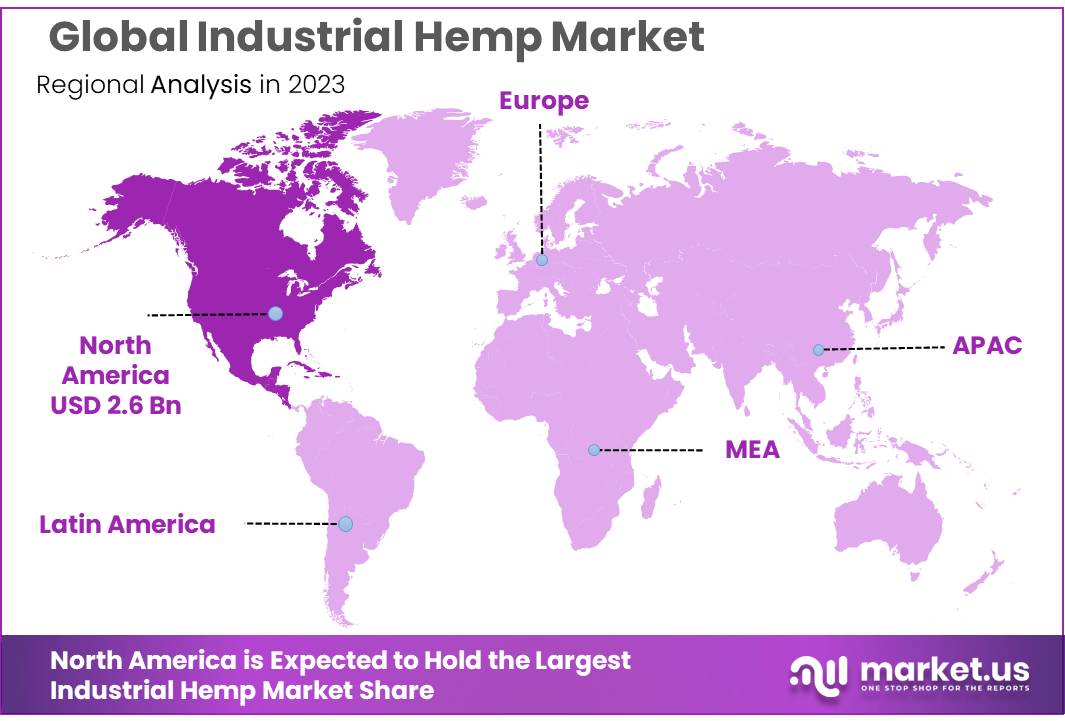

The Global Industrial Hemp Market size is expected to be worth around USD 40.7 Bn by 2033, from USD 6.8 Bn in 2023, growing at a CAGR of 19.6% during the forecast period from 2024 to 2033. North America is currently the dominant region in the hemp market, commanding a substantial share of 38.3%, equating to approximately USD 2.6 billion.

The Global Industrial Hemp Market has emerged as a transformative segment within agriculture and manufacturing, driven by its versatile applications across diverse industries. Industrial hemp, derived from the Cannabis sativa plant, contains low levels of tetrahydrocannabinol (THC) and is primarily cultivated for its fibers, seeds, and oil. Its eco-friendly properties, including rapid growth and low water requirements, make it an attractive crop for sustainable industries ranging from textiles and construction to food, cosmetics, and biofuels.

The hemp cultivation and processing is evolving, with governments worldwide recognizing its economic and environmental benefits. Regulatory frameworks in countries such as the U.S., Canada, and parts of Europe have increasingly relaxed, allowing for controlled cultivation and trade.

Driving factors include the growing demand for sustainable materials and the versatility of hemp-derived products. Hemp fibers are extensively used in textiles and bioplastics, while hemp seeds and oil find applications in health supplements, cosmetics, and food products.

According to the Food and Agriculture Organization (FAO), global hemp seed production exceeded 170,000 metric tons in 2021, reflecting its increasing integration into the food and nutraceutical industries. The construction sector is also a significant growth driver, with hempcrete—a lightweight and carbon-negative building material—gaining traction in eco-conscious markets.

Key trends shaping the market include advancements in processing technologies, enabling higher yields and better quality products. Innovations in decortication and extraction methods have improved the efficiency of separating hemp fibers and extracting cannabinoids like cannabidiol (CBD).

The rising demand for plant-based products, particularly in food and beverages, has further bolstered the market for hemp seeds and oil. Additionally, hemp’s potential in carbon sequestration and soil health improvement aligns with global sustainability goals, making it a preferred crop for regenerative agriculture.

Future growth opportunities lie in expanding applications across emerging industries, such as biofuels, bioplastics, and pharmaceuticals. Hemp-derived CBD, in particular, holds significant promise due to its therapeutic properties, driving demand in wellness and medicinal markets. Developing regions in Africa and South America, where climatic conditions are favorable for hemp cultivation, represent untapped potential.

Statistically, the global industrial hemp market was supported by an increase in hemp cultivation areas, which surpassed 400,000 hectares globally in 2021, according to FiBL (Research Institute of Organic Agriculture). With rising investments in research, cultivation, and processing, the industrial hemp market is positioned for sustained growth, driven by its adaptability, eco-friendliness, and the increasing adoption of sustainable practices across industries.

Key Takeaways

- Industrial Hemp Market size is expected to be worth around USD 40.7 Bn by 2033, from USD 6.8 Bn in 2023, growing at a CAGR of 19.6%.

- Hemp Seed held a dominant market position, capturing more than a 29.2% share.

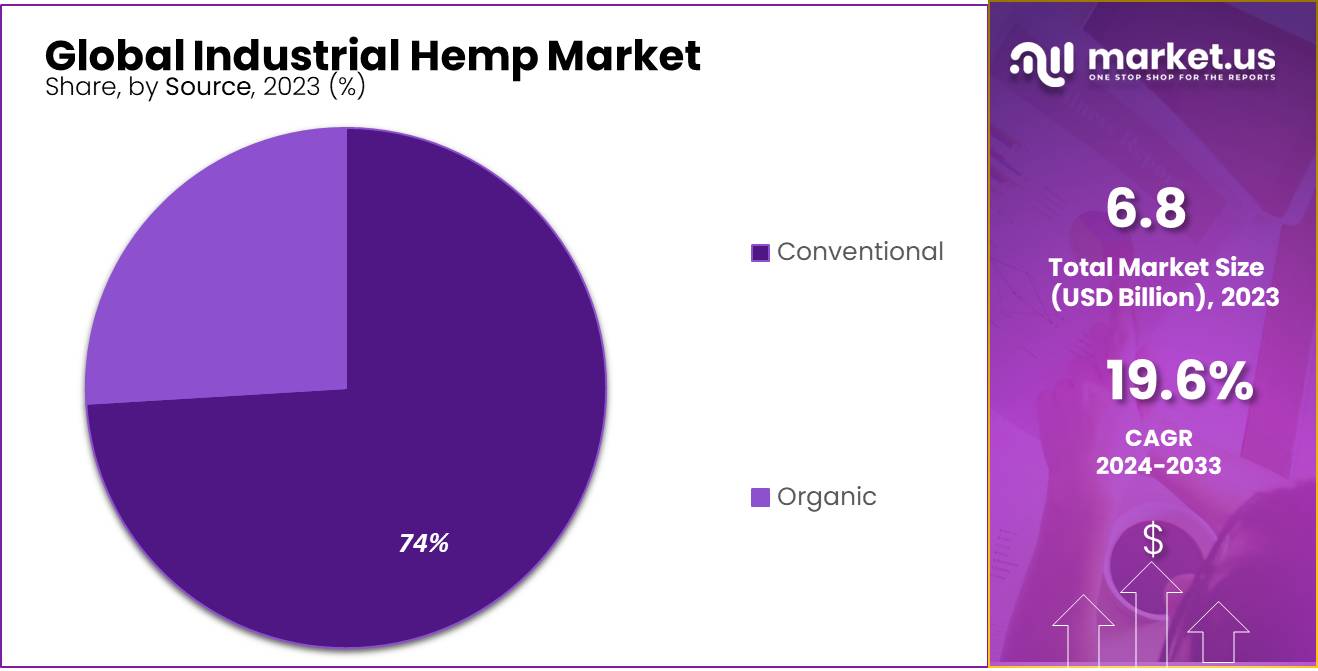

- Conventional segment of the industrial hemp market held a dominant position, capturing more than a 77.1% share.

- Food & Beverages segment of the industrial hemp market held a dominant position, capturing more than a 39.1% share.

- B2B (Direct Sales) channel for the industrial hemp market held a dominant position, capturing more than a 54.3% share.

- North America is currently the dominant region in the hemp market, commanding a substantial share of 38.3%, equating to approximately USD 2.6 billion.

Industrial Hemp Business Environment Analysis

The industrial hemp industry operates in a dynamic environment influenced by regulatory changes, evolving consumer demand, and advancements in agricultural practices. Industrial hemp, a versatile crop used in textiles, construction materials, food, and personal care products, has gained prominence due to its eco-friendly characteristics and wide-ranging applications.

Additionally, the plant’s diverse applications—ranging from hemp fibers in textiles to hemp seeds in nutritional products—have positioned it as a valuable resource for various industries. The hemp-derived CBD segment has seen particular growth, with CBD-infused products capturing a significant share of the personal care and wellness market.

The hemp industry faces several challenges, including high processing costs and limited infrastructure for harvesting and post-harvest processing. Despite these barriers, opportunities abound in emerging markets such as India and Africa, where favorable climatic conditions and increasing demand for natural fibers present significant potential. Additionally, the construction industry’s growing interest in hempcrete, a sustainable alternative to traditional concrete, underscores the untapped potential of hemp in eco-friendly building solutions.

The industrial hemp market is projected to experience robust growth, driven by its alignment with global sustainability goals and increasing consumer preference for biodegradable materials. By 2024, global production is expected to exceed 250,000 hectares, supported by technological advancements in processing and expanded applications in sectors such as automotive and pharmaceuticals. As regulatory frameworks stabilize and investment in infrastructure increases, the hemp industry is poised to become a cornerstone of the green economy, delivering economic, environmental, and social benefits on a global scale.

By Type Analysis

In 2023, Hemp Seed held a dominant market position, capturing more than a 29.2% share. This segment’s prominence is largely attributed to the versatility of hemp seeds, which are used in a variety of food products due to their nutritional benefits, including high protein content, essential fatty acids, and vitamins. Hemp seeds are not only consumed directly but are also processed into products like hemp milk and protein powder, appealing to a growing consumer base focused on health and wellness.

Hemp Seed Oil, another significant segment, is prized for its nutritional profile and is increasingly incorporated into dietary supplements and skincare products. Its rich omega fatty acid content makes it a favored option for health-conscious consumers. This segment’s growth is further propelled by its use in cosmetic formulations, where it’s valued for its moisturizing and skin barrier-enhancing properties.

CBD Hemp Oil has seen remarkable growth due to its therapeutic properties, with applications ranging from pain relief to anxiety management. As regulations surrounding cannabis and its derivatives continue to evolve, the CBD Hemp Oil market segment is expected to expand significantly, reflecting increased consumer acceptance and broader legal endorsements.

Hemp Bast, the fiber from the hemp stalk, is widely used in textile and composite materials. This segment benefits from the sustainability trend, as hemp fibers offer an eco-friendly alternative to synthetic fibers in the production of clothing, bags, and other textiles.

Hemp Hurd, the woody core of the hemp plant, is primarily utilized in the construction and animal bedding industries. Its application in hempcrete for construction demonstrates a growing shift toward sustainable building materials, which is expected to drive further interest and market growth in this segment.

By Source Analysis

In 2023, the Conventional segment of the industrial hemp market held a dominant position, capturing more than a 77.1% share. This segment’s strength is primarily due to the established agricultural practices and the extensive infrastructure that supports the mass production of hemp. Conventional hemp is typically grown in larger quantities and at a lower cost compared to its organic counterpart, making it a popular choice for manufacturers requiring bulk quantities, especially for applications in textiles, construction, and non-food products.

The organic segment, though smaller in market share, is witnessing rapid growth driven by the increasing consumer demand for products made from naturally grown ingredients without the use of synthetic chemicals and pesticides. Organic hemp is particularly favored in the food, supplement, and cosmetic industries where the purity of raw materials is highly valued.

This trend towards organic hemp is supported by a growing awareness of health, wellness, and environmental sustainability among consumers. As more people seek out eco-friendly and health-conscious alternatives, the demand for organic hemp products is expected to continue rising, potentially narrowing the market share gap with the conventional segment in the coming years.

By Application Analysis

In 2023, the Food & Beverages segment of the industrial hemp market held a dominant position, capturing more than a 39.1% share. This segment’s strong performance is driven by the increasing incorporation of hemp seeds and hemp seed oil into a variety of food products, including snacks, oils, and beverages, due to their rich nutritional profile high in proteins, fatty acids, and fiber. The growing trend of plant-based diets among health-conscious consumers has also significantly contributed to the expansion of this segment.

The Textiles segment follows, utilizing hemp fibers for the production of sustainable and durable fabric. The renewability and low environmental impact of hemp make it attractive in the textile industry, which is increasingly moving towards sustainable practices.

In Pharmaceuticals, hemp is valued for its cannabinoids, primarily CBD, which are used in a variety of therapeutic applications. The recognition of hemp’s medicinal benefits has led to greater investment and development in this segment, with a focus on pain management, mental health disorders, and inflammatory diseases.

Personal Care Products made from hemp, including lotions, oils, and soaps, are gaining popularity due to hemp oil’s moisturizing and skin health-enhancing properties. The Animal Nutrition segment benefits from hemp’s nutritional content, offering a source of protein and fiber in pet foods and supplements.

By Distribution Channel Analysis

In 2023, the B2B (Direct Sales) channel for the industrial hemp market held a dominant position, capturing more than a 54.3% share. This channel’s prominence is largely due to the bulk purchasing habits of industries that utilize hemp in manufacturing processes across various sectors such as textiles, construction, and pharmaceuticals. Direct sales enable businesses to negotiate better prices and streamline their supply chains, which is crucial for industries relying on hemp as a raw material.

Retail Stores also play a significant role in the distribution of industrial hemp products, particularly for consumer-focused items like food and beverage products, personal care items, and hemp-based fabrics. These stores, including specialty health and wellness shops, provide critical consumer access to hemp products and help in educating the public about hemp’s benefits.

Online Sales have seen substantial growth, driven by the increasing convenience of e-commerce platforms and the broader selection of hemp products available online. This channel is particularly popular for CBD products, where consumers appreciate the privacy and extensive product information available at their fingertips.

Key Market Segments

By Type

- Hemp Seed

- Hemp Seed Oil

- CBD Hemp Oil

- Hemp Bast

- Hemp Hurd

By Source

- Conventional

- Organic

By Application

- Food & Beverages

- Textiles

- Pharmaceuticals

- Personal Care Products

- Animal Nutrition

- Paper

- Construction Materials

- Others

By Distribution Channel

- B2B (Direct Sales)

- Retail Stores

- Online Sales

- Others

Drivers

Increasing Demand for Hemp-Based Products

The global industrial hemp market is witnessing substantial growth, primarily driven by the increasing demand for hemp-based products across various sectors. This surge in demand is underpinned by the growing awareness of hemp’s ecological benefits and its versatility in numerous applications. Hemp, derived from the Cannabis sativa plant species, is cultivated for its fiber, seeds, and oil, which can be utilized in a wide range of products including textiles, nutritional supplements, and body care products.

Hemp fibers are highly regarded for their durability, strength, and environmental sustainability, making them a popular choice in the textile industry. The shift towards sustainable and eco-friendly fashion is significantly contributing to the expansion of hemp in apparel and home furnishings. Hemp textiles not only offer longevity but also have a much lower water footprint compared to conventional cotton. Additionally, hemp’s breathability and antibacterial properties enhance its appeal in the clothing sector, aligning with the increasing consumer preference for natural and functional fabrics.

Beyond textiles, hemp seeds and oils are gaining traction in the food and beverage sector due to their high nutritional value. Hemp seeds are a rich source of essential fatty acids, protein, and fiber, making them an ideal ingredient in health food products. The legalization of hemp in various regions has further propelled its inclusion in dietary supplements and functional foods. Moreover, the growing vegan and plant-based dietary trends are amplifying the demand for hemp-based food products, as consumers seek sustainable and health-oriented alternatives to animal-derived ingredients.

In the personal care industry, hemp oil is celebrated for its skin-beneficial properties, including moisturization and the ability to soothe inflammation. The antioxidant and anti-aging qualities of hemp oil are being leveraged in a variety of skincare and cosmetic products, fueling growth in this segment. The global shift towards organic and natural beauty products has seen hemp emerge as a key ingredient, catering to the consumer’s growing preference for chemical-free and non-synthetic products.

The cumulative effect of these factors is a robust expansion of the global industrial hemp market. As industries continue to recognize hemp’s potential and consumers increasingly prioritize sustainability and health, the demand for hemp-based products is expected to rise steadily.

This trend is further supported by ongoing research and development activities that enhance hemp’s applicability and performance across different sectors. With a global move towards more environmentally friendly and sustainable raw materials, industrial hemp stands out as a versatile and beneficial commodity, promising continued growth and diversification of its applications in the years to come.

Restraints

Regulatory Challenges

Regulatory challenges present a significant restraint in the Global Industrial Hemp Market. Despite its potential for diverse applications and environmental benefits, the legal landscape for hemp remains fragmented and often contradictory across various jurisdictions. This inconsistency in regulations not only impedes market growth but also introduces substantial uncertainties for businesses operating within this sector.

The complexity primarily arises from the legal status of hemp compared to other forms of cannabis, such as marijuana. Hemp, which is scientifically classified as Cannabis sativa L., is distinguished mainly by its low tetrahydrocannabinol (THC) content—the psychoactive component in cannabis. Most jurisdictions regulate hemp based on its THC levels, typically setting a legal threshold that defines hemp as having THC concentrations of 0.3% or lower on a dry weight basis. However, this threshold is not universally adopted, leading to significant regulatory discrepancies both internationally and within countries.

In the United States, the 2018 Farm Bill marked a pivotal shift by federally legalizing hemp and removing it from the list of controlled substances, categorizing it as an agricultural commodity. This legal recognition was intended to spur growth in the hemp industry by enabling nationwide cultivation, processing, and sale.

However, the implementation of this law varies widely at the state level, with differing regulatory frameworks regarding licensing, THC testing standards, and product labeling. These variations complicate the operational logistics and scalability of hemp businesses, impacting their ability to engage uniformly across state lines.

Globally, the situation is similarly challenging. While some countries in the European Union and Canada have established progressive policies that support the hemp industry, others maintain stringent restrictions that limit hemp cultivation and trade to specific uses or tightly controlled conditions. Such international regulatory diversity not only hampers the export and import of hemp and its derivatives but also affects multinational supply chains, complicating global operations and strategic planning.

Moreover, the dynamic nature of hemp legislation further complicates this landscape. As governments adjust policies based on new research and public sentiment, companies must stay agile and informed to navigate these changes. Continuous updates to regulations can lead to unpredictability, requiring businesses to adapt quickly and sometimes at great cost.

To mitigate these regulatory challenges, companies involved in the Global Industrial Hemp Market must engage proactively with legal experts and invest in compliance infrastructure. Participating in industry associations and advocacy groups can also be instrumental in influencing policy changes and harmonizing standards. Despite these obstacles, the market’s potential remains significant, with opportunities for those who can navigate the complex regulatory environment effectively.

Opportunity

Advancements in Hemp Cultivation Technologies

The Global Industrial Hemp Market is poised for significant growth, buoyed by advancements in hemp cultivation technologies. These innovations are pivotal in enhancing the efficiency, yield, and quality of hemp, thereby expanding its applications and market potential. As the demand for sustainable and versatile products continues to rise, the development of cutting-edge agricultural technologies is creating lucrative opportunities within the hemp industry.

One of the key technological advancements driving the hemp market is the improvement in genetic engineering and plant breeding techniques. Researchers and companies are increasingly focusing on developing hemp strains with specific traits such as higher fiber quality, increased cannabinoid content, and better resistance to pests and diseases.

These genetically optimized strains are not only more productive but also offer higher consistency in quality, which is crucial for industrial applications like textiles, construction materials, and bioplastics. Such enhancements directly address the primary needs of manufacturers who require uniformity and reliability in raw materials.

Moreover, advancements in cultivation practices are also playing a critical role. Precision agriculture techniques, including the use of drones and IoT-based sensors, are being employed to monitor hemp fields in real time. These technologies help in optimizing water usage, nutrient management, and harvesting times, which significantly improves crop yield and reduces environmental impact. The integration of such smart farming solutions in hemp cultivation supports sustainable practices and aligns with the global push towards environmental conservation.

In addition to genetic and agricultural innovations, post-harvest technologies are also evolving. New processing methods that increase the efficiency of fiber extraction and cannabinoid separation are being developed. These processes are crucial for maximizing the usability of hemp in various industries and ensuring that the plant’s valuable components are not wasted. For instance, technologies that streamline the decortication process—the separation of hemp’s fibrous outer layer from the inner core—are essential for making hemp a more competitive alternative to traditional fibers like cotton and synthetic materials.

Trends

Eco-Friendly Product Adoption

A significant trend in the Global Industrial Hemp Market is the increasing consumer preference for eco-friendly and sustainable products. This shift is particularly evident in industries such as construction, automotive, and textiles, where hemp is valued for its low environmental impact. The cultivation of hemp requires minimal chemical inputs such as pesticides and herbicides compared to traditional crops, making it a more sustainable choice.

Government regulations and initiatives also play a crucial role in this trend. In the U.S., the 2018 Farm Bill legalized hemp cultivation, leading to increased production and research into its various applications. Moreover, state and federal funding for agricultural research, such as the grants provided to Oregon State University and Cornell University for hemp-related studies, underscores the commitment to supporting sustainable agricultural practices.

The rising awareness and demand for eco-friendly products are reflected in the growth projections for the industrial hemp market. Additionally, indicate a surge in the use of hemp-based products in the food and beverage sector, further propelled by the growing vegan and health-conscious consumer base.

Regional Analysis

North America is currently the dominant region in the hemp market, commanding a substantial share of 38.3%, equating to approximately USD 2.6 billion. This dominance is largely driven by progressive regulatory frameworks, particularly in the U.S. and Canada, where hemp cultivation has been legalized and integrated into various industrial applications, including textiles and bioplastics. The region’s focus on sustainable agriculture and substantial investments in hemp research contribute to its leading position.

Europe follows closely, showcasing robust market growth due to its long-standing history of hemp cultivation. Countries like France and the Netherlands lead in production, supported by favorable EU policies that promote hemp as an eco-friendly alternative to traditional crops. The market is further bolstered by the growing demand for hemp in automotive, construction, and textile industries.

Asia Pacific is witnessing rapid growth in the industrial hemp market, driven by major producers like China and India. The region benefits from favorable climatic conditions for hemp cultivation and a burgeoning awareness of hemp’s environmental and health benefits. The application of hemp in textiles and pharmaceuticals is particularly notable in this region, aligning with local industry needs and consumer preferences.

Latin America and the Middle East & Africa are emerging regions in the hemp market, experiencing gradual growth. In Latin America, countries such as Uruguay and Colombia are pioneering the legalization and commercialization of hemp, setting a precedent for market development. In the Middle East & Africa, the market is still nascent but shows potential due to increasing interest in sustainable and alternative crops.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Global Industrial Hemp Market is characterized by a dynamic competitive landscape, featuring a range of key players that significantly influence market trends and developments. Among these, American Cannabis Company, Inc. and Curaleaf Holdings Inc. are notable for their expansive market reach and innovative product offerings, particularly in hemp-derived CBD products. These companies, along with Green Thumb Industries and Cronos Group Inc., are pivotal in driving forward the innovations in hemp biotechnology and product diversification.

European entities such as HempFlax BV, BAFA, and MH Medical Hemp GmbH contribute profoundly to the market, especially in the cultivation and processing segments. HempFlax BV, in particular, is known for its sustainable practices and has been a pioneer in the European hemp industry, promoting the environmental benefits of hemp. Additionally, Canah International has made significant strides in integrating hemp into consumer products, enhancing the visibility and acceptance of hemp-based foods and textiles across Europe.

In North America, companies like Ecofibre Limited and Colorado Hemp Works focus on harnessing the nutritional potential of hemp seeds, positioning themselves strongly in the food and beverages sector. The region also sees innovative approaches from companies like Industrial Hemp Manufacturing, LLC, and Hemp Oil Canada, which are integral in pushing the boundaries of hemp’s applications in industrial and health-related fields. The presence of these companies underscores a robust growth trajectory for the industrial hemp market, driven by technological advancements and increasing consumer awareness of hemp’s benefits.

Top Key Players

- American Cannabis Company, Inc.

- American Hemp

- BAFA

- Boring Hemp Company

- Botanical Genetics, LLC

- Canah International

- CBD Biotechnology Co.

- Colorado Hemp Works

- Cronos Group Inc.

- Curaleaf Holdings Inc.

- Dun Agro Hemp Group

- Ecofiber Industries Operations

- Ecofibre Limited

- GenCanna

- Green Thumb Industries

- Hemp Oil Canada

- HempFlax BV

- HempMeds Brasil

- Industrial Hemp Manufacturing, LLC

- Konoplex Group

- Marijuana Company of America Inc.

- MH Medical Hemp GmbH

- Parkland Industrial Hemp Growers Cooperative Ltd.

- Plains Industrial Hemp Processing Ltd.

- South Hemp Tecno

- Terra Tech Corp.

- Valley Bio Limited

Recent Developments

In 2023, Abbott reported total revenue of $40.1 billion, with $2.9 billion invested in research and development. The company employs approximately 114,000 people across more than 160 countries.

American Hemp’s operations focus on producing high-quality hemp fibers and products, aligning with the increasing demand for sustainable materials in industries such as textiles, construction, and personal care.

Report Scope

Report Features Description Market Value (2023) USD 6.8 Bn Forecast Revenue (2033) USD 40.7 Bn CAGR (2024-2033) 19.6% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Hemp Seed, Hemp Seed Oil, CBD Hemp Oil, Hemp Bast, Hemp Hurd), By Source (Conventional, Organic), By Application (Food and Beverages, Textiles, Pharmaceuticals, Personal Care Products, Animal Nutrition, Paper, Construction Materials, Others), By Distribution Channel (B2B (Direct Sales), Retail Stores, Online Sales, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape American Cannabis Company, Inc., American Hemp, BAFA, Boring Hemp Company, Botanical Genetics, LLC, Canah International, CBD Biotechnology Co., Colorado Hemp Works, Cronos Group Inc., Curaleaf Holdings Inc., Dun Agro Hemp Group, Ecofiber Industries Operations, Ecofibre Limited, GenCanna, Green Thumb Industries, Hemp Oil Canada, HempFlax BV, HempMeds Brasil, Industrial Hemp Manufacturing, LLC, Konoplex Group, Marijuana Company of America Inc., MH Medical Hemp GmbH, Parkland Industrial Hemp Growers Cooperative Ltd., Plains Industrial Hemp Processing Ltd., South Hemp Tecno, Terra Tech Corp., Valley Bio Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- American Cannabis Company, Inc.

- American Hemp

- BAFA

- Boring Hemp Company

- Botanical Genetics, LLC

- Canah International

- CBD Biotechnology Co.

- Colorado Hemp Works

- Cronos Group Inc.

- Curaleaf Holdings Inc.

- Dun Agro Hemp Group

- Ecofiber Industries Operations

- Ecofibre Limited

- GenCanna

- Green Thumb Industries

- Hemp Oil Canada

- HempFlax BV

- HempMeds Brasil

- Industrial Hemp Manufacturing, LLC

- Konoplex Group

- Marijuana Company of America Inc.

- MH Medical Hemp GmbH

- Parkland Industrial Hemp Growers Cooperative Ltd.

- Plains Industrial Hemp Processing Ltd.

- South Hemp Tecno

- Terra Tech Corp.

- Valley Bio Limited